Professional Documents

Culture Documents

Studying Different Systematic Value Investing Strategies On The Eurozone Market

Uploaded by

caque40Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Studying Different Systematic Value Investing Strategies On The Eurozone Market

Uploaded by

caque40Copyright:

Available Formats

www.value-investing.

eu

Studying different

Systematic Value Investing Strategies

on the

Eurozone stock market

by Philip Vanstraceele and Luc Allaeys

May 2010

www.value-investing.eu

www.value-investing.eu

ontents:

- Section 1:

Introduction

- Section 2:

Methodology and Data

- Section 3:

Workflow

- Section 4:

Results

- Section 5:

Conclusions

www.value-investing.eu

Section 1: Introduction

s devoted Value Investors, it was our intention to back-test existing screening models for Eurozone

stocks, as well as models that we had developed.

Being located in Europe ourselves, we were interested in finding out how European stocks react- what would the

outcome be- of applying different Value-screening methods to stocks and especially to a portfolio of stocks.

For this project we studied different value-investment strategies that we could implement in our application.

We were especially attracted to existing methods, The Magic Formula by Joel Greenblatt, Joseph Piotroskis nine

point scoring mechanism, Benjamin Grahams Net Current Asset Value and using our own ERP5.

For this paper we went back 10 years in time and used fundamental constituents familiar to value investors such

as Price to Book, Return on Investments, Direction of Earnings, Earnings Yield etc.

We were also curious to learn whether markets were, indeed, as efficient as the theory indicates they are in the

modern finance.

And contradictory in a big way. Its now very clear that the market makes BIG mistakes in pricing stocks. It

doesnt see through reported accounting numbers. Its typically overly optimistic about to-be-reported earnings.

It projects that successful firms will continue their success for far too long into the future

(Haugen; The inefficient Stock Market).

As we proceeded, we also asked ourselves questions such as;

-Should we invest in an index fund rather than in individual stocks?

-Where and how can we find undervalued stocks ?

-What happens to performance if we add more stocks to a Value portfolio?

-What happens to performance if we join two Value screeners together?

www.value-investing.eu

Section 2: Methodology and Data

ata

When making back tests, you must ensure that you eliminate some of the problems that may occur

when doing an exercise like this. Here is a short list of the problems that you should be accounted for.

1.Survival Bias:

Most studies dont include companies that went bankrupt or that were taken over by others. In

our test these companys were not excluded.

2.Look ahead Bias:

When you are using data for your stock ranking that was not available at the moment of portfolio

formation, your results will suffer from look-ahead bias. This biases results upwards.

We worked with accounting data from the prior fiscal year and waited 6 months to form our

portfolios and actual trading.

Example:

Back-testing for 1999, we took the accounting data from the end of 1998 and formed the different

portfolios on 13/06/1999. This ensured that all accounting data was available on portfolio

formation.

We formed our portfolios and waited 6 months before actually buying them. Then we held them

until 13/06/2000 before again rebalancing the complete portfolio.

We back-tested for the period: 13/06/1999 and 13/06/2009

3.Bid-Asked bounce:

It is practically impossible to buy large positions in micro cap stocks (<25 mil). If you do so it will

influence the price very negatively. The price will skyrocket.

If you buy small positions you might get away with it if the stock has some liquidity. In our

screener you can choose your own minimum required market cap. For our back-test we began at

a minimum market cap of 25 mil.

4.Data mining:

You can run your computer a thousand times and pick the best results to publish. We on the other

hand used the same methodology over and over again through our study with the same

constituents.

www.value-investing.eu

5.A Reliable Database :

Before we started this project we investigated different data providers. There are very good

sources available in todays market but very few had the necessary data coverage with respect to

Europeans stocks as Thomson has.

So we selected the Thomson DataStream application and it has been doing a great job for us.

6.Small sample Bias :

You can have a strategy that does very well over a 5-year period or longer and that may then go

horribly wrong. We therefore tested the different strategies over a 10 year period. This should

give the necessary time span we need to test the solidity and endurance of these strategies in

detail.

All things considered, the last decade has been quite turbulent for the stock markets all over the

globe. We had one bull market and two major crashes (a luxury for back-testers).

ethodology

To be able to compare different strategies we concentrated on 4 models :

-The Magic Formula by Joel Greenblatt, Joseph Piotroskis nine point scoring mechanism,

Benjamin Grahams Net Current Asset Value and our own ERP5 .

We also back-tested combinations of these methods.

www.value-investing.eu

. The Magic Formula by Joel Greenblatt (The little book that beats the market.

Published by Wiley & Sons Inc.)

How the formula is calculated ?

The formula start with the list of all the companies in the Euro monetary zone .

For example in the Eurozone we have +/- 3.400 companies available in our list. The formula then assigns a rank to

those companies, from 1 to 3.400, based on their return of capital (ROIC).The company with the highest ROIC

gets rank 1, the company with the lowest gets rank 3.400.

Next, the formula repeats the same procedure, but this time the ranking is done using earning Yield(EY). The

company with the highest yield is assigned a rank of 1, and the company with the lowest earning yield receives a

rank of 2000.

Finally, the formula simply combines the rankings in search of the companies that have the best combination of

both two factors. So a company that is ranked 232nd best in return on capital and 153rd highest in EY, gets a

better combined ranking than a company that is ranked 1st in ROIC but only 1150th best in earning Yield because

the first company has a better combined rank of 385 (232+153=385) than the second company has (1+1150 =1151)

How are ROIC and EY defined?

Return on Capital =

EBIT / (Net Working Capital + Net Fixed Assets)

Earnings Yield =

EBIT / Enterprise Value.

The return on invested capital measures how efficiently the assets of a company have been used to generate

income. The higher this ratio, the better.

A good company is not always a good investment. The value of a good company can be so high, that it is a bad

investment idea. Most obvious, or most used, to measure this is the P/E ratio. If this ratio is reversed, it is

expressed in terms of the percentage between the operational profit and market capitalisation.

A share with P/E of 20 has an earning yield of 5%.

Greenblatt goes a step further. He does not compare the operational profit just the market capitalisation, but with

just the total value of the company (Enterprise Value) . The total value of the company is the market capitalisation

plus financial debts minus available cash.

Stocks are skipped if they are not in an industry to which the formula applies. (Banks and insurance companies are

skipped from the screener!)

Excess Cash is determined:

If Total Current Assets are greater than 2 * Total Current Liabilities, then Excess Cash is determined to be the lesser of Cash

And Short Term Investments or Total Current Assets - 2 * Total Current Liabilities, otherwise it is zero.

EBIT

is calculated as the trailing twelve months operating profit if available (if not then EBIT equals last year operating income)

Net Working Capital

is calculated as Total Current Assets - Excess Cash - Total Current Liabilities if Total Current Assets exceeds Total Current

Liabilities, otherwise it is zero

Net Fixed Assets

is calculated as Total Assets - Total Current Assets - Total Intangible assets

www.value-investing.eu

Enterprise Value

is calculated as Market Cap + Long-Term Debt + Minority Interest + Preferred Stock - Excess Cash. If the returned value for

Enterprise value is negative, then a default value of 1 is used.

www.value-investing.eu

. Joseph Piotroskis 9- point scoring mechanism

(Paper published in 2000 Value Investing: The Use of Historical Financial Statement Information to Separate

Winners from Losers- http//www.chicagobooth.edu/faculty/selectedpapers/sp84.pdf).

Piotroski came up with a nine point scoring mechanism for stocks;

In this paper he showed that by using a set of nine different fundamentals it is possible to outperform the market

by 10% a year on average from 1976 to 1996.

It is clear that we were attracted to this formula and that we would implement this kind of screeners on our

website.

It was designed to be applied to value investment in low Price/Book (P/B) stocks, mainly the lowest 20%.

This limits the strategy to true value companies.

But it is useful for any set of stocks. (We have also applied the algorithm to the best 20% Magic Formula stocks

and to the best 20 % ERP5 companies)

Piotroski's methodology starts by narrowing stock choices to those trading in the top 20 percent of the market

based on their book/market ratios (or, conversely, the bottom 20 percent of the market based on price/book

ratios).

He found that just buying low price/book stocks does not produce excess returns over the long term, because

many low price/book companies are trading at a discount because they deserve to be they're dogs with poor

prospects.

When he applied a series of additional tests of financial strength to these low price/book stocks, however,

Piotroski was able to separate the dogs from the good prospects.

Among the variables he examined: return on assets, current ratio, cash flow from operations, change in gross

margin, and change in asset turnover.

The strategy usually finds smaller companies whose stocks are flying under Wall Street's radar.

