Professional Documents

Culture Documents

Jesters 2006 501c10 Summerville Court 113

Uploaded by

api-3727794100%(3)100% found this document useful (3 votes)

81 views7 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

100%(3)100% found this document useful (3 votes)

81 views7 pagesJesters 2006 501c10 Summerville Court 113

Uploaded by

api-3727794Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

SCANNED JUN 2 5 2007,

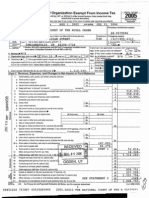

Short Form ano 145150

* Return of Organization Exempt From income Tax —

© som 990-EZ Under section SC) 527, or 4471) ofthe Internal Revenue Code 2006

(except black lung benefit trust or private foundation)

> Soorsona aganamons. aneantlingoganesion as insin secon S120)19) ms He Foam

Open to Public

=A" > moa nas ye aout png eae pateee

1 For the 2008 calendar year, or tax year beginning 2006, and ending or

B crease Tame coma 1D Employer ideniication number

Claccesowme [0% ROYAL ORDER OF JESTERS-COURT 113 | __23-7063960

Den noae Scr | erate PD pce acces a rr © Telshone nurter

ie, LOO _CHALCOTT PLACE _ =

ee: | eivoroen stm enya P+ 1 F Group Exemption

P= _ SUMMERVILLE sc_29485 Number. op

«Section 01(cJa) organizations and 4947{a)T] nonerempl chariable tata mustaach | @ Accouning method &] Gash CL] Accusl

‘a completed Schedule A (Form 990 or 980-E2) - | omer tspeaiyy >

H check » I ihe oganzaton

1 Wobste: » 2 ‘snot roquredto atach

4 organization type (check ny ona)-RUSOT(e)( LQ insartno) [Taoeri@iipor C1527 | _schooul 8 (Form 290, 260 €2 or 950-FF)

Woneck + El te orenzaion x na savior SOSa))eugporingoxgerzaton and vs rose reps re normaly not more han S25000 Aetun

‘snot requred, but he organzaion chooses oe a etry, be sure to le a compet i

{Add nes 5,62 ad 7, wine 9 delerune gloss recep, $100,000 or mo. le Form S00 seas oi FomawoEZ eS 99, 417

[Part | Revenue, Expenses, and Changes in Net Assets or Fund Balances (S00 pago #7 ofhernstwciors )

Contnbutons. ois, grants, an ela amount rocowed : I

retura

7

2. Program sence revenue eluding government fees and contracts

3. Momborsnip dues and assessments,

4 evostment acme

$52 Gross amount trom sale of assets other than ventory

' Less costo other basis and sales expenses :

€ Gan yee tem sal of assets cer than venir (ne Salas Ie Sb each schedule)

{6 Speci! events and actwrbas (attach schedule) If any amount i Fram gaming, check here

Gross revenue inotincluing — $ ct contrbutons

spartedon ine 1) vee [ead

+ (ts cnc onenes der fan eae eps bee

Netcom o (ss) ro spec evens and ates (ine 6 es ine 6)

7 Groas sales of eventary, las returns ang allowances js

Less costo gods sls 1 |

€ Gross prot or (loss rom salos of nvertry ine 7a ees ne 7)

© Otner revenue ceserbe >

9. Total revenue (addines 1.3 0,4 Se, fe, Te and

70” Grans and sda amounis par (afiach scheGue)

11 Beneits pad oo for members ,

12 Solans, ote componsaton, and eevee bens

12 Protessonal es and afer payments to dependent conracors

4 Occupancy ren, ules, and mantenarce =. + «

18 Poning, putheaton, postage, and shopng

18 Omer expenses (Sesenbe > STM.

17 Tota expenses (as ines 10 ough 16)

18 Excuts ode for he year fine 9 ss ine 17)

19. Hotasso ound balances a begneg of yea {tom ine 27, clu (A) (rust agree ih

crcl year hgutereprid on prot years rtm)

20. Other changes = nel asetso fund balances (tach expanaton)

21_Net assets or rd balenes at ond of your (comb ies 18 tough 20) : » fay 2

Fart IIT Balance Sheets ~ 1 Toa asseis on ine 25, cots (6) ae $50,000 or move, We Form 960 wslead ol Fom 860-82

{See page Sto the mstucions)

22 Cash savings, and wvasiments

23 Land anabuidings

24 Ome: asset (doscnbe P

25° Totalacsets

25 Total labiites(desenbe > )

21 _Netassols of fund balance (ne 27 cok (6) must aes wih ine 2ip

For Prvacy het and Paperwork Reduction Act Notice ee the separate instructions

RECEIVED.

