Professional Documents

Culture Documents

Excel Excel Stuff Investment Related Workbooks Duration and Convexity Calculator

Uploaded by

api-27174321Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Excel Stuff Investment Related Workbooks Duration and Convexity Calculator

Uploaded by

api-27174321Copyright:

Available Formats

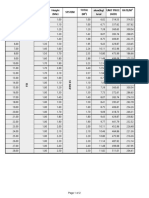

Bond Price $875.38 $820.74 If Yield Changes By 1.

00%

Face Value 1,000 1000 Bond Price Will Change By -54.63

Coupon Rate 8.00% 8%

Life in Years 10 10 Modified Duration Predicts -57.03

Yield 10.00% 11% Convexity Adjustment 2.47

Frequency 2 2 Total Predicted Change -54.56

Macaulay Duration 6.84 Actual New Price $820.74

Modified Duration 6.51 Predicted New Price $820.82

Convexity 56.49 Difference $0.08

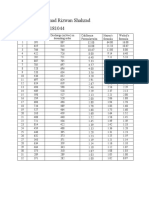

Period Cash Flow PV Cash Flow Duration Calc Convexity Calc

0 ($875.38)

1 40.00 38.10 38.10 69.11

2 40.00 36.28 72.56 197.45

3 40.00 34.55 103.66 376.09

4 40.00 32.91 131.63 596.97

5 40.00 31.34 156.71 852.82

6 40.00 29.85 179.09 1,137.09

7 40.00 28.43 198.99 1,443.92

8 40.00 27.07 216.59 1,768.07

9 40.00 25.78 232.06 2,104.85

10 40.00 24.56 245.57 2,450.08

11 40.00 23.39 257.26 2,800.10

12 40.00 22.27 267.28 3,151.62

13 40.00 21.21 275.77 3,501.80

14 40.00 20.20 282.84 3,848.14

15 40.00 19.24 288.61 4,188.45

16 40.00 18.32 293.19 4,520.86

17 40.00 17.45 296.68 4,843.78

18 40.00 16.62 299.17 5,155.85

19 40.00 15.83 300.76 5,455.92

20 1,040.00 391.97 7,839.30 149,320.02

Total 11,975.81 197,783.01

-6.24%

-6.51%

0.28%

-6.23%

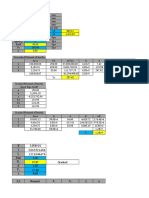

N

CFt

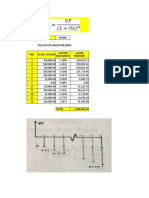

∑ (1 + i )

t =1

t

t

DMac =

VB

N

∑ (t )

1 CF

t 2

+t

(1 +i) (1 +i)

2 t

t =

1

C =

VB

You might also like

- Bruce KovnerDocument12 pagesBruce KovnerNavin Ratnayake100% (1)

- Fixed Income Bond Trading 1999 - Rich-Cheap & Relative ValueDocument38 pagesFixed Income Bond Trading 1999 - Rich-Cheap & Relative Valueapi-27174321100% (1)

- Fixed Income Yield Curve Building With BondsDocument30 pagesFixed Income Yield Curve Building With Bondsapi-27174321No ratings yet

- Solucionario - Tovar Soto RobinsonDocument11 pagesSolucionario - Tovar Soto RobinsonEnrique CarhuamacaNo ratings yet

- Derivatives Swaps IntRate 97 BWDocument37 pagesDerivatives Swaps IntRate 97 BWapi-27174321No ratings yet

- Marketing Revision BookletDocument18 pagesMarketing Revision BookletGodfreyFrankMwakalinga0% (1)

- "A Study On Awareness of Demat" in HDFC BankDocument91 pages"A Study On Awareness of Demat" in HDFC BankArfath Akmal80% (5)

- Grafico-Voltaje-TiempoDocument5 pagesGrafico-Voltaje-TiempoChristy AlvealNo ratings yet

- Voltaje (V) V/s Tiempo (Segundos)Document5 pagesVoltaje (V) V/s Tiempo (Segundos)Christy AlvealNo ratings yet

