Professional Documents

Culture Documents

Financial Viability Analysis of The Road Sector Projects in

Uploaded by

anon_777502935Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Viability Analysis of The Road Sector Projects in

Uploaded by

anon_777502935Copyright:

Available Formats

Financial Viability Analysis of the Road Sector Projects in India.

SUBMITTED TO:

UNDER THE GUIDANC

PREPARED AND SUBMITTED BY

ABSTRACT:

As India continues to grow at more than 8%, a balanced increase in the gross capital formation (GCF) in infrastructure as a proportion of the GDP emerges as the most important key in sustaining high economic growth. Though recently there have been investments in the infrastructure sector, the GCF as a proportion of GDP continues to be lower at around 5%. As far as the physical infrastructure is concerned, there exists a huge deficiency, in our view. Inadequate infrastructure is identified as one of the biggest constraints of doing business in India. Therefore, to give proper direction to highway development The Planning Commission of India has estimated an investment of INR

3118 billion under the Eleventh Plan versus the INR 1448 billion spent under the Tenth Plan. Further Private participation is crucial to meet the investment goal in infrastructure because there are limitations to budgetary support from the Indian government. For this purpose a proper framework is being put in place to enhance participation of the private sector in various segments of infrastructure. So we can expect a strong private participation in roads through BOT projects. BOT stands for "Built, Operate and Transfer". BOT model uses private investment to undertake the infrastructure development that has historically been the preserve for the public sector. In a BOT project a private company is given a concession to built and operate a facility that would normally be built and operated by the government. The facility might be a power plant, airport, toll road, etc. But we are here concerned with the financial attractiveness of toll road projects to the Private Infrastructure developers. For this purpose I have provided an insight to the various opportunities available like the tax benefits and various aids and grants announced by the Government. I have also tried to bring to notice all the major risks involved and steps to mitigate such risks. Further I have done a comprehensive financial analysis in which I have made certain assumptions and calculated the BOT toll road projects IRR and DSCR, which proves the fact that such projects are, indeed, not only financially lucrative but also has a dazzling future.

CERTIFICATE OF ORIGINALITY

The thesis Financial Viability Analysis of the Road Sector Projects in India submitted by for his MBA program has been pursued and completed under my guidance. The same has been upto my expectation and so I, hereby, approve the same.

ii

iii

Thesis Topic Approval (Fin) SS/ 2006-08

Thesis to me show details Apr 29 Reply

Dear Vijay, This is to inform that the thesis topic Financial Viability Analysis of the Road Sector Projects in India, as proposed by you, has been approved .This email is an official confirmation that you would be doing your thesis work under the guidance of. Make it a comprehensive thesis; the objective of a thesis should be value addition to the existing knowledge base. Please ensure that the objectives as stated by you in your synopsis are met using the appropriate research design. You must always use the thesis title as approved and registered with us. You are required to correspond with us by sending atleast six response sheets to (format attached along with this mail) at regular intervals, before 31st May 2008 (the last date for thesis submission).

Regards,

ACKNOWLEDGEMENT

Guidance, assistance and cooperation of a lot of people is always involved in successfully completing a project, and so with great pleasure and privilege I wish to thank those people who have been actively supporting me in the project. First of all, I would like to thank, for providing me an opportunity to work on this project. He constantly encouraged and guided me to streamline this project from conceptualization to finish.

iv

I am especially thankful to for guiding me through the project with valuable inputs and suggestions. He has been a source of constant support and encouragement. The whole of has been immensely supportive and very helpful during course of the thesis. Last but not the least, I would also like to thank from National Highways Authority of India for providing me documents pertaining to the subject under study.

Table of Contents

Chapter I: Introduction.

1.1 1.2 Study Background. Scope. 1 1 2

Chapter II: An Overview of Indian Road Sector.

2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9

3 Classification of Roads. 3 National Highway Network. 5 Trend in Road Traffic. 5 Deficiencies in the Road Sector - mismatch between demand for road 7 transport and road space. Revenue from road transport and expenditure on roads. 7 Economic losses due to poor conditions of roads. 8 The dwindling Public Sector Outlay on Transport. 8 Agencies involved in Road Sector Development in India. 10 Road Development Plans. 13 v

2.10

Current status.

Research Methodology Chapter III: Trends in Road Sector Financing.

14 15

16 3.1 Traditional Financing Mechanism. 16 3.1.1 Budgetary Allocations. 16 3.1.2 Central Road Fund. 16 3.1.3 Octroi. 16 3.1.4 Foreign Aid to Road Sector. 17 3.1.4.1 Historical Background. 17 3.1.4.2 World Bank Aided Projects. 17 3.1.4.3 Asian Development Bank Aided Projects. 20 3.1.4.4 OECF/JBIC Aided Projects 23 3.2 Alternative Financing Mechanism. 24 3.2.1 Market Borrowings. 24 3.2.2 Private Sector Participation. 26 3.2.2.1 Government of India initiatives. 26 3.2.2.2 Implementation Models. 27 BOT (Toll Based). 27 BOT (Annuity). 31 Govt. owned SPV. 32 MOU (Negotiated Deal). 33 Govt. to Govt. Cooperation. 34 3.2.2.3 The Route Map already followed A Data Base on 35 Indias Road Sector Privatization Efforts. 37 37 39 39 40 43 44 44 45 45 46 47 48 51

Chapter IV: Critical Issues Private Sector Road Financing.

4.1 Stages in development of Road Sector Projects. 4.2 Financial Structuring of BOT Road Projects. 4.2.1 Project Financing. 4.2.2 Means of Financing. 4.2.3 Components of Project Costs. 4.3 Procurement Issues and Selection of Concessionaire. 4.3.1 Bidding Criteria. 4.4 Governments Role in facilitating BOT Projects. 4.4.1 Supportive Legal Framework. 4.4.2 Administrative Framework. 4.4.3 Govt. incentives and other form of support. 4.5 Contract Package and Project Agreements. 4.6 Identification of Risks Matrices and Instruments for Mitigation.

vi

4.6.1 Risks involved in Road Sector Projects. 4.6.2 Instruments for mitigating risks.

51 53 65

Chapter V: Lessons from International Experience.

5.1 International Practices. 65 5.2 Advantages & Disadvantages of common Govt. support measures for 66 Toll Road development. 5.3 Examples of Toll Adjustment Procedures. 70 73 73 73 74 74 76 76 77 78 79 80 84 94

Chapter VI: The Way Forward Opportunities for PSP in Road Sector Development & Conclusion.

6.1 Opportunities. 6.2 Findings. 6.3 Recommendations/Suggestions. 6.4 Conclusion The Middle Path.

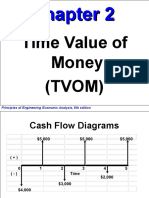

Chapter VII: Model: Financial Viability Analysis.

7.1 Description. 7.2 Sensitivity Analysis. 7.3 IRR & DSCR

Bibliography. Appendix A: Model Excel Sheets. Appendix B: Model of Concession Agreements Response Sheets

vii

1. Introduction

1.1 Study Background

The road sector has been, and will be for a long time, the dominant form of transport for freight and passenger movement throughout the world. In India the decade of 90s witnessed a series of economic reforms. The government since then is committed to second generation reforms aimed at achieving an annual growth rate of 7 to 8 percent. Such acceleration in growth is bound to create a massive demand for infrastructure services such as power, telecom, roads, ports, railways and civil aviation. Over the last few years, the road development scenario has changed rapidly. Until 1991, government was exclusively responsible for the development and maintenance of the road sector. In the absence of user charges, the road sector in India has relied entirely on the budgetary allocation and funding by multilateral agencies, which stagnated at about 3 percent of the total plan expenditure during the seventh and eighth five-year plans. The major initiative taken in the road sector was the constitution of the Central Road Fund with the introduction of a cess on fuel. Over the years this has become the major source of financing highways development programme. The revenue from the cess has increased from Rs. 2000 crores at time of its inception to Rs. 5000-6000 crores per annum. The era of 90s also witnessed major changes in the policies. To facilitate & induct the capital from private sector into road development, policies were amended and several incentives were introduced. Further to give proper direction to highway development, the National Highways Authority of India was made operational. A clear mandate was set for NHAI. A concrete plan of development was announced for National Highways and Rural Roads in the form of NHDP and Pradhan Mantri Gramin Sadak Yojana. It has thrown excellent Business opportunities for contractors, equipment manufacturers and suppliers, consultants, road developers, investors and managers. It is also expected to give a boost to the economy through increased demands for raw materials and job opportunities. However, it has also thrown challenges. Challenges, not to garner resources, but to ensure

2 optimum utilization of available resources, challenges to domestic contracting industry to modernize and upgrade to meet international competition, challenges to domestic equipment manufacturers to compete with multinational companies in the liberal import regime and finally challenges for the government to keep the momentum high as also to mobilize private sector participation.