Piotroski scanned the companies on the following basis, Financial performance, Leverage liquidity, source of

funds and Operating efficiency.

www.value-investing.eu

In addition to the price-to-book ratio, the analysis is based on accounting fundamentals and consists of awarding

one point for each of the following tests:

-

positive earnings [F_ROA]

positive cash flow [F_CFO]

increasing ROA [F_ROA]

increasing cash flow from operations [F_ACCRUAL]

decreasing long term debt as a proportion of total assets [F_LEVER]

increasing current ratio (indicating an increasing ability to pay off short term debt) [F_LIQUID]

decreasing or stable numbers of outstanding shares [EQ_OFFER]

increasing assets turnover (indicating an increasing sales as a proportion of total assets) [F_TURN]

increasing gross margin [_MARGIN]

All 9 factors added together being summed up leads;

F_SCORE =[F_ROA]+ [F_CFO]+ [F_ROA]+ [F_ACCRUAL]+ [F_LEVER]+ [F_LIQUID]+ [EQ_OFFER]+ [F_TURN]+ [_MARGIN]

Each company is given either a score 0 or 1. The sum of the variables is between 0 and 9.

The companies are then ranked from best to worst.

Important:

The only difference between the Original Piotoski formula and our model is in the way we evaluate outstanding

shares.

-If the number of shares outstanding is stable we assign a value of 0,5

-If the number of shares outstanding decreases (share repurchase) we assign a value of 1

www.value-investing.eu

. Benjamin Grahams NCAV (Net Current Asset Value) (The intelligent

Investor published in 1949)

Benjamin Graham, considered by many to be the architect of fundamental analysis, described a strategy for

identifying deep value stocks, which in his view are low-risk candidates.

Grahams strategy, dubbed the Net Current Asset Value approach, apparently works very well.

One research study, covering the years 1970 through 1983 showed that portfolios picked at the beginning of each

year, and held for one year, returned 29,4%, on average, over the 13 year period, compared to 11,5% for the S&P

500 Index.

Despite the impressive results, the strategy is relatively unknown to individual investors.

The reason for that is that it requires some digging.

A normal computation of a companys book value is defined as:

Total Assets Total Liabilities.

Graham had a different point of view about that matter. He stated that

NCA= Current Assets (cash, inventories and accounts receivable) Total Liabilities

This strategy calls for buying stocks trading at 2/3 or less of their NCAV.

In our methodology the NCAV-ratio should be greater than 1,33, and we define the ratio as Net Current Assets

Value / Market Value.

This ratio is used to find companies that are trading below their net current assets value.

Its a stringent requirement, since most companies have negative NCAVs. But Graham was looking for firms

trading so cheaply that there was little danger of their falling further. His strategy calls for selling the shares when

they trade at their NCAV.

But of course, on is free to choose the Margin of Safety that one prefers.

10

www.value-investing.eu

.The ERP5 Value Stock Screener

Finding stocks with a considerable margin of safety isnt a standalone issue.

We have devised a way of combining several great ideas into one method and back-testing it over time, to see

whether these ideas could be combined to make a robust model.

We combined Greenblatts Earning Yield & Return on Invested Capital, Price to Book Value (one of most

important indicators for Value Investing stocks; previous studies by Rosenberg,Reid, and Lanstein 1984; Fama

and French 1992; Lakonishok, Shleifer, and Vishny 1994) and the 5-year trailing Return on Invested Capital.

We code named it ERP5, based on the initials of the 4 factors.

For convenience:

- Earning Yield is EBIT / Enterprise Value

How much is a business earning compared to the enterprise value purchase price of the company?

- ROIC

How well a company uses its capital to generate income?

- Price to Book Value

How much Margin of Safety there is on the investment.

- 5 Year trailing ROIC

This gives a clear trend of earnings over a 5-year period.

Each factor is calculated separately and then ranked within the same factor.

Finally the ranking of the factors is summed up and re-ranked.

Example:

- Company A has scores of 12/125/40/600 totalling 777

- Company B has scores of 1/1/5/1500 totalling 1507

Company A has better overall score and is therefore better than B

This in the end will give us a more weighed measurement of Value.

11

www.value-investing.eu

Section 3: Workflow

or convenience we back-tested the 4 strategies (Piotroski, ERP5, NCAV and The Magic Formula) over a 10 year period and compared the results to the Dow Jones EuroSTOXX .

The EuroSTOXX index is the more liquid version of the EuroSTOXX 600 index. It has +/- 313 companies in the index over

the Euro Monetary zone (12 countries).

-As discussed earlier we apply a buy and hold strategy for 1 year (we didnt short) for our different portfolios and

rebalanced the portfolios once a year at exactly the same time .

-We were looking for evidence that putting your eggs in different baskets is an adage that makes sense.

-We back-tested throughout the whole market capitalisation spectrum of the EU zone .

-We excluded Financial- and Insurance companies from our screeners!!

-We back tested the different strategies and calculated the price-index PI (excluding dividends) on an equally

weighted basis .

The following strategies were back tested :

(MV; the minimum Market Value in Millions and C ; the number of companies in the portfolio).

-MV25 C20

-MV25 C50

-MV50 C20

-MV50 C50

-MV100 C20

-MV100 C50

-MV250 C20

-MV500 C20

-MV1.000 C20

-MV1.000 C50

-MV2.000 C20

-MV2.000 C40

-MV5.000 C20

-MV25 C20&50

-MV50 C20&50

-MV100 C20&50

-MV1.000 C20&50

-MV2.000 C20&50

12

www.value-investing.eu

n the Euro Monetary zone there are +/- 4.080 companies with a primary quote on the stock market.

If we exclude the financials and insurers are excluded +/- 3.400 companies remain.

In order to quantify the landscape of this zone we split them up in different capitalisations being.

Large-cap: 10 billion200 billion

77 companies

2%

Mid-cap: 1 billion10 billion

308 companies

9%

Small-cap: 300 million1 billion

334 companies

10%

Micro-cap: 25 million-300 million

1.189 companies

35%

Nano-cap: Below 25 million

1.446 companies

44%

The spectrum below 25 million comprises a portion that is smaller than 1 million (294 companies, or 10%) and a

larger number (1.152 companies, or 34%) of companies between 1 and 25 million.

The US market on the other hand looks somewhat different with a total of some 8.000 companies( excluding

banks and insurance) .

Above 200 billion

4 companies

0,05%

Large-cap: 10 billion200 billion

229 companies

3%

Mid-cap: 1 billion10 billion

1.045 companies

13,95%

Small-cap: 300 million1 billion

856 companies

10%

Micro-cap: 25 million-300 million

1.724 companies

21%

Nano-cap: Below 25 million

4.267 companies

52%

13

www.value-investing.eu

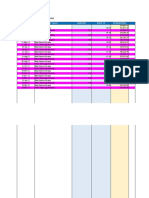

Section 4: Results

A

Each of the four strategies invested for 100 over C companies on an equally weighted basis

(and the DJ Eurostoxx also rebased to 100) held for a 10 -year period (13/06/1999 to 13/06/2009).

The price index is graphically displayed over a 10-year period.

Additionally the Return is calculated with a 100 invested (here the DJ Eurostoxx is also rebased to 100).

B

The same strategies (with the same Minimum Market Caps) were back-tested with a changing number of

companies in the portfolios.

C

Finally we back-tested the strategies by deciles split up (minimum Market Cap 10,100 and 500 Mil.) to see

whether any consistency appeared among the different screening methods.

Here we included the dividends on a equally weighted basis.

14

www.value-investing.eu

Name

PIOT2520 - PI

ERP2520

NCAV2520 -

MF2520

DJ EURO STOXX

Code

X%PIOT(PI)

X%ERP

X%NCAV

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

118,21

117,07

111,78

129,42

136,78

13/06/2001

128,64

151,11

126,53

134,18

112,37

13/06/2002

135,94

176,98

129,77

130,37

84,64

13/06/2003

155,94

266,74

124,91

183,92

67,98

14/06/2004

256,04

378,89

185,49

254,43

77,24

13/06/2005

377,28

427,94

248,51

276,65

90,34

13/06/2006

496,57

482,36

305,87

292,63

100,02

13/06/2007

795,46

610,14

444,82

443,75

133,60

13/06/2008

713,34

518,43

422,7

327,99

107,39

12/06/2009

535,71

449,39

352,91

330,77

72,78

Return Y

18,28%

16,22%

13,44%

12,71%

-3,13%

Back-testing in the micro cap zone (min market cap 25mil) is always difficult and has to be interpreted with great

caution because of the bid-ask bounce that could occur.

