Professional Documents

Culture Documents

Bill of Exchange FAQ

Uploaded by

Monica PopoviciOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bill of Exchange FAQ

Uploaded by

Monica PopoviciCopyright:

Available Formats

Bills of Exchange

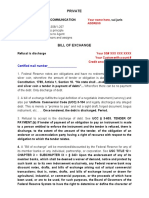

Question 1: Could you briefly explain Bill of Exchange? Answer 1: A Bill of Exchange is a negotiable instrument governed by detailed legislation in most countries and used for extending credit to a buyer which also gives the seller security. This document usually is accepted by the buyer, the drawee who thereupon is called the acceptor. The acceptance is written on the Bill of Exchange by stating accepted. By accepting the draft, the acceptor has undertaken to pay the Bill of Exchange amount at its maturity. The legal structure of a Bill of Exchange is similar to that of a cheque, but a cheque must be drawn on a bank and is payable upon presentation to that bank Question 2: What does it look like and how should it be filled in? Answer 2:

Drawers name, mailing address (place of issue) B Date of issue Drawees name, mailing address C Payable with L) Place of payment M) Amount in words and currency D I Accepted by K Drawers signature J Currency and amount in figures E F Pay against this Bill of Exchange to H Drawers ref Bill of Exchange A Maturity G

Main feature of a Bill of Exchange. A) Bill of Exchange included in the current text (applicable also under H) B) Drawers name = Name and address of the issuer of the Bill of Exchange i.e. the Seller.

C) Drawees name = Name and address of the paying part. D) The amount expressed in letters. E) The amount expressed in figures. F) Date of issue = the date of the issuance of the Bill of Exchange. G) Maturity = The maturity date of the Bill of Exchange. Upon immediate payment , write At sight. Upon payment at a pre-determined date, write maturity yyyy-mm-dd at a pre-determined date after shipment, e.g. 60 days after B/L date, write60 days date in G) and under F) date of shipment When a Bill of Exchange matures at a pre-determined period after acceptance, e.g. 60 days sight the acceptance shall include maturity date. H) Payee = the party receiving payment at maturity. In this field usually is written ourselves and the issuer of the Bill of Exchange makes an endorsement on the reverse of the Bill of Exchange. The endorsement is consisting of the firms stamp alt. the companys written name plus a signature of the person authorised to sign the Bill of Exchange. If required in a Letter of Credit or otherwise that a First and Second of Exchange should be presented, write on the first First (Second unpaid) and on the second Second (First unpaid) I) Field for additional information if applicable, e.g. Letter of Credit No. J) Drawers signature = The Sellers firm stamp+ signature alt. the companys written name plus the signature of the person authorised to sign the Bill of Exchange. K) When the drawee has accepted the Bill of Exchange he is called acceptor. L) It could be payable at a the domicile of a third party, e.g. a bank, whose address should be stated. M) Place of payment is the domicile of the drawee provided that M) is not evidencing otherwise. Question 3: Which international conventions are usually governing Bills of Exchange? Answer 3: Usually the Geneva or UK convention.

Question 4: What happens if the acceptor doesnt pay timely? Answer 4: Default of payment must be evidenced by an authentic act (protest for nonacceptance or non-payment), usually carried out by a Notary Public at the place where payment of the Bill of Exchange should have been done. The bona-fide holder (a holder in good faith) of the Bill of Exchange should approach the Notary Public. A summary protocol is established upon protesting. This may be utilized by the Bill of Exchange holder facilitating summary proceedings. A protest is made official at the place where payment should have been made. Question 5: In case of non-payment at maturity, what would an omission to protest imply for a bona-fide holder? (a holder in good faith) Answer 5: The bonafide holder is losing his Bill of Exchange rights against endorsers, the drawer and other Bill of Exchange parties with the exception for the acceptor. The holder maintains his right against the acceptor for three years, calculated from the date of maturity. Question 6: Can you explain endorsement? Answer 6: Endorsement is a legal term for the physical handing over of the instrument. The person handing over it (the endorser) to a succeding party can either endorse to a named party or make it payble to the bearer that is the person duly holding the Bill of exchange. Question 7: Can interest be specified in a Bill of exchange? Answer 7: When a bill of exchange is payable at sight, or at a fixed period after sight, the drawer may stipulate that the sum payable shall bear interest. The rate of interest must be specified in the Bill of Exchange, in default of such specification the stipulation shall be deemed not to be written. Question 8: From which date runs the interest in a Bill of Exchange? Answer 8:

