Professional Documents

Culture Documents

Chapter 3

Uploaded by

Steve CouncilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3

Uploaded by

Steve CouncilCopyright:

Available Formats

CHAPTER 5: SPECIFIC TAX REFORMS

49 13

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the vertical equity condition, it reallyC H AthisT E Rat 3 lower income levels reducing the does P only the wealth of these lowest income taxpayers, not the intended consequence.

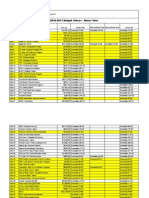

Figure 5.5: South Carolina income tax: Current tax rates compared to inflation-indexed rates, 2009

Income Tax Rates/Brackets if 1959 Tax Current Income Tax Schedule was Inflation Adjusted to by Russell S. Sobel and Peter T. Leeson Rates/Brackets 2009 Taxable Income $5,000 $10,000 $15,000 $20,000 $30,000 $50,000 $75,000 $100,000 $150,000 $200,000 Tax Amount $71 $290 $604 $954 $1,654 $3,054 $4,804 $6,554 $10,054 $13,554 Average Tax Rate 1.42% 2.90% 4.03% 4.77% 5.51% 6.10% 6.41% 6.56% 6.70% 6.77% Tax Amount $125 $250 $377 $527 $834 $1,695 $3,127 $4,877 $8,377 $11,877 Average Tax Rate 2.5% 2.5% 2.51% 2.63% 2.78% 3.39% 4.17% 4.88% 5.58% 5.94%

WHY CAPTALISM WORKS

Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

50 18 18

UUNLEASHING CAPITALISM NLEASHING CAPITALISM

manufacturing property tax inin the country. In Figure 5.8 we present the effective property tax manufacturing property tax the country. In Figure 5.8 we present the effective property tax rates data for Southeastern states, for comparison. The ranks given for the states are out of all rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50 states. The net tax and effective tax rate are calculated based on property valued atat $25 50 states. The net tax and effective tax rate are calculated based on property valued $25 million ($12.5 million ininmachinery and equipment, $12.5 million inininventories, and $2.5 million ($12.5 million machinery and equipment, $12.5 million inventories, and $2.5 million inin fixtures). Notice that South Carolinas effective tax rate on industrial property is million fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware isis listed in over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware listed in the figure because it it is the lowest-tax state.) the figure because is the lowest-tax state.)

Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007

State Rank (of 50) State Rank (of 50) South Carolina 11 South Carolina Mississippi Mississippi Texas Texas Tennessee Tennessee West Virginia West Virginia Louisiana Louisiana Georgia Georgia Florida Florida Alabama Alabama North Carolina North Carolina Kentucky Kentucky Virginia Virginia Delaware Delaware 44 66 10 10 14 14 17 17 20 20 24 24 35 35 37 37 47 47 49 49 50 50 Net Tax Net Tax $1,864,900 $1,864,900 $1,291,050 $1,291,050 $1,264,358 $1,264,358 $1,033,544 $1,033,544 $833,234 $833,234 $783,407 $783,407 $760,381 $760,381 $677,683 $677,683 $533,776 $533,776 $491,071 $491,071 $327,100 $327,100 $241,498 $241,498 $238,840 $238,840 Effective Tax Rate Effective Tax Rate 3.73% 3.73% 2.58% 2.58% 2.53% 2.53% 2.07% 2.07% 1.67% 1.67% 1.57% 1.57% 1.52% 1.52% 1.36% 1.36% 1.11% 1.11% 0.98% 0.98% 0.65% 0.65% 0.48% 0.48% 0.48% 0.48%

Source: National Association ofof Manufacturers (2009) Source: National Association Manufacturers (2009) * Taxes measured inin the states largest city only. * Taxes measured the states largest city only.

Importantly, South Carolinas effective tax rate isisalmost 2.5 times greater than Importantly, South Carolinas effective tax rate almost 2.5 times greater than Georgias tax, and almost 4 4 times greater than North Carolinas. This puts South Carolina at a Georgias tax, and almost times greater than North Carolinas. This puts South Carolina at a serious disadvantage, inin terms of its ability to attract and keep industry. Since South Carolina serious disadvantage, terms of its ability to attract and keep industry. Since South Carolina has the highest tax inin the country on industrial property, it should be no surprise that it has has the highest tax the country on industrial property, it should be no surprise that it has one of the lowest per capita incomes and economic growth rates inin the country. one of the lowest per capita incomes and economic growth rates the country. Although it it is probably not critical that South Carolina set its tax rate to the lowest in Although is probably not critical that South Carolina set its tax rate to the lowest in the country, it itshould definitely make it itatatleast competitive for the Southeast. Since the country, should definitely make least competitive for the Southeast. Since Georgias rate isis effectively 1.52 percent and North Carolinas is just under 1 percent, a rate effectively 1.52 percent and North Carolinas is just under 1 percent, a rate Georgias rate atataround 1 1percent might be sufficient totoattract more industry. Working to reduce the around percent might be sufficient attract more industry. Working to reduce the various taxes applied toto industry would seriously improve the states competitiveness. various taxes applied industry would seriously improve the states competitiveness. Such a a significant reduction in taxes on industrial property would obviously lead to a Such significant reduction in taxes on industrial property would obviously lead to a reduction inintax revenues on industrial property, atatleast initially. However, the overall reduction tax revenues on industrial property, least initially. However, the overall revenue may ininfact increase once the growth rate inin the state begins to pick up andmore revenue may fact increase once the growth rate the state begins to pick up and more industry moves into the state. Furthermore, ifif the official tax rates are lowered, then the state industry moves into the state. Furthermore, the official tax rates are lowered, then the state

CHAPTER 5: SPECIFIC TAX REFORMS

51 13

Presumably the original intent of imposing a tax rate schedule with graduated marginal tax rates was to make the income tax progressive. However, what progressivity exists in the states income tax structure is due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, since the marginal tax rate increases over such small steps in income, as shown in Figure 5.5, most of the progressivity occurs at lower income levels, not higher levels of income. At higher income levels, the average tax rate hardly increases at all. This nature of the current tax is directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the vertical equity condition, it really does this only at the lower income levels reducing the wealth of these lowest income taxpayers, not andintended consequence. Russell S. Sobel the Peter T. Leeson

WHY CAPITALISM WORKS

Figure 5.5: South Carolina income tax: Current tax rates compared to inflation-indexed rates, 2009

Income Tax Rates/Brackets if 1959 Tax Current Income Tax Schedule capitalism has allowed The previous chapter showed that increased reliance onwas Inflation Adjusted toother Rates/Brackets 2009 states and countries to become more prosperous. To promote capitalism in South Carolina, its political and legal institutions must do two things: (1) strongly protect private property rights Tax Tax Average Tax Rate Taxable Income and enforce contracts; and (2) Average fromRate Amount refrain Tax adopting policies or undertaking actions that Amount infringe on voluntary actions and contracting in the private sector. $5,000 $71 $125 1.42% Unfortunately, governments often enact policies that interfere with2.5% capitalism without $10,000 $250 2.90% 2.5% fully understanding the$290 economic consequences. While policy makers in South Carolina and other states are indeed$604 and reasonable people,$377 do not have2.51% training in smart most formal $15,000 4.03% advanced economics. To ensure that the true economic consequences of policies are better $20,000 $954 $527 4.77% 2.63% understood, elected officials and citizens must become more knowledgeable about a few basic $30,000 $1,654 $834 5.51% 2.78% principles of economics. We hope this book will help to accomplish that goal. For readers wanting to learn more, we suggest the easy-to-read book, Common Sense Economics: What $50,000 $3,054 $1,695 6.10% 3.39% Everyone Should Know about Wealth and Prosperity, by James D. Gwartney, Richard L. $75,000 $4,804 $3,127 6.41% 4.17% Stroup, and Dwight R. Lee.1 With better knowledge of fundamental economics and the basic $100,000 $6,554 $4,877 6.56% structures that operate within an economythe reasons why and how 4.88% capitalism works policy$150,000 make better state policy decisions. $8,377 makers can $10,054 6.70% 5.58% In this chapter we discuss these basic economic principles, including the concepts of $200,000 $13,554 $11,877 6.77% 5.94% wealth creation and entrepreneurship.2 In addition, we examine the concept of unintended consequencesor secondary effectsthe reason why, for policy making, good intentions Figure enough shows what the outcomes. simply are not 5.5 alsoto guarantee good average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, especially at higher levels of incomes. It keeps tax rates extremely low for the lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the table. As South Carolina income taxes continue to climb while the Milton Friedmanremain tax brackets and his 1 We also suggest the equally easy-to-read classic, Free to Choose by Nobel Laureate stagnant, Friedman. becomes a relatively high-tax state. This has a negative impact on the state wife, Rose

2

This chapter is based on Sobel and Leeson (2007).

