Professional Documents

Culture Documents

Kitchen Ware Solution

Uploaded by

Irfan Shaikh0 ratings0% found this document useful (0 votes)

503 views6 pagesA private equity firm intends to purchase all of. Blaine's outstanding shares at a price higher than $16. Per share for acquisition. At the end of 2006, the company held $231 million in cash and securities.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA private equity firm intends to purchase all of. Blaine's outstanding shares at a price higher than $16. Per share for acquisition. At the end of 2006, the company held $231 million in cash and securities.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

503 views6 pagesKitchen Ware Solution

Uploaded by

Irfan ShaikhA private equity firm intends to purchase all of. Blaine's outstanding shares at a price higher than $16. Per share for acquisition. At the end of 2006, the company held $231 million in cash and securities.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

,80

Blaine Kitchenware nc. case study

Basic case

Blaine Kitchenware was a mid-sized producer of small appliances primarily used in

residential kitchens. By 2006, the company's products consisted of a wide range of

small kitchen appliances. For the period 2003 to 2006, the industry posted modest

annual unit sales growth of 2%. n 2006, 65% of its revenue was generated from

shipments to U.S. wholesalers and retailers. BK's market research consistently showed

that the Blaine brand was well-known and well-regarded by consumers. During the year

ended December 31, 2006, Blaine earned net income of $53.6 million on revenue of

$342 million. Approximately 85% of Blaine's revenue and 80% of its operating income

came from the sale of mid-tier products.

Blaine's 2006 EBTDA margin of nearly 22% was among the strongest within the peer

group. Blaine's operating margins had decreased slightly over the last three years.

Margins declined due to integration costs and inventory write-downs associated with

recent acquisitions. Growth in Blaine's top line was attributable almost exclusively to

acquisitions. Despite the company's profitability, returns to shareholders had been

somewhat below average. Blaine's return on equity (ROE) was significantly below that

of its publicly traded peers. Moreover, its earnings per share had fallen significantly

since 2004, partly due to dilutive acquisitions. Stock price appreciation, during 2004-

2006, compounded annual return for BK's shareholders, including dividends and stock

price appreciation were approximately 11% per year which was below the 16% annul

compounded returned by shareholders of Blaine's peer group during the same period.

At the end of 2006, the company held $231 million in cash and securities, Blaine's

balance sheet was the strongest in the industry.

Now a private equity firm intends to purchase all of Blaine's outstanding shares at a

price higher than $16.25 per share for acquisition, the banker suggested BK itself could

do the same thingborrow money to buy back its own shares.

Relevant information for decision

Capital structure

Corporate capital structure is the ratio between all funding sources, and capital structure

is actually the ratio of debt capital. Because the cost of debt capital was significantly

lower than the cost of equity capital. The debt has greatly reduced the role of integrated

enterprise cost of capital. Therefore, it can increase earnings per share and its stock

value by improving the proportion of corporate debt appropriately, which assumes a

crucial role of financial leverage.

The capital structure of Blaine is prudent and conservative. The main source of funding

for business comes from equity capital. Such capital structure makes the risk of its

financing is low as well as the cost of its financing is high. Thus, the returns to

shareholders do not have a high level.

Debt ratio =debt asset /total asset 100'

Equity capital ratio =equity capital /total capital 100%

2004 2005 2006

Debt ratio 16.0% 16.7% 17.5%

Equity capital ratio 84.0% 83.3% 82.5%

For Blaine, the debt ratio is extremely low, only 16.7% average, and accordingly the

equity capital ratio is relatively high, reached 83.3% average. We can easily find that

improving the proportion of corporate debt can increase the earning per share and

finally increase the stock value. So the Blaine should consider borrow money to enlarge

the debt ratio.

Financial leverage effect

Enterprises financial leverage of funds has a magnifying affect, when the business uses

the liabilities, the effects of financial leverage will show. However, debt is not always

excellent, and we should firstly analyze whether the profitability of raising the funds for

capital is greater than the interest rate. f it is so'the use of debt will substantially

increase their earning per share.

Maintaining a proper balance is a premise to adjust surplus fund transfers and increase

return on investment owners. Due to the low debt ratio and high equity capital ratio of

Blaine, it positions in under-levered. The shareholders are paying a price for that.

Debt management can bring huge profit for Blaine'although the enterprises maybe

face great risks due to large debt. Either too much or too little does not mean that it is a

good balance. f the debt is too small, it cannot be effectively achieved balance the

benefits to the enterprise.

The financial position

During the year ended December 31, 2006 Blaine earned net income of $53.6 million on

revenue of $342 million.

