Professional Documents

Culture Documents

IFCI Infra Bond 2012 Application Form

Uploaded by

Prajna CapitalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFCI Infra Bond 2012 Application Form

Uploaded by

Prajna CapitalCopyright:

Available Formats

Private & Confidential- Not for circulation

Form No.

1753536

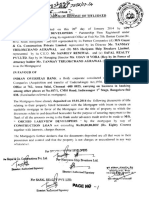

Regd Office: IFCI Tower,61 Nehru Place, New Delhi-110019 Ph No.(011) 41792800,41732000; Website: www.ifciltd.com APPLICATION FORM FOR UNSECURED, REDEEMABLE, NON CONVERTIBLE IFCI LONG TERM INFRASTRUCTURE BONDS SERIES V ELIGIBLE FOR DEDUCTION UNDER SECTION 80CCF OF THE INCOME TAX ACT, 1961 UPTO Rs 20,000 FOR THE FINANCIAL YEAR 2011-12 (Please carefully read the Instruction overleaf and the Information Memorandum before filling up the form) ISSUE OPENS ON: February 29, 2012

ISSUE CLOSES ON : March 27, 2012

Brokers Name & Code Sub Broker code Bank Branch Sr.No.& Stamp For Use by collecting bank & branch

KISL

Dear Sirs,

310109

I (Cumulative) 8.50 % p.a 12 years 5th and 7th year (A) (B) (A)x(B) 5,000/II (Annual) 8.50% p.a 12 years 5th and 7th year 5,000/-

Date of receipt of Application Registrars reference no.

Date of credit of Cheque/DD in IFCI account

I/We have read and understood the Information Memorandum of Private Placement of Infrastructure Bonds Series V U/S 80CCF of Income Tax Act 1961. I/We bind myself/ourselves to their provisions and apply for allotment. Please place my/our name(s) on the register of Bond Holder(s). Options Interest Rate Tenor Buy back Facility (At the end of) Face Value & Issue Price(Rs./Bond) Number of Bonds applied Amount Payable(Rs.) Total Amount Payable(Rs.) Total Amount Payable (Rs. in words) Constitution of Applicant (Tick the appropriate box) Bond Certificate Mode (Tick the appropriate box) 1. Resident Indian Individual (Major) 1. Physical Mode 2. HUF 2. DEMAT Mode III (Cumulative) 8.72 % p.a 15 years 5th and 10th year 5,000/IV (Annual) 8.72 % p.a 15 years 5th and 10th year 5,000/Cheque/Demand Draft Details No. Date Drawn on (Name of Bank and Branch)

APPLICANTS DETAILS [ Name(s) should be in the same order as it appears in the demat account ] - Depository Participant details mandatory if applied for Demat mode

Depository Name DP NAME DP ID CLIENT ID First /Sole Applicants Name In Full (in capital letters) (Karta in case of HUF) Second Applicants Name In Full (in capital letters) Third Applicants Name In Full (in capital letters) Fathers/Husbands Name of First/Sole Applicant Address in Full of First/Sole Applicant Pin Code Telephone No.(with STD Code): BANK PARTICULARS Bank Name............................................................ E-mail id: Account No. Branch Name......................................................... FOR NECS/ECS PAYMENT 9 Digit Code number of the Bank & Branch appearing on the MICR cheque issued by the Bank (Please attach a Photocopy of Cheque or a Cancelled Cheque issued by your Bank for verifying the accuracy of the Code No.) NECS/ECS Mandate: YES Branch City/Town.. National Securities Depository Limited (NSDL) Central Depository Services (India) Limited (CDSL) For CDSL mention 16 digit Account number

N

Proof of Demat Account details may be attached to avoid mismatch

Important Note: In respect of bonds subscribed to in Demat form, the demographic details like address, bank account details, and nomination etc. shall be picked by the Registrar from the Demat Accounts of Applicant(s). For physical bonds, self attested copies of address proof, PAN Card and a cancelled or copy of cheque of the bank account mentioned above are to be attached.

Details of Nominee (For Individuals Only) Name... Name of Guardian (For minor applicant) Address Relation with Applicant... .. Date of Birth (if minor).... Signature of Nominee/Guardian (optional)........................................... SOLE/ FIRST APPLICANT PERMANENT ACCOUNT NUMBER SIGNATURE SECOND APPLICANT THIRD APPLICANT

PLACE: __________________________ DATE:__________________________ Disclaimer: The Bond issue is being made strictly on a private placement basis. It is not and should not be deemed to constitute an offer to the public in general. It cannot be accepted by any person other than to whom it is directed. -------------------- -------------------------------------------------------------------------------------------------TEAR HERE-------------------------------------------------------------------------------------------------------------.

