Professional Documents

Culture Documents

Midterm Version 1

Uploaded by

faensaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Version 1

Uploaded by

faensaCopyright:

Available Formats

11B 2008 Midterm

Version #1

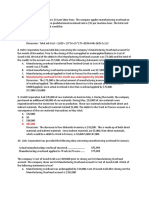

Student: ___________________________________________________________________________ 1. At the beginning of December, Altro Corporation had $26,000 of raw materials on hand. During the month, the company purchased an additional $76,000 of raw materials. During December, $72,000 of raw materials were requisitioned from the storeroom for use in production. The credits to the Raw Materials account for the month of December total: A. $26,000 B. $102,000 C. $76,000 D. $72,000

2. Desco Electronics, Inc. manufactures car radios. The direct material cost assigned to car radios that Desco started during the period but did not fully complete would be found in the ending balance of: A. raw materials inventory. B. work in process inventory. C. finished goods inventory. D. both raw materials inventory and work in process inventory.

3. Chipata Corporation applies manufacturing overhead to jobs on the basis of machine-hours. Chipata estimated 25,000 machine-hours and $10,000 of manufacturing overhead cost for the year. During the year, Chipata incurred 26,200 machine-hours and $11,300 of manufacturing overhead. What was Chipata's underapplied or overapplied overhead for the year? A. $480 overapplied B. $820 underapplied C. $1,300 overapplied D. $1,300 underapplied

4. Carcia Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product.

The best estimate of the total cost to manufacture 6,300 units is closest to: A. $1,274,490 B. $1,287,090 C. $1,312,290 D. $1,236,690

5. Reamer Company uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for next year:

Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be: A. $6.80 B. $6.00 C. $3.00 D. $3.40

6. Limousine Conversion Company purchases ordinary Cadillacs, cuts them in half, and then adds a middle section to the vehicles to create stretch limousines. With respect to the number of cars converted, the cost of the Cadillacs purchased for conversion by Limousine Conversion Company would best be described as a: A. fixed cost B. mixed cost C. step-variable cost D. variable cost

7. During March, Zea Inc. transferred $50,000 from Work in Process to Finished Goods and recorded a Cost of Goods Sold of $56,000. The journal entries to record these transactions would include a: A. credit to Cost of Goods Sold of $56,000 B. debit to Finished Goods of $56,000 C. credit to Work in Process of $50,000 D. credit to Finished Goods of $50,000

8. Which of the following is correct concerning reactions to INCREASES in activity?

A. Item A B. Item B C. Item C D. Item D

9. A staff position: A. relates directly to the carrying out of the basic objectives of the organization. B. is supportive in nature, providing service and assistance to other parts of the organization. C. is superior in authority to a line position. D. none of these.

10. In a predetermined overhead rate in a job-order costing system that is based on machine-hours, which of the following would be used in the numerator and denominator?

A. Item A B. Item B C. Item C D. Item D

11. Brabec Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 19,700 hours. At the end of the year, actual direct labor-hours for the year were 17,700 hours, the actual manufacturing overhead for the year was $392,940, and manufacturing overhead for the year was underapplied by $35,400. The estimated manufacturing overhead at the beginning of the year used in the predetermined overhead rate must have been: A. $357,540 B. $397,940 C. $431,775 D. $387,940

12. With respect to a fixed cost, an increase in the activity level within the relevant range results in: A. an increase in fixed cost per unit. B. a proportionate increase in total fixed costs. C. an unchanged fixed cost per unit. D. a decrease in fixed cost per unit.

13. Job 910 was recently completed. The following data have been recorded on its job cost sheet:

The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $15 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 910 would be: A. $3,220 B. $3,760 C. $5,935 D. $3,445

14. A company produces a single product. The following volume and average cost data for two accounting periods have been provided by management:

The best estimate for the cost formula for the total cost of producing and selling the product (where X is the number of units produced and sold in a period) is: A. $1,000 + $1.125 X B. $1,000 + $3.50 X C. $1,500 + $3.50 X D. $1,500 + $4.00 X

15. Matthias Corporation has provided data concerning the company's Manufacturing Overhead account for the month of May. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $53,000 and the total of the credits to the account was $69,000. Which of the following statements is true? A. Manufacturing overhead applied to Work in Process for the month was $69,000. B. Manufacturing overhead for the month was underapplied by $16,000. C. Manufacturing overhead transferred from Finished Goods to Cost of Goods Sold during the month was $53,000. D. Actual manufacturing overhead incurred during the month was $69,000.

16. The one cost that would be classified as part of both prime cost and conversion cost would be: A. indirect material. B. direct labor. C. direct material. D. indirect labor.

17. Lawton Company produces canned tomato soup in a single processing department and has a process costing system in which it uses the weighted-average method. The company sold 250,000 units in the month of January. Data concerning inventories follow:

What were the equivalent units for conversion costs for January? A. 235,000 B. 247,000 C. 251,000 D. 253,000

18. Marc Corp. has a job-order costing system. The following debits (credits) appeared in the Work in Process account for the month of May:

Marc applies overhead to jobs at a predetermined rate of 80% of direct labor cost. Job No. 23, the only job still in process at the end of May has been charged with direct labor of $5,000. The amount of direct materials charged to Job No. 23 was: A. $6,250 B. $7,500 C. $13,000 D. $17,000

19. Utility costs at Service, Inc. are a mixture of fixed and variable components. Records indicate that utility costs are an average of $0.40 per hour at an activity level of 9,000 machine hours and $0.25 per hour at an activity level of 18,000 machine hours. Assuming that this activity is within the relevant range, what is the expected total utility cost if the company works 13,000 machine hours? A. $4,225 B. $5,200 C. $4,000 D. $3,250

20. Clerical costs in the billing department of Craig Company are a mixture of variable and fixed components. Records indicate that average unit processing costs are $0.50 per account processed at an activity level of 32,000 accounts. When only 22,000 accounts are processed, the total cost of processing is $12,500. Assuming that this activity is within the relevant range, at a budgeted level of 25,000 accounts: A. processing costs are expected to total $8,750. B. fixed processing costs are expected to be $10,400. C. the variable processing costs are expected to be $0.35 per account processed. D. processing costs are expected to total $14,975.