15

www.value-investing.eu

Name

Code

14/06/1999

13/06/2000

13/06/2001

13/06/2002

13/06/2003

14/06/2004

13/06/2005

13/06/2006

13/06/2007

13/06/2008

12/06/2009

Return Y

PIOT2550

X%PIOT(PI)

100

115,37

131,11

140,87

149,78

237,64

317,06

459,25

698,38

627,84

481,72

17,03%

ERP52550

X%ERP5

100

125,29

152,76

170,44

214,46

309,22

377,55

449,08

602,54

489,37

400,12

14,87%

NCAV2550

X%NCAV

100

117,75

131,21

126,68

128,74

205,4

271,45

360,72

465,64

394,84

334,3

12,83%

16

MF2550

X%MF

100

115,79

121,88

120,45

136,25

188,05

212,67

244,46

349,87

282,52

238,9

9,10%

EURO STOXX

DJEURST

100

136,78

112,37

84,64

67,98

77,24

90,34

100,02

133,6

107,39

72,78

-3,13%

www.value-investing.eu

Name

PIOT5020

ERP55020

NCAV5020

MF 5020

DJ EURO STOXX

Code

X%PIOT(PI)

X%ERP

X%NCAVB

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

118,06

122,97

128,76

106,37

136,78

13/06/2001

140,51

166,21

143,76

113,05

112,37

13/06/2002

148,13

165,03

147,17

97,08

84,64

13/06/2003

153,87

167,64

136,16

91,31

67,98

14/06/2004

228,61

241,06

200,66

129,02

77,24

13/06/2005

325,64

293,19

271,48

138,75

90,34

13/06/2006

435,19

360,23

337,58

150,87

100,02

13/06/2007

697,77

543,16

474,22

218,34

133,60

13/06/2008

604,58

446,05

417,59

160,78

107,39

12/06/2009

458,5

388,96

317,29

144,48

72,78

Return Y

16,45%

14,55%

12,24%

3,75%

-3,13%

In the spectrum above 50 mil MC, which is perfectly feasable to invest in for a private portfolio

all value strategies outpreform the market quite substantially.

17

www.value-investing.eu

Name

Code

14/06/1999

13/06/2000

13/06/2001

13/06/2002

13/06/2003

14/06/2004

13/06/2005

13/06/2006

13/06/2007

13/06/2008

12/06/2009

Return Y

PIOT5050

X%P

100

111,88

129,25

139,87

143,05

215,02

283,32

387,39

601,28

516,77

394,28

14,70%

ERP55050

X%E

100

126,16

159,86

172,59

172,78

254,09

312,79

369,74

513,19

422,85

344,06

13,15%

NCAV5050

X%NCAV

100

125,82

145,22

141,86

137,15

209,07

276,81

338,8

435,21

366,64

293,91

11,38%

18

MF5050

X%M

100

126,1

140,68

131,41

117,9

154,09

165,33

189,19

260,32

199,43

166,07

5,20%

EURO STOXX

DJEURST

100

136,78

112,37

84,64

67,98

77,24

90,34

100,02

133,6

107,39

72,78

-3,13%

www.value-investing.eu

Name

PIOT10020

ERP510020

NCAVB10020

MF10020

DJ EURO STOXX

DJEURST

Code

X%PIOT(PI)

X%ERP

X%NCAVB

X%MF

14/06/1999

100

100

100

100

100

13/06/2000

109,52

121,76

134,12

128,51

136,78

13/06/2001

128,5

160,64

154,95

145,41

112,37

13/06/2002

137,04

166,13

150,53

117,07

84,64

13/06/2003

132,35

153,55

148,77

111,97

67,98

14/06/2004

195,13

224,26

212,06

155,38

77,24

13/06/2005

280,8

282,71

269,5

175,81

90,34

13/06/2006

379,22

358,36

305,64

200,22

100,02

13/06/2007

570,39

484,94

404,69

272,43

133,60

13/06/2008

516,84

380,68

354,19

208,78

107,39

12/06/2009

436,09

313,23

270,98

182,8

72,78

Return Y

15,87%

12,10%

10,48%

6,22%

-3,13%

19

www.value-investing.eu

Name

PIOT10050

ERP10050

NCAV10050

MF10050

DJ EURO STOXX

Code

X%PIOT(PI)

X%ERP

X%NCAV

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

117,54

109,54

128,77

126,06

136,78

13/06/2001

136,41

136,94

143,68

145,55

112,37

13/06/2002

148,61

138,93

140,36

135,58

84,64

13/06/2003

146,01

127,74

139,25

125,66

67,98

14/06/2004

211,51

176,12

198,78

164,06

77,24

13/06/2005

288,63

222,52

249,74

188,61

90,34

13/06/2006

387,23

275,32

291,66

228,87

100,02

13/06/2007

601,24

368

372,47

317,07

133,60

13/06/2008

503,68

290,51

307,28

245,25

107,39

12/06/2009

408,68

234,03

251,53

199,17

72,78

Return Y

15,12%

8,87%

9,66%

7,13%

-3,13%

Here you can see that adding more stocks (from 20 to 50) to a portfolio doesnt necessarely increase your return.

20

www.value-investing.eu

Name

PIOT25020

ERP525020

NCAV25020

MF25020

EURO STOXX

DJEURST

Code

X%PIOT

X%ERP5

X%NCAV

X%MF

14/06/1999

100

100

100

100

100

13/06/2000

99,9

121,48

154,54

126,25

136,78

13/06/2001

115,83

157,35

185,77

158,46

112,37

13/06/2002

119,66

173,17

171,03

126,03

84,64

13/06/2003

102,4

149,89

163,68

108,98

67,98

14/06/2004

153,02

196,11

225,02

148,4

77,24

13/06/2005

205,65

272,62

264,84

174,87

90,34

13/06/2006

288,9

326,8

287,66

206,16

100,02

13/06/2007

448,22

439,38

405,4

269,07

133,60

13/06/2008

369,93

326,78

346,02

207,45

107,39

12/06/2009

318,37

253,11

285,53

177,61

72,78

Return Y

12,28%

9,73%

11,06%

5,91%

-3,13%

21

www.value-investing.eu

Name

PIOT50020

ERP550020

NCAV50020

MF50020

EURO STOXX

Code

X%PIOT(PI)

X%ERP5

X%NCAV

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

102,69

115,36

143,71

115,14

136,78

13/06/2001

117,23

129,82

160,56

121,58

112,37

13/06/2002

123,59

143,7

136,8

130,05

84,64

13/06/2003

107,49

111,75

131,73

115,44

67,98

14/06/2004

149,68

150,37

171,15

160,09

77,24

13/06/2005

192,52

188,68

204,62

193,09

90,34

13/06/2006

240,03

219,29

220,77

229,49

100,02

13/06/2007

355,33

287,83

303,4

301,2

133,60

13/06/2008

301,85

223,96

250,13

229,8

107,39

12/06/2009

252,69

180,35

201,06

193,96

72,78

Return Y

9,71%

6,07%

7,23%

6,85%

-3,13%

22

www.value-investing.eu

Name

PIOT100020

ERP51000C20

NCAV100020

MF100020

EURO STOXX

Code

X%PIOT(PI)

X%ERP5

X%NCAV

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

98,92

116,01

177,38

125,46

136,78

13/06/2001

119,29

129,4

157,09

138,52

112,37

13/06/2002

119,9

141,31

138,76

136,62

84,64

13/06/2003

95,68

118,69

129,65

123,56

67,98

14/06/2004

129,47

153

170,94

164,7

77,24

13/06/2005

172,57

190,65

199,43

195,65

90,34

13/06/2006

213,33

224,25

217,6

222,96

100,02

13/06/2007

324,24

308,4

307,94

298,37

133,60

13/06/2008

272,65

268,59

252

236,08

107,39

12/06/2009

211,75

227,21

199,23

206,58

72,78

Return Y

7,79%

8,55%

7,14%

7,52%

-3,13%

23

www.value-investing.eu

Name

PIOT100050

ERP5100050

NCAV100050

MF100050

EURO STOXX

Code

X%PIO(PI)

X%ERP

X%NCA

X%M

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

107,61

114,85

152,57

126,69

136,78

13/06/2001

121,86

123,87

121,91

135,09

112,37

13/06/2002

125,56

127,25

99,42

132,93

84,64

13/06/2003

105,88

108,92

91,97

116,84

67,98

14/06/2004

140,09

136,18

115,51

145,63

77,24

13/06/2005

186,01

167,06

130,09

173,02

90,34

13/06/2006

225,36

199,94

147,13

200,7

100,02

13/06/2007

337,29

273,37

193,12

289,29

133,60

13/06/2008

264,05

235,09

158,38

241,15

107,39

12/06/2009

195,36

190,95

121,67

185,88

72,78

Return Y

6,93%

6,68%

1,98%

6,40%

-3,13%

24

www.value-investing.eu

Name

PIOT200020

ERP5200020

NCAV200020

MF200020

EURO STOXX

Code

X%PIOT(PI)

