Professional Documents

Culture Documents

FDIC - Statistics On Depository Institutions Report: Assets and Liabilities

Uploaded by

Adam BelzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FDIC - Statistics On Depository Institutions Report: Assets and Liabilities

Uploaded by

Adam BelzCopyright:

Available Formats

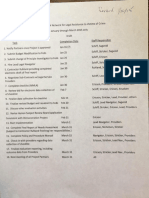

FDIC - Statistics on Depository Institutions Report

1 Number of institutions reporting Assets and Liabilities 2 Total assets 3 Net loans and leases 4 Other real estate owned 5 Total deposits 6 Total equity capital 7 Noncurrent loans and leases 8 Tier one (core) capital 9 Tier 2 Risk-based capital

Iowa Banks 12/31/2011 $ in 000's Total (Sum) and Average (W) 345 68,588,931 41,991,618 363,458 55,645,897 7,000,863 626,288 6,368,624 543,821

Iowa Banks 12/31/2010 $ in 000's Total (Sum) and Average (W) 360 66,068,217 42,074,440 391,135 53,495,481 6,431,740 814,597 6,064,350 541,709

Net Loans and Leases Construction and development loans 1,612,361 1,870,518 Commercial RE 8,932,258 9,199,433 Commercial real estate owner-occupied 3,960,670 3,945,728 Commercial real estate other non-farm non4,169,393 4,018,916 residential 14 Multifamily residential real estate 1,388,295 1,305,930 15 1-4 family residential loans 9,296,112 9,513,417 16 Farmland loans 5,932,519 5,571,919 17 Farm loans 6,467,450 5,974,900 18 Construction and development loans 1,612,361 1,870,518 19 Total loans and leases N/A N/A * Note: Other loans and leases category items may not total for TFR Reporters due to reporting differences. (Year-to-date) (Year-to-date) Income and Expense 20 Net income 685,381 414,134 10 11 12 13 Performance and Condition Ratios Return on assets (ROA) Return on Equity (ROE) Noncurrent loans to loans Core capital (leverage) ratio Total risk-based capital ratio (Year-to-date) 1.03% 10.20% 1.47% 9.42% 14.54% (Year-to-date) 0.64% 6.37% 1.90% 9.21% 14.06%

21 22 23 24 25

Key for Column Selections:

Column 1 Selections Custom Peer Group (Criteria): R.ACTIVE = 1 AND R.STALP = 'IA' as of 12/31/2011

Column 2 Selections

Custom Peer Group (Criteria): R.ACTIVE = 1 AND R.STALP = 'IA' as of 12/31/2010

erences.

You might also like

- BSISDocument61 pagesBSISMahmood KhanNo ratings yet

- Bank Balance Sheets and Income StatementsDocument61 pagesBank Balance Sheets and Income StatementsAniket BardeNo ratings yet

- Fourth Quarter 2008 Earnings Review: January 16, 2009Document35 pagesFourth Quarter 2008 Earnings Review: January 16, 2009Mark ReinhardtNo ratings yet

- Banking Sector January 2011Document2 pagesBanking Sector January 2011Sharon ManziniNo ratings yet

- Basel II Assessing Default and Loss Characteristic of Proj Fin LoansDocument13 pagesBasel II Assessing Default and Loss Characteristic of Proj Fin LoansSoumya Ranjan PradhanNo ratings yet

- Fitch RatingsDocument7 pagesFitch RatingsTareqNo ratings yet

- JPM Mortgage WarningsDocument21 pagesJPM Mortgage WarningsZerohedgeNo ratings yet

- Fixed Income Investor Review Highlights and Financial StrengthDocument43 pagesFixed Income Investor Review Highlights and Financial StrengthAhsan AliNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- CRISIL Event UpdateDocument4 pagesCRISIL Event UpdateAdarsh Sreenivasan LathikaNo ratings yet

- WFC Financial OverviewDocument25 pagesWFC Financial Overviewbmichaud758No ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- Mda CibcDocument12 pagesMda CibcAlexandertheviNo ratings yet

- Financial Performance of Dhaka BankDocument6 pagesFinancial Performance of Dhaka Bankdiu_diptoNo ratings yet

- Unit-2, Regulations of Depository InstitutionsDocument6 pagesUnit-2, Regulations of Depository InstitutionsUmesh LagejuNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Week 3 BUS 650 Assignment Finance Goff ComputerDocument12 pagesWeek 3 BUS 650 Assignment Finance Goff Computermenafraid100% (4)

