Professional Documents

Culture Documents

Where's Best Buy Headed? The Answer May Not Be So Clear...

Uploaded by

Walter BialasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Where's Best Buy Headed? The Answer May Not Be So Clear...

Uploaded by

Walter BialasCopyright:

Available Formats

WHERES BEST BUY HEADED?

THE ANSWER MAY NOT BE SO CLEAR

Just after New Years Forbes published an article entitled Why Best Buy is Going out of BusinessGradually (http://www.forbes.com/sites/larrydownes/2012/01/02/why-best-buy-isgoing-out-of-business-gradually/5/). With Best Buys shipping stumble during the holidays, the topic was ripe to be picked up by the media. While Best Buy does have challenges ahead with addressing online retailing and its stock price decline, the articles death spiral theme leading to a slow wind down seemed like an unusually strong tone. I decided to look at some of Best Buys performance metrics over time and see what the numbers showed. With the strong press, my guess was that there would be quantifiable erosion in performance over the last few years. First, Best Buy is a huge company. In FY2011 they generated total revenues of more than $50 billion from domestic and international operations. Best Buys domestic revenues also came in at over $37 billion (in comparison, Circuit City did $11.7 billion in 2008). Focusing on their US operations, what astounded me was that since the peak of the boom in 2007, their domestic revenues increased more than $6 billion, or almost 20%. This alone suggests Best Buys spiraling down might be overstated. Pundits also quickly point out that Best Buy has been losing market share to the likes of Amazon and Walmart due to poor customer service and higher prices. The information out there does not support this conclusion. In fact, in looking at the national consumer expenditure survey as a way to tally electronics and appliance sales across retailer categories, Best Buy has been increasing its market position. As can be noted below, in 2010 Best Buy garnered almost a 25%-share of the consumer electronics and appliance market, up from 20% when Circuit City was operating.

MARKET SHARE & US REVENUE GROWTH - BEST BUY

30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% $40.0 $35.0 $30.0 $25.0 $20.0 $15.0 $10.0 $5.0 $0.0

Market Share

Revenues - US (Billions)

Source: Best Buy 10K Reports; Consumer Expenditure Survey; Walter S. Bialas

Productivity per square foot is a different story, though. From a corporate standpoint, total revenues have been flat. According to company 10K reports, FY2011 came in at $865 per square foot. Slightly down from 2010, this metric has shown limited growth over the last few years. Domestic store performance has shown a similar trend, however, the overall rate is much higher coming in at $1,151 per square foot in FY2011. This per square foot rate is also close to the companys best number it has ever put on the boards and reflects a decent rebound in domestic revenues per square foot since the downturn, given the broad economic challenges we have all faced. What the US benchmark also demonstrates is the magnitude of the drag international operations have had on sales, despite increasing revenues. Same store sales are down slightly and some note that growth is being driven more by new store openings. While this is true, it must be recognized that consistent, high same store sales gains are difficult to achieve in a mature format like Best Buy. The chart below highlights longterm space growth and productivity gains for US operations and shows an inflection point where revenues have flattened in the face of continued store growth.

STORE EXPANSION & PRODUCTIVITY - BEST BUY

50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 $200 $0 $600 $400 $1,000 $800 $1,400 $1,200

Total US Space (Millions of SF)

Source: Best Buy 10K Reports; Walter S. Bialas

Revenues / SF - US

Another observation from this longer-term perspective is that Best Buy successfully rode the wave of the consumer electronics revolution. It is easy to forget that over this period the face of home entertainment changed. It was only in the mid-1990s that home theaters came into vogue and many upgraded to larger TVs (remember the giant 36 inchers) and related sound systems. By the late 1990s, VHS players were being scrapped for the new DVD format (test marketed in the US in 1997). And, over the last several years, the price decline of the high definition flat screens and Blue Ray disks (introduced in 2006) fueled revenue and market share increases. The challenge today is that there is no discernible consumer electronics revolution on the horizon that matches the magnitude of these changes, or a housing boom to fuel appliance sales. While 3D flat screens are being offered at reasonable prices and OLEDs are just now being introduced at the Consumer Electronics Show in Las Vegas, these are refinements and will not entice consumers to upgrade their hardware across the board.

For Best Buy, the question is how they reinvent their established brand in an era where consumers are spending more conservatively and where limited new products or technologies (even after accounting for smartphones and tablets) will be driving shoppers into their stores. Perhaps just as important is the fact that this sector has evolved into a commodity, where the lowest price (and availability) wins the sale. In this environment, ease of shopping and shipping drive the purchase. This forces Best Buy to compete with both bricks & mortar and online alternatives. While they are well positioned to do battle as evidenced by the companys solid domestic revenues and market share, consumer loyalty to a defined brand appears to be less relevant in todays online world where immediate fulfillment is the key. It is easy to argue for more downsized stores to maximize sales productivity, but that will also impact inventory choices for shoppers. While Best Buy has taken several knocks, gross and operating profits for their domestic operations have been stable. It is reasonable to assume that this stability will be pressured over the foreseeable future as Best Buy addresses consumer preferences and deals with their large inventory of physical store space. In any event, it seems premature to begin anticipating a wind down anytime soon. Best Buy looks to have the foundation in place to remain relevant, even though the companys selling space may look different in the years ahead and challenge shopping center owners to adapt to the companys changing needs.