- LaboratoriosDocument101 pagesLaboratoriosAnaNo ratings yet

- Relajacion CorregidoDocument10 pagesRelajacion CorregidoLaura Benitez LozanoNo ratings yet

- 100 pips/day with 160% profit in month SEO optimized titleDocument104 pages100 pips/day with 160% profit in month SEO optimized titleriz131122No ratings yet

- S&P CNX Nifty: As On 02-JUL-2010 16:00:13 Hours ISTDocument4 pagesS&P CNX Nifty: As On 02-JUL-2010 16:00:13 Hours ISTkartikdhl7No ratings yet

- Minimos Cuadrados 1Document6 pagesMinimos Cuadrados 1daniel suanchaNo ratings yet

- Estrategias BTC by Delox (Diario Cripto)Document5 pagesEstrategias BTC by Delox (Diario Cripto)FranciscoSuarezNo ratings yet

- BB Airport Citimall: Semi-Monthly SummaryDocument1 pageBB Airport Citimall: Semi-Monthly SummaryIaAn Krstoper SaronNo ratings yet

- Assignment 4 - 2Document4 pagesAssignment 4 - 2divyaNo ratings yet

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Document11 pagesNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiNo ratings yet

- Discounted Cash Flows at WACCDocument11 pagesDiscounted Cash Flows at WACCapi-15357496No ratings yet

- M. Rizwan Shahzad,, (BSCT01181044)Document3 pagesM. Rizwan Shahzad,, (BSCT01181044)tamoor aliNo ratings yet

- Layers Chicken PlanDocument2 pagesLayers Chicken PlanpatrickNo ratings yet

- Resolución Práctica Calificada 3: Subcuenca 01 Subcuenca 02 TC TCDocument2 pagesResolución Práctica Calificada 3: Subcuenca 01 Subcuenca 02 TC TCNicole HuamaníNo ratings yet

- Resolucion de Tablas de ExcelDocument7 pagesResolucion de Tablas de Excellucy JiménezNo ratings yet

- Year Population Unemployment (%)Document61 pagesYear Population Unemployment (%)Tuấn Việt Âu DươngNo ratings yet

- Zona 6: Dovela No Bλx Hλy Α Υ Cu Φ Ii Λw=Υbh Ni=Wcos Α M M Ton/M^3 Ton/M^2 B/Cosα Ton/M Ton/MDocument5 pagesZona 6: Dovela No Bλx Hλy Α Υ Cu Φ Ii Λw=Υbh Ni=Wcos Α M M Ton/M^3 Ton/M^2 B/Cosα Ton/M Ton/MgustavoNo ratings yet

- Project Financial DashboardDocument23 pagesProject Financial DashboardSteve UkohaNo ratings yet

- Book 1Document2 pagesBook 1Nixon MusngiNo ratings yet

- Data TanahDocument32 pagesData TanahhansenwidNo ratings yet

- Result and Discussion FilmDropswise CondensationDocument5 pagesResult and Discussion FilmDropswise CondensationKelvin CrixalixNo ratings yet

- Assignment 2 WK 6to7Document6 pagesAssignment 2 WK 6to7Peng GuinNo ratings yet

- Natco PharmaDocument15 pagesNatco PharmaRohit ChoudharyNo ratings yet

- Vapor PressureDocument42 pagesVapor PressureSamuel OnyewuenyiNo ratings yet

- Excavación masiva y relleno de material propioDocument12 pagesExcavación masiva y relleno de material propioIvan ParraNo ratings yet

- GraficasDocument6 pagesGraficasbaironnieves6No ratings yet

- Tahoe Salt Case SolutionDocument1 pageTahoe Salt Case SolutionNotThatRobinRatreNo ratings yet

- Tabla para El Calculo de La Curva MasaDocument8 pagesTabla para El Calculo de La Curva MasaGesslerLyndonMedranoSanchezNo ratings yet

- Tutorial 2 - Pentland Field Cashflow MatrixDocument3 pagesTutorial 2 - Pentland Field Cashflow MatrixLawrence MbahNo ratings yet