21. Glory Company's gross margin exceeded its contribution margin by $25,000. If sales totaled $175,000 when net operating income equaled $20,000 and total selling and administrative expenses equaled $55,000, then the contribution margin equaled: A. $75,000 B. $80,000 C. $30,000 D. $50,000

22. The cost of goods manufactured for October at Toule Manufacturing Corporation was $907,000. The following changes occurred in Toule inventory accounts during October:

What was Toule's cost of goods sold for October? A. $869,000 B. $886,000 C. $928,000 D. $945,000

23. Which costs will change with an increase in activity within the relevant range? A. Unit fixed cost and total fixed cost B. Unit variable cost and total variable cost C. Unit fixed cost and total variable cost D. Unit fixed cost and unit variable cost

24. During the month of April, LTP Company incurred $30,000 of manufacturing overhead, $40,000 of direct labor, and purchased $25,000 of raw materials. Between the beginning and the end of the month, the raw materials and work in process inventories decreased by $4,000 and $3,000, respectively. The total manufacturing costs used in the computation of cost of goods manufactured during the month of April was: A. $88,000 B. $91,000 C. $99,000 D. $102,000

25. Colby Company has a process costing system in which the weighted-average method is used. The company adds all materials at the beginning of the process in the Molding Department, which is the first of two stages of its production process. Information concerning the materials used in the Molding Department during March is as follows:

What was the materials cost of the work in process inventory at March 31? A. $11,220 B. $7,500 C. $5,100 D. $7,650

26. Kew Company uses the weighted-average method in its process costing system. The company had 3,000 units in work in process at April 1 that were 60% complete with respect to conversion cost. During April, 10,000 units were completed. At April 30, 4,000 units remained in work in process and they were 40% complete with respect to conversion cost. Direct materials are added at the beginning of the process. How many units were started during April? A. 9,000 B. 9,800 C. 10,000 D. 11,000

27. Heller Cannery, Inc., uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The company estimated that it would incur $510,000 in manufacturing overhead during the year and that it would work 100,000 machine-hours. The company actually worked 105,000 machine-hours and incurred $540,000 in manufacturing overhead costs. By how much was manufacturing overhead underapplied or overapplied for the year? A. $4,500 overapplied B. $4,500 underapplied C. $30,000 overapplied D. $30,000 underapplied

28. Daffe Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the total estimated manufacturing overhead was $165,600. At the end of the year, actual direct labor-hours for the year were 11,900 hours, manufacturing overhead for the year was overapplied by $10,760, and the actual manufacturing overhead was $160,600. The predetermined overhead rate for the year must have been closest to: A. $14.40 B. $13.92 C. $13.50 D. $14.90

29. During July at Loeb Corporation, $83,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $4,000. The journal entry to record the requisition from the storeroom would include a: A. debit to Work in Process of $79,000 B. debit to Work in Process of $83,000 C. credit to Manufacturing Overhead of $4,000 D. debit to Raw Materials of $83,000

30. Which of the following statements about product costs is true? A. Product costs are deducted from revenue when the production process is completed. B. Product costs are deducted from revenue as expenditures are made. C. Product costs associated with unsold finished goods and work in process appear on the balance sheet as assets. D. Product costs appear on financial statements only when products are sold.

31. Edde Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.

The best estimate of the total variable manufacturing cost per unit is: A. $127.70 B. $150.30 C. $22.60 D. $72.80

32. Health Beverage Company uses a process costing system to collect costs related to the production of its celery flavored cola. The cola is first processed in a Mixing Department at Health and is then transferred out and finished up in the Bottling Department. The finished cases of cola are then transferred to Finished Goods Inventory. The following information relates to Health's two departments for the month of January:

How many cases of cola were completed and transferred to Finished Goods Inventory during January? A. 66,000 B. 71,000 C. 72,000 D. 74,000

33. Pelican Corporation uses a weighted-average process costing system to collect costs related to production. The following selected information relates to production for March:

All materials at Pelican are added at the beginning of the production process. Conversion costs are incurred uniformly over the production process. What total amount of cost should be assigned to the units in work in process at the end of March? A. $14,840 B. $15,420 C. $24,920 D. $25,860

34. In the preparation of the schedule of Cost of Goods Manufactured, the accountant incorrectly included as part of manufacturing overhead the rental expense on the firm's retail facilities. This inclusion would: A. overstate period expenses on the income statement. B. overstate the cost of goods sold on the income statement. C. understate the cost of goods manufactured. D. have no effect on the cost of goods manufactured.

35. Which of the following statements related to job-order costing and process costing are true? A. Under both costing methods, manufacturing overhead costs are included in the computation of unit product costs. B. Under both costing methods, the journal entry to record the completion of production will involve crediting a work in process account. C. Under both costing methods, the journal entry to record the cost of goods sold will involve crediting the finished goods account. D. All of the above are true.