Scope

Study of the past trends in financing of the road sector projects in India with a special emphasis on terms of financing, institutions involved in financing of the road sector projects, role of World Bank, ADB, etc. o Risks perceived by lenders in financing of the road sector projects and ways to mitigate these risks. o Public Private Partnership: Role of the private sector in the development of the road projects in India. o Also prepare a Model to show the Financial Viability of the Road Sector Project.

2. An Overview of Indian Road Sector

2.1 Classification of Roads

India has the second largest road networks in the world totaling more than 3.3 million km at present. For the purpose of management and administration, roads in India are divided into the following five categories: 1. National Highways (NH). 2. State Highways (SH). 3. Major District Roads (MDR). 4. Other District Roads (ODR). 5. Village Roads (VR). The National Highways are intended to facilitate medium and long distance inter-city passenger and freight traffic across the country. The State Highways are supposed to carry the traffic along major centers within the State. Other District Roads and Village Roads provide villagers accessibility to meet their social needs as also the means to transport agriculture produce from village to nearby markets. Major District Roads provide the secondary function of linkage between main roads and rural roads.

Indian Road Network

CATEGORIES

National Highways State Highways Major District Roads Village & Other Roads Total Length

LENGTH (KMS)

58,112* 1,37,119 4,70,000 26,50,000 33,15,231

(As we can see from the above bar chart that NHs are less than 2% but carry more than 40% of traffic)

2.2 National Highway Network

The National Highways are the primary arteries of the countrys traffic, connecting to nations capital to the various State capitals, major ports and centres of industries. The

5 national Highway system is owned by Central Government. The legal status is given by National Highways Act, 1956. When the era of planning started in India (in 1956), the length of National Highway system was 19,811 kms. This has now increased to 58,112 kms. The additions to National Highway System have been made after careful evaluation of various demands or needs arising from time to time. National Highways constitute less than 2% of the total road network, but carry nearly 40% of the total road traffic.

2.3 Trend in Road Traffic

The roads and highways in India account for about 87 per cent of the total passenger traffic and about 65 per cent of the total freight traffic in the country.

Traffic Movement (%)

Freight Year 1951 1961 1971 1991 2000 2015 (estimated) Road 11 28 35 53 65 80 Rail 89 72 65 47 35 20 Passengers Road 28 42 59 79 87 92 Rail 72 58 41 21 13 8

Traffic Movement in Bar Chart

(The Blue And Red bars are for Freight Traffic and Green and Purple for Passenger Traffic)

Its evident from above that the Freight transport by road has risen from 6 billion tonne km (BTK) in 1951 to 400 BTK in 1995 and 800 BTK in 2001. Passenger traffic has risen from 23 billion-passenger km (BPK) to 1,500 BPK in 1995 and 3000 BPK in 2001. The annual growth of road traffic is expected to be 9% to 10%. Current boom in the automobile sector may even increase the future growth rate of road traffic. While the traffic has been growing at a fast pace, it has not been possible to provide matching investment in the road sector, due to the competing demands from other sectors, especially the social sectors, and this has led to a large number of deficiencies in the network. Many sections of the highways are in need of capacity augmentation, pavement strengthening, rehabilitation of bridges, improvement of riding quality, provision of traffic safety measures, etc. There are congested road sections passing through towns where bypasses are required. Many old bridges are in need of rehabilitation/replacement along with capacity augmentation.

2.4 Deficiencies in Road Sector

7 Road development has been ignored in most of the development plans of India. There has been no matching growth of the main road network comprising of National and State Highways as seen from the table given below: Category National Highways State Highways Major District Roads & Other Roads Total 1951 22,255 60,000 3,18,000 4,00,255 2007 58,112 1,37,119 31,20,000 33,15,231 % Change 161% 128% 881% 728%

The main roads have not kept pace with traffic in terms of quality also. Out of the total 1,95,231 km. Length of National and State Highways only 2% of their length is fourlane, 34% two-lane, and 64% single lane. As far as NHs are concerned, only 5% of their length is four-lane, 80% two-lane and the balance 15% continues to be single lane. Thus the road sector, in spite of its high priority is adversely affected by the poor quality and service levels. The poor quality of Indian roads is highlighted by congestion, old fatigued bridges and culverts, railway crossings, low safety, no bypasses and slow traffic movement.

2.5 Revenue from road transport and expenditure on roads

The entire revenue received by the Government by road transport taxation is not ploughed back on the roads. Presently the total allocations, central and state, available for road development are to the tune of Rs.11,000 crore, which is just 42% of total transportation revenues received by the government. This implies the inefficiency of our system, which consumes 58% of the total revenues received by the transportation sector.

2.6 Economic losses due to poor conditions of roads

The poor condition of roads has a telling effect on the economy. Movement of traffic on poor and congested roads increases the cost of operation of vehicles as well as loss of

8 valuable time and also contributing to high rate of road accidents. Our commercial vehicles are able to make only 250-300 kms in single day against 500-600 kms in developed countries. It has been roughly estimated that a saving of Rs. 25,000 crores per year could be brought about by road improvements. These savings would be in the form of reduced fuel consumption, lower wear and tear of vehicles and less damage to tyres. These can be avoided by modernizing the roads.

2.7 The dwindling Public Sector Outlay on Transport

In the successive Five Year Plans, the public sector outlay on transport has been declining. Plan (Year) Total Outlay or Expenditure Expenditure 1st Plan (1951-56) 2nd Plan (1956-61) 3rd Plan (1961-66) 4th Plan (1966-69) 5th Plan (1969-74) 6th Plan (1974-79) 7th Plan (1980-85) 8th Plan (1985-90) Annual Plan (1990-92) 9th Plan (1992-97) 1968 4672 8577 6625 15778 39426 109292 179277 137034 341000 Road Sector 135 224 440 309 862 1701 3807 6335 3779 13210 on % age of Total Plan Expenditure 6.7% 4.8% 5.1% 4.6% 5.5% 4.1% 3.5% 3.5% 2.8% 3.0%

Ninth & Tenth Five Year Plan:

The following goals and objectives are defined for the Road Sector in the 9th & 10th Plan. 1. Phased removal of deficiencies in the existing NH network in the tune with traffic needs for 10-15 years with emphasis on high-density corridors for four laning. 2. Bring in highway-user oriented project planning in identifying package of projects section wise rather than isolated stretches. 3. Greater attention to rehabilitation and reconstruction of weak/dilapidated bridges for the safety of the traffic. 4. Modernization of road construction technology for speedy execution and quality assurance. 5. Engineering measures to improve road safety and conservation of energy. 6. Continued emphasis on Research f& development. 7. Integrating the development plans with Railways and other modes of transport. 8. Integrating the development plans with Railways and other modes of transport. 9. Providing employment opportunities to the labour force in rural areas. 10. Special attention for development of roads in the North-Eastern Region. 11. Encouraging private sector participation in development of roads.