From the date of the Bill of Exchange issuance, unless some other date is specified. Question 9: What consequences would it have where a person is acting for another person, a firm or company without authority to do so? Answer 9: He is bound himself as a party to the Bill of Exchange. Question 10: If a bill of exchange bears forged signatures, or signatures of fictitious persons, which are the consequences for the other persons who signed the Bill of Exchange? Answer 10: The obligations of the other persons who signed it are still valid. Question 11: What liability to a bona-fide holder have drawers, acceptors, endorsers or guarantors by aval in a Bill of Exchange? Answer 11: They are jointly and severally liable to the holder. The holder has the right of proceeding against all these persons individually or collectively without being required to observe the order in which they have become bound. Question 12: Ive heard that a Bill of Exchange could be guaranteed by an additional party, e.g. a bank? Answer 12: Thats correct, its called avalization. By signing as in this example the avalising party commits itself unconditionnally to pay in case the acceptor or drawee

should default.

Drawers name, mailing

AB Kylmaskiner Box 239 S-103 29 STOC

Drawees name, mailin

ABC Prawn Imp North Harbour

5

You might also like

- Bills of Exchage-Behaviour-Treatment and SystemDocument32 pagesBills of Exchage-Behaviour-Treatment and SystemUsaid Khan67% (15)

- Ion of Bill of ExchangeDocument11 pagesIon of Bill of Exchangeshami00992100% (1)

- How Does A Bill of Exchange Work?: Signed by The Person Giving It (Drawer)Document3 pagesHow Does A Bill of Exchange Work?: Signed by The Person Giving It (Drawer)asif abdullah78% (9)

- Financing Foreign Trade and International Trade DocumentsDocument9 pagesFinancing Foreign Trade and International Trade DocumentsStaidCasper100% (1)

- International Bill of Exchange and Promissory NotesDocument41 pagesInternational Bill of Exchange and Promissory NotesW897% (36)

- GUIDE TO DRAFTING A BILL OF EXCHANGEDocument1 pageGUIDE TO DRAFTING A BILL OF EXCHANGEDavid Oloo Stone100% (4)

- Bills of ExchangeDocument5 pagesBills of Exchangesara24391100% (3)

- How to correctly complete a bill of exchangeDocument2 pagesHow to correctly complete a bill of exchangeVũ Nguyễn100% (1)

- Bill of Exchange TemplateDocument2 pagesBill of Exchange TemplateSwank96% (25)

- Promissory Note PaymentDocument4 pagesPromissory Note Paymentjoe100% (7)

- CDs explainedDocument6 pagesCDs explainedcha chaNo ratings yet

- The Bill of ExchangeDocument11 pagesThe Bill of ExchangeInter_vivos56% (9)

- Bills of Exchange (Drafts) : Sample L/CDocument4 pagesBills of Exchange (Drafts) : Sample L/Cjuan andres praxedes mateo100% (3)

- Bill of ExchangeDocument12 pagesBill of ExchangeSandesh Jadhav89% (18)

- 27.bill of Exchange Promissory Note and CheckDocument9 pages27.bill of Exchange Promissory Note and Checkpreston_402003No ratings yet

- Bills of ExchangeDocument11 pagesBills of Exchangesmilesam50% (2)

- Bill of ExchangeDocument1 pageBill of ExchangeFreeman Lawyer100% (9)

- Bill of Exchange (Credit Instruments)Document12 pagesBill of Exchange (Credit Instruments)Aziz ShaikhNo ratings yet

- Promissory Note vs Bill ExchangeDocument4 pagesPromissory Note vs Bill ExchangeEloiza Evans80% (5)

- Discounting Bills of Exchange FinancingDocument7 pagesDiscounting Bills of Exchange FinancingEsha Ali ButtNo ratings yet

- Bankers AcceptanceDocument3 pagesBankers AcceptanceGilner PomarNo ratings yet

- Jans Bonded Promissory NoteDocument1 pageJans Bonded Promissory Noteexousiallc100% (1)

- IBOE LanguageDocument1 pageIBOE Languageexousiallc100% (6)

- Preauthorzed Letter of CreditDocument1 pagePreauthorzed Letter of Creditlakeshia1lovinglife10% (1)

- PS-bill of Exchange ActDocument35 pagesPS-bill of Exchange ActPhani Kiran MangipudiNo ratings yet

