Professional Documents

Culture Documents

Math of Investments

Uploaded by

Keziah MecarteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Math of Investments

Uploaded by

Keziah MecarteCopyright:

Available Formats

Mathematics of Investments

Math 110, Winter 2006, Jason Grout

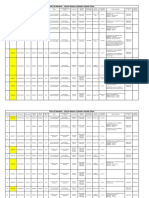

You want to retire in 40 years. You gure youll have end of the year, even if the compounding is dierent, we to open some kind of savings account, so you scrape up have the idea of an eective rate of interest (or annual your savings and look at your options. percentage rate or APR). The eective rate of interest for a given account is the interest rate you would need Exercise 1. One bank oers you a 1% annual interest in an annually compounding account to get the amount rate (which is really good these days), compounded anof money you receive after a year in your given account. nually. This means that the bank will pay you 1% of Suppose you have $1,000 to invest at 1% annual interest. your money at the end of the year. (a) Suppose a bank compounds every day (365 times a (a) If you initially deposit $1,000, how much will you year). How much will you have at the end of a year? have in one year? What is the eective rate of interest? (b) How much will you have in two years? (dont forget (b) How much will you have in a year if a bank comthat you will earn interest on the money the bank pounds every hour (365*24=8,760 times a year)? paid you for the rst year). What is the eective rate of interest? (c) How much will you have in three years? Five years? (c) How much will you have in a year if a bank com(d) How much will you have in n years? (write a forpounds every minute (365*24*60=525,600 times a mula) year)? What is the eective rate of interest? (e) How much will you have in 40 years? The amounts you have at the end of the year seem (f) If you manage to deposit $10,000, how much will you to approach a certain number. To nd out what that have in 40 years? number is, we rewrite the compounding formula as Exercise 2. Another bank oers you a 1% annual in(n/r)rt 1 terest rate, but this time it is compounded quarterly. F =P 1+ This means the bank will pay you every quarter. Since n/r they are paying four times as often, they pay you 1/4 1 and we examine the quantity (1 + n/r )n/r as n becomes of your interest rate each time, so the bank pays you (.25)(1%) = .25% of your money each time. Assume larger and larger. If we x r, then n/r becomes large as n becomes large. Let m = n/r. again that you deposit $1,000. (a) How much money will you have in three months (1 Exercise 4 (The number e). Fill in the table for the 1 values of (1 + m )m . quarter)? (b) Six months (2 quarters)? 1 m (c) One year? Two, three, and ve years? m 1+ m (d) How much will you have in n years? (write a for1 mula) 10 (e) How much will you have in 40 years? 100 (f) If you deposit $10,000, how much will you have in 1,000 40 years? 10,000 (g) Another bank oers you 1.001%, but compounded 100,000 semi-annually (twice a year). How much will you 1,000,000 get there in 40 years? 10,000,000 The formula you should have come up with should be These values seem to approach a number as n gets something like bigger and bigger. We call this number e, and an apr nt F =P 1+ proximation is e = 2.718281828459045. n Returning to our original problem, if we compound where F is the future value of your money, P is the continuously (i.e., n is innite), then present value (the initial investment, or principal), r is F = P ert . the interest rate (expressed as a decimal), n is the number of compounding periods per year, and t is the number Suppose you invest $1,000 and a bank will pay you of years. 1% interest, compounded continuously. Exercise 3 (Compounding again). It seems that, given (a) How much money will you have after 1 year? What a xed interest rate, compounding more often results in is the eective rate of interest? the bank paying you more. In order to still be able to (b) How much money will you have after 5 years? compare how much money you will actually have at the (c) How much money will you have after 40 years?