10

2.8 Agencies involved in Road Sector Development in India

Ministry of Road Transport & Highways (MORT&H)

Ministry of Road Transport & Highways is responsible for the formulation and implementation of policies and programmes for the development and maintenance of Roads & Highways. All roads other than National Highways in the various states fall within the jurisdiction of respective State Governments. Ministry being an Apex Organization in the Highway Sector makes specifications placed down on codes of practice for all items and activities related to construction of roads and bridges. The Ministry has basically been divided in two wings i.e. Roads & Highways and Transport. The various associated agencies under the ministry are: o NHAI o CRRI o IRCC o NITHE o IRC o IABSE

NHAI (National Highways Authority of India)

The execution of National Highway projects were either handled by State or Central Governments so there was a problem in fixing the responsibility between the between the two. Moreover, dual control of the Central and State Government often led to delays in decision-making. The Central Government realized a need of central agency that could directly facilitate the matter so, The National Highways Authority of India that was constituted under National Highways Authority of India Act, 1998 and made operational in February 1995. The Authority is an Autonomous Body with executive responsibility for the development, maintenance and operation of those National Highways and associated facilities vested in it by the Ministry of Surface Transport. The Authority has been entrusted with the projects under National Highways Projects (ADB loan, OECF, World Bank). In addition, NHAI is also responsible for the maintenance and development of Golden Quadrilateral, North South & East West corridors, providing port connectivity and some selected

11 projects like Naini Bridge, Hapur Bypass, Durg Bypass etc. NHAI is also responsible for implementation of the policy of privatization in highway sector.

CRRI (Central Road Research Institute)

Road research has played an important role in Indias road development. The problems of planning, design construction and maintenance of roads in India is unique and challenging and the ready made solutions from other countries are not found feasible and economical. Indigenous solutions have to be devised to suit the countrys local needs and resources. This task has been carried out by Central Road Research Institute (CRRI), Delhi, established in 1950, as one of the chain of the major laboratories under the council of Scientific and Industrial Research. The CRRI has many divisions, dealing with the diverse areas such as flexible pavements, rigid pavements, geotechnical engineering, roads, bridges, pavements performance, traffic and transportation, environment and road safety.

IRCC (Indian Road Construction Corporation Limited)

IRCC is a public sector enterprise under the Ministry of Road Transport and Highways. It was incorporated during 1976 as a specialized commercial enterprise in the field of construction of roads, bridges, airfield pavement and allied civil works both in Indian and abroad.

NITHE (National Institute of Training For Highways Engineers)

NITHE was established in 1983 for training of Highway engineers in Central & State Government Departments as well as private sector. It is a society under the administrative control of the Ministry of Road Transport & Highways. NITHE organizes foundational training programmes refresher courses and specialized courses for the in service Highway Engineers of Central & State Governments.

IRC (Indian Roads Congress)

The Indian Roads Congress (IRC) was set up by the Government of India in consultation with the State Governments in December, 1934. It is the premier body of Highways Engineers in India. The Principal objectives of the India Roads Congress are to provide a

12 national forum for regular pooling of experience and ideas on all matters concerned with the construction and maintenance of highways, to recommend standard specifications and to provide a platform for the expression of professional opinion on matters relating to roads and road transport including those of organizations and administration. It is also publishing Journals, monthly magazines and research bulletins. IRC is a registered society under the Registration of Society Act and is financed by contribution from Central Government, various State Governments and also contributions from its Members and sale of Publication.

IABSE (Indian National Group of the International Association for Bridge and Structural Engineering)

The International Association for Bridge and Structural Engineering (IABSE) was founded in 1929 in Zurich by Engineers from 14 countries, who recognized both the necessity for a closer human collaboration and exchange of information, knowledge and discoveries across all national borders. The Government of India, Ministry of Road Transport and Highways in consultation with various State Governments set up the Indian National Group (ING) of IABSE in May 1957. The goals of the Association are, promotion of international collaboration between engineering and researchers and particularly representatives of science, industry and public authorities. It also encourages the members for promotion and exchange of technical and scientific knowledge. The Indian National Group deals with all aspects of planning, design, analysis, detailing, construction, management, operation, maintenance, repair and rehabilitation of structures of all kind including Bridges.

Public Works Department (PWD):

In India PWD was first established in the Punjab Presidency in mid of the 19th Century out of Military Board. It is an institution now 150 years old and is firmly in saddle in all the States of the country. This institute i.e. State Public Works Department is the premier body responsible for delivery of developmental works, be it building, roads or bridges. In the Road Sector the road connectivity of villages, construction and maintenance of State Highways, Major District Roads, Other District Roads along with maintenance and

13 construction of National Highways as an agent of Government of India is the responsibility of the State PWDs.

2.9 Road Development Plans

The country prepares a long term Road Development Plan once in every 20 years. The first was the Nagpur Plan (1943), which set the blue print for the period upto 1961. The second was the Bombay Plan, which was for the period 1961-1981. Next plan was the Lucknow Plan covering the period 1981-2001. The recent plans that are going on is the National Highway Development Plan & Pradhan Mantri Gramin Sadak Yojana.

National Highway Development Plan: For augmenting the capacity of National

Highways, sequel to Prime Ministers announcement, Central Government with National Highway Authority of India (NHAI) as its nodal agency is undertaking National Highway Development Project (NHDP). The plan envisages four and six laning of the following roads: o Golden Quadrilateral: Delhi-Mumbai-Chennai-Kolkata-Delhi. o North-South Corridor: Srinagar to Kanyakumari with spur from Salem to Cochin. o East-West Corridor: Silchar to Porbunder. o Port Connectivity to Major Ports.

Pradhan Mantri Gramin Sadak Yojana: Under the Pradhan Mantri Gramin

Sadak Yojana, two lakh villages with over 1,000 population will be connected to the nearest highway by 2008. All villages with a population above 500 will be connected by 2009. The cost is estimated at Rs. 60,000 crores. Indian villages need roads which serve for decades without maintenance, are hard enough to withstand iron-tyred bullock carts and can be used even monsoons.

National Highways Development Project (NHDP)

In order to improve the road network on a country wide level, the National Highway Development Project was set up by the PMO. The project aims to develop the Golden Quadrilateral, the North-South and East-West Corridor and other work including Port

14 Connectivity, as these are the high volume sectors carrying the substantial portion of the road traffic in India. The total length of Golden Quadrilateral is 5952 kms, North-South-East-West Corridor is 7300 kms and that of Port Connectivity 400 kms. The project envisages a total investment of Rs 58,000 crores spread over a nine-year period. Golden Quadrilateral is scheduled for completion by the end of 2003 and North-South-East-West Corridor by the year 2009.

2.10 Current Status

1. Of the 58,112 kms of National Highways in India about 33 per cent are single lane and only about 2 per cent of the total road network is four lane. The poor quality of Indian roads is highlighted by congestion, old fatigued bridges and culverts, railway crossings, low safety, no bypasses and slow traffic movement. 2. Considering the importance of the road sector in the country, the government has embarked on the ambitious National Highway Development Project covering 14,000 km with a cost of Rs. 58,000 crore and the projects have already started rolling. 3. The Indian construction industry that had been experiencing a slowdown witnessed a growth of 9 per cent and 8.5 per cent for the periods Financial Year 2000 and Financial Year 2001 (1st half) respectively. This was possible due to the increased spending in infrastructure and the actual taking off of some of the Road Sector projects.

15

Research Methodology:

The research design which I have planned for my thesis will be of the following nature.

Research Data Source Research approach Research instrument Type of questionnaire Type of questions

: Analytical & Exploratory. : Secondary data. : Survey method. : Personal interviews & Financial Model. : Structured non-disguised. : Open ended.

I would be working on secondary data because of the fact that the various financial aspects of the projects like the Projects Initial Investment, the Payment Pattern, duration of the project, Project IRR, etc. have to be analysed to show the viability of such projects. For this purpose I will have to indepth and exhaustive study of all the available secondary data like journals, websites and other related documents.

