Professional Documents

Culture Documents

Kruger, Carl and Turano, Michael - Plea Agreements

Uploaded by

liz_benjamin64900 ratings0% found this document useful (0 votes)

11K views13 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11K views13 pagesKruger, Carl and Turano, Michael - Plea Agreements

Uploaded by

liz_benjamin6490Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

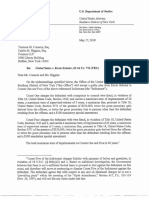

U.S. Department of Justice

United States Attorney

Southern District of New York

The Siva Malo Ballin

One Sain Andrew's Plasa

‘New York Nev Tork 10007,

December 19, 2011

Benjemin Brafinan, Esq

Brafman & Associates, P.C.

767 Third Avenue, 26th Floor

New York, NY 10017

Re: United States v. Carl Kruger, $3 11 Cr. 300 (JSR)

Dear Mr. Brafman:

On the understandings specified below, the Office of the United States Attomey for the

Southern District of New York (“this Office”) will accept a guilty plea from Carl Kruger (“the

defendant”) 1o Counts One through Four of the above-referenced indictment (“Indictment”).

Count One charges that between in or about 2007 and in or about March 2011, the defendant

conspired to commit honest services mail and wire fraud by receiving bribes, in violation of Title

18, United States Code, Sections 1341, 1343, 1346 and 1349. Count One carries a maximum term

of imprisonment of 20 years, a maximum term of supervised release of 3 years, a maximum fine,

pursuant to Title 18, United States Code, Section 3571 of the greatest of $250,000, twice the gross

pecuniary gain derived from the offense, or twice the gross pecuniary loss to persons other than the

defendant resulting from the offense, and a $100 mandatory special assessment.

‘Count Two charges that between in or about 2007 and in or about March 2011, the defendant

conspired to commit bribery in violation of Title 18, United States Code, Section 371. Count Two

carries a maximum term of imprisonment of 5 years, a maximum term of supervised release of 3

years, a maximum fine, pursuant to Title 18, United States Code, Section 3571 of the greatest of

$250,000, twice the gross pecuniary gain derived from the offense, or twice the gross pecuniaiy loss

to persons other than the defendant resulting from the offense, and a $100 mandatory special

assessment.

Count Three charges that between in or about 2007 and in or about March 2011, the

defendant conspired to commit honest services mail and wire fraud by receiving bribes, in violation

of Title 18, United States Code, Sections 1341, 1343, 1346 and 1349, Count Three carries a

‘maximum term of imprisonment of 20 years, a maximum term of supervised release of 3 years, a

‘maximum fine, pursuant to Title 18, United States Code, Section 3571 of the greatest of $250,000,

twice the gross pecuniary gain derived from the offense, or twice the gross pecuniary loss to persons

other than the defendant resulting from the offense, and a $100 mandatory special assessment.

‘Count Four charges that between in or about 2007 and in or about March 2011, the defendant

conspired to commit bribery in violation of Title 18, United States Code, Section 371. Count Four

carries a maximum term of imprisonment of 5 years, a maximum term of supervised release of 3

‘years, a maximum fine, pursuant to Title 18, United States Code, Section 3571 of the greatest of

$250,000, twice the gross pecuniary gain derived from the offense, or twice the gross pecuniary loss

to persons other than the defendant resulting from the offense, and a $100 mandatory special

assessment,

In addition to the foregoing, the Court must order restitution as specified below.

The total maximum term of imprisonment on Counts One through Four is 50 years’

imprisonment.

Itis understood that, prior to the date of sentencing, the defendant shall file, as necessary,

amended U.S. Individual Income Tax Returns for calendar years 2006 through 2010, The defendant

will also pay any past taxes determined to be due and owing to the United States by him, including

any applicable penalties and interest, on such terms and conditions as will be agreed upon between

him and the Internal Revenue Service (“IRS”). In addition, the defendant stipulates to the

applicability of civil fraud penalties should they be deemed to be applicable by the IRS. The

defendant agrees to cooperate fully with the IRS in the determination of any income taxes, penalties

and interest owing, including the provision of any documents and information requested by the IRS

in that determination,

In consideration of the defendant's plea to the above offense and his admission of relevant

conduct, the defendant will not be further prosecuted criminally by this Office and, with respect to

any potential tax offenses, the Tax Division, Department of Justice, for any crimes relating to: (1)

the conduct alleged in 11 Mag. 648; (2) the conduct alleged in 11 Cr. 300 (JSR) or its superseding

indictments; (3)any other payments made to Olympian and/or Bassett; (4) any income that Olympian

and/or Bassett received but failed to report to relevant tax authorities; and (5) any payments to

