Professional Documents

Culture Documents

PHFB

Uploaded by

beacon-docsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PHFB

Uploaded by

beacon-docsCopyright:

Available Formats

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

10/29/08

PHFB daily

0.25

0.20

0.15

0.10

Phantom Fiber Corporation

144 Front Street West, Suite 580 0.05

Toronto, Ontario Canada, M5J 2L7 volume © BigCharts.com

400

300

Phone: 416-703-4007

Thousands

200

Fax: 416-703-0900 100

E-mail (IR): PHFB@firstcapitalinvestors.com 0

Website: www.phantomfiber.com Aug Sep Oct

MARKET DATA Company Introduction

Phantom Fiber Corporation (OTCBB: PHFB) develops and markets

wireless software applications and mobile solutions to offer broad

Symbol PHFB support of the world’s leading mobile platforms and environments.

Exchanges OTC BB

Using its proprietary data transmission technology - Smart Stream-

Current Price $0.08

Price Target $0.30 ing™ - the Company’s wireless platform software allows custom-

Rating Speculative Buy ers to extend the transactional capabilities of their Web sites and

Outstanding Shares 19.35 Million deliver wireless, fully secured transactions at speeds significantly

Market Cap. $1.55 Million exceeding browser-based mobile phone applications. The software

Average 3-m Volume 8,682 works with more than 1,500+ different mobile devices, including

personal digital assistants (PDA) and mobile phones with Micro-

Source: Yahoo Finance, Analyst Estimates soft PocketPC, Palm, Symbian, i-Mode, Blackberry, Research In Mo-

tion, Smart Phone and Java platforms. In addition, PHFB currently

supports more than 600 network carriers worldwide.

Initial applications for the Company’s mobile solutions were online

gaming, such as horse racing, fixed odd game providers, and sports

book software companies. These applications required speed, rapid

account updates, security and a rich user experience. With an es-

tablished brand in the gaming and entertainment sector, PHFB’s

platform is also being deployed by enterprises seeking to imple-

ment high-performance mobile applications in remote video sur-

veillance, banking and brokerage, logistics and distribution.

A number of software providers and clients have signed multi-year

exclusive contracts with Company. Some of the top sports book and

horse racing software providers partnering with PHFB include:

United Tote, Finsoft, Orbis, BetOptions, BidNation, IQ-Ludorum,

Kiron Interactive, Digital Gaming Solutions, BoDog, Interactive

Gaming & Wagering, and ASI/Extension. The Company has also

signed agreements with Scientific Games (p.ari-mutuel), Sports

Phantom Fiber Corporation (OTCBB: PHFB) 1

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Acumen, Churchill Downs, YouBet and Phantom EFX in the U.S., and Swiss Lottery and Electracade in Europe.

PHFB has partnered with key enterprise and e-commerce companies such as AireSurf Networks Inc., Guard

Dev, Citadel Commerce, FireOne Group and Navaho Networks, among others.

The Company was founded in 2002 and is based in Toronto, Canada. PHFB conducts its business through its

wholly owned subsidiaries Phantom Fiber Corporation and Phantom Fiber Inc.

Investment Highlights

Favorable industry outlook

According to Gartner research, worldwide mobile phone sales reached 1.15 billion units in 2007 and are forecast

to grow 11% to 1.28 billion units by year-end 2008. The mobile phone market is poised for double-digit growth

in 2009 as well. This growth is supported by robust demand for mobile content and software solutions.

According to iSuppli Corp., the global market for mobile phone premium content, including music, gaming and

video, is expected to expand to more than $43 billion by 2010, rising 42.5% annually from $5.2 billion in 20041.

Further Gartner research shows that worldwide mobile gaming revenues are on-track to increase 16.1% in 2008

to $4.5 billion, and are expected to grow 10.2% annually between 2007 and 2011, with worldwide end-user

spending of $6.3 billion in 2011. The North American market is forecast to grow from $845 million currently to

approximately $1.2 billion in 2011.

Business model providing wireless data transition solutions

PHFB develops and markets wireless software applications and mobile solutions. Its products offer broad sup-

port for all of the world’s leading mobile platforms and environments. Using the proprietary data transmission

technology - Smart Streaming™ - PHFB wireless platform software allows customers to extend the transactional

capabilities of their Web sites and deliver fully secured wireless transactions at higher speeds than browser-

based mobile phone applications to more than 1,500+ assorted mobile devices. PHFB also supports more than

600 network carriers worldwide.

Focus on wireless gaming and entrainment sectors

PHFB’s applications represent a suite of “game frames” developed to quickly enable wireless gambling solutions

in sports betting, including horse racing and team wagering, or in softer games like bingo and poker. Wireless

provides a cost-effective alternative to the traditional overhead associated with placing wagers. It gives users

access to wagering systems directly from their seats and allows race operators to reduce the number of terminals

and cashiers required on race day. The Company has integrated its solution with the world’s leading tote and

gaming providers to deliver the best value-added functionality.

1. www.cellular-news.com/story/16425.php

Phantom Fiber Corporation (OTCBB: PHFB) 2

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Expansion into financial services, healthcare and logistics verticals

Over the past year, PHFB has expanded its sales and marketing efforts, and has secured clients in the financial and

mobile payments vertical (such as FireOne, Citadel, and Navaho Networks), healthcare, logistics and distribution

software providers, as well as in the security and remote-monitoring industries. Last quarter, PHFB successfully

rolled out a real-time foreign exchange trading application for FX Solutions and a personal healthcare manage-

ment system for My Medical Records. The Company has also secured a contract with GTX Corp. to develop

a Personal Location System, with numerous applications in pari-mutual, lottery, athletic and personal location

tracking.

Client portfolio creates recurring revenues

In the last four years, PHFB has built a sizable portfolio of clients in various verticals. These clients include Finsoft

PLC, Real-Time Gaming, Bid Nation, Digital Gaming Solutions, Kiron Interactive, Bet Options, Dynamite Ideas,

GTS, Orbis, and Parlay Entertainment. The Company recently signed Scientific Games, Sports Acumen, Churchill

Downs, YouBet and Phantom EFX in the U.S.

