Professional Documents

Culture Documents

Does A Faulty Barometer Herald A Storm For Stocks Bs

Uploaded by

dec10titanmassOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Does A Faulty Barometer Herald A Storm For Stocks Bs

Uploaded by

dec10titanmassCopyright:

Available Formats

Title: Does a Faulty Barometer Herald bad weather for Stocks? Number Of Words: 1776 Summary: ?

The The month of january Barometer? simply states that ?As goes The month of january, so goes the entire year,? also it?utes tallied up a apparently amazing predicting record since prior to Yale Hirsch of Stock Trader?s Almanac first made popular it as soon as 1972.

Key phrases: Stocks, Stock Exchange, The month of january Barometer, investor, trading, trader, predicting, investment, S&P, s and p, DJIA,

Body Building: In the event you fire your financial consultant and employ a month to be able to optimize your resource allocation? Most likely so, if you think maybe advocates of the time-honored indicator of future stock exchange performance referred to as ?The The month of january Barometer.? The Barometer simply states that ?As goes The month of january, so goes the entire year,? also it?utes tallied up a apparently amazing predicting record since prior to Yale Hirsch of Stock Trader?s Almanac first made popular it as soon as 1972. Since 1938, the direction of change from the benchmark S&P within the first month from the gate has matched up the entire year in general greater than a whopping 80% of times, making The month of january undoubtedly probably the most predictive month around the calendar. The outcomes are similarly impressive if you are using the Dow Johnson Industrial Average (DJIA) like a yardstick and, even though it somewhat reduces the precision from the predicting tool, should you assess effectiveness within the next 11 or 12 several weeks to prevent double-counting The month of january?s moves within the periods it?s designed to foreshadow. Dating back the beginning from the NASDAQ Composite Index in 1971, The month of january accomplishes the finest success associated with a month in anticipating the movement of OTC stocks through the following 11 or 12 several weeks, and ranks second simply to April in the correlation with calendar-year final results. Beginning from 1950, an up The month of january has meant in regards to a 13% grow in stock values through the rest of the year, while opening having a lower month presaged in regards to a 1% loss. Criticisms from the The month of january Barometer

The historic evidence looked much more compelling at the beginning of this decade, however the The month of january Barometer laid an egg in 3 of history five years. In 2001, an optimistic The month of january known as a premature finish to some bear market that got ugly after Al Qaeda suicide hijackers assaulted the planet Trade Center and Government. In 2003, stocks rejected in The month of january, ongoing an in-depth correction within the wake of the sharp initial rally from the final bear market low from the previous October, but switched greater in spring to climb 26.4% by year-finish, still the greatest annual gain because the the nineteen nineties. This past year, the marketplace fell again in The month of january, simply to begin to see the S&P 500 eke out a 3% gain its 2005, even though Dow edged lower a part of a percent. However, the lackluster display through the blue chips really understated the result from the Barometer?s error each year by which more compact stocks outperformed for any sixth straight some time and the typical stocks mutual fund came back an overall total 9.5%. Supporters from the The month of january Barometer sometimes indicate the twentieth Amendment, a bit of Depression-era legislation also called the ?Lame Duck Amendment,? to describe why it really works. The Twentieth Amendment necessitates that presidential terms, in addition to individuals of senators and reps, shall conclude in The month of january, and requires congress to convene on The month of january 3. Formerly, they didn?t toss the rascals out until March. Despite ratification at the begining of 1933, the amendment didn?t be effective until 1934. Hence the country was instructed to endure 4 several weeks of lame-duck leadership from the at that time extremely unpopular Herbert Hoover following the 1932 election, because the Great Depression deepened and Wall Street surrendered the huge majority of its spectacular gains accomplished throughout the summer time of ?32, following a stock exchange bottom. Now, the leader provides his Condition from the Union Address, highlighting focal points for that year ahead, and uncovers his suggested budget in The month of january, making the month particularly influential, approximately the idea goes. Obviously, they don?t hold national elections each year, and many of the leaders are incumbents or political figures with already well-known agendas. When the timing from the presidential inauguration is really important, why didn?t a ?March Barometer? predict stocks? future before 1934? From 1897 through 1933, the direction taken through the DJIA in The month of january corresponded fully year?s results 23 occasions from 37, versus just 20 of 37 for March. The record throughout that interval stays exactly the same even when you substitute the S&P for that Dow starting in 1928, the very first year they tabulated daily prices for that S&P. Staunch defenders from the The month of january Barometer prefer to commence their documentation in 1938, stating the especially uneven congressional margins loved by Dems earlier underneath the FDR Administration. This smacks of classic backfitting, however. Is the real cause of some-year delay in implementation of the pet prognostic technique rather function as the disastrous performance proven through the The month of january Barometer within the 1934-1937 time-frame? In 1934, the S&P leaped a strong 10% in The month of january, simply to slide 19% throughout the following 12 several weeks. Should you offered on The month of january?s 4% dip to start 1935, you skipped a roaring 57% advance. And when a 4% increase in The month of january 1937 tempted you to definitely bite, the stock exchange?s October 1937 crash broke up with you licking your wounds among a 41% plunge. Another advantage to selecting