1

(d) How much money will you have if you invest $10,000 Exercise 8 (The Early Bird). From the last problem, for 40 years? we see that money we invest early will grow drastically more than money we invest later. You decide to take You quickly realize that you need to save up quite a advantage of that knowledge and plan to invest early. bit more money to be able to retire and live on your You still cant invest all the money right now, though. savings for several decades. Working out an investment plan is one way to gradually Exercise 5 (Ination). Living costs increase in the next add to your retirement fund. Suppose you invest in a 40 years as well. A standard rule of thumb is that living mutual fund that pays you 10% interest (compounded expenses will increase by 3% each year. If you plan on continuously). having a retirement income of $24,000 (in todays living (a) You decide to invest for the next 5 years, but then you gure that your expenses will not allow you to costs), how much will you need in 40 years? Hint: How invest again. If you invest $2,000 a year for the much will $24,000 grow, at 3% per year, in 40 years? next 5 years, how much will you have in 40 years? Exercise 6 (Present Value). Hint: Calculate the future value of each of the $2,000 (a) Assume that you will live for 30 years after you reyearly investments and add them. tire. If you need $80,000 a year for 30 years, how (b) Thats not quite enough. Suppose you invest $3,000 much will you need saved up when you start your rea year for the next 5 years. How much will you have tirement in 40 years? Dont account for ination afin 40 years? ter you retire. When you retire, you put your money (c) Thats still not enough. Suppose you invest $6,000 into an account that earns interest at the rate of ina year for the next 5 years. How much will you have ation. in 40 years? (b) The value of your investment in the future is called (d) Were getting closer to the amount we need in 40 the future value of your investment. The value of years. Suppose you regure your nances and calcuyour investment right now is called the present value. late that you can invest $6,000 a year for the next 8 Assume that a bank will pay you 1% interest, comyears. pounded quarterly. If you want to have $2,400,000 (e) Were getting tired of writing out all these calculain 40 years, how much do you need to invest right tions. Suppose you gure that you can invest for the now? In other words, what is the present value of next 10 years. Write a formula for how much you $2,400,000 in 40 years at 1% interest compounded will have in 40 years if you invest n dollars each year quarterly? for 10 years. (c) That seemed like a lot. A good money market fund (f) Use the formula you just wrote to calculate how will pay about 4% right now. Assume that you inmuch you need to invest each year for 10 years so vest in a money market fund that is continuously that you will have $2,400,000 in 40 years. compounding. How much do you need to invest now to have a future value of $2,400,000 in 40 years? Exercise 9 (Better late than never). On the other hand, (d) Even that seems like quite a bit. A 10 year CD has you look at your nances now and decide that you couldnt interest rate of 5%. How much do you need to invest possibly invest now. in that now, assuming continuous compounding? (a) Suppose you start investing in the same mutual fund (e) The average return on a good growth mutual fund in 10 years. Calculate how much you will have in 40 over a long period of time is about 10%. How much years if you invest $6,700 for 10 years, starting 10 do you need to invest to have $2,400,000 in 40 years, years from now (so that the rst $6,700 will only assuming continuous compounding? have 30 years to grow). (b) Wow, thats not nearly enough. Suppose that you Exercise 7 (How fast will it grow?). Suppose you inkeep investing $6,700 for the rest of the 30 years, vest in a mutual fund that yields 10% annual interest, starting in 10 years. How much will you have in 40 continuously compounding. years then? (a) You would rst like to see how much your money (c) Thats still not nearly enough. Calculate what you grows when it is invested now compared to several will need to invest every year for the rest of your years from now. How much will $1 grow with 10% working life, starting in 10 years, in order to have interest for 40 years? (i.e., how much will every dol$2,400,000 in 40 years. lar you invest be worth?) (d) Suppose you start investing in 20 years. Calculate (b) How much will that same $1 grow if invested next what you will need to invest every year for the rest year (so it only grows for 39 years?) of your working life, starting in 20 years, in order to (c) How much will the $1 earn if invested in 5 years? have $2,400,000 in 40 years. (i.e., it earns interest for 35 years?) (d) How much will the $1 earn if invested in 10 years? (e) How much will the $1 earn if invested in 20 years?

