Professional Documents

Culture Documents

11-09-11 Coalition Letter - Oppose High Conforming Loan Limits

Uploaded by

Adam BerklandOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11-09-11 Coalition Letter - Oppose High Conforming Loan Limits

Uploaded by

Adam BerklandCopyright:

Available Formats

Twelve Scholars and Conservative Organizations Oppose Reinstating Elevated Conforming Loan Limits

November 9, 2011 Dear Senators and Representatives, As distinguished scholars and representatives of the undersigned organizations, we want to draw your attention to an important policy change contained in the minibus appropriations bill that is going to conference this week. The Senate version of the bill would reinstate elevated conforming loan limit levels for Fannie Mae, Freddie Mac, and the FHA. The previous limit up to $729,750 in certain high cost areas fell as scheduled to $625,000 on October 1. Unless conferees strip the provision out of the larger measure this week, this sudden reversal in policy will soon come to a vote on both the House and Senate floor. Officials on both sides of the aisle agree that the GSEs cannot continue in their current form. Currently they enjoy funding advantages and explicit government backing that crowd out private capital from the housing markets. However, if the conforming loan limit is gradually reduced, the governments dominance will cover ever-smaller segments of the market and the healthy, privately-funded jumbo market for loans above the limit can expand to fill the void. Data shows that private capital has already rushed in to the segment no longer covered by the GSEs. Reinstating the elevated limits merely sets back this progress and gives ground on an approach to winding down government housing support that even the White House has agreed is best. Moreover, with close to $15 trillion in federal debt and an already abysmal $169 billion price tag on the Fannie and Freddie bailout, it is unconscionable that the federal government would even consider extending pricey subsidies for $700,000 mortgages. Proponents know they could not pass this measure through Congress with an open and honest process, so it is especially troubling that they have buried such a significant policy change in a long and complicated funding measure. The complete lack of transparency and public debate in this case is unacceptable. The nations housing markets will not recover until the government ends its overwhelming and inefficient mortgage subsidies. It is time to wind down the GSEs, and gradually lowering the conforming loan limits is a vital part of this process. We urge you to oppose reinstating the elevated limits in the looming minibus appropriations bill. Sincerely,

Phil Kerpen Vice President for Policy Americans for Prosperity Grover Norquist President Americans for Tax Reform Edward Pinto Resident Fellow American Enterprise Institute* Peter J. Wallison Arthur F. Burns Fellow in Financial Policy Studies American Enterprise Institute* Andrew Roth Vice President of Government Affairs The Club for Growth Erica Gordon Director of Policy & Government Affairs Council for Citizens Against Government Waste John Berlau Director, Center for Investors and Entrepreneurs Competitive Enterprise Institute Dr. Anthony B. Sanders Distinguished Professor of Real Estate Finance George Mason University School of Management* Russ Vought Political Director Heritage Action for America Andrew Langer President Institute for Liberty Seton Motley President Less Government Duane Parde President National Taxpayers Union

*Institutional affiliation for identification purposes only.

You might also like

- Navigating the Mortgage Modification Mess ¡V a Cautionary Tale: A Cautionary TaleFrom EverandNavigating the Mortgage Modification Mess ¡V a Cautionary Tale: A Cautionary TaleNo ratings yet

- Talkot Capital - The End of White Picket FinanceDocument24 pagesTalkot Capital - The End of White Picket FinanceKyle AkinNo ratings yet

- Dissent from the Majority Report of the Financial Crisis Inquiry CommissionFrom EverandDissent from the Majority Report of the Financial Crisis Inquiry CommissionNo ratings yet

- Mauldin, Gabriel & WhalenDocument8 pagesMauldin, Gabriel & WhalenshamikbhoseNo ratings yet

- The Real Crash: America's Coming Bankruptcy - How to Save Yourself and Your CountryFrom EverandThe Real Crash: America's Coming Bankruptcy - How to Save Yourself and Your CountryRating: 4 out of 5 stars4/5 (5)

