Professional Documents

Culture Documents

PA State Budget 2012-13 For Smarties

Uploaded by

Commonwealth Foundation0 ratings0% found this document useful (0 votes)

64 views1 pageSince the 1970s, state government spending increased by $11,800 per family of four. State budget exceeds forecasted revenues by an estimated $900 million. Debt and pension payments continue to rise. Key criminal justice reforms will provide major cost savings in future years.

Original Description:

Original Title

PA State Budget 2012-13 for Smarties

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSince the 1970s, state government spending increased by $11,800 per family of four. State budget exceeds forecasted revenues by an estimated $900 million. Debt and pension payments continue to rise. Key criminal justice reforms will provide major cost savings in future years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

64 views1 pagePA State Budget 2012-13 For Smarties

Uploaded by

Commonwealth FoundationSince the 1970s, state government spending increased by $11,800 per family of four. State budget exceeds forecasted revenues by an estimated $900 million. Debt and pension payments continue to rise. Key criminal justice reforms will provide major cost savings in future years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

dget 2012-13 For PA StAte Bu

Ayer edition! PennSylvAniA tAxP

Five Facts about the 2012-13 state budget

1. budget shrinks state government spending for second time in 40 years. Since the 1970s, state government spending increased by $11,800 per family of four (or $2,950 per resident). 2. We are spending more than we make. Over the last two years, the state budget exceeds forecasted revenues by an estimated $900 million. Spending cannot continue to exceed revenues. 3. debt and pension payments continue to rise. Costs will continue to escalate in future years as bills for prior spending and promised benefits come due. 4. corrections spending does not grow for the first time in decades. Key criminal justice reforms will provide major cost savings in future years. 5. Welfare spending increases again. Important reforms, such as new work requirements, will provide long-term savings, but federal mandates are driving increases in Medical Assistance, the single largest item in the budget.

Pennsylvanias Four alarm Fire

Pennsylvanias fiscal house is threatened by a four-alarm fire. Dramatic increases in debt and pension payments are unavoidable, and corrections and welfare spending will rise absent reforms. Action must be taken now to fireproof our economy. Public Welfare spendingthe single largest area of the state budgetis projected to grow eight percent per year. Welfare spending already consumes 40 cents out of every tax dollar in Pennsylvania. Spending is growing faster than taxpayers income and government revenues. corrections spending is expected to grow almost seven percent per year. Over the last 30 years, the Pennsylvania Department of Corrections budget grew 1,700 percent. Pension contributions will increase by 40 percent per year. Taxpayer contributions are set to rise from $500 million in 2010 to $6 billion in 2015. Payments on state debt are forecast to grow seven percent annually. State and local debt already adds up to almost $10,000 per person in PA.

PrinciPles For budgeting

no new taxes. Pennsylvania already has the 10th highest state and local tax burden out of the 50 states. Ten percent of Pennsylvanians income goes to state and local taxes. government must live within its means. If state government had limited its spending growth to inflation plus population since 2000, taxpayers would be saving $3,412 per family of four (or $853 per resident). Prioritize every dollar. Fund results, not programs. eliminate unnecessary spending. Government has no money of its own; it has only that which it first removes from the productive sector of society.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Calpine RGGI LawsuitDocument208 pagesCalpine RGGI LawsuitCommonwealth FoundationNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Makati City Charter UpheldDocument2 pagesMakati City Charter Upheldmellikeslaw100% (2)

- By Laws Phil Cycling)Document15 pagesBy Laws Phil Cycling)kalvin19100% (2)

- Chapter 1 - Introduction To MicroeconomicsDocument28 pagesChapter 1 - Introduction To MicroeconomicsArup SahaNo ratings yet

- 1 CorpsDocument206 pages1 Corpssameera prasathNo ratings yet

- De Guzman - PIL Digest 1Document15 pagesDe Guzman - PIL Digest 1Andrea Gural De GuzmanNo ratings yet

- The Rights of Minorities To Establish and Administer Educational Institutions Under The Constitution of Indi1Document10 pagesThe Rights of Minorities To Establish and Administer Educational Institutions Under The Constitution of Indi1Tshewang Dorjee LamaNo ratings yet

- The Indigenous People's Rights Act of 1997Document99 pagesThe Indigenous People's Rights Act of 1997PingotMagangaNo ratings yet

- UFCW 1776 LetterDocument1 pageUFCW 1776 LetterCommonwealth FoundationNo ratings yet

