Professional Documents

Culture Documents

FCPA Guidance Request Letter 02-21-2012

Uploaded by

dougj1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FCPA Guidance Request Letter 02-21-2012

Uploaded by

dougj1Copyright:

Available Formats

February 21, 2012

The Honorable Lanny A. Breuer Assistant Attorney General Criminal Division U.S. Department of Justice 950 Pennsylvania Avenue, NW Washington, D.C. 20530-0001

Robert Khuzami Director of Enforcement U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549

Guidance Concerning the Foreign Corrupt Practices Act Dear Messrs. Breuer and Khuzami: In a speech on November 8, 2011 to the 26th National Conference on the Foreign Corrupt Practices Act, Assistant Attorney General Breuer stated that in 2012, in what I hope will be a useful and transparent aid, we expect to release detailed new guidance on the Acts criminal and civil enforcement provisions. On behalf of the more than three million businesses and organizations whose interests we represent, we the undersigned organizations, write to request that this guidance address several issues and questions of significant concern to businesses seeking in good faith to comply with the FCPA. Detailed, authoritative guidance on these matters will enhance companies compliance with the FCPA by clarifying the rules of the road and by mitigating the significant interpretive challenges that companies face when applying the text of the statute to complex real-world circumstances. Definitions of Foreign Official and Instrumentality The FCPA prohibits corrupt payments or offers of payment to foreign officials, but it does not provide adequate guidance on who is a foreign official. Although a foreign official is defined as any officer or employee of a foreign government or any department, agency, or instrumentality thereof, or of a public international organization, or any person acting in an official capacity for or on behalf of any such government or department, agency, or instrumentality, or for or on behalf of any such public

February 21, 2012

international organization,1 the statute does not provide any definition of instrumentality. It is therefore unclear what types of entities are instrumentalit[ies] of a foreign government such that their employees are considered foreign officials. As a result, it is often difficult for companies to determine when they are dealing with foreign officials, particularly in markets in which many companies are at least partially state-owned. Your agencies have interpreted the terms foreign official and instrumentality broadly but, as yet, have not provided a clear, uniform definition to which companies may conform their conduct. Courts have treated the issue as multi-faceted and highly fact-specific, holding recently that Congress did not intend either to include or to exclude all state-owned enterprises from the ambit of the FCPA,2 and that whether a state-owned enterprise qualifies as an instrumentality is a question of fact for the jury to decide based on a variety of factors, including the level of investment in the entity by a foreign state, the foreign states characterization of the entity and its employees, the foreign states degree of control over the entity, the purpose of the entitys activities, the entitys obligations and privileges under the foreign states law, the circumstances surrounding the entitys creation and the foreign states extent of ownership of the entity.3 This highly fact-dependent and discretionary approach to which foreign companies qualify as instrumentalities of foreign governments and who may be a foreign official engenders tremendous uncertainty and risks serious misallocation of resources by U.S. businesses seeking to sell their goods and services in foreign markets, with the result that either transactions are forgone or insufficient resources are available to vet transactions that warrant attention. Without a clear understanding of the parameters of instrumentality and foreign official, companies have no way of knowing whether the FCPA applies to a particular transaction or business relationship, particularly in countries like China where most if not all companies are at least partially owned or controlled by the state. The result of these circumstances has been a chilling effect on legitimate business activity (as companies perceive a real risk of prosecution even in scenarios involving only the most remote and attenuated connection to foreign governments) and a costly misallocation of compliance resources (as companies dedicate resources to policing and investigating even such remote and attenuated situations).

1 2

15 U.S.C. 78dd-1(f)(1)(A), 78dd-2(h)(2)(A), 78dd-3(f)(2)(A). U.S. v. Noriega, et al., No. 02:10-cr-01031-AHM, Criminal Minutes General (C.D. Cal. Apr. 20, 2011), ECF No. 474, at 2, 14. U.S. v. Carson, et al., No. 08:09-cr-00077-JVS, Criminal Minutes General (C.D. Cal. May 18, 2011), ECF No. 373, at 5.

February 21, 2012

The forthcoming guidance therefore should address the meanings of instrumentality and foreign official in at least the following respects: The guidance should identify the percentage ownership or level of control by a foreign government that ordinarily will qualify a corporation as an instrumentality. Majority ownership or control of a voting majority of outstanding shares would be appropriate standard thresholds, and would be entirely consistent with the 1997 OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions. The OECD Convention defines foreign public official as any person holding a legislative, administrative or judicial office of a foreign country, whether appointed or elected; any person exercising a public function for a foreign country, including for a public agency or public enterprise; and any official or agent of a public international organization.4 The OECD Convention goes on to define public enterprise as any enterprise, regardless of its legal form, over which a government or governments, may, directly or indirectly, exercise a dominant influence. This is deemed to be the case, inter alia, when the government or governments hold the majority of the enterprises subscribed capital, control the majority of votes attaching to shares issued by the enterprise or can appoint a majority of the members of the enterprises administrative or managerial body or supervisory board. Similar principles of majority ownership and dominant influence should apply to the interpretation of instrumentality under the FCPA. The Department and the SEC should clarify that, in order for a company to be considered an instrumentality, it typically must perform governmental or quasi-governmental functions. The guidance also should provide a detailed list of what those functions may include. The guidance also should identify exceptions, if any, to the foregoing general principles. For example, does majority ownership of a company by a sovereign wealth fund necessarily render employees of that company foreign officials? What if the majority ownership by a foreign government is indirect, e.g., the individual is employed by a subsidiary of a subsidiary of a company whose majority owner is a foreign government or a sovereign wealth fund? What if an individual works only part time for a government entity (e.g., a doctor with dual practices, both public and private) is that individual a foreign official and if so, when?

1997 OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, Article I, Paragraph 4(a) & Commentary.

February 21, 2012

Consideration of Compliance Programs in Enforcement Decisions Under the current FCPA enforcement regime, the business community lacks confidence that the Department and the SEC will give sufficient consideration to potential defendant companies strong, pre-existing compliance programs when making enforcement decisions. The Departments Principles of Federal Prosecution of Business Organizations provide that when determining the proper treatment of a corporate target, prosecutors should consider, among other factors, the existence and effectiveness of the corporations pre-existing compliance program.5 The SEC, in its Seaboard factors, also advises that its staff should consider a companys compliance program when making enforcement decisions.6 However, the guidance under both the Principles of Federal Prosecution and the Seaboard factors regarding compliance programs is presented in a manner so general that it provides little concrete aid to companies attempting to implement or enhance compliance programs. Accordingly, we respectfully request that the Department and the SEC provide guidance regarding what would be considered an effective FCPA compliance program that would merit favorable consideration in enforcement decisions. If the forthcoming guidance on this issue consists merely of a recitation in summary form of specific corporate compliance programs that have been adopted pursuant to deferred prosecution agreements, non-prosecution agreements or SEC settlements, the marginal utility of such guidance to the cause of FCPA compliance in the business community will be limited. Instead, the guidance should establish standards that businesses may adopt and incorporate as part of their compliance programs, and identify the specific components that the Department and SEC consider to be essential to a robust FCPA compliance program. The guidance also should describe how the Department and the SEC factor companies voluntary disclosures of FCPA violations by their employees into enforcement decisions. Parent-Subsidiary Liability The FCPA itself does not set forth circumstances when a parent company may be held liable for a foreign subsidiarys violations of the anti-bribery provisions of the FCPA. This lack of statutory clarity has been compounded by an apparent difference in

5

See Principles of Federal Prosecution of Business Organizations, Title 9, Chapter 928.300 and 9-28.800, UNITED STATES ATTORNEY MANUAL, available at http://www.justice.gov/usao/eousa/foia_reading_room/usam/title9/28mcrm.htm. Exchange Act Release No. 44969 (Oct. 23, 2001) (informally known as the Seaboard report).

February 21, 2012

enforcement policy between the Department and the SEC. The Department takes the position that a parent corporation may be held liable for the acts of [a] foreign subsidiar[y] [only] where they authorized, directed, or controlled the activity in question.7 By contrast, the SEC has charged parent companies with civil violations of the anti-bribery provisions based on actions by a subsidiary of which the parent is entirely ignorant.8 The SECs approach appears to be contrary not only to well-established common law principles of corporate liability, but also to the statutory language of the anti-bribery provisions, which require evidence of knowledge and intent for liability. It is also contrary to the position taken by the drafters of the FCPA, who recognized the inherent jurisdictional, enforcement and diplomatic difficulties raised by the inclusion of foreign subsidiaries of U.S. companies in the direct prohibitions of the bill and who made clear that an issuer or domestic concern generally should be liable for the actions of a foreign subsidiary only if the issuer or domestic concern engaged in bribery by acting through the subsidiary.9 At most, the drafters indicated that if a parent companys ignorance of the actions of a foreign subsidiary resulted from conscious avoidance of knowledge, the parent could be in violation of section 102 requiring companies to devise and maintain adequate accounting controls.10 The SECs theory that a parent company can be liable for a subsidiarys violations of the anti-bribery provisions even where the subsidiarys improper acts were undertaken without the parents knowledge, consent, assistance or approval also has not been tested in court. In the absence of any judicial guidance on the contours and the limits, if any, of this potential parent-company liability, it remains a source of significant concern for U.S. companies with foreign subsidiaries. Accordingly, we respectfully request that the forthcoming guidance clarify and confirm that both the Department and the SEC consider parent company liability under the FCPAs anti-bribery provisions to extend only to circumstances in which the parent actually authorized, directed or controlled the improper activity of its subsidiary.

Department of Justice, Laypersons Guide to FCPA, available at http://www.justice.gov/criminal/fraud/fcpa/docs/lay-persons-guide.pdf. See, e.g., In re United Industrial Corp., Exchange Act Release No. 60005, 2009 WL 1507586 (May 29, 2009), available at http://www.sec.gov/litigation/admin/2009/3460005.pdf; SEC Litig. Rel. No. 21063, 2009 WL 1507590 (May 29, 2009), available at http://www.sec.gov/litigation/litreleases/2009/lr21063.htm. See H.R. Conf. Rep. 95-831, at 14 (1977). See S. Rep. No. 95-114, at 11 (1977).

9 10

6 Successor Liability

February 21, 2012

Under the FCPA, a company may be held liable for the actions of a company that it acquires or merges with even if those actions took place prior to the acquisition or merger and were entirely unknown to the acquiring company. While a company in certain circumstances may mitigate its risk by conducting due diligence prior to an acquisition or merger (or, in certain circumstances, immediately following the transaction),11 such due diligence is only a factor that the Department or the SEC may consider when deciding whether to exercise their discretion not to prosecute or file claims. Even when an acquiring company has conducted exhaustive due diligence and immediately voluntarily reported suspected violations of the target company, for example, the benefits of such diligence are uncertain and usually unknowable. The threat of successor liability even if a thorough investigation is undertaken prior to a transaction has had a significant chilling effect on mergers and acquisitions, and therefore clearer parameters for successor liability under the FCPA are needed. The Department and the SEC should clarify that they ordinarily will not pursue an enforcement action against a company for pre-acquisition violations by an acquiree. If the successor company inherits employees who continue to commit FCPA violations, such new or continuing conduct may, of course, be imputed to the new company. At the very least, if a company conducts reasonable due diligence prior to an acquisition, the company ordinarily should not be subject to any enforcement action for pre-acquisition conduct by the acquired entity. What constitutes sufficient due diligence may vary depending on the risks in a given transaction e.g., whether the target company does significant business in regions that are known for corruption the size and complexity of the transaction, and the existence or absence of legal or structural impediments to reasonable pre-acquisition diligence. But sufficient pre-acquisition due diligence should not require a full internal investigation and the expenditure of significant resources by the company. Instead, the governments forthcoming guidance should outline reasonable standards for such diligence and identify factors that will be considered in determining whether diligence was adequate. The guidance also should provide realistic standards for post-acquisition due diligence where pre-acquisition due diligence could not be undertaken or was significantly limited. Although the Department addressed this topic in Opinion Release 08-02, the Departments guidance required the company in question to conduct diligence on a scale equivalent to a massive internal investigation in order to avoid prosecution for any FCPA violations committed by the acquired company prior to the transaction. For

11

See Department of Justice FCPA Opinion Procedure Release No. 08-02 (Jun. 13, 2008), available at http://www.usdoj.gov/criminal/fraud/fcpa/opinion/2008/0802.html.

February 21, 2012

example, the company was advised that it should retain outside counsel and forensic accountants to conduct a full examination of the acquirees emails and financial and accounting records and to interview the acquirees personnel, and to accomplish all of this on a rigid and aggressive schedule spanning less than six months (with high risk issues to be identified, investigated and reported to the Department within 90 days of the transaction closing).12 The sweeping expectations set forth in Opinion Release 08-02 are unrealistic and unduly punitive. They merit thorough reconsideration. De Minimis Gifts and Hospitality The Department has stated that it does not prosecute conduct involving de minimis gifts and hospitality to foreign officials. For example, during a June 14, 2011 hearing before the House Subcommittee on Crime, Terrorism and Homeland Security, when Acting Deputy Assistant Attorney General Greg Andres was asked Are de minimis cases ever brought? he testified, Theyre not, sir. And just to clear the record, the Department of Justice has never prosecuted somebody for giving a cup of coffee to a foreign official, a martini, two martinis, a lunch, a taxi ride or anything like that.13 Notwithstanding the Departments assurances, such gifts and hospitality remain subject to prosecution at the whim of the government. They are therefore a subject of considerable concern both for business personnel who regularly encounter situations involving such hospitality the business lunch, the site visit that includes transportation for guests, the pitch meeting that includes gifts of company trinkets and for companies compliance personnel, who frequently must devote disproportionate resources to investigating, analyzing and attempting to resolve such situations. Compliance officers routinely are called upon to address questions relating to how much can be spent on a meal, how many meals in a year may an official be invited to attend, and similar issues. The risk that the Department could prosecute de minimis gift and hospitality cases, in combination with the absence of any guidelines from the government regarding the threshold below which it ordinarily will not bring those cases, has resulted in a serious misallocation of compliance resources to detect and address potential breaches that should fall below any reasonable threshold. While we recognize that exceptional circumstances may exist in which the Department or the SEC concludes that a de minimis gift nevertheless merits charges, we submit that it should be possible to identify a clear standard for gifts and hospitality that ordinarily will not be subject to enforcement action and to address common scenarios that arise in the course of business interactions with foreign officials. For example, in what

12 13

Id. Hearing of the Crime, Terrorism and Homeland Security Subcommittee of the House Judiciary Committee (June 14, 2011), Tr. at 16-17.

February 21, 2012

circumstances would it violate the FCPA to provide foreign officials with tickets to a sporting event or concert? In what circumstances would it violate the FCPA to pay for business class or first class flights, car services, hotel accommodations, meals or other travel expenses for foreign officials in connection with business-related travel? In what circumstances would it violate the FCPA to pay for meals or travel expenses for relatives of foreign officials (e.g., inviting a foreign official and his or her spouse to attend a dinner with employees of the business)? In addition to providing much-needed clarity with respect to commonplace business activities, such guidance also will help companies avoid wasting resources on internal investigations of technical but inconsequential breaches (e.g., the taxi ride or business lunch) and instead allocate those resources to detecting, investigating, and preventing those more serious instances of corruption that the FCPA was intended to address. As you know, the U.K. Ministry of Justice already has provided such guidance regarding the application of the U.K. Bribery Act. According to that guidance, Bona fide hospitality and promotional, or other business expenditure which seeks to improve the image of a commercial organisation, better to present products and services, or establish cordial relations, is recognised as an established and important part of doing business and it is not the intention of the Act to criminalise such behaviour. The Government does not intend for the Act to prohibit reasonable and proportionate hospitality and promotional or other similar business expenditure intended for these purposes.14 The Ministry of Justice cites, as examples of ordinarily legitimate hospitality, the provision of airport to hotel transfer services to facilitate an on-site visit, dining and tickets to an event, or reasonable travel and accommodation to allow foreign public officials to visit [a companys] distant mining operations so that those officials may be satisfied of the high standard and safety of the companys installations and operating systems.15 Similar concrete examples in your forthcoming guidance would be extremely useful to the business community. Mens Rea Standard for Corporate Criminal Liability Although the FCPA expressly limits an individuals liability for violations of the anti-bribery provisions to situations in which the individual has committed those violations willfully, it does not contain any similar language with regard to corporate criminal liability.16 This inconsistency in the statutory language appears to expose companies to criminal penalties for violations of the FCPA even if there is no identifiable person of authority who knew that the conduct was unlawful or even wrong. Because

14 15 16

U.K. Ministry of Justice, The Bribery Act 2010 Guidance, at 26. Id. at 30-31. 15 U.S.C. 78dd-3(a)(2).

February 21, 2012

corporations act only through their employees or agents and therefore can be liable only if an individual for whom the corporation is liable has committed the criminal act, it should not be possible to convict a corporation unless the employee is liable. Such individual liability requires willful conduct, and so should corporate liability. Given that the statute does not explicitly address the mens rea standard for corporate criminal liability, we request that the Department clarify its position on that standard, including by stating whether the Departments view is that a company may be criminally sanctioned for FCPA bribery violations of which the company had no direct knowledge. Declination Decisions We also request that the Department reconsider its practice of not providing information about its decisions to close FCPA-related investigations with no enforcement action. An understanding of the real-world circumstances that result in a declination would be tremendously useful to companies seeking to comply with the FCPA. In particular, to the extent that a declination decision is based on the robustness of a companys compliance program, information about that program would help provide a standard against which other companies may measure their own programs. The Department could and should make information about its declinations available without identifying the companies or individuals at issue just as it already does in its Opinion Releases. Other Recurring Issues Given the complexity of the FCPA and the modern business environment, compliance officials at companies regularly confront many issues of interpretation and application in addition to those identified above. Among those recurring situations are the following, and we respectfully request that the forthcoming guidance address these scenarios. Companies that enter into business relationships with relatives of government officials face risks under the FCPA, but it should not be the case that such relationships are never appropriate. Accordingly, the guidance should outline recommended best practices and examples of prophylactic measures that would be expected by DOJ and SEC with regard to business relationships with relatives of foreign officials. In addition, the guidance should address those circumstances where a company has no knowledge of a family members connections to government or are unlikely to have any business before or with applicable government bodies. Charitable organizations and institutions in many nations have significant government ties. What standards should govern corporate donations to

10

February 21, 2012

charities that have connections with foreign governments? What level of diligence is required or expected when making charitable donations? How are U.S. companies to treat apprentice programs or secondment arrangements in which their employees are assigned to work for a foreign customer in which a foreign government holds an interest, with the salaries of the apprenticed employees paid by the U.S. company? Under the FCPA, are such apprenticed or seconded employees treated as employees of a foreign instrumentality such that their salaries are viewed as bribes? * * *