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- Management Presentation Performance Highlights Q1 FY12 Q: Rural Electrification Corporation LimitedDocument13 pagesManagement Presentation Performance Highlights Q1 FY12 Q: Rural Electrification Corporation LimitedVijay BiloriyaNo ratings yet

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocument5 pagesBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittleNo ratings yet

- Libyan InvestmentsDocument20 pagesLibyan InvestmentsAyam ZebossNo ratings yet

- Unilever Thomson 19feb2011Document10 pagesUnilever Thomson 19feb2011Fahsaika JantarathinNo ratings yet

- UAE Real Estate Sector Update October 2008Document40 pagesUAE Real Estate Sector Update October 2008Mustafa ChaudhryNo ratings yet

- RBI-Fin Stability ReportDocument97 pagesRBI-Fin Stability ReportHariganesh CNo ratings yet

- FY 2012-13 First Quarter Results: Investor PresentationDocument31 pagesFY 2012-13 First Quarter Results: Investor PresentationSai KalyanNo ratings yet

- 2nd Quarter Results 2011 12Document1 page2nd Quarter Results 2011 12satyendra_upreti2011No ratings yet

- City Developments Downgraded to Sell on Residential Uncertainties; Hotel Segment Remains FirmDocument6 pagesCity Developments Downgraded to Sell on Residential Uncertainties; Hotel Segment Remains FirmJay NgNo ratings yet

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingNo ratings yet

- Icici Bank: Performance HighlightsDocument16 pagesIcici Bank: Performance HighlightsAngel BrokingNo ratings yet

- Hindustan Construction Company Financial Analysis 2010-2014Document21 pagesHindustan Construction Company Financial Analysis 2010-2014Harsh MohapatraNo ratings yet

- Standard Chartered Bank Nepal Ltd. Naya Baneshwor, KathmanduDocument1 pageStandard Chartered Bank Nepal Ltd. Naya Baneshwor, Kathmandukheper1No ratings yet

- Strong 1Q Results and Capital StrengthDocument46 pagesStrong 1Q Results and Capital Strengthsandeeppal02No ratings yet

- CHAP - 04 - Financial Statements of Bank - For StudentDocument87 pagesCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252No ratings yet

- ASML 2012 Annual AccountsDocument150 pagesASML 2012 Annual Accountsjasper laarmansNo ratings yet

- Conference Call Presentation? 3Q14Document11 pagesConference Call Presentation? 3Q14FibriaRINo ratings yet

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- Turning The Corner, But No Material Pick-UpDocument7 pagesTurning The Corner, But No Material Pick-UpTaek-Geun KwonNo ratings yet

- APQ3FY12Document19 pagesAPQ3FY12Abhigupta24No ratings yet

- AB Bank key financial highlights 2013-2011Document1 pageAB Bank key financial highlights 2013-2011SikdarMohammadImrulHossainNo ratings yet

- 13TH FC RECOMMENDATIONSDocument3 pages13TH FC RECOMMENDATIONSSushama VermaNo ratings yet

- University of Wales and Mdis: Introduction To Accounting (Hk004)Document11 pagesUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNo ratings yet

- Basel Disclouser Chaitra2070Document2 pagesBasel Disclouser Chaitra2070Krishna Bahadur ThapaNo ratings yet

- IAS 30 and IFRS 7 Bank DisclosuresDocument51 pagesIAS 30 and IFRS 7 Bank DisclosuresMovie MovieNo ratings yet

- Binder - HCT - Collusion - MartinDocument9 pagesBinder - HCT - Collusion - MartinMy-Acts Of-SeditionNo ratings yet

- 4 ACE LTD., 2012 Annual Report (Form 10-K), at 27Document1 page4 ACE LTD., 2012 Annual Report (Form 10-K), at 27urrwpNo ratings yet

- Balance Sheet of UltraTech CementDocument1 pageBalance Sheet of UltraTech CementJeremy JohnsonNo ratings yet

- ICICI Group: Strategy & Performance: September 2011Document42 pagesICICI Group: Strategy & Performance: September 2011helloashokNo ratings yet

- CHAP - 02 - Financial Statements and Bank Performance AnalysisDocument74 pagesCHAP - 02 - Financial Statements and Bank Performance AnalysisPhuc Hoang DuongNo ratings yet

- Dubai Islamic Bank Results Update 16 AugustDocument4 pagesDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanNo ratings yet

- Chapter - Iii: 13 FC RecommendationsDocument3 pagesChapter - Iii: 13 FC RecommendationsSushama VermaNo ratings yet

- WSJ Jpmfiling0510Document191 pagesWSJ Jpmfiling0510Reza Abusaidi100% (1)