PROFIT METRICS AS A % OF US REVENUE - BEST BUY

30% 25% 20% 15% 10% 5% 0%

Gross Proft

Operating Profit

Source: Best Buy 10K Reports; Walter S. Bialas

Walter Bialas has more than 25 years of real estate advisory experience in consulting, banking, and development. He has served as chair of ICSCs North American Research Task Force and is an active member of ULIs Advisory Services program. He can be reached at 703-919-8553 or by email at wbialas@verizon.net.

January 2012

You might also like

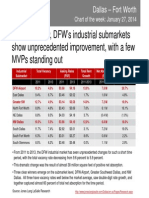

- DFW Industrial Market Shows Unprecedented ImprovementDocument1 pageDFW Industrial Market Shows Unprecedented ImprovementWalter BialasNo ratings yet

- Transportation Improvements Pave The Way For Continued Suburban Office Growth in DallasDocument1 pageTransportation Improvements Pave The Way For Continued Suburban Office Growth in DallasWalter BialasNo ratings yet

- Dallas' Top Office SubmarketsDocument1 pageDallas' Top Office SubmarketsWalter BialasNo ratings yet

- JLL - Dallas Skyline Review - Spring 2014Document1 pageJLL - Dallas Skyline Review - Spring 2014Walter BialasNo ratings yet

- Legacy Town Center's Performance Driven by Amenities and Mixed-UseDocument1 pageLegacy Town Center's Performance Driven by Amenities and Mixed-UseWalter BialasNo ratings yet

- High Tenant Diversity - Technology, Finance and Business Services Leadind Sectors in Far North Dallas SubmarketDocument1 pageHigh Tenant Diversity - Technology, Finance and Business Services Leadind Sectors in Far North Dallas SubmarketWalter BialasNo ratings yet

- Recent Home Prices and Demand in Dallas - Fort WorthDocument1 pageRecent Home Prices and Demand in Dallas - Fort WorthWalter BialasNo ratings yet

- Industrial and Flex Product Sales Transactions Steady in Dallas - Fort WorthDocument1 pageIndustrial and Flex Product Sales Transactions Steady in Dallas - Fort WorthWalter BialasNo ratings yet

- Build-To-Suit Projects and Retailers Driving Dallas' Industrial ConstructionDocument1 pageBuild-To-Suit Projects and Retailers Driving Dallas' Industrial ConstructionWalter BialasNo ratings yet

- Fort Worth Economy Shows Resilience Over Last Economic Cycels and Is Poised For Future GrowthDocument1 pageFort Worth Economy Shows Resilience Over Last Economic Cycels and Is Poised For Future GrowthWalter BialasNo ratings yet

- Alliance Airport, A Key Logistics Cetner in The DFW RegionDocument1 pageAlliance Airport, A Key Logistics Cetner in The DFW RegionWalter BialasNo ratings yet

- Nebraska Furniture Mart Expanding To DallasDocument1 pageNebraska Furniture Mart Expanding To DallasWalter BialasNo ratings yet

- Continued Hotel Recovery in Dallas Should Fuel Revenue IncreasesDocument1 pageContinued Hotel Recovery in Dallas Should Fuel Revenue IncreasesWalter BialasNo ratings yet

- Planning, Patience and Public Investment Shaping Dallas' CBD Into A "New" DowntownDocument1 pagePlanning, Patience and Public Investment Shaping Dallas' CBD Into A "New" DowntownWalter BialasNo ratings yet

- Long-Term Planning Creates New Downtown Dallas GatewayDocument1 pageLong-Term Planning Creates New Downtown Dallas GatewayWalter BialasNo ratings yet

- Retail Distress in Major Markets - Shopping Center Leasing Makes Headway at Reducing DistressDocument2 pagesRetail Distress in Major Markets - Shopping Center Leasing Makes Headway at Reducing DistressWalter BialasNo ratings yet

- Development Trends in The Rosslyn-Ballston CorridorDocument1 pageDevelopment Trends in The Rosslyn-Ballston CorridorWalter BialasNo ratings yet

- Projects Begin To Crystalize Around New Gateway To Downtown DallasDocument1 pageProjects Begin To Crystalize Around New Gateway To Downtown DallasWalter BialasNo ratings yet

- Retail Spending Patterns - Where We StandDocument2 pagesRetail Spending Patterns - Where We StandWalter BialasNo ratings yet

- Case Shiller Index ReviewDocument2 pagesCase Shiller Index ReviewWalter BialasNo ratings yet