ACKNOWLEDGEMENT SLIP FOR APPLICANT

ACKNOWLEDGEMENT SLIP (TO BE FILLED IN BY APPLICANT)

DATE:

Form no.:

1753536

IFCI LIMITED, IFCI TOWER, 61 NEHRU PLACE, NEW DELHI 110 019 Received from ......................................................................................................................................................................... Address...................................................................an application for......................... number of IFCI Long Term Infrastructure Bonds- Series V having benefits u/s 80 CCF of Income Tax Act, 1961 upto Rs. 20,000/- for the year 2011-12 for investment of Rs... vide cheque/DD No..............dated........................drawn on ..........................................................................payable at..................................................................................... Note: Cheques/DDs should be drawn in favour of IFCI Limited- Infra Bond and crossed A/C Payee only. Please write Applicants Name, Phone No. & Application No. on reverse of the cheque/DD. Acknowledgement is subject to realisation of cheque/DD. Page 1 of 2

Basic Terms of Issue:

I II III IV Cumulative Annual Cumulative Annual 12 (Twelve) years 12 (Twelve) years 15 (Fifteen) years 15 (Fifteen) years 8.50 % p.a. 8.72 % p.a. 8.50 % p.a. 8.72 % p.a. Coupon (Annual compounding) (Annual compounding) 5,000/5,000/5,000/5,000/Face value (Rs./Bond) One Bond One Bond One Bond One Bond Minimum Application One Bond One Bond One Bond One Bond In Multiples of Bonds shall be under lock-in for 5 years from deemed date of Allotment during which no transfer is permitted. Lock-in period At the end of 5th and 7th At the end of 5th and 7th At the end of 5th and 10th At the end of 5th and 10th year from the Deemed year from the Deemed date year from the Deemed year from the Deemed date Buy Back Option date of Allotment of Allotment date of Allotment of Allotment At the time of At the time of March 31 every year March 31 every year Coupon Payment Date redemption redemption March 31, 2024 March 31, 2024 March 31, 2027 March 31, 2027 Maturity Date October 31 to December 30 of Calendar years 2016 October 31 to December 30 of Calendar years 2016 Buy Back Intimation Period and 2018 and 2021 13,309/5,000/17,524/5,000/Maturity Amount (Rs.) Redemption Amount, (in case buyback option is exercised)(Rs.): 7,519/5,000/7,595/5,000/At end of Year 5 8,851/5,000/Not Applicable Not Applicable At end of Year 7 Not Applicable Not Applicable 11,537/5,000/At end of Year 10 INSTRUCTIONS: Applicants are advised to read information memorandum carefully in order to satisfy themselves before making an application for subscription. For a copy of information memorandum, the applicant may request the issuer company/arrangers or download from www.ifciltd.com. 1) Application Form must be completed in BLOCK LETTERS IN ENGLISH. 2) Signatures should be made in English / Hindi. Signatures made in any other Indian language must be attested by an authorised official of a Bank or by a Magistrate / Notary Public under his / her official seal. 3) Bonds will be issued in demat form or physical form, as opted in the application. 4) Application shall be for a minimum number of one Bond and multiples of one Bond thereafter. 5) The benefit under section 80 CCF is limited to Rs. 20,000 in a financial year, but there is no upper limit on investment. 6) Applications can be made in single or joint names (not more than three); in case of joint names, all payments will be made out in favour the applicant whose name appears first in the application form; all notices, correspondence and communication will be addressed to the first applicant. 7) The payment can be made either through Cheque/Demand Draft/Payorders, drawn and made payable in favour of IFCI Limited - Infra Bond and crossed Account Payee Only and deposited along with the Application, directly with the designated branches of HDFC Bank and IndusInd Bank (Collecting Bankers) for crediting the amount to IFCI Limited -Infra Bond. The details of collection centres are available in Information Memorandum. The Cheque must be drawn on any bank including a Co-operative Bank, which is a member or a sub-member of the Bankers Clearing House, located at the place where the Application Form is submitted. 8) Cash, Outstation Cheques, Money Orders or Postal Orders will NOT be accepted. 9) As a matter of precaution against possible fraudulent encashment of interest warrants due to loss / misplacement, applicants are requested to mention the full particulars of their bank account, as specified in the Application Form (Bank detail should match the details provided in the Demat account). Interest warrants will then be made out in favour of the sole / first applicants account. Cheques will be issued as per the details in the register of Bondholders at the risk of the sole / first applicant at the address registered with Corporation or as per Demat Account. 10) The PAN No of the Sole / First Applicant and all Joint Applicants(s) should be mentioned correctly in the Application Form. If the applicant opts for bonds in physical certificate form, then the self-certified copy of the PAN Card of the sole/first holder and self certified address proof of the sole/first holder along with cancelled cheque must be attached to the application form. Any of the following documents shall be considered as a verifiable proof of address: Ration card issued by the Government Authority; or Valid driving license issued by any transport authority of the Republic of India; or Electricity bill (not older than 3 months); or Landline telephone bill (not older than 3 months); or Valid passport issued by the Government of India; or Voters Identity Card issued by the Government of India; or Passbook or latest bank statement issued by a bank operating in India (not older than 3 months); or Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or A letter from a recognized public authority or public servant verifying the identity and residence of the Applicant; or Aadhaar card issued by UIDAI. 11) As per the current income tax laws, for bonds in demat form, there will not be any tax deduction at source (TDS) from the annual/cumulative interest since the bonds would be listed on BSE. However, in respect of bonds held in physical form tax shall be deducted, if applicable as per extant law. 12) Receipt of application will be acknowledged by Bankers stamping the Acknowledgement Slip appearing below the Application Form. No separate receipt will be issued. 13) The applications would be scrutinized and accepted as per the provisions of the terms and conditions of the Private Placement, and as prescribed under the other applicable Statutes/Guidelines etc. IFCI is entitled, at its sole and absolute discretion, to accept or reject any application, in part or in full, without assigning any reason whatsoever. An application form, which is not complete in any respect, is liable to be rejected. 14) All future communications should be addressed to the Registrar or to IFCI at their registered office mentioned below. 15) The issue will open on February 29, 2012 and will remain open till March 27, 2012. However, the issuer would have an option to pre-close or extend the issue by giving 1 day notice to the arrangers. Deemed date of allotment- March 31, 2012.