Generally, PHFB charges a one-time fee ranging from $50,000 to $250,000 for integration and customization ser-

vices to match the functionality of the client’s Internet offerings. In addition, on customers with a client base

greater than 10,000 mobile users, the Company generates recurring revenues via a revenue-sharing or monthly

subscription arrangement.

Expansion into European, Australian and Asian markets

During 2008, the Company entered the EU market by signing agree-

ments with Swiss Lottery and Electracade. In October 2008, PHFB an-

nounced further expansion into Australia and Asia through an agree-

ment with Smart Ventures and Beach Hut Media. PHFB’s focus in the

Australian and Asian markets is initially in three vertical markets:

Gaming, Retail and Financial Services. The Asian markets have been

recognized for their mobile society and dependence on the latest mo-

bile technologies, eclipsing PC-based alternatives.

Triple-digit revenue growth

During the last four years, PHFB has reported impressive revenue

growth, confirming increasing market acceptance of offered services.

The Company’s revenue increased 309% year-over-year to $517,678

during the first six months of 2008 because of significant new customer

additions. Recently signed agreements support our outlook for 2008

revenues approaching $2 million. Going forward, we expect the lat-

est agreements to drive 100%-200% annual revenue growth through

2010.

Phantom Fiber Corporation (OTCBB: PHFB) 3

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Business Model

The Company has created a mobile transaction enablement software business that provides a mobile transport

layer and delivers encrypted packets over cellular networks on behalf of hosting clients. PHFB develops wireless

software applications and mobile solutions that allow enterprises to experience high-performance functionality

on today’s mobile devices and global communication networks. The Company’s wireless data delivery platform

allow users to experience Internet-like graphics and Internet-like speed in an end-to-end highly secure solution

across 1500+ mobile devices and 600+ network carriers. All applications based on PHFB’s proprietary platform

can be applied to any enterprise requiring speed and a rich-user experience in their mobile solutions. Once

deployed, the platform utilizes PHFB’s proprietary Smart Streaming™ data transmission technology to deliver

high-speed, client-side performance that intuitively adapts to device and network properties.

The Company initially focused on applications in the gaming and entertainment sector (e.g. casinos, sports

betting, lottery, racing, poker rooms, etc.). PHFB’s technology provides a suite of “game frames” developed to

quickly enable wireless gambling solutions in sports betting where speed and simultaneous delivery matters.

PHFB’s clients represent approximately 300 sports bookings and horse racing sites, or about 75% of the sports

wagering and horse racing industries.

In the last two years, the Company has expanded its platform functionality with strong live streaming video

technology and wireless financial solutions. PHFB provides an integrated interactive component to existing

monitoring systems that allows security companies to remotely access their systems through hundreds of differ-

ent mobile device types. The Company’s proprietary technology gives customer instant access, via their mobile

device, to their business surveillance systems, and also provides a secure connection for monitoring home-

based security, child care facilities and other properties.

The Company is expanding into the financial sector and recently signed a multi-year contract to deliver an inte-

grated mobile solution for FX Solutions LLC, a leading U.S. online foreign exchange broker serving both retail

and institutional customers. PHFB’s mobile solution will integrate directly into FX Solutions proprietary Global

Trading System platform to provide new functionality and features for traders.

The Company combines low implementation costs with a rapid deployment strategy using reusable software

objects to reduce initial purchase barriers. PHFB’s business model generates revenues through the sale of propri-

etary software and custom integration services. The Company typically enters into exclusive multi-year, reve-

nue-sharing agreements with partners who use the Company’s technology to offer services or functions such as

games, content and other features.

Phantom Fiber Corporation (OTCBB: PHFB) 4

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

PHFB typically charges a one-time fee ranging from $50,000 to $250,000 for integration and customization ser-

vices. For customers with more than 10,000 mobile users, a service charge or transaction fee applies. The Company

also participates in revenue- sharing or monthly subscription arrangements.

Corporate strategy

The Company plans to develop additional products and services, innovative features, and expand distribution

to attract new customers while enhancing its value for existing clients. In implementing its initial strategy, PHFB

established the following criteria:

• Users were likely to be “early adopters” of wireless technologies;

• There was no dominant competitor apparent;

• The Company could implement a stable recurring revenue model; and

• Focus on consumer-based applications that leverage product portability.

The Company’s goal for next year is to expand geographically and on a product platform basis into the broker-

age, banking, trading, logistics and distribution and healthcare markets. PHFB also plans to expand its platform

functionality with stronger video streaming technology and other analytical data to further differentiate its com-

petitive offering.

In addition, PHFB intends to further penetrate vertical markets where it has a presence. Each client typically

represents several operators or sites licensing the Company’s software. As a result, each partnership agreement re-

sults in the deployment of PHFB’s technology across a number of sites and creates backlog. The Company is work-

ing through the backlog amassed on existing contracts and is helping its partners market their mobile products. To

address this backlog, PHFB is introducing methodologies and product constructs designed to more quickly build

brand for the underlying operators.

Technology

The language spoken by the application server must be

translated into a format that the mobile device can under-

stand. PHFB’s Advanced Wireless Platform is the module

that connects the application server portion to the end-user

client. Essentially, the mobile solution may be viewed as

just another communication channel from the back-end’s

perspective, resembling that of the existing Internet portal.

Since the mobile solution just plugs into the existing appli-

cation framework, no changes or additional support are re-

quired for hosting the mobile solution.

Phantom Fiber Corporation (OTCBB: PHFB) 5

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

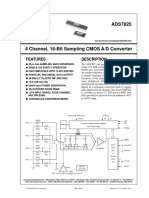

PHFB’s Advanced Wireless Platform

Source: the Company`s Web site.

The Company’s wireless platform is built using a building block or object approach. This technical architecture

was chosen to protect performance and ensure scalability on the device. Some of the primary features of the

platform are:

• Enhanced user experience: The wireless framework offers a rich graphic experience without compromising

performance.