X%ERP5

X%NCAV

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

103,62

120,41

209,63

146,05

136,78

13/06/2001

112,01

131,94

183,11

158,46

112,37

13/06/2002

110,99

137,35

155,83

157,49

84,64

13/06/2003

91,33

128,54

128,46

148,64

67,98

14/06/2004

117,52

162,5

152,49

187,68

77,24

13/06/2005

154,29

194,39

175,09

225,98

90,34

13/06/2006

183,84

234,28

211,07

253,23

100,02

13/06/2007

295,29

319,18

304,24

323,55

133,60

13/06/2008

259,98

258,21

239,13

239,69

107,39

12/06/2009

180,41

203,89

182,02

185,08

72,78

Return Y

6,08%

7,38%

6,17%

6,35%

-3,13%

25

www.value-investing.eu

Name

PIOT200040

ERP5200040

NCAV200040

MF200040

EURO STOXX

Code

X%PIO

X%ERP

X%NCA

X%M

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

105,43

121,76

173,52

130,43

136,78

13/06/2001

114,75

123,81

137,18

124,84

112,37

13/06/2002

104,52

118,81

108,49

119,85

84,64

13/06/2003

90,71

106,8

97,07

105,27

67,98

14/06/2004

118,85

135,46

109,93

130,52

77,24

13/06/2005

142,73

169,49

122,1

157,41

90,34

13/06/2006

165,95

205,61

146,44

183,96

100,02

13/06/2007

257,04

280,89

201,25

264,14

133,60

13/06/2008

210,02

238,72

160,61

206,46

107,39

12/06/2009

146,47

184,13

122,14

157,36

72,78

Return Y

3,89%

6,29%

2,02%

4,64%

-3,13%

26

www.value-investing.eu

Name

PIOT500020

ERP5500020

NCAV500020

MF5000C20

EURO STOXX

Code

X%PIOT(PI)

X%ERP5

X%NCAV

X%MF

DJEURST

14/06/1999

100

100

100

100

100

13/06/2000

114,39

126,1

165,78

125,58

136,78

13/06/2001

127,95

121,41

121,84

116,67

112,37

13/06/2002

111,95

103,49

90,26

103,63

84,64

13/06/2003

89,53

90,24

80,94

86,24

67,98

14/06/2004

115,67

108,1

86,83

97,57

77,24

13/06/2005

133,76

131,78

91,78

116,28

90,34

13/06/2006

153,48

150,73

102,47

130,61

100,02

13/06/2007

221,58

197,02

137,3

169,07

133,60

13/06/2008

172,84

163,24

116,47

136,7

107,39

12/06/2009

122,15

128,98

85,55

105,39

72,78

Return Y

2,02%

2,58%

-1,55%

0,53%

-3,13%

27

www.value-investing.eu

28

www.value-investing.eu

29

www.value-investing.eu

30

www.value-investing.eu

C

We ranked all companies and split them up in deciles. (Minimum Market Caps 10 100 and 500 Millon Euros).

Our purpose in doing that was to see wether there was any consistency in the screeneing methods over a number

of years.

As you see, the ranking methods are robust over a 10-year stimespan.