52 18

UNLEASHING CAPITALISM

manufacturing property tax in the country. In Figure 5.8 we present the effective property tax VOLUNTARY EXCHANGE, WEALTH CREATION, AND VALUE ADDED rates data for Southeastern states, for comparison. The ranks given for the states are out of all 50 states. The we tend to think of ourtax rate in dollars, truebased onhas nothing to do with While net tax and effective wealth are calculated wealth property valued at $25 million ($12.5 million in wealth in a and equipment, $12.5 pie waiting inventories, and $2.5 paper money itself. Total machinery society is not a fixed million in to be divided among million in fixtures). is constantlySouth Carolinas effectiveus; the economic pie grows each us. Wealth, instead, Notice that being created by each of tax rate on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. example will listed to day. Wealth is created through both production and exchange. An (Delaware is help in the figure because it is the lowest-tax state.) illustrate. Suppose that two neighbors trade a bushel of hay for a load of wood. Both are now better off; after all, they were only willing to trade with each other because each wanted what theFigure 5.8:had more than Propertytraded away. Southeastern states*, 2007 other person Industrial what they Taxes in Both have become wealthier in every sense of the word even though 50) new money has been printed, nor existing money passed State Rank (of no Net Tax Effective Tax Rate around. South Carolina 1 $1,864,900 On an everyday basis, money only represents wealth to people3.73% it measures the because Mississippi $1,291,050 2.58% quantity of these tradesor 4 purchaseswe can undertake when we exchange money that we earn Texas producing at our 6 from jobs for the goods and services produced2.53% by others. A man on a $1,264,358 deserted island with $1 million is very poor indeed without anything to purchase with the Tennessee $1,033,544 2.07% money. On the other hand, 10man deserted on an island with no money, but a group of other a West Virginia 14 people, will be much wealthier because of his $833,234 produce and 1.67% ability to exchange with others evenLouisiana in the absence of paper money on the island. 17 $783,407 1.57% Taking the example further, suppose a group of island castaways decided that half of Georgia 20 $760,381 1.52% them should dig holes and the other half should fill them in. After a full-days work, they Florida 24 $677,683 1.36% would have nothing to show for this effort; nothing was produced. Holes were dug and filled again. No wealth was created, even though people worked very hard. 1.11% Alabama 35 $533,776 Wealth would be created if instead half the tribe collected coconuts and the other half North Carolina 37 $491,071 0.98% fished. Now they would have dinner. Suppose one castaway invents a new tool that increases 0.65% Kentucky $327,100 the number of fish she can 47 catch. This invention would further increase wealth; there is more food Virginia at the dinner table. In49 the new tool $241,498 fact, might increase productivity so much that only 0.48% half as many castaways are needed fishing, and the extra castaways are free to labor at a new Delaware 50 $238,840 0.48% task such as building a shelter, further increasing wealth. As these examples illustrate, there is Source: National Association of Manufacturers (2009) a close link betweenthe states largest citywealth, and the quantity, quality, and value (or * Taxes measured in prosperity, or only. usefulness) of the output produced. Prosperous placesthose with high levels of income and wealthbecome thatSouthby producingeffective tax rate valuable goods times greater than Importantly, way Carolinas large quantities of is almost 2.5 and services. One difference between this castaway North Carolinas. This puts South Carolina at a Georgias tax, and almost 4 times greater thananalogy and our daily economic lives, however, is that disadvantage, in termsthe its ability tosharing and keep industry. Since South example, serious we might anticipate of castaways attract the fruits of their labor, for Carolina splitting the fish caught that day. on large and advanced should be no longer that it has has the highest tax in the country In aindustrial property, it economy itno surprise works this way. Instead, each of us gets paid in dollars, or money income, the country. one of the lowest per capita incomes and economic growth rates infor what we produce at our jobs. We then go it isstores and not critical thatmoney for the goodsits tax rate to the lowest by Although to probably exchange that South Carolina set and services produced in others at their it should definitely make it at least competitive for the Southeast. Since the country, jobs. The amount of income we earn is determined by both the just under 1 are willing to Georgias rate is effectively 1.52 percent and North Carolinas is prices peoplepercent, a rate pay us for what we are producing and howto attract moreitindustry.produce. For individuals, at around 1 percent might be sufficient many units of we can Working to reduce the states, taxes applied to industry would seriously value of output. A worker with a variousand nations, income is determined by theimprove the states competitiveness.backhoe will be Such a productive reduction in taxes onaindustrialand will earn more as a result. to a more significant than a worker with shovel property would obviously lead An entrepreneur producing apple pies will be more prosperous initially. However, the overall reduction in tax revenues on industrial property, at least than one producing mud pies because may in fact increase once on growth rate in the are willing to pay more and more revenue people place a higher value the apple pies (and thus state begins to pick up for them). This logic leads state. obvious, and simple, litmus test that can be used to decide if a industry moves into the to one Furthermore, if the official tax rates are lowered, then the state suggested new policy or law is good, or bad, for the South Carolina economydoes it