Olympian and/or Bassett that are determined by the IRS to be “income” attributable to him, but

which he failed to report to relevant tax authorities. In addition, at the time of sentencing, the

Government will move to dismiss any open Count(s) against the defendant, The defendant agrees

that with respect to any and all dismissed charges he is not a “prevailing party” within the meaning

of the “Hyde Amendment,” Section 617, P.L. 105-119 (Nov. 26, 1997), and will not file any claim

under that law.

‘The defendant hereby admits the forfeiture allegations with respect to Counts One through

Four of the Indictment and agrees to forfeit to the United States, pursuant to Title 18, United States

Code, Section 981 and Title 28, United States Code, Section 2461, a sum of money not to exceed

$450,000 in United States currency, representing the amount of proceeds traceable to the

commission of the offenses alleged in Counts One through Four of the Indictment. It is further

understood that any forfeiture of the defendant's assets shall not be treated as satisfaction of any fine,

coeaen 2

restitution, cost of imprisonment, or any other penalty the Court may impose upon him in addition

to forfeiture. The defendant further agrees to make restitution in an amount not to exceed $450,000

and that the obligation to make such restitution shall be made a condition of probation, see 18 USC

§3563(b)(2), or of supervised release, see 18 USC §3583(d), as the case may be.

In consideration of the foregoing and pursuant to United States Sentencing Guidelines

(‘USS.G.” or *Guidelines”) Section 6B1.4, the parties hereby stipulate to the following:

A. Offense Level

1. The applicable Guidelines manual is the Guidelines manual that went into effect on

November 11, 2010.

2. Pursuant to U.S.S.G. § 3D1.1, Counts One through Four are grouped because they

involve @ common criminal objective and because the offense levels for these offenses are

determined largely on the basis of the total amount of loss.

3. __ The base offense level applicable to Counts One through Four is 14, pursuant to

USSG. § 2C1.1(@)(1).

4. Because the offenses involved more than one bribe, 2 levels are added pursuant to

US.S.G. § 2C1.1(6(1).

5. Because the value of the bribes and/or a reasonable estimate of the benefits received

in exchange for the bribes is greater than $400,000 but less than $1,000,000, 14 levels are added

pursuant to U.S.S.G. § 2BL.1(6)(1)(H).

6. Because the offenses involved an elected public official, 4 levels are added pursuant

to US.S.G. § 2C1.10)G).

7. Assuming the defendant clearly demonstrates acceptance of responsibility, to the

satisfaction of the Goverment, through his allocution and subsequent conduct prior to the

imposition of sentence, a 2-level reduction will be warranted, pursuant to U.S.S.G. § 3E1.1(@),

Furthermore, assuming the defendant has accepted responsibility as described in the previous

sentence, an additional 1-level reduction is warranted, pursuant to U.S.S.G. § 3E1.1(b), because the

defendant gave timely notice of his intention to enter a plea of guilty, thereby permitting the

Government to avoid preparing for trial against him and permitting the Cour to allocate its resources

efficiently.

In accordance with the above, the applicable Guidelines offense level is 31.

ososzent 3

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Court Ruling On Legislative Compensation Commission.Document19 pagesCourt Ruling On Legislative Compensation Commission.liz_benjamin6490No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 62 - Opinion 2.4.19, Grant Hoyt MTDDocument24 pages62 - Opinion 2.4.19, Grant Hoyt MTDliz_benjamin6490No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 340 Local Elected Officials Write in Support of Fusion Voting in NYDocument10 pages340 Local Elected Officials Write in Support of Fusion Voting in NYliz_benjamin6490No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- John Cahill's New Job.Document1 pageJohn Cahill's New Job.liz_benjamin6490No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Gov Cuomo Approves Prosecutorial Misconduct Commission Bill....Document1 pageGov Cuomo Approves Prosecutorial Misconduct Commission Bill....liz_benjamin6490No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 2019StateoftheStateBook 2Document356 pages2019StateoftheStateBook 2liz_benjamin6490No ratings yet