36. Consider the following costs:

What is the total amount of manufacturing overhead included above? A. $78,000 B. $139,000 C. $44,000 D. $37,000

37. Abel Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is $38,000 and if direct materials are $47,000, the manufacturing overhead is: A. $152,000 B. $11,750 C. $21,250 D. $9,500

38. Which of the following is NOT a period cost? A. Monthly depreciation of the equipment in a fitness room used by factory workers. B. Salary of a billing clerk. C. Insurance on a company showroom, where current and potential customers can view new products. D. Cost of a seminar concerning tax law updates that was attended by the company's controller.

39. All of the following statements are correct when referring to process costing except: A. Process costing would be appropriate for a jeweler who makes custom jewelry to order. B. A process costing system has the same basic purposes as a job-order costing system. C. Units produced are indistinguishable from each other. D. Costs are accumulated by department.

40. The following production and average cost data for a month's operations have been supplied by a company that produces a single product.

The total fixed manufacturing cost and variable manufacturing cost per unit are as follows: A. $3,600; $7.50 B. $3,600; $9.90 C. $7,600; $7.50 D. $7,600; $9.90

41. If overhead is underapplied, then: A. actual overhead cost is less than estimated overhead cost. B. the amount of overhead cost applied to Work in Process is less than the actual overhead cost incurred. C. the predetermined overhead rate is too high. D. the Manufacturing Overhead account will have a credit balance at the end of the year.

42. Which of the following approaches to preparing an income statement calculates gross margin?

A. Item A B. Item B C. Item C D. Item D

43. The following data have been provided for the most recent month's operations:

The beginning work in process inventory is: A. $11,000 B. $42,000 C. $53,000 D. $37,000

44. Limber Company uses the weighted-average method in its process costing system. Operating data for the first processing department for the month of June appear below:

According to the company's records, the conversion cost in beginning work in process inventory was $15,264 at the beginning of June. Additional conversion costs of $68,208 were incurred in the department during the month. What was the cost per equivalent unit for conversion costs for the month? (Round off to three decimal places.) A. $0.873 B. $0.696 C. $0.842 D. $1.060

45. Epolito Corporation incurred $87,000 of actual Manufacturing Overhead costs during September. During the same period, the Manufacturing Overhead applied to Work in Process was $89,000. The journal entry to record the incurrence of the actual Manufacturing Overhead costs would include a: A. debit to Work in Process of $89,000 B. credit to Manufacturing Overhead of $87,000 C. debit to Manufacturing Overhead of $87,000 D. credit to Work in Process of $89,000

46. Last month a manufacturing company had the following operating results:

What was the cost of goods manufactured for the month? A. $588,000 B. $526,000 C. $521,000 D. $531,000

47. Wayne Company's beginning and ending inventories for the month of June were as follows:

Wayne applies manufacturing overhead cost to jobs based on direct labor-hours, and the predetermined rate is $5.75 per direct labor-hour. The company does not close underapplied or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year. What is the amount of cost of goods manufactured? A. $508,750 B. $502,000 C. $585,000 D. $487,750

48. The management of Bushovisky Corporation, a manufacturing company, has provided the following financial data for January:

The contribution margin for January was: A. $15,000 B. $152,000 C. $91,000 D. $154,000

49. In the standard cost formula Y = a + bX, what does the "b" represent? A. total cost B. total fixed cost C. total variable cost D. variable cost per unit

50. A security guard's wages at a factory would be an example of:

A. Item A B. Item B C. Item C D. Item D

11B 2008 Midterm Key

Version #1

1. At the beginning of December, Altro Corporation had $26,000 of raw materials on hand. During the month, the company purchased an additional $76,000 of raw materials. During December, $72,000 of raw materials were requisitioned from the storeroom for use in production. The credits to the Raw Materials account for the month of December total: A. $26,000 B. $102,000 C. $76,000 D. $72,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #55 Learning Objective: 4 Level: Easy

2. Desco Electronics, Inc. manufactures car radios. The direct material cost assigned to car radios that Desco started during the period but did not fully complete would be found in the ending balance of: A. raw materials inventory. B. work in process inventory. C. finished goods inventory. D. both raw materials inventory and work in process inventory.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #34 Learning Objective: 4 Level: Easy

3. Chipata Corporation applies manufacturing overhead to jobs on the basis of machine-hours. Chipata estimated 25,000 machine-hours and $10,000 of manufacturing overhead cost for the year. During the year, Chipata incurred 26,200 machine-hours and $11,300 of manufacturing overhead. What was Chipata's underapplied or overapplied overhead for the year? A. $480 overapplied B. $820 underapplied C. $1,300 overapplied D. $1,300 underapplied

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #39 Learning Objective: 3 Learning Objective: 5 Learning Objective: 8 Level: Medium

4. Carcia Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product.

The best estimate of the total cost to manufacture 6,300 units is closest to: A. $1,274,490 B. $1,287,090 C. $1,312,290 D. $1,236,690

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #41 Learning Objective: 1 Learning Objective: 3 Level: Hard

5. Reamer Company uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for next year:

Reamer estimates that 500 direct labor-hours and 1,000 machine-hours will be worked during the year. The predetermined overhead rate per hour will be: A. $6.80 B. $6.00 C. $3.00 D. $3.40

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #49 Learning Objective: 3 Level: Medium

6. Limousine Conversion Company purchases ordinary Cadillacs, cuts them in half, and then adds a middle section to the vehicles to create stretch limousines. With respect to the number of cars converted, the cost of the Cadillacs purchased for conversion by Limousine Conversion Company would best be described as a: A. fixed cost B. mixed cost C. step-variable cost D. variable cost