16

3. Trends in Road Sector Financing

3.1 Traditional Financing Mechanism

3.1.1 Budgetary Allocations: Roads are primarily funded through budgetary

allocations. Central government provides funds for National Highways and State Government for other roads. Further to give proper direction to highway development The Planning Commission of India has estimated an investment of INR3,118 billion under the Eleventh Plan versus the INR1,448 billion spent under the Tenth Plan.

3.1.2 Central Road Fund: The Central Road Fund derives its revenues out of the

duty on customs and excise levied on petrol and diesel. It is expected to provide Rs. 6,000 crore annually for National Highway Development Program. The states are also getting Rs. 1962 crore for development of state roads. A dedicated road fund has been created by the central government. It is expected that the total collections in the fund will be to the tune of around Rs. 10,000 crore. The allocations from the fund would be as shown: o 50% of the proceeds from additional excise duty on diesel would be allocated for development of rural roads. o Of the remaining balance, 57.5% would be provided for national highways, 27% for state roads, 3% for development of roads of interstate and economic importance and 12.5% for railway safety works such as rail roads over bridges, manning of level crossings etc.

3.1.3 Octroi: Octroi is the fees collected by the local authorities of towns and cities

from the trucks, which carry goods. It is one of the major avenues of resource generation of municipalities. The fund collected by octroi is generally used to develop the other district roads and village roads. Since the collection of octroi results in long detention of trucks on the roadside and entails waste of time and fuel, so central Government is pressurizing to abolish this mode of taxation.

17

3.1.4 Foreign Aid to Road Sectors:

3.1.4.1 Historical Background: The first major external aid for roads was for the development of certain National Highway Section in Maharashtra, Bihar, Bengal started in 1960s. This was funded by International Development Association (IDA), an affiliate of World Bank. Though efforts were made in the seventies to continue external aid for the roads by the World Bank, but were unsuccessful because of the differences on two issues: a. b. Inviting Global tenders The engagement of consultants.

Negotiations were again revived in the mid-eighties, when the Government of India agreed to the World Banks condition that tenders should be called on the basis of International Competitive bidding. Since then there have been a number of externally aided highway projects, both in Central Sector for National Highways and in the State Sector for State Highways and Rural Roads. 3.1.4.2 World Bank Aided Projects: Various projects that have been funded by world bank are: 1. India: State Highways Project Date: June 20, 1997 LOAN AMOUNT: IBRD-US $ 70 million PROJECT DESCRIPTION: The project will help relieve traffic congestion and reduce travel times by widening and upgrading priority roads, enhancing road maintenance, and strengthening the state road agency's ability to manage its road programs and assets. The main components of the project are: (i) civil works for widening and strengthening of about 1,400 kms of high-traffic volume State Highways and Major District Roads; (ii) reduction in the backlog of periodic maintenance work on 2,000 kms of state highways and major district roads and twenty kilometers of national highway damaged by a recent cyclone will receive emergency maintenance; and (iii) the Institutional Development Plan of the Roads and Buildings Department (RBD) will be supported through corporate strategy development, studies and/or pilot projects, training and staff development.

18 India: Third National Highways Project Date: June 6, 2000 LOAN AMOUNT: IBRD-US $ 516 million TERMS: Grace period=5 years, maturity=20 years PROJECT DESCRIPTION: This project will help bring down transport costs by increasing highway capacity, reducing traffic jams and road accidents, separating local and through traffic in towns, and improving pavements. The project will support the National Highway Authority of India (NHAI) in the development and maintenance of the 6,000 km "golden quadrilateral" between Delhi, Calcutta, Chennai, and Mumbai, and the development of the strategically important NorthSouth and East-West corridors and access to key ports. Specifically, the project will finance civil works for widening and strengthening about 475 kms of national highway from two lanes to four, six lane divided carriageways. It will also cover environmental management, including tree plantation, and a program of road work to introduce alternative maintenance contracting methods and improve traffic management and safety. 2. India: Gujarat State Highway Project

Date: September 6, 2000 LOAN AMOUNT: IBRD-US $ 381 million TERMS: Grace period=5 years; maturity=20 years PROJECT DESCRIPTION: The project will strengthen and widen about 800-900 kms of state highways while implementing periodic maintenance of an additional 1,000 kms of state highways. It will also finance technical assistance, training, and equipment needed to meet increasing demands on road services and infrastructure. The resulting reduction in transport bottlenecks is expected to help support the longterm economic growth needed to reduce poverty. 3. Date: May 24, 2001 LOANS AMOUNT: IBRD-US $ 360 million equivalent Terms: Grace period=5 years; maturity=20 years India: Karnataka State Highways Improvement Project

19 PROJECT DESCRIPTION: This project will finance road widening and strengthening, and technical assistance for improved management of road resources and road safety. The project will enhance and expand the core road network through institutional strengthening of Karnataka's main road agency and support for a pilot road safety program. Specifically, the project will upgrade and widen about 1,000 kms and repair an additional 1,300 kms of state roads. The project will also invest in Karnataka's road agency -- the Public Works Department -- to provide training for staff and modernize equipment and systems of strategic importance in improving state roads. 4. Date: June 22, 2001 CREDIT AMOUNT: IDAUS $ 589 million equivalent TERMS: Grace period = 5 years; Maturity = 14 years PROJECT DESCRIPTION: The project will fund the upgrading of this New DelhiCalcutta highway, a 1,300 kms stretch which suffers from major traffic congestion. The project will cut travel time and boost safety on. It will also help highway agencies improve management and delivery of highway services, including the management of a growing number of private sector contracts for road maintenance. The project will specifically upgrade 420 kms of national highway sections through Bihar, Jharkhand and Uttar Pradesh; implement road safety works; and pilot initiatives to foster private sector involvement in road financing. India: Kerala State Transport Project Loan Date: March 14, 2002 AMOUNT: IBRD US $ 255 million TERMS: Grace period = 5 years; Maturity = 20 years PROJECT DESCRIPTION: Kerala State, on Indias southwest coast, has the highest rate of road accidents of any state in India. The Kerala State Transport Project will address the rapid increase in demand for road services that has contributed to this low level of road safety. The project will enhance road capacity and provide targeted safety programs designed to boost both safety and efficiency of Keralas roads. India: Grand Trunk Road Improvement Project

20 India: Mizoram State Roads Project Date: March 14,2002 CREDIT AMOUNT: IDA- US $ 60 million TERMS: Grace period = 10 years; Maturity = 35 years PROJECT DESCRIPTION: The credit will improve road capacity, quality, and safety through rehabilitation and maintenance. Specifically, the Mizoram project will expand or rehabilitate over 700 kms of the states core road network - nearly threefourths of the states total network over the next five years. These physical improvements will benefit an estimated 70 percent of the States largely poor population that relies on the road network on a daily basis. 3.1.4.3 Asian Development Bank Aided Projects: The Bank's policy focuses on alleviating constraints to economic development and attracting private sector participation to develop and maintain an efficient and dynamic multimodal transport system. Assistance is given to develop roads, railways, and ports. Bank support for roads is focused on policy reforms, and attracting private sector participation for the development of national highways and expressways, as well as state highways. Having helped support the establishment of the National Highway Authority, the Bank has strengthened its efforts in promoting reforms of the institutional and regulatory framework. It encourages improved efficiency in public sector operations and removal of bottlenecks in highdensity corridors. The promotion of environmental and safety standards are carefully examined during project preparation. There have been three loans from the Asian Development Bank to the Highway Sector and four other State Level loans. 1. Loan No. 918-IND: Road Improvement Project This project consists of improvement of Roads Equipment: Procurement of quality control, pavement evaluation and maintenance equipment for the PWDs of the five states concerned. o Consulting Services: Provision of consulting services to (a) assist the Executing agencies in construction supervision of the Project; (b) undertake a

21 study for the development of a long-term plan for expressways; and (c) carry out a study for the updating of road user cost data. o Incremental Operation and Administration: Incremental operation and administration costs for the implementation of the Project. 2. Loan No. 1041-IND: Second Road Improvement This project comprises: o o Improvement of Roads: Procurement of equipment for traffic counting, Consulting Services: Provision of consulting services to assist the weighing and pavement evaluation. Executing Agencies in the implementation of the Project. 3. Loan No. 1274-IND: National Highways Project The Project comprises: o Highway Improvement: This component of the Project will cover improvement of the five national highway sections, totaling about 330 km in the five states. The improvements will include widening to four lanes (234 km) and strengthening of the existing pavements with asphaltic concrete surfacing. The five sections of the Project are: o Consulting Services: Consulting services for construction supervision of civil works under the Project are envisaged to be carried out by an appropriate combination of international and domestic consultants. 4. Loan No. 1279-IND: Bombay-Vadodara Expressway Technical Assistance Project The Project was formulated to assist the Government, through the provision of consulting services, with the preparation of detailed designs and contract documentation required for the implementation of the construction projects to develop an expressway between Bombay and Vadodara.