• Cross-platform & network compatibility: The client-side software supports Windows/CE, Palm, Symbian,

Apple, i-Mode, RIM Blackberry, SmartPhone and Java-enabled phones (J2ME). This cross-platform compat-

ibility eliminates the need to recompile the application for devices running different operating systems, us-

ing different devices and running on different network protocols.

• Performance: The client can deliver Internet-type speed across networks. This approach puts less demand on

the server and network and allows the Company to provide the user with improved performance and better

graphic presentation.

PHFB’s advanced wireless platform includes several unique and proprietary functions such as:

• Secure State Management – Maintains a checkpoint connection in “no signal” areas. Should a user lose signal

for a period of time, their mobile device will auto refresh once a connection is re-established.

• Security – The communication component of the Company’s software uniquely delivers an end-to-end en-

Phantom Fiber Corporation (OTCBB: PHFB) 6

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

crypted secure solution over a secure socket layer (SSL) similar to secure Internet sites.

• SmartStream™ – Communications are handled using a proprietary raw data format to provide landline Inter-

net speed on today’s wireless devices. SmartStream also queues and prioritizes transmissions to assure a high

quality user experience and application responsiveness.

• Client Libraries - Presentation graphics and animation are stored in local device libraries, eliminating redun-

dant delivery and creating a vivid user experience without compromising performance.

• Store & Forward – Users without wireless connectivity or in a weak signal area can continue to use PHFB’s

software through a local storage method. The software incorporates an encrypted database on the device that

can be synchronized once a signal is detected. This allows enterprise customers to continue collecting or refer-

encing information from mobile device without hindering the work flow process.

Services

Mobile gaming

The Company has partnered with the world’s leading content developers and platforms to provide operators with

the widest range of content for mobile devices. PHFB’s gaming offering provides superior high-resolution inter-

activity complemented with speed rivaling the PC experience.

PHFB’s current content offering includes:

• Traditional Casino Games, such as Peer-to-Peer Poker, Blackjack and Roulette;

• Bonus and Progressive 5 Reel Multi-line;

• Animated Slots;

• Lottery, Keno, Bingo and Scratch Tickets;

• Virtual Horse Racing;

• Fixed Odd and Skill Games; and

• Reverse Auction Products.

Mobile pari-mutuel

Mobile provides a cost-effective alternative to the traditional

overhead associated with placing wagers and giving users ac-

cess to wagering systems from their seats. It also allows race

operators to reduce the number of terminals and cashiers re-

quired on race day.

The Company has integrated its solution with the world’s

leading tote providers to deliver the following value-added

functionality:

• Account Access via existing online username/password

that provides full transactional capability including ca-

shier access, reward points, integrated customer support

and detailed transactional history.

• Program Display in a real time format and detail/summa-

ry screens that provide odds, MTP, scratches, last minutes

changes, news alerts, program and handicapping informa-

Phantom Fiber Corporation (OTCBB: PHFB) 7

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

tion, and weather conditions.

• Live Alert System/SMS Channel that directs players immediately to the wager window when a user- trig-

gered event occurs.

• Video and Multi-Media tools that allow players to tap into live video feeds or search archived information

to be played on-demand.

Mobile banking

PHFB’s mobile banking solution extends a highly personalized offering of timely, relevant information to bank-

ing clients.

Some of the features provided by the Company’s platform are:

• Basic Account access;

• Bill payments and management;

• Transfer between accounts;

• Notifications on service upgrades;

• Integrated customer care via e-mail and online chat;

• Access to credit, mortgages and investment accounts;

• Mobile Trading and investing; and

• Branch/ATM finder.

Mobile trading

PHFB’s mobile trading solution extends a highly personalized offering of timely functionality and reliable infor-

mation to a client. Features include:

• Real-time trading that delivers true real-time quotes with no delays, and the functionality client need to buy,

sell, set limits and view trade histories;

• Single click trading with the option of confirmation windows to minimize the risk of data entry error and

increase customer confidence;

• An interface consistent with client’s existing system which enables full, fast and accurate trading without a

long learning curve; and

• Live graphing of real-time data and market information in a number of formats, including simple trending

or comparison charting, or more complex analytical charting such as Bollinger Bands.

Phantom Fiber Corporation (OTCBB: PHFB) 8

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Industry Outlook

Mobile phone market

According to Gartner research, worldwide mobile phone sales reached 1.15 billion units in 2007 and are expected

to approach 1.28 billion units by year-end 2008, an 11% increase2; the market is poised for 10% growth in 2009.

Mobile phone sales growth will increasingly rely on emerging markets as mature regions such as Western Europe,

Japan and North America, reach saturation.

Nokia achieved a 37% market share in 2007 when it sold slightly more than 430 million phones worldwide. Al-

though its market share slipped, Motorola maintained second place at 14%, but the gap narrowed between it and

third-placed Samsung with 13% market share. Annual worldwide revenues from mobile phone sales surpassed

$110 billion in 2007.

Global Mobile Phone Sales, millions units

Source: www.tmcnet.com/usubmit/2006/jan/1278911.htm.

Smart mobile device market

With the ongoing development of new Internet services such as YouTube, Facebook, MySpace, Google Maps,

Skype, Chat and Gmail, the future of mobile computing lies with devices that are truly mobile, always connected,

and able to provide a rich Internet browsing experience. According to ABI Research, the market for Mobile Inter-

net Devices (MIDs) such as ultra-mobile PCs (UMPCs) and netbooks will grow 167% annually over the next five

years. ABI expects total revenues generated by vendors in the market to increase from $3.5 billion in 2008 to nearly

$27 billion in 20133.

2. www.gartner.com/it/page.jsp?id=736913

3. www.computerweekly.com/Articles/2008/10/13/232636/ultra-mobile-device-market-set-for-rapid-evolu-

Phantom Fiber Corporation (OTCBB: PHFB) 9

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

At present, smart phones represent 22% of the mobile market, creating demand for Web-based services on the

mobile network4. These high-end devices comprised around 10% of the global mobile phone market by units in

2007. With annual growth of 60%, smart phones are the fastest growing segment of the technology market.

In 2007, around 118 million smart phones were sold globally. Nokia shipped more than 60 million of the 118

million-unit total, while Research In Motion (RIM) ranked second with 12 million units shipped5. In the first half

of 2008, global smart phone sales to end-users rose to 64 million units, up 22% compared with the first half of

2007. Rounding out the top six smart phone makers behind Nokia and BlackBerry are HTC (4.1% of the market),

Sharp (4.1%) and Fujitsu (3.3%). Other smart phone makers made up the remaining 23.6%6.

The smart phone market is still growing at a healthy clip, estimated at 72% year-over-year; and analysts expect

sales to approach 200 million smart phones in 2008.

By OS provider, Symbian has the largest share at 57% worldwide, but lags behind other companies in the small

but highly visible North American market. RIM OS has the second largest share at 17.4% followed by Windows

CE at12%. Smart phones are widely deployed across Asia and enjoy great popularity because of the low barrier

to entry for third-party developers to write new applications for the platform.

Operating Systems Used in Smartphones, Q2 2008 Smart phone market share, Q2 2008

Source: http://en.wikipedia.org/wiki/Smartphone#cite_note-13 Source: http://www.cn-c114.net/578/a343562.html

Mobile gaming

According to iSuppli Corp., the global market for mobile phone premium content, including music, gaming

and video, is expected to expand to more than $43 billion by 2010, rising 42.5% annually from $5.2 billion in

2004 7.

4. www.letsgomobile.org/en/3392/mobile-device-market-trends/

5. www.allaboutsymbian.com/news/item/6671_The_State_of_the_Smartphone_Ma.php

6. www.cn-c114.net/578/a343562.html

7. www.cellular-news.com/story/16425.php

Phantom Fiber Corporation (OTCBB: PHFB) 10

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Video games in their original versions on PCs and/or consoles represent a form of entertainment recognized

across a large population, while portable consoles have moved the market toward gaming on a mobile device.

Worldwide mobile gaming revenues are on-track to hit $4.5 billion in 2008, a 16.1% increase from 2007 revenues

of $3.9 billion. Gartner predicts that mobile gaming revenues will expand 10.2% annually between 2007 and 2011

and reach $6.3 billion in 2011. The North American market is projected to grow from $845 million currently to ap-

proximately $1.2 billion in 2011.

Mobile Gaming Revenue, $ billions

Source: www.gartner.com/it/page.jsp?id=706407

Systems integration market

In recent years, the worldwide systems integration (SI) services market has experienced its strongest growth since

the dot-com boom in the late 1990s. According to a new study published by IDC, after years of sluggish returns

and historic lows, the worldwide market experienced 4% growth in 20058.

According to a new IDC study, SI vendors reported a healthy market in 2007 with a slight increase in hourly bill

rates as customers continued to turn to SI vendors for integration projects that tie together disparate applications

and processes9. According to IDC, 2008 will likely be another strong year.

Accenture and IBM Global Services are the worldwide leaders for SI services. Other major players in the global

market are the Japanese SIs, including Fujitsu, Hitachi and NEC Corporation. In 2007, the U.S. market was domi-

nated by companies with a strong presence in the federal government market, namely Lockheed Martin, CSC and

SAIC.

8. http://news.top-consultant.com/UK/newsletter161106.htm

9. www.businesswire.com/portal/site/home/permalink/?ndmViewId=news_view&newsId=20081009005045&newsLang=en

Phantom Fiber Corporation (OTCBB: PHFB) 11

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Financial Analysis

Revenues

In the last four years, PHFB has reported robust revenue growth and increasing market acceptance of its services.

The Company’s revenue increased 309% year-over-year during the first six months of 2008 to a record $517,678,

reflecting significant new customer additions. Going forward, the Company is likely to significantly improve on

FY2007 results by reporting revenues ranging near $2 million in FY 2008.

Revenue track, $

Source: SEC Filings; fiscal year ending December 31.

Income statement

In 2007, the Company’s operating expenses declined by $1.1 million, due mainly to reduced spending on public

relations, investor relations and advertising, as well as lower general and administrative expenses because of

the absence of bonuses paid in the prior year. Net losses increased, however, because of the recognition of an

additional $2.7 million of interest on accretion of senior convertible debt in FY 2007.

During the first six months of FY 2008, PHFB incurred net losses of $509,129, mainly due to the recognition

of $1,071,789 of interest on accretion of senior convertible debt. This loss was partially offset by a net gain of

$1,1725,332 related to the change in value of derivative instruments associated with the convertible debt issue.

Phantom Fiber Corporation (OTCBB: PHFB) 12

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Operating results, $

FY06 FY07 % Chg H1 FY07 H1 FY08 % Chg

Revenue 309.3 495.3 60% 126.6 517.7 309%

Operating expenses 3,358 2,246 -33% 1,141 1,213 6%

Research and development 1,081 919.9 -15% 502.1 535.0 7%

Sales and marketing 853.0 454.9 -47% 214.3 184.2 -14%

General and Administrative 1,425 871.1 -39% 424.4 493.9 16%

Other Income (Expense) 144.2 (1,909) n/m 399.2 186.3 -53%

Net Income (2,905) (3,660) n/m (614.989) (509,129) n/m

EPS, $ (0.19) (0.21) n/m (0.04) (0.03) n/m

Source: SEC Filings; year ending December 31.

Despite strong revenue growth, the Company has not yet reached breakeven on an operating basis. PHFB is

implementing an aggressive marketing plan to drive revenue growth and position the business for profitability

in 2009.

Liquidity and capital resources

At June 30, 2008, the Company had a working capital deficit of $2.3 million, down from $5.8 million at year-end

2007. The change in working capital was due to a decline in short term and other borrowings of $825,120, which

were converted into convertible debt, a $324,482 reduction in accrued liabilities, a $427,168 increase in accounts

payable, a change in value of derivative instruments of $340,692, and a change in senior convertible notes of

$2,232,030 due to refinancing.

Balance sheet, $

31-Dec-07 31-Mar-08 30-Jun-08

-

Cash and equivalents 44,642 12,301 -

(2,317,234)

Net Working Capital (5,839,241) (3,504,637) (2,317,234)

561,996

Total Assets 515,751 409,653 561,996

5,820,892

Liabilities, including 5,896,660 4,769,074 5,820,892

4,139,831

Debt 4,320,789 3,637,997 4,139,831

(5,258,896)

Equity, including (5,380,909) (4,278,421) (5,258,896)

(12,295,788)

Accumulated deficit (11,786,659) (11,223,838) (12,295,788)

Source: SEC Filings; year ending December 31.

Phantom Fiber Corporation (OTCBB: PHFB) 13

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

To date, PHFB has financed its operation mainly from private placements of equity and debt instruments; how-

ever, this may cause dilution and increase financial risks. The Company plans to raise sufficient additional

capital over the next several months to eliminate or significantly reduce its current debt and provide adequate

working capital for operating activities.

Outlook and Valuation

PHFB has secured many new customer contracts that will favorably impact 2008 and 2009 results. Over the past

year, PHFB has expanded its sales and marketing efforts, and has secured clients in the financial and mobile pay-

ments vertical (such as FireOne, Citadel, and Navaho Networks), healthcare, logistics and distribution software

providers, and the security and remote-monitoring industries. Last quarter, PHFB rolled out a real-time foreign

exchange trading application for FX Solutions and a personal healthcare management system for My Medical

Records. The Company also secured a contract with GTX Corp. to develop a Personal Location System. Further

geographic expansion into Australia and Asia has been accomplished through agreements with Smart Ventures

and Beach Hut Media.

During the first half of FY 2008, revenue growth exceeded 300%, and PHFB signed several agreements that sup-

port our outlook for FY 2008 revenues approaching $2 million. Going forward, we expect new sales agreements,

geographical expansion and new verticals to fuel 100%-200% annual revenue growth through 2010.

Income statement forecast, $

2006 2007 2008E 2009E 2010E

Revenue: 309,271 495,285 2,005,904 5,215,351 10,430,702

Operating expenses:

Research and development 1,080,682 919,952 1,404,133 1,564,605 1,668,912

Sales and marketing 853,000 454,884 501,476 730,149 938,763

General and administrative 1,424,764 871,072 902,657 1,095,224 1,147,377

Total operating expenses 3,358,446 2,245,908 2,808,266 3,389,978 3,755,053

Operating income (3,049,175) (1,750,623) (802,362) 1,825,373 6,675,649

Other income (expenses): 144,239 (1,909,226) (954,613) (1,050,074) (1,155,082)

EBT (2,904,936) (3,659,849) (1,756,975) 775,299 5,520,568

Net income (2,904,936) (3,659,849) (1,756,975) 542,709 3,864,397

Diluted EPS ($0.19) ($0.21) ($0.08) $0.03 $0.19

2009

Source: Analyst estimates

We expect the Company to break even in 2009 and report impressive earnings gains as its technology and cus-

tomer base are further leveraged.

We also think the Company will issue equity to finance its growth plans. Considering also the issued convertible

notes, we expect shares outstanding to exceed 30 million by the end of 2010.

Phantom Fiber Corporation (OTCBB: PHFB) 14

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Peer comparisons

We looked at companies providing gaming, mobile and wireless software solutions for the gaming and financial

services industries as valuation peers for PHFB. Peer companies are trading at 8.65 times forward P/E multiples.

Comparative analysis

Company Name Ticker Price per Mrkt. Cap. P/E P/S

29-Oct-08 symbol Share, $ $ Mn 2008 2009 2008 2009

CryptoLogic Ltd. CRYP 4.14 56 20.70 7.81 0.79 0.69

Sybase Inc. SY 25.09 1,990 12.36 11.56 1.76 1.70

Research In Motion Ltd. RIMM 47.82 27,050 13.36 10.09 2.45 1.72

Aristocrat Leisure Ltd. ALL.AX AUD 3.96 AUD 2,716 9.97 8.65 2.44 2.33

THQ Inc. THQI 7.62 509 10.89 7.86 0.45 0.41

Peers Median 12.36 8.65 1.76 1.70

PHANTOM FIBER CORP PHFB 0.08 1.55 n/m 2.70 0.77 0.30

Source: Reuters and analyst Estimates

We value PHFB at a 10 times forward P/E multiple because of the market’s favorable growth outlook, the Com-

pany’s revenue momentum and increasing worldwide adoption of its innovative platform. We multiply our 10

times forward P/E multiple by our $0.03 FY 2009 EPS estimate to obtain a $0.30 price target. As a result, we are

initiating coverage of PHFB with a Speculative Buy rating and a $0.30 price target.

However, we strongly advise investors to consider the risk factors discussed in the next section which cause us to

accentuate the “Speculative” aspect of our rating.

Phantom Fiber Corporation (OTCBB: PHFB) 15

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Investment Risks

Limited sales history

The Company has a limited sales history in the wireless applications and enterprise mobile market area. As a

result, PHFB may experience revenue volatility as its sales order backlog, and project bookings are not at levels

to smooth revenues or sustain quarterly growth. If the Company’s projected revenues for a particular period fall

below expectations, PHFB may not be able to adjust spending quickly enough to offset revenue declines, and

overall results would suffer.

Lack of sufficient capital

To date, PHFB has reported losses from operations, negative working capital, and an insignificant cash balance.

PHFB will not generate sufficient cash from operations to fund its business plan in 2008. Its ability to grow may

depend on obtaining additional debt or equity financing. If the Company is unable to raise additional cash, its

business plan could stall.

Dependence on strategic partners

The Company derives a significant portion of its license revenues from sales of its proprietary wireless platform

software through strategic partners, systems integrators, value-added resellers and original equipment manu-

facturers. The loss of any of these third-party relationships could have an adverse impact on PHFB’s operations.

Moreover, if these partners change their business focus or enter into strategic alliances with other companies, their

need for PHFB’s service could be reduced or eliminated.

Market competitiveness

The wireless applications market is highly competitive and characterized by rapid and significant technological

change, frequent product introductions, evolving wireless platforms and industry standards. A number of compa-

nies have achieved strong results providing services similar to PHFB’s. These competitors have greater revenues,

customer lists, market acceptance, brand recognition and financial resources.

System failure

The Company’s business is dependent on PHFB wireless platform’s ability to rapidly and efficiently process sub-

stantial quantities of data and transactions. These operations could be interrupted by any damage to, or failure of,

mobile device software, hardware or networks. Any system failures, delays or other problems could harm PHFB’s

reputation and result in the loss of customers.

Phantom Fiber Corporation (OTCBB: PHFB) 16

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Management

Jeff Halloran Mr. Halloran brings to the Company more than 20 years of experience in emerging digital technologies and

telecommunications. He became CEO, president and chairman of PHFB in January 2002. Mr. Halloran as-

Founder, President and CEO sumed the positions of principal financial officer and principal accounting officer effective January 1, 2005.

From March 2001 to November 2001, he was CEO of Sona Innovations Inc., a wireless software company.

From March 1989 to February 2001, Mr. Halloran was CEO and president of Relational Solutions Inc., an

international consulting firm specializing in information management and strategic information planning.

From August 1987 to March 1989, he was a consulting manager for Oracle Corp., providing database con-

sulting services. Mr. Halloran graduated from St. Clair College in 1982 with a degree in business adminis-

tration.

Herb Sears Mr. Halloran brings to the Company more than 20 years of experience in emerging digital technologies and

telecommunications. He became CEO, president and chairman of PHFB in January 2002. Mr. Halloran as-

Chief Technology Officer sumed the positions of principal financial officer and principal accounting officer effective January 1, 2005.

From March 2001 to November 2001, he was CEO of Sona Innovations Inc., a wireless software company.

From March 1989 to February 2001, Mr. Halloran was CEO and president of Relational Solutions Inc., an

international consulting firm specializing in information management and strategic information planning.

From August 1987 to March 1989, he was a consulting manager for Oracle Corp., providing database con-

sulting services. Mr. Halloran graduated from St. Clair College in 1982 with a degree in business adminis-

tration.

Shane Lourensse Mr. Lourensse has more than 10 years experience in sales with software and technology based business

solutions. Prior to joining Phantom Fiber, he was a senior account manager in the technology consulting

VP Business Development division of Telus, Canada’s second-largest telecom and wireless carrier. Previously, Mr. Lourensse was sales

director for a publicly traded company specializing in software solutions for the online gaming market.

Dennis Logan Mr. Logan became a director in September 2007. He currently serves as a managing director of Investment

Banking for Desjardins Securities. Prior to joining Desjardins Securities, from May 2005 until June 2007, Mr.

Director Logan was a director in the Investment Banking Group at Westwind Partners where he focused on both

corporate finance and merger & acquisition activity in the real estate, technology and special situations sec-

tors. Before that, Mr. Loganheld Investment Banking positions with LOM Ltd from August 2003 to January

2005; CIBC World Markets from April 2000 to May 2003; and TD Securities Inc. from May 1998 to April

2000. He began his career in financial services in September 1994 as a staff accountant with Ernst & Young

LLP. Mr. Logan holds both an Honours Bachelor of Art in philosophy & economics (1991), an MBA (1994)

from the University of Toronto, and is a Chartered Accountant.

Phantom Fiber Corporation (OTCBB: PHFB) 17

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Shimon Constante Mr. Constante became a director in November 2006. He is the CEO of mPortico, a private mobile distribu-

tion and marketing services provider. Prior to founding mPortico, from March 2003 until August 2005, Mr.

Director Constante was the Head of Mobile Business Development at 888.com, an online entertainment company.

Prior to that, from July 2000 until January 2002, Mr. Constante was the head of Technology and Business

Research at Aduva, a privately-held technology company. Mr. Constante received a Bachelor of Art in

psychology in 1999 and an executive MBA from the Kellogg School of Management at Northwestern Uni-

versity in 2004.

Konstantine Lucas Mr. Lucas became a director in February 2006. He currently serves as executive vice president of Warner

Bros. Domestic Cable Distribution. From September 1998 until April 2000, Mr. Lucas was a consultant to

Director the media industry, including cable networks and MGM Studios. From May 1995 to August 1998, Mr. Lucas

was president of programming for the Family Channel. Before joining the Family Channel, from August

1986 to September 1993, Mr. Lucas was executive vice president of Viacom Entertainment Group, and

president of West Coast Operations and Viacom Productions. Before that, Mr. Lucas held several positions

at ABC Entertainment, culminating in his position as vice president and assistant to the president of ABC

Entertainment.

Stephen Gesner Mr. Gesner became a director on February, 2006. Mr. Gesner currently serves as the executive vice presi-

dent and CIO of Resolve Corporation. He previously served as chief information officer of Meridian Credit

Director Union from April 2005 to December 2007. From May 2004 to March 2005, Mr. Gesner was the vice president

of financial services of marketing for TELUS Communications. During the period May 2003 to December

2003, he served as the CTO for Cap Gemini Ernst and Young Canada. Before that, Mr. Gesner worked for

14 years at TD Bank Financial Group. Mr. Gesner began his career with Ford Motor Company of Canada

in September 1979 and held several positions in finance, treasury, production planning and industrial re-

lations through December 1988. Mr. Gesner holds an Honours Bachelor of Science from York University

(1977) and an MBA from the Schulich School of Business (1979).

Phantom Fiber Corporation (OTCBB: PHFB) 18

Analyst: Victor Sula, Ph.D.

Initial Report

October 30th, 2008

Disclaimer

DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS REPORT. We are not registered as a securities broker-dealer or

an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither

licensed nor qualified to provide investment advice.

The information contained in our report should be viewed as commercial advertisement and is not intended to be investment advice. The report is not provided

to any particular individual with a view toward their individual circumstances. The information contained in our report is not an offer to buy or sell securities.

We distribute opinions, comments and information free of charge exclusively to individuals who wish to receive them.

Our newsletter and website have been prepared for informational purposes only and are not intended to be used as a complete source of information on any

particular company. An individual should never invest in the securities of any of the companies profiled based solely on information contained in our report.

Individuals should assume that all information contained in the report about profiled companies is not trustworthy unless verified by their own independent

research.

Any individual who chooses to invest in any securities should do so with caution. Investing in securities is speculative and carries a high degree of risk; you

may lose some or all of the money that is invested. Always research your own investments and consult with a registered investment advisor or licensed stock

broker before investing.

The report is a service of BlueWave Advisors, LLC, a financial public relations firm that has been compensated by the companies profiled. All direct and third

party compensation received has been disclosed within each individual profile in accordance with section 17(b) of the Securities Act of 1933. This compensa-

tion constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled companies. BlueWave Advisors, LLC,

and/or its affiliated will hold, buy, and sell securities in the companies profiled. When compensated in shares, all readers should be aware that is our policy to

liquidate all shares immediately. We reserve the right to buy or sell the shares of any the companies mentioned in any materials we produce at any time. This

compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled companies. BeaconEquity.com

is a Web site wholly-owned by BlueWave Advisors, LLC. BlueWave Advisors, LLC has been compensated fifty thousand dollars from Pine Mountain Ventures,

a shareholder of PHFB, as a marketing budget to manage a comprehensive investor awareness program including the creation and distribution of this report

as well as other investor relations efforts.

Information contained in our report will contain “forward looking statements” as defined under Section 27A of the Securities Act of 1933 and Section 21B of the

Securities Exchange Act of 1934. Subscribers are cautioned not to place undue reliance upon these forward looking statements. These forward looking state-

ments are subject to a number of known and unknown risks and uncertainties outside of our control that could cause actual operations or results to differ ma-

terially from those anticipated. Factors that could affect performance include, but are not limited to, those factors that are discussed in each profiled company’s

most recent reports or registration statements filed with the SEC. You should consider these factors in evaluating the forward looking statements included in

the report and not place undue reliance upon such statements.

We are committed to providing factual information on the companies that are profiled. However, we do not provide any assurance as to the accuracy or com-

pleteness of the information provided, including information regarding a profiled company’s plans or ability to effect any planned or proposed actions. We

have no first-hand knowledge of any profiled company’s operations and therefore cannot comment on their capabilities, intent, resources, nor experience and

we make no attempt to do so. Statistical information, dollar amounts, and market size data was provided by the subject company and related sources which

we believe to be reliable.

To the fullest extent of the law, we will not be liable to any person or entity for the quality, accuracy, completeness, reliability, or timeliness of the information

provided in the report, or for any direct, indirect, consequential, incidental, special or punitive damages that may arise out of the use of information we provide

to any person or entity (including, but not limited to, lost profits, loss of opportunities, trading losses, and damages that may result from any inaccuracy or

incompleteness of this information).

We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.

finra.org.

All decisions are made solely by the analyst and independent of outside parties or influence.

I, Victor Sula, Ph.D, the author of this report, certify that the material and views presented herein represent my personal opinion regarding the content and

securities included in this report. In no way has my opinion been influenced by outside parties, nor has my compensation been either directly or indirectly

tied to the performance of any security listed. I certify that I do not currently own, nor will own and shares or securities in any of the companies featured in

this report.

Victor Sula, Ph.D. - Senior Analyst

Victor Sula, Ph.D. has held the position of Senior Analyst with several independent investment research firms since 2004. Prior to 2004, Mr. Sula held Senior

Financial Consultant positions within the World Bank sponsored Agency for Restructuring and Enterprise Assistance and TACIS sponsored Center for Produc-

tivity and Competitiveness of Moldova, where he was involved in corporate reorganization and liquidation. He is also employed as Associate Professor at the

Academy of Economic Studies of Moldova. Mr. Sula earned his Ph.D. degree in 2001 and bachelor’s degree in Finance in 1997 from the Academy of Economic

Studies of Moldova. Mr. Sula is currently a level III candidate in the CFA program.

Phantom Fiber Corporation (OTCBB: PHFB) 19

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Company Introduction: Empire Film Group IncDocument17 pagesCompany Introduction: Empire Film Group Incbeacon-docsNo ratings yet

- Company Introduction: China Energy Recovery IncDocument17 pagesCompany Introduction: China Energy Recovery Incbeacon-docsNo ratings yet

- Company Introduction: Carbon Sciences IncDocument7 pagesCompany Introduction: Carbon Sciences Incbeacon-docs100% (4)

- Background: Initial Report February 25th, 2009 Initial Report February 25th, 2009Document6 pagesBackground: Initial Report February 25th, 2009 Initial Report February 25th, 2009beacon-docsNo ratings yet

- LOJNDocument7 pagesLOJNbeacon-docs100% (4)

- NTRODocument16 pagesNTRObeacon-docsNo ratings yet

- OOILDocument9 pagesOOILbeacon-docsNo ratings yet

- Background: Intuitive Surgical, IncDocument6 pagesBackground: Intuitive Surgical, Incbeacon-docsNo ratings yet

- OOILDocument9 pagesOOILbeacon-docsNo ratings yet

- CLRIDocument16 pagesCLRIbeacon-docsNo ratings yet

- Background: Initial Report February 6th, 2009 Initial Report February 6th, 2009Document6 pagesBackground: Initial Report February 6th, 2009 Initial Report February 6th, 2009beacon-docsNo ratings yet

- Background: Initial Report December 29th, 2008 Initial Report December 29th, 2008Document6 pagesBackground: Initial Report December 29th, 2008 Initial Report December 29th, 2008beacon-docsNo ratings yet

- Company Introduction: Tombstone Exploration CorpDocument16 pagesCompany Introduction: Tombstone Exploration Corpbeacon-docsNo ratings yet

- Company Introduction: Initial Report January 20th, 2009 Initial Report January 20th, 2009Document18 pagesCompany Introduction: Initial Report January 20th, 2009 Initial Report January 20th, 2009beacon-docs100% (5)

- NanoDocument6 pagesNanobeacon-docsNo ratings yet

- Company Introduction: China Energy Recovery IncDocument17 pagesCompany Introduction: China Energy Recovery Incbeacon-docsNo ratings yet

- EEGCDocument28 pagesEEGCbeacon-docsNo ratings yet

- Company Introduction: Supportsave Solutions, IncDocument17 pagesCompany Introduction: Supportsave Solutions, Incbeacon-docsNo ratings yet

- RNNMDocument20 pagesRNNMbeacon-docsNo ratings yet

- EEGCDocument28 pagesEEGCbeacon-docsNo ratings yet

- AMGNDocument7 pagesAMGNbeacon-docsNo ratings yet

- Company Introduction: Universal Bioenergy IncDocument18 pagesCompany Introduction: Universal Bioenergy Incbeacon-docsNo ratings yet

- ECOSreportDocument17 pagesECOSreportbeacon-docsNo ratings yet

- GSPIDocument8 pagesGSPIbeacon-docsNo ratings yet

- MFGDDocument16 pagesMFGDbeacon-docsNo ratings yet

- NMKTDocument22 pagesNMKTbeacon-docsNo ratings yet

- Company Introduction: Initial Report October 15th, 2008Document19 pagesCompany Introduction: Initial Report October 15th, 2008beacon-docsNo ratings yet

- Company Introduction: Neohydro Technologies, CorpDocument17 pagesCompany Introduction: Neohydro Technologies, Corpbeacon-docs100% (1)

- PLTGDocument20 pagesPLTGbeacon-docs100% (1)

- JESD204B Survival GuideDocument101 pagesJESD204B Survival Guidenguyentienduy1512No ratings yet

- Mindjet Large Scale Deployment GuideDocument59 pagesMindjet Large Scale Deployment GuideJenderalKancilNo ratings yet

- Application Performance Analysis - Sharkfest - WiresharkDocument58 pagesApplication Performance Analysis - Sharkfest - WiresharktaicyberNo ratings yet

- Digital System Design by Using VERILOGDocument13 pagesDigital System Design by Using VERILOGkpkarthi2001No ratings yet

- NEX2U Plus Manual (Full) - DealerDocument41 pagesNEX2U Plus Manual (Full) - DealerArbey GonzalezNo ratings yet

- Med PDFDocument30 pagesMed PDFSharfuddin ShariffNo ratings yet

- Business Level 3 Btec Extended Diploma CourseworkDocument7 pagesBusiness Level 3 Btec Extended Diploma Courseworkemlwymjbf100% (1)

- 5th Lecture - 8085 Timing DiagramDocument18 pages5th Lecture - 8085 Timing Diagramcgupta1be21No ratings yet

- TLMA User ManualDocument39 pagesTLMA User ManuallettymcNo ratings yet

- Pex 4Document2 pagesPex 4anishsukumar000gmailcomNo ratings yet

- SCCM Interview Questions and AnswersDocument12 pagesSCCM Interview Questions and AnswersParthasarathy SowrirajanNo ratings yet

- Summer Internship ReportDocument38 pagesSummer Internship ReportAmit YadavNo ratings yet

- Verizon Law Enforcement GuideDocument11 pagesVerizon Law Enforcement GuideAnabelle CruzNo ratings yet

- Archmodels Vol 171 PDFDocument16 pagesArchmodels Vol 171 PDFMrDingo007No ratings yet

- Petra UMA Schematics Document Cover PageDocument103 pagesPetra UMA Schematics Document Cover PageFRANCISCO JAVIER JARAMILLO MNo ratings yet

- Assignment On Blockchain PDFDocument3 pagesAssignment On Blockchain PDFshahinNo ratings yet

- Blackbook Pdf2022-Chapter-AI in Consumer Behavior-GkikasDC-TheodoridisPKDocument31 pagesBlackbook Pdf2022-Chapter-AI in Consumer Behavior-GkikasDC-TheodoridisPKneetuguptaxz00No ratings yet

- MC SIMOTION D410 Operating Manual PDFDocument101 pagesMC SIMOTION D410 Operating Manual PDFramon nava100% (1)

- Computer Integrated Manufacturing.Document29 pagesComputer Integrated Manufacturing.cooldude2000No ratings yet

- GCSE OCR 1.1 Common CPU Components and Their FunctionDocument7 pagesGCSE OCR 1.1 Common CPU Components and Their FunctionMichael O’LearyNo ratings yet

- Xerox Workcentre 56Xx 07 To Workcentre 56Xx '08 MFD Comparison White PaperDocument28 pagesXerox Workcentre 56Xx 07 To Workcentre 56Xx '08 MFD Comparison White Papergh hombreNo ratings yet

- Symfony Book 3.0Document234 pagesSymfony Book 3.0ManuelLaraNo ratings yet

- DSA FileDocument24 pagesDSA Fileshivangiimishraa1819No ratings yet

- Features Description: 1996 Burr-Brown Corporation PDS-1304B Printed in U.S.A. October, 1997Document16 pagesFeatures Description: 1996 Burr-Brown Corporation PDS-1304B Printed in U.S.A. October, 1997Hector Jose Murillo CordobaNo ratings yet

- Report AutocadDocument38 pagesReport AutocadRISHAV RAUSHANNo ratings yet

- Autosar Sws Saej1939transportlayerDocument81 pagesAutosar Sws Saej1939transportlayermegatornadoNo ratings yet

- Three Key Requirements of Enterprise SD-WAN: Integrated Security, Multicloud Connectivity, and Application ReliabilityDocument7 pagesThree Key Requirements of Enterprise SD-WAN: Integrated Security, Multicloud Connectivity, and Application Reliabilitymasterlinh2008No ratings yet

- Floating-Point IP Cores User Guide: Updated For Intel Quartus Prime Design Suite: 20.1Document117 pagesFloating-Point IP Cores User Guide: Updated For Intel Quartus Prime Design Suite: 20.1Chí Thành VõNo ratings yet

- Guide To GTMDocument78 pagesGuide To GTMCapitan SwankNo ratings yet

- Image - ProcessingDocument24 pagesImage - ProcessingIon StratanNo ratings yet