Registrar: - Karvy Computershare Private Limited, Plot nos.17-24, Vittal Rao Nagar, Madhapur, Hyderabad 500 081 Toll Free No.1-800-3454001 Tel : +91 40 4465 5000 Fax: +91 40 2343 1551 Email: einward.ris@karvy.com or ifcibond@karvy.com Issuer: - IFCI LIMITED, Resources Department, IFCI Tower, 61, Nehru Place, New Delhi 110019 Email: infrabonds@ifciltd.com

Options Interest Payment Frequency Tenor

Page 2 of 2

You might also like

- IFCI Long Term Infra Bonds Application FormDocument2 pagesIFCI Long Term Infra Bonds Application FormPrajna CapitalNo ratings yet

- REC Capital Gain Bond-10200083Document4 pagesREC Capital Gain Bond-10200083viralshukla4290No ratings yet

- Ifci Infra Bonds Terms Sept2011Document1 pageIfci Infra Bonds Terms Sept2011navneet1107No ratings yet

- Common Application FormDocument2 pagesCommon Application FormJeta SharmaNo ratings yet

- REC Infra Bond Application FormDocument2 pagesREC Infra Bond Application FormPrajna CapitalNo ratings yet

- Common Application Form for Equity Oriented SchemesDocument2 pagesCommon Application Form for Equity Oriented SchemesARVINDNo ratings yet

- Western Marine Shipyard LimitedDocument2 pagesWestern Marine Shipyard LimitednsucopyNo ratings yet

- Zero Balance Form - SFLBDocument3 pagesZero Balance Form - SFLBroshcrazyNo ratings yet

- 12345Document8 pages12345induchellamNo ratings yet

- Shriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Document48 pagesShriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- DSP BlackRock Tax Saver Fund Application FormDocument4 pagesDSP BlackRock Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- Envoy Textile LTD ProspectusDocument2 pagesEnvoy Textile LTD Prospectusshobu_iujNo ratings yet

- Application Form: Green Delta Mutual FundDocument4 pagesApplication Form: Green Delta Mutual Fundsumon1982No ratings yet