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- 5&6 PDFDocument23 pages5&6 PDFWendyNo ratings yet

- FINC1302 - Exer&Asgnt - Revised 5 Feb 2020Document24 pagesFINC1302 - Exer&Asgnt - Revised 5 Feb 2020faqehaNo ratings yet

- Sheet 1 Time Value of MoneyDocument5 pagesSheet 1 Time Value of MoneyAhmed RagabNo ratings yet

- Business Maths - Must ReadDocument17 pagesBusiness Maths - Must Readreddy iibfNo ratings yet

- CAPMDocument12 pagesCAPMReynan Paul TamondongNo ratings yet

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringNo ratings yet

- Understanding The Time Value of MoneyDocument5 pagesUnderstanding The Time Value of Moneygeneration.m31989No ratings yet

- FinanceDocument9 pagesFinanceNikhil MittalNo ratings yet

- TVM Exercises for MBA 614 Time Value of MoneyDocument2 pagesTVM Exercises for MBA 614 Time Value of MoneyAmir GhasdiNo ratings yet

- Compound InterestDocument4 pagesCompound InterestDaniel DemessieNo ratings yet

- Optional Maths Revision Tutorial Questions: X X X A A A A A ADocument44 pagesOptional Maths Revision Tutorial Questions: X X X A A A A A ASaizchiNo ratings yet

- Understanding The Time Value of MoneyDocument13 pagesUnderstanding The Time Value of MoneyDaniel HunksNo ratings yet

- Compound Interest ExercisesDocument4 pagesCompound Interest ExercisesFernanda FerreiraNo ratings yet

- CH 05Document11 pagesCH 05kmarisseeNo ratings yet

- Lococos Katherina MidtermDocument22 pagesLococos Katherina Midtermapi-237105574No ratings yet

- Time Value of MoneyDocument28 pagesTime Value of MoneyReservoir ChronicleNo ratings yet

- Topic: Time Value of Money: AssignmentDocument3 pagesTopic: Time Value of Money: AssignmentAntoniaNo ratings yet

- TVM Practice ProblemsDocument1 pageTVM Practice ProblemsFaran KhanNo ratings yet

- Understanding The Time Value of MoneyDocument20 pagesUnderstanding The Time Value of MoneyanayNo ratings yet

- PracticeDocument8 pagesPracticehuongthuy1811No ratings yet

- 332 Mid 15Document5 pages332 Mid 15Nicholas PoulimenakosNo ratings yet

- ProblemsDocument28 pagesProblemsKevin NguyenNo ratings yet

- Opportunity Cost Principle: Time Value of MoneyDocument5 pagesOpportunity Cost Principle: Time Value of Moneysweetgirl198701No ratings yet

- Two Dollars Earned: Using Timelines To Visualize Cash FlowsDocument23 pagesTwo Dollars Earned: Using Timelines To Visualize Cash FlowsBella Jean ObaobNo ratings yet

- Concepts 'N' Clarity: Time Value of MoneyDocument11 pagesConcepts 'N' Clarity: Time Value of MoneyKarla CorreaNo ratings yet

- Time Value of Money Sample ProblemsDocument7 pagesTime Value of Money Sample Problemsbanti198750% (2)

- TvmextraDocument8 pagesTvmextragl620054545No ratings yet

- Time Value of MoneyDocument29 pagesTime Value of MoneyAzim Samnani100% (1)

- Time Value of Money IDocument44 pagesTime Value of Money IVipul MehtaNo ratings yet

- Bus Math Sample Problem in HandoutsDocument7 pagesBus Math Sample Problem in HandoutsAria & Kira CatzNo ratings yet

- Time Value of MoneyDocument42 pagesTime Value of MoneyVipul MehtaNo ratings yet

- 2851Document18 pages2851LilyNo ratings yet

- Quiz No-02Document2 pagesQuiz No-02kalir12100% (1)

- IE 342 Study Set 1Document1 pageIE 342 Study Set 1cilekalerjisiNo ratings yet

- ProblemsDocument20 pagesProblemsReyna BaculioNo ratings yet

- FIN 438 Practice ProblemsDocument5 pagesFIN 438 Practice ProblemstayyabNo ratings yet