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #19 Learning Objective: 1 Level: Easy

7. During March, Zea Inc. transferred $50,000 from Work in Process to Finished Goods and recorded a Cost of Goods Sold of $56,000. The journal entries to record these transactions would include a: A. credit to Cost of Goods Sold of $56,000 B. debit to Finished Goods of $56,000 C. credit to Work in Process of $50,000 D. credit to Finished Goods of $50,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #63 Learning Objective: 4 Level: Easy

8. Which of the following is correct concerning reactions to INCREASES in activity?

A. Item A B. Item B C. Item C D. Item D

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #39 Learning Objective: 5 Level: Easy

9. A staff position: A. relates directly to the carrying out of the basic objectives of the organization. B. is supportive in nature, providing service and assistance to other parts of the organization. C. is superior in authority to a line position. D. none of these.

AACSB: Reflective Thinking AICPA BB: Resource Management AICPA FN: Decision Making Garrison - Chapter 01 #29 Learning Objective: 2 Level: Easy

10. In a predetermined overhead rate in a job-order costing system that is based on machine-hours, which of the following would be used in the numerator and denominator?

A. Item A B. Item B C. Item C D. Item D

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #22 Learning Objective: 3 Level: Easy Source: CPA, adapted

11. Brabec Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 19,700 hours. At the end of the year, actual direct labor-hours for the year were 17,700 hours, the actual manufacturing overhead for the year was $392,940, and manufacturing overhead for the year was underapplied by $35,400. The estimated manufacturing overhead at the beginning of the year used in the predetermined overhead rate must have been: A. $357,540 B. $397,940 C. $431,775 D. $387,940

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #44 Learning Objective: 3 Learning Objective: 5 Learning Objective: 8 Level: Hard

12. With respect to a fixed cost, an increase in the activity level within the relevant range results in: A. an increase in fixed cost per unit. B. a proportionate increase in total fixed costs. C. an unchanged fixed cost per unit. D. a decrease in fixed cost per unit.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #21 Learning Objective: 1 Level: Easy

13. Job 910 was recently completed. The following data have been recorded on its job cost sheet:

The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $15 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 910 would be: A. $3,220 B. $3,760 C. $5,935 D. $3,445

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #32 Learning Objective: 2 Learning Objective: 5 Level: Easy

14. A company produces a single product. The following volume and average cost data for two accounting periods have been provided by management:

The best estimate for the cost formula for the total cost of producing and selling the product (where X is the number of units produced and sold in a period) is: A. $1,000 + $1.125 X B. $1,000 + $3.50 X C. $1,500 + $3.50 X D. $1,500 + $4.00 X

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #47 Learning Objective: 1 Learning Objective: 3 Level: Hard Source: CIMA, adapted

15. Matthias Corporation has provided data concerning the company's Manufacturing Overhead account for the month of May. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $53,000 and the total of the credits to the account was $69,000. Which of the following statements is true? A. Manufacturing overhead applied to Work in Process for the month was $69,000. B. Manufacturing overhead for the month was underapplied by $16,000. C. Manufacturing overhead transferred from Finished Goods to Cost of Goods Sold during the month was $53,000. D. Actual manufacturing overhead incurred during the month was $69,000.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #52 Learning Objective: 4 Learning Objective: 8 Level: Medium

16. The one cost that would be classified as part of both prime cost and conversion cost would be: A. indirect material. B. direct labor. C. direct material. D. indirect labor.

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #21 Learning Objective: 1 Level: Easy

17. Lawton Company produces canned tomato soup in a single processing department and has a process costing system in which it uses the weighted-average method. The company sold 250,000 units in the month of January. Data concerning inventories follow:

What were the equivalent units for conversion costs for January? A. 235,000 B. 247,000 C. 251,000 D. 253,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #40 Learning Objective: 2 Level: Medium Source: CPA, adapted

18. Marc Corp. has a job-order costing system. The following debits (credits) appeared in the Work in Process account for the month of May:

Marc applies overhead to jobs at a predetermined rate of 80% of direct labor cost. Job No. 23, the only job still in process at the end of May has been charged with direct labor of $5,000. The amount of direct materials charged to Job No. 23 was: A. $6,250 B. $7,500 C. $13,000 D. $17,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #67 Learning Objective: 5 Learning Objective: 7 Level: Hard Source: CPA, adapted

19. Utility costs at Service, Inc. are a mixture of fixed and variable components. Records indicate that utility costs are an average of $0.40 per hour at an activity level of 9,000 machine hours and $0.25 per hour at an activity level of 18,000 machine hours. Assuming that this activity is within the relevant range, what is the expected total utility cost if the company works 13,000 machine hours? A. $4,225 B. $5,200 C. $4,000 D. $3,250

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #34 Learning Objective: 1 Learning Objective: 3 Level: Hard

20. Clerical costs in the billing department of Craig Company are a mixture of variable and fixed components. Records indicate that average unit processing costs are $0.50 per account processed at an activity level of 32,000 accounts. When only 22,000 accounts are processed, the total cost of processing is $12,500. Assuming that this activity is within the relevant range, at a budgeted level of 25,000 accounts: A. processing costs are expected to total $8,750. B. fixed processing costs are expected to be $10,400. C. the variable processing costs are expected to be $0.35 per account processed. D. processing costs are expected to total $14,975.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #35 Learning Objective: 1 Learning Objective: 3 Level: Hard