- Common Application Form: Broker Name / ARN Sub Broker Code Appl. No. MA-CAF-ISC Date, Time Stamp Number Reference NoDocument2 pagesCommon Application Form: Broker Name / ARN Sub Broker Code Appl. No. MA-CAF-ISC Date, Time Stamp Number Reference NoVaibhav BansalNo ratings yet

- Axis Bank Fixed Deposit FormDocument4 pagesAxis Bank Fixed Deposit Formramu2011No ratings yet

- AFCL Other FormDocument3 pagesAFCL Other FormihshourovNo ratings yet

- Icici Pru MF Sip - Plus-Form Arvind Thakur EuinDocument7 pagesIcici Pru MF Sip - Plus-Form Arvind Thakur EuinARVINDNo ratings yet

- LN TBond FormDocument90 pagesLN TBond FormboargzcrNo ratings yet

- Sbi MF Chota Sip Arn Euin Arvind ThakurDocument2 pagesSbi MF Chota Sip Arn Euin Arvind ThakurARVINDNo ratings yet

- Beacon - NRBDocument2 pagesBeacon - NRBRashed ChowdhuryNo ratings yet

- Sip & Micro Sip PDC Form - 29.04.2013Document4 pagesSip & Micro Sip PDC Form - 29.04.2013Aayush ShahNo ratings yet

- Debit Mandate FormDocument4 pagesDebit Mandate FormAshishNo ratings yet

- Add On Card Application PDFDocument2 pagesAdd On Card Application PDFraom_2No ratings yet

- Indian Overseas Bank ..BranchDocument6 pagesIndian Overseas Bank ..Branchanwarali1975No ratings yet

- Axis Mutual Fund - Lumpsum FormDocument3 pagesAxis Mutual Fund - Lumpsum FormPushpakVanjariNo ratings yet

- IRFC Tax Free Bond Dec15Document48 pagesIRFC Tax Free Bond Dec15Robin FlyerNo ratings yet

- HUDCO Tax Free Bond Application FormDocument8 pagesHUDCO Tax Free Bond Application FormPrajna CapitalNo ratings yet

- LNT Bond FormDocument8 pagesLNT Bond FormsunajbaniNo ratings yet

- Update Bank, Address and Nomination DetailsDocument2 pagesUpdate Bank, Address and Nomination DetailsvatsonwizzluvNo ratings yet

- L&T Long Term Infrastructure Bond Tranche 1 Application FormDocument8 pagesL&T Long Term Infrastructure Bond Tranche 1 Application FormPrajna CapitalNo ratings yet

- Account Opening CertificateDocument2 pagesAccount Opening CertificateSRINJOY SEALNo ratings yet

- L&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Document8 pagesL&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNo ratings yet

- Malek Spinning Mills Limited: Application FormDocument2 pagesMalek Spinning Mills Limited: Application FormZahid HossainNo ratings yet

- Non Face To Face Form With AMB Declaration PDFDocument10 pagesNon Face To Face Form With AMB Declaration PDFrohit.godhani9724No ratings yet

- SSS Form Salary LoanDocument4 pagesSSS Form Salary LoanMikoy Lacson100% (4)

- IREDA Bond Application FormDocument2 pagesIREDA Bond Application FormSarah DeanNo ratings yet

- Individual KYC PDFDocument2 pagesIndividual KYC PDFSivakumarNo ratings yet

- Green Delta Mutual Fund: Application FormDocument5 pagesGreen Delta Mutual Fund: Application Formkabir_bg82No ratings yet

- Systematic Investment Plan S I P: SIP Enrolment FormDocument4 pagesSystematic Investment Plan S I P: SIP Enrolment FormRahul SinghNo ratings yet

- SBI Change-Of-Bank-Mandate-Form PDFDocument1 pageSBI Change-Of-Bank-Mandate-Form PDFsstewariNo ratings yet

- Data2 Dapimage 1409021911 CreditCardApplication1409021911Document4 pagesData2 Dapimage 1409021911 CreditCardApplication1409021911Michel ThompsonNo ratings yet

- Trading Account Opening Form: Mandatory Documents Document Significance Page NumberDocument11 pagesTrading Account Opening Form: Mandatory Documents Document Significance Page NumberSandeep GhosthNo ratings yet

- Home Loan Application FormDocument4 pagesHome Loan Application FormSudeep ChatterjeeNo ratings yet