- Corp Finance Hw1Document5 pagesCorp Finance Hw1Tran Tuan LinhNo ratings yet

- What Is The Present Value ofDocument27 pagesWhat Is The Present Value ofJade Ballado-TanNo ratings yet

- Time Value of Money - Problem SetDocument2 pagesTime Value of Money - Problem Setalan david melchor lopezNo ratings yet

- Quant: Lecture 3 Time Value of Money: (Practice The Financial Calculator)Document9 pagesQuant: Lecture 3 Time Value of Money: (Practice The Financial Calculator)My Huyen TranNo ratings yet

- Assign 2Document3 pagesAssign 2Abdul Moqeet100% (1)

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Solution of Assignment On Time Value of MoneyDocument11 pagesSolution of Assignment On Time Value of MoneyArif RahmanNo ratings yet

- Compound InterestDocument5 pagesCompound InterestMimimiyuhNo ratings yet

- Dividend Growth Rate CalculationDocument6 pagesDividend Growth Rate CalculationCrew's GamingNo ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- ACTL10001 Introduction to Actuarial Studies Problem SetsDocument29 pagesACTL10001 Introduction to Actuarial Studies Problem SetshollowkenshinNo ratings yet

- TVM ProblemsDocument10 pagesTVM ProblemsVaibhav Jain0% (1)

- Solve The Following Crossword Round Your Final Answers To TheDocument3 pagesSolve The Following Crossword Round Your Final Answers To TheAmit PandeyNo ratings yet

- TVM PresDocument5 pagesTVM Presapi-3781097No ratings yet

- FRMTest 01Document18 pagesFRMTest 01Kamal BhatiaNo ratings yet

- University of Pennsylvania The Wharton SchoolDocument18 pagesUniversity of Pennsylvania The Wharton SchoolBassel ZebibNo ratings yet

- EECO - Problem Set - Annuities and PerpetuitiesDocument10 pagesEECO - Problem Set - Annuities and PerpetuitiesWebb PalangNo ratings yet

- C1_M1_Review of Elementary Finance Tools quiz answersDocument5 pagesC1_M1_Review of Elementary Finance Tools quiz answersVikaNo ratings yet

- TVM CWDocument4 pagesTVM CWDua hussainNo ratings yet

- Financial MathematicsDocument28 pagesFinancial MathematicsLieno MNo ratings yet

- CVFDDVDocument2 pagesCVFDDVPranjal SinghNo ratings yet

- The MicroscopeDocument5 pagesThe MicroscopeKeziah MecarteNo ratings yet

- Auditing - RF-12 Quiz BowlDocument12 pagesAuditing - RF-12 Quiz BowlWilson CuasayNo ratings yet

- Calculating Time Value of Money for Various Cash Flow ScenariosDocument12 pagesCalculating Time Value of Money for Various Cash Flow ScenariosKeziah MecarteNo ratings yet

- At-5915 - Other PSAs and PAPSsDocument11 pagesAt-5915 - Other PSAs and PAPSsPau Laguerta100% (1)

- List of Naruto Char.Document40 pagesList of Naruto Char.Keziah MecarteNo ratings yet

- Ch01 - Auditing, Attestation, and AssuranceDocument9 pagesCh01 - Auditing, Attestation, and AssuranceRamon Jonathan Sapalaran100% (2)

- Chapter 1 The Role of Public Accountant in An American EconDocument22 pagesChapter 1 The Role of Public Accountant in An American EconShara Joy B. ParaynoNo ratings yet

- Auditing - RF-12 Quiz BowlDocument12 pagesAuditing - RF-12 Quiz BowlWilson CuasayNo ratings yet

- Lesson 1: The Powerpoint Window: The Quick Access ToolbarDocument20 pagesLesson 1: The Powerpoint Window: The Quick Access ToolbarKeziah MecarteNo ratings yet

- Avoided Deforestation PartnersDocument1 pageAvoided Deforestation PartnersKeziah MecarteNo ratings yet