21. Glory Company's gross margin exceeded its contribution margin by $25,000. If sales totaled $175,000 when net operating income equaled $20,000 and total selling and administrative expenses equaled $55,000, then the contribution margin equaled: A. $75,000 B. $80,000 C. $30,000 D. $50,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #68 Learning Objective: 4 Level: Hard

22. The cost of goods manufactured for October at Toule Manufacturing Corporation was $907,000. The following changes occurred in Toule inventory accounts during October:

What was Toule's cost of goods sold for October? A. $869,000 B. $886,000 C. $928,000 D. $945,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Measurement AICPA FN: Reporting Garrison - Chapter 02 #72 Learning Objective: 3 Learning Objective: 4 Level: Hard

23. Which costs will change with an increase in activity within the relevant range? A. Unit fixed cost and total fixed cost B. Unit variable cost and total variable cost C. Unit fixed cost and total variable cost D. Unit fixed cost and unit variable cost

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #17 Learning Objective: 1 Level: Medium

24. During the month of April, LTP Company incurred $30,000 of manufacturing overhead, $40,000 of direct labor, and purchased $25,000 of raw materials. Between the beginning and the end of the month, the raw materials and work in process inventories decreased by $4,000 and $3,000, respectively. The total manufacturing costs used in the computation of cost of goods manufactured during the month of April was: A. $88,000 B. $91,000 C. $99,000 D. $102,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Measurement AICPA FN: Reporting Garrison - Chapter 02 #80 Learning Objective: 4 Level: Hard

25. Colby Company has a process costing system in which the weighted-average method is used. The company adds all materials at the beginning of the process in the Molding Department, which is the first of two stages of its production process. Information concerning the materials used in the Molding Department during March is as follows:

What was the materials cost of the work in process inventory at March 31? A. $11,220 B. $7,500 C. $5,100 D. $7,650

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #31 Learning Objective: 2 Learning Objective: 3 Level: Medium Source: CPA, adapted

26. Kew Company uses the weighted-average method in its process costing system. The company had 3,000 units in work in process at April 1 that were 60% complete with respect to conversion cost. During April, 10,000 units were completed. At April 30, 4,000 units remained in work in process and they were 40% complete with respect to conversion cost. Direct materials are added at the beginning of the process. How many units were started during April? A. 9,000 B. 9,800 C. 10,000 D. 11,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #48 Learning Objective: 2 Level: Medium Source: CPA, adapted

27. Heller Cannery, Inc., uses a predetermined overhead rate based on machine-hours to apply manufacturing overhead to jobs. The company estimated that it would incur $510,000 in manufacturing overhead during the year and that it would work 100,000 machine-hours. The company actually worked 105,000 machine-hours and incurred $540,000 in manufacturing overhead costs. By how much was manufacturing overhead underapplied or overapplied for the year? A. $4,500 overapplied B. $4,500 underapplied C. $30,000 overapplied D. $30,000 underapplied

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #35 Learning Objective: 3 Learning Objective: 5 Learning Objective: 8 Level: Medium Source: CPA, adapted

28. Daffe Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the total estimated manufacturing overhead was $165,600. At the end of the year, actual direct labor-hours for the year were 11,900 hours, manufacturing overhead for the year was overapplied by $10,760, and the actual manufacturing overhead was $160,600. The predetermined overhead rate for the year must have been closest to: A. $14.40 B. $13.92 C. $13.50 D. $14.90

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #46 Learning Objective: 3 Learning Objective: 5 Learning Objective: 8 Level: Hard

29. During July at Loeb Corporation, $83,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $4,000. The journal entry to record the requisition from the storeroom would include a: A. debit to Work in Process of $79,000 B. debit to Work in Process of $83,000 C. credit to Manufacturing Overhead of $4,000 D. debit to Raw Materials of $83,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #59 Learning Objective: 4 Level: Easy

30. Which of the following statements about product costs is true? A. Product costs are deducted from revenue when the production process is completed. B. Product costs are deducted from revenue as expenditures are made. C. Product costs associated with unsold finished goods and work in process appear on the balance sheet as assets. D. Product costs appear on financial statements only when products are sold.

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #30 Learning Objective: 2 Level: Medium

31. Edde Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.

The best estimate of the total variable manufacturing cost per unit is: A. $127.70 B. $150.30 C. $22.60 D. $72.80

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #43 Learning Objective: 1 Learning Objective: 3 Level: Medium

32. Health Beverage Company uses a process costing system to collect costs related to the production of its celery flavored cola. The cola is first processed in a Mixing Department at Health and is then transferred out and finished up in the Bottling Department. The finished cases of cola are then transferred to Finished Goods Inventory. The following information relates to Health's two departments for the month of January:

How many cases of cola were completed and transferred to Finished Goods Inventory during January? A. 66,000 B. 71,000 C. 72,000 D. 74,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #29 Learning Objective: 1 Level: Medium

33. Pelican Corporation uses a weighted-average process costing system to collect costs related to production. The following selected information relates to production for March:

All materials at Pelican are added at the beginning of the production process. Conversion costs are incurred uniformly over the production process. What total amount of cost should be assigned to the units in work in process at the end of March? A. $14,840 B. $15,420 C. $24,920 D. $25,860

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #49 Learning Objective: 3 Learning Objective: 4 Level: Hard

34. In the preparation of the schedule of Cost of Goods Manufactured, the accountant incorrectly included as part of manufacturing overhead the rental expense on the firm's retail facilities. This inclusion would: A. overstate period expenses on the income statement. B. overstate the cost of goods sold on the income statement. C. understate the cost of goods manufactured. D. have no effect on the cost of goods manufactured.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #33 Learning Objective: 4 Level: Hard