1938 like a beginning point, while disregarding the whole 1897-1937 period, rests in the truth that most market years are up years, and also the newer era captures the secular bull marketplaces of 1949-1968 and 1982-2000, departing the worst many years of the Depression and also the relatively dull marketplaces from the first two decades from the twentieth century. In 1897-1937, stocks increased only 23 from 41 occasions (56%), in comparison to 47 of 67 (twelve months was unchanged), or 70%, subsequently. The month of january in the past ranks because the second-most powerful thirty day period for stocks, trailing only December. The month of january Barometer?s Notable Failures Still, in on the century because the creation of reliable daily stock earnings, the The month of january Barometer has a 72% (78 of 108) rate of success, including an amount of precision approaching 80% throughout individuals years where the market closed greater in The month of january, as was the situation this season. The S&P 500, through Friday, Feb 10, 2006, remains over 1% lower this month after striking new bull market levels a couple of short days ago. Accordingly, this appears like a great time to look at a few of the The month of january Barometer?s noticably failures following individuals times when it made an appearance to demand further stock cost appreciation. 1902: The DJIA established your final bull market peak in June 1901 and ongoing to edge lower slightly in 1902. 1903: Railroad stocks had risen for more than 6 years, a lot more than tripling with no serious setback, once they capped in September 1902. Their yearlong bear market only agreed to be getting began when 1903 folded around, as well as their eventual collapse would drag lower the industrials. 1906: Final bull market full of late The month of january, and also the DJIA was nearly cut in two prior to the finish of 1907. 1914: A 5-year bear market, which started by having an not successful assault on all-time levels in 1909, climaxes in This summer 1914 when government bodies shut lower the brand new You are able to Stock Market in the start of The First World War. 1917: After stocks a lot more than double to some November 1916 final top within the initial few many years of the War, by which America will get wealthy delivering the Allies in Europe, the marketplace drops 40% by December 1917, as direct U.S. participation within the conflict looms. 1929-31: Stocks crash after an explosive rally within the summer time of 1929 caps an 8-year bull run, ushering within the Great Depression. Positive traders prematurely bid stocks greater to start each one of the next 24 months, simply to be sorry. 1934: After a lot more than doubling in under annually, the brand new bull market stalls following fresh

levels in Feb 1934. 1937: A March top culminates funding of nearly five years and 372% within the DJIA prior to the short but severe 1937-38 ?Roosevelt Recession,? which saw industrial production fall faster than throughout 1929-32 and cut the Dow in two. 1946: A final thrust greater carrying out a 10% Feb correction basically postpones the inevitable. The 129% DJIA grow in a span in excess of four years concluding inside a May 29, 1946 peak grossly understates the extent from the advance prior to our prime. The S&P does considerably much better than that, along with other earnings leave nowhere chips within the dust. Railroad stocks nearly triple, and also the Dow Johnson Utility Average quadruples. 1966: Another bull market launches within the second year from the decade, simply to die within the sixth, because the Dow touches 1000 the very first time on the way to a Feb 9, 1966 closing high. 1994: On Feb 2, the anniversary date that preceded the 1946 correction, and in the fourth year of the bull market, stocks start a 10% correction, as with 1946. This time around, however, instead of rapidly racing to some final top following the correction has ended, the stock exchange trades inside a narrow range through the relaxation of the season before busting out greater in 1995. 2001: The the nineteen nineties bull market amazingly lasts over 20 years, using the NASDAQ Composite from the mere 325 to above 5000 in March 1990. Following a run like this, the ensuing bear market wasn?t nearly complete despite a reflex rally at the begining of 2005. So What Can be Learned? What are the training we are able to originate from the 14 notable failures from the The month of january Barometer referred to above? Six from the good examples (1902, 1903, 1917, 1930, 1931, 2001) involve false The month of january rallies that developed in early stages of bear marketplaces. Clearly, we don?t squeeze into this category. The bear market following a late the nineteen nineties tech-stock mania bottomed on October 9, 2002. Our market achieved its subsequent high-to-date just recently. Could we've already seen the ultimate top, or might the whole advance since 2002 represent simply a stretched out bear market rally? The second possibility could be basically uncommon, given how long passed because the low. Nonetheless, bull marketplaces happen to be recognized to expire inside a shorter time compared to three years and three several weeks needed to trudge towards the The month of january 11, 2006 closing levels within the DJIA and S&P. Nearly half of previous misleadingly bullish Januarys came late in lengthy or effective bull marketplaces,

throughout time (1906, 1929, 1934, 1937, 1946, 1966) of the final tops. The second 3 such cases, like our present situation, all unfolded following ?second-year lows,? but offered up more time and much more energetic advances compared to 2002-06 bull market to date. The Two-month, 12% bounce within the S&P from the low last October 13 would represent an uncharacteristically brief and anemic concluding bull leg, especially anticlimactic around the heels of the flat year. Unlike 1946, 1965-66 and 1994, we haven?t seen a tenPercent market decline in a while. The biggest correction the marketplace could muster in 2005 was around the order of sevenPercent. The less-than-stellar 52% maximum improvement within the closing cost from the Dow since its October 9, 2002 trough can also be tepid by bull market standards. As with 1942-46, the S&P is in front of the DJIA, and larger indexes have crushed both blue-nick measures, however the S&P?s reluctance so far to challenge its all-time high, unlike the Dow after it had been similarly cut in two a century ago, further attests towards the underachieving character from the existing bull. Still, this bull marketplace is undeniably lengthy within the tooth, and sufficient time remains in 2006 to setup your final top after which possibly stage a decline large enough to create a liar from the The month of january Barometer for any fourth amount of time in 6 years.

