Professional Documents

Culture Documents

New York State Consumer Real Estate Sentiment Scores: Siena Research Institute

Uploaded by

jspectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New York State Consumer Real Estate Sentiment Scores: Siena Research Institute

Uploaded by

jspectorCopyright:

Available Formats

SIENA RESEARCH INSTITUTE

SIENA COLLEGE, LOUDONVILLE, NY

WWW.SIENA.EDU/SRI

Siena College Research Institute & New York State Association of REALTORS

New York State Consumer Real Estate Sentiment Scores

4th Quarter 2011

For Immediate Release: Monday, January 23, 2012 For information/comment: Dr. Don Levy 518-783-2901 For data summary, or charts, visit www.nysar.com or www.siena.edu/sri

Most Expect Market to Hold Steady or Improve a Little in Year to Come Sentiment towards Current Real Estate Market Edges Lower; Hits 2-Year Low

Buffalo, Rochester, Syracuse Least Forlorn; Improvement Expected in Most Areas

Albany, NY -- New Yorkers assessment of the current real estate market edged even lower after hitting a seven quarter low in October, according to Dr. Don Levy, SRIs Director. A staggering forty-nine percent say the market has worsened over the last year while only fifteen percent believe conditions have improved. But expectations for the market and property values a year from today are slightly stronger across the state and in all areas than they were only three months ago. Residents continue to say that it is a phenomenal time to buy but a very problematic moment to sell. While a quarter expect sellers lives to improve over the next year, nearly half predict prospects for sellers to remain about the same through 2012 as they are today.

4th Quarter 2011 Real Estate Sentiment:

4th Quarter 2011 -41.7 (-2.4) 4.3 (5.4) -50.8 (-3.8) 3.2 (3.5) 29.2 (-2.3) 16.0 (2.8)

NYC -38.6 (-6.0) 5.1 (1.0) -51.6 (-11.5) 4.0 (-3.1) 23.2 (-2.9) 11.5 (0.9)

Suburbs

-52.1 (-3.0) 2.1 (6.7) -50.0 (6.8) 3.4 (10.1) 41.1 (-1.3) 20.6 (-4.5)

Upstate -38.3 (2.2) 4.7 (10.7) -50.5 (-1.3) 2.1 (8.8) 29.3 (-1.7) 19.0 (9.6)

Overall Current Overall Future Sell Current Sell Future Buy Current Buy Future

( ) reflects change from previous quarter

The overall current Real Estate Sentiment score among New Yorkers in the fourth quarter of 2011 is -41.7 well below the point where equal percentages of citizens feel optimistic and pessimistic about the housing market and it is down 2.4 points from last quarter. Looking forward, the overall future Real Estate Sentiment score is 4.3 (up from -1.1 last quarter) indicating that New Yorkers expect the overall real estate market and the value of property to remain virtually unchanged over the next year. Consumers see now as a poor time to sell with a score significantly below breakeven at -50.8, but as a very good time to buy with a high positive score of 29.2.

Overall Current -41.7 -38.6 -52.1 -38.3 -45.4 -37.2 -36.6 -38.7 -43.8 -42.2 -38.9 Overall Future 4.3 5.1 2.1 4.7 1.8 10.1 7.7 2.2 5.9 7.0 -1.7 Sell Current -50.8 -51.6 -50.0 -50.5 -53.7 -49.8 -46.2 -48.4 -52.6 -50.3 -52.3 Sell Future 3.2 4.0 3.4 2.1 1.9 6.9 8.2 2.7 3.6 6.5 -4.1 Buy Current 29.2 23.2 41.1 29.3 13.8 42.4 50.3 33.8 25.7 40.6 9.3 Buy Future 16.0 11.5 20.6 19.0 11.5 18.8 26.4 13.4 18.1 23.1 3.9

NEW YORK STATE NYC Suburbs Upstate Less than $50,000 $50,000-$100,000 $100,000 or more Male Female Homeowner Renter

Consumer views of the housing market continue to be through the dark prism of a limited economic recovery and slow employment growth, said Duncan MacKenzie, NYSAR CEO. Naturally, this would result in a negative outlook on the housing market, and is undoubtedly keeping some consumers on the sidelines despite record-low mortgage rates. However, homes are still selling and when we release our annual housing data later this week, it will show that 2011 statewide sales were only 4-percent below 2010. The good news there for both homeowners and sellers is that the statewide median sales price remains stable. Homeownership in the Empire State continues to provide both quality of life and financial benefits.