- How Workers Are Forced To Fund Attack AdsDocument2 pagesHow Workers Are Forced To Fund Attack AdsCommonwealth FoundationNo ratings yet

- Commonwealth Foundation Testimony On RGGI 10.28.19Document3 pagesCommonwealth Foundation Testimony On RGGI 10.28.19Commonwealth FoundationNo ratings yet

- Commonwealth Foundation RTKDocument10 pagesCommonwealth Foundation RTKCommonwealth FoundationNo ratings yet

- Vape Tax VictimsDocument2 pagesVape Tax VictimsCommonwealth FoundationNo ratings yet

- Memo in Support of DOC and PBPP MergerDocument2 pagesMemo in Support of DOC and PBPP MergerCommonwealth FoundationNo ratings yet

- Constitutional and Legal Requirements of A Balanced Budget in PennsylvaniaDocument1 pageConstitutional and Legal Requirements of A Balanced Budget in PennsylvaniaCommonwealth FoundationNo ratings yet

- Pennsylvania Government Flow ChartDocument1 pagePennsylvania Government Flow ChartCommonwealth FoundationNo ratings yet

- SAT Scores by State 2015Document2 pagesSAT Scores by State 2015Commonwealth FoundationNo ratings yet

- Obamacare Has Harmed Pennsylvania FamiliesDocument2 pagesObamacare Has Harmed Pennsylvania FamiliesCommonwealth FoundationNo ratings yet

- AFSCME Local 2528 PAC SolicitationDocument3 pagesAFSCME Local 2528 PAC SolicitationCommonwealth FoundationNo ratings yet

- Top 10 Legislative Recipients of Union Political MoneyDocument1 pageTop 10 Legislative Recipients of Union Political MoneyCommonwealth FoundationNo ratings yet

- Charter Testimony October 2016Document6 pagesCharter Testimony October 2016Commonwealth FoundationNo ratings yet

- Pennsylvania Sat 1986-2011 (Intern's Conflicted Copy 2016-06-16)Document13 pagesPennsylvania Sat 1986-2011 (Intern's Conflicted Copy 2016-06-16)Commonwealth FoundationNo ratings yet

- Pennsylvanians Flee From High TaxesDocument4 pagesPennsylvanians Flee From High TaxesCommonwealth FoundationNo ratings yet

- What Is Paycheck Protection?Document1 pageWhat Is Paycheck Protection?Commonwealth FoundationNo ratings yet

- Mary Isenhour Letter To PERCDocument2 pagesMary Isenhour Letter To PERCCommonwealth FoundationNo ratings yet

- Public Pensions: Past, Present and FutureDocument2 pagesPublic Pensions: Past, Present and FutureCommonwealth FoundationNo ratings yet

- Patient-Centered Medicaid Reform ActDocument14 pagesPatient-Centered Medicaid Reform ActCommonwealth FoundationNo ratings yet

- DPW Welfare Waste, Fraud & Abuse SavingsDocument2 pagesDPW Welfare Waste, Fraud & Abuse SavingsCommonwealth FoundationNo ratings yet

- PA Pension ReformDocument31 pagesPA Pension ReformCommonwealth FoundationNo ratings yet

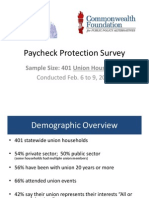

- Paycheck Protection Survey: Sample Size: 401 Union HouseholdsDocument7 pagesPaycheck Protection Survey: Sample Size: 401 Union HouseholdsCommonwealth FoundationNo ratings yet

- Pennsylvania's Pension Crisis: Facts and MythsDocument2 pagesPennsylvania's Pension Crisis: Facts and MythsCommonwealth FoundationNo ratings yet

- Liquor Privatization Facts and MythsDocument2 pagesLiquor Privatization Facts and MythsCommonwealth FoundationNo ratings yet

- Social Impacts of Liquor PrivatizationDocument6 pagesSocial Impacts of Liquor PrivatizationCommonwealth FoundationNo ratings yet

- Unsinkable: The True Story of Pennsylvania's Sinking Pension SystemDocument1 pageUnsinkable: The True Story of Pennsylvania's Sinking Pension SystemCommonwealth FoundationNo ratings yet

- Letter To Corbett: Reject Medicaid ExpansionDocument4 pagesLetter To Corbett: Reject Medicaid ExpansionCommonwealth FoundationNo ratings yet

- FM3 Privatization PollDocument15 pagesFM3 Privatization PollCommonwealth FoundationNo ratings yet

- Comparison ChartDocument1 pageComparison ChartCommonwealth FoundationNo ratings yet

- Art Barat UrutDocument168 pagesArt Barat Urutnev uckNo ratings yet

- Barangay Council Resolution Adopting The Standing Rules of The Barangay 198 Barangay CouncilDocument8 pagesBarangay Council Resolution Adopting The Standing Rules of The Barangay 198 Barangay CouncilAryl LyraNo ratings yet

- Francis Bacon Biography: Quick FactsDocument7 pagesFrancis Bacon Biography: Quick FactsnoorNo ratings yet

- PS 101 Syllabus (Fall 2018) Jennifer Martinez Portland State University US GovernmentDocument6 pagesPS 101 Syllabus (Fall 2018) Jennifer Martinez Portland State University US GovernmentHardlyNo ratings yet

- Constitution of the Kingdom of BhutanDocument75 pagesConstitution of the Kingdom of Bhutanktobgay6821No ratings yet

- John Giduck List of False Military Claims - FINALDocument12 pagesJohn Giduck List of False Military Claims - FINALma91c1anNo ratings yet

- Anti ATM Sangla ExplanatoryDocument2 pagesAnti ATM Sangla ExplanatoryCy ValenzuelaNo ratings yet

- Direct Roles and Functions of ICjDocument24 pagesDirect Roles and Functions of ICjEswar StarkNo ratings yet

- Letter To Blinken and Power On Sri Lankan Economic CrisisDocument3 pagesLetter To Blinken and Power On Sri Lankan Economic CrisisAdaderana OnlineNo ratings yet

- Local Government Administration and Grassroots Development in Some Selected Councils in Fako Division, CameroonDocument7 pagesLocal Government Administration and Grassroots Development in Some Selected Councils in Fako Division, CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Memorandum To The European Parliament: Facts Behind The Greek Politics Towards Macedonia by Risto NikovskiDocument5 pagesMemorandum To The European Parliament: Facts Behind The Greek Politics Towards Macedonia by Risto NikovskiIreneo100% (1)

- Indian Constitution: Time: 3 Hours. Maximum Marks 100. Part - A. Attempt Any Two Questions (2 20 40)Document6 pagesIndian Constitution: Time: 3 Hours. Maximum Marks 100. Part - A. Attempt Any Two Questions (2 20 40)Obalesh VnrNo ratings yet

- Strunk Bar Complaint Against Adam Bennett SchiffDocument9 pagesStrunk Bar Complaint Against Adam Bennett Schiffkris strunk100% (3)

- EO 55 Temporary Stay at Home Order Due To Novel Coronavirus (COVID 19)Document3 pagesEO 55 Temporary Stay at Home Order Due To Novel Coronavirus (COVID 19)ABC7News100% (1)

- Land Dispute Leads to Contempt CaseDocument5 pagesLand Dispute Leads to Contempt CaseRuab PlosNo ratings yet

- CompiledDocument73 pagesCompiledNishchay TiwariNo ratings yet

- MGR Statue in Malaysia 28-6-2011Document15 pagesMGR Statue in Malaysia 28-6-2011Rajagopal RaoNo ratings yet

- General Exceptions in Criminal LawDocument15 pagesGeneral Exceptions in Criminal LawMeer SalarNo ratings yet

- A Popular History of Ireland: From The Earliest Period To The Emancipation of The Catholics - Volume 2 by McGee, Thomas D'Arcy, 1825-1868Document321 pagesA Popular History of Ireland: From The Earliest Period To The Emancipation of The Catholics - Volume 2 by McGee, Thomas D'Arcy, 1825-1868Gutenberg.org100% (2)

- G.R. No. 195670 December 3, 2012 WILLEM BEUMER, Petitioner, AVELINA AMORES, RespondentDocument3 pagesG.R. No. 195670 December 3, 2012 WILLEM BEUMER, Petitioner, AVELINA AMORES, RespondentAnonymous wINMQaNNo ratings yet

- Rosebud Sioux Tribe Criminal Court - June 2019 Adult ArraignmentsDocument30 pagesRosebud Sioux Tribe Criminal Court - June 2019 Adult ArraignmentsOjinjintka News100% (1)

- Annex A DICT Towers and Real EstateDocument10 pagesAnnex A DICT Towers and Real EstateWendel Jonn L. AbaraNo ratings yet

- Tajikistan - Russia Relations in Historical PerspectiveDocument16 pagesTajikistan - Russia Relations in Historical PerspectiveAnonymous CwJeBCAXp100% (1)