Online document and project management for investors with file sharing and collaboration tools

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Midf FormDocument3 pagesMidf FormRijal Abd ShukorNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Google Hacking CardingDocument114 pagesGoogle Hacking CardingrizkibeleraNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 02 Ching Kian Chuan v. CADocument2 pages02 Ching Kian Chuan v. CACarissa Bonifacio100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- CSI Effect PaperDocument6 pagesCSI Effect PaperDanelya ShaikenovaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 201908021564725703-Pension RulesDocument12 pages201908021564725703-Pension RulesanassaleemNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- C. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRADocument1 pageC. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRAJocelyn Yemyem Mantilla VelosoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- حماية الغير بالإشهار القانوني للشركة التجاريةDocument17 pagesحماية الغير بالإشهار القانوني للشركة التجاريةAmina hltNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Save Clay Court OpinionDocument12 pagesSave Clay Court OpinionWNDUNo ratings yet

- 14 Virgines Calvo v. UCPBDocument1 page14 Virgines Calvo v. UCPBEloise Coleen Sulla PerezNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Clerkship HandbookDocument183 pagesClerkship Handbooksanddman76No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Philippine Health Care Providers, Inc. Vs CIR Case DigestDocument2 pagesPhilippine Health Care Providers, Inc. Vs CIR Case DigestJet jet NuevaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Copyreading and Headline Writing Exercise 2 KeyDocument2 pagesCopyreading and Headline Writing Exercise 2 KeyPaul Marcine C. DayogNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RMNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Swot of ICICI BankDocument12 pagesSwot of ICICI Bankynkamat100% (6)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Tab 82Document1 pageTab 82Harshal GavaliNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chinese OCW Conversational Chinese WorkbookDocument283 pagesChinese OCW Conversational Chinese Workbookhnikol3945No ratings yet

- Full Download Family Therapy Concepts and Methods Nichols 10th Edition Test Bank PDF Full ChapterDocument36 pagesFull Download Family Therapy Concepts and Methods Nichols 10th Edition Test Bank PDF Full Chaptercategory.torskhwbgd100% (15)

- Despiece Upgrade PDFDocument5 pagesDespiece Upgrade PDFjonbilbaoNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Republic of The Philippines Province of Capiz Municipality of DumaraoDocument2 pagesRepublic of The Philippines Province of Capiz Municipality of DumaraoCHEENY TAMAYO100% (1)

- G.R. No. 160384 - Cesar T. Hilario v. Alan T. SalvadorDocument11 pagesG.R. No. 160384 - Cesar T. Hilario v. Alan T. SalvadorKIM COLLEEN MIRABUENANo ratings yet

- Baile Ateneo The Ateneo Fiesta Dance Sport ShowdownDocument3 pagesBaile Ateneo The Ateneo Fiesta Dance Sport ShowdownCalingalan Hussin CaluangNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- D'Alembert's Solution of The Wave Equation. Characteristics: Advanced Engineering Mathematics, 10/e by Edwin KreyszigDocument43 pagesD'Alembert's Solution of The Wave Equation. Characteristics: Advanced Engineering Mathematics, 10/e by Edwin KreyszigElias Abou FakhrNo ratings yet

- Farm Animal Fun PackDocument12 pagesFarm Animal Fun PackDedeh KhalilahNo ratings yet

- Art 1455 and 1456 JurisprudenceDocument7 pagesArt 1455 and 1456 JurisprudenceMiguel OsidaNo ratings yet

- Vasquez Vs CADocument8 pagesVasquez Vs CABerNo ratings yet

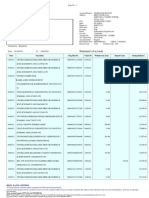

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 1788-10 Series 310 Negative Pressure Glove Box ManualDocument10 pages1788-10 Series 310 Negative Pressure Glove Box Manualzivkovic brankoNo ratings yet

- Board of Commissioners V Dela RosaDocument4 pagesBoard of Commissioners V Dela RosaAnonymous AUdGvY100% (2)

- Art 6. Bengzon Vs Blue Ribbon Case DigestDocument3 pagesArt 6. Bengzon Vs Blue Ribbon Case DigestCharlotte Jennifer AspacioNo ratings yet

- Permitting Procedures HazardousDocument35 pagesPermitting Procedures HazardousCarol YD56% (9)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)