35. Which of the following statements related to job-order costing and process costing are true? A. Under both costing methods, manufacturing overhead costs are included in the computation of unit product costs. B. Under both costing methods, the journal entry to record the completion of production will involve crediting a work in process account. C. Under both costing methods, the journal entry to record the cost of goods sold will involve crediting the finished goods account. D. All of the above are true.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #16 Learning Objective: 1 Level: Hard

36. Consider the following costs:

What is the total amount of manufacturing overhead included above? A. $78,000 B. $139,000 C. $44,000 D. $37,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #64 Learning Objective: 1 Level: Medium

37. Abel Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is $38,000 and if direct materials are $47,000, the manufacturing overhead is: A. $152,000 B. $11,750 C. $21,250 D. $9,500

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #59 Learning Objective: 1 Level: Hard

38. Which of the following is NOT a period cost? A. Monthly depreciation of the equipment in a fitness room used by factory workers. B. Salary of a billing clerk. C. Insurance on a company showroom, where current and potential customers can view new products. D. Cost of a seminar concerning tax law updates that was attended by the company's controller.

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #24 Learning Objective: 1 Level: Medium

39. All of the following statements are correct when referring to process costing except: A. Process costing would be appropriate for a jeweler who makes custom jewelry to order. B. A process costing system has the same basic purposes as a job-order costing system. C. Units produced are indistinguishable from each other. D. Costs are accumulated by department.

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #27 Learning Objective: 10 Level: Medium

40. The following production and average cost data for a month's operations have been supplied by a company that produces a single product.

The total fixed manufacturing cost and variable manufacturing cost per unit are as follows: A. $3,600; $7.50 B. $3,600; $9.90 C. $7,600; $7.50 D. $7,600; $9.90

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #38 Learning Objective: 1 Learning Objective: 3 Level: Hard Source: CIMA, adapted

41. If overhead is underapplied, then: A. actual overhead cost is less than estimated overhead cost. B. the amount of overhead cost applied to Work in Process is less than the actual overhead cost incurred. C. the predetermined overhead rate is too high. D. the Manufacturing Overhead account will have a credit balance at the end of the year.

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #29 Learning Objective: 8 Level: Medium

42. Which of the following approaches to preparing an income statement calculates gross margin?

A. Item A B. Item B C. Item C D. Item D

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Measurement Garrison - Chapter 05 #30 Learning Objective: 4 Level: Medium

43. The following data have been provided for the most recent month's operations:

The beginning work in process inventory is: A. $11,000 B. $42,000 C. $53,000 D. $37,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Measurement AICPA FN: Reporting Garrison - Chapter 02 #78 Learning Objective: 4 Level: Hard

44. Limber Company uses the weighted-average method in its process costing system. Operating data for the first processing department for the month of June appear below:

According to the company's records, the conversion cost in beginning work in process inventory was $15,264 at the beginning of June. Additional conversion costs of $68,208 were incurred in the department during the month. What was the cost per equivalent unit for conversion costs for the month? (Round off to three decimal places.) A. $0.873 B. $0.696 C. $0.842 D. $1.060

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 04 #35 Learning Objective: 2 Learning Objective: 3 Level: Medium

45. Epolito Corporation incurred $87,000 of actual Manufacturing Overhead costs during September. During the same period, the Manufacturing Overhead applied to Work in Process was $89,000. The journal entry to record the incurrence of the actual Manufacturing Overhead costs would include a: A. debit to Work in Process of $89,000 B. credit to Manufacturing Overhead of $87,000 C. debit to Manufacturing Overhead of $87,000 D. credit to Work in Process of $89,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 03 #61 Learning Objective: 4 Level: Easy

46. Last month a manufacturing company had the following operating results:

What was the cost of goods manufactured for the month? A. $588,000 B. $526,000 C. $521,000 D. $531,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Measurement AICPA FN: Reporting Garrison - Chapter 02 #69 Learning Objective: 3 Learning Objective: 4 Level: Hard

47. Wayne Company's beginning and ending inventories for the month of June were as follows:

Wayne applies manufacturing overhead cost to jobs based on direct labor-hours, and the predetermined rate is $5.75 per direct labor-hour. The company does not close underapplied or overapplied manufacturing overhead to Cost of Goods Sold until the end of the year. What is the amount of cost of goods manufactured? A. $508,750 B. $502,000 C. $585,000 D. $487,750

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Measurement Garrison - Chapter 03 #65 Learning Objective: 5 Learning Objective: 6 Level: Medium

48. The management of Bushovisky Corporation, a manufacturing company, has provided the following financial data for January:

The contribution margin for January was: A. $15,000 B. $152,000 C. $91,000 D. $154,000

AACSB: Analytic AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #71 Learning Objective: 4 Level: Easy

49. In the standard cost formula Y = a + bX, what does the "b" represent? A. total cost B. total fixed cost C. total variable cost D. variable cost per unit

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 05 #24 Learning Objective: 1 Level: Medium

50. A security guard's wages at a factory would be an example of:

A. Item A B. Item B C. Item C D. Item D

AACSB: Reflective Thinking AICPA BB: Critical Thinking AICPA FN: Reporting Garrison - Chapter 02 #18 Learning Objective: 1 Learning Objective: 5 Level: Medium Source: CPA, adapted