S}- MAY: 1-7 2007

IRSOSE

OGDEN, UT. -

3

Form 990-€2 (2008) ROYAL ORDER OF JESTERS-COURT 113 23-

~ (Part If] Statement of Program Service Accomplishments (See page 51 of he mstuctons )

‘What s the organgation's pamary exempt purpose? FRATERNAL

Deserbe wnat was achieved n carrying out the organization's exempt purposes Ina lea’ and conde manne,

describe the services proved, the numberof persons benefited, or oer relevant information for each program tle

1063960 ___Page2

Expenses

(Required or 01(6)3)

lane (4) organizations

‘ano 48¢7(a)1) rusts,

ptional for ainers

2% HELPING CRIPPLED CHILDREN

Games [iis amon includes ore gran, check here eT] ene

2

Gans § ) ins amount nates loraign erants check hare > 1 lee

xo

(Gees 7 His amount naudeslcogn grants check bere > T] | 208

21 Other program saves (atach schecio) io

(Gants § es anastncuts remo. checinee + Cate

3 Total program service expenses (addios Zea wough a). re

[Part IV] List of Officers, Directors, Trustees, and Key Employees (List each one even # not compensated See page 52 of the instructions )

a

9 ne a et Shame feame grcaigess | wows

[Part V]_ Other Information (Nowe the statement requremantn General nsvucton V) Yes [Ne

133 Did tho organization engage in any actwty not previously ported to tho IRS? W*Ves,” attach a Gelaled

‘desception of each actorty 33 FS

34 Were any changes made tothe organing or ceronng cements but not reported to tre IRS? "Yes

tach a conformed copy ofthe changes é vee [ae me

35 ft crganzaton nod ncome rom buoness acts, such a those reported on ines 2, 6. and 7 among ote), bt not

report on Form 990-7, attach a statement explarung your reason fo not reporting the come on Form 860-7 |

‘2 he organization have unclated business gross income of $1,000 or moe or 6033(2) notice, reporing, and

proxy tax requirements? asa] 1X

b 1-¥es- hat Hod tax ceturn on Form 880-T forts year? : 3s NZAL

2 Was there a iqueaton, dsoluon,trmnaton oF sbstatalcontecton dung he year? (W"Yes. tach a

statement) ea 6 x

[a Emteramountot patil expendtures, arectorindrect as desorbed nihe nstuctons >

1 Did ne organization he Form 1120-POL for is year? é 5 3m N/al

283 Dame organzaton borom mo mako any loans oan ier, Greta. ust, orkey employee or were

any such loans made a pnor year and stil unpaid al th stato the porod covered by ts return? 30 x

'b st-Yes," attach the sehecle spectied nthe line 38 nsttuchons and enor the amount

wwolved vee eee oe oe 280

38. S01(cI(7) oqganzatons Enter

| Itation foes and captal coninbutons wcluded on ine 9 5 390

Gross recrps, included on ke 9, for pubic use of cub facies : 336

Form 980-EZ (2008)

+ fom 9eoez (e008 _ ROYAL ORDER OF JESTERS-COURT 113 _23-7063960 Pages

[Part V]_ Other Taformation Note na statement oquramontn Genera irsticton V Continued)

403 501(0%9)organcatons Ener amount of tax mpceed en the oan Gung the year under

scion 4911 _ secton4gi2 s0ctan 4065

5011) ane (4 crpanaatare Od the oranaation ngage ray seston aBSH excess Bonet vansacton dina ho [Yes [Ne

year or 60 become aware oan excess bene ragacton roma pr year? I'Yesatach an explanation

Err amt of tax mposed on ogbnzaton managers or ésquaiispersons cueng

the year under sectons 4912, 4955, and4058 =. sss Bae »

Enter amount o ax on ine 40 remoursed by the organization « »

‘lorgenzctons Aart ime durag the tax year, was the orgaicabon @ pany 10 @ promod tax shay

twansacton?

41, —Lstthe states wah which acopy of nis roturnis ied = SC

42a Thebooks aremncare ol » & CHARLIE MILLE! Telophoneno > B43

Locateda® 100 CHALCOTT PLACE SUMMERVILEE ___—=SC- zp+a » 29485

' Atany me during tho calendar year, dd the organization Rave an wierestin ora signature or oer auihorty

cover a nancial accountin a foreign country (auch as a bank account, secures account, or ober financial

account)? a

t1"¥es enter rename fhe foregn country

‘Soe the instructone for exceptions and ting requremants for Form TO F 80-22.1.

© Avany time during tne calondar year, di the organaaton mantan an oftice outst ofthe US? eee eel

1-¥e=," enter the name of he foreign county»

43 Section 4947(a)(1) nonexempt chantabe trusts ting Form G-EZ m leu of Ft

and enter the amount of tax-exempt interest reconed or accrued durng the tax year

nese | Moreen LIZ [OE 0?

i Pierre. (Alea [ate —

7 —

Pree | ame p=

Form $90-Ez (2006)

You might also like

- 2005 501c10 Jesters Court 113Document6 pages2005 501c10 Jesters Court 113api-3727794100% (3)

- 501c10 2003 990Document12 pages501c10 2003 990api-3727794No ratings yet

- CEO $100K Sat 070203Document1 pageCEO $100K Sat 070203api-3727794100% (3)

- Ceo $100K 060802Document7 pagesCeo $100K 060802api-3727794100% (3)

- 501c10 2004 990Document11 pages501c10 2004 990api-3727794No ratings yet

- Atty MTG $51K 050401Document10 pagesAtty MTG $51K 050401api-3727794100% (3)

- Atty SAT $51K 071201Document1 pageAtty SAT $51K 071201api-3727794100% (4)

- 2005 501 C 10Document14 pages2005 501 C 10api-3727794No ratings yet

- 501c3 2006 990Document22 pages501c3 2006 990api-3727794No ratings yet

- 501c3 2005 990Document19 pages501c3 2005 990api-3727794No ratings yet