22 5. Loan No. 1747-IND: Surat-Manor Tollway Project The Project will improve the 180 km stretch between Surat and Manor of National Highway 8 linking the states of Gujarat and Maharashtra, including strengthening of the highway's pavements. Thus ease congestion in freight and passenger traffic between the industrial and agricultural areas of Gujarat and the west coast ports, including Mumbai. The objectives of the project are to remove capacity constraints and improve road safety on critical sections of the western transport corridor from Delhi to Mumbai. The completed project highway will be operated and maintained by the private sector through a toll concession. The commercialization of the operation and maintenance of the project represents a significant step in increasing private participation in national highway development in India and is expected to have a demonstration effect on the management of other national highway sections. 6. Loan No. 1839-IND: Western Transport Corridor Project The project will upgrade the 259-km Tumkur-Haveri section of the Western Transport Corridor (WTC) from a two-lane, single-carriage highway to a four-lane, divided highway. The safety features will include a dual carriageway to prevent headon collisions and service roads to separate slow-moving and fast-moving traffic. They will also include overbridges for pedestrians, bypasses to separate through traffic from local traffic, and fences to prevent unlawful crossing and reduce noise pollution in populated areas. 7. Loan no. 1870-IND: West Bengal Corridor Development Project The project will upgrade India's national and state highways that link West Bengal's southern ports of Kolkata and Haldia with eastern India, Bangladesh, Bhutan and Nepal. Specifically, the project will improve: o 370 km of National Highway 34, which was identified for priority assistance because of its strategic importance and its impact on poverty reduction. o 150 km of connecting state highways that link the corridor to Bangladesh. o 100 km of rural roads, giving poor communities easier access to markets, schools, and hospitals and thus improving their job and income opportunities.

23 3.1.4.4 OECF/JIBC Aided Projects: Five National Highway Projects have been so far funded by Overseas Economic Cooperation Fund of Japan/Japan Bank for Inrenational Cooperation so far. The total loan is of the order 37.557 billion Japanese Yen. Four of these projects are for four-laning and one is for major bridge across River Yamuna at Allahabad.

Project Name National Highway-2 Improvement Project National Highway-5 Improvement Project

Date of Approval 9 Jan, 1992

Amount of approval 4855 million Yen 11,360 million Yen 4,827 million Yen 5,836 million Yen 10,679 million Yen

Interest Rate 2.6%

Repayment Period 30 years

Grace Period 10 years

24 Jan, 1994

2.6%

30 years

10 years

National Highway-24 28 Feb 1995 Improvement Project National Highway-5 28 Feb 1995 Improvement Project Calcutta Transport 25 Feb 1997

2.6%

30 years

10 years

2.6%

30 years

10 years

2.3%

30 years

10 years

Infrastructure Development Project

24

3.2 Alternative Financing Mechanism

3.2.1 Market Borrowing:

1. Issuing of Infrastructure Bonds by NHAI guaranteed by Government: In financial year 2006, the authority issue raised Rs.7,500 crore and in financial year 2007, Rs.8,100 crore from the issue of Infrastructure Bonds. The authority is going to raise Rs.10,200 crore in the financial year 2008-2009. Specifications:

The Authority / Issuer / National Highways Authority of India, Authority NHAI incorporated under the National Highways Authority of India Act, 1988.

Issue

Offer

Private Private Placement of Non-Convertible Redeemable Taxable Bonds (with benefits under section 54EC of Income Tax Act 1961for Long Term Capital Gains).

Placement

Bond(s)

Non-convertible redeemable taxable bond(s) in the nature of debentures with benefits under section 54EC of Income Tax Act 1961for Long Term Capital Gains, also referred to as NHAI Bonds(s).

Category Amount Offered Put/Call Option Credit Rating Rating Agency

Non-Financial Public sector unit. On tap 3 Years AAA Crisil

25 2. Issuing of Infrastructure Bonds by Maharashtra State Road Development Corporation (MSRDC): Specifications Nature Secured, Non-Convertible, Redeemable, Taxable Bonds Guaranteed by State Government of Maharashtra for Rating Rating Agency Tenor Amount Offered Put/Call option Coupon Rate Category timely payment of interest and repayment of principle. CARE (A+SO) CARE 7/10/12/15 years 250 crores. 5/7/10/none respectively. 11/11.25/11.50/11.72% respectively. Non-Financial SLU

3. Issuing of Infrastructure Bonds by Roads and Bridges Development Corporation of Kerala Ltd. (RBDCK): Specifications Nature Secured, Non-Convertible, Redeemable, Taxable Bonds Guaranteed by State Government of Kerala for timely Tenor Amount Offered Put/Call option Coupon Rate Category payment of interest and repayment of principle. 7 years. 25 crores. 5 years. 12.25% annually. Non-Financial SLU

3.2.2 Private Sector Participation:

Public Private Partnerships (PPPs) are characterized by the sharing of investment, risk, responsibility and reward between the partners. The reasons for establishing such partnerships vary but generally involve the financing, design, construction, operation and maintenance of public infrastructure and services. The underlying logic for establishing

26 partnerships is that both the public and the private sector have unique characteristics that provide them with advantages in specific aspects of service or project delivery. The most successful partnership arrangements draw on the strengths of both the public and private sector to establish complementary relationships. The roles and responsibilities of the partners may vary from project to project. As the roles and responsibilities of the private and public sector partners differs on individual servicing initiatives, but the overall role and responsibilities of government do not change. Public private partnership is one of a number of ways of delivering public infrastructure and related services. It is not a substitute for strong and effective governance and decision making by government. In all cases, government remains responsible and accountable for delivering services and projects in a manner that protects and furthers the public interest. Public private partnerships can vary in: o o o The degree of risk allocated between the partners. The amount of expertise required on the part of each partner to The potential implications for user fee payers.

negotiate contracts.

3.2.2.1 Government of India Initiatives: The following measures have been implemented by the Government. o o o o o o NHAI. Road sector has been declared as an industry. This facilitates Provisions of Monopolies and Restrictive Trade Practices Act National Highways Act has been amended to enable levy of fee The Road Sector has been declared as an infrastructure to The establishment of the Infrastructure Development Finance The establishment of National Highway Authority of India borrowing on easy terms. have been relaxed to enable firms to enter the highway sector. on National Highways, Bridges and Tunnels. permit floating bonds. Company (IDFC).

27 o o Permitting upto 100% foreign equity participation for the Significant import duty concessions available on equipment

projects set up by foreign private entrepreneurs. and raw material being imported by projects in various Infrastructure Sectors.