You might also like

- Man Account Hw1Document5 pagesMan Account Hw1Quỳnh Anh Tô TrầnNo ratings yet

- 2020 Practice MCQsDocument28 pages2020 Practice MCQsĐàm Quang Thanh TúNo ratings yet

- Managerial Accouting TestDocument16 pagesManagerial Accouting TestBùi Yến NhiNo ratings yet

- Managerial Accounting ExamDocument10 pagesManagerial Accounting ExamJeremy Linn100% (1)

- Managerial Accounting and Cost Concepts ChapterDocument14 pagesManagerial Accounting and Cost Concepts ChapterHardly Dare GonzalesNo ratings yet

- Managerial Accounting Canadian Canadian 10th Edition Garrison Test Bank DownloadDocument132 pagesManagerial Accounting Canadian Canadian 10th Edition Garrison Test Bank DownloadjoelmalonentadsbkficNo ratings yet

- Questions For ExamDocument9 pagesQuestions For ExamjojoinnitNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- Process costing system equivalent units weighted average methodDocument11 pagesProcess costing system equivalent units weighted average methoddunyaNo ratings yet

- Job Order Costing Self-Test #2Document8 pagesJob Order Costing Self-Test #2Jean NestaNo ratings yet

- Practice Exam For Exam I ANSWERSDocument11 pagesPractice Exam For Exam I ANSWERSqueenlolNo ratings yet

- F2 Mock Questions 201603Document12 pagesF2 Mock Questions 201603Renato WilsonNo ratings yet

- MAGNAYE - Assignment 3 - Process CostingDocument9 pagesMAGNAYE - Assignment 3 - Process CostingGie MagnayeNo ratings yet

- Unit2 MultiDocument39 pagesUnit2 MultiStacy BenNo ratings yet

- Process Costing Equivalent UnitsDocument9 pagesProcess Costing Equivalent UnitsAubrey BlancasNo ratings yet

- Final Exam AkmenlanDocument12 pagesFinal Exam AkmenlanThomas DelongeNo ratings yet

- P of Acc II Exam 1 2010V-Answer KeyDocument16 pagesP of Acc II Exam 1 2010V-Answer KeyMichael GuyNo ratings yet

- Sample MidTerm MC With AnswersDocument5 pagesSample MidTerm MC With Answersharristamhk100% (1)

- Managerial Accounting Final Exam ReviewDocument20 pagesManagerial Accounting Final Exam ReviewAnbang Xiao100% (1)

- 102 Test No. 3 Solutions KeeperDocument17 pages102 Test No. 3 Solutions KeepergirlyserendipityNo ratings yet

- Muhammad SalmanDocument9 pagesMuhammad SalmanSalman SaeedNo ratings yet

- Budget Preparation & Cost Management Sample QuestionsDocument15 pagesBudget Preparation & Cost Management Sample QuestionsAccountingLegal AccountingLegalNo ratings yet

- Preliminary Examination MC (Q)Document9 pagesPreliminary Examination MC (Q)Vanessa HaliliNo ratings yet

- SunwayTes Management Accountant Progress Test 2Document13 pagesSunwayTes Management Accountant Progress Test 2FarahAin FainNo ratings yet

- COSTING METHODSDocument10 pagesCOSTING METHODSMarilyn FernandezNo ratings yet

- Uas AkmenDocument17 pagesUas Akmenabdul aziz faqihNo ratings yet

- MCQ Cost and Cost AnalysisDocument5 pagesMCQ Cost and Cost AnalysisThao Le TranNo ratings yet

- Practice Test 1 New For Summer 2010Document16 pagesPractice Test 1 New For Summer 2010samcarfNo ratings yet

- AccountingDocument13 pagesAccountingAnnalou Galacio BeatoNo ratings yet

- Assignment 3 Process CostingDocument9 pagesAssignment 3 Process CostingGie MagnayeNo ratings yet

- Job Order Costing HMDocument11 pagesJob Order Costing HMYamato De Jesus NakazawaNo ratings yet

- Management Accounting Midterm TestDocument5 pagesManagement Accounting Midterm TestSơn HoàngNo ratings yet

- Calculate total job cost using direct labor hours and machine hoursDocument2 pagesCalculate total job cost using direct labor hours and machine hourselsana philipNo ratings yet

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- Brewer, Introduction To Managerial Accounting, 3/eDocument15 pagesBrewer, Introduction To Managerial Accounting, 3/eJoe BlackNo ratings yet

- Acmas 2137 Final SADocument5 pagesAcmas 2137 Final SAkakaoNo ratings yet

- GA Co. production costs review quizDocument6 pagesGA Co. production costs review quizPhuong DungNo ratings yet

- Exam 2 Fall2013Document8 pagesExam 2 Fall2013Amanda RushNo ratings yet

- 203 Practice WTR 2013 PDFDocument22 pages203 Practice WTR 2013 PDFKarim IsmailNo ratings yet

- Exam 1 Practice AccountingDocument7 pagesExam 1 Practice Accountings430230No ratings yet

- Chapter 16 Job Process Costing and AnalysisDocument37 pagesChapter 16 Job Process Costing and AnalysisDavidStevePerezNo ratings yet

- Analyzing Manufacturing Overhead and Product Costing TechniquesDocument11 pagesAnalyzing Manufacturing Overhead and Product Costing Techniquesjoanna mercadoNo ratings yet

- Food Costs Supervisory SalariesDocument11 pagesFood Costs Supervisory SalariesJames CrombezNo ratings yet

- Saa Group Cat TT7 Mock 2011 PDFDocument16 pagesSaa Group Cat TT7 Mock 2011 PDFAngie NguyenNo ratings yet