- Bill of Exchange GuideDocument0 pagesBill of Exchange Guidemy hoangNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeChetan SapraNo ratings yet

- Promissory Note Vs Bill PF ExchangeDocument2 pagesPromissory Note Vs Bill PF ExchangelexscribisNo ratings yet

- Bankers Acceptance Document for Purchase FinancingDocument2 pagesBankers Acceptance Document for Purchase Financingcktee77No ratings yet

- Enforcing Security Interests Under UCC Article 9ADocument35 pagesEnforcing Security Interests Under UCC Article 9AMichael JonesNo ratings yet

- Invoice for Non-Negotiable Bill of ExchangeDocument2 pagesInvoice for Non-Negotiable Bill of ExchangeBlak Lib86% (7)

- Letter of AdviceDocument2 pagesLetter of AdviceAndrew100% (6)

- BOE Bonded TemplateDocument2 pagesBOE Bonded TemplateSuzanne Cristantiello100% (6)

- Private Document Tender of PaymentDocument2 pagesPrivate Document Tender of PaymentPennyDoll94% (17)

- Bill of Exchange (Careful... )Document12 pagesBill of Exchange (Careful... )Jayanth Kumar93% (61)

- Bill of Exchange Group 4Document11 pagesBill of Exchange Group 4creepyguyNo ratings yet

- Bills of ExchangeDocument16 pagesBills of Exchangeimran shaikh100% (1)

- Void Where Prohibited by Law: Private Issue Private IssueDocument1 pageVoid Where Prohibited by Law: Private Issue Private IssueMikeDouglas89% (18)

- Letter of Credit TemplateDocument3 pagesLetter of Credit TemplateAnis InayahNo ratings yet

- 1 Certified Promissory NoteDocument5 pages1 Certified Promissory NoteLouis100% (8)

- IboeDocument2 pagesIboeHossein ParastehNo ratings yet

- 2012 June 15.bills of ExchangeDocument20 pages2012 June 15.bills of ExchangeAy Ar Ey Valencia100% (1)

- Bill of ExchangeDocument14 pagesBill of ExchangeMa Angelica Micah Labitag100% (8)

- Demand DraftDocument25 pagesDemand DraftDaksha PathakNo ratings yet

- 2 Bill of Exchange TemplateDocument1 page2 Bill of Exchange Templatepoppadoc19594% (17)

- Bill of ExchangeDocument4 pagesBill of ExchangeSara SanamNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- Bill of Exchange Case StudyDocument5 pagesBill of Exchange Case StudySudhir Kochhar Fema Author100% (2)

- International Bill of Exchange TemplateDocument1 pageInternational Bill of Exchange Templatejj85% (88)

- Definition of 'Endorsement' and Types of EndorsementsDocument5 pagesDefinition of 'Endorsement' and Types of EndorsementsMohib Ali100% (1)

- Bills and Notes GuideDocument8 pagesBills and Notes Guidebonnie.barma2831No ratings yet

- Private Registered Setoff and Discharge Bond: Non-NegotiableDocument7 pagesPrivate Registered Setoff and Discharge Bond: Non-NegotiableSwank100% (8)

- Negotiable Instruments 1229854285942730 1Document59 pagesNegotiable Instruments 1229854285942730 1Sameer Gopal100% (1)

- RemittanceDocument3 pagesRemittanceSalman Abrar100% (2)

- Promissory NoteDocument1 pagePromissory Noteapi-300362811No ratings yet

- Bills of Exchange and International PDFDocument61 pagesBills of Exchange and International PDFtraded12100% (2)

- LetterOfCredit Collateral Agreement M00AE M0071 A0003Document4 pagesLetterOfCredit Collateral Agreement M00AE M0071 A0003Ekologija FinansijeNo ratings yet

- Bill of ExchangeDocument3 pagesBill of Exchangemlo356100% (8)

- PV ManualDocument102 pagesPV ManualLind D. QuiNo ratings yet

- Module 6 Teaching Prof First Sem 2022-23Document33 pagesModule 6 Teaching Prof First Sem 2022-23Merleah Faith Soriano DumaquitNo ratings yet

- Law of Crimes: Internal Assessment - II Research PaperDocument16 pagesLaw of Crimes: Internal Assessment - II Research PaperIkshvaku MalhotraNo ratings yet

- Instant Download Quickbooks Online For Accounting 1st Edition Glenn Owen Solutions Manual PDF Full ChapterDocument29 pagesInstant Download Quickbooks Online For Accounting 1st Edition Glenn Owen Solutions Manual PDF Full Chapterdariusluyen586100% (4)