CHAPTER 5: S HY CAPITALISM WORKS CHAPTER 3: WPECIFIC TAX REFORMS

53 13

Presumably the net amount or of imposing a tax rate schedule with graduated increase, or decrease, theoriginal intent value of output (of goods and services) produced in marginal tax rates wassuchmake the adopted in some European nations for example, which the state. Regulations, to as those income tax progressive. However, what progressivity exists in the states income tax structure is result in reduced output and reduced standards of restrict the workweek to 35 hours, clearly due to the zero tax on the first $2,630 of income, and because of the graduated marginal tax rates. However, principle must be appliedrate living as a result. For a tax-funded government program, this since the marginal tax by increases over net change in outputthat is,as shown in Figure account forof the progressivity looking at the such small steps in income, one must properly 5.5, most the reduced output occurs by the taxes or other resourceshigher levels fund the policy. higher income levels, the caused at lower income levels, not necessary to of income. At averageOne rate hardly increases at all. This previouslythe current tax is directly contradictory tax of Adam Smiths insights in his nature of mentioned 1776 book, An Inquiry into to the goal of progressivity. So although of Nations, is it appears that the tax satisfies the the Nature and Causes of the Wealth on the surface that labor productivity, the main vertical equity wage rates, it really does this only at the lower income levels reducing the determinant of condition, is increased through specialization and the division of labor. When wealth of these lowest incometasks, like workers intended consequence. labor is divided into specific taxpayers, not the in an assembly-line, they can produce more as a group than could have been produced individually. The same holds true when individuals specialize 5.5: South Carolina income tax: Current tax rates compared to Figure across different occupations and industries. However, according to Smith, our ability to specialize, thereby increasing our productivity and enhancing inflation-indexed rates, 2009 our wages, depends on the size or extent of the market to which we sell. When consumer markets are larger in size, smaller specialized stores can survive that could not have survived in a smaller marketplace. Cheraws population, for example, Tax Income Tax Rates/Brackets if 1959 might Currentgeneral purpose pet stores, each carrying a broad line of Income Tax be able to support one or two Schedule was Inflation Adjusted to Rates/Brackets products. In a place like Greenville, however, a dozen or more stores can flourish, with a 2009 greater extent of specialization, one store, for example, might specialize in snakes and other Tax Tax Average to Rate reptiles, while another specializes in birds. Increasing the size of the marketsTaxwhich South Average Tax Rate Taxable Income Amount Carolinas goods andAmount sell could increase wealth by allowing South Carolinians to services $5,000 $71 $125 1.42% 2.5% specialize more specifically in areas where they do best. Population growth in metropolitan areas would be one way of increasing market size. $10,000 $290 $250 2.90% 2.5% But another way to increase market size is to enact policy reform that better enables the $15,000 $604 $377 4.03% 2.51% businesses in South Carolina to sell and compete in larger national and global marketplaces $20,000 $954 $527 4.77% 2.63% and expand their customer base. To compete in these markets South Carolina businesses need to be on a level playing field with their competitors. $834 Carolinas taxes and regulations South $30,000 $1,654 5.51% 2.78% are a competitive disadvantage to firms located in the state. The higher prices South Carolina $50,000 $3,054 $1,695 6.10% 3.39% businesses must charge for their products greatly limits the markets in which they can $75,000 $3,127 4.17% compete. If these tax $4,804 and regulatory6.41% could be reduced through policy reform, firms costs could $100,000 competitive pricing, increasing their market shares and the extent of their offer more $6,554 $4,877 6.56% 4.88% markets. This would allow both the businesses themselves, and their workers, to become $8,377 $150,000 $10,054 6.70% 5.58% more specialized and earn higher incomes as a result. $200,000 to specialization and the division of labor, capital investment also increases $11,877 6.77% 5.94% In addition $13,554 labor productivity. Higher levels of education (more human capital) and better machinery, buildings, and tools to work with (more physicaltax rates can for various incomes and taxes Figure 5.5 also shows what the average capital) are help our citizens produce more output and generate system in South Carolina. In investments in sawmills provide a good under the current tax more income. Recent capital the right columns it also shows what the example average tax rates would be if the 1959 tax optimizing edger earns $13 per The taxes andof this. An experienced operator of a newer tables were indexed for inflation. hour compared to shows that the wage rate a worker previously is more uniformly progressive, figure clearlythe $10 per hour 1959 indexed tax rate structure earned manually edging boards. Operators at new stacking systems earn keeps tax rates extremely the for the lowest income especially of higher levels of incomes. It $12 per hour compared to low $9 per hour wage rate workers previously earned manually staking lumber. Similarly, workers running newer individuals in the state. optimizing trimmers earn $14 that hourcurrent tax system charges allwage of $8 per hour for Figure 5.5 also shows per the compared with the previous income groups more in workers doing manual trimming. With only exception is the $5,000 income earner in the taxes than an indexed rate schedule. The this new capital equipment workers are more productive and earn higher income a result. table. As South Carolina wages astaxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

54 18

UNLEASHING CAPITALISM UNLEASHING CAPITALISM

manufacturing property tax in the country. In Figure a worker operatingeffective property tax For those familiar with the logging industry, 5.8 we present the a feller buncher, a rates data for with claws and a round built-in saw The ranks given for the states are roughly huge machine Southeastern states, for comparison. that the worker drives, can harvestout of all 50 and a The net tax and effective the same amount of time as worker with a chainsaw. twostates. half times as much timber intax rate are calculated basedaon property valued at $25 million ($12.5 wage rate machinery and equipment, $12.5 million in as well. This capital As a result, the million in he earns is roughly two to three times higher inventories, and $2.5 million in fixtures). worker to South productive and thus to rate on industrial equipment allows theNotice thatbe moreCarolinas effective taxearn more income. property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware is listed in But new factories, better machinery, and equipment are expensive. They require large the figure because it the property (a feller investments in assetsisand lowest-tax state.) buncher, for example, can cost a half-million dollars or more). In South Carolina, taxes (such as property taxes on capital equipment), regulations, and lawsuits decrease the return from capital investment and thereby lower the inflow of capital into the state. As we discussed in Chapter 2, South Carolina has the highest Figure 5.8: Industrial Property Taxes in Southeastern states*, 2007 property taxes in the nation on a representative manufacturing facilitys equipment and State Rank (of 50) Net Tax Effective Tax Rate machinery. This results in South Carolinas workers being less productiveand earning less South 1 $1,864,900 3.73% as a result. Carolina The income a state 4 produces from $1,291,050 depends not 2.58%on how much is its output only Mississippi produced (which can be expanded through specialization, division of labor, and capital 2.53% Texas 6 $1,264,358 investment), but also on the price per unit, or value, of the goods and services produced. A Tennessee 10 2.07% timber stand containing mostly River Birch $1,033,544produce less income than one with a trees will higher proportion of more 14 valuable Live Oak$833,234 trees. Income can be 1.67% increased not only by West Virginia increasing labor productivity, but also by raising the value per unitor value addedof Louisiana 17 $783,407 1.57% South Carolina labor. Georgia 20 1.52% However, the answer to the question $760,381 specific uses of South Carolinas of which resources create the most value, and thus income, is not obvious. In fact, the answer is so Florida 24 $677,683 1.36% complex that it is not something any one person or group of people knows, not even a group 1.11% Alabama 35 $533,776 of expert economic planners. It is an answer that must be discovered by individuals in the North Carolina 37 $491,071 private sector through the decentralized process of entrepreneurship, a0.98% of private trial process and error. This is the topic of our next section. $327,100 0.65% Kentucky 47 Before moving on, however, let us complete our discussion of the process of wealth Virginia 49 $241,498 0.48% creation started above. As we pointed out, in a real-world economy things work a bit Delaware 50 $238,840 0.48% differently than in the castaway example because we must first earn income by producing Source: National Only then do we use that goods and services.Association of Manufacturers (2009)income to acquire the goods and services * Taxes measured the produced by others.inThestates largest city only. income into prosperity and wealth through ability to turn our exchange is the second important part of this process. Importantly, South Carolinas effective tax rate is almost 2.5 times greater than As consumers, we turn income into wealth through the acquisition of goods and Georgias tax, and almost 4 times greater than North Carolinas. This puts South Carolina at a services like food, clothing, shelter, and recreation. In our shopping, we search out and serious disadvantage, in terms of its ability to attract and keep industry. Since South Carolina negotiate with potential sellers from around the globe. We spend time and effort on this has the highest tax in the country on industrial property, it should be no surprise that it has search because maximizing the value we get from our limited budgets makes us wealthier. one of the lowest per capita incomes and economic growth rates in the country. Finding a product we want to buy at a lower price increases our wealth because we now have Although it is probably not critical that South Carolina set its tax rate to the lowest in more money to spend on other things. the country, it should definitely make it at least competitive for the Southeast. Since This is the reason why restrictions on the ability of citizens to freely engage in trade Georgias rate is effectively 1.52 percent and North Carolinas is just under 1 percent, a rate with people from other geographic areas through tariffs, quotas, taxes, and other restrictions, at around 1 percent might be sufficient to attract more industry. Working to reduce the destroy wealth. Individuals cannot generate as much value and happiness from their limited various taxes applied to industry would seriously improve the states competitiveness. incomes. Not only are there fewer options to select among, but also the taxes and regulations Such a significant reduction in taxes on industrial property would obviously lead to a make things more costly for us to purchase, reducing our ability to stretch our budgets and reduction in tax revenues on industrial property, at least initially. However, the overall revenue may in fact increase once the growth rate in the state begins to pick up and more industry moves into the state. Furthermore, if the official tax rates are lowered, then the state