- The Latest Job Report - "Where's The Beef"...Document2 pagesThe Latest Job Report - "Where's The Beef"...Walter BialasNo ratings yet

- DC Retail Space Leasing LeaderDocument1 pageDC Retail Space Leasing LeaderWalter BialasNo ratings yet

- Rosslyn-Ballston Versus Bethesda-Chevy ChaseDocument1 pageRosslyn-Ballston Versus Bethesda-Chevy ChaseWalter BialasNo ratings yet

- Case Shiller Index ReviewDocument2 pagesCase Shiller Index ReviewWalter BialasNo ratings yet

- DC Region Jobs - Part 2Document1 pageDC Region Jobs - Part 2Walter BialasNo ratings yet

- DC Front-Runner in Office LeasingDocument1 pageDC Front-Runner in Office LeasingWalter BialasNo ratings yet

- DC Region Jobs - Part 1Document1 pageDC Region Jobs - Part 1Walter BialasNo ratings yet

- Net Office Absorption As A Share of Leasing in DCDocument1 pageNet Office Absorption As A Share of Leasing in DCWalter BialasNo ratings yet

- Recovery in Commercial Real Estate - Wanting For JobsDocument2 pagesRecovery in Commercial Real Estate - Wanting For JobsWalter BialasNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BCG Breaking Compromises May1997Document3 pagesBCG Breaking Compromises May1997anahata2014No ratings yet

- CarmaxDocument29 pagesCarmaxGuan Jie Xue100% (1)

- Strategic Management 2nd Edition Rothaermel Solutions Manual 1Document19 pagesStrategic Management 2nd Edition Rothaermel Solutions Manual 1dorothy100% (46)

- Best Buy Co., Inc. Customer-CentricityDocument8 pagesBest Buy Co., Inc. Customer-CentricityjddykesNo ratings yet

- AnalyticsDocument49 pagesAnalyticsdebashisdasNo ratings yet

- Progress Test Elementary Units 7, 8 and 9Document3 pagesProgress Test Elementary Units 7, 8 and 9emmrodriguez8100% (1)

- Value Investor Insight 2006-12Document20 pagesValue Investor Insight 2006-12Lucas Beaumont100% (1)

- Business Analytics: Company: BlackberryDocument15 pagesBusiness Analytics: Company: BlackberryAngelica EsguireroNo ratings yet

- ACCT2119 ABO Assessment 1 Case Study Sem 1 2024Document3 pagesACCT2119 ABO Assessment 1 Case Study Sem 1 2024ytzhang315No ratings yet

- Best BuyDocument15 pagesBest BuySharifah Norhafiza Syed Othman100% (1)

- ManagerDocument2 pagesManagerapi-78015046No ratings yet

- Strategy Formulation. Action Plan Choice (2023)Document52 pagesStrategy Formulation. Action Plan Choice (2023)Basit AliNo ratings yet

- Case Assignment MNGMNT BirhaassasaDocument9 pagesCase Assignment MNGMNT BirhaassasaBirhanu BerihunNo ratings yet

- Brand AuthenticityDocument17 pagesBrand AuthenticitySuryaWigunaNo ratings yet

- Circuit City Case StudyDocument2 pagesCircuit City Case Studyjannetka1100% (1)

- Corporate VenturingDocument28 pagesCorporate Venturingniveditha2495No ratings yet

- Case Study 1Document2 pagesCase Study 1Bizuwork Simeneh100% (2)

- Team-8 ResidencyPPTDocument17 pagesTeam-8 ResidencyPPTsai raoNo ratings yet

- 9382 - Best Buy Growth Through Segmentation.Document7 pages9382 - Best Buy Growth Through Segmentation.CfhunSaatNo ratings yet

- Best Buy's mission to make technology deliver on its promises to customersDocument12 pagesBest Buy's mission to make technology deliver on its promises to customersMiles Allen I. BenemeritoNo ratings yet

- Case Study - Circuit City CaseDocument4 pagesCase Study - Circuit City CaseMohammedNo ratings yet

- Compensation Chap 1Document23 pagesCompensation Chap 1Evelyn Grace Edwin RajanNo ratings yet

- The Everything Store Jeff Bezos and The Age of Amazon-Notebook (PDFDrive)Document24 pagesThe Everything Store Jeff Bezos and The Age of Amazon-Notebook (PDFDrive)Roman TilahunNo ratings yet

- Argyle Conversation With Steven WolkDocument6 pagesArgyle Conversation With Steven WolkMindtree LtdNo ratings yet

- Chapter One The Pay Model: 1 - 1 Compensation - Thirteenth EditionDocument23 pagesChapter One The Pay Model: 1 - 1 Compensation - Thirteenth EditionJerome Formalejo100% (1)

- Circuit City: By: Nicholas Holt, Silvana Karam, Ashish PatelDocument24 pagesCircuit City: By: Nicholas Holt, Silvana Karam, Ashish PatelAl AminNo ratings yet