Professional Documents

Culture Documents

Linear Technology Case - Ashmita Srivastava

Uploaded by

Ashmita SrivastavaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Linear Technology Case - Ashmita Srivastava

Uploaded by

Ashmita SrivastavaCopyright:

Available Formats

HULT INTERNATIONAL BUSINESS SCHOOL MFIN : Corporate Finance Professor: Herb Meiberger

Case Solution: Dividend Policy at Linear Technology

Introduction:

Submitted by: Ashmita Srivastava Student ID: 86177

Linear Technology was founded in 1981 by Robert Swanson and is currently headquartered in Milpitas, California. Its primary focus is on designing, manufacturing and marketing integrated circuits used in cellular phones, digital cameras etc. It went public in 1986 on NASDAQ. The major forms of employee compensation for the company are profit sharing and employee stock option plans. Trends in Dividends: Linear Technology announced its first dividend on October 13th, 1992 @ $0.05 per share. The dividend was set low very thoughtfully because the company did not want to get in trouble in the long term by cutting dividends and a low payout ratio resulting in low investors confidence. Reasons for declaring dividends: Linear Technology was very well positioned in the industry. Positive cash flows To gain Investors confidence Access to new investors Major issues with declaring DividendsThere are a lot of controversies attached to declaring a dividend especially by a high tech company expecting good growth The general phenomenon is that declaring dividends sends a signal to the market that the growth rate of the company is expected to slow down in future. Tech companies compensate dividends by offering Stock options to their employees and hence use excess cash to repurchase shares to compensate the dilution caused when employees exercise the stock options. Declaring dividend increases the no. of shares outstanding lowering the earnings per share. Dividends are taxed twice at corporate level and at investor level, and hence repurchase is better. If the company declares an increase in dividend in 4th quarter of April 2003, its payout ratio will be higher than many tech companies in the industry Agency ProblemA major dilemma while deciding about whether to choose cash dividends or reinvesting arises because of the conflict of goals of stockholders and the management. If the cash dividend is declared, it will lower the cash balance and hence there will be less cash available for positive Net Present Value projects lowering the wealth of the company which is not desirable for the management but cash dividends makes the shareholders happy. Dividend Policies of the Competitors: It is not common for high tech companies to provide dividends. It is evident from the dividend policy at Maxim and Microsoft, who declared their first dividend as late as in 2002 and 2003

respectively. Cisco decided not to offer any dividends and to use its cash for investment and buyback purposes. It was only Intel that declared its dividends in the year 1992, a month before Linear technology declared theirs.

Analysis:

A company has the following options to distribute cash to its shareholders-

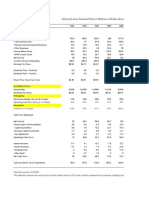

Payout Ratio Over the past 5 years1998 10.11% 1999 11.37% 2000 9.72% 2001 9.64% 2002 27.32%

Payout ratio= Dividend on Common Equity / Net Income (Exhibit 1)

Net Profit Ratio over the past 5 years: 1998 37.3% 1999 38.3% 2000 40.78% 2001 43.9% 2002 38.7%

Net Profit ratio= Net Income/Sales (Exhibit 1) LT is expecting its payout ratio to be around 25% to 30% in future. The Net Profit ratio seems quite impressing. As seen in Exhibit 2, LT has 6th highest cash balance ($1552 Million) compared to the companies in the semiconductor Index (SOX) in 2002 and $1.5 Billion by the end of 3Q of 2003. Linear Technologys current position: With a high payout ratio, net profit ratio and cash balance, LT had a lot of options to deal with its cash balance. However, it had no plans of acquisitions and hence a major use of cash was to be ignored. Now, there are 2 options- Increase in the dividends or repurchase of shares with is slow growth rate against the benchmark standards. It has involved itself in a stock split four times since the 1992, indicating that stock prices were quite high. If Dividends are increased:

If the dividends are increased, it is a good indicator that company can sustain it over a long period of time but at the same time it sends signal to the market about its slow growth which decreases its stock price. It will also result in a high payout ratio than most of the firms in the industry. Though it will make shareholders happy but according to Miller and Modigliani, as long as the firm is earning return that is expected by the market, it does not really matter if the returns to the shareholders come in the form of dividends or repurchase of shares. If repurchase of shares is done: If there is a repurchase of shares, it indicates that the company has less shares outstanding and hence the Earnings per share rises. It is a good way to distribute cash amongst the shareholders without raising dividends and hence avoiding the double taxation problem. It also send signals to the market that the share price of a company might rise as the company buyback shares when the share price is low. However, it is important that the company makes this decision at the right time by pricing its shares accurately.

Conclusion and Recommendation:

The decision depends on companys present and future growth as well as the pros and cons of both, declaring an increase in dividend and repurchase of shares. Paying cash dividends will not only reduce cash to invest in profitable projects but also involve double taxation and fall in stock price problems. On the other hand, repurchase of shares can increase shareholders wealth without raising dividends and hence avoiding double taxation and wrong signaling to the market about slower growth rate in future. As it is evident that there is no need of any financing for Linear Technology and it already has a high payout ratio, in my opinion it should not declare a further increase in dividends. Declaring an increase in dividends will further increase the payout ratio, not withstanding with the trend of the industry. Also, it would be a safe game to keep the dividends at present level to avoid any dividend cuts in future lowering investors confidence and also at the same time retain investors confidence by still offering a dividend.

You might also like

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Linear Tech's Dividend PolicyDocument4 pagesLinear Tech's Dividend PolicyRishabh KothariNo ratings yet

- Dividend Policy at Linear Technology - Case Analysis - G05Document2 pagesDividend Policy at Linear Technology - Case Analysis - G05Srikanth Kumar Konduri60% (5)

- Linear Technology's dividend policy decision: pay dividends or repurchase sharesDocument6 pagesLinear Technology's dividend policy decision: pay dividends or repurchase sharesprashantkumarsinha007100% (1)

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDocument2 pagesMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7No ratings yet

- Annualized Net Income GrowthDocument25 pagesAnnualized Net Income GrowthAdarsh Chhajed0% (2)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Dividend Decision at Linear TechnologyDocument8 pagesDividend Decision at Linear TechnologyNikhilaNo ratings yet

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- SpyderDocument3 pagesSpyderHello100% (1)

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73No ratings yet

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Massey Ferguson CaseDocument6 pagesMassey Ferguson CaseMeraSultan100% (1)

- 1998 Smokeless Tobacco Brand Market SharesDocument11 pages1998 Smokeless Tobacco Brand Market SharesOmkar BibikarNo ratings yet

- Petrozuata CaseDocument10 pagesPetrozuata CaseBiranchi Prasad SahooNo ratings yet

- Paginas Amarelas Case Week 8 ID 23025255Document4 pagesPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Finance Simulation: Estimated Equity Value of Bel Vino CorporationDocument4 pagesFinance Simulation: Estimated Equity Value of Bel Vino Corporationvardhan73% (11)

- Buffets Bid For Media GeneralDocument23 pagesBuffets Bid For Media GeneralTerence TayNo ratings yet

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocument17 pages9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNo ratings yet

- Energy GelDocument4 pagesEnergy Gelchetan DuaNo ratings yet

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust Incapi-371968794% (16)

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- JetBlue Airways IPO ValuationDocument9 pagesJetBlue Airways IPO ValuationMuyeedulIslamNo ratings yet

- Dividend Policy at PFL GroupDocument5 pagesDividend Policy at PFL GroupWthn2kNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Assignment Schumpeter Finanzberatung DEC-5-21Document2 pagesAssignment Schumpeter Finanzberatung DEC-5-21RaphaelNo ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- Facebook, Inc: The Initial Public OfferingDocument5 pagesFacebook, Inc: The Initial Public OfferingHanako Taniguchi PoncianoNo ratings yet

- Yell Case Exhibits Growth RatesDocument12 pagesYell Case Exhibits Growth RatesJames MorinNo ratings yet

- Petrozuata Financial ModelDocument3 pagesPetrozuata Financial Modelsamdhathri33% (3)

- Sure CutDocument37 pagesSure Cutshmuup1100% (4)

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- Arundel Case SolDocument14 pagesArundel Case SolRohan RustagiNo ratings yet

- Finance Simulation Valuation ExerciseDocument7 pagesFinance Simulation Valuation ExerciseAdemola Adeola0% (2)

- Ust SolutionDocument3 pagesUst SolutionAdeel_Akram_Ch_9271No ratings yet

- Monmouth CaseDocument6 pagesMonmouth CaseMohammed Akhtab Ul HudaNo ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Strategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersDocument13 pagesStrategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersPrashant JhakarwarNo ratings yet

- Corporate Finance UST CaseDocument7 pagesCorporate Finance UST Casepradhu1100% (1)

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- CongoleumDocument16 pagesCongoleumMilind Sarambale0% (1)

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143No ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Debt Policy at UST Inc.Document47 pagesDebt Policy at UST Inc.karthikk1990100% (2)

- Jones Electrical Faces Cash Shortfall Despite ProfitsDocument5 pagesJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliNo ratings yet

- Dividend Paying StocksDocument3 pagesDividend Paying StocksNagella anilkumarNo ratings yet

- DividendsDocument5 pagesDividendsMinettaLaneNo ratings yet

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Important Theory Q&aDocument13 pagesImportant Theory Q&amohsin razaNo ratings yet

- 2 - 16th April 2008 (160408)Document5 pages2 - 16th April 2008 (160408)Chaanakya_cuimNo ratings yet

- LinearDocument3 pagesLinearAEKaidarovNo ratings yet

- Problem StatementDocument3 pagesProblem StatementLeo Pratama GaniNo ratings yet

- Evaluation of Evidence-Based Practices in Online Learning: A Meta-Analysis and Review of Online Learning StudiesDocument93 pagesEvaluation of Evidence-Based Practices in Online Learning: A Meta-Analysis and Review of Online Learning Studiesmario100% (3)

- Arcmap and PythonDocument29 pagesArcmap and PythonMiguel AngelNo ratings yet

- Towards Emotion Independent Languageidentification System: by Priyam Jain, Krishna Gurugubelli, Anil Kumar VuppalaDocument6 pagesTowards Emotion Independent Languageidentification System: by Priyam Jain, Krishna Gurugubelli, Anil Kumar VuppalaSamay PatelNo ratings yet

- Written Test Unit 7 & 8 - Set ADocument4 pagesWritten Test Unit 7 & 8 - Set ALaura FarinaNo ratings yet

- Friday August 6, 2010 LeaderDocument40 pagesFriday August 6, 2010 LeaderSurrey/North Delta LeaderNo ratings yet

- Wells Fargo StatementDocument4 pagesWells Fargo Statementandy0% (1)

- GPAODocument2 pagesGPAOZakariaChardoudiNo ratings yet

- ANA Stars Program 2022Document2 pagesANA Stars Program 2022AmericanNumismaticNo ratings yet

- Chapter 1Document11 pagesChapter 1Albert BugasNo ratings yet

- Spelling Errors Worksheet 4 - EditableDocument2 pagesSpelling Errors Worksheet 4 - EditableSGillespieNo ratings yet

- 01.09 Create EA For Binary OptionsDocument11 pages01.09 Create EA For Binary OptionsEnrique BlancoNo ratings yet

- Inver Powderpaint SpecirficationsDocument2 pagesInver Powderpaint SpecirficationsArun PadmanabhanNo ratings yet

- House & Garden - November 2015 AUDocument228 pagesHouse & Garden - November 2015 AUHussain Elarabi100% (3)

- BMW E9x Code ListDocument2 pagesBMW E9x Code ListTomasz FlisNo ratings yet

- Senarai Syarikat Berdaftar MidesDocument6 pagesSenarai Syarikat Berdaftar Midesmohd zulhazreen bin mohd nasirNo ratings yet

- FraudDocument77 pagesFraudTan Siew Li100% (2)

- Introduction To Alternative Building Construction SystemDocument52 pagesIntroduction To Alternative Building Construction SystemNicole FrancisNo ratings yet

- SS2 8113 0200 16Document16 pagesSS2 8113 0200 16hidayatNo ratings yet

- Dr. Xavier - MIDocument6 pagesDr. Xavier - MIKannamundayil BakesNo ratings yet

- Adkins, A W H, Homeric Values and Homeric SocietyDocument15 pagesAdkins, A W H, Homeric Values and Homeric SocietyGraco100% (1)

- Chapter 8, Problem 7PDocument2 pagesChapter 8, Problem 7Pmahdi najafzadehNo ratings yet

- Tomato & Tomato Products ManufacturingDocument49 pagesTomato & Tomato Products ManufacturingAjjay Kumar Gupta100% (1)

- Information BulletinDocument1 pageInformation BulletinMahmudur RahmanNo ratings yet

- String length recommendations and brace height advice for Uukha bowsDocument1 pageString length recommendations and brace height advice for Uukha bowsPak Cik FauzyNo ratings yet

- Biomass Characterization Course Provides Overview of Biomass Energy SourcesDocument9 pagesBiomass Characterization Course Provides Overview of Biomass Energy SourcesAna Elisa AchilesNo ratings yet

- Kristine Karen DavilaDocument3 pagesKristine Karen DavilaMark anthony GironellaNo ratings yet

- Beyond Digital Mini BookDocument35 pagesBeyond Digital Mini BookAlexandre Augusto MosquimNo ratings yet

- COVID 19 Private Hospitals in Bagalkot DistrictDocument30 pagesCOVID 19 Private Hospitals in Bagalkot DistrictNaveen TextilesNo ratings yet

- Executive Support SystemDocument12 pagesExecutive Support SystemSachin Kumar Bassi100% (2)

- DODAR Analyse DiagramDocument2 pagesDODAR Analyse DiagramDavidNo ratings yet