- Personal Details: Application No: TFS/PB/BE/ / ..Document4 pagesPersonal Details: Application No: TFS/PB/BE/ / ..Shishir SaxenaNo ratings yet

- Add-on Card Application FormDocument2 pagesAdd-on Card Application FormPunitGoNo ratings yet

- Account OpeningDocument2 pagesAccount OpeningSuresh MandaNo ratings yet

- Direct Client & Broker AgreementDocument55 pagesDirect Client & Broker Agreementdoanthanh88No ratings yet

- Add On Card ApplicationDocument2 pagesAdd On Card ApplicationvivekNo ratings yet

- Account Opening RequirementDocument2 pagesAccount Opening RequirementlenovojiNo ratings yet

- SBFTC Application FormDocument8 pagesSBFTC Application FormAkshay PsNo ratings yet

- Opening & Operation of Bank AccountDocument21 pagesOpening & Operation of Bank AccountNazmul H. PalashNo ratings yet

- Uti Sip FormDocument1 pageUti Sip FormSulekha ChakrabortyNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- DSP BlackRock RGESS Fund - Series 1Document2 pagesDSP BlackRock RGESS Fund - Series 1Prajna CapitalNo ratings yet

- DSP BlackRock RGESS Fund - Series 1 Applciation FormDocument10 pagesDSP BlackRock RGESS Fund - Series 1 Applciation FormPrajna CapitalNo ratings yet

- Save Tax Get RichDocument11 pagesSave Tax Get RichPrajna CapitalNo ratings yet

- PFS Infrastructure Bond Series 2 Application FormDocument2 pagesPFS Infrastructure Bond Series 2 Application FormPrajna CapitalNo ratings yet

- IDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Document8 pagesIDFC Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNo ratings yet

- IDFC Infrastructure Bond Tranche 3 Application Form 2012Document8 pagesIDFC Infrastructure Bond Tranche 3 Application Form 2012Prajna CapitalNo ratings yet

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalNo ratings yet

- HUDCO Tax Free Bond Application FormDocument8 pagesHUDCO Tax Free Bond Application FormPrajna CapitalNo ratings yet

- REC TAx Free Bond Application FormDocument8 pagesREC TAx Free Bond Application FormPrajna CapitalNo ratings yet

- IRFC Tax Free Bond Application FormDocument8 pagesIRFC Tax Free Bond Application FormPrajna CapitalNo ratings yet

- L&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Document8 pagesL&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalNo ratings yet

- SREI Infrastructure Bond Application FormDocument8 pagesSREI Infrastructure Bond Application FormPrajna CapitalNo ratings yet

- UTI Equity Tax Savings Plan Application FormDocument40 pagesUTI Equity Tax Savings Plan Application FormPrajna CapitalNo ratings yet

- Reliance Tax Saver (ELSS) Fund Application FormDocument34 pagesReliance Tax Saver (ELSS) Fund Application FormPrajna CapitalNo ratings yet

- PFC Tax Free Bonds Application FormDocument8 pagesPFC Tax Free Bonds Application FormPrajna CapitalNo ratings yet

- NHAI Tax Free Bond Application FormDocument8 pagesNHAI Tax Free Bond Application FormPrajna CapitalNo ratings yet

- Sahara Tax Gain Fund Application FormDocument24 pagesSahara Tax Gain Fund Application FormPrajna CapitalNo ratings yet

- Mutual Fund Tax Reckoner 2011 - 2012Document1 pageMutual Fund Tax Reckoner 2011 - 2012Prajna CapitalNo ratings yet

- Tax Saver Mutual FundsDocument2 pagesTax Saver Mutual FundsPrajna CapitalNo ratings yet

- Muthoot Finance NCD Application Form Dec 2011 - Jan 2012Document8 pagesMuthoot Finance NCD Application Form Dec 2011 - Jan 2012Prajna CapitalNo ratings yet

- Taurus Tax Shield Application FormDocument22 pagesTaurus Tax Shield Application FormPrajna CapitalNo ratings yet

- Religare Tax Plan Application FormDocument44 pagesReligare Tax Plan Application FormPrajna CapitalNo ratings yet

- Tata Tax Saving Fund Application FormDocument36 pagesTata Tax Saving Fund Application FormPrajna CapitalNo ratings yet

- Principal Personal Tax Saver Fund Application FormDocument2 pagesPrincipal Personal Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- Sundaram Tax Saver Application FormDocument20 pagesSundaram Tax Saver Application FormPrajna CapitalNo ratings yet

- Principal Personal Tax Saver Fund Application FormDocument2 pagesPrincipal Personal Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- Magnum Tax Gain Scheme 1993 Application FormDocument50 pagesMagnum Tax Gain Scheme 1993 Application FormPrajna CapitalNo ratings yet

- ChallenDocument2 pagesChallenGajendrakumarHNo ratings yet

- Direct Rollover and Withholding Form For Lump Sum Pension PaymentsDocument5 pagesDirect Rollover and Withholding Form For Lump Sum Pension PaymentsMichaelMorganNo ratings yet

- Ali Reza Iftekhar - A ProfileDocument2 pagesAli Reza Iftekhar - A ProfileAthena Hasin0% (1)

- Pefindo Ratings Update for Indofood, Bank Nagari and Other EntitiesDocument6 pagesPefindo Ratings Update for Indofood, Bank Nagari and Other EntitiesChristophorine Raden Karina SetyadiNo ratings yet

- Abiria Card NewsDocument2 pagesAbiria Card NewsabiriacardNo ratings yet

- Sample Format: Invitation For Prequalification: Guidelines: Procurement Under IBRD Loans and IDA CreditsDocument3 pagesSample Format: Invitation For Prequalification: Guidelines: Procurement Under IBRD Loans and IDA CreditsSandeep JoshiNo ratings yet

- Financial Planning and BudgetingDocument3 pagesFinancial Planning and BudgetingMuhammad RamzanNo ratings yet

- Union Bank Audit ReportDocument45 pagesUnion Bank Audit ReportCyril Chettiar90% (10)

- Interest Rate Swaps Basics 1-08 USDocument6 pagesInterest Rate Swaps Basics 1-08 USbhagyashreeskNo ratings yet

- Rights of Surety Against CreditorDocument16 pagesRights of Surety Against CreditorPrasenjit Tripathi100% (1)

- AGICL AXIS BANK Statement JULY 2016 PDFDocument6 pagesAGICL AXIS BANK Statement JULY 2016 PDFSagar Asati100% (1)

- Customer's Credit Card Settlement DetailsDocument3 pagesCustomer's Credit Card Settlement DetailsNoble InfoTechNo ratings yet

- Chapter 1Document20 pagesChapter 1Momentum PressNo ratings yet

- StatementDocument5 pagesStatementgabrielsg3No ratings yet

- Banking sector challenges in Bangladesh: people, products, regulationsDocument2 pagesBanking sector challenges in Bangladesh: people, products, regulationsSajib DevNo ratings yet

- DtonDocument122 pagesDtonUtkarsh SinhaNo ratings yet

- Balance Sheet Analysis of Manufacturing CompanyDocument3 pagesBalance Sheet Analysis of Manufacturing CompanyPrateek JainNo ratings yet

- FinAccess Report 09Document76 pagesFinAccess Report 09Yatta NgukuNo ratings yet

- Flow of Funds ModuleDocument7 pagesFlow of Funds ModuleKanton FernandezNo ratings yet

- Mid-Term Exam.2021.2022Document3 pagesMid-Term Exam.2021.2022Việt Phương NguyễnNo ratings yet

- Al KafalahDocument19 pagesAl KafalahMahyuddin KhalidNo ratings yet

- Affidavit - Doc 0Document33 pagesAffidavit - Doc 0Cherrie Tersol TañedoNo ratings yet

- A Detail Study of Foreign Exchange Market in IndiaDocument35 pagesA Detail Study of Foreign Exchange Market in IndiaImdad Hazarika100% (2)

- Parcor Quiz 2Document4 pagesParcor Quiz 2JOY LYN REFUGIONo ratings yet

- E Bucks Gold BusinessDocument40 pagesE Bucks Gold BusinessDanielle Toni Dee NdlovuNo ratings yet

- Lesson 5Document21 pagesLesson 5Carlos miguel GonzagaNo ratings yet

- Attitudes of Employees Towards The Performance Appraisal System of Janata Bank LTDDocument49 pagesAttitudes of Employees Towards The Performance Appraisal System of Janata Bank LTDFahimNo ratings yet

- Branch Banking IBP Stage 1 PDFDocument216 pagesBranch Banking IBP Stage 1 PDFSarim Shahid67% (3)

- Reported SpeechDocument2 pagesReported SpeechKinga SzászNo ratings yet