- 05-14-15 GF&Co - Has Sen. Shelby Gone CorkerDocument6 pages05-14-15 GF&Co - Has Sen. Shelby Gone CorkerJoshua RosnerNo ratings yet

- Shelter from the Storm: How a COVID Mortgage Meltdown Was AvertedFrom EverandShelter from the Storm: How a COVID Mortgage Meltdown Was AvertedNo ratings yet

- 2012 02 02 Letter To Edward Demarco Re Fannie Mae Freddie MacDocument2 pages2012 02 02 Letter To Edward Demarco Re Fannie Mae Freddie MacDinSFLANo ratings yet

- Bringing Back Subprime? The Hazards of Restructuring The GSEsDocument12 pagesBringing Back Subprime? The Hazards of Restructuring The GSEsCenter for Economic and Policy ResearchNo ratings yet

- Committee On Financial Services: United States House of RepresentativesDocument3 pagesCommittee On Financial Services: United States House of RepresentativesDinSFLANo ratings yet

- Emergency Economic Stabilization ActDocument4 pagesEmergency Economic Stabilization Actmusic2hisearsNo ratings yet

- U.S. Bailout Plan Calms Markets, But Struggle Looms Over DetailsDocument5 pagesU.S. Bailout Plan Calms Markets, But Struggle Looms Over Detailsdavid rockNo ratings yet

- Slaters 29Document2 pagesSlaters 29tmurseNo ratings yet

- Fluker 101215Document6 pagesFluker 101215tennis10sNo ratings yet

- Reforming America's Housing Finance MarketDocument32 pagesReforming America's Housing Finance MarketForeclosure FraudNo ratings yet

- Senate Hearing, 112TH Congress - The Responsible Homeowner Refinancing Act of 2012Document52 pagesSenate Hearing, 112TH Congress - The Responsible Homeowner Refinancing Act of 2012Scribd Government DocsNo ratings yet

- Federal Reserve System: Board of GovernorsDocument28 pagesFederal Reserve System: Board of GovernorsAdam DeutschNo ratings yet

- Senate Hearing, 113TH Congress - Housing Finance Reform: Essential Elements To Provide Affordable Options For HousingDocument84 pagesSenate Hearing, 113TH Congress - Housing Finance Reform: Essential Elements To Provide Affordable Options For HousingScribd Government DocsNo ratings yet

- Letter To Secretary Geithner On Changes To HARP To Assist More HomeownersDocument3 pagesLetter To Secretary Geithner On Changes To HARP To Assist More HomeownersThe Partnership for a Secure Financial FutureNo ratings yet

- Reform of Fha'S Title I Manufactured Housing Loan: HearingDocument35 pagesReform of Fha'S Title I Manufactured Housing Loan: HearingScribd Government DocsNo ratings yet

- Testimony Julia Gordon 10-26-2010Document36 pagesTestimony Julia Gordon 10-26-2010Dawn HoganNo ratings yet

- Federal Reserve System: Boardof GovernorsDocument28 pagesFederal Reserve System: Boardof Governorsboboharra9781No ratings yet

- Housing Finance RecommendationsDocument6 pagesHousing Finance Recommendationsapi-261468864No ratings yet

- Future of Housing Finance ReformDocument7 pagesFuture of Housing Finance ReformCenter for American ProgressNo ratings yet

- 2023 Biden Mortgage LetterDocument4 pages2023 Biden Mortgage LetterRedRiverMediaNo ratings yet

- Parlimentarian LetterDocument13 pagesParlimentarian LetterColin MeynNo ratings yet

- Financial System and The Subprime CrisisDocument21 pagesFinancial System and The Subprime CrisisEdd DeNo ratings yet

- Modernization of Federal Housing Administration ProgramsDocument132 pagesModernization of Federal Housing Administration ProgramsScribd Government DocsNo ratings yet

