Professional Documents

Culture Documents

David S Cercone Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

David S Cercone Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

Revl 1/20il

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization USDC, WDPA

5a. Report Type (check appropriate type)

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

I. Person Reporting (last name, first, middle initial) Cercone, David S.

4. Title (Article Ill judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 04/18/2011 6. Reporting Period 01/01/2010 to 12/31/2010

Nomination, [] Initial

Date [] Annual [] Final

U.S. District Judge - Active

5b. [] Amended Report

7. Chambers or Office Address Suite 7270, 700 Grant Street U.S. Courthouse Pittsburgh, PA 15219

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. mepor, lng i,aivid.,to,++; s~e ~,p. 9-13 of filing instructions.)

D NONE (No reportablepositions.)

POSITION

I. Director 2. 3. 4. 5. Custodian

NAME OF ORGANIZATION/ENTITY

Boys and Girls Club of Western Pennsylvania Account # 1

II. AGREEMENTS. tRe, oning i.aiviauot onty; see pp. t4.t6 ol~nng instructions.) [~] NONE (No reportable agreements.)

DATE

I. 2002 2. 2003 3.

PARTIES AND TERMS

Administrative Office of PA Courts - eligible to receive health care benefits for life Pa. State Employees Retirement System - elected to receive montly pension payment for life

Cercone, David S.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting Cercone, David S.

Date of Report 04/18/201 I

IlL NON-INVESTMENT INCOME. (Repo.ing individual and spouse; seepp. 17-24 of filing instructions.)

A. Fliers Non-Investment Income ~~ NONE (No reportable non-investment income.) DATE

I. 2010 2. 2010 3. 4.

SOURCE AND TYPE

University of Pittsburgh - teaching salary PA. State Employees Retirement System - pension

INCOME

(yours, not spouses)

$14,200.00 $34,966.00

B. Spouses Nondnvestment Income - if you were married during anyportlon of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE

SOURCE AND TYPE

Administrative Office of PA Courts - magisterial district judges salary

I. 2010 2. 3. 4.

IV. REIMBURSEMENTS --transportation, Iodglng, food, entertalnmen~

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.)

SOURCE

I. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting Cercone, David S.

Date of Report 04/18/2011

~]

NONE (No reportable gifts.)

SOURCE DESCRIPTION VALUE

1. 2. 3. 4. 5.

VI. LIABILITIES. a,,a,,,~s ,hos, o/seo~se ~.~ aeee,,,t~,,t chUar~,; s,, ~,,. ~:-~ of filing instructions,)

[~] NONE (No reportable liabilities.)

CREDITOR Chase Home Finance 2. 3. 4. 5. Allegheny Valley Bank of Pittsburgh

DESCRIPTION

Mortgage on Rental Property Naples, FL (Pt. VII, line 17) Bank loan

VALUE CODE M J

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting Cercone, David S.

Date of Report 04/! 8/201 I

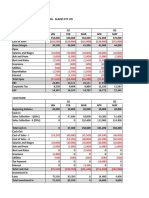

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of fillng instructions.)

[~] NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B, Income during reporting period (l) Amount Code I (A-H) (2) Type (e.g.. div., rent, or int.) C. Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 Transactions during reporling period

(l) Type (e.g., buy, sell. redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-H)

(s)

Identity of buye~seller (ifprivate ~ansaction)

(Q-W)

I. 2. 3. 4. 5. 6. 7. : 8. I 9. 10. I!. 12. 13. 14. 15. 16. 17. Delaware Tax Free PA Mutual Fund Davis NY Venture Mutual Fund Citizens Bank Accounts American Balanced Fund 529B American Funds Cash Mgt Trust of America-529B IRA - American Funds: Bond Fund of America - American Funds: Capilal Income Builder -American Funds: Income Fund of America -American Funds: Cash Mgt. Trust of America American Funds: Income Fund of America Wachovia Bank: Bank Deposit Sweep Money Market Rental Property, Naples, FL (8/11/2003 $265.000) A A D Dividend Interest Rent J J N T R A C A B A D Dividend Dividend Interest Dividend Dividend Dividend K K K J J M T T T Sold (part) 12/17/10 J A

I. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns C I and D3 ) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50,001 - $100.000 J =$15.000 or less N =$250,001 - $500,000 P3 =$25,000.001 o $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50.000 O =$500.001 - $ 1,000,000 R =Cost (Real Estate Only) V ~ Other

C =$2,501 - $5.000 HI =$1,000,001 - $5,000,000 L =$50,001 - $ 100.000 P I =$1,000,001 - $5,000,000 P4 =More than $50,000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000.000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000.000 T =Cash Market

E 3515.001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting Cercone, David S.