- Lineas de TendenciaDocument31 pagesLineas de TendenciaDANIEL EDUARDO ROSALES CASTELLANOSNo ratings yet

- Interes Simple Prestamo Tiempo Valor FuturoDocument2 pagesInteres Simple Prestamo Tiempo Valor FuturoRomel Canchari GutierrezNo ratings yet

- Overall Total Sales Corpo Albertos 8.2022Document13 pagesOverall Total Sales Corpo Albertos 8.2022petchie tenorioNo ratings yet

- Tensione Di Vapore Formula Di AntoineDocument84 pagesTensione Di Vapore Formula Di AntoinealessandroNo ratings yet

- TechBuilder - MPPT CALCULATORDocument6 pagesTechBuilder - MPPT CALCULATORBabumani MandiNo ratings yet

- 4 - Slab Bridge Final April23 - 2014Document1 page4 - Slab Bridge Final April23 - 2014teweldeNo ratings yet

- CRD WorksheetDocument36 pagesCRD WorksheetSunny May RonasNo ratings yet

- Interes SimpleDocument7 pagesInteres SimpleNox34No ratings yet

- Ship Specs Regression AnalysisDocument15 pagesShip Specs Regression Analysisaulia zahraniNo ratings yet

- Compound Vs Simple Interest 8% Per Year For 40 YearsDocument3 pagesCompound Vs Simple Interest 8% Per Year For 40 YearstreNo ratings yet

- E-Phemt TAV-581+: Typical Performance DataDocument5 pagesE-Phemt TAV-581+: Typical Performance DataAbolfazl Yousef ZamanianNo ratings yet

- Beam analysis with tension stiffeningDocument2 pagesBeam analysis with tension stiffeningAbel BerhanmeskelNo ratings yet

- PL FluidosDocument4 pagesPL FluidosjorgecarroNo ratings yet

- GRADIENTES TrabajoDocument12 pagesGRADIENTES TrabajoAnderson IzaquitaNo ratings yet

- Calculate Present and Future Values of Cash FlowsDocument12 pagesCalculate Present and Future Values of Cash FlowsAnderson IzaquitaNo ratings yet

- FV 1000 1 2 3 C 10% Fvofcf E.Y. 10% PV OF CF 90.909090909 82.6446281 826.446281 T 3 Price FV C E.Y. T Price FV C E.Y. T PriceDocument10 pagesFV 1000 1 2 3 C 10% Fvofcf E.Y. 10% PV OF CF 90.909090909 82.6446281 826.446281 T 3 Price FV C E.Y. T Price FV C E.Y. T PriceMayank GuptaNo ratings yet

- Pozos en recta análisisDocument38 pagesPozos en recta análisisCristhian Quispe ManriqueNo ratings yet

- Costos 1Document11 pagesCostos 1richicuellar62No ratings yet

- Analisis Granulometrico #De Mallas Abertura Peso Gr. % Peso Ret. % Ac (+) % Ac (-)Document4 pagesAnalisis Granulometrico #De Mallas Abertura Peso Gr. % Peso Ret. % Ac (+) % Ac (-)AnthoniNo ratings yet

- Beggining StockDocument2 pagesBeggining StockelsatesfamaryamNo ratings yet

- Solutions Chapter 7Document6 pagesSolutions Chapter 7houssamNo ratings yet

- Watershed PDFDocument41 pagesWatershed PDFCARMEN CANALNo ratings yet

- Costos 3Document16 pagesCostos 3richicuellar62No ratings yet

- Pile CapacityDocument14 pagesPile CapacityAnisuzzaman SikderNo ratings yet

- Prowess Annual Report Data ComparisonDocument12 pagesProwess Annual Report Data ComparisonamanNo ratings yet

- Cost/Dia Const Cost Avg Dia Avg WT Total FT Inch FT Cost/Mi Differential CPC Chad Alliance Agppt Turkey Epc2Document3 pagesCost/Dia Const Cost Avg Dia Avg WT Total FT Inch FT Cost/Mi Differential CPC Chad Alliance Agppt Turkey Epc2gharavii2063No ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- 500074-A-Robotics-4u (0307)Document165 pages500074-A-Robotics-4u (0307)api-27174321No ratings yet