- Why Constitutions MatterDocument6 pagesWhy Constitutions MatterZerohedge100% (1)

- Bipartisan Solutions For Housing Finance Reform?Document141 pagesBipartisan Solutions For Housing Finance Reform?Scribd Government DocsNo ratings yet

- H Inc.: The ReaderDocument10 pagesH Inc.: The ReaderanhdincNo ratings yet

- 1 Covered Bond Council Mortgage Loan Securitization FINAL 1Document3 pages1 Covered Bond Council Mortgage Loan Securitization FINAL 1Richard RydstromNo ratings yet

- Pham Letter Final GrassleyDocument5 pagesPham Letter Final GrassleyMartin AndelmanNo ratings yet

- Real Estate Services Update: August 2011Document4 pagesReal Estate Services Update: August 2011narwebteamNo ratings yet

- Brookings Institution Principal ForgivenessDocument22 pagesBrookings Institution Principal ForgivenessDinSFLANo ratings yet

- Real Estate Services Update: November/December 2011Document4 pagesReal Estate Services Update: November/December 2011narwebteamNo ratings yet

- October Builders OutlookDocument15 pagesOctober Builders OutlookTedEscobedoNo ratings yet

- SSRN-Stabilize Housing Market and All Will FollowDocument3 pagesSSRN-Stabilize Housing Market and All Will FollowMartin AndelmanNo ratings yet

- History of MortgagesDocument3 pagesHistory of MortgagesELHAM AMADUNo ratings yet

- Real Estate Services Update: June 2011Document4 pagesReal Estate Services Update: June 2011narwebteamNo ratings yet

- Senate Hearing, 113TH Congress - Housing Finance Reform: Essential Elements of A Government Guarantee For Mortgage-Backed SecuritiesDocument115 pagesSenate Hearing, 113TH Congress - Housing Finance Reform: Essential Elements of A Government Guarantee For Mortgage-Backed SecuritiesScribd Government DocsNo ratings yet

- Real Estate Services Update: September 2011Document4 pagesReal Estate Services Update: September 2011narwebteamNo ratings yet

- Printing Changes in Tax Laws Drive More Americans Into Municipal BondsDocument4 pagesPrinting Changes in Tax Laws Drive More Americans Into Municipal BondsMaryNo ratings yet

- Organizations Call On FHFA To Address DisplacementDocument8 pagesOrganizations Call On FHFA To Address DisplacementPete MaddenNo ratings yet

- The Subprime Lending Debacle: Competitive Private Markets Are The Solution, Not The Problem, Cato Policy Analysis No. 679Document20 pagesThe Subprime Lending Debacle: Competitive Private Markets Are The Solution, Not The Problem, Cato Policy Analysis No. 679Cato InstituteNo ratings yet

- Final Paper (Final Draft)Document11 pagesFinal Paper (Final Draft)gko2408No ratings yet

- Obama's Full Address On Debt Ceiling ImpasseDocument6 pagesObama's Full Address On Debt Ceiling ImpasseJohn SmithNo ratings yet

- SF Chronicle - Modified Mortgages - Lenders Talking, Then BalkingDocument5 pagesSF Chronicle - Modified Mortgages - Lenders Talking, Then BalkingTA WebsterNo ratings yet

- SPRING 2012: Policy Continues To Drive Housing PerformanceDocument4 pagesSPRING 2012: Policy Continues To Drive Housing PerformancelsteamdebokNo ratings yet

- FHFA Joint AG LetterDocument3 pagesFHFA Joint AG LetterDinSFLANo ratings yet

- Ortgaging: UR UtureDocument5 pagesOrtgaging: UR UturereasonorgNo ratings yet

- Obama Debt Ceiling TalksDocument5 pagesObama Debt Ceiling TalksTobaccoVietnamNo ratings yet