Magic Formula / Minimum Market Cap 10mll

YEAR

D1

D2

D3

T1999

35,76%

22,63%

D4

D5

D6

D7

D8

D9

D10

46,37%

49,94%

41,16%

27,23%

41,62%

26,68%

34,72%

43,45%

T2000

7,52%

3,15%

-5,91%

-16,11%

-16,70%

-21,72%

-23,46%

-22,19%

-31,73%

-28,02%

T2001

-3,77%

-10,98%

-11,24%

-10,27%

-9,44%

-13,39%

-15,87%

-21,53%

-33,14%

-42,57%

T2002

-8,46%

-11,96%

-7,96%

-16,97%

-11,96%

-9,59%

-10,55%

-11,62%

-10,97%

-5,92%

T2003

35,69%

32,49%

33,13%

25,95%

26,21%

24,36%

19,28%

26,30%

34,00%

39,35%

T2004

32,60%

22,16%

22,75%

20,42%

21,81%

19,49%

26,73%

18,65%

16,05%

14,67%

T2005

17,19%

24,88%

16,65%

19,61%

23,99%

25,01%

19,39%

20,79%

20,95%

13,07%

T2006

39,60%

37,55%

38,96%

39,77%

41,60%

42,80%

47,58%

36,35%

36,71%

16,70%

T2007

-13,68%

-19,39%

-17,91%

-17,20%

-14,81%

-14,95%

-20,51%

-18,14%

-24,79%

-29,66%

T2008

-25,66%

-23,32%

-25,28%

-26,91%

-26,06%

-27,84%

-29,88%

-30,84%

-30,52%

-28,58%

Total

142,87%

70,38%

82,79%

43,82%

59,38%

26,94%

21,11%

-4,47%

-26,44%

-40,90%

9,28%

5,47%

6,22%

3,70%

4,77%

2,41%

1,93%

-0,46%

-3,02%

-5,12%

D5

D6

D7

D8

D9

D10

Return

Graham NCAV on Market Value / Minimum Market Cap 10mll

YEAR

D1

D2

D3

D4

T1999

27,64%

48,47%

28,35%

40,23%

43,70%

25,90%

35,96%

60,56%

54,20%

28,96%

T2000

40,55%

0,01%

3,38%

-15,13%

13,76%

-28,59%

-3,40%

-32,07%

-26,93%

-21,29%

T2001

-18,40%

-8,59%

-16,29%

-8,96%

-20,14%

-34,15%

-22,77%

-41,57%

-26,84%

-41,57%

T2002

-38,42%

-0,15%

-11,51%

-8,72%

-11,40%

-12,57%

9,68%

-6,94%

-15,65%

-14,45%

T2003

40,11%

49,36%

34,55%

24,72%

47,92%

44,18%

43,48%

23,19%

26,95%

6,30%

T2004

36,24%

29,86%

23,84%

15,27%

19,10%

-5,48%

10,54%

46,54%

12,19%

4,66%

T2005

40,74%

23,47%

16,38%

15,56%

18,16%

10,82%

34,38%

17,27%

17,36%

19,01%

T2006

49,41%

28,32%

38,36%

20,39%

30,84%

39,99%

24,60%

45,01%

23,21%

39,75%

T2007

29,21%

-16,74%

-17,23%

-8,02%

-13,62%

-18,66%

-31,78%

-23,58%

-17,52%

-26,17%

T2008

-43,88%

-17,00%

-19,67%

-25,03%

-18,25%

-24,34%

-27,11%

-25,90%

-23,57%

-33,57%

Total

162,38%

187,78%

75,35%

36,39%

122,44%

-32,65%

46,91%

3,09%

-9,71%

-53,96%

Return

10,13%

11,15%

5,78%

3,15%

8,32%

-3,88%

3,92%

0,30%

-1,02%

-7,46%

31

www.value-investing.eu

Piotroski Price to Book (20% best companies) / Minimum Market Cap 10mll

YEAR

D1

D2

D3

D4

D5

D6

D7

D8

D9

D10

T1999

21,02%

35,74%

56,53%

10,83%

39,55%

15,34%

36,82%

93,91%

73,41%

102,33%

T2000

83,88%

12,64%

1,97%

-5,42%

-9,71%

-4,25%

14,31%

-33,14%

-31,94%

-35,17%

T2001

-28,20%

-0,38%

-0,38%

-17,00%

-23,79%

-26,23%

-22,85%

-27,48%

-34,96%

-7,47%

T2002

7,26%

-8,05%

7,97%

6,60%

10,88%

-9,59%

-2,53%

-0,17%

-11,82%

-7,52%

T2003

39,88%

35,12%

24,76%

45,19%

33,37%

1,48%

1,80%

-1,12%

21,66%

33,53%

T2004

44,33%

30,71%

14,89%

1,02%

33,51%

-6,71%

-4,69%

16,79%

0,22%

19,29%

T2005

55,37%

46,06%

18,63%

25,20%

18,50%

28,90%

11,96%

22,27%

26,06%

16,65%

T2006

59,39%

54,04%

39,12%

49,74%

46,97%

37,58%

52,67%

49,97%

40,30%

50,00%

T2007

38,94%

-14,47%

-9,44%

-21,69%

-26,32%

-17,99%

-26,51%

-23,88%

-17,58%

-11,73%

T2008

-34,27%

-26,76%

-34,77%

-36,40%

-28,24%

-37,21%

-27,19%

-33,47%

-40,60%

-41,23%

Total

682,53%

248,59%

139,92%

27,03%

74,60%

-36,32%

4,36%

0,67%

-28,53%

62,29%

Return

22,84%

13,30%

9,15%

2,42%

5,73%

-4,41%

0,43%

0,07%

-3,30%

4,96%

D3

D4

D5

D6

D7

D8

D9

D10

ERP5 / Minimum Market Cap 10mll

YEAR

D1

D2

T1999

19,70%

19,96%

13,77%

23,20%

18,37%

22,24%

23,94%

24,03%

27,27%

-0,29%

T2000

16,40%

12,35%

5,87%

0,84%

-0,34%

-2,57%

-10,33%

-3,52%

-2,81%

-18,92%

T2001

-12,05%

1,66%

-6,09%

-0,09%

2,09%

-2,00%

-1,19%

-13,67%

-2,69%

-24,49%

T2002

-21,80%

-7,61%

-10,47%

-12,20%

-10,69%

-11,99%

-5,66%

-7,13%

-1,71%

-7,17%

T2003

35,88%

38,22%

35,89%

31,57%

31,03%

26,44%

23,39%

28,60%

31,76%

19,93%

T2004

47,59%

26,05%

31,94%

18,47%

26,68%

29,25%

21,64%

26,50%

21,25%

13,73%

T2005

35,26%

19,11%

29,97%

18,63%

27,10%

22,50%

19,62%

18,96%

16,29%

12,25%

T2006

51,57%

37,81%

43,36%

44,12%

41,92%

42,56%

43,14%

43,29%

34,26%

16,81%

T2007

1,56%

-18,63%

-16,48%

-16,08%

-17,60%

-15,23%

-17,22%

-21,41%

-22,62%

-31,63%

T2008

-51,38%

-25,57%

-26,43%

-26,73%

-28,14%

-27,26%

-28,74%

-30,59%

-31,04%

-31,62%

Total

94,53%

119,25%

107,84%

78,56%

90,73%

80,79%

57,04%

45,11%

57,48%

-52,62%

Return

6,88%

8,17%

7,59%

5,97%

6,67%

6,10%

4,62%

3,79%

4,65%

-7,20%

D5

D6

D7

D8

D9

D10

20% best MFI ranked by Piotroski/ Minimum Market Cap 10mll

YEAR

D1

D2

D3

D4

T1999

35,31%

22,96%

22,83%

33,48%

47,99%

55,23%

27,78%

28,41%

14,99%

37,65%

T2000

39,51%

11,11%

11,01%

6,01%

5,29%

6,34%

7,39%

-6,95%

-7,35%

-3,53%

T2001

3,82%

-5,32%

-13,15%

7,32%

-3,28%

-2,02%

-21,65%

-14,56%

-18,61%

-16,66%

T2002

-14,80%

-0,28%

-8,43%

-2,13%

-13,96%

-12,97%

-14,56%

-14,62%

-23,01%

-10,46%

T2003

32,15%

55,98%

28,65%

35,65%

32,17%

38,12%

28,57%

33,04%

25,43%

19,26%

T2004

49,51%

27,26%

29,03%

25,76%

38,28%

23,67%

19,99%

16,71%

40,85%

16,52%

T2005

33,99%

29,99%

17,52%

23,52%

48,23%

9,01%

11,45%

22,09%

11,01%

10,26%

T2006

48,50%

37,86%

37,25%

39,76%

31,32%

40,07%

56,05%

32,06%

32,60%

44,43%

T2007

26,78%

-18,75%

-16,49%

-13,12%

-20,40%

-18,22%

-18,06%

-6,12%

-19,90%

-17,24%

T2008

-40,53%

-17,36%

-22,08%

-31,36%

-24,32%

-22,28%

-26,63%

-21,75%

-30,12%

-31,26%

Total

394,92%

208,09%

88,94%

161,04%

177,93%

133,33%

48,15%

60,32%

-2,81%

24,74%

Return

17,34%

11,91%

6,57%

10,07%

10,76%

8,84%

4,01%

4,83%

-0,28%

2,24%

32

www.value-investing.eu

20% best ERP5-ranked by Piotroski / Minimum Market Cap 10mll

YEAR

D1

D2

D3

D4

D5

D6

D7

D8

D9

D10

26,30%

15,83%

37,55%

11,06%

20,10%

21,83%

11,29%

T1999

32,16%

14,62%

9,14%

T2000

23,31%

11,54%

11,46%

3,02%

10,62%

3,35%

16,88%

-0,60%

1,64%

-2,95%

T2001

7,28%

1,68%

6,65%

-0,13%

6,62%

-5,17%

-0,59%

-2,96%

-5,29%

-6,85%

T2002

-7,73%

-4,36%

1,18%

-6,21%

-5,26%

-19,90%

-1,28%

-14,48%

-16,32%

-13,94%

T2003

33,93%

54,58%

36,04%

32,63%

38,65%

35,38%

40,62%

28,99%

37,57%

27,64%

T2004

61,75%

31,07%

39,18%

22,21%

34,70%

30,96%

24,83%

25,92%

23,44%

15,31%

T2005

38,28%

29,72%

27,25%

23,53%

49,89%

14,51%

15,00%

27,35%

12,11%

14,84%

T2006

53,80%

32,86%

43,89%

40,78%

36,87%

41,23%

49,78%

35,92%

34,51%

54,06%

T2007

40,39%

-13,78%

-18,68%

-16,33%

-22,06%

-10,19%

-18,92%

-15,08%

-16,02%