- p53 ROS C6 H2O2Document13 pagesp53 ROS C6 H2O2api-27174321No ratings yet

- Index ofDocument1 pageIndex ofapi-27174321No ratings yet

- תזה - אנגליתDocument64 pagesתזה - אנגליתapi-27174321No ratings yet

- Fixed Income YCM 2001 - Yield Curve TheoriesDocument35 pagesFixed Income YCM 2001 - Yield Curve Theoriesapi-27174321100% (1)

- Fixed Income SecuritiesDocument103 pagesFixed Income Securitiesaru1977No ratings yet

- Fixed Income YCM 2001 - Interest Rate DerivativesDocument57 pagesFixed Income YCM 2001 - Interest Rate Derivativesapi-27174321No ratings yet

- Fixed Income YCM 2001 - Interpolation TechniquesDocument26 pagesFixed Income YCM 2001 - Interpolation Techniquesapi-27174321100% (1)

- Fixed Income Bond Trading 1999 - Trading The Yield CurveDocument62 pagesFixed Income Bond Trading 1999 - Trading The Yield Curveapi-27174321100% (2)

- Interest Rate ModelsDocument109 pagesInterest Rate ModelsJessica HendersonNo ratings yet

- Fixed Income Modeling Tax-Specific Yield CurveDocument35 pagesFixed Income Modeling Tax-Specific Yield Curveapi-27174321No ratings yet

- Basis Trading BasicsDocument51 pagesBasis Trading BasicsTajinder SinghNo ratings yet

- Fixed Income Bond Trading 1999 - Bond Hedging & Risk ManagementDocument43 pagesFixed Income Bond Trading 1999 - Bond Hedging & Risk Managementapi-27174321No ratings yet

- Fixed Income Bond Trading 1999 - Bonds With Embedded OptionsDocument26 pagesFixed Income Bond Trading 1999 - Bonds With Embedded Optionsapi-27174321No ratings yet

- Fixed Income Bond Trading 1999 - Bond Portfolio ManagementDocument75 pagesFixed Income Bond Trading 1999 - Bond Portfolio Managementapi-27174321No ratings yet

- Eco No Metrics Forecasting 2001 - ARCH ModelsDocument55 pagesEco No Metrics Forecasting 2001 - ARCH Modelsapi-27174321No ratings yet

- Eco No Metrics Forecasting 2001 - Time SeriesDocument95 pagesEco No Metrics Forecasting 2001 - Time Seriesapi-27174321No ratings yet

- Eco No Metrics Forecasting 2001 - VAR AnalysisDocument52 pagesEco No Metrics Forecasting 2001 - VAR Analysisapi-27174321No ratings yet

- Derivatives WarrantsDocument35 pagesDerivatives Warrantsapi-27174321No ratings yet

- Derivatives Swaps Currency 97Document39 pagesDerivatives Swaps Currency 97api-27174321No ratings yet

- Eco No Metrics Forecasting 2001 - Neural NetworksDocument41 pagesEco No Metrics Forecasting 2001 - Neural Networksapi-27174321No ratings yet

- Eco No Metrics Forecasting 1999 - Testing StrategiesDocument30 pagesEco No Metrics Forecasting 1999 - Testing Strategiesapi-27174321No ratings yet

- Eco No Metrics Forecasting 1999 - Chaos TheoryDocument45 pagesEco No Metrics Forecasting 1999 - Chaos Theoryquantum227No ratings yet

- Eco No Metrics Forecasting 1999 - NonLinear DynamicsDocument43 pagesEco No Metrics Forecasting 1999 - NonLinear Dynamicsapi-27174321No ratings yet

- Derivatives - Option ValuationDocument73 pagesDerivatives - Option ValuationBala MuruganNo ratings yet

- Derivatives Equity SwapsDocument46 pagesDerivatives Equity Swapsapi-27174321No ratings yet

- Option Risk ManagementDocument44 pagesOption Risk ManagementThanh Tam LuuNo ratings yet