3.2.2.2 Implementation Models

o o o o o BOT (Toll Based) BOT (Annuity) Govt. owned SPV MOU (negotiated deal) Govt. to Govt. Cooperation

Built, Operate and Transfer (BOT-Toll Based) BOT stands for "Built, Operate and Transfer". BOT model uses private investment to undertake the infrastructure development that has historically been the preserve for the public sector. In a BOT project a private company is given a concession to built and operate a facility that would normally be built and operated by the government. The facility might be a power plant, airport, tollroad, tunnel or water treatment plant. The private company is also responsible for financing and designing the project. At the end of the concession period the private company returns ownership of the project to the government. The concession period is determined primarily by the length of the time needed for the facility revenue stream to pay off the company's debt and provide a reasonable rate of return. The various variants of BOT scheme are: o Build, Own and Operate (BOO): The Government either transfer ownership and responsibility for an existing facility or contracts with a private partner to build, own and operate a new facility in perpetuity. The private partner generally provides the financing. o Build, Own, Operate and Transfer (BOOT): The private developer obtains exclusive franchise to finance-build, operate, maintain, manage and collect user

28 fees for a fixed period to amortize investment. At the end of the franchise, title reverts to a public authority or Government. o Build, Lease/Rent and Transfer BLT/BRT): The Government contracts with the private partner to build a facility to provide a public service. The private partner then leases the facility to the Government for a specified period after which ownership vests with the Government. This approach can be taken where Government requires a new facility or service but may not be in a position to provide financing. o Build, Transfer and Operate (BTO): The Government contracts with a private partner to finance and build a facility. Once completed, the private partner transfers ownership of the facility to the Government. The Government then leases the facility back to the private partner under a long term lease during which the private partner has an opportunity to recover its investment and a reasonable rate of return. o Modernize, Own/Operate and Transfer (MOT): The private partner takes a facility from the Government, expands or modernizes it, then operates the facility under a contract with the Government. The private partner is expected to invest in facility expansion or improvement and is given a specified period of time in which to recover the investment and realize a return. o BOR: Build, Operate and Renewal of the concession. o DBFO: o DCMF: Design, Build, Finance and Operate. Design, Construct, Manage and Finance.

o ROO: Rehabilitate, Own and Operate. o ROT: Rehabilitate, Own and Transfer. In a BOT project, the Government decides the need of the project and its scope. The design, performance and maintenance of the project is tailored to the objectives of the country and the private sponsors are selected by appropriate bidding or evaluation process in order to arrive at the price that is fair to both the Government and the sponsors. A properly drafted agreement limits the private sponsors to a reasonable rate of return and ensures that the project serves the country's national interest and economy. Advantages of BOT Scheme:

29 o Cost savings: With BOT Scheme, Government is able to realize cost savings for both the construction of capital projects as well as the operation and maintenance of services. For example, construction cost savings can often be realized by combining design and construction in the same contract. The close interaction of designers and constructors in a team can result in more innovative and less costly designs. The design and construction activity can be carried out more efficiently, thereby decreasing the construction time and allowing the facility to be put to use more quickly. Private partners may be able to reduce the cost of operating or maintaining facilities by applying economies of scale, innovative technologies, more flexible procurement and compensation arrangements, or by reducing overhead. o Risk sharing: With public private partnership, Government can share the risks with a private partner. Risks could include cost overruns, inability to meet schedules for service delivery, difficulty in complying with environmental and other regulations, or the risk that revenues may not be sufficient to pay operating and capital costs. o Improved levels of service or maintaining existing levels of service: Public private partnerships can introduce innovation in how service delivery is organized and carried out. It can also introduce new technologies and economies of scale that often reduce the cost or improve the quality and level of services. o Enhancement of revenues: BOT scheme may set user fees that reflect the true cost of delivering a particular service. BOT scheme also offer the opportunity to introduce more innovative revenue sources that would not be possible under conventional methods of service delivery. o More efficient implementation: Efficiencies may be realized through combining various activities such as design and construction, and through more flexible contracting and procurement, quicker approvals for capital financing and a more efficient decision-making process. More efficient service delivery not only allows quicker provision of services, but also reduces costs. o Economic benefits: Increased involvement of Government in BOTs can help to stimulate the private sector and contribute to increased employment and economic

30 growth. Local private firms that become proficient in working in BOTs can export their expertise and earn income outside of the region. Project Structure

G ov ernm ental A gency

Su bscrip tion A greem ent I nsu rance

I nsu rers

P olicies

C on cessionaire

L oan A greem ent

L en d ers

E ngineeri ng P rocu rem ,ent C onstru ction C ontract

I nd ep enden t D esign C onsu ltant

Disadvantages of BOT Scheme:

EPC C ontractors

In the absence of historical traffic data, there is uncertainty involved in achieving the estimated traffic on the new road facility based on a diversion analysis. The up-front capital grant, which may be upto 25% of the project cost and will have to be matched by at least an equal amount of equity contribution by the PD will provide enough confidence to the private developers to bid for the project. The private participant will bid for the grant amount on the basis of his perception of the various project risks viz. construction, operations & maintenance, financing and revenue (traffic volume and toll collection).

31

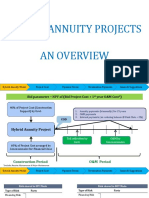

BOT (Annuity Scheme)

In this option, a private developer is responsible for design, development, construction, operation, maintenance and financing of the project. It is a kind of a BOT scheme in which the prospective bidder for the road project submit their estimates of the annual payment they expect from the Sponsors for taking up the project. The sponsors would award the project to the bidders asking the lowest annuity payments. Revenue to the concessionaire accrues from annuity payments to be made by the governmental agency, which reduces the revenue risk for the concessionaire. In this type the governmental agency may or may not retain the right for collecting the tolls from the users of the facility. Project Structure

Insurers

Insurance Policies

Private Developers

Subscription Agreement

Equity Investors

Governmental Agency

Concession Agreement Land, Annuity Feasibility Studies

Promoters/ Sponsor

Loan Agreement

Lenders

Independent Consultant Contract

Tolling Contract

Engineering Procurement , Construction Contract

Operation & Maintenance Contracts

Independent Consultant

EPC Contractors

O&M

Contracts

Advantages o Selection of the private developer is through an international competitive bidding process wherein the bidders asking for the lowest annuity amount is awarded the BOT contract. This leads to induction of private party on the most competitive terms.

32 o As the revenue (traffic volume and toll collection) risk is substantially mitigated, financing for the project can be arranged on the most competitive commercial terms. Disadvantages o The entire revenue risk will be fully borne by the Government. o Impose a high financial burden on the Government is for a long period.

Govt. Owned Special Purpose Vehicle (SPV)

In this case the Promoter shall be responsible for the development and implementation of the Project and form a Special Purpose Vehicle (SPV) as the implementing agency. In this approach, a Private Developer (PD) shall be selected through an International Competitive Bidding process. The Project shall be awarded to the PD on BOT basis for a fixed concession period. The PD shall be responsible for design, development, construction, operation, maintenance and financing of the Project. Promoter has to provide a one-time capital grant to cover a part of the revenue shortfall risk. The PD shall domicile the Project and all the activities related thereto in a Special Purpose Vehicle (SPV). The investments made in the Project by the SPV and returns thereon shall be recovered by way of revenues generated from the operation of the project. The SPV shall be entitled to collect tolls from the users of the Project road at rates to be specified in the Concession Agreement. The toll rates shall be indexed to inflation (WPI, CPI, etc.) and may undergo annual revision. Advantages The advantages in this model are: o As the SPV would be promoted by a Sovereign body, this will be looked upon favourably by lenders / investors thereby facilitating financing on commercial terms.

33 Project Structure

Governmental Agency

Subscription A greement Insurance

Insurers

Policies

SPV/ Corporation

Loan A greement

Lenders

Engineering Procurement , Construction Contract

Independent Design Consultant

EPC Contractors

O&M Contractor

Disadvantages The disadvantages in such a strategy could be: o It would be detrimental to the achievement of overall policy of public-private partnership for infrastructure development. o It would create a significant burden on the budget of Government/Promoter for a long period.