CHAPTER 5: S HY CAPITALISM WORKS CHAPTER 3: WPECIFIC TAX REFORMS

55 13

Presumably wealth. 3 This is one reason to avoid tax rate schedule with graduated turn our income into the original intent of imposing a adopting policies that interfere with, marginal tax rates was to make the income tax progressive. However, what progressivity tax, or restrict Internet purchases. exists in the states income tax structure is due to the zerothe result of both production and As this section has discussed, our well-being is tax on the first $2,630 of income, and because of the graduated marginal taxbe accomplished by increasing the amountrate exchange. Becoming more prosperous can rates. However, since the marginal tax of increases over such small steps in income, as shownthe Figure 5.5, most of the progressivity wealth created in the state through: (1) increasing in in quantity, quality, and value of goods occurs at lower income citizensnot higher and (2) of income. the higher income levels, the and services the states levels, produce, levels increasing At number and value of average tax rate hardly increases citizens make, both withcurrent South directly contradictory voluntary exchanges the states at all. This nature of the other tax is Carolinians and with to the goal of progressivity. So although on the surface it appears that the tax satisfies the people from around the world. verticalPolicy reform that lowers taxes and regulations the lowerachieve these goals because it equity condition, it really does this only at can help income levels reducing the wealth of theseincreased specialization of not theand increased capital investmentincreasing results in: (1) lowest income taxpayers, labor intended consequence. labor productivity and wages; (2) increased ability of residents and businesses to buy and sell with individuals from across the state, nation, and globe; and (3) more private sector Figure 5.5: South Carolina income tax: Current tax rates compared to entrepreneurship that allows the decentralized decisions of workers and business owners inflation-indexed rates, 2009 rather than government planningto help search out and identify the ever-changing bundle of goods and services that creates the most value and income for South Carolina. Income Tax Rates/Brackets if 1959 Tax Current Income Tax Schedule was Inflation Adjusted to Rates/Brackets 2009 ENTREPRENEURSHIP AND DISCOVERY Tax Tax Average Tax Rate Taxable the many potential things South Rate Of Income Amount Average Tax Carolina could produce with its resources, it Amount should set its sights on those having the highest value in the marketplace. However, this target $5,000 $71 $125 1.42% 2.5% is an ever shifting one, with new opportunities arising and others dwindling every day. One $10,000 $250 2.90% 2.5% important reason the $290 economic system of capitalism is especially good at generating prosperity is because $604 a good job at chasing this ever-moving 2.51% through the it does target $15,000 $377 4.03% continuous process of entrepreneurship and discovery. $20,000 $954 $527 4.77% 2.63% Sifting through these many combinations is a difficult task because the number of $30,000 $834 5.51% 2.78% possible combinations$1,654 of societys resources is almost limitless. Two quick illustrations will help to$50,000the vastness of these opportunities. First, think for a moment about the typical clarify $3,054 $1,695 6.10% 3.39% automobile license plate. Many have three letters, a space, and three numbers. There is a $75,000 $4,804 $3,127 6.41% 4.17% formula for calculating the total number of combinationsthe total number of possible $100,000 $6,554 $4,877 different license platesthat could be6.56% using these three letters and4.88% created three numbers. The answer is more than $10,054 you might think: 17,576,000. $8,377 let us consider the number of Second, $150,000 6.70% 5.58% possible ways to arrange a deck of cards. Even with only 52 cards, there is a mind-blowing $200,000 $13,554 $11,877 6.77% 5.94% number of possible ways to arrange themthe answer is a 68 digit number:

80,658,175,170,943,878,571,660,636,856,403,766,975,289,505,440,883,277,824,000,000,000,000

Figure 5.5 also rearrange a the average tax rates are for various incomes that each With this many ways toshows what deck of 52 cards, the astonishing implication is and taxes under the current taxshuffle ain South Carolina. In the right columns it also new orderingthe and every time you system deck of cards you are most likely making a shows what of taxes and average tax rates would be ifand is likely never towereseen again. Ininflation. The cards that has never been seen before, the 1959 tax tables be indexed for fact, even if figure human that has ever lived on the Earth did nothing but shuffleuniformly progressive, every clearly shows that the 1959 indexed tax rate structure is more cards 24 hours a day especially at higher levelsunrealistically assuming they could shuffle thefor the1,000 times per their entire life, and even of incomes. It keeps tax rates extremely low deck lowest income individuals in the state. Figure 5.5 also shows that the current tax system charges all income groups more in taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the 3 If the benefits from the spending undertaken with the tax revenue, or from the regulation, are things we value table. enough, the tradeoff might be worth it. Of course, if to climb the case,the would expect citizens to As South Carolina income taxes continue this were while we tax brackets remain highly stagnant, contribute tobecomes a relatively high-tax activity, This has a negative impact on voluntarily the state the cause, or privately regulate the state. being considered. But when the value

created by government policy is lower than our losses from the resulting higher prices and more limited availability of goods and services, societys well-being is reduced.

56 18

UNLEASHING CAPITALISM

manufacturing property not even come close to making itwe present fraction of the numbertax second, we would have tax in the country. In Figure 5.8 through a the effective property of rates possible Southeastern states, for comparison. Theof human history.4 states are out of all total data for arrangements of the deck throughout all ranks given for the 50 states. The returning and the economy, rate clearly have more than property valued at $25 Now, net tax to effective tax we are calculated based on just three letters and million ($12.5 millionwith which to work. Instead, we have million in of different resources numbers, or 52 cards, in machinery and equipment, $12.5 thousands inventories, and $2.5 million in be combined intothat South Carolinas this many tax rateto work with, the number that could fixtures). Notice final products. With effective inputs on industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. is almost infinite. in of possible different final product combinations that could be produced (Delaware is listed the figure because it is the lowest-tax state.) it is the competitive behavior of entrepreneurs Entrepreneurship is important because that drives this search for new possible combinations of resources that create more value. A vibrant entrepreneurial climate is one that maximizes the number of new combinations attempted. Some of these new combinationsTaxes more valuable than existing combinations Figure 5.8: Industrial Property will be in Southeastern states*, 2007 and some will not. In a market economy, it is the profit and loss system that is used to sort State Rank combinations Net Tax Effective Tax Rate through these new resource (of 50) discovered by entrepreneurs, discarding bad ideas South Carolina 1 3.73% through losses and rewarding good ones $1,864,900 through profits. A growing, vibrant economy depends not only on entrepreneurs discovering, evaluating, and exploiting opportunities to Mississippi 4 $1,291,050 2.58% create new goods and services, but also on the speed at which ideas are labeled as successes 2.53% Texas 6 $1,264,358 or failures by the profit and loss system. Tennessee economic 10 $1,033,544 2.07% From an standpoint then, business failure has a positive side; it gets rid of bad ideas, Virginia up resources to be used in other endeavors. In our1.67% example, where half of West freeing 14 $833,234 the castaways were digging holes and the other half filling them in, business failure would be Louisiana 17 $783,407 1.57% equivalent to the half that were filling in the holes going out of business and losing their jobs. Georgia 20 $760,381 1.52% A capitalist economic system causes this failure and then replaces it with a profitable business that installs underground piping in the holes to$677,683 provide running water.1.36% Florida 24 A vibrant economy will have both a large number of new business start-ups and a 1.11% Alabama 35 $533,776 large number of business failures. Minimizing business failures should not be a goal of public North Carolina 37 $491,071 0.98% policy. Instead the goal should be to maximize the number of new combinations attempted, which also implies having 47 lot of failures. In an economy where all entrepreneurseven a 0.65% Kentucky $327,100 those with crazy and marginal ideascan try them out in the marketplace, there will be a lot Virginia 49 $241,498 0.48% of business failures. The benefit is that it increases the odds that we will stumble on that oneDelaware 50 $238,840 0.48% in-a-million new major innovation, or the next fortune 500 company. Business failures are a Source: National Association of Manufacturers in knowing whether a new idea will meet the natural result of the uncertainty involved (2009) * Taxes measured in market test. From anthe states largest city only. it is better to try 100 new ideas and have 60 fail, economic perspective, than to only try 50 and have 30 fail. By doing so, we end up with 20 additional new Importantly, South Carolinas effective tax rate is almost 2.5 times greater than businesses. Georgias tax, and almost 4Josephgreater than North Carolinas. This puts South Carolina at a Noted economist times Schumpeter (1934 [1911]) stressed the role of the serious disadvantage,innovator of its ability toout new combinations ofSince Southto create entrepreneur as an in terms who carries attract and keep industry. resources Carolina has the highest tax in previously exist.industrial property, itnew combinations is entirely new products that did not the country on The result of these should be no surprise that it has one of the that open considerable opportunities for growth rates in the country. Schumpeters industries lowest per capita incomes and economic economic advancement. In Although it is probably not critical that South Carolina set its tax rate to the of these view, the entrepreneur is a disruptive force in an economy because the introductionlowest in the country, it should definitely obsolescence leastothers, a process the Southeast. Since new combinations leads to the make it at of competitive for he termed creative Georgias rate is effectively 1.52 percent and North Carolinas is just under 1 percent, a rate destruction. at around 1 introduction of the sufficient disc, and the corresponding disappearance of the The percent might be compact to attract more industry. Working to reduce the various taxes applied to industry would seriously improve the states competitiveness. vinyl record, is just one of many examples of this process. Cars, electricity, aircraft, and Such a significant reduction significantly advanced our way of life; but in the process personal computers are others. Each in taxes on industrial property would obviously lead to a reduction in tax revenues on industrial property, considerably. Economists today overall of doing so, other industries died or shrunk at least initially. However, the accept revenue may in fact increase once the growth rate in the state begins to pick up and more industry moves into the state. Furthermore, if the official tax rates are lowered, then the state 4