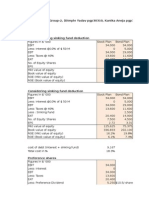

2004 2005 2006

Net income $ 53,112 $ 52435 $ 53,630

Dividends $ 18,589 $ 22871 $ 28,345

Average shares outstanding 41,309 48970 59,052

Earnings per share $ 1.29 $1.07 $ 0.91

Dividend per share $ 0.45 $0.47 $ 0.48

Payout ratio 35.0% 43.6% 52.9%

Revenue growth 3.2% 5.5% 11.1%

Gross margin 30.0% 28.5 % 27.0%

EBT margin 21.4% 19.7% 18.7%

EBTDA margin 23.8% 22.4% 21.6%

Effective tax rate 32.0% 31.7 % 30.8%

Net income margin 18.2 % 17.0% 15.7%

Total current assets $ 376,351 $ 364,449 $339,678

Total current liabilities $ 62,935 $ 70,705 $76,581

Total liabilities $79,840 $92,290 $103,890

From the above figures, we can observe that net income margin and earnings per share

have declined in the past three year. The majority of liabilities are current liabilities and

the current assets are over liquid.

Operating conditions

Facing its competitors, Blaine holds prices firm and its organic revenue growth had

suffered in recent years. Finally, some of its core products lost market share. Growth in

Blaine's top line was attributable almost exclusively to acquisitions.

Blaine's stock price was not far off its all-time high, yet its performance clearly lagged

that of its peers.

Approximately 85% of Blaine's revenue and 80% of its operating income came from the

sale of mid-tier products. Blaine had introduced some technology, targeting higher-end

consumers and intended to compete at higher price points.

Blaine began by taking advantage of NAFTA, engaging suppliers and performing some

manufacturing in Mexico. By 2003, BK also had established relationships with several

Asian manufacturers.

BK had undertaken a strategy focused on rounding out and complementing its product

offerings by acquiring small independent manufacturers or the kitchen appliance

product lines of large.

Business owners and management staff

The attitude of the owners to the control enterprise may affect the capital structure. f

business owners do not want to be acquired by other companies'perhaps BK would

repurchase stock and maximize the use of debt financing.

Family members on the board may not welcome some of the possible effects of a large

share repurchase. Assuming that family members held on to their shares, their

percentage ownership of Blaine would rise, reversing a downward trend dating from

BK's PO. t also would give the board more flexibility in setting future dividends per

share.

Both Dubinski and the board knew that the recent trend in BK's payout ratio was

unsustainable and that this concerned some family members. The board's attitude to

risk is a factor affecting capital structure.

Alternative solutions (advantage/disadvantage)

The stability in operating is very essential to the capital structure if a company's sales

and earnings are stable and growing trend, it can use debt to raise more funds.

bank debt-- credit agreement

Advantage:

Borrowing money from bank is low-risk and low cost.

Disadvantage:

Good business reputation and debt service in time.

equity investment

Advantage:

Percentage ownership would rise, increase the control to company.

Disadvantage:

The cost of equity capital is much higher than the cost of debt capital, investors expect

higher returns; because the risk of equity investment is significantly higher than debt

investment.

corporate bonds

Advantage:

Easy to adjust the capital structure, protect the right of shareholder

Disadvantage:

The relatively high cost of capital may bring financial risks.

Plan of action

There are two principles of debt. One is expected rate of return must be higher than

lending rate. The other is that it must have enough cash for debt service in the worst

case.

Blaine should consider the actual situation, raise and use money from the timing and

reasonable amount, and predict and arrange the proportion of long and short term

funds. Blaine may be consider borrow money from bank and issue bonds.

To sum up, the most key point to liabilities is the relationship between the EBT margin

and the loan interest rate.

You might also like

- BKI Capital Structure AnalysisDocument9 pagesBKI Capital Structure Analysisnandyth100% (3)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionMohan Kumar89% (37)

- Final FMDocument53 pagesFinal FMSourabh Arora80% (5)

- Blaine Kitchenware CalculationDocument11 pagesBlaine Kitchenware CalculationAjeeth71% (7)

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Blain Kitchenware CF CaseDocument25 pagesBlain Kitchenware CF CaseAnurag Chandel67% (3)

- Introduction To The CaseDocument48 pagesIntroduction To The CaseRohit Jain100% (5)

- Blaine Kitchenware, Inc. - Capital Structure DATADocument5 pagesBlaine Kitchenware, Inc. - Capital Structure DATAShashank Gupta100% (1)

- Week 12 Risk ManagementDocument29 pagesWeek 12 Risk ManagementRay Mund100% (1)

- Financial analysis of company shares and earningsDocument1 pageFinancial analysis of company shares and earningsRoderick Jackson JrNo ratings yet

- Case #1: Blaine Kitchenware, IncDocument6 pagesCase #1: Blaine Kitchenware, IncKenyaYetuNo ratings yet

- Group 5 PresentationDocument73 pagesGroup 5 PresentationSourabh Arora100% (4)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionFarhanie Nordin100% (2)