- Comic Strip About Cattie The CatterpillarDocument1 pageComic Strip About Cattie The CatterpillarKeziah MecarteNo ratings yet

- Account Statement From 30 Jul 2018 To 30 Jan 2019Document8 pagesAccount Statement From 30 Jul 2018 To 30 Jan 2019Bojpuri OfficialNo ratings yet

- Brick TiesDocument15 pagesBrick TiesengrfarhanAAANo ratings yet

- Thin Film Deposition TechniquesDocument20 pagesThin Film Deposition TechniquesShayan Ahmad Khattak, BS Physics Student, UoPNo ratings yet

- Ancient Greek Divination by Birthmarks and MolesDocument8 pagesAncient Greek Divination by Birthmarks and MolessheaniNo ratings yet

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDocument4 pagesMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldeNo ratings yet

- Non Circumvention Non Disclosure Agreement (TERENCE) SGDocument7 pagesNon Circumvention Non Disclosure Agreement (TERENCE) SGLin ChrisNo ratings yet

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDocument5 pagesMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNo ratings yet

- Sysmex Xs-800i1000i Instructions For Use User's ManualDocument210 pagesSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- Break Even AnalysisDocument4 pagesBreak Even Analysiscyper zoonNo ratings yet

- August 03 2017 Recalls Mls (Ascpi)Document6 pagesAugust 03 2017 Recalls Mls (Ascpi)Joanna Carel Lopez100% (3)

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- DIN Flange Dimensions PDFDocument1 pageDIN Flange Dimensions PDFrasel.sheikh5000158No ratings yet

- Dole-Oshc Tower Crane Inspection ReportDocument6 pagesDole-Oshc Tower Crane Inspection ReportDaryl HernandezNo ratings yet

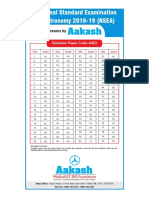

- National Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423Document1 pageNational Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423VASU JAINNo ratings yet

- Evaluating MYP Rubrics in WORDDocument11 pagesEvaluating MYP Rubrics in WORDJoseph VEGANo ratings yet

- 5511Document29 pages5511Ckaal74No ratings yet

- 8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemDocument13 pages8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemSatish JadhaoNo ratings yet

- The Ultimate Advanced Family PDFDocument39 pagesThe Ultimate Advanced Family PDFWandersonNo ratings yet

- Customer Perceptions of Service: Mcgraw-Hill/IrwinDocument27 pagesCustomer Perceptions of Service: Mcgraw-Hill/IrwinKoshiha LalNo ratings yet

- Portfolio Artifact Entry Form - Ostp Standard 3Document1 pagePortfolio Artifact Entry Form - Ostp Standard 3api-253007574No ratings yet

- Electronics Project Automatic Bike Controller Using Infrared RaysDocument16 pagesElectronics Project Automatic Bike Controller Using Infrared RaysragajeevaNo ratings yet

- Change Management in British AirwaysDocument18 pagesChange Management in British AirwaysFauzan Azhary WachidNo ratings yet

- 50 Years of Teaching PianoDocument122 pages50 Years of Teaching PianoMyklan100% (35)

- Evolution of Bluetooth PDFDocument2 pagesEvolution of Bluetooth PDFJuzerNo ratings yet

- India Today 11-02-2019 PDFDocument85 pagesIndia Today 11-02-2019 PDFGNo ratings yet

- Progressive Myoclonic Epilepsies - Practical Neurology 2015. MalekDocument8 pagesProgressive Myoclonic Epilepsies - Practical Neurology 2015. MalekchintanNo ratings yet

- CR Vs MarubeniDocument15 pagesCR Vs MarubeniSudan TambiacNo ratings yet

- Sarvali On DigbalaDocument14 pagesSarvali On DigbalapiyushNo ratings yet

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Document4 pagesHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyNo ratings yet

- Origins and Rise of the Elite Janissary CorpsDocument11 pagesOrigins and Rise of the Elite Janissary CorpsScottie GreenNo ratings yet