- The Mortgage Market: Presented By: Brady Anderson Chad Atkinson Charles Jones Mcleod Robinson Laura RogersDocument31 pagesThe Mortgage Market: Presented By: Brady Anderson Chad Atkinson Charles Jones Mcleod Robinson Laura Rogerschhassan7No ratings yet

- Danske Markets - US Debt Default Unlikely 20110727Document10 pagesDanske Markets - US Debt Default Unlikely 20110727SynergyFinanceNo ratings yet

- Real Estate Services Update: May 2011Document4 pagesReal Estate Services Update: May 2011narwebteamNo ratings yet

- 2020.06.03 Letter To Leadership On Homeowner ProtectionsDocument7 pages2020.06.03 Letter To Leadership On Homeowner ProtectionsAarthiNo ratings yet

- Office of The City AdministratorDocument6 pagesOffice of The City AdministratorSusie CambriaNo ratings yet

- Reform Financial SysDocument7 pagesReform Financial Sysed_dickauNo ratings yet

- Housing Crisis ReportDocument26 pagesHousing Crisis ReportsechNo ratings yet

- ASR032014Document32 pagesASR032014Jeremy KimNo ratings yet

- Joint Letter House Draft Farm Bill 7-10-2012 FinalDocument2 pagesJoint Letter House Draft Farm Bill 7-10-2012 FinalAdam BerklandNo ratings yet

- Joint Statement On H.R. 3582Document1 pageJoint Statement On H.R. 3582Adam BerklandNo ratings yet

- 01-23-12 Coalition Letter - Support Pro-Growth BudgetingDocument2 pages01-23-12 Coalition Letter - Support Pro-Growth BudgetingAdam BerklandNo ratings yet

- 12-8-11 Coalition Letter - Oppose U.S.-funded Euro BailoutDocument2 pages12-8-11 Coalition Letter - Oppose U.S.-funded Euro BailoutAdam BerklandNo ratings yet

- Understanding Marketing Management Within Global ContextDocument10 pagesUnderstanding Marketing Management Within Global ContextShiela Mae ArcuenoNo ratings yet

- Maharashtra New Industrial Policy On Pharmaceutical SectorDocument3 pagesMaharashtra New Industrial Policy On Pharmaceutical SectorDivya AnandNo ratings yet

- Partnership 1Document6 pagesPartnership 1Irish AnnNo ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!krishna krishNo ratings yet

- John T. Reed - The Biggest Mistakes Real Estate Investors MakeDocument4 pagesJohn T. Reed - The Biggest Mistakes Real Estate Investors MakeDenis100% (1)

- Subenji Offer Letter FinalDocument2 pagesSubenji Offer Letter FinalAbhijith M WarrierNo ratings yet

- Case Digest 2 TTHSDocument39 pagesCase Digest 2 TTHSClarey MengulloNo ratings yet

- Introduction To Direct MarketingDocument14 pagesIntroduction To Direct Marketingvishal_shekhar2416No ratings yet

- Mishbahul AzmanDocument4 pagesMishbahul AzmanHarlis NasutionNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Senior Corporate Communications Executive in New York City Resume Joe GoodeDocument2 pagesSenior Corporate Communications Executive in New York City Resume Joe GoodeJoeGoodeNo ratings yet

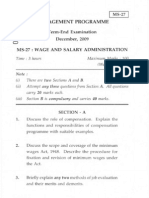

- MS 27dec09Document6 pagesMS 27dec09Richa ShrivasravaNo ratings yet

- Do Electric Vehicles Need Subsidies - A Comparison of Ownership Costs For Conventional, Hybrid, and Electric VehiclesDocument40 pagesDo Electric Vehicles Need Subsidies - A Comparison of Ownership Costs For Conventional, Hybrid, and Electric VehiclesNikos KasimatisNo ratings yet

- Assessing The Effects of Interactive Blogging On Student Attitudes Towards Peer Interaction, Learning Motivation, and Academic AchievementsDocument10 pagesAssessing The Effects of Interactive Blogging On Student Attitudes Towards Peer Interaction, Learning Motivation, and Academic AchievementsSimonNo ratings yet