-25,60%

T2008

-49,54%

-22,56%

-18,37%

-26,97%

-23,83%

-18,55%

-21,10%

-24,32%

-25,20%

-30,90%

Total

426,49%

189,89%

202,09%

109,93%

194,42%

126,45%

146,39%

78,98%

57,86%

15,93%

Return

18,07%

11,23%

11,69%

7,70%

11,40%

8,52%

9,44%

5,99%

4,67%

1,49%

D4

D5

D6

D7

D8

D9

D10

MAGIC FORMULA LIST -MIN MARKET CAP 100 MLL

YEAR

D1

D2

D3

T1999

24,93%

25,46%

40,65%

29,83%

28,50%

29,91%

38,45%

41,55%

13,17%

44,29%

T2000

10,96%

1,07%

-8,75%

-19,31%

-18,10%

-23,93%

-26,43%

-29,11%

-37,98%

-46,98%

T2001

-6,31%

-7,20%

-8,77%

-9,72%

-12,16%

-13,69%

-14,58%

-14,01%

-25,55%

-33,32%

T2002

-9,59%

-13,09%

-6,98%

-13,99%

-15,93%

-9,23%

-10,43%

-5,10%

-6,51%

-11,43%

T2003

34,70%

36,07%

28,75%

31,33%

28,21%

26,99%

27,46%

24,81%

26,10%

26,75%

T2004

25,52%

27,92%

23,46%

25,09%

22,52%

29,32%

27,29%

21,49%

19,93%

19,12%

T2005

19,19%

22,48%

17,06%

19,69%

18,85%

19,71%

20,74%

19,77%

12,19%

19,66%

T2006

42,20%

29,79%

41,83%

38,33%

40,94%

48,27%

40,64%

51,95%

37,24%

31,07%

T2007

-16,98%

-22,91%

-20,13%

-16,46%

-18,78%

-11,61%

-17,37%

-19,53%

-17,32%

-29,25%

T2008

-26,27%

-26,19%

-26,54%

-26,81%

-27,99%

-26,55%

-29,17%

-30,01%

-30,72%

-27,83%

Total

105,95%

61,01%

68,63%

35,28%

19,62%

46,52%

25,66%

27,26%

-34,83%

-45,37%

Return

7,49%

4,88%

5,36%

3,07%

1,81%

3,89%

2,31%

2,44%

-4,19%

-5,87%

D3

D4

D5

D6

D7

D8

D9

D10

NCAVB LIST MIN MARKET CAP 100 MLL

YEAR

D1

D2

T1999

37,75%

48,54%

36,91%

23,69%

24,67%

31,84%

40,64%

35,72%

4,46%

36,72%

T2000

43,59%

0,06%

-3,59%

-19,93%

-14,04%

-34,15%

-24,80%

-42,97%

-36,69%

-46,16%

T2001

-56,57%

15,35%

-23,96%

-23,04%

-25,43%

-20,71%

-31,03%

-42,00%

-40,68%

-41,19%

T2002

-54,47%

0,63%

-2,90%

-12,26%

-6,07%

-20,57%

-10,54%

-4,97%

-24,03%

-24,24%

T2003

14,93%

44,42%

33,56%

41,76%

15,90%

32,72%

31,72%

42,39%

15,69%

30,26%

T2004

53,47%

30,09%

27,66%

19,08%

18,54%

14,38%

14,55%

9,70%

13,18%

23,52%

T2005

38,04%

19,81%

24,18%

23,21%

12,22%

14,37%

23,77%

20,81%

14,85%

21,18%

T2006

52,06%

21,73%

35,75%

24,12%

49,44%

38,65%

38,95%

28,76%

40,67%

22,91%

T2007

8,29%

-20,68%

-17,43%

-21,09%

-4,38%

-19,81%

-31,67%

-20,00%

-32,42%

-21,38%

T2008

-48,85%

-17,65%

-25,88%

-13,76%

-22,38%

-22,04%

-23,78%

-19,20%

-28,73%

-33,47%

Total

-19,80%

208,75%

71,43%

17,49%

28,37%

-17,72%

-11,82%

-32,98%

-69,64%

-58,88%

Return

-2,18%

11,93%

5,54%

1,62%

2,53%

-1,93%

-1,25%

-3,92%

-11,24%

-8,50%

33

www.value-investing.eu

PIOTROSKI PRICE TO BOOK LIST MIN MARKET CAP 100 MLL

YEAR

D1

D2

D3

D4

D5

D6

D7

D8

D9

D10

T1999

17,57%

34,26%

36,53%

62,10%

28,87%

20,83%

4,99%

28,39%

59,63%

73,79%

T2000

72,35%

7,92%

-2,49%

17,26%

12,10%

-13,96%

-12,64%

-15,66%

-25,44%

-37,52%

T2001

-38,90%

-6,80%

6,92%

-6,90%

-15,68%

-4,49%

-9,40%

-34,31%

-10,01%

-23,33%

T2002

-20,06%

-10,21%

-3,66%

-4,81%

-12,98%

-6,41%

-5,04%

-13,42%

-23,17%

-6,34%

T2003

46,06%

15,81%

26,28%

26,57%

42,55%

32,94%

24,31%

11,23%

11,71%

18,06%

T2004

38,02%

8,14%

15,51%

32,48%

17,94%

1,09%

20,90%

11,52%

21,37%

21,24%

T2005

53,05%

32,25%

22,07%

17,61%

17,73%

36,96%

25,79%

6,11%

39,02%

18,30%

T2006

60,29%

66,95%

50,74%

59,71%

50,23%

52,17%

41,75%

58,34%

24,54%

21,65%

T2007

9,09%

-9,66%

-15,16%

6,30%

-25,51%

-27,23%

-17,53%

-24,01%

-14,75%

-20,92%

T2008

-49,40%

-31,70%

-37,71%

-30,67%

-32,56%

-28,19%

-23,19%

-33,14%

-27,84%

-46,45%

Total

170,18%

106,84%

94,51%

290,96%

58,36%

36,01%

33,96%

-34,79%

18,83%

-31,98%

Return

10,45%

7,54%

6,88%

14,61%

4,70%

3,12%

2,97%

-4,19%

1,74%

-3,78%

D3

D4

D5

D6

D7

D8

D9

D10

ERP5 LIST MIN MARKET CAP 100 MLL

YEAR

D1

D2

T1999

16,69%

14,92%

15,59%

28,55%

19,85%

18,48%

31,04%

13,86%

32,17%

17,98%

T2000

39,06%

11,18%

9,21%

-0,73%

2,02%

-8,77%

-0,21%

-10,45%

-7,80%

-15,87%

T2001

-8,21%

-2,48%

-5,48%

1,77%

2,30%

-7,09%

0,27%

-6,26%

-10,35%

-13,24%

T2002

-21,00%

-8,55%

-13,15%

-11,13%

-12,71%

-8,48%

-13,32%

-8,20%

-3,21%

-2,07%

T2003

36,48%

36,89%

28,97%

31,05%

34,39%

29,52%

27,93%

25,79%

27,96%

19,81%

T2004

46,39%

28,50%

30,22%

25,25%

21,15%

31,13%

28,92%

25,44%

21,52%

7,52%

T2005

31,09%

21,60%

22,21%

17,59%

18,98%

21,68%

20,32%

12,66%

15,60%

13,32%

T2006

54,34%

38,02%

38,57%

42,62%

41,07%

49,04%

44,11%

41,30%

46,52%

28,03%

T2007

11,70%

-20,88%

-20,98%

-16,79%

-13,27%

-20,18%

-14,71%

-14,70%

-20,41%

-28,01%

T2008

-51,40%

-27,35%

-24,52%

-30,39%

-28,01%

-24,41%

-29,74%

-33,41%

-29,87%

-30,65%

Total

158,24%

93,38%

75,79%

84,03%

86,30%

70,78%

94,78%

25,19%

55,43%

-21,33%

Return

9,95%

6,82%

5,80%

6,29%

6,42%

5,50%

6,89%

2,27%

4,51%

-2,37%

D7

D8

D9

D10

20,40%

20% best MAGIC FORMULA ORDER BY PIOTROSKY SCORE -MIN MARKET CAP 100 MLL

YEAR

D1

D2

D3

D4

D5

D6

T1999

56,35%

31,60%

12,73%

26,07%

27,75%

29,51%

20,76%

55,71%

25,36%

T2000

24,74%

13,48%

T2001

-6,79%

-1,35%

18,16%

1,16%

9,71%

-12,60%

20,20%

-10,45%

-10,47%

-9,22%

-3,78%

-15,88%

6,15%

-2,29%

-9,37%

-15,66%

-20,40%

-12,31%

T2002

-7,25%

-7,80%

-7,19%

-8,48%

-12,81%

-18,02%

-2,66%

-15,46%

-19,10%

-24,79%

T2003

T2004

8,14%

47,43%

48,93%

20,43%

41,43%

29,55%

38,55%

38,87%

22,06%

27,22%

57,88%

34,73%

24,39%

25,06%

29,63%

23,25%

24,94%

18,56%

18,02%

37,92%

T2005

50,35%

36,06%

22,56%

22,89%

32,80%

16,30%

13,48%

21,84%

19,46%

12,29%

T2006

47,95%

28,85%

34,47%

41,34%

30,94%

40,28%

44,74%

37,29%

41,76%

37,33%

T2007

18,09%

-22,15%

-17,88%

-18,92%

-12,89%

-28,77%

-21,78%

-21,32%

-10,97%

-33,16%

T2008

-58,61%

-24,55%

-24,87%

-20,39%

-35,42%

-18,66%

-26,29%

-27,76%

-29,18%

-30,41%

Total

213,00%

177,83%

124,09%

65,80%

132,61%

36,84%

109,92%

55,63%

11,19%

-9,27%

Return

12,09%

10,76%

8,40%

5,19%

8,81%

3,19%

7,70%

4,52%

1,07%

-0,97%

34

www.value-investing.eu

20% best ERP5 ORDER BY PIOTROSKY SCORE -MIN MARKET CAP 100 MLL

YEAR

D1

D2

D3

D4

D5

D6

D7

D8

D9

D10

T1999

34,77%

11,59%

5,13%

39,98%

6,81%

16,58%

7,14%

23,20%

15,86%

15,79%

T2000

29,15%

13,36%

18,14%

5,02%

8,76%

12,67%

5,35%

14,30%

0,32%

-6,50%

T2001

3,45%

1,77%

1,56%

-3,75%

9,71%

-0,38%

-4,07%

-0,32%

-3,20%

-8,69%

T2002

-9,32%

-6,36%

-9,66%

-11,34%

-2,10%

-17,82%

-5,56%

-16,09%

-16,22%

-15,24%

T2003

17,53%

38,80%

29,81%

30,09%

32,61%

31,49%

43,50%

37,19%

28,00%

37,03%

T2004

70,77%

32,09%

30,93%

29,53%

32,94%

38,96%

16,33%

22,67%

