Professional Documents

Culture Documents

MJC 2011 H1 Econs Crowding Out Effect

Uploaded by

onnoezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MJC 2011 H1 Econs Crowding Out Effect

Uploaded by

onnoezCopyright:

Available Formats

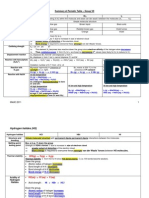

Crowding Effect: An evaluation to the use of Expansionary Fiscal Policy Key Assumption: Increase in Gov expenditure needs to be financed

by borrowing from the same source of private lending institution and/or government has no past reserves/savings from previous budget year surpluses. revious

For H2s: Government spending if financed by borrowing competition for loans dd for loans from D1 to D2 upward pressure on i/r increase i/r from R1 to R2 raises the cost of borrowing cost of borrowing > expected yielf of the investment project fewer investment projects are profitable volume of investments falls from Q1 to Q2

Individuals may also be discouraged from borrowing scouraged returns to savings are higher opportunity costs of savings increase consumption expenditure on goods bought on credit falls Fall in I and C might offset G AD falls from AD2 to AD3 limits the effectiveness of expansionary FP Hence total net effect of Increase G = AD1 increase to l AD3 instead of AD2.

You might also like

- H2 Physic 2009 A Level SolutionsDocument28 pagesH2 Physic 2009 A Level Solutionsonnoez0% (2)

- H2 Physic 2010 A Level SolutionsDocument32 pagesH2 Physic 2010 A Level Solutionsonnoez50% (4)

- H2 Physic 2008 A Level SolutionsDocument21 pagesH2 Physic 2008 A Level Solutionsonnoez40% (5)

- MJC 2011 H1 Econs Merit GoodsDocument3 pagesMJC 2011 H1 Econs Merit GoodsonnoezNo ratings yet

- MJC 2011 H1 Econs - Tradable PermitsDocument3 pagesMJC 2011 H1 Econs - Tradable PermitsonnoezNo ratings yet

- H2 Physic 2007 A Level SolutionsDocument19 pagesH2 Physic 2007 A Level SolutionsonnoezNo ratings yet

- 9740 2007 H2 Maths Paper 1 &2 QuestionsDocument8 pages9740 2007 H2 Maths Paper 1 &2 QuestionsonnoezNo ratings yet

- MJC 2011 H1 Econs TariffDocument5 pagesMJC 2011 H1 Econs TariffonnoezNo ratings yet

- H2 Chem Summary of Group IIDocument4 pagesH2 Chem Summary of Group IIonnoezNo ratings yet

- H2 Chem Summary of Transition ElementDocument7 pagesH2 Chem Summary of Transition Elementonnoez100% (2)

- MJC 2011 H1 Econs Interest Elasticity EvaluationDocument2 pagesMJC 2011 H1 Econs Interest Elasticity EvaluationonnoezNo ratings yet

- H2 Chem Summary of Chemical PeriodicityDocument7 pagesH2 Chem Summary of Chemical Periodicityonnoez100% (2)

- H2 Chem Summary of Group VIIDocument3 pagesH2 Chem Summary of Group VIIonnoezNo ratings yet

- MJC 2011 H1 Econs Marshall Lerner ConditionDocument6 pagesMJC 2011 H1 Econs Marshall Lerner ConditiononnoezNo ratings yet

- HCI Chem H2 Paper 1 Question PaperDocument17 pagesHCI Chem H2 Paper 1 Question PaperonnoezNo ratings yet

- 2011 H2 Chem SRJC Prelim Paper 2Document16 pages2011 H2 Chem SRJC Prelim Paper 2onnoezNo ratings yet

- 2011 ACJC H2 Chem P1,2 AnswersDocument15 pages2011 ACJC H2 Chem P1,2 Answersonnoez100% (1)

- MJC 2011 H2 Chem Paper 3 No ANSWERSDocument13 pagesMJC 2011 H2 Chem Paper 3 No ANSWERSonnoezNo ratings yet

- 2011 H2 Chem SRJC Prelim Paper 1Document20 pages2011 H2 Chem SRJC Prelim Paper 1onnoezNo ratings yet

- 2011 H2 Chem SRJC Prelim Paper 2 Suggested AnswersDocument15 pages2011 H2 Chem SRJC Prelim Paper 2 Suggested AnswersonnoezNo ratings yet

- MJC 2011 H2 Chem Paper 2 NO ANSWERSDocument21 pagesMJC 2011 H2 Chem Paper 2 NO ANSWERSonnoezNo ratings yet

- 2011 H2 Chem ACJC Prelim Paper 2Document16 pages2011 H2 Chem ACJC Prelim Paper 2onnoez0% (1)

- 2011 H2 Chem ACJC Prelim Paper 1Document21 pages2011 H2 Chem ACJC Prelim Paper 1onnoezNo ratings yet

- 2011 H2 Chem SRJC Prelim Paper 1 Suggested AnswersDocument1 page2011 H2 Chem SRJC Prelim Paper 1 Suggested AnswersonnoezNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)