- COA Unit 2 Issue of Shares - ProblemsDocument3 pagesCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNo ratings yet

- Global Pensions Awards 2004 - Currency Overlay Manager of The YearDocument1 pageGlobal Pensions Awards 2004 - Currency Overlay Manager of The Yearuiw86No ratings yet

- Smooth Love Potion To PHP Chart (SLPPHP) CoinGeckoDocument1 pageSmooth Love Potion To PHP Chart (SLPPHP) CoinGeckoLonie Jay DonaireNo ratings yet

- UntitledDocument71 pagesUntitledIsaque Dietrich GarciaNo ratings yet

- Remeasurement and Subsequent Translation of Financial Statements and Hedging AgainstDocument1 pageRemeasurement and Subsequent Translation of Financial Statements and Hedging AgainstMuhammad ShahidNo ratings yet

- Abhfl NCD Im 29112022Document88 pagesAbhfl NCD Im 29112022tonkkumawatNo ratings yet

- Financial Management Paper 2.4march 2023Document17 pagesFinancial Management Paper 2.4march 2023johny SahaNo ratings yet

- CTM IndividualDocument6 pagesCTM IndividualPhang Yu ShangNo ratings yet

- Getting Out EarlyDocument33 pagesGetting Out EarlyZerohedgeNo ratings yet

- Security Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskDocument4 pagesSecurity Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskEdwin HauwertNo ratings yet

- R. Abilash 12bsphh010774 PDM-CDocument2 pagesR. Abilash 12bsphh010774 PDM-CAbilash RamanNo ratings yet

- Topic 04 Foreign Exchange MarketsDocument32 pagesTopic 04 Foreign Exchange MarketsAnisha SapraNo ratings yet

- How to analyze stock valuation using P/E ratio, PEG ratio, EY, P/B ratio & moreDocument5 pagesHow to analyze stock valuation using P/E ratio, PEG ratio, EY, P/B ratio & morePrasun PushkarNo ratings yet

- Ep Module II Ns June 2021Document89 pagesEp Module II Ns June 2021Sarmishtha JanaNo ratings yet

- FINANCIAL DERIVATIVES Unit - 1Document18 pagesFINANCIAL DERIVATIVES Unit - 1Neehasultana ShaikNo ratings yet

- Michael Flaherman AB 2833 Letter-SignedDocument8 pagesMichael Flaherman AB 2833 Letter-Signedmflaherman6436No ratings yet

- Risk ManagementDocument5 pagesRisk Managementdhanie_theresia981No ratings yet

- CFA InstituteDocument4 pagesCFA InstituteJaya MuruganNo ratings yet

- Members:: Writing A Documentary ReviewDocument8 pagesMembers:: Writing A Documentary ReviewBrian Ferndale Sanchez GarciaNo ratings yet

- Long Term Financial Planning and Growth CapstrnDocument125 pagesLong Term Financial Planning and Growth CapstrnAnonymous bDbMHLNo ratings yet

- Sol. Man. - Chapter 10 She 1Document5 pagesSol. Man. - Chapter 10 She 1Nikky Bless LeonarNo ratings yet

- MBA (Sem 4) Theory Examination 2019-20 Financial Derivatives Multiple Choice QuestionsDocument17 pagesMBA (Sem 4) Theory Examination 2019-20 Financial Derivatives Multiple Choice QuestionsRiya Kaushik67% (3)

- Forex DJ Marker PRO Strategy - ManualDocument11 pagesForex DJ Marker PRO Strategy - ManualSimamkele NtwanambiNo ratings yet

- 14 22Document9 pages14 22Hitesh SherasiyaNo ratings yet

- Screen Based Trading, Financial MarketDocument9 pagesScreen Based Trading, Financial MarketApu ChakrabortyNo ratings yet

- Weekly market report highlights declines and gainsDocument7 pagesWeekly market report highlights declines and gainsSudheera IndrajithNo ratings yet

- Stock Valuation: Prepared By: Wael Shams EL-DinDocument40 pagesStock Valuation: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet