Professional Documents

Culture Documents

Harimau Plastics

Uploaded by

Poh Yih ChernCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harimau Plastics

Uploaded by

Poh Yih ChernCopyright:

Available Formats

INVESTMENT ANALYSIS (GSM 5421) DR. CHEN CHAW MIN GROUP PROJECT 2 Case Study: Harimau Plastics Sdn.

. Bhd. 1. This is a group project in which each of the group has to do the following: i. ii. iii. iv. v. vi. a brief fundamental valuation analysis of Harimau Plastics; determine the worth of the original RM1 million investment in 1996 at the end of 2004 (how much per share) - based on discounted cash flow method of Harimau Plastics free cash flow; Calculate the Net Tangible Asset to determine the share price of Harimau Plastics at end of 2004 Carry out a relative valuation method with other companies of similar industry as a comparison. what is your valuation in terms of price per share of Harimau Plastics. What is your recommendation to the founders the FAIR PRICE to issue at IPO and state your justification how you arrive at that value.

2. Each group needs to prepare presentation slides (not more than 30 slides) of the above and made a presentation not more than 25 minutes on 6 December 2011. Question and answer (5 minutes) will follow after each groups presentation. 3. Your forecast cash flow is up to year 2008 and you can assume a perpetuity growth of an annual rate of 4% of the free cash flow after year 2008. 4. You need to determine your weighted cost of capital (WACC) and please explain how you derive at the cost of capital for Harimau Plastics. 5. If some data are not available, you could make some assumptions but the assumptions must be realistic and base on literature review or supported by published reports. 5. This is a group work and I expect every member of the group to participate actively, contribute and prepare the case study as a team. 6. You need to hand in your presentation slides to me before the start of the presentation. 7. Class participation is very important and those who cannot attend must have valid reasons.

UNIVERSITY PUTRA MALAYSIA GRADUATE SCHOOL OF MANAGEMENT INVESTMENT ANALYSIS (GSM5421) CASE STUDY HARIMAU PLASTICS SDN. BHD. Harimau Plastics is a player in the ever growing plastics industry in Malaysia. The company established in 1996, is located in an industrial park in a small town of Perlis. The companys founders are 3 individuals with diverse backgrounds in both educational and functional working experiences. The People behind Harimau Plastics Sdn. Bhd. Datuk D, age 63 years old, is the Executive Chairman of the company. He has vast experience in the plastics industry. He started work with a plastics manufacturer in Singapore as a production apprentice at age of 20. That was the only company he had ever worked for. His dedication and willingness to take on any assignment enabled him to rise through the ranks even overtaking those with tertiary and professional qualifications, to become the Deputy Managing Director of the company. His knowledge of the plastic industry is very extensive. He opted to retire in 1995 following strategic differences with major shareholders. A man who had work non-stop, he did not really know the meaning of retirement. After taking things easy for a few months, he got restless and wanted to occupy his time usefully. Not long after that, he decided to venture into the business world, and with two other individuals, established Harimau Plastics Sdn. Bhd. (Harimau Plastics) Mr. R, aged 57, is the Finance and Administration Director of the company. A Malaysian and a graduate of University of Putra with a Degree in Finance, he worked as one of the senior banker in one of the largest banks in Singapore before deciding to join hands with Datuk D to set up Harimau Plastics. His friendship with Datuk dates back to 1985 when he interviewed him as part of the procedure to assess his application for business financing. Since that day, both became great friends. Therefore, when Datuk D informed Mr. R of his plans to establish a plastics manufacturing factory in Perlis, Mr. R who longed to return to Malaysia did not waste any time and immediately agreed to become his business partner. Dr. C, aged 50, is the Operations Director of the company. Dr. C, also a Malaysian is a graduate from UTM with a degree in Chemical Engineering. Upon graduation, he joined one of the Malaysian operations of a leading oil company as a management trainee. The oil company identified him as one of their future 2

managerial prospects and gave him numerous assignments to hone his skills, besides giving him the opportunity to gain further academic qualifications. He took the opportunity to obtain his PhD from a British University. Dr. C moved up quickly, serving as the head of several refineries in a neighboring country and his future was bright. However, over the years he had grown increasingly frustrated at all the politicking around him. His mind was increasingly not on his job anymore. The trigger point to leave came when he received a phone call one afternoon from Datuk D, who he became a close friend from the time they first met at a conference on the petrochemical industry in Singapore in 1990. Starting the business After scouting around for a suitable site, they decided on Padang Besar, Perlis after considering factors such as labour availability and affordability, land for future expansion, transportation and shipment infrastructures and proximity to foreign markets such as Thailand, Singapore and Indonesia. The state government has also offered them concessions as an inducement to invest. They decided to establish their operations in an abandoned factory that they bought at an auction. The factory structure and layout were almost similar to what they had envisioned. For funding, the three mortgaged their property and used their own money to kick-start the factory. Their strong reputation in the commercial sector enabled to the company to: i. ii. iii. obtain substantial short-term and long-term financing for the company speedily and at favourable rates. secure some orders to get the factory into running mode. obtain favourable terms for key raw materials.

The Vision and Operations The founders ambitious plan for the company was to turn it into a comprehensive manufacturer of thermo-formed plastic food containers, catering to the needs of the domestic market as well as the regional markets of Thailand, Singapore and Indonesia. The founders incorporated the company in 1996 with a fully issued and paid-up capital of RM1,000,000 consisting of 1,000,000 shares with par value of RM1 each. Following the recruitment of key personnel and after painstaking planning and organization, the company finally commenced production in November 1996, its maiden production of jelly containers done with a second-hand made thermoforming machine and second-hand mould imported from Japan. 3

Financial Performance and Challenges The company was just beginning to get a toehold in the industry, only for the Asian Financial Crisis to strike in July 1997. Harimau Plastics sales and production suddenly seemed untenable, unsupported by market fundamentals. The three founders were undeterred and did their best to seek new orders, to maintain and improve quality and efficiency and to exercise stringent operational and financial discipline. They paid themselves a token of RM5,000 each as a monthly salary so as to lead by example, and to show that the organization is more important than the individual. The company posted net losses in financial years 1997 and 1998. The market situation improved in 1999. Revenue improved slightly, but the company still posted a reduced net loss for the financial year 1999. The founders did not lose sight of their larger goals for the company. The financial crisis had swept away a few players from the scene. With the competitors eliminated and with the market on the edge of strong recovery, the founders decided that financial years 2000 and 2001 would be pivotal years for the company. They intensified new product development, introduced newer products into the market, moved into more value added businesses and spurred domestic and foreign marketing efforts, all aided and funded by low cost financing from domestic banks. The banks, after being adversely affected in 1997 and 1998, were eager to lend money once more and the trio took full advantage of the situation. With low financing cost, Harimau Plastics introduced sophisticated, state of the art machinery from Germany, Italy and Japan. The future looked brighter by the day and by the end of the financial year 2002, Harimau Plastics had turned into a respected player, albeit a small and growing one, in the market. A snapshot of Harimau Plastics at the end of the financial year 2002 revealed the following: a) The company produced its own extruded thermoforming sheets. b) The company had three thermoforming machines, one thermoformed container-printing machine, one extruder and one grinder of waste material. c) The company had one small mineral water bottling operation. d) The company had marketing and distribution offices in major towns in Malaysia besides having offices in Singapore, Bangkok and Jakarta.

The company decided to acquire its own extruder upon realizing its vulnerability vis--vis its relationship with its plastic sheet supplier. The extruder enabled Harimau Plastics to extrude out 500 kg to 1 ton plastic rolls to be fed into thermoforming machines. The thermoformed container-printing machine allowed the company to perform value added work. Such value added work allowed the companys products to fetch higher prices. The mineral water bottling operation is a textbook case of how a many company can leverage on its strengths to venture into a new area. Why should it not?. Harimau Plastics was already capable of manufacturing plastic bottles. All is needed to do was to install the bottling facility. The company did and has been marketing and distributing its mineral water products through its own branch offices. The company went on to record stellar performances in the financial years 2003 and 2004, Harimau Plastics income statements for financial years 1997-2004 are as shown in Appendix 1. Tragedy struck No one had anticipated of the tragedy lurking around the corner. In late 2004, Datuk D suffered a massive stroke and the left side of his body was paralyzed. A few months earlier, cancer had claimed his wife. These personal tragedies transformed a witty person full of wisdom into a shell of his formal self. While physically and psychologically recuperating, he rarely spoke to anyone, except on most important matters. Day by day, he distanced himself more and more from the business that he had built from scratch with his two comrades. This forced both Mr. R and Dr. C to re-evaluate their organizational and personal lifestyles. They wondered whether at their age, it was necessary to work at such breakneck pace. For how long could they subject their minds and bodies to such stress? Mr. R, a chronic smoker had already been identified as suffering from mild stress related disorder and the doctor had already warned him that the signs of future medical problems were all there. Dr. C dealt with the pressures of work by over-eating and he no longer resembled the young, nimble and energetic person he once was. He was suffering from liver complications and diabetes too.

Exit Strategy At the end of year 2004, they reached a consensus that the time was ripe for them to withdraw from the day-to-day management of the company. They had loomed over the company as larger than life figures. Perhaps what the company needed now was a new identity, a fresh breath of air. Over the years, the many talents recruited had gained enough knowledge and skills of the industry and of the company. They were more than capable of taking charge and leading the company into its next stage of growth. However, there had to be a way for them the founders of the company to benefit from the exit. They had to gain from their controlling shareholding in the firm. They had made numerous personal sacrifices. They had mortgaged almost all their personal belongings. Furthermore, they had lived on salaries markedly below what their peers earned in the same industry. If their exit did not result in any personal gain, all their efforts over the years would have gone down the drain. The company decided to engage your investment company to help plot a viable solution. Following a few meetings involving the three founders, you proposed that the three consider divestment of Harimau Plastics to a new party as a way of exiting the day-to-day toil and gaining financially for their non-stop efforts over the years. You suddenly remembered a prospective buyer, Mr. Harry Mao, who is cash rich and looking for a suitable business and company to invest into. You quickly contacted him and he, of course was very excited. The founders ask your company to carry out a thorough investment analysis of Harimau Plastics and determine a fair valuation price (at end of year 2004) per share for them to sell. !!!! You have just seen that valuation can be something deliberate or triggered by unexpected circumstances. Do not be afraid, if you move forward slowly, but be afraid if you stand still

Appendix 1

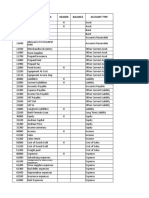

Revenue Less: COGS Gross Profit Less: Administrative and marketing expenses Earnings before interest, tax and depreciation (EBITD) Less: Interest expanse (net) Less: Depreciation Profit before tax (PBT) Less: Tax expense Net Profit (loss) There are minor rounding effects.

FY-97 2,250 (1,688) 563 (270) 293 (345) (155) (208) (208)

Income Statement for financial years endings 31 December (All values in RM'000) FY-98 FY-99 FY-00 FY-01 FY-02 FY-03 2,450 2,800 5,500 10,450 13,000 16,100 (1,715) (1,820) (3,300) (6,270) (8,450) (10,143) 735 980 2,200 4,180 4,550 5,957 (196) (224) (550) (941) (1,170) (1,771) 539 (600) (304) (365) (365) 756 (563) (515) (321) (321) 1,650 (616) (702) 332 332 3,240 (744) (851) 1,645 1,645 3,380 (693) (897) 1,790 1,790 4,186 (612) (853) 2,721 (50) 2,671

FY-04 26,500 (15,900) 10,600 (2,650) 7,950 (532) (860) 6,558 (75) 6,483

Harimau Plastic Sdn Bhd's balance sheets for financial years 1997-2004 are as below:

FY-97 Current assets Cash Account receivables Raw material inventory Work in progress inventory Finished goods inventory Total current assets Fixed assets Total fixed assets (less depreciation) Total assets Current Liabilities Account payables Other payables Total current liabilities Debts (short-term and long-term) Short-term debt Long-term debt Total debts Total liabilities Shareholders' equity Issued and paid-up capital Retained earnings/ loss brought forward Current year net profit/ loss Shareholders' equity Total liabilities + Shareholders' equity 3 563 375 281 378 1,600

FY-98 723 463 308 206 333 2,033

Balance Sheet as at 31 December (All values in RM'000) FY-99 FY-00 FY-01 FY-02 1,138 550 442 325 467 2,922 745 1,250 867 663 917 4,440 910 2,488 1,692 1,281 1,742 8,112 970 3,125 2,117 1,575 2,167 9,953

FY-03 2,316 3,900 2,633 1,988 2,683 13,520

FY-04 1,980 6,500 4,367 3,263 4,417 20,525

2,430 4,030 375 12 387 1,000 2,000 3,000 3,387 1,000 (150) (208) 643 4,030

3,246 5,279 483 18 502 1,500 3,000 4,500 5,002 1,000 (358) (365) 278 5,279

4,342 7,263 517 40 557 2,000 4,750 6,750 7,307 1,000 (723) (321) (44) 7,263

5,140 9,580 967 75 1,042 2,500 5,750 8,250 9,292 1,000 (1,044) 332 288 9,580

5,379 13,491 1,742 16 1,757 2,800 7,000 9,800 11,557 1,000 (712) 1,645 1,933 13,491

5,132 15,085 2,192 20 2,211 2,150 7,000 9,150 11,361 1,000 933 1,790 3,724 15,085

4,279 17,799 2,733 21 2,754 1,650 7,000 8,650 11,404 1,000 2,724 2,671 6,395 17,799

3,469 23,994 4,442 25 4,467 650 6,000 6,650 11,117 1,000 5,395 6,483 12,878 23,994

There are minor rounding effects. (Note that in FY-99 the company had more liabilities than assets, resulting in negative shareholders' equity. The company is insolvent. In essence, the owners had lost all the money they pumped into the business. Such situation normally arises when the company posts repeated net losses.

10

You might also like

- Residences - OG ChartDocument1 pageResidences - OG ChartPoh Yih ChernNo ratings yet

- Tekla - Steel Detailing - Basic Training DrawingDocument160 pagesTekla - Steel Detailing - Basic Training DrawingEileen Christopher100% (1)

- Staircase RailingDocument1 pageStaircase RailingPoh Yih ChernNo ratings yet

- 300 Solved Problems in Geotechnical EngineeringDocument0 pages300 Solved Problems in Geotechnical Engineeringmote3488% (17)

- Advance Installation 2013 enDocument64 pagesAdvance Installation 2013 enPoh Yih ChernNo ratings yet

- Brochure CEPCODocument2 pagesBrochure CEPCOMat Uyin0% (1)

- HARTA-Annual Report 2014 PDFDocument177 pagesHARTA-Annual Report 2014 PDFPoh Yih Chern100% (1)

- SikaGrout-215 2011-11 - 1 PDFDocument4 pagesSikaGrout-215 2011-11 - 1 PDFFaiz RahmatNo ratings yet

- Spun PileDocument7 pagesSpun Pileمحمد فيذول100% (2)

- Tie Rod CalculationDocument1 pageTie Rod CalculationPoh Yih ChernNo ratings yet

- Tekla - Steel Detailing - Basic Training DrawingDocument160 pagesTekla - Steel Detailing - Basic Training DrawingEileen Christopher100% (1)

- Module 5 (Lunar Landing)Document3 pagesModule 5 (Lunar Landing)Poh Yih ChernNo ratings yet

- Lect-3-Risk and Return (Compatibility Mode)Document70 pagesLect-3-Risk and Return (Compatibility Mode)Poh Yih ChernNo ratings yet

- Tie Rod CalculationDocument1 pageTie Rod CalculationPoh Yih ChernNo ratings yet

- ViewDocument3 pagesViewPoh Yih ChernNo ratings yet

- Arahan Teknik Jalan 2D-85-RoadMarkingDileanationDocument39 pagesArahan Teknik Jalan 2D-85-RoadMarkingDileanationAhmad Idham100% (1)

- SAP 2000 Truss Analysis TutorialDocument28 pagesSAP 2000 Truss Analysis TutorialPoh Yih ChernNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Account Name Header Balance Account Type Account NumberDocument5 pagesAccount Name Header Balance Account Type Account NumberJohanNo ratings yet

- 1.1.1. Hoba - General TransactionsDocument29 pages1.1.1. Hoba - General TransactionsJane DizonNo ratings yet

- CFA Secret Sauce QuintedgeDocument23 pagesCFA Secret Sauce QuintedgejagjitbhaimbbsNo ratings yet

- Chapter 12-The Cost of Capital: Multiple ChoiceDocument27 pagesChapter 12-The Cost of Capital: Multiple ChoiceJean CabigaoNo ratings yet

- ar40771-LingBaoGold 2008Document137 pagesar40771-LingBaoGold 2008nikkei225traderNo ratings yet

- Cleanliness Is Next To Godliness EssayDocument4 pagesCleanliness Is Next To Godliness Essayafabeaida100% (2)

- Business AnalysisDocument26 pagesBusiness AnalysisAfnanNo ratings yet

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Intermediate Accounting 2 Week 1 Lecture AY 2020-2021 Chapter 1: Current LiabilitiesDocument7 pagesIntermediate Accounting 2 Week 1 Lecture AY 2020-2021 Chapter 1: Current LiabilitiesdeeznutsNo ratings yet

- Resa Afar 2205 Quiz 2Document14 pagesResa Afar 2205 Quiz 2Rafael Bautista100% (1)

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - Questionsalil naik100% (1)

- Ar Elnusa 2018Document458 pagesAr Elnusa 2018Arif fikriNo ratings yet

- Grand Kartech Tbk. (S) : Company Report: July 2015 As of 31 July 2015Document3 pagesGrand Kartech Tbk. (S) : Company Report: July 2015 As of 31 July 2015Rina AfriyaniNo ratings yet

- Chapter - 6 Investment EvaluationDocument33 pagesChapter - 6 Investment EvaluationbelaynehNo ratings yet

- Managerial Accounting Und Erst A DingsDocument98 pagesManagerial Accounting Und Erst A DingsDebasish PadhyNo ratings yet

- MSU Accounting Departmental QuizDocument8 pagesMSU Accounting Departmental QuizMica R.No ratings yet

- Corporations Equity MCQDocument10 pagesCorporations Equity MCQMagdy KamelNo ratings yet

- Insas BerhadDocument3 pagesInsas BerhadventriaNo ratings yet

- AccountingDocument6 pagesAccountingMarjon Villanueva0% (1)

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- F7 Revision Test Section A and B 1Document15 pagesF7 Revision Test Section A and B 1Farman ShaikhNo ratings yet

- Chapter 1 Accounting in ActionDocument52 pagesChapter 1 Accounting in ActionAnonymous EvbW4o1U7100% (1)

- Financial Accounting Ch04Document57 pagesFinancial Accounting Ch04b2dm2k100% (1)

- Appendix FDocument17 pagesAppendix FD3 Pajak 315No ratings yet

- Day 1 Master Class by CS S Sudhakar Dividend KMP 20-6-2020 PDFDocument91 pagesDay 1 Master Class by CS S Sudhakar Dividend KMP 20-6-2020 PDFsmchmpNo ratings yet

- Financial Statements Analysis - StudentsDocument63 pagesFinancial Statements Analysis - StudentsThanh TienNo ratings yet

- IBIG 04 05 Valuation DCF AnalysisDocument118 pagesIBIG 04 05 Valuation DCF AnalysisCarloNo ratings yet

- Cfas midterm flashcardsDocument17 pagesCfas midterm flashcardsCleofe Mae Piñero AseñasNo ratings yet