- 2019StateoftheStateBook 2Document356 pages2019StateoftheStateBook 2liz_benjamin6490No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NYC DSS Letter To Broome Co.Document4 pagesNYC DSS Letter To Broome Co.liz_benjamin6490No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sen. Brad Hoylman Asks Gov. Andrew Cuomo To Veto Hymn Bill.Document3 pagesSen. Brad Hoylman Asks Gov. Andrew Cuomo To Veto Hymn Bill.liz_benjamin6490No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- U.S. v. Christopher Collins Et Al Indictment 18 CR 567Document30 pagesU.S. v. Christopher Collins Et Al Indictment 18 CR 567WGRZ-TVNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Onondaga Co Comptroller Bob Antonacci To Run For State SenateDocument2 pagesOnondaga Co Comptroller Bob Antonacci To Run For State Senateliz_benjamin6490No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Letter 5-9-18Document2 pagesLetter 5-9-18Nick ReismanNo ratings yet

- U.S. v. Kevin Schuler Plea AgreementDocument5 pagesU.S. v. Kevin Schuler Plea Agreementliz_benjamin6490No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- IDC Leader Jeff Klein Requests JCOPE Investigation Into Forcible Kissing Claim.Document1 pageIDC Leader Jeff Klein Requests JCOPE Investigation Into Forcible Kissing Claim.liz_benjamin6490No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- IDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.Document3 pagesIDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.liz_benjamin6490No ratings yet

- Vetoes Issued by Gov. Andrew Cuomo, October 2017Document18 pagesVetoes Issued by Gov. Andrew Cuomo, October 2017liz_benjamin6490No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- GOP 37th SD Candidate Samard Khojasteh Letter To Committee Members.Document2 pagesGOP 37th SD Candidate Samard Khojasteh Letter To Committee Members.liz_benjamin6490No ratings yet

- Nassau County Tracking Memo F10.30.17Document1 pageNassau County Tracking Memo F10.30.17liz_benjamin6490No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Mailer For Democratic 37th SD Candidate Shelley MayerDocument2 pagesMailer For Democratic 37th SD Candidate Shelley Mayerliz_benjamin6490No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- McLaughlin Responds To Assembly Action Against Him.Document2 pagesMcLaughlin Responds To Assembly Action Against Him.liz_benjamin6490No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Letter of Resignation From The Senate - Andrea Stewart CousinsDocument1 pageLetter of Resignation From The Senate - Andrea Stewart CousinsNick ReismanNo ratings yet

- NY - Nassau County Survey Polling Memorandum 10-27-2017-2Document3 pagesNY - Nassau County Survey Polling Memorandum 10-27-2017-2liz_benjamin6490No ratings yet

- Official Denny Farrell Resignation Letter.Document1 pageOfficial Denny Farrell Resignation Letter.liz_benjamin6490No ratings yet

- Martins Backer Calls For B of E Probe of Curran Campaign.Document1 pageMartins Backer Calls For B of E Probe of Curran Campaign.liz_benjamin6490No ratings yet

- Skelos Corruption Decision Overturned.Document12 pagesSkelos Corruption Decision Overturned.liz_benjamin6490No ratings yet

- NYPIRG's 2017 Session Review.Document5 pagesNYPIRG's 2017 Session Review.liz_benjamin6490No ratings yet

- Rauh vs. de Blasio DecisionDocument13 pagesRauh vs. de Blasio Decisionliz_benjamin6490No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Senate Dems Analysis of Lulus Paid To Non-Committee Chairs.Document5 pagesSenate Dems Analysis of Lulus Paid To Non-Committee Chairs.liz_benjamin6490No ratings yet

- Albany Money Machine June 2017Document5 pagesAlbany Money Machine June 2017liz_benjamin6490No ratings yet

- March Fundraising Invite For Assemblyman Lavine's Nassau Co Exec RunDocument2 pagesMarch Fundraising Invite For Assemblyman Lavine's Nassau Co Exec Runliz_benjamin6490No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)