- 11th Physics Full Book MCQs PDFDocument34 pages11th Physics Full Book MCQs PDFWaqas Rajpoot100% (1)

- Rizal Commercial Banking Corporation vs. Serra, 701 SCRA 124, July 10, 2013Document7 pagesRizal Commercial Banking Corporation vs. Serra, 701 SCRA 124, July 10, 2013TNVTRLNo ratings yet

- PROJECT HSE REQUIREMENTSDocument129 pagesPROJECT HSE REQUIREMENTSzizu1234No ratings yet

- Jonathon Rowles v. Chase Home Finance, LLC Reply Memo in Support of Petition For TRODocument33 pagesJonathon Rowles v. Chase Home Finance, LLC Reply Memo in Support of Petition For TROForeclosure Fraud100% (1)

- 1948 Peru Military Rebellion Leads to Diplomatic DisputeDocument2 pages1948 Peru Military Rebellion Leads to Diplomatic DisputeHenna Lowe SanchezNo ratings yet

- Steve Mostyn TWIA Complaint Letter To U.S. Department of JusticeDocument4 pagesSteve Mostyn TWIA Complaint Letter To U.S. Department of JusticeTexas Public RadioNo ratings yet

- History of PNP.Document15 pagesHistory of PNP.Jorge Tessie ZamoraNo ratings yet

- 10 Encounters (Ladies of The Evening) Book 3Document34 pages10 Encounters (Ladies of The Evening) Book 3Mats-PeterHopfNo ratings yet

- Historical Development of CRPC 1973Document32 pagesHistorical Development of CRPC 1973Chirantan KashyapNo ratings yet

- Physics 2 Lab ReportDocument4 pagesPhysics 2 Lab Reportapi-236349398No ratings yet

- Mpaariaa AmicusDocument31 pagesMpaariaa AmicusEriq GardnerNo ratings yet

- Walmart Business Environment Week 2 Assignment BUSN310Document5 pagesWalmart Business Environment Week 2 Assignment BUSN310Hope Mwangi JohnNo ratings yet

- Tacit ProcurationDebt CollectorDocument11 pagesTacit ProcurationDebt Collectorgs8600mm100% (2)

- Anderson v. HoDocument3 pagesAnderson v. HoSJ San JuanNo ratings yet

- T7 B10 Team 7 MFRs Boivin FDR - 9-17-03 Leo Boivin Interview W Notes On MFRDocument4 pagesT7 B10 Team 7 MFRs Boivin FDR - 9-17-03 Leo Boivin Interview W Notes On MFR9/11 Document ArchiveNo ratings yet

- Kelsen's Pure Theory of LawDocument3 pagesKelsen's Pure Theory of LawManishaNo ratings yet

- Shareholder Agreement 06Document19 pagesShareholder Agreement 06Josmar TelloNo ratings yet

- Haddad v. Indiana Pacers Et Al - Document No. 69Document5 pagesHaddad v. Indiana Pacers Et Al - Document No. 69Justia.comNo ratings yet

- NIDCR Guidelines for Levels of Clinical Site MonitoringDocument5 pagesNIDCR Guidelines for Levels of Clinical Site MonitoringJosef BreuerNo ratings yet

- SDSDDocument197 pagesSDSDShymon Fababeir100% (2)

- Lorenzo Shipping Vs Chubb and SonsDocument13 pagesLorenzo Shipping Vs Chubb and SonsJake Ariño100% (1)

- Nxivm Doc 475: Lauren Salzman Pleads GuiltyDocument2 pagesNxivm Doc 475: Lauren Salzman Pleads GuiltyTony OrtegaNo ratings yet

- Guaranty and SuretyDocument2 pagesGuaranty and SuretyIresh VelanoNo ratings yet

- Registration of Association in KenyaDocument2 pagesRegistration of Association in KenyaSTEVENNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument188 pagesF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterNo ratings yet

- Review of LiteratureDocument14 pagesReview of LiteratureAbhishek SaravananNo ratings yet

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceFrom EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Richardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesFrom EverandRichardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesNo ratings yet

- Export & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesFrom EverandExport & Import - Winning in the Global Marketplace: A Practical Hands-On Guide to Success in International Business, with 100s of Real-World ExamplesRating: 5 out of 5 stars5/5 (1)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)