For an insightful and more thorough demonstration of the process of computing combinations for a deck of cards see http://www.worsleyschool.net/science/files/deck/ofcards.html.

CHAPTER 5: S HY CAPITALISM WORKS CHAPTER 3: WPECIFIC TAX REFORMS

57 13

Presumably the original intent creative destruction rate schedule with economic Schumpeters insight that this process of of imposing a tax is an essential part of graduated marginal and prosperity and make the incomeuniquely suited to However, what progressivity progress tax rates was to that capitalism is tax progressive. foster it. exists in the states income tax structure is much better to have on the first $2,630 of and loss A point worth clarifying is that it is due to the zero tax a decentralized profit income, and because of through these new combinations, than a government approval boardrate system sorting the graduated marginal tax rates. However, since the marginal tax or increases over such small The reason is thatas shown in Figure 5.5, mostofficials can be very decision-making process. steps in income, the incentives facing public of the progressivity occurs atthan theincome levels, notventure capitalists income. At higher While each venture different lower incentives facing higher levels of and entrepreneurs. income levels, the average tax rate hardly increases at all. This nature of the the table, ultimately their success or capitalist and entrepreneur brings different motivations to current tax is directly contradictory to the goal of progressivity. So although on generates wealth.5 Thisthatthe market test the failure is determined by whether their idea the surface it appears is the tax satisfies we vertical to earlier. The samereally does this only at officials in income levels reducing tax alluded equity condition, it is not true for public the lower charge of handing out the wealth of these lowest income taxpayers, nothaveintended consequence. creating wealth. For incentives or low-interest loans. They may the other concerns beyond example, officials may be concerned about where a new business is located in order to maximize 5.5: South Carolinavoters. But tax: Current tax rates that this decision Figure political support among income there is no reason to think compared to corresponds with the most economically advantageous one. In addition, there is inflation-indexed rates, 2009 that could be in charge of no individual, or group of individuals, this discovery process. There is nobody, not even those seemingly in the best position to know, who can predict which business opportunities are Tax most viable in if 1959 Tax Income the Rates/Brackets advance. For Current Income Tax founder of Digital Equipment Corporation, who example, Ken Olson, president, chairman and Schedule was Inflation Adjusted to Rates/Brackets was at the forefront of computer technology in 1977, stated: There is no reason anyone 2009 would want a computer in their home. Today his remark sounds funny because we all have Tax Tax Average Tax Rate computers in our homes, but at the time even Rate in the infant computer industry did not see Average Tax those Taxable Income Amount this coming. An even Amount better example might be the story of Fred Smith, the founder of Federal $71 $125 1.42% 2.5% Express$5,000 Corporation. He actually wrote the business plan for FedEx as his senior project for his strategic management class at Yale. While we all$250 in retrospect2.5% FedEx was a know that $10,000 $290 2.90% successful business idea, Smiths professor at Yale, one of the leading experts on business $15,000 $604 $377 4.03% strategy, wrote on his paper in red ink: The concept is interesting and 2.51% well-formed, but in $20,000 $954 the idea must be feasible.$527 4.77% 2.63% order to earn better than a C The point? Even smart professors, business leaders, and government officials cannot $30,000 $1,654 $834 5.51% 2.78% possibly pre-evaluate business ideas and identify those that will be most successful and those $50,000 $3,054 $1,695 6.10% 3.39% that will fail. A thriving economy is created when individual entrepreneurs have the freedom $75,000 $4,804 $3,127 6.41% 4.17% to try new ideas, risking their own assets, or the assets of their private investors, and the profit and loss system is used to decide their fate. While some policy makers may think hydrogen $100,000 $6,554 $4,877 6.56% 4.88% fuel is the future of the state economy, the truth is that South Carolinas future is yet to be $8,377 $150,000 $10,054 6.70% 5.58% discovered, and when it is, it will likely be in something that is not yet invented or known at $200,000 $13,554 $11,877 6.77% 5.94% the present time. In the end, it is South Carolinas citizens that must discover the future for the state, not the state political process. Figure 5.5 also shows what the average tax rates are for various incomes and taxes under the current tax system in South Carolina. In the right columns it also shows what the taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The 5 It is important to recognize that from societys perspective the profits earned by entrepreneurs represent gains figure clearly shows that the 1959 indexed bid resources away from more uniformly progressive, tax rate structure is alternative uses, production costs to society as a whole. Because entrepreneurs must especiallyvalue of those resources to society in their tax rates extremely low for only lowest when an at higher levels of incomes. It keeps alternative uses. Thus, profit is the earned income reflect the individualstakes a set of resources and produces something worth more to consumers than the other goods that entrepreneur in the state. could have been produced with those resources. A loss tax system charges all income groups morethat Figure 5.5 also shows that the current happens when an entrepreneur produces something in consumers do not value as highly as the other goods thatexception been produced with those same resources. taxes than an indexed rate schedule. The only could have is the $5,000 income earner in the For example, an entrepreneur who takes the resources necessary to produce a fleece blanket sold for $50 and table. turns South Carolina income taxes continue to$10 profit. Since the price of the resources used As them into a pullover that sells for $60 has earned a climb while the tax brackets remain instead stagnant, the reflect the opportunityrelatively high-tax state. This has a negative impact the by entrepreneurs state becomes a cost of their employment in other uses, the $10 profit generated by on

entrepreneur reflects the amount by which they have increased the value of those resources. By increasing the value created by our limited resources, entrepreneurs increase overall wealth in a society.