- Finals SolutionsDocument9 pagesFinals Solutionsi_dreambig100% (3)

- Multiple Choice QuestionsDocument7 pagesMultiple Choice QuestionsshallytNo ratings yet

- Cost Concepts & Costing Systems ReviewDocument21 pagesCost Concepts & Costing Systems ReviewFernando AlcantaraNo ratings yet

- Cost Accounting Qualifying Exam Reviewer 2017Document12 pagesCost Accounting Qualifying Exam Reviewer 2017Adrian Francis100% (1)

- Discussion - Job CostingDocument3 pagesDiscussion - Job CostingHannah Jane ToribioNo ratings yet

- Chapter 04 Testbank: StudentDocument43 pagesChapter 04 Testbank: StudentHiền DiệuNo ratings yet

- Question and Answer - 63Document31 pagesQuestion and Answer - 63acc-expertNo ratings yet

- CACCDocument3 pagesCACCMarielle JalandoniNo ratings yet

- FAR_Exams2Document4 pagesFAR_Exams2Francine PimentelNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Fed Rate Cut N ImplicationsDocument8 pagesFed Rate Cut N Implicationssplusk100% (1)

- Principles of Marketing - Customer RelationshipDocument5 pagesPrinciples of Marketing - Customer RelationshipRosette Anne Fortun MorenoNo ratings yet

- Industrial Organization Chapter SummaryDocument54 pagesIndustrial Organization Chapter SummaryNaolNo ratings yet

- Valid strike requisites and labor lawsDocument26 pagesValid strike requisites and labor lawsGerald GuhitingNo ratings yet

- Panukalang ProyektoDocument10 pagesPanukalang ProyektoIsidro Jungco Remegio Jr.No ratings yet

- Guess - CLSP - Icmap - Complete-August-2013 - FinalDocument7 pagesGuess - CLSP - Icmap - Complete-August-2013 - FinalAzam AziNo ratings yet

- Developing Jordan's Urban Transport Infrastructure and Regulatory SystemDocument17 pagesDeveloping Jordan's Urban Transport Infrastructure and Regulatory Systemmohammed ahmedNo ratings yet

- Business Exit Strategy - 1Document2 pagesBusiness Exit Strategy - 1SUBRATA MODAKNo ratings yet

- Legend:: Bonus Computation (Shortcut) ExampleDocument4 pagesLegend:: Bonus Computation (Shortcut) ExampleJeremyDream LimNo ratings yet

- New HR Strategy Makes Lloyd's A "Best Company"Document4 pagesNew HR Strategy Makes Lloyd's A "Best Company"Rob3332No ratings yet

- Bank GuaranteeDocument30 pagesBank GuaranteeKaruna ThatsitNo ratings yet

- MANAGEMENT Spice JetDocument21 pagesMANAGEMENT Spice JetAman Kumar ThakurNo ratings yet

- Commission Fines Ajinomoto Cheil and Daesang in Food Flavour Enhancers Nucleotides CartelDocument1 pageCommission Fines Ajinomoto Cheil and Daesang in Food Flavour Enhancers Nucleotides CartelRohit JangidNo ratings yet

- Average Down StrategyDocument11 pagesAverage Down StrategyThines KumarNo ratings yet

- HTTPS:WWW - Studocu.com:row:document:the University of The South Pacific:auditing:solutions Test Bank:40332482:download:solutions Test BankDocument66 pagesHTTPS:WWW - Studocu.com:row:document:the University of The South Pacific:auditing:solutions Test Bank:40332482:download:solutions Test BankXuân NhiNo ratings yet

- MQ3 Spr08gDocument10 pagesMQ3 Spr08gjhouvanNo ratings yet

- Week 7 Class Exercises (Answers)Document4 pagesWeek 7 Class Exercises (Answers)Chinhoong OngNo ratings yet

- Unit-3 Social Cost Benefit AnalysisDocument13 pagesUnit-3 Social Cost Benefit AnalysisPrà ShâñtNo ratings yet

- Bluescope Steel 2016Document48 pagesBluescope Steel 2016Romulo AlvesNo ratings yet

- Major Parts in A Business Plan - Home WorkDocument3 pagesMajor Parts in A Business Plan - Home Workأنجز للخدمات الطلابيةNo ratings yet

- SWOT Analysis of UKDocument4 pagesSWOT Analysis of UKlovely singhNo ratings yet

- 1597165857AFE 202 ASSIGNMENT Aransiola Grace Oluwadunsin Business PlanDocument16 pages1597165857AFE 202 ASSIGNMENT Aransiola Grace Oluwadunsin Business PlanMBI TABENo ratings yet

- PatanjaliDocument52 pagesPatanjaliShilpi KumariNo ratings yet

- Payslip 9Document1 pagePayslip 9api-473435909No ratings yet

- Reverse LogisticDocument8 pagesReverse LogisticĐức Tiến LêNo ratings yet

- Options, Futures, and Other Derivatives Chapter 9 Multiple Choice Test BankDocument6 pagesOptions, Futures, and Other Derivatives Chapter 9 Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- Journal FSRU 2Document68 pagesJournal FSRU 2Shah Reza DwiputraNo ratings yet

- BBMF2023Document7 pagesBBMF2023Yi Lin ChiamNo ratings yet

- CENECO vs. Secretary of Labor and CURE - Employees' right to withdraw membershipDocument1 pageCENECO vs. Secretary of Labor and CURE - Employees' right to withdraw membershipเจียนคาร์โล การ์เซียNo ratings yet