- Bba2 Eco2 Asg 2023 PDFDocument6 pagesBba2 Eco2 Asg 2023 PDFIzelle Ross GreenNo ratings yet

- PPG - Vigor ZN 302 SR - EnglishDocument5 pagesPPG - Vigor ZN 302 SR - EnglisherwinvillarNo ratings yet

- Export Import NotesDocument214 pagesExport Import NotesNikhil Kothavale100% (2)

- Questionnaire: S.K.School of Business Management, Hemchandracharya North Gujarat UniversityDocument4 pagesQuestionnaire: S.K.School of Business Management, Hemchandracharya North Gujarat UniversityDhavalNo ratings yet

- Banking and Financial Institution: Midterm Examination Tuesday, November 23, 2021 Name: Permit NumberDocument5 pagesBanking and Financial Institution: Midterm Examination Tuesday, November 23, 2021 Name: Permit NumberCherilyn BongcawilNo ratings yet

- Charter PartyDocument16 pagesCharter PartyChinnadurai SenguttuvanNo ratings yet

- Faberge v. IACDocument2 pagesFaberge v. IACjdg jdgNo ratings yet

- Conceptual Model of Internet Banking Adoption With Perceived Risk and Trust FactorsDocument7 pagesConceptual Model of Internet Banking Adoption With Perceived Risk and Trust FactorsTELKOMNIKANo ratings yet

- Consumer SurveyDocument18 pagesConsumer SurveyJahnvi DoshiNo ratings yet

- Business PDFDocument146 pagesBusiness PDFKhalidANo ratings yet

- DHL Express Assignment of Rights UsDocument1 pageDHL Express Assignment of Rights Usderyl.baharudinNo ratings yet

- VRIO AnalysisDocument2 pagesVRIO AnalysisrenjuannNo ratings yet

- Assignment Brief - Btec (RQF) Higher National Diploma in BusinessDocument2 pagesAssignment Brief - Btec (RQF) Higher National Diploma in BusinessRan KarNo ratings yet

- CFA Level 3 - Formula Sheet (NO PRINT)Document35 pagesCFA Level 3 - Formula Sheet (NO PRINT)Denis DikarevNo ratings yet

- Wayne Johnson AnnouncementDocument5 pagesWayne Johnson AnnouncementAlexandria DorseyNo ratings yet

- Africa Enterprise Challenge Fund (AECF) - Gender and Social Inclusion Analysis of The Solar Home SystemsDocument2 pagesAfrica Enterprise Challenge Fund (AECF) - Gender and Social Inclusion Analysis of The Solar Home SystemsWallaceAceyClarkNo ratings yet

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The War after the War: A New History of ReconstructionFrom EverandThe War after the War: A New History of ReconstructionRating: 5 out of 5 stars5/5 (2)

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- The Next Civil War: Dispatches from the American FutureFrom EverandThe Next Civil War: Dispatches from the American FutureRating: 3.5 out of 5 stars3.5/5 (48)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityRating: 5 out of 5 stars5/5 (1)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- To Make Men Free: A History of the Republican PartyFrom EverandTo Make Men Free: A History of the Republican PartyRating: 4.5 out of 5 stars4.5/5 (21)

- Confidence Men: Wall Street, Washington, and the Education of a PresidentFrom EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentRating: 3.5 out of 5 stars3.5/5 (52)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismFrom EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismRating: 4.5 out of 5 stars4.5/5 (42)

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushFrom EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushRating: 4 out of 5 stars4/5 (6)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismRating: 4 out of 5 stars4/5 (1)

- Commander In Chief: FDR's Battle with Churchill, 1943From EverandCommander In Chief: FDR's Battle with Churchill, 1943Rating: 4 out of 5 stars4/5 (16)