Current Sentiment Scores

2010 - 2011

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Buy Current Sell Current

35.3

32.5

35.1

33.1

31.4

30.7

31.5

29.2

Overall Current

-18.8 -28.3 -38.9 -30.0 -31.0 -40.1 -32.0 -42.2 -26.6 -30.9 -36.7 -41.3 -39.3 -47.0 -41.7 -50.8

Thriving

While still negative, sentiment towards the current real estate market including property values is strongest and improving in Buffalo, Rochester and Syracuse. Statewide, some relief is in sight, as future expectations are up ever so slightly across the state and in every area except in the Capital Region. Despite scary numbers today for sellers, residents of Buffalo, Albany and Long Island anticipate meaningful improvement. Residents of Binghamton, Mid-Hudson and Rochester expect no change, Dr. Levy said.

Each Real Estate Sentiment score is derived through statistical diffusion weighted to consider response intensity. A sentiment score of zero (0) in any category, reflects a breakeven point at which equal levels of optimism and pessimism among the population have been measured relative to the overall market, or buying or selling real estate. Scores can range from an absolute low of -100 to a high of 100 but scores below -50 or above +50 are both rare and extreme. If 100 percent of people describe the overall market or either buying or selling as greatly improved the sentiment score would equal 100. Conversely, universal extreme pessimism would score -100. Scores measure and reflect the collective sentiment of residents of New York State. Current scores report recent change in consumer sentiment while future scores measure consumers projected change in sentiment as they approach the coming year. In reviewing the Sentiment Scores look first at the relationship within each category Overall, Sell, and Buy between current and future. Current scores measures sentiment towards the present relative to the recent past while future projects change in sentiment from the current to one year from now. An increase from a current score to a future score denotes a positive change in sentiment relative to the present. In every case when considering any of the six sentiment scores, a net positive number indicates that the collective sentiment is such that people sense improvement while a negative net score predicts or measures a collective recognition of worsening. Todays six scores including both negative current sentiment in two cases and positive future scores is indicative of a changing market.

A thriving real estate market remains out of reach for New Yorkers but while a plurality of thirty-eight percent expect 2012 to be a year of treading real estate, more, thirty-three percent predict better conditions to be on next years horizon than the twenty-two percent that anticipate more decline, notes Dr. Levy.

The SRI survey of Consumer Real Estate Sentiment was conducted throughout October, November and December 2011 by random telephone calls to 2,407 New York State residents over the age of 18. A minimum of 400 additional respondents were surveyed in each MSA except NYC and Long Island. The NYC sample was obtained as part of the statewide survey and the Long Island sample was primarily obtained through the statewide survey and augmented so as to guarantee a minimum of 400 respondents. As the sentiment scores are developed through a series of calculations, margin of error does not apply. For more information or comments, please call Dr. Don Levy at 518.783.2901. Data and charts can be found at www.siena.edu/sri/ . SRI is an independent, non-partisan research institute. SRI subscribes to the American Association of Public Opinion Research (AAPOR) Code of Professional Ethics and Practices.

Region Charts & Graphs

Overall Current -42.5 (-5.8) -46.5 (-2.4) -21.5 (4.3) -48.6 (-1.7) -50.7 (5.2) -20.9 (6.6) -24.8 (3.0) -44.7 (-7.2) Overall Future 8.4 (-6.7) 2.2 (5.6) 18.4 (8.2) 6.4 (5.8) 0.0 (1.6) 14.7 (3.2) 7.1 (2.5) 3.5 (7.5) Sell Current -46.7 (-2.5) -50.9 (3.5) -34.7 (0.6) -47.2 (7.6) -53.7 (8.2) -40.9 (-1.0) -50.9 (-7.1) -49.7 (3.0) Sell Future 10.7 (-2.0) -0.6 (1.8) 12.7 (4.2) 8.6 (14.2) 0.5 (10.7) 0.8 (-5.7) -3.2 (-6.2) -4.3 (2.7) Buy Current 34.9 (-7.4) 21.5 (-5.2) 36.4 (8.0) 41.2 (-4.8) 42.6 (-2.9) 40.1 (3.3) 38.8 (0.0) 26.2 (-7.9) Buy Future 23.2 (-5.9) 18.4 (8.9) 21.9 (2.8) 22.7 (-1.9) 23.7 (-7.2) 23.2 (4.1) 10.4 (-3.4) 12.2 (-4.5)

Albany MSA Binghamton MSA Buffalo MSA Long Island MSA Mid-Hudson MSA Rochester MSA Syracuse MSA Utica MSA

( ) reflects change from previous quarter

Consumer Real Estate Sentiment

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 New York City 4th Quarter 2011

23.2 11.5 5.1

Overall Current Overall Future

4.0

Current Sell Future Sell Current Buy Future Buy

-38.6 -51.6

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Albany 4th Quarter 2011

34.9 23.2 8.4

Overall Current Overall Future

10.7

Current Sell Future Sell Current Buy Future Buy

-42.5

-46.7

Consumer Real Estate Sentiment

Binghamton 4th Quarter 2011 55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0

21.5 2.2

Overall Current Overall Future

18.4

Current Sell Future Sell Current Buy Future Buy

-0.6

-46.5

-50.9

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Buffalo 4th Quarter 2011

36.4 18.4 21.9

12.7

Overall Current

Overall Future

Current Sell Future Sell Current Buy Future Buy

-21.5 -34.7

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Long Island 4th Quarter 2011

41.2 22.7 8.6 6.4

Overall Current Overall Future Current Sell Future Sell Current Buy Future Buy

-48.6

-47.2

Consumer Real Estate Sentiment

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 Mid-Hudson 4th Quarter 2011

42.6 23.7 0.5

Current Sell Future Sell Current Buy Future Buy

0.0

Overall Current Overall Future

-50.7

-53.7

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Rochester 4th Quarter 2011

40.1 23.2 14.7

0.8

Overall Current Overall Future Current Sell Future Sell Current Buy Future Buy

-20.9 -40.9

Consumer Real Estate Sentiment

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 Syracuse 4th Quarter 2011

38.8

7.1

Overall Current Overall Future

10.4

Current Sell Future Sell Current Buy Future Buy

-3.2

-24.8

-50.9

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Utica 4th Quarter 2011

26.2 12.2 3.5

Overall Current Overall Future Current Sell Future Sell Current Buy Future Buy

-4.3

-44.7

-49.7

You might also like

- New York State Consumer Real Estate Sentiment Scores: Siena Research InstituteDocument7 pagesNew York State Consumer Real Estate Sentiment Scores: Siena Research InstitutejspectorNo ratings yet

- 3Q13RealEstateRelease FinalDocument2 pages3Q13RealEstateRelease FinalJon CampbellNo ratings yet

- 1Q12RealEstateRelease FinalDocument2 pages1Q12RealEstateRelease FinalLeigh Hornbeck TrombleyNo ratings yet

- Zillow Q3 Real Estate ReportDocument4 pagesZillow Q3 Real Estate ReportLani RosalesNo ratings yet

- May 2012 RCI ReportDocument24 pagesMay 2012 RCI ReportNational Association of REALTORS®No ratings yet

- Beverly-Hanks & Associates: Second Quarter Market Report 2011Document20 pagesBeverly-Hanks & Associates: Second Quarter Market Report 2011ashevillerealestateNo ratings yet

- Siena Research Institute: National Confidence Frighteningly Low NY S Better But Lowest Since Feb 09Document4 pagesSiena Research Institute: National Confidence Frighteningly Low NY S Better But Lowest Since Feb 09Robert TranNo ratings yet

- MSARelease 4Q12 FinalDocument2 pagesMSARelease 4Q12 Finalcara12345No ratings yet

- 2016 NAR Research Resource GuideDocument9 pages2016 NAR Research Resource GuideNational Association of REALTORS®50% (2)

- Realtors Confidence IndexDocument25 pagesRealtors Confidence IndexNational Association of REALTORS®No ratings yet

- Siena Research Institute: NY Consumer Sentiment Flat, Trails Nation, Down 5% From A Year AgoDocument4 pagesSiena Research Institute: NY Consumer Sentiment Flat, Trails Nation, Down 5% From A Year AgojspectorNo ratings yet

- Residential Economic Issues & Trends ForumDocument56 pagesResidential Economic Issues & Trends ForumNational Association of REALTORS®No ratings yet

- Siena Research Institute: Stock Market Roller Coaster Leaves Consumer Confidence Low and FlatDocument4 pagesSiena Research Institute: Stock Market Roller Coaster Leaves Consumer Confidence Low and FlatNick ReismanNo ratings yet

- Oct 2014 RCI ReportDocument27 pagesOct 2014 RCI ReportNational Association of REALTORS®No ratings yet

- Union City Full Market Report (Week of February 10, 2014)Document6 pagesUnion City Full Market Report (Week of February 10, 2014)Harry KharaNo ratings yet

- 1Q12 MSARelease FinalDocument2 pages1Q12 MSARelease FinaljspectorNo ratings yet

- 2014 11 Realtors Confidence Index 2014-12-22Document26 pages2014 11 Realtors Confidence Index 2014-12-22National Association of REALTORS®No ratings yet

- Are Indias Cities in A Housing BubbleDocument9 pagesAre Indias Cities in A Housing BubbleAshwinBhandurgeNo ratings yet

- Nest Report Charlottesville: Q4 2011Document9 pagesNest Report Charlottesville: Q4 2011Jonathan KauffmannNo ratings yet

- Case-Shiller October 2011Document5 pagesCase-Shiller October 2011Nathan MartinNo ratings yet

- Property Intelligence Report July 2013Document4 pagesProperty Intelligence Report July 2013thomascruseNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For November 2014Document4 pagesMonterey Homes Market Action Report Real Estate Sales For November 2014Nicole TruszkowskiNo ratings yet

- Nest Report: Charlottesville Area Real Estate Market Report Q3 2012Document9 pagesNest Report: Charlottesville Area Real Estate Market Report Q3 2012Jonathan KauffmannNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For October 2014Document4 pagesMonterey Homes Market Action Report Real Estate Sales For October 2014Nicole TruszkowskiNo ratings yet

- Weekly Economic Commentary 3-26-12Document6 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- Weekly Economic Commentary 3-26-12Document11 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- REALTORS® Confidence Index July 2012Document26 pagesREALTORS® Confidence Index July 2012National Association of REALTORS®No ratings yet

- Coldwell Banker Luxury Market ReportDocument18 pagesColdwell Banker Luxury Market ReportFrank VyralNo ratings yet

- The Kearney Report - Boulder Real Estate Market Report 2011Document8 pagesThe Kearney Report - Boulder Real Estate Market Report 2011neilkearneyNo ratings yet

- Case-Shiller August 2011Document5 pagesCase-Shiller August 2011Nathan MartinNo ratings yet

- REMAX National Housing Report - July 2012 FinalDocument2 pagesREMAX National Housing Report - July 2012 FinalSheila Newton TeamNo ratings yet

- Q2 2012 Charlottesville Nest ReportDocument9 pagesQ2 2012 Charlottesville Nest ReportJim DuncanNo ratings yet

- Home Sales Continue To Grow As Median Prices ModerateDocument8 pagesHome Sales Continue To Grow As Median Prices ModeratePaul KnoffNo ratings yet

- Fed Snapshot Sep 2011Document47 pagesFed Snapshot Sep 2011workitrichmondNo ratings yet

- Realtors Confidence Index 2015-07-22Document29 pagesRealtors Confidence Index 2015-07-22National Association of REALTORS®No ratings yet

- Week of Oct 31 - Market Update For Single Family Homes - North Miami Beach, FLDocument6 pagesWeek of Oct 31 - Market Update For Single Family Homes - North Miami Beach, FLSoraya E. CaciciNo ratings yet

- ColumbiaDocument2 pagesColumbiaEllie McIntireNo ratings yet

- 4.29.14 CED Report PDFDocument17 pages4.29.14 CED Report PDFRecordTrac - City of OaklandNo ratings yet

- REALTORS® Confidence Index: August 2014Document26 pagesREALTORS® Confidence Index: August 2014National Association of REALTORS®No ratings yet

- Nest Realty Q2 2013 Charlottesville Real Estate Market ReportDocument9 pagesNest Realty Q2 2013 Charlottesville Real Estate Market ReportJonathan KauffmannNo ratings yet

- Siena Research Institute: Consumer Sentiment in NY Reaches Five Year HighDocument4 pagesSiena Research Institute: Consumer Sentiment in NY Reaches Five Year Highcara12345No ratings yet

- Fhfa Hpi 2012Q2Document83 pagesFhfa Hpi 2012Q2Lani RosalesNo ratings yet

- Consumer Confidence Poll 06-12Document4 pagesConsumer Confidence Poll 06-12cara12345No ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For June 2011Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiNo ratings yet

- 2015 04 Realtors Confidence Index 2015-05-21Document31 pages2015 04 Realtors Confidence Index 2015-05-21National Association of REALTORS®No ratings yet

- Quarterly Review NOV11Document22 pagesQuarterly Review NOV11ftforee2No ratings yet

- Realtors® Confidence Index December 2016Document30 pagesRealtors® Confidence Index December 2016National Association of REALTORS®100% (1)

- Carmel Highlands Homes Market Action Report For Real Estate Sales June 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- Nationwide'S Health of Housing Markets (Hohm) ReportDocument8 pagesNationwide'S Health of Housing Markets (Hohm) ReportBarbara MillerNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales July 2011Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales July 2011Nicole TruszkowskiNo ratings yet

- Deloitte Corporate Finance Retail and Consumer Update q4 2011Document8 pagesDeloitte Corporate Finance Retail and Consumer Update q4 2011KofikoduahNo ratings yet

- Pleasanton Full Market Report (Week of January 27th, 2014)Document6 pagesPleasanton Full Market Report (Week of January 27th, 2014)Harry KharaNo ratings yet

- Economic and Housing Market OutlookDocument56 pagesEconomic and Housing Market OutlookNational Association of REALTORS®No ratings yet

- Econ Focus 6-20-11Document1 pageEcon Focus 6-20-11Jessica Kister-LombardoNo ratings yet

- Buy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsFrom EverandBuy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsNo ratings yet

- Summary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterFrom EverandSummary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Investing in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeFrom EverandInvesting in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeNo ratings yet

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorNo ratings yet

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorNo ratings yet

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinNo ratings yet

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorNo ratings yet

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorNo ratings yet

- State Health CoverageDocument26 pagesState Health CoveragejspectorNo ratings yet

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsNo ratings yet

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorNo ratings yet

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorNo ratings yet

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorNo ratings yet

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinNo ratings yet

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanNo ratings yet

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorNo ratings yet

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorNo ratings yet

- Class of 2022Document1 pageClass of 2022jspectorNo ratings yet

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorNo ratings yet

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorNo ratings yet

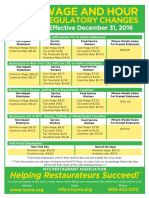

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorNo ratings yet

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyNo ratings yet

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanNo ratings yet

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonNo ratings yet

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorNo ratings yet

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorNo ratings yet

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorNo ratings yet

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorNo ratings yet

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorNo ratings yet

- Voting Report CardDocument1 pageVoting Report CardjspectorNo ratings yet

- Info SectionDocument68 pagesInfo Sectionnewcomersguide100% (1)

- Kalia SchemeDocument5 pagesKalia SchemeAshish MohapatraNo ratings yet

- DBP V CaDocument11 pagesDBP V CaDebbie YrreverreNo ratings yet

- Shaheem Final Project LAST WORKDocument69 pagesShaheem Final Project LAST WORKAshish WilsonNo ratings yet

- KCC RuralDocument13 pagesKCC RuralSitesh PratapNo ratings yet

- HO 2 Installment Sales ActivitiesDocument3 pagesHO 2 Installment Sales ActivitiesddddddaaaaeeeeNo ratings yet

- Property LawDocument15 pagesProperty Lawdevansh100% (1)

- Final Insurance Project PDFDocument17 pagesFinal Insurance Project PDFAnand Yadav100% (1)

- Call Money MarketDocument24 pagesCall Money MarketArnav ShahNo ratings yet

- Torts Case2Document10 pagesTorts Case2Cindy-chan DelfinNo ratings yet

- Corporate Finance MCQsDocument0 pagesCorporate Finance MCQsonlyjaded4655100% (1)

- Business ManagerDocument3 pagesBusiness ManagerJON snowNo ratings yet

- 20 Spouses Solangon V Salazar PDFDocument6 pages20 Spouses Solangon V Salazar PDFcarafloresNo ratings yet

- Asset Privatization Trust Vs Court of AppealsDocument4 pagesAsset Privatization Trust Vs Court of AppealsHappy KidNo ratings yet

- Kevin Cullen Resume 2018Document2 pagesKevin Cullen Resume 2018Kevin CullenNo ratings yet

- Joint Venture AgreementsDocument83 pagesJoint Venture AgreementsmysorevishnuNo ratings yet

- What Is The Difference Between Commercial Banking and Merchant BankingDocument8 pagesWhat Is The Difference Between Commercial Banking and Merchant BankingScarlett Lewis100% (2)

- CP3P Foundation Exam - Sample QuestionsDocument10 pagesCP3P Foundation Exam - Sample QuestionsSaroosh Danish67% (6)

- (Problems) - Audit of LiabilitiessDocument17 pages(Problems) - Audit of Liabilitiessapatos0% (2)

- Global Financial Crisis and Key Risks: Impact On India and AsiaDocument24 pagesGlobal Financial Crisis and Key Risks: Impact On India and AsiaGauravNo ratings yet

- Appendix-B (Answers To End-Of-Chapter Problems)Document7 pagesAppendix-B (Answers To End-Of-Chapter Problems)SourovNo ratings yet

- Sarfaesi Work Manual Book-Actual PDFDocument43 pagesSarfaesi Work Manual Book-Actual PDFDikshita GuhaNo ratings yet

- Torres vs. LimjapDocument4 pagesTorres vs. LimjapKaren Faye TorrecampoNo ratings yet

- HUD 223(f) refinance program overviewDocument2 pagesHUD 223(f) refinance program overvieweimg20041333No ratings yet

- Revised SWORN STATEMENT OF ASSETSDocument3 pagesRevised SWORN STATEMENT OF ASSETSCadir HussinNo ratings yet

- Secured Loans Vs Unsecured Loans Which Is Right For YouDocument8 pagesSecured Loans Vs Unsecured Loans Which Is Right For YouCredit TriangleNo ratings yet

- Spouses Juico Versus China Banking CorpDocument1 pageSpouses Juico Versus China Banking Corpremingiii100% (1)

- Signed Order Confirming Plan For ScribdDocument10 pagesSigned Order Confirming Plan For ScribdNorma OrtizNo ratings yet

- Financial Mathematics For ActuariesDocument62 pagesFinancial Mathematics For ActuariesbreezeeeNo ratings yet