- Yes Bank: Emergin G StarDocument5 pagesYes Bank: Emergin G StarAnkit ModaniNo ratings yet

- COMPARATIVE FINANCIAL POSITIONDocument4 pagesCOMPARATIVE FINANCIAL POSITIONशिशिर ढकालNo ratings yet

- Banks 1st Q 2012Document36 pagesBanks 1st Q 2012annawitkowski88No ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- Minneapolis Presentation On Local Government Salary Cap Exception 11-30-17Document2 pagesMinneapolis Presentation On Local Government Salary Cap Exception 11-30-17Adam BelzNo ratings yet

- SER Memo 11 27 17Document8 pagesSER Memo 11 27 17Adam BelzNo ratings yet

- 2017 Mpls Notification To LCCDocument18 pages2017 Mpls Notification To LCCAdam BelzNo ratings yet

- PayablesDocument1 pagePayablesAdam BelzNo ratings yet

- Search Warrant - WashburnDocument8 pagesSearch Warrant - WashburnMelissa TurtinenNo ratings yet

- Sabri Ahmed Promissory NotesDocument5 pagesSabri Ahmed Promissory NotesAdam BelzNo ratings yet

- Sabri Commentary Somali Mall, Aug. 25, 2017Document2 pagesSabri Commentary Somali Mall, Aug. 25, 2017Adam BelzNo ratings yet

- 17-12691 Becker v. Hodges (Order Quashing Writ and Dismissing Petition)Document14 pages17-12691 Becker v. Hodges (Order Quashing Writ and Dismissing Petition)Adam BelzNo ratings yet

- Sabri Letter About Warsame - July 31, 2017Document2 pagesSabri Letter About Warsame - July 31, 2017Adam BelzNo ratings yet

- Hodges Expectations For HarteauDocument1 pageHodges Expectations For HarteauAdam BelzNo ratings yet

- Harteau Release of All Claims Final 8.30.17Document7 pagesHarteau Release of All Claims Final 8.30.17Adam BelzNo ratings yet

- Summons and Complaint - Becker v. Hodges - 8-17-17Document5 pagesSummons and Complaint - Becker v. Hodges - 8-17-17Adam BelzNo ratings yet

- Friends For Farah: Challenge FormDocument1 pageFriends For Farah: Challenge FormAdam BelzNo ratings yet

- Letter To The Honorable Ben Carson FINALDocument1 pageLetter To The Honorable Ben Carson FINALAdam BelzNo ratings yet

- Summons and Complaint - Becker v. Hodges - 8-17-17Document5 pagesSummons and Complaint - Becker v. Hodges - 8-17-17Adam BelzNo ratings yet

- To Do List Council On Crime and JusticeDocument1 pageTo Do List Council On Crime and JusticeAdam BelzNo ratings yet

- Harteau Employment AgreementDocument4 pagesHarteau Employment AgreementAdam BelzNo ratings yet

- Staff Report On Minimum Wage PolicyDocument34 pagesStaff Report On Minimum Wage PolicyAdam Belz100% (1)

- Challenge TFFDocument3 pagesChallenge TFFAdam BelzNo ratings yet

- Farah Challenge 2Document1 pageFarah Challenge 2Adam BelzNo ratings yet

- Farah List of Delegates Challenged 2Document9 pagesFarah List of Delegates Challenged 2Adam BelzNo ratings yet

- Farah Challenge 4 PDFDocument1 pageFarah Challenge 4 PDFAdam BelzNo ratings yet

- GarySchiffForCityCouncilPressRelease4 21Document1 pageGarySchiffForCityCouncilPressRelease4 21Adam BelzNo ratings yet

- Noor - DFL ChallengeDocument23 pagesNoor - DFL ChallengeAdam BelzNo ratings yet

- Farah Press Release 4.21.2017Document1 pageFarah Press Release 4.21.2017Adam BelzNo ratings yet

- Surdyk's Notice of Adverse Action 3-13-17Document2 pagesSurdyk's Notice of Adverse Action 3-13-17Adam BelzNo ratings yet

- Multiple: The Official CallDocument4 pagesMultiple: The Official CallAdam BelzNo ratings yet

- OES Survey For RestaurantsDocument16 pagesOES Survey For RestaurantsAdam BelzNo ratings yet

- FM17044 StarTribune FullPageAd 3HDocument1 pageFM17044 StarTribune FullPageAd 3HAdam BelzNo ratings yet

- 2 15 13 Final Sales Tax BookletDocument16 pages2 15 13 Final Sales Tax BookletAdam BelzNo ratings yet