Memorandum of Understanding (MoU negotiated deal)

As per this structure, the Project shall be awarded to a private Project Developer (PD) on a Build-Operate-Transfer (BOT) basis based on negotiated terms for a pre-determined (fixed/variable) concession period. The PD and Government shall enter into a Memorandum of Understanding (MoU) for this purpose. The PD shall be responsible for design, development, construction, operation, maintenance and financing of the Project.

34 Advantages o This structure allows for harnessing the efficiencies (operational and financing) of private sector o Reduces financial burden on Government as only a one-time capital grant will be required to be given to the project. Disadvantages o Selection of the private developer is not through a public/open process. Hence issues of transparency may arise. o As this would be a negotiated deal, this transaction may lead to price distortions in the absence of a competitive mechanism for selection of the private participant.

Government to Government Cooperation

In this case a Memorandum of Understanding may be signed between Government of India and Government of interested countries (e.g. Malaysia, Korea, Japan, Canada etc.) or their nominated company/companies. The SPV will be formed by companies from the country with whom the MoU is signed. The Project implementation shall be on BOT basis, which will encompass design, engineering, financing, procurement, construction, operating, maintenance and tolling of the Project highway. Example NHAI has signed an agreement with Government of Malaysia promoted Swarna Tollway Limited in order to implement certain sections of two National Highways in the State of Andhra Pradesh. Advantages

The SPV implementing the project will have the backing of both the Government of India and its own Government. The structure allows for introduction of international experience in similar projects.

Disadvantages

35

The satisfactory conclusion of Government-to-Government negotiations may take excessively long time. As this would be a negotiated deal, this transaction may lead to price distortions in the absence of a competitive mechanism for selection of the concessionaire.

Project Structure

Foreign G ovt Com pany 1 Foreign G ovt Com pany 2 Foreign Govt Com pany 3

Subscription Agreement Assignment Concession Agreement of Loan Agreements

Governm ent of India

Independent Consultant Contract

SPV

Insurance Policies

Lenders

Independent Consultant

O&M Contract

Tolling Contract

EPC Contracts

Insurers

EPC Contract Section

EPC Contract Section

Contractor 1

Contractor 2

3.2.2.3 The Route Map already followed A Data Base on Indias Road Sector Privatization Efforts For realizing Indias ambitious growth plans, it is critical that this invaluable asset of road network must be substantially upgraded to maximize the effectiveness. Towards this capacity enhancement of the road network, both in qualitative and quantitative terms, the NHDP and Pradhan Mantri Gramin Sadak Yojana are the major initiatives. These projects have the vast potential in creating the employment. The Government in collaboration with Private Sector has already awarded and completed various projects by

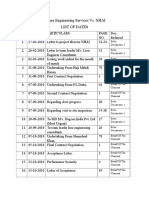

36 using different implementing models like BOT (Toll Based / Annuity), SPV, MOU and Govt. to Govt. cooperation to ensure unobstructed mobility and accessibility and serving the need of a modern India. Private Sector participation through BOT (Toll Based / Annuity) and SPV Projects NH No. Length (km) BOT (Toll Based) Projects Satara Kagal 4 133 Tumkur Neelmangla 4 32 Nellore Tada 5 111 ROB at Kishangarh 8 1 Jaipur Kishangarh 8 90.38 Delhi Gurgaon 8 27.7 BOT (Annuity) Projects Palsit Dankuni 2 65 Panagarh Palsit 2 65 Maharashtra Belgaum 4 77 Ankapalli Tuni 5 59 Nellore Bypass 5 17.2 SPV Projects Jaipur Bypass 8 34.7 Ahmedabad Vadodara 8 50 Expressway Moradabad Bypass 24 18 Stretch Status Completed Completed Under Implementation 4 Laned Awarded Completed Under Implementation Under Implementation Under Implementation Under Implementation Approved for Award Completed Completed Completed

(The project details are given in the annexure)

37

4. Critical Issues Private Sector Road Financing

4.1 Stages in development of Road Sector Projects

1. Identification: o Identify Project. o Define Form of Financing. o Preliminary Feasibility Study. o Assign Project Manager and Team. o Government. 2. Government Preparation for Tendering: o Procurement Procedure. o Prequalification. o Project Agreement. o Tender Documents o Bid Evaluation Criteria. 3. Sponsor's Preparation to Bid: o Form Consortium / Possibly Project Company. o Feasibility Study o Identification of Project Potential. o Submit Bid Package. 4. Selection: o Evaluate Bids. o Clarifications / Adjustments. o Project Award. 5. Development: o Form Project Company. o Equity Contributions.

38 o Loan Agreement. o Financial Closing. o Construction Contract. o Supply Contract. o Off-take Contract. o Insurance Contract. o Operation & Maintenance Agreement. 6. Implementation: o Construct facility and Install Equipment. o Testing. o Acceptance. o Technology Transfer and Capability Building. o Evaluation. 7. Operation: o O&M during the Concession Period. o Inspection. o Training. o Technology Transfer and Capability Building. 8. Transfer: o Transfer Procedures.

39

4.2 Financial Structuring of BOT Road Projects

The various types and sources of capital are available for financing the BOT Road Projects. As each type of capital bears different level of risks so by means of various financing techniques and legal instruments different types of capital are matched to different project risks. Financial Structuring is done to establish the appropriate mix of debt, equity and mezzanine capital and also to ensure that funds are arranged from appropriate sources. This process is also referred as assembling the financial package. 4.2.1 Project Financing: In BOT projects financing is done through "Project Finance" technique. Lender seeks finance either through limited recourse basis or a non-recourse basis. The lender in a non-recourse financing arrangement will look only to the project's asset and revenue stream for repayment, not to the additional sources of security, such as the total assets or balance sheet of the project sponsors. But most of BOT projects are financed on a limited recourse basis rather than Non-recourse basis because in this recourse is available against the project company and its assets, including real estate, plant and equipment, contractual rights, performance bonds, insurance, government guarantees and other commitments the project company has obtained. The rate of return of a BOT project must be sufficient not only to repay the lenders but also to reward the sponsors for committing their equity and know-how and for assuming the risks involved in such projects. In such financing, a separate project company is established by the project sponsors to implement the project. This type has several advantages for sponsors: o It allows the sponsors to borrow funds to finance a project without increasing their liabilities beyond their investment in the project. On the sponsors balance sheet, therefore, their exposure to the project is the amount of their equity contribution to the project and nothing more. o Lenders to the project assume a part of project risks, since they are lending without full recourse and primarily on the basis of the project assts.

40 BOT financing is a specialized form of project financing. Some of the common features of BOT financing are as follows: o It involves the financing of a discrete venture that is more often defined by its revenue stream than by its products or markets. o It involves several interrelated contracts with third parties, such as suppliers, purchasers and Government agencies, which are crucial to the credit support for the project. o Project loan repayments are secured by project cash flows, as specified in contractual agreements or as indicated by demand forecasts, rather than project assets. o Project sponsors will rely primarily on guarantees to minimize their exposure to project risks and uncertainty. 4.2.2 Means of Financing Financing or capital is required for the implementation of all the projects. The types of funds available for the projects are: o Equity Capital. o Debt Capital. o Mezzanine Capital. o Institutional Investors. o Capital Market Funding. o International Financial Institutions. o Support by Export Credit Agencies. o Combined Public and Private Finance. Each type of capital plays a specific role in the project financing and has its own risk characteristics so the return on each type of capital depends on the risk characteristics of each type. 1. Equity Capital: Equity is the lowest-ranking capital of all in terms of its claims on the assets of a project. It represents the funds injected by the owners of the project. In this all the