58 18

UNLEASHING CAPITALISM

manufacturing property tax in the country. In Figure 5.8 we present the effective property tax In addition, many good ideas die because entrepreneurs simply cannot put together the rates data for Southeastern states, for comparison. The ranks given forrules, regulations,ofand initial level of resources necessary to comply with the many the states are out all 50 states. The net tax to open a businessrateSouth Carolina.basedwillproperty valued one of permissions necessary and effective tax in are calculated We on never know if at $25 million ($12.5 million another FedEx. If we want a thrivingmillion in inventories, and must these could have been in machinery and equipment, $12.5 economy, South Carolina $2.5 million in to make it easier that South Carolinas effective tax rate on test their ideas in the find ways fixtures). Notice and less costly for entrepreneurs to try to industrial property is over 7.8 times higher than the most industry-friendly state, Delaware. (Delaware is listed in marketplace. the figure because itentrepreneurship, state.) To promote is the lowest-tax government often attempts to enact new programs, such as state-run venture capital funds, government-funded or subsidized business incubators, economic development authorities, or even to create new positions within the education system aimed atIndustrial Property Taxes in Southeastern states*, 2007 Figure 5.8: expanding entrepreneurship education within schools and colleges. Unfortunately, these policies grow the government sector, and shrink the private sector. The State simple fact is that theRank (ofand privateNet Tax sum to 100 Effectiveof the economy, and public 50) sectors percent Tax Rate South Carolina 1 $1,864,900 3.73% expansion of government spending means reductions in private spending, and of the resources available within the private sector. One wonders, for example, whether the hundreds of Mississippi 4 $1,291,050 2.58% millions of tax dollars spent to build the Innovista building in Columbia would have created 6 $1,264,358 moreTexas and opportunities had this money simply been left in the2.53% sectors hands. jobs private Tennesseethis project claim that so far it probably has created fewer jobs than even the 10 $1,033,544 2.07% Opponents of Hardees Restaurant that used to occupy the land on which it was built.6 West Virginia 14 $833,234 1.67% Entrepreneurship is the means by which we discover ways to increase the value Louisiana 17 $783,407 1.57% created by the states labor, physical, and natural resources (or economic inputs, in the Georgia $760,381 1.52% framework of Figure 2.1 20 Chapter 2). Successful entrepreneurship expands the overall in economic pie and allows us to generate more$677,683 wealth and prosperity. To encourage growth, Florida 24 1.36% policy reform must reduce the burdens on entrepreneurial start-ups and learn to tolerate 1.11% Alabama 35 $533,776 business failures. North Carolina 37 $491,071 0.98% Kentucky 47 $327,100 0.65%

ADAM SMITH (AGAIN): THE INVISIBLE HAND PRINCIPLE Virginia 49 $241,498 0.48%

Delaware 50 $238,840 0.48% Under capitalism there is no captain of the ship, no central economic planning Source: National Association of Manufacturers (2009) authority making the the states largest the only. * Taxes measured in decisions for city economy as a whole. How, in the absence of this central economic planning, can an economy thrive? Adam Smiths most important insight was theImportantly,the invisible hand effective tax rate is almost 2.5 timesanswer to than concept of South Carolinas of the marketplace which provides the greater this fundamental question. Georgias tax, and almost 4 times greater than North Carolinas. This puts South Carolina at a serious Smiths insight was that the ability to attract and keep industry. Since South Carolina disadvantage, in terms of its incentives under capitalism are arranged in such a way that even though we the country on industrial property, it should be no our own economic has the highest tax inall pursue different goals and objectives to advance surprise that it has interests, lowest per capita incomes and economic growth rates those actions one of thewe are in turn faced with strong incentives to pursue in the country.that also create the most wealth it is society asnotwhole. An example will help to illustrate to the lowest in Although for probably a critical that South Carolina set its tax rate Adam Smiths invisible hand it should in action. make it at least competitive for the Southeast. Since the country, principle definitely Suppose effectively maple lumber increases because of higher consumer demand for Georgias rate isthe price of 1.52 percent and North Carolinas is just under 1 percent, a rate maple furniture. This single price change will attract more industry.faced by decision makers at around 1 percent might be sufficient to change the incentives Working to reduce the throughout the economy, likely resulting in changes in the states competitiveness. various taxes applied to industry would seriously improve which properties are harvested, the percent Such a significantsawmills versus other uses, the incentive of non-furniture makers to of maple sent to reduction in taxes on industrial property would obviously lead to a substitute away from maple,on industrial property,by these market prices are whatthe overall reduction in tax revenues etc. The signals sent at least initially. However, enable our workers may in fact increase once the growth rate in the state begins to pick up and more revenue and businesses to identify changes in which goods and services create the most value. industry moves into the state. Furthermore, if the official tax rates are lowered, then the state

6

See South Carolina Policy Council (2009).

CHAPTER 5: S HY CAPITALISM WORKS CHAPTER 3: WPECIFIC TAX REFORMS

59 13

Presumably the us when new of imposing a tax rate schedule with graduated Price signals not only telloriginal intentopportunities are arising; they also help us to find out marginal tax rates doingto make the income tax progressive. However, what we are using when what we are was is no longer as highly valued, or when the resources progressivity existsfound an alternative use in structure is due to evenzero tax on the first $2,630 of income, have in the states income tax which they create the more value. and because of the graduated marginal tax rates. that unregulated prices are a necessary Nobel Laureate F.A. Hayek (1945) stressed However, since the marginal tax rate increases over a functioning capitalism-based economy. Figure 5.5, most of the progressivity ingredient for such small steps in income, as shown in The information contained in prices occurs buyer preferences,levels, not higher and the cost of production isincome levels, the about at lower income relative scarcity, levels of income. At higher essential to good average tax rate hardly increases at all. these nature of the current tax is often missing in the business decision making. However, This all-important prices are directly contradictory to the goal of progressivity. So although on the surface it appears that the tax satisfies the government sector. verticalFor policy, taxes should be does this only at people pay income levels reducing the equity condition, it really viewed as prices the lower for the goods and services wealth of these lowest income taxpayers, notfirm intended consequence. and sewers, it would they receive from government. If a private the provided roads, water, extend service to any new development willing to pay a price high enough to cover the firms costs of reaching and servicing the area. When tax: Current tax rates compared to Figure 5.5: South Carolina income government runs these services, however, the prices it charges are often out of line with true costs. This can result in development not being inflation-indexed rates, 2009 undertaken when and where it should be; or being undertaken when and where it should not. Policies should be designed to avoid interfering with market prices; and when possible, we should also attempt to set taxes and user fees for government provided goods and services at Income Tax Rates/Brackets if 1959 Tax Current Income Tax levels more analogous to market prices. Additionally, consumer was Inflation Adjusted tooften Schedule choice mechanisms can Rates/Brackets be introduced into government provided goods and services, such as with school voucher (i.e., 2009 parental choice) programsas long as the money follows their choiceto help infuse more Tax Average Tax Rate of a profit and loss system into government provision. Tax Average Tax Rate Taxable Income Amount Amount $5,000 $71 1.42% $125 2.5% $10,000 $290 $250 2.90% 2.5% SPONTANEOUS ORDER: A THRIVING ECONOMY IS A RESULT OF $15,000 4.03% 2.51% HUMAN ACTION,$604 HUMAN DESIGN $377 NOT $20,000 $954 $527 4.77% 2.63% Nobel Laureate F.A. Hayek (1967) contributed to our understanding of economic $30,000 $1,654 $834 5.51% 2.78% progress by realizing that much of the economy is the result of human action but not human $50,000 $1,695 6.10% design. What Hayek $3,054 mind with this distinction was that many 3.39% had in institutions are not consciously designed.$4,804 they are the result of the efforts of many individuals, each Rather, $75,000 $3,127 6.41% 4.17% pursuing their own ends, whose activities create order through time. The English language is $100,000 $6,554 $4,877 6.56% 4.88% one example, as is the common law and a successful economic system. No one person or $8,377 $10,054 6.70% group $150,000 can sit down and create these things by human design. 5.58% of people Hayek called these outcomes 6.77% spontaneous orders. Another example of spontaneous $200,000 $13,554 $11,877 5.94% order is the marketplace itselfthe nexus of interpersonal relationships based on producing, buying, and selling goods and services. When there are large gains to be had, Hayek pointed Figure 5.5 also shows what the average tax rates are for various incomes and taxes out, these relationships spontaneously arise without any right columns it also shows what the under the current tax system in South Carolina. In the central economic planning. Hayeks concept can be illustrated with an example. Suppose a college in South taxes and average tax rates would be if the 1959 tax tables were indexed for inflation. The Carolina added a new dormitory on campus that was separated from the classroom buildings figure clearly shows that the 1959 indexed tax rate structure is more uniformly progressive, by several acres of levels of incomes. The college could hire someone to plan and pave the especially at higher undeveloped land. It keeps tax rates extremely low for the lowest income sidewalks in advance so that students could walk to campus. Alternatively, students could be individuals in the state. allowed to have one semester in which they tracked through the woods on their own, creating Figure 5.5 also shows that the current tax system charges all income groups more in their own pathways. The college could then retrospectively pave these pathways. The deeper taxes than an indexed rate schedule. The only exception is the $5,000 income earner in the and wider a pathway is, the wider the sidewalk is made. Many of the road systems in the table. As South Carolina income taxes continue to climb while the tax brackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

