Professional Documents

Culture Documents

01-30-12 Coalition Letter NAT GAS

Uploaded by

james_valvoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01-30-12 Coalition Letter NAT GAS

Uploaded by

james_valvoCopyright:

Available Formats

An Open Letter to the United States Congress:

No Special Tax Treatment for Natural Gas Vehicles!

Dear Members of Congress: We are writing to renew our objections to the New Alternative Transportation to Give Americans Solutions (NAT GAS) Act (S. 1863, H.R.1380), or any other effort to create or expand special tax treatment for the production, conversion or sale of vehicles that run on natural gas. Several members of this coalition expressed similar concern in a letter dated May 24, 2011. Given President Obamas recent public pronouncements that he wants to expand his portfolio of politically advantaged vehicles from electric cars to include natural gas vehicles, we feel the need to remind Congress about the perils of government attempting to conduct industrial policy by picking winners and losers in the countrys automobile fleet. The NAT GAS Act would provide preferential treatment for nearly every aspect of the natural gas-fueled vehicle industry, from production to purchase and the infrastructure needed to fuel such vehicles. Tax incentives like these allow government to decide which energy sources thrive or failand thereby distort the market. Americas experience with a number of similar energy policy preferences dating back to the 1970s has shown that businesses benefiting from these incentives become reliant on government in order to stay in business. As a result, an entire industry of lobbyists is spawned to protect a benefit without which many businesses could not succeed in the free market. We believe that evenly applying low taxation across the board allows market participants to make choices that are not manipulated by Washington policymakers. By targeting tax preferences toward one type of transportation fuelnatural gasthe NAT GAS Act does the exact opposite. Americas tax code is already overburdened with too many carveouts for special interests that raise compliance costs, distort decision making and advantage the politically well connected. The last thing Congress should be doing is making the tax code more complex. The millions of Americas represented by the undersigned groups urge you not to support any effort to perpetuate the Washington-insider business model where the well connected use the tax code to gain a market advantage over their competitors. We urge you to reject special tax treatment for natural gas vehicles. Sincerely, January 30, 2012

Thomas J. Pyle President American Energy Alliance Donald Ferguson Executive Director American Tradition Partnership Tim Phillips President Americans for Prosperity Grover Norquist President Americans for Tax Reform Chris Chocola President The Club for Growth Tom Schatz President Council for Citizens Against Government Waste Matthew Brouillette President & CEO Commonwealth Foundation Myron Ebell President Freedom Action

Michael A. Needham Chief Executive Officer Heritage Action for America Heather Higgins President Independent Womens Voice Seton Motley President Less Government Colin A. Hanna President Let Freedom Ring Amy Ridenour President National Center for Public Policy Research Duane Parde President National Taxpayers Union Jim Martin Chairman 60 Plus Association Ryan Alexander President Taxpayers for Common Sense

You might also like

- Alan Reynolds, The Politics of Alternative EnergyDocument61 pagesAlan Reynolds, The Politics of Alternative EnergyAlan ReynoldsNo ratings yet

- Factors Making Common Consumers Bike Opinion LeadersDocument5 pagesFactors Making Common Consumers Bike Opinion Leaderssumit5558No ratings yet

- Economics Higher Level Paper 3: Instructions To CandidatesDocument20 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres LopezNo ratings yet

- U.S. To Announce Rollback of Auto Pollution Rules, A Key Effort To Fight Climate Change - The New York TimesDocument6 pagesU.S. To Announce Rollback of Auto Pollution Rules, A Key Effort To Fight Climate Change - The New York TimesKishan PatelNo ratings yet

- The Surprising Incidence of Tax Credits For The Toyota PriusDocument32 pagesThe Surprising Incidence of Tax Credits For The Toyota PriusAkandNo ratings yet

- Do Governments Impede Transportation Innovation?Document15 pagesDo Governments Impede Transportation Innovation?Mercatus Center at George Mason UniversityNo ratings yet

- PrivitiIzation CPDocument135 pagesPrivitiIzation CPSeed Rock ZooNo ratings yet

- Becker Posner BlogDocument46 pagesBecker Posner Blogjoaovalbom_miww7641No ratings yet

- Semana 8 - Kraft FurlongDocument20 pagesSemana 8 - Kraft FurlongDavid CelisNo ratings yet

- It Pays To Be Friendly To Big OilDocument4 pagesIt Pays To Be Friendly To Big OilProtect Florida's BeachesNo ratings yet

- Republican Carbon Tax Plan May Breakthrough on ClimateDocument1 pageRepublican Carbon Tax Plan May Breakthrough on Climateibrar kaifNo ratings yet

- LWV Guide 2012Document3 pagesLWV Guide 2012Hersam AcornNo ratings yet

- Economic IntegrationDocument11 pagesEconomic IntegrationTrayle HeartNo ratings yet

- Senate Hearing, 110TH Congress - Oil DemandDocument94 pagesSenate Hearing, 110TH Congress - Oil DemandScribd Government DocsNo ratings yet

- How Campaign Contributions and Lobbying Can Lead To Inefficient Economic PolicyDocument12 pagesHow Campaign Contributions and Lobbying Can Lead To Inefficient Economic PolicyCenter for American ProgressNo ratings yet

- On Climate Change, Republicans Need A Crash Course in Capitalism - BloombergDocument4 pagesOn Climate Change, Republicans Need A Crash Course in Capitalism - BloombergAlex PUNo ratings yet

- The Refining Industry, Public Policy, and PoliticsDocument15 pagesThe Refining Industry, Public Policy, and PoliticsCm SinghNo ratings yet

- PHP 9 HC CNEDocument1 pagePHP 9 HC CNENATSOIncNo ratings yet

- BUSINESS, GOVERNMENT AND SOCIETY RELATIONSHIPDocument9 pagesBUSINESS, GOVERNMENT AND SOCIETY RELATIONSHIPChristina E JosephNo ratings yet

- 99 S Money in Politics ToolkitDocument15 pages99 S Money in Politics ToolkitmgottsegNo ratings yet

- CEI Staff Letter To President Obama - November 7, 2012Document3 pagesCEI Staff Letter To President Obama - November 7, 2012Competitive Enterprise InstituteNo ratings yet

- The Fight Over Using Natural Gas for Transportation: AntagonistsFrom EverandThe Fight Over Using Natural Gas for Transportation: AntagonistsRating: 5 out of 5 stars5/5 (1)

- Umact Cra Multi-Party 2012-06-11Document2 pagesUmact Cra Multi-Party 2012-06-11Phil KerpenNo ratings yet

- 01-23-12 Coalition Letter - Support Pro-Growth BudgetingDocument2 pages01-23-12 Coalition Letter - Support Pro-Growth BudgetingAdam BerklandNo ratings yet

- CFE Paper on US Environmental Federalism and Climate PolicyDocument12 pagesCFE Paper on US Environmental Federalism and Climate PolicyGuillaume AlexisNo ratings yet

- Extensive Subsidies For Renewable Energy TechnologiesDocument258 pagesExtensive Subsidies For Renewable Energy TechnologiesAR Squared100% (1)

- What Does This Mean For YouDocument7 pagesWhat Does This Mean For YouJordan CrookNo ratings yet

- International Business Critical AnalysisDocument3 pagesInternational Business Critical AnalysisDayna HillNo ratings yet

- LCV's 2008 Environmental FacebookDocument1 pageLCV's 2008 Environmental Facebookjay.natoli3467No ratings yet

- Buying The Democrat Party Lock, Stock and BarrelDocument15 pagesBuying The Democrat Party Lock, Stock and BarrelRoscoe B DavisNo ratings yet

- CRS Issue Brief on Alternative Fuels and Advanced Technology VehiclesDocument14 pagesCRS Issue Brief on Alternative Fuels and Advanced Technology Vehiclesmailsk123No ratings yet

- SSRN Id3279629Document63 pagesSSRN Id3279629Jose PapoNo ratings yet

- Legal Regulatory and Political IssuesDocument28 pagesLegal Regulatory and Political IssuesErra PeñafloridaNo ratings yet

- Determinants of Automobile Demand and Implications For Hybrid-Electric Market PenetrationDocument59 pagesDeterminants of Automobile Demand and Implications For Hybrid-Electric Market PenetrationsiddhiNo ratings yet

- The Empty Promise of Green Jobs 9222011Document5 pagesThe Empty Promise of Green Jobs 9222011ztowerNo ratings yet

- 1 The Taxation of Fuel Economy: B 2011 by National Bureau of Economic Research. All Rights ReservedDocument38 pages1 The Taxation of Fuel Economy: B 2011 by National Bureau of Economic Research. All Rights ReservedcssdfdcNo ratings yet

- 2013 4 23 Week in ReviewDocument2 pages2013 4 23 Week in Reviewapi-215003736No ratings yet

- Rauner Exelon National Group Letter 2016-12-01Document1 pageRauner Exelon National Group Letter 2016-12-01Jon DeckerNo ratings yet

- Analysis On The Ethanol BubbleDocument8 pagesAnalysis On The Ethanol BubbleRobert KimNo ratings yet

- 07-27-12 Coalition Letter Farm Bill Short ExtensionDocument2 pages07-27-12 Coalition Letter Farm Bill Short Extensionjames_valvoNo ratings yet

- House Hearing, 112TH Congress - Running On Empty: The Effects of High Gasoline Prices On Small BusinessesDocument76 pagesHouse Hearing, 112TH Congress - Running On Empty: The Effects of High Gasoline Prices On Small BusinessesScribd Government DocsNo ratings yet

- Ethanol Fact Book Highlights Long History of Bipartisan SupportDocument56 pagesEthanol Fact Book Highlights Long History of Bipartisan Supportjodes_jmNo ratings yet

- House Hearing, 110TH Congress - Hearing On Cap, Auction, and Trade: Auctions and Revenue Recycling Under Carbon Cap and TradeDocument221 pagesHouse Hearing, 110TH Congress - Hearing On Cap, Auction, and Trade: Auctions and Revenue Recycling Under Carbon Cap and TradeScribd Government DocsNo ratings yet

- Crack Down On SpeculatorsDocument2 pagesCrack Down On Speculatorsapi-136957572No ratings yet

- Term Limits and The Republican Congress: The Case Strengthens, Cato Briefing PaperDocument20 pagesTerm Limits and The Republican Congress: The Case Strengthens, Cato Briefing PaperCato InstituteNo ratings yet

- Chapter 19 GovernmentDocument23 pagesChapter 19 GovernmentAshley VuNo ratings yet

- 01-29-08 Public Citizen-A Consumer's Guide To The 2008 StateDocument4 pages01-29-08 Public Citizen-A Consumer's Guide To The 2008 StateMark WelkieNo ratings yet

- Deems Inquiry 3 FinalDocument7 pagesDeems Inquiry 3 Finalapi-316332476No ratings yet

- The Facts About Oil and Natural Gas Taxes and "Subsidies"Document1 pageThe Facts About Oil and Natural Gas Taxes and "Subsidies"Energy TomorrowNo ratings yet

- Threats To FordDocument8 pagesThreats To Fordarif arifinNo ratings yet

- Joint Statement On H.R. 3582Document1 pageJoint Statement On H.R. 3582Adam BerklandNo ratings yet

- REPORT: Legislating Under The Influence - How Corporations Write State Laws in MinnesotaDocument83 pagesREPORT: Legislating Under The Influence - How Corporations Write State Laws in MinnesotaMike Dean100% (1)

- Le Rapport de L'institut Fraser Sur Une Réforme Des Lois Sur Les Cotisations Syndicales.Document36 pagesLe Rapport de L'institut Fraser Sur Une Réforme Des Lois Sur Les Cotisations Syndicales.Radio-CanadaNo ratings yet

- 2012 1009 RomneyAgricultureDocument16 pages2012 1009 RomneyAgricultureChad WhiteheadNo ratings yet

- Reducing Gasoline Consumption: Comparing CAFE Standards, Gasoline Taxes, and Cap-and-Trade ProgramsDocument51 pagesReducing Gasoline Consumption: Comparing CAFE Standards, Gasoline Taxes, and Cap-and-Trade ProgramsConor KennyNo ratings yet

- Fuel Economy and Us PoliticsDocument22 pagesFuel Economy and Us PoliticsalicorpanaoNo ratings yet

- MCRPDocument4 pagesMCRPapi-336520982No ratings yet

- Senate Hearing, 111TH Congress - Climate Change LegislationDocument89 pagesSenate Hearing, 111TH Congress - Climate Change LegislationScribd Government DocsNo ratings yet

- Celgene BMS Staff Report 09-30-2020 PDFDocument45 pagesCelgene BMS Staff Report 09-30-2020 PDFArnold VenturesNo ratings yet

- SSTH037060 AnhPhan Project3Document3 pagesSSTH037060 AnhPhan Project3Châu Anh Phan NguyễnNo ratings yet

- 2013 4 30 Week in ReviewDocument2 pages2013 4 30 Week in Reviewapi-215003736No ratings yet

- Fiscal Clif InfographicDocument1 pageFiscal Clif Infographicjames_valvoNo ratings yet

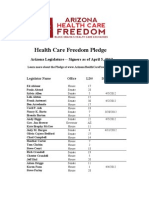

- AZHCxpledgers07 19 2012Document3 pagesAZHCxpledgers07 19 2012james_valvoNo ratings yet

- Fiscal Clif InfographicDocument1 pageFiscal Clif Infographicjames_valvoNo ratings yet

- Fiscal Clif InfographicDocument1 pageFiscal Clif Infographicjames_valvoNo ratings yet

- Coalition PebbleDocument4 pagesCoalition Pebblejames_valvoNo ratings yet

- 07-27-12 Coalition Letter Farm Bill Short ExtensionDocument2 pages07-27-12 Coalition Letter Farm Bill Short Extensionjames_valvoNo ratings yet

- AFPF FHFA 2012 0020 Eminent DomainDocument4 pagesAFPF FHFA 2012 0020 Eminent Domainjames_valvoNo ratings yet

- AZHCpledgers10 08 2012Document3 pagesAZHCpledgers10 08 2012james_valvoNo ratings yet

- SJR48 Multiparty LetterDocument2 pagesSJR48 Multiparty LetterPhil KerpenNo ratings yet

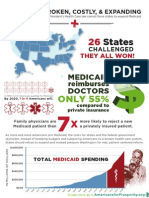

- 07 24 12 Medicaid InfographicDocument1 page07 24 12 Medicaid Infographicjames_valvoNo ratings yet

- Funding Chart 4Document2 pagesFunding Chart 4james_valvoNo ratings yet

- Az HC Pledge July 2012Document3 pagesAz HC Pledge July 2012james_valvoNo ratings yet

- Az HC Pledge July 2012Document3 pagesAz HC Pledge July 2012james_valvoNo ratings yet

- Az HC Pledge July 2012Document3 pagesAz HC Pledge July 2012james_valvoNo ratings yet

- Joint Letter DearSpeaker 7-24-2012Document2 pagesJoint Letter DearSpeaker 7-24-2012Phil KerpenNo ratings yet

- 07-24-12 Coalition Letter On Conrad BCA ViolationDocument2 pages07-24-12 Coalition Letter On Conrad BCA Violationjames_valvoNo ratings yet

- 2012-05-02 Michigan Health Care Freedom PledgeDocument1 page2012-05-02 Michigan Health Care Freedom Pledgejames_valvoNo ratings yet

- Title 17 Coalition LetterDocument2 pagesTitle 17 Coalition Letterjames_valvoNo ratings yet

- No Climate TaxDocument1 pageNo Climate Taxjames_valvoNo ratings yet

- NLRB Cra Multi-Party FinalDocument2 pagesNLRB Cra Multi-Party Finaljames_valvoNo ratings yet

- AZHCxpledgers07 19 2012Document3 pagesAZHCxpledgers07 19 2012james_valvoNo ratings yet

- Joint Farm Bill Letter Senate May23Document2 pagesJoint Farm Bill Letter Senate May23james_valvoNo ratings yet

- No Climate TaxDocument1 pageNo Climate Taxjames_valvoNo ratings yet

- Azhcpledgersigners04 11 2012Document3 pagesAzhcpledgersigners04 11 2012james_valvoNo ratings yet

- AzhcfpledgeDocument1 pageAzhcfpledgejames_valvoNo ratings yet

- Health Care ExchangesDocument2 pagesHealth Care Exchangesjames_valvoNo ratings yet

- Health Care ExchangesDocument2 pagesHealth Care Exchangesjames_valvoNo ratings yet

- AFPComment CMS-9989-P ExchangeDocument5 pagesAFPComment CMS-9989-P Exchangejames_valvoNo ratings yet

- AFPComment CMS-9975-P 3RsDocument6 pagesAFPComment CMS-9975-P 3Rsjames_valvoNo ratings yet

- Transaction History: Dola Mall Electronic Commerce Co LTDDocument1 pageTransaction History: Dola Mall Electronic Commerce Co LTDNeil LeeNo ratings yet

- GMG AirlineDocument15 pagesGMG AirlineabusufiansNo ratings yet

- Robot Book of KukaDocument28 pagesRobot Book of KukaSumit MahajanNo ratings yet

- Careem Analytics Test - Data Set #1Document648 pagesCareem Analytics Test - Data Set #1Amrata MenonNo ratings yet

- 2BBC One Lotto2Document4 pages2BBC One Lotto2Krishna PriyaNo ratings yet

- Understanding Consumer Equilibrium with Indifference CurvesDocument6 pagesUnderstanding Consumer Equilibrium with Indifference CurvesJK CloudTechNo ratings yet

- DF L3251A3-T22-930-012CA - Dongfeng Truck Parts CatalogDocument255 pagesDF L3251A3-T22-930-012CA - Dongfeng Truck Parts CatalogLifan Cinaautoparts Autoparts100% (1)

- Indgiro 20181231 PDFDocument1 pageIndgiro 20181231 PDFHuiwen Cheok100% (1)

- Student Partners Program (SPP) ChecklistDocument4 pagesStudent Partners Program (SPP) ChecklistSoney ArjunNo ratings yet

- The Utopian Realism of Errico MalatestaDocument8 pagesThe Utopian Realism of Errico MalatestaSilvana RANo ratings yet

- Project Report SSIDocument140 pagesProject Report SSIharsh358No ratings yet

- Ali BabaDocument1 pageAli BabaRahhal AjbilouNo ratings yet

- 8 Top Questions You Should Prepare For Bank InterviewsDocument10 pages8 Top Questions You Should Prepare For Bank InterviewsAbdulgafoor NellogiNo ratings yet

- Tax invoice for ceiling fanDocument1 pageTax invoice for ceiling fansanjuNo ratings yet

- Stock DividendsDocument7 pagesStock DividendsShaan HashmiNo ratings yet

- Becker Friedman Institute Annual Report 2013-14Document24 pagesBecker Friedman Institute Annual Report 2013-14bficommNo ratings yet

- Mama's AssignmentDocument34 pagesMama's AssignmentUche Aquilina OzegbeNo ratings yet

- Quan Tri TCQTDocument44 pagesQuan Tri TCQTHồ NgânNo ratings yet

- Econ 002 - INTRO MACRO - Prof. Luca Bossi - February 12, 2014 Midterm #1 SolutionsDocument9 pagesEcon 002 - INTRO MACRO - Prof. Luca Bossi - February 12, 2014 Midterm #1 SolutionsinmaaNo ratings yet

- Annual Return GSTR9Document16 pagesAnnual Return GSTR9Raj KumarNo ratings yet

- Inspire - Innovate - EnterpriseDocument11 pagesInspire - Innovate - EnterpriseLashierNo ratings yet

- Geoweb Channel OverviewDocument8 pagesGeoweb Channel OverviewJonathan CanturinNo ratings yet

- Liquidity Preference TheoryDocument5 pagesLiquidity Preference TheoryAaquib AhmadNo ratings yet

- OCI DiscussionDocument6 pagesOCI DiscussionMichelle VinoyaNo ratings yet

- Chairing A Meeting British English TeacherDocument7 pagesChairing A Meeting British English TeacherJimena AbdoNo ratings yet

- Deed of Sale for Movable AssetsDocument2 pagesDeed of Sale for Movable AssetsAyesha JaafarNo ratings yet

- Budget Deficit: Some Facts and InformationDocument3 pagesBudget Deficit: Some Facts and InformationTanvir Ahmed SyedNo ratings yet

- Organic Chicken Business RisksDocument13 pagesOrganic Chicken Business RisksUsman KhanNo ratings yet