Dale of Report 04/I 8/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicatepart of report.)

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting Cercone, David S.

Date of Report 04/I 8/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: $/David S. Cercone

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Rev. 1/2oz l

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization USDC, WDPA 5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

I. Person Reporting (last name, first, middle initial) Cercone, David S.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 07/8/20

6. Reporting Period 01/01/2010 to 12/31/2010

U.S. District Judge - Active

5b. [] Amended Report 7. Chambers or Office Address 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

Suite 7270, 700 Grant Street U.S. Courthouse Pittsburgh, PA 15219

IMPORTANT NOTES: The instructions accompanying this form must be followea~ Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. meponing inaiviauat only; se, p,. 9-13 of filing instructions.)

D

1. 2.

NONE (No reportable positions.)

POSITION

Director Custodian

NAME OF ORGANIZATION/ENTITY

Boys and Girls Club of Westem Pennsylvania Account # !

II. AGREEMENTS. (Reporting individual only; seepp. 14-16 of filing instructions.)

~-q NONE (No reportable agreements.) DATE

1.2002 2.2003 3. PARTIES AND TERMS Administrative Office of PA Courts - eligible to receive health care benefits for life Pa. State Employees Retirement System - elected to receive montly pension payment for life

Cercone, David S. A

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting Cercone, David S.

Date of Report 07/8/201 l

III. NON-INVESTMENT INCOME. (Reporting individual and spouse; see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income

~ NONE(No reportable non-investment income.) DATE

I. 2010 2. 2010 3. 4.

SOURCE AND TYPE

University of Pittsburgh - teaching salary PA. State Employees Retirement System - pension

INCOME

(yours, not spouses)

$14,200.00 $34,966.00

B. Spouses Non-Investment Income - if you were married during anyportion of the reportingyear, complete this section.

(Dollar amount not required except for honoraria.)

~-~

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

Administrative Office of PA Courts - magisterial district judges salary

1. 2010 2. 3. 4.

IV. REIMBURSEMENTS - tra,spor,ation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.)

SOURCE

I. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting Cercone, David S.

Date of Report 07/8/2011

V. GIFTS. ancludes those to spouse u.d dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.)

SOURCE 1. 2. 3. 4. 5. DESCRIPTION

VALUE

VI. LIABILITIES. ancludes those of spouse and dependent children; seepp. 32-33 of f!ling instructions.)

[~] NONE (No reportable liabilities.) CREDITOR Chase Home Finance 2. 3. 4. 5. Allegheny Valley Bank of Pittsburgh DESCRIPTION Mortgage on Rental Property Naples, FL (Pt. VII, line 17) Bank loan VALUECODE M J

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting Cercone, David S.

Date of Report 07/8/2011

VII. INVESTMENTS and TRU STS - i.comc, vatue, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

D NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) Amount Code l (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (l) (2) Value Value Code 2 Method (J-P) Code 3 Transactions during reporting period

0)

Type (e.g., buy, sell, redemption)

(2)

Date

(3)

Value

mm/dd!yy Code 2 (J-P)

(4) Gain Code I (A-H)

(Q-W)

I. 2. 3. 4. 5. 6. 7. Delaware Tax Free PA Mutual Fund Davis NY Venture Mutual Fund Citizens Bank Accounts Account #1 (Custodian) -American Balanced Fund 529B -American Funds Cash Mgt Trust of America-529B IRA B A D Dividend Dividend Dividend J J M T T T Sold (pan) 12/17/10 J A A C A Dividend Dividend Interest K K K T T T

(5) Identity of buyer/seller (if private transaction)

8. - American Funds: Bond Fund of America 9. 10. 11. 12. 13. 14. 15. 16. 17. - American Funds: Capital Income Builder -American Funds: Income Fund of America -American Funds: Cash Mgt. Trust of America American Funds: Income Fund of America Wachovia Bank: Bank Deposit Sweep Money Market Rental Property, Naples, FL (8/11/2003 $265.000) U.S. Savings Bond A A D A Dividend Interest Rent Interest J

J

T

T R T

N J

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$ 50,001 - $ 100,000 J =$15,000 or less N =$250,001 -$500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G = $100,001 - $1,000,000 K =$15,001 - $50,000 O=$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H 1 =$1,000,001 - $ 5,000,000 L =$50,001 - $100,000 PI =$1,000,001 -$5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D -$5,001 - $15,000 H 2 =More than $5,000,000 M $100,001 - $250,000 P2 $5.000,001 -$25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting Cercone, David S.