60 18

UNLEASHING CAPITALISM

manufacturing are the resultin the country. Inin which trailblazers paths were then used tax United States property tax of this process Figure 5.8 we present the effective property by rates data foreventually the states, ones paved to become major highways.7 states are out of all wagons, and Southeastern larger for comparison. The ranks given for the 50 states. The net taxdifference is that when aare calculated basedto arise naturally it will be The important and effective tax rate system is allowed on property valued at $25 million ($12.5 million in machinerydesires of those involved and create the most value. $2.5 much more likely to satisfy the true and equipment, $12.5 million in inventories, and One million in in Ohio that pre-planned its sidewalks has subsequently had to install benches and university fixtures). Notice that South Carolinas effective tax rate on industrial property is over 7.8 times higher than the mostwalking in the wrong places and(Delaware is listedthe holly shrubs to discourage people industry-friendly state, Delaware. making trails in in the figure because it is the lowest-tax state.) planned sidewalks. Spontaneous orders work grass. Students simply were not using the better with human nature and help to accomplish our specific goals in the most efficient manner. The unplanned sidewalks simply go where people need them the most. While we Industrial Smith and Hayeks reasons why an economy organized as Figure 5.8: have exploredProperty Taxes in Southeastern states*, 2007 a ship without a captain is best, let us now turn to the reasons why having a strong captain in State Rank (of Net Tax Effective Tax Rate control can prevent prosperity. 50) South Carolina 1 $1,864,900 3.73% Mississippi 4 $1,291,050 2.58%

GOOD INTENTIONS ARE NOT ENOUGH: 2.53% Texas 6 $1,264,358 THE PREVALENCE OF UNINTENDED CONSEQUENCES Tennessee 10 $1,033,544 2.07%

West Virginia 14 $833,234 1.67% As we mentioned in the introduction to this chapter, what often happens is that new Louisiana 17 $783,407 1.57% policies restricting capitalism are enacted because they sound like good ideas. Unfortunately, these policies frequently have unintended consequences that work against the Georgia 20 $760,381 1.52% very goals they were intended to achieve. Florida 24 $677,683 1.36% The minimum wage is a good case in point. While many people are in favor of the 1.11% Alabama minimum wage law, they 35 support it because $533,776 it helps low income families. The they think published scientific evidence, however, rejects this view and instead concludes that the North Carolina 37 $491,071 0.98% minimum wage actually makes the intended beneficiaries worse off.8 So, for the same 0.65% Kentucky 47 $327,100 reasonthe goal of helping those in needeconomists are generally opposed to minimum Virginia 49 $241,498 0.48% wage legislation. This position can only be reached by examining all of the other indirect changes that happen as a 50 result of a minimum wage, such as less 0.48% training, fewer worker Delaware $238,840 employee benefits, and most importantly fewer jobs and higher unemployment for low-skilled Source: National Association of Manufacturers (2009) * Taxes workers. measured in the states largest city only. Again, it is important to remember that economics is a science, not a political position. Importantly, the publicly stated intent or goal of theis almost 2.5 times greater than We care little about South Carolinas effective tax rate policy, and rather evaluate policy Georgias tax, and almost 4 times greater than real-world evidence. Good South Carolina at a based on published research that examines North Carolinas. This puts intentions are not serious disadvantage, in terms of its ability to attract and keep industry.help toSouth Carolina enough to guarantee good outcomes. A few more examples will Since illustrate this has the highest tax in the country on industrial property, it should be no surprise that it has important point. one of the lowest per capita incomes and economic growth rates in the country. (ADA) were The employment provisions of the Americans with Disabilities Act passed Although it is probably lowering barriers to employment for tax rate to persons. The with the intention of not critical that South Carolina set its disabled the lowest in the country, it should definitely make on at least competitive further requires employers legislation prohibits discrimination based it disability status and for the Southeast. Since Georgias rate is effectively 1.52 percent employees Carolinas is just Has the ADA livedrate to make reasonable accommodations for and North with disabilities. under 1 percent, a up at its stated1intent? Has it expanded employment among the industry. Working to reduce the to around percent might be sufficient to attract more disabled? various taxes applied to industry would seriously improve the states competitiveness. Such a significant reduction in taxes on industrial property would obviously lead to a 7 reductionin-depth illustration ofon industrial property, at is given in the famous I, Pencil essay by A more in tax revenues this idea for interested readers least initially. However, the overall Leonard Read, available Educations revenue may in fact increase at once the growth rate in for state begins to pick up andwebsite the Foundation the Economic more http://www.fee.org/pdf/books/I,%20Pencil%202006.pdf. industry moves into the state. Furthermore, if the official tax rates are lowered, then the state 8

For evidence, see some of the studies complied by the Joint Economic Committee of Congress, available at http://www.house.gov/jec/cost-gov/regs/minimum/case.htm

CHAPTER 5: S HY CAPITALISM WORKS CHAPTER 3: WPECIFIC TAX REFORMS

61 13

Presumably the original intent of imposing a tax rate schedule with graduated Thomas DeLeire, a public policy professor at the University of Chicago, wrote his marginal tax rateson the to make the effects of the ADA legislation when what progressivity Ph.D. dissertation was employment income tax progressive. However, he was in graduate exists in the states income tax structure is due to the zero tax on the first $2,630harmed the school at Stanford University. His research shows that the ADA has actually of income, and because opportunities for disabled Americans.9 By increasing the cost marginal disabled employment of the graduated marginal tax rates. However, since the of hiring tax rate increasesand making it harder to income, as this legislation has resulted in a progressivity workers over such small steps in fire them, shown in Figure 5.5, most of the reduction in occurs at lower income levels, not higher levelsthe ADA, 60 out of every 100 disabled men employment among disabled individuals. Prior to of income. At higher income levels, the average tax rate hardlyAfter the ADA went into effect,the current employment fell to less than were able to find jobs. increases at all. This nature of however, tax is directly contradictory to the goal disabled men. After adjusting for othersurface itDeLeire concludestax satisfies the 50 per 100 of progressivity. So although on the factors, appears that the that 80 percent vertical decline condition, it by thedoes this only atcreated by the ADA. While the entire of this equity was caused really bad incentives the lower income levels reducing the wealth of these lowest income taxpayers, not the intended consequence. for the disabled, the purpose of this legislation was to increase the employment opportunities data simply do not support this view. Instead, the ADA seems to have made it more difficult and costly5.5: South Carolina income tax: Current reduced job compared to Figure for employers to hire disabled workers, resulting in tax rates opportunities for disabled people. If the goal is to expand employment opportunities for disabled Americans, inflation-indexed rates, 2009 the research suggests that the ADA is not the answer. Environmental policy often has the most devastating examples of unintended consequences. Under the Endangered Species Act, for example, large areas around1959nesting Income Tax Rates/Brackets if the Tax Current Income Tax be declared protected habitats, which then grounds of the red-cockaded woodpecker can Schedule was Inflation Adjusted to Rates/Brackets imposes stringent restrictions on the surrounding property owners (a loss of control rights in 2009 the terminology introduced in Chapter 2). When the Federal Fish and Wildlife Service put Tax Tax Average Tax Rate Boiling Springs Lakes, North Carolina on notice that active nests were beginning to form near Average Tax Rate Taxable Income Amount the town, it unleashed a frenzy of action on the part Amount of the residents, but not of the type you $5,000(Associated Press 2006). Foreseeing the potential future restrictions on their $71 $125 1.42% 2.5% might expect property use, landowners swarmed 2.90% hall to $250 for lot-clearing permits. After the city apply $10,000 $290 2.5% removing the trees, the land would no longer be in danger of being declared an $15,000 $604 $377 4.03% 2.51% environmentally protected habitat because no future nests could form on the property. $20,000 incidents have occurred throughout $527range of this 2.63% $954 4.77% Similar the bird, and the total habitable nesting area $1,654 species5.51% United States has fallen dramatically as a result for this in the $30,000 $834 2.78% of the poor incentive structure created by the law. The red-cockaded woodpecker has lost a $50,000 $3,054 $1,695 6.10% 3.39% significant portion of its habitat, moving it closer to extinction because of the unintended $75,000 $4,804 $3,127 6.41% 4.17% consequences of the Endangered Species Act. As these with even the best intentions can create $100,000 examples illustrate, policy designed $4,877 $6,554 6.56% 4.88% unintended consequences that work against the original goal of the policy. The concept of $8,377 $150,000 $10,054 6.70% 5.58% unintended consequences vividly illustrates why having an economic captain can often $200,000 $13,554 $11,877 6.77% 5.94% produce more harm for an economy than not having one. One additional problem with government regulations is that there is no natural profit and loss-type system to shows out bad policies through time. Infor various incomes and taxes Figure 5.5 also weed what the average tax rates are the end, some policies just do not live up to their stated goals, South Carolina. at too high of a cost. also shows what the under the current tax system in or do so but onlyIn the right columns itIn 2003, for example, 10 West and average tax a maximum eight hour operating restriction on taxi for inflation. law taxes Virginia imposedrates would be if the 1959 tax tables were indexeddrivers. This The was intended to reduce the 1959 indexed accident rates among taxi cabs. Policy makers, figure clearly shows thatdriver fatigue and tax rate structure is more uniformly progressive, however, at higher levels unintended It keeps tax rates extremely low for the the incentives especially overlooked the of incomes. consequences resulting from changing lowest income faced by cab the state. individuals indrivers. With fewer hours to drive in a day, cab drivers started driving at faster speeds Figure 5.5fewer shows that the current the law result in a significant reduction in the and took also breaks. Not only did tax system charges all income groups more in number of an indexed ratein the state,The only exception driving$5,000 intoxicated incidents, taxes than cabs operating schedule. which led to more is the while income earner in the but it As South the very problem it was designed climb while the tax there are fewer table. exacerbatedCarolina income taxes continue toto reduce. Even thoughbrackets remain stagnant, the state becomes a relatively high-tax state. This has a negative impact on

9 10

See DeLeire (1997, 2000). See Corey and Curott (2007) for a longer description of this law and its consequences in West Virginia.

62 18

UNLEASHING CAPITALISM

manufacturing property tax in thethe total number of 5.8 we present the effective property has cabs on the road due to the law, country. In Figure accidents committed by cab drivers tax rates data for West Virginia sincefor comparison. has been passed.for the states are out of all increased in Southeastern states, the regulation The ranks given Despite this information 50 states. The net tax and policy makersrate are calculateddo not on property valuedget $25 being widely-known, state effective tax in West Virginia based have the time to at the million ($12.5 million in machinerydeal with too many other, more in inventories, and $2.5 law off the books due to having to and equipment, $12.5 million pressing, current issues. million in fixtures). Notice that South Carolinas effective tax to go back and look into the Simply put, government lawmakers just do not have the time rate on industrial property is over 7.8 times higher than the most industry-friendlyintroduce the legislation to repeal them. effectiveness of all laws from the past, nor the time to state, Delaware. (Delaware is listed in the figure because it is the lowest-tax state.) This highlights the need for one important reform that should be applied to each and every new state program and regulationa sunset provision. Sunset provisions are statements put into the law as it is created that cause the law to expire naturally at some point in the 5.8: Industrial Property Taxes in Southeasternwith a simple phrase Figure future unless certain conditions are met. This can be done states*, 2007 such as: If this regulation can not prove, with data, that it is accomplishing its stated goal State Rank (of 50) Effective to Rate within five years, it shall expire. SomeNet Tax lawmakers may even desire Taxinsert the words South Carolina $1,864,900 meeting its stated goal at a1reasonable cost to not only ensure the 3.73% is accomplishing policy its goal, but also in a cost effective manner. $1,291,050 Mississippi 4 2.58% Texas 6 $1,264,358 2.53% Tennessee 10 $1,033,544 VOTE EARLY, VOTE OFTEN: BAD PEOPLE OR BAD2.07% INCENTIVES? West Virginia 14 $833,234 1.67% Economists are of the opinion that government agencies tend 1.57%less efficient than to be Louisiana 17 $783,407 private firms. But the reason has nothing to do with bad politicians or the particular people Georgia 20 $760,381 1.52% involved in the government sector. Getting more out of government is not a matter of getting Florida 24 $677,683 1.36% better people in government. Government workers are smart, caring, and devoted to their causes. The problem is that the reward structurethe rules of the gamewithin their jobs 1.11% Alabama 35 $533,776 does not provide the right incentives to encourage the best outcomes. Nobel Laureate James North Carolina 37 $491,071 0.98% Buchanan, with coauthor Gordon Tullock, published a seminal book on this subject called the Kentucky 47 $327,100 Calculus of Consent (1962). As they pointed out, in government there 0.65% is no invisible hand. An example will help to illustrate. Virginia 49 $241,498 0.48% Most people know that government budgets are often given as fixed amounts for each Delaware 50 $238,840 0.48% fiscal year. At the end of the year, any remaining money in the budget is usually taken back Source: National Manufacturers (2009) and if Taxes measuredAssociation of years city only. is likely be reduced because the agency did not * money remains the states largest funding in the next need all of the money it was allocated. To avoid this outcome, government agencies are notorious for spending their remainingeffective rapidly atis almost of each fiscal year. than Importantly, South Carolinas budgets tax rate the end 2.5 times greater The point is that even a person who greater than North Carolinas. This puts South at home, a Georgias tax, and almost 4 times was very careful and frugal with their moneyCarolina ator would disadvantage, a private its ability to would begin to behave Since South Carolina serious be at a job inin terms of corporation, attract and keep industry.differently under this different set of tax that country on industrial property, it should be no surprise that it has has the highest rulesin theare present in the government sector. In government, the problem is not of people; it per capita incomes and economic growth rates in the country. one thethe lowest is the incentives they face. Although it is probably not critical that South Carolina set its tax rate to the lowest in the country, it should definitely make it at least competitive for the Southeast. Since THE NIRVANA FALLACY Georgias rate is effectively 1.52 percent and North Carolinas is just under 1 percent, a rate at around 1nirvana fallacybe the logical to attractcomparing actual Working to unrealistic, The percent might is sufficient error of more industry. things with reduce the various taxes applied to industry wouldsome might see a problem in the current health care idealized alternatives.11 For instance, seriously improve the states competitiveness. system Such a significant reduction this failure, industrial property would obviously lead care and propose that because of in taxes on we should have a government-run health to a reduction in tax the logic that industrial government-run system would overcome alloverall system, based on revenues on this ideal property, at least initially. However, the of the revenue may in fact increase once the growth rate in the state begins to pick up and more industry moves into the state. Furthermore, if the official tax rates are lowered, then the state 11

For a more detailed wiki/Nirvana_fallacy. discussion, and source for this definition, see http://en.wikipedia.org/

CHAPTER 5: S HY CAPITALISM WORKS CHAPTER 3: WPECIFIC TAX REFORMS

63 13