41 project obligations are to be met before any distributions made to the equity investors. If a project fails, all other claims must be met before any claims made by equity investors. Equity investors therefore bear a higher risk than any other provider of the capital so, equity capital is also referred as risk capital. However, if a project is successful, then the surplus after all obligations are met will entirely accrue to the shareholders and results in the capital gains. In BOT project, the fixed assets are transferred to the Government at no cost, so the equity investors return on investment will come only from the revenues generated during that period so these investors must be fairly compensated for being the highest risk takers. 2. Debt Capital: Project's senior debt has the highest ranking of all the capital. Senior debt has first claim over all the assets of a project and must be repaid first. Only after the claims of senior debt are satisfied, the claims of other capitals are considered. As the senior debt bears the limited risk so the returns are limited just to the payment on the loans, irrespective of the profitability of the projects. Equity investors prefer a high debtequity ratio, while creditors prefer a low debt-equity ratio because a higher debtequity ratio leads to lower cost of capital and vice-a-versa. Generally the BOT projects financed in India are at debt-equity ratio of 70:30. 3. Mezzanine Capital: It is a more flexible instrument than either pure equity or debt, as it has characteristics of both the debt and equity capital. So the risk involved is between debt and equity capital. Examples of mezzanine financing are subordinated loans and preference shares. The subordinated loans and preference shares both have the characteristics of the debt as the regular payment of interest and capital is to be made, but the payments are subordinated to senior debt and to be made only when the project funds are available. For project sponsors, the advantage of mezzanine financing is that it enables projects to be financed with more debt and less equity. 4. Institutional Investors:

42 In addition to subordinated loans provided by the project sponsors or by Governmental financial institutions, subordinated debt can be obtained from financing companies, investment funds, insurance companies, collective investment schemes and other institutional investors. The institutions normally have large sums available for long-term investment and may represent an important source of additional capital for infrastructure projects. The main reasons for accepting the risk of providing capital to infrastructure projects are the prospects of remuneration and interest in diversifying investment. 5. Capital Market Funding: Funds may be raised by the placement of preferred shares, bonds and other negotiable instruments on a recognized stock exchange. The public offer of negotiable instruments requires regulatory approval and compliance with requirements of the relevant jurisdiction. 6. International Financial Institutions: International financial institutions also play a significant role as the provider of loans, guarantees or equity to privately financed infrastructure projects. A number of projects have been financed by World Bank, Asian Development Bank, International Finance Corporation or by other development banks. 7. Support by Export Credit Agencies (ECA's): Export credit agencies provide support to the projects in form of loans, guarantees or a combination of both. The participation of export credit agencies may provide a number of advantages, such as lower rate of interest than commercial banks and longer-term loans. 8. Combined Public & Private Finance: The public funds originate from Government Income and sovereign borrowing. They are combined with private funds as initial investment or as long-term payments, or may take governmental grants or guarantees. Infrastructure projects are sponsored by

43 the Government through equity participation in the concessionaire, thus reducing the amount of equity and debt needed from private sources.

4.2.3 Components of Project Costs While deciding the type of capital and sources of finance to be used, it is important to first identify the main components of project costs, so that the needs and risk characteristics of each can be matched by the appropriate funding. The main components of project costs are as follows: o Pre-investment Costs. o Bidding & Procurement Costs. o Project Development Costs. o Construction Costs. o Operating Costs. o Termination Costs. 1. Pre-investment Costs: These are the costs incurred by the project sponsors in developing the project concept and preliminary project design. 2. Bidding & Procurement Costs: A project concession can be awarded through either competitive bidding or direct negotiation with sponsors. In both the cases, the government agency responsible for awarding the concession has to carry out an outline study of the project to collect information needed for the bidding documents and prepare themselves for negotiations with sponsors. The bidders and sponsors also have to undertake extensive design and analysis work to prepare their bids and to have meaningful negotiations with the government. 3. Operating Costs: These are the costs involved while operating the facility upon completion of construction.

44 4. Project Development Costs: On the basis of the preliminary project design, the project sponsors have to further develop and refine the BOT scheme during the bidding and the post-concession award period. 5. Construction Costs: This is the main expenditure in any project. It includes the construction of the entire facility, including the purchase and installation of equipment. 6. Termination Costs: At termination the costs may or may not be involved. If the project agreement requires the facility to be transferred it may involve a cash payment by the government agency taking-over that facility.

4.3 Procurement Issues and Selection of Concessionaire

An adequate procurement strategy or procedure must be in place before a BOT policy can be carried out. The success of a BOT project will depend to a large extent on what has occurred before the sponsor group was selected. Procurement procedures are influenced by various factors like the business environment, the infrastructure policy and the nature of the particular BOT project. There are two approaches for procurement are: o Competitive Tendering o Negotiated System Following objectives should be satisfied before choosing a particular procurement procedure: 1. 2. 3. 4. 5. 6. 7. 8. Satisfy the needs of the particular BOT project. Ensure procedural clarity, fairness and transparency. Promote competition. Encourage private sector innovation and alternative solutions. Assure investors, lenders and other parties that government has Strengthen public confidence in the BOT approach to Promote an early award of an project. Minimize the cost of developing BOT projects.

selected the right BOT proposal. infrastructure development.

45 4.3.1 Bidding Criteria The selection process of the Project Developer shall be based on technical competence of the bidder and a financial bid. While the parameters of technical competence are only qualifying in nature, the financial bids shall form the criteria of selecting the Project Developer. In the financial bid, the criteria for selection may be one of the following: o Bidding on the basis of least grant sought from the Government with pre-specified toll rates and concession period. o Bidding on the basis of length of the concession period with pre-specified grant element and toll rates. However NHAI had finally adopted the bidding criteria on the basis of grant. o Bidding on the basis of least toll rates with pre-specified concession period and grant. o Returns (IRR / NPV basis) expected by the bidder as calculated on the basis of a pre-specified formula. In this case, the concession period shall be flexible and shall expire once the pre-specified returns are achieved. The toll rates shall be prespecified.

4.4 Governments Role in facilitating BOT Projects

One of the advantage of the BOT concept for the Government is that a considerable workload, including responsibility for financing, designing, construction and operation of the projects, is transferred from the Government agencies and ministries traditionally responsible for infrastructure projects to the private sector. However, this does not imply that Governments role is limited to supervision and monitoring of BOT projects. BOT infrastructure projects require that the Government play an active role, in preconstruction and pre-investment phases of a project. It is the Government that initially approves the use of the BOT concept in connection with the infrastructure projects. It decides the procurement process, manages the procurement proceedings and defines the criteria for the selection of BOT sponsors. The various facilities that the Government should provide to BOT projects are: 4.4.1 Supportive Legal Framework for a BOT projects: The attractiveness of a BOT project to the private sector depends to the large extent on the way the

46 Government address the fundamental legal issues, such as enforcement of contracts, private ownerships, security arrangements, taxes, remittance of foreign exchange and profits. Inadequate legal framework can undermine the strength and effectiveness of contracts for BOT projects. The elements of a legal and regulatory framework for implementing a successful BOT projects are: o The basic legislative authority for awarding BOT projects: It includes designating the individual ministries, government agencies authorized to procure and implement BOT project. It also includes passing regulations that define the responsibilities of the government agencies and ministries for the development and implementation of the projects, issuance of licenses and permits and central Government approvals. o Enabling public legislation: The Government may have to enact legislation authorizing the acquisition of land for the project, the transfer of public assets to the project and provision of work permits or other necessary government input. o Adequate security legislation: The creation and protection of security interests, mortgages and liens in respect to project assets in favour of the lenders and enforcement of remedies under the security package should be assured by countrys legal system. o Legislation to promote foreign investment: Various incentives should be given to the sponsors like the right to exchange local currency into foreign currency, simplified import licensing and custom procedures, right of foreign investors to establish companies in the country, tax regime for foreign investment etc. o Protection of contract rights under the governing law and by adequate legal institutions. 4.4.2 Administrative Framework for BOT projects:

The Government must establish a credible and efficient administrative framework to successfully implement the BOT projects. The potential sponsors and lenders will evaluate the organization, experience and procedures of the procuring administrative entity, an efficient administrative framework will accelerate private sectors investment in BOT projects.