Date of Report 07/8/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndlcatepart of report.)

FINANCIAL DISCLOSURE REPORT Page 6 of 6 IX. CERTIFICATION.

Name of Person Reporting Cercone, David S.

Date of Report 07/8/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S[ David S. Cercone

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviDocument5 pagesSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviRamswaroop Khichar100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- T3-Sample Answers-Consideration PDFDocument10 pagesT3-Sample Answers-Consideration PDF--bolabolaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- KPMG - Target Operating ModelDocument2 pagesKPMG - Target Operating ModelSudip Dasgupta100% (1)

- Sample Final Exam FINA 521Document4 pagesSample Final Exam FINA 521khalidhamdanNo ratings yet

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Schoolboard PowerpointDocument2 pagesSchoolboard PowerpointJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- Bank Mandiri ProfileDocument2 pagesBank Mandiri ProfileTee's O-RamaNo ratings yet

- Low Cost Housing Options for Bhutanese RefugeesDocument21 pagesLow Cost Housing Options for Bhutanese RefugeesBala ChandarNo ratings yet

- Sanraa Annual Report 08 09Document49 pagesSanraa Annual Report 08 09chip_blueNo ratings yet

- MAS Annual Report 2010 - 2011Document119 pagesMAS Annual Report 2010 - 2011Ayako S. WatanabeNo ratings yet

- ACST101 Final Exam S1 2015 QuestionsDocument20 pagesACST101 Final Exam S1 2015 Questionssamathuva12No ratings yet

- Personal Finance PowerPointDocument15 pagesPersonal Finance PowerPointKishan KNo ratings yet

- Leadership in Change Management Group WorkDocument11 pagesLeadership in Change Management Group WorkRakinduNo ratings yet

- 2011HB 06651 R00 HBDocument350 pages2011HB 06651 R00 HBPatricia DillonNo ratings yet

- Acquisition Analysis and RecommendationsDocument49 pagesAcquisition Analysis and RecommendationsAnkitSawhneyNo ratings yet

- Accounting and FinanceDocument5 pagesAccounting and FinanceHtoo Wai Lin AungNo ratings yet

- CVP - Quiz 1Document7 pagesCVP - Quiz 1Jane ValenciaNo ratings yet

- Module 10 PAS 33Document4 pagesModule 10 PAS 33Jan JanNo ratings yet

- 8 Indicators TS 3.aflDocument24 pages8 Indicators TS 3.afludhaya kumarNo ratings yet

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDocument6 pagesCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaNo ratings yet

- 07R911036CDocument899 pages07R911036Cbreanna4teen9949No ratings yet

- Horsham Rural City Council Agenda May 2019Document110 pagesHorsham Rural City Council Agenda May 2019Jade BateNo ratings yet

- Business TransactionsDocument6 pagesBusiness TransactionsMarlyn Joy Yacon100% (1)

- Assignment 1Document2 pagesAssignment 1Babar Ali Roomi0% (1)

- Model ByeLaws of Housing Cooperative SocietiesDocument65 pagesModel ByeLaws of Housing Cooperative SocietiesbluedremzNo ratings yet

- Revenue Recognition Guide for Telecom OperatorsDocument27 pagesRevenue Recognition Guide for Telecom OperatorsSaurabh MohanNo ratings yet

- Chapter 6Document17 pagesChapter 6MM M83% (6)

- Step by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyDocument25 pagesStep by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyIkhlas SadiminNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- P4 Taxation New Suggested CA Inter May 18Document27 pagesP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranNo ratings yet

- VC, PE, Angel investors and startup ecosystem parties in IndonesiaDocument82 pagesVC, PE, Angel investors and startup ecosystem parties in IndonesiaGita SwastiNo ratings yet

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet