Professional Documents

Culture Documents

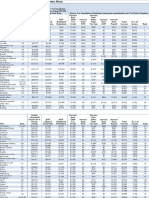

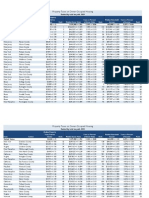

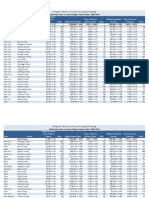

Facts and Figures 2012: Estate Tax Rates and Exemptions, As of January 1, 2012

Uploaded by

Tax Foundation0 ratings0% found this document useful (0 votes)

8K views1 pageEstate Tax Rates and Exemptions, As of January 1, 2012

State Conn. Del. Hawaii Ill. Maine (a) Md. (b) Mass. Minn. N.J. (b) N.Y. N.C. Ohio (c) Ore. R.I. Tenn. (d) Vt. Wash. D.C. Exemption $2M $5M $3.6M $2M $1M $1M $1M $1M $675,000 $1M $5M $338,333 $1M $859,350 $1M $2.75M $2M $1M Rate (Min. to Max.) 7.2% - 12% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 6% - 7% 0.8% - 16% 0.8% - 16% 5.5% - 9.5% 0.8% - 16% 10% - 19% 0.8% - 16%

(a) M

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEstate Tax Rates and Exemptions, As of January 1, 2012

State Conn. Del. Hawaii Ill. Maine (a) Md. (b) Mass. Minn. N.J. (b) N.Y. N.C. Ohio (c) Ore. R.I. Tenn. (d) Vt. Wash. D.C. Exemption $2M $5M $3.6M $2M $1M $1M $1M $1M $675,000 $1M $5M $338,333 $1M $859,350 $1M $2.75M $2M $1M Rate (Min. to Max.) 7.2% - 12% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 6% - 7% 0.8% - 16% 0.8% - 16% 5.5% - 9.5% 0.8% - 16% 10% - 19% 0.8% - 16%

(a) M

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8K views1 pageFacts and Figures 2012: Estate Tax Rates and Exemptions, As of January 1, 2012

Uploaded by

Tax FoundationEstate Tax Rates and Exemptions, As of January 1, 2012

State Conn. Del. Hawaii Ill. Maine (a) Md. (b) Mass. Minn. N.J. (b) N.Y. N.C. Ohio (c) Ore. R.I. Tenn. (d) Vt. Wash. D.C. Exemption $2M $5M $3.6M $2M $1M $1M $1M $1M $675,000 $1M $5M $338,333 $1M $859,350 $1M $2.75M $2M $1M Rate (Min. to Max.) 7.2% - 12% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 0.8% - 16% 6% - 7% 0.8% - 16% 0.8% - 16% 5.5% - 9.5% 0.8% - 16% 10% - 19% 0.8% - 16%

(a) M

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

Estate Tax Rates and Exemptions,

As of January 1, 2012

State

Conn.

Del.

Hawaii

Ill.

Maine (a)

Md. (b)

Mass.

Minn.

N.J. (b)

N.Y.

N.C.

Ohio (c)

Ore.

R.I.

Tenn. (d)

Vt.

Wash.

D.C.

Exemption

$2M

$5M

$3.6M

$2M

$1M

$1M

$1M

$1M

$675,000

$1M

$5M

$338,333

$1M

$892,865

$1M

$2.75M

$2M

$1M

Rate (Min. to Max.)

7.2% - 12%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

0.8% - 16%

6% - 7%

0.8% - 16%

0.8% - 16%

5.5% - 9.5%

0.8% - 16%

10% - 19%

0.8% - 16%

(a) Maine's exemption will increase to $2M on Jan 1, 2013.

(b) Maryland and New Jersey have both an estate and an inheritance tax.

(c) Ohio's estate tax is repealed effective Jan 1, 2013.

(d) Some sources (including The Tennessee Department of Revenue) list Tennessee's

estate tax as an inheritance tax, but it functions as an estate tax.

Source: American Family Business Foundation.

Tax Foundation

www.TaxFoundation.org

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Fed U.S. Federal Individual Income Tax Rates History, 1862-2013Document68 pagesFed U.S. Federal Individual Income Tax Rates History, 1862-2013Tax Foundation96% (23)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Federal Taxes Paid Vs Federal Spending Received by States, 1981-2005Document51 pagesFederal Taxes Paid Vs Federal Spending Received by States, 1981-2005Javier Arvelo-Cruz-SantanaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Christmas Cheer Return: Filing StatusDocument2 pagesChristmas Cheer Return: Filing StatusTax FoundationNo ratings yet

- Explainer: Nevada Governor Sandoval's Business License Fee Restructuring - Appendix ADocument10 pagesExplainer: Nevada Governor Sandoval's Business License Fee Restructuring - Appendix ATax FoundationNo ratings yet

- Facts & Figures 2015: How Does Your State Compare?Document55 pagesFacts & Figures 2015: How Does Your State Compare?Tax FoundationNo ratings yet

- Tax Foundation 2014 Annual ReportDocument32 pagesTax Foundation 2014 Annual ReportTax FoundationNo ratings yet

- Facts and Figures 2014Document55 pagesFacts and Figures 2014Tax FoundationNo ratings yet

- North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformDocument84 pagesNorth Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformTax Foundation100% (1)

- Facts and Figures 2013Document56 pagesFacts and Figures 2013Tax FoundationNo ratings yet

- Powerpoint Presentation For "North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth Reform"Document38 pagesPowerpoint Presentation For "North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth Reform"Tax FoundationNo ratings yet

- How Is The Money Used? Federal and State Cases Distinguishing Taxes and FeesDocument98 pagesHow Is The Money Used? Federal and State Cases Distinguishing Taxes and FeesTax FoundationNo ratings yet

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Facts and Figures - How Does Your State Compare? 2013 EditionDocument56 pagesFacts and Figures - How Does Your State Compare? 2013 EditionTax FoundationNo ratings yet

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Tax Watch, Winter 2013Document28 pagesTax Watch, Winter 2013Tax FoundationNo ratings yet

- Federal Income Tax Rates History, Nominal Dollars, 1913-2013Document66 pagesFederal Income Tax Rates History, Nominal Dollars, 1913-2013Tax Foundation100% (1)

- Proptax 08 10 TaxespaidDocument67 pagesProptax 08 10 TaxespaidTax FoundationNo ratings yet

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- Proptax 06 10 TaxpaidDocument102 pagesProptax 06 10 TaxpaidTax FoundationNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- Tax Watch Summer 2012Document24 pagesTax Watch Summer 2012Tax FoundationNo ratings yet

- Proptax10 Taxes PaidDocument27 pagesProptax10 Taxes PaidTax FoundationNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- Proptax 08 10 IncomeDocument66 pagesProptax 08 10 IncomeTax FoundationNo ratings yet

- Proptax 06 10 HomevalueDocument102 pagesProptax 06 10 HomevalueTax FoundationNo ratings yet