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- FM SolutionDocument11 pagesFM SolutionBilal Naseer100% (4)

- Blaine KitchenwareDocument23 pagesBlaine Kitchenwaresweenie796% (25)

- Wrigley Gum 21Document18 pagesWrigley Gum 21Fidelity RoadNo ratings yet

- Blaine Kitchenware Inc PDFDocument13 pagesBlaine Kitchenware Inc PDFpatriciolivares3009No ratings yet

- Blaine Excel HWDocument5 pagesBlaine Excel HWBoone LewisNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Deluxe's Restructuring and Capital StructureDocument4 pagesDeluxe's Restructuring and Capital StructureshielamaeNo ratings yet

- Blaine Kitchenware Business Case AnalysisDocument8 pagesBlaine Kitchenware Business Case Analysisjen18612100% (2)

- Hill CountryDocument8 pagesHill CountryAtif Raza AkbarNo ratings yet

- Case: Blaine Kitchenware, IncDocument5 pagesCase: Blaine Kitchenware, IncWilliam NgNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Blaine Kitchenware 3Document8 pagesBlaine Kitchenware 3Chris100% (1)

- Mr. Butler's Loan Requirements for Lumber Company ExpansionDocument6 pagesMr. Butler's Loan Requirements for Lumber Company ExpansionamanNo ratings yet

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143No ratings yet

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Blaine KitchenwareDocument1 pageBlaine KitchenwareSam Skf100% (1)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Optimal capital structure mixDocument41 pagesOptimal capital structure mixOloye ElayelaNo ratings yet

- Finance Case - Blaine Kitchenware - GRP - 11Document4 pagesFinance Case - Blaine Kitchenware - GRP - 11Shona Baroi100% (3)

- Blaine Kitchenware Inc.Document13 pagesBlaine Kitchenware Inc.vishitj100% (4)

- Exhibits of Blaine Kitchenware, Inc - CaseDocument6 pagesExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Cooper Case SolutionsDocument6 pagesCooper Case SolutionsDarshan Salgia100% (1)

- Blaine Kitchenware Case Study SolutionDocument5 pagesBlaine Kitchenware Case Study SolutionMuhammad Shariq Siddiqui100% (3)

- Blain Kitchenware VenkatDocument19 pagesBlain Kitchenware Venkatgvsfans50% (2)

- Blaines KitchenwareDocument11 pagesBlaines Kitchenwarevic1989vic75% (4)

- Blaine-Kitchenware Case CalculationsDocument6 pagesBlaine-Kitchenware Case CalculationsDennis Alexander Guerrero100% (1)

- Finance Case - Blaine KitchenwareDocument8 pagesFinance Case - Blaine KitchenwareodaiissaNo ratings yet

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Blaine Kitchenware CaseDocument4 pagesBlaine Kitchenware Caseskyhannan80% (5)

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncUmair ahmedNo ratings yet

- Blaine Kitchenware Capital Structure AnalysisDocument1 pageBlaine Kitchenware Capital Structure AnalysisomirNo ratings yet

- Blaine Kitchenware Inc: Capital Structure Case StudyDocument23 pagesBlaine Kitchenware Inc: Capital Structure Case StudyMai PhamNo ratings yet

- BKI's Capital Structure and Payout PoliciesDocument4 pagesBKI's Capital Structure and Payout Policieschintan MehtaNo ratings yet

- Calculation of Blain Kitchenware CaseDocument2 pagesCalculation of Blain Kitchenware CaseAsad Bilal67% (3)

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliNo ratings yet

- Blaine Kitchenware Case QuestionDocument1 pageBlaine Kitchenware Case QuestionSimran Malhotra100% (1)

- LE Midterm EXAM 2 ReviewDocument16 pagesLE Midterm EXAM 2 ReviewaudriNo ratings yet

- Blaine Kitchenware financial analysis and capital structure optimizationDocument11 pagesBlaine Kitchenware financial analysis and capital structure optimizationBala GNo ratings yet

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncChrisNo ratings yet

- MS 5241 Financial ManagementDocument5 pagesMS 5241 Financial ManagementAbhishek GuptaNo ratings yet

- Blaine Kitchenware Inc Case SummaryDocument1 pageBlaine Kitchenware Inc Case SummaryDeva Prayag100% (1)

- Accounting Ratios Analysis of Orange Ltd and IndustryDocument6 pagesAccounting Ratios Analysis of Orange Ltd and IndustryKin Fai LeungNo ratings yet

- Capital Structure Composition Make Up Long Term Capital Resources Loans Reserves Shares BondsDocument18 pagesCapital Structure Composition Make Up Long Term Capital Resources Loans Reserves Shares BondsMuhammadAliNo ratings yet

- Analysis of Infosys LTDDocument18 pagesAnalysis of Infosys LTDshikhachaudhryNo ratings yet