26,62%

25,86%

T2005

42,97%

31,19%

22,27%

27,60%

32,81%

18,00%

16,51%

23,90%

23,41%

14,66%

T2006

50,12%

28,91%

42,14%

37,94%

36,46%

44,67%

50,61%

37,50%

30,05%

42,60%

T2007

27,94%

-13,48%

-20,21%

-15,97%

-25,17%

-16,68%

-20,44%

-26,28%

-9,22%

-32,26%

T2008

-56,19%

-29,17%

-18,28%

-25,83%

-32,40%

-15,12%

-31,50%

-22,98%

-24,08%

-23,62%

Total

294,18%

129,06%

119,49%

131,92%

101,66%

137,20%

63,24%

91,75%

68,99%

22,26%

Return

14,70%

8,64%

8,18%

8,78%

7,27%

9,02%

5,02%

6,73%

5,39%

2,03%

MAGIC FORMULA LIST -MIN MARKET CAP 500 MLL

YEAR

D1

D2

D3

D4

D5

D6

D7

D8

D9

D10

T1999

27,88%

28,20%

39,38%

27,77%

29,40%

5,70%

29,22%

40,53%

14,98%

20,20%

T2000

6,22%

-6,46%

-8,53%

-18,19%

-12,04%

-17,94%

-17,24%

-11,25%

-28,24%

-44,02%

T2001

1,37%

-4,79%

-12,67%

-10,42%

-9,28%

-12,30%

-18,89%

-12,32%

-13,72%

-29,33%

T2002

-12,49%

-9,91%

-11,40%

-14,26%

-19,96%

-13,44%

-5,91%

-9,19%

-5,23%

-13,61%

T2003

32,79%

23,42%

28,00%

26,82%

22,41%

25,72%

28,65%

30,75%

31,14%

25,02%

T2004

23,22%

26,95%

19,43%

24,73%

26,65%

29,12%

39,69%

27,06%

19,85%

8,27%

T2005

18,50%

18,86%

14,28%

18,33%

13,90%

17,57%

19,56%

15,05%

20,28%

14,69%

T2006

44,02%

35,00%

43,49%

41,79%

42,72%

42,41%

42,24%

37,40%

44,98%

41,79%

T2007

-15,34%

-21,35%

-17,88%

-15,00%

-18,07%

-14,73%

-16,29%

-16,27%

-17,32%

-26,75%

T2008

-24,89%

-26,60%

-21,26%

-29,99%

-25,12%

-22,99%

-27,07%

-34,44%

-28,95%

-33,25%

Total

113,94%

49,30%

59,89%

26,80%

27,76%

17,52%

52,27%

43,19%

8,62%

-55,79%

7,90%

4,09%

4,80%

2,40%

2,48%

1,63%

4,29%

3,66%

0,83%

-7,84%

Return

NCAVB LIST MIN MARKET CAP 500 MLL

YEAR

D1

D2

D3

D4

D5

T1999

35,92%

91,54%

34,90%

33,82%

20,16%

T2000

96,72%

-9,19%

-13,81%

-24,48%

T2001

-77,57%

-7,85%

-19,59%

T2002

-34,06%

-8,35%

T2003

13,80%

32,11%

T2004

42,46%

T2005

T2006

D7

D8

D9

124,70%

16,68%

14,20%

61,32%

108,91%

-53,07%

-26,79%

-43,04%

-30,77%

-48,21%

-59,01%

-16,44%

-30,06%

-30,35%

-32,74%

-31,19%

-32,46%

-29,45%

-21,81%

-12,85%

-22,18%

-10,51%

-20,61%

-12,50%

-27,14%

-19,40%

31,55%

32,15%

27,42%

22,77%

21,40%

22,09%

10,18%

27,10%

18,52%

27,20%

19,16%

11,22%

30,80%

2,18%

12,91%

19,51%

12,44%

16,86%

13,84%

12,14%

19,68%

11,93%

18,07%

13,67%

9,83%

12,61%

-6,48%

38,18%

39,67%

39,82%

21,23%

41,01%

39,68%

51,75%

35,97%

22,01%

4,89%

T2007

-6,32%

-23,33%

-13,68%

-14,28%

-13,16%

-7,06%

-21,35%

-16,83%

-16,84%

-22,46%

T2008

-49,48%

-19,89%

-24,60%

-27,29%

-23,75%

-22,58%

-19,87%

-39,77%

-20,08%

-26,41%

Total

-50,99%

124,60%

24,84%

4,80%

-54,54%

95,34%

-52,15%

-50,90%

-50,57%

-61,05%

-6,88%

8,43%

2,24%

0,47%

-7,58%

6,93%

-7,11%

-6,87%

-6,80%

-9,00%

Return

35

D6

D10

www.value-investing.eu

PIOTROSKI PRICE TO BOOK LIST MIN MARKET CAP 500 MLL

YEAR

D1

D2

D3

D4

D5

T1999

11,75%

36,95%

25,12%

19,63%

18,07%

-11,23%

T2000

28,66%

9,82%

8,44%

4,20%

-0,45%

T2001

-34,02%

-1,72%

8,84%

-24,30%

T2002

-48,08%

-12,54%

-9,43%

-25,16%

T2003

61,01%

31,88%

9,50%

8,43%

T2004

21,99%

27,60%

13,41%

T2005

42,56%

31,05%

22,25%

T2006

48,84%

60,91%

T2007

11,96%

T2008

Total

Return

D8

D9

D10

5,38%

43,42%

24,16%

30,91%

-6,11%

-23,94%

2,78%

-29,72%

-27,55%

-0,09%

-4,73%

-24,87%

-16,90%

-28,70%

-30,43%

14,43%

-14,63%

-7,18%

-20,49%

-8,30%

-3,11%

26,00%

63,66%

33,97%

26,01%

2,41%

15,67%

34,98%

40,10%

26,82%

12,63%

24,99%

5,39%

2,60%

26,93%

9,92%

24,16%

22,25%

6,79%

0,15%

36,67%

52,76%

37,53%

54,29%

47,64%

67,42%

37,51%

59,81%

26,00%

-14,62%

-23,50%

-12,83%

-23,79%

-21,28%

-35,14%

-18,01%

-19,19%

-29,17%

-49,94%

-28,59%

-41,15%

-28,81%

-29,17%

-30,43%

-32,34%

-35,58%

-25,19%

-30,82%

15,04%

179,70%

39,64%

11,96%

117,16%

41,23%

-24,23%

18,98%

-40,42%

-35,98%

1,41%

10,83%

3,40%

1,14%

8,06%

3,51%

-2,74%

1,75%

-5,05%

-4,36%

ERP5 LIST MIN MARKET CAP 500 MLL

YEAR

D1

D2

D3

D4

T1999

13,13%

11,93%

37,97%

17,30%

T2000

21,31%

14,51%

-2,46%

T2001

-2,83%

1,25%

T2002

-21,88%

T2003

28,48%

T2004

D7

D6

D7

D8

D9

3,85%

17,21%

26,84%

16,22%

18,69%

7,49%

-1,83%

1,04%

3,25%

-3,07%

-12,99%

5,17%

-13,94%

-10,60%

-4,29%

-1,79%

-8,63%

-2,95%

-12,57%

-13,59%

-8,09%

-14,67%

-19,21%

-11,67%

-12,13%

-12,53%

-7,42%

-12,04%

-5,01%

-5,48%

25,22%

32,61%

22,42%

27,67%

34,72%

27,58%

25,38%

24,55%

27,25%

44,57%

38,04%

25,08%

19,50%

29,55%

35,17%

30,70%

20,13%

24,38%

8,36%

T2005

27,95%

22,44%

16,81%

15,83%

15,26%

15,73%

14,46%

14,38%

14,22%

20,42%

T2006

64,05%

42,47%

39,39%

42,00%

42,26%

43,00%

41,82%

49,90%

42,11%

37,43%

T2007

17,80%

-22,95%

-20,00%

-14,94%

-14,61%

-15,78%

-12,79%

-17,67%

-16,61%

-23,26%

T2008

-47,49%

-26,28%

-24,02%

-29,06%

-27,21%

-24,59%

-27,53%

-33,80%

-31,55%

-31,49%

Total

151,23%

89,64%

59,58%

41,34%

52,63%

85,12%

88,99%

9,45%

47,09%

-3,59%

9,65%

6,61%

4,78%

3,52%

4,32%

6,35%

6,57%

0,91%

3,93%

-0,36%

Return

D5

D6

D10

20% best MAGIC FORMULA ORDER BY PIOTROSKY SCORE - MIN MARKET CAP 500 MLL

YEAR

D1

D2

D3

D4

D5

D6

D7

D8

D9

D10

T1999

53,40%

43,13%

-9,19%

41,80%

33,15%

37,56%

-2,99%

36,12%

11,42%

49,38%

T2000

42,63%

16,21%

8,16%

10,28%

-14,40%

-15,38%

-13,33%

4,39%

-6,60%

-14,17%

T2001

-19,20%

5,09%

-5,46%

-5,06%

-9,23%

20,51%

-7,47%

-5,15%

-14,14%

5,03%

T2002

16,72%

-14,22%

-20,46%

-11,24%

-11,85%

-12,15%

-15,63%

-9,25%

-24,13%

-8,35%

T2003

15,01%

31,89%

54,60%

23,83%

26,30%

37,41%

39,16%

25,59%

4,62%

18,65%

T2004

46,01%

21,77%

22,39%

22,31%

34,57%

29,57%

26,37%

10,78%

24,51%

29,01%

T2005

42,08%

17,88%

57,20%

15,33%

18,69%

14,77%

10,63%

-1,29%

16,53%

6,12%

T2006

40,92%

39,42%

47,77%

35,52%

34,06%

50,74%

34,86%

43,29%

56,26%

32,21%

T2007

5,97%

-25,57%

-17,94%

-11,01%

-14,17%

-29,61%

-10,68%

-18,13%

-5,82%

-28,64%

T2008

-54,56%

-18,13%

-18,88%

-25,68%

-27,84%

-31,31%

-24,67%

-23,88%

-40,84%

-24,18%

Total

234,09%

141,14%

116,09%

106,29%

52,76%

83,53%

15,87%

49,98%

-10,41%

43,41%

12,82%

9,20%

8,01%

7,51%

4,33%

6,26%

1,48%

4,14%

-1,09%

3,67%

Return

36

www.value-investing.eu

20% best ERP5 ORDER BY PIOTROSKY SCORE - MIN MARKET CAP 500 MLL

YEAR

D1

D2

D3

D4

D5

D6

D7

T1999

19,20%

41,93%

17,67%

49,00%

14,89%

29,80%

-2,99%

T2000

25,32%

16,13%

23,45%

0,41%

5,79%

2,23%

5,97%

D8

D9

D10

3,86%

25,28%

12,51%

6,38%

-4,11%

-9,42%

T2001

9,56%

4,88%

3,87%

-4,36%

14,33%

-0,64%

-17,51%

11,07%

-15,68%