As you know, we believe that modest legislative revisions and clarifications of the FCPA remain the best option for providing the certainty needed by the regulated community. Nevertheless, the formal guidance that we understand you will provide in 2012 should carry sufficient precedential weight to be reliable and meaningful for businesses seeking to comply with the FCPA. For example, it should have the same force as other policies of the Department and the SEC, such as the Principles of Federal Prosecution of Business Organizations and the SEC Enforcement Manual. Additionally, in order to avoid conflicting interpretations and ensure a uniform policy, the guidance should be issued by (or at least adopted by) both your agencies and should apply, as Assistant Attorney General Breuers remarks appeared to indicate, to both criminal and civil enforcement. Guidance that the Department and the SEC are entirely free to disregard in future enforcement decisions would foster only greater uncertainty, not greater compliance. We appreciate your consideration of this letter, and we would welcome an opportunity to meet with you, at your convenience, to discuss our requests. Sincerely,

US Chamber of Commerce US Chamber Institute for Legal Reform Advanced Medical Technology Association American Gaming Association American Institute of Certified Public Accountants American Insurance Association Arkansas Cattlemens Association Arkansas Farm Bureau Bay Area Council

11 California Manufacturing and Technology Association Civil Justice Association of California The Coalition of Service Industries Faulkner County Farm Bureau The Financial Services Roundtable Generic Pharmaceutical Association International Association of Drilling Contractors International Stability Operations Association Iowa Association of Business and Industry National Association of Criminal Defense Lawyers National Association of Manufacturers National Foreign Trade Council Pharmaceutical Research and Manufacturers of America The Poultry Federation Professional Services Council Retail Industry Leaders Association Southern California Biomedical Council TechAmerica Technology Hampton Roads Virginia Biotechnology Association Virginia International Business Council Western Independent Refiners Association West Virginia Bankers Association West Virginia Manufacturers Association West Virginia Farm Bureau

February 21, 2012

You might also like

- Hedge Funds and Private Equity FundsDocument13 pagesHedge Funds and Private Equity FundsMarketsWikiNo ratings yet

- Doctrine of Indoor Management: Holistic Analysis From Legal and Business PrismDocument7 pagesDoctrine of Indoor Management: Holistic Analysis From Legal and Business PrismKaustubh PatilNo ratings yet

- GFI Comments On FinCEN Notice of Proposed Rulemaking On Customer Due Diligence Requirements For Financial InstitutionsDocument9 pagesGFI Comments On FinCEN Notice of Proposed Rulemaking On Customer Due Diligence Requirements For Financial InstitutionsGlobal Financial IntegrityNo ratings yet

- Defending-Govt-Contractors Sept-Oct 2021 Champion - Published VersionDocument8 pagesDefending-Govt-Contractors Sept-Oct 2021 Champion - Published VersionSara KropfNo ratings yet

- AGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and StockholdersDocument65 pagesAGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and Stockholdersrachellesg75% (12)

- 3 - Knowing The Foreign Corrupt Practices Act As Applied in The PhilippinesDocument2 pages3 - Knowing The Foreign Corrupt Practices Act As Applied in The PhilippinesAliah MagumparaNo ratings yet

- FCPA ReportDocument22 pagesFCPA ReportK ARULAPPANNo ratings yet

- Merger and Acquisition End Term Summative AssessmentDocument13 pagesMerger and Acquisition End Term Summative AssessmentHusain BohraNo ratings yet

- 1615 H Street NW - Washington, DC - 20062Document12 pages1615 H Street NW - Washington, DC - 20062api-249785899No ratings yet

- Business and Economic Crime in An International ContexDocument21 pagesBusiness and Economic Crime in An International Contexحسن خالد وسوNo ratings yet

- Ghillyer EthicsNow IM Ch06Document28 pagesGhillyer EthicsNow IM Ch06JeenahNo ratings yet

- SEC Reams and Retools ItselfDocument2 pagesSEC Reams and Retools ItselfStradlingNo ratings yet

- FcpaDocument4 pagesFcpaRajarshi DaharwalNo ratings yet

- FCPA Due Diligence in M&A: Deloitte Forensic CenterDocument6 pagesFCPA Due Diligence in M&A: Deloitte Forensic CenterHoracioMGMNo ratings yet

- Laws of The Lands - Jason de BrettevilleDocument1 pageLaws of The Lands - Jason de BrettevilleStradlingNo ratings yet

- DAO Legal Framework Jennings Kerr10.19.21 FinalDocument30 pagesDAO Legal Framework Jennings Kerr10.19.21 FinalLastminute LaiNo ratings yet

- Ethics in An International EnvironmentDocument12 pagesEthics in An International EnvironmenthannknotNo ratings yet