-3,67%

T2002

-4,32%

-14,90%

-24,03%

-22,44%

-12,97%

-19,43%

-22,77%

-16,80%

-17,43%

-8,65%

T2003

27,92%

28,77%

22,40%

35,74%

16,51%

31,91%

38,84%

31,72%

26,47%

32,99%

T2004

55,56%

27,71%

22,73%

27,79%

21,68%

54,29%

43,28%

14,66%

35,38%

25,48%

T2005

43,23%

44,81%

24,62%

16,51%

16,37%

27,30%

19,39%

11,77%

14,01%

22,68%

T2006

50,59%

50,45%

52,99%

42,07%

26,31%

54,70%

40,61%

33,02%

37,64%

52,56%

T2007

25,19%

-24,11%

-11,25%

-15,51%

-29,14%

-16,73%

-14,18%

-36,11%

1,02%

-28,96%

T2008

-53,71%

-22,45%

-11,09%

-34,79%

-28,97%

-22,88%

-29,90%

-23,61%

-20,84%

-29,43%

Total

289,46%

210,22%

159,07%

75,57%

26,85%

173,46%

31,57%

11,89%

79,72%

40,41%

14,56%

11,99%

9,99%

5,79%

2,41%

10,58%

2,78%

1,13%

6,04%

3,45%

Return

37

www.value-investing.eu

Section 5: Conclusions

Actually buying an index fund isnt a really great idea if you want some performance in the end.

Those who bought and held an Index fund in 1999 would have suffered a total loss of 27,22% or a 3% annually by

June 2009!

As all the graphs make very clear, 100 invested in 1999 with different Value Investing strategies and different

market caps would have beaten the market, even with an mechanical stock screener and trading only once a year.

Actually sticking with your investment plan is a good thing (and is often the hardest part) if you dont want to

spend a lot of time on your investments.

Working with stock screeners and rebalancing your portfolio only once a year gives you the necessary discipline

which can sometimes be necessary.

Imagine what a full-time Value investor from Graham and Doddsville could achieve

The Value Investing strategies may underperform the market for several years, but over the long term they

clearly outperform it.

Adding consistently more stocks to your portfolio wont make returns better (we did not study the volatility

factor). This would be logical if a value strategy worked and adding more stocks brought you more to the market

average return.

Analysing the returns from the EU market and the US gives roughly the same results.

By combining different Value screening methods (ERP5/Piotroski and MF/Piotroski) you can increase your

return.

The use of combined value screeners gives you an 360 perspective on the concept of Value and protects

you from the possible loss of principal, which is, in our viewpoint the most important aspect of risk.

Using the NCAV and splitting it up in deciles sometimes gives you strange results but you have to consider that

using NCAV doesnt always reflect how cheap a company is. Graham himself only bought companies trading

at 2/3 of their NCAV.

Even if the stock market sometimes is irrational and things dont look very nice at all,

stick to fundamentals of value and dont let Mr Marketget into your system.

Dont buy stocks expensive because of projected earnings to far in the future.

Stick with the solid data that you have and over the long run youll do fine.

38

You might also like

- The Defensive Value Investor: A complete step-by-step guide to building a high-yield, low-risk share portfolioFrom EverandThe Defensive Value Investor: A complete step-by-step guide to building a high-yield, low-risk share portfolioNo ratings yet

- Quantitative Strategies for Achieving Alpha: The Standard and Poor's Approach to Testing Your Investment ChoicesFrom EverandQuantitative Strategies for Achieving Alpha: The Standard and Poor's Approach to Testing Your Investment ChoicesRating: 4 out of 5 stars4/5 (1)

- Systematic Value Investing Does It Really WorkDocument16 pagesSystematic Value Investing Does It Really WorkJUDS1234567No ratings yet

- Jean Marie Part 1Document5 pagesJean Marie Part 1ekramcalNo ratings yet

- Ben Graham Net Current Asset Values A Performance UpdateDocument9 pagesBen Graham Net Current Asset Values A Performance UpdateB.C. MoonNo ratings yet

- 10 "The Rediscovered Benjamin Graham"Document6 pages10 "The Rediscovered Benjamin Graham"X.r. GeNo ratings yet

- Jean Marie Part 2 - The InterviewsDocument5 pagesJean Marie Part 2 - The Interviewsekramcal100% (1)

- Peter LynchDocument2 pagesPeter LynchShiv PratapNo ratings yet

- Buffett - 50% ReturnsDocument3 pagesBuffett - 50% ReturnsRon BourbondyNo ratings yet

- Notes From A Seth Klarman MBA LectureDocument5 pagesNotes From A Seth Klarman MBA LecturePIYUSH GOPALNo ratings yet

- Idea VelocityDocument2 pagesIdea Velocitynirav87404No ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- Print Article on Value Investor Seth KlarmanDocument2 pagesPrint Article on Value Investor Seth KlarmanBolsheviceNo ratings yet

- R. Driehaus, Unconventional Wisdom in The Investment ProcessDocument6 pagesR. Driehaus, Unconventional Wisdom in The Investment Processbagelboy2No ratings yet

- Ako Capital - Quantificar Esses Intangíveis PDFDocument33 pagesAko Capital - Quantificar Esses Intangíveis PDFAndré ksNo ratings yet

- Ken Fisher "Super Stocks" Raimondas LenceviciusDocument13 pagesKen Fisher "Super Stocks" Raimondas LenceviciusAravind MauryaNo ratings yet

- Picking Stocks and 100 To 1 PDFDocument7 pagesPicking Stocks and 100 To 1 PDFJohn Hadriano Mellon FundNo ratings yet

- Investing For GrowthDocument8 pagesInvesting For GrowthAssfaw KebedeNo ratings yet

- g38n12d VariantPerceptionDocument2 pagesg38n12d VariantPerceptionVariant Perception ResearchNo ratings yet

- Benjamin Graham and The Birth of Value InvestingDocument85 pagesBenjamin Graham and The Birth of Value Investingrsepassi100% (1)

- Private Debt Investor Special ReportDocument7 pagesPrivate Debt Investor Special ReportB.C. MoonNo ratings yet

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Document6 pagesValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- Value Investor Insight - March 31, 2014Document11 pagesValue Investor Insight - March 31, 2014vishubabyNo ratings yet

- Jan Issue Vii TrialDocument21 pagesJan Issue Vii TrialDavid TawilNo ratings yet

- Detect Financial Shenanigans ChecklistDocument10 pagesDetect Financial Shenanigans ChecklistTrinh NgocNo ratings yet

- Understanding Debt and Currency CrisesDocument2 pagesUnderstanding Debt and Currency CrisesVariant Perception Research0% (1)

- FINANCIAL FRAUD DETECTION THROUGHOUT HISTORYDocument40 pagesFINANCIAL FRAUD DETECTION THROUGHOUT HISTORYkabhijit04No ratings yet

- Sequoia Transcript 2012Document20 pagesSequoia Transcript 2012EnterprisingInvestorNo ratings yet

- Summary of Piotroski FscoreDocument3 pagesSummary of Piotroski FscoreFredNo ratings yet

- Glenn Greenberg at ColumbiaDocument2 pagesGlenn Greenberg at ColumbiaJUDS1234567No ratings yet

- 52-Week High and Momentum InvestingDocument32 pages52-Week High and Momentum InvestingCandide17No ratings yet