- Letter To DOJ and SEC Re. FCPA GuidanceDocument11 pagesLetter To DOJ and SEC Re. FCPA GuidanceaccountabilityrdtbleNo ratings yet

- Final Bribery Act ArticleDocument2 pagesFinal Bribery Act ArticleGuy FaceyNo ratings yet

- Fcpa Guide 2020 FinalDocument133 pagesFcpa Guide 2020 FinaljuliaNo ratings yet

- International Business PracticesDocument3 pagesInternational Business PracticesSheila Arenajo ArtilleroNo ratings yet

- 1998 AmendmentsDocument7 pages1998 AmendmentsHimeshNo ratings yet

- M A Due Diligence PDFDocument7 pagesM A Due Diligence PDFPrashant MauryaNo ratings yet

- Goodman Dodd Frank S Impact On Financial Entities Financial Activities and TreasuryDocument3 pagesGoodman Dodd Frank S Impact On Financial Entities Financial Activities and TreasurySudh BoyNo ratings yet

- The Appropriations Law Answer Book: A Q&A Guide to Fiscal LawFrom EverandThe Appropriations Law Answer Book: A Q&A Guide to Fiscal LawNo ratings yet

- Regulation of Securities, Markets, and Transactions: A Guide to the New EnvironmentFrom EverandRegulation of Securities, Markets, and Transactions: A Guide to the New EnvironmentNo ratings yet

- Solution Manual For Managers and The Legal Environment Strategies For Business 9th Edition Constance e Bagley Isbn 10 1337555088 Isbn 13 9781337555081Document11 pagesSolution Manual For Managers and The Legal Environment Strategies For Business 9th Edition Constance e Bagley Isbn 10 1337555088 Isbn 13 9781337555081Paul Fuselier100% (32)

- Title XVDocument2 pagesTitle XVBelen Espanola NobleNo ratings yet

- Como Fazer Seus Próprios PerfumesDocument5 pagesComo Fazer Seus Próprios PerfumesAndersonNo ratings yet

- Mergers Acquisitions - Philippines PDFDocument10 pagesMergers Acquisitions - Philippines PDFAl GNo ratings yet

- Business Law Today Article - August 2, 2010Document4 pagesBusiness Law Today Article - August 2, 2010Stuart DemingNo ratings yet

- Definition Politics and LawDocument23 pagesDefinition Politics and LawLira Serrano AgagNo ratings yet

- Managing The Risks of Global Bribery in BusinessDocument2 pagesManaging The Risks of Global Bribery in BusinessMine SayracNo ratings yet

- Trade Relations - monday.corruption-FCPA (Fall 2007)Document20 pagesTrade Relations - monday.corruption-FCPA (Fall 2007)Ajit ShindeNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- IBA OECD Task Force On The Role of Lawyers Report (2019)Document48 pagesIBA OECD Task Force On The Role of Lawyers Report (2019)ruzainisarifNo ratings yet

- 20-03 04 Wiley ThomasDocument4 pages20-03 04 Wiley ThomasAbhishek SinghNo ratings yet

- Lesson 1 Governance Additional NotesDocument6 pagesLesson 1 Governance Additional NotesCarmela Tuquib RebundasNo ratings yet

- Merger and ConsolidationDocument40 pagesMerger and ConsolidationalbycadavisNo ratings yet

- Foreign Corrupt Practices Act and UK Bribery Act in Developing CountriesDocument9 pagesForeign Corrupt Practices Act and UK Bribery Act in Developing CountriesRobin Singh100% (1)

- UK Bribery Bill AdviceDocument10 pagesUK Bribery Bill AdviceeriphyleNo ratings yet

- s73610 32Document7 pagess73610 32MarketsWikiNo ratings yet

- Shareholder Rights and The Equitable Treatment of ShareholdersDocument30 pagesShareholder Rights and The Equitable Treatment of Shareholdersbinhbdth2No ratings yet

- OSCB33 (ContractorEthics) MemoDocument3 pagesOSCB33 (ContractorEthics) MemoCeleste KatzNo ratings yet

- DOJ's "Top 10 For Effective FCPA Compliance ProgramsDocument2 pagesDOJ's "Top 10 For Effective FCPA Compliance ProgramsmrvirginesNo ratings yet

- Copy (3) of Copy of Corporate Governance 1Document20 pagesCopy (3) of Copy of Corporate Governance 1bappa85No ratings yet

- Fsa 3,4,5Document17 pagesFsa 3,4,5wambualucas74No ratings yet

- PEPs and Enhanced Due DiligenceDocument2 pagesPEPs and Enhanced Due DiligencebryanNo ratings yet

- Damodaram Sanjivayya National Law University, Sabbavaram, VisakhapatnamDocument21 pagesDamodaram Sanjivayya National Law University, Sabbavaram, VisakhapatnamShruti YadavNo ratings yet

- June 14 2010-Dept of Treasury - Regulatory Bulletin Fraud & Insider Abuse (Revised)Document41 pagesJune 14 2010-Dept of Treasury - Regulatory Bulletin Fraud & Insider Abuse (Revised)83jjmackNo ratings yet

- CLSP 2 MarkDocument2 pagesCLSP 2 Mark18-UCO-327 Naveen Kumar.DNo ratings yet

- Gerald Fish ManDocument4 pagesGerald Fish ManMarketsWikiNo ratings yet

- Insider Trading Latest - MMDocument9 pagesInsider Trading Latest - MMMariam Mindiashvili0% (1)

- A Resource Guide To The U.S. Foreign Corrupt Practices ActDocument130 pagesA Resource Guide To The U.S. Foreign Corrupt Practices ActVanessa SchoenthalerNo ratings yet

- Statement OF Greg Andres Acting Deputy Assistant Attorney General Criminal DivisionDocument11 pagesStatement OF Greg Andres Acting Deputy Assistant Attorney General Criminal Divisionmgp1388No ratings yet

- Standards of Business Conduct - Legal StandardsDocument12 pagesStandards of Business Conduct - Legal StandardsImnevada AcidNo ratings yet

- CH 4Document6 pagesCH 4Mona Adila PardedeNo ratings yet

- Ming Zhang ComplaintDocument13 pagesMing Zhang Complaintdougj1No ratings yet

- BIS ZTE Federal Register Notice and Related DocumentsDocument33 pagesBIS ZTE Federal Register Notice and Related Documentsdougj1No ratings yet

- BIS Advisory Opinion On General Technology Note 3.25.14Document2 pagesBIS Advisory Opinion On General Technology Note 3.25.14dougj1No ratings yet

- Census Bureau - Foreign Trade Letter No. 8 Dated April 3, 2014Document1 pageCensus Bureau - Foreign Trade Letter No. 8 Dated April 3, 2014dougj1No ratings yet

- Pages From BIS Annual Report 2013Document3 pagesPages From BIS Annual Report 2013dougj1No ratings yet

- Export Control Reform Dashboard (June 2012)Document1 pageExport Control Reform Dashboard (June 2012)dougj1No ratings yet

- Export Control Reform Administration EO (3.8.2013)Document5 pagesExport Control Reform Administration EO (3.8.2013)dougj1No ratings yet

- Zhang IndictmentDocument8 pagesZhang Indictmentdougj1No ratings yet

- BIS Entity List Additions (10.8.2012)Document27 pagesBIS Entity List Additions (10.8.2012)dougj10% (1)

- Executive Order 13628 (10.9.12)Document7 pagesExecutive Order 13628 (10.9.12)dougj1No ratings yet

- AWA ITAR-Export Controls ProgramsDocument4 pagesAWA ITAR-Export Controls Programsdougj1No ratings yet

- ICC Incoterms 2010 Program 25 April 2013Document2 pagesICC Incoterms 2010 Program 25 April 2013dougj1No ratings yet

- ECR Control List Tracker June 2012Document1 pageECR Control List Tracker June 2012dougj1No ratings yet

- DHL AAEI Export Conference Nov 17, 2011Document1 pageDHL AAEI Export Conference Nov 17, 2011dougj1No ratings yet

- DDTC Freight Forwarders Debarred Guidance (2.27.12)Document3 pagesDDTC Freight Forwarders Debarred Guidance (2.27.12)dougj1No ratings yet

- Burma Sanctions - OFAC GLs and Reporting Requirements (July 11, 2012)Document6 pagesBurma Sanctions - OFAC GLs and Reporting Requirements (July 11, 2012)dougj1No ratings yet

- Flowserve VSD Event Flyer - December 6, 2011Document1 pageFlowserve VSD Event Flyer - December 6, 2011dougj1No ratings yet

- UN LIST OF LIBYA INDIVIDUALS AND ENTITIES (Dec. 16, 2011)Document8 pagesUN LIST OF LIBYA INDIVIDUALS AND ENTITIES (Dec. 16, 2011)dougj1No ratings yet

- WA 2011 - Internal Compliance ProgrammesDocument7 pagesWA 2011 - Internal Compliance Programmesdougj1No ratings yet

- EU Export - Controls - 2011 - Trusted Trade Institute July 18, 2011Document1 pageEU Export - Controls - 2011 - Trusted Trade Institute July 18, 2011dougj1No ratings yet

- TTI EU Customs Law and Practice Master Class March 8-9, 2011Document1 pageTTI EU Customs Law and Practice Master Class March 8-9, 2011dougj1No ratings yet

- DHL AAEI Export Conference Nov 17, 2011Document1 pageDHL AAEI Export Conference Nov 17, 2011dougj1No ratings yet

- DDTC Freight Forwarders Debarred Guidance (2.24.12)Document3 pagesDDTC Freight Forwarders Debarred Guidance (2.24.12)dougj1No ratings yet

- UK Export Control Organisation Notice Re US-UK Defence Trade Cooperation TreatyDocument2 pagesUK Export Control Organisation Notice Re US-UK Defence Trade Cooperation Treatydougj1No ratings yet

- Xe Services 081810 Settlement Summary 090610Document1 pageXe Services 081810 Settlement Summary 090610John P. PrieckoNo ratings yet

- AAR 071510 Settlement Summary 081210Document1 pageAAR 071510 Settlement Summary 081210dougj1No ratings yet

- NEI Executive OrderDocument3 pagesNEI Executive Orderdougj1No ratings yet

- U.S. Customs Import Trends FY 2010 Mid-Year ReportDocument10 pagesU.S. Customs Import Trends FY 2010 Mid-Year Reportdougj1No ratings yet

- Importance of Human Resource ManagementDocument9 pagesImportance of Human Resource Managementt9inaNo ratings yet

- Hanan 07 C.V.-aucDocument6 pagesHanan 07 C.V.-aucAhmed NabilNo ratings yet

- Yujuico vs. Far East Bank and Trust Company DigestDocument4 pagesYujuico vs. Far East Bank and Trust Company DigestEmir MendozaNo ratings yet

- 73 220 Lecture07Document10 pages73 220 Lecture07api-26315128No ratings yet

- Lecture 4-Concrete WorksDocument24 pagesLecture 4-Concrete WorksSyakir SulaimanNo ratings yet

- Agency TheoryDocument2 pagesAgency TheoryAmeh SundayNo ratings yet

- Advanced Competitive Position AssignmentDocument7 pagesAdvanced Competitive Position AssignmentGeraldine Aguilar100% (1)

- I INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowDocument18 pagesI INVENTED THE MODERN AGE: The Rise of Henry Ford by Richard SnowSimon and SchusterNo ratings yet

- Problem Set 1 SolutionsDocument16 pagesProblem Set 1 SolutionsAhmed SamadNo ratings yet

- Bcom Final Year ProjectDocument65 pagesBcom Final Year ProjectSHIBIN KURIAKOSE87% (69)

- Bank Alfalah Internship ReportDocument22 pagesBank Alfalah Internship Reportmemon_maryam786No ratings yet

- 782 Sap SD Credit or Risk ManagementDocument12 pages782 Sap SD Credit or Risk Managementrohit sharmaNo ratings yet

- Leonardo Roth, FLDocument2 pagesLeonardo Roth, FLleonardorotharothNo ratings yet

- Lexis® Gift VouchersDocument1 pageLexis® Gift VouchersNURUL IZZA HUSINNo ratings yet

- Menu EngineeringDocument9 pagesMenu Engineeringfirstman31No ratings yet

- Bahan Presentasi - Kelompok 3 - Supply ChainDocument46 pagesBahan Presentasi - Kelompok 3 - Supply ChainpuutNo ratings yet

- RBI FAQ of FDI in IndiaDocument53 pagesRBI FAQ of FDI in Indiaaironderon1No ratings yet

- A Flock of Red Flags PDFDocument10 pagesA Flock of Red Flags PDFSillyBee1205No ratings yet

- A Guide About Bank AccountsDocument6 pagesA Guide About Bank AccountsHelloprojectNo ratings yet

- Internship ReportDocument20 pagesInternship ReportbumbumpingNo ratings yet

- Obayomi & Sons Farms: Business PlanDocument5 pagesObayomi & Sons Farms: Business PlankissiNo ratings yet

- F23 - OEE DashboardDocument10 pagesF23 - OEE DashboardAnand RNo ratings yet

- Freight Charge Notice: To: Garment 10 CorporationDocument4 pagesFreight Charge Notice: To: Garment 10 CorporationThuy HoangNo ratings yet

- Ifrs 5Document2 pagesIfrs 5Foititika.netNo ratings yet

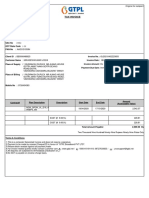

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDocument1 pageTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- 01 Pengantar SCMDocument46 pages01 Pengantar SCMAdit K. BagaskoroNo ratings yet

- Chandelier Exit 26 Jun 2016Document4 pagesChandelier Exit 26 Jun 2016Rajan ChaudhariNo ratings yet

- GeM Bidding 2401209Document4 pagesGeM Bidding 2401209SRARNo ratings yet

- Flowchart of Raw Materials Purchasing FunctionDocument1 pageFlowchart of Raw Materials Purchasing Function05. Ariya ParendraNo ratings yet

- Unit 1 Evolution of Management ThoughtDocument4 pagesUnit 1 Evolution of Management ThoughtParvez SaifNo ratings yet