Professional Documents

Culture Documents

Howe Barnes

Uploaded by

Joel KellerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Howe Barnes

Uploaded by

Joel KellerCopyright:

Available Formats

Daniel Cardenas

Senior Vice President

dcardenas@howebarnes.com

(312) 655-2986

June 4, 2008

Don Worthington

First Vice President

dworthington@howebarnes.com

(415) 538-5733

Kristin Hotti

Vice President

khotti@howebarnes.com

(415) 538-5712

Howe Barnes Hoefer & Arnett

Brian Martin, CFA

Vice President

bmartin@howebarnes.com

(312) 655-2987

Mary Quinn

Vice President

mquinn@howebarnes.com

(312) 655-2984

Jason Werner, CFA

Vice President

jwerner@howebarnes.com

(312) 655-2947

Coverage Universe

CONTENTS

BUY

CALIFORNIA

MIDWEST

Ryan Whitmore, CFA

Research Associate

rwhitmore@howebarnes.com

(312) 655-2955

PAGES

3-5

PACIFIC NORTHWEST

SOUTHEAST

FOOTNOTES

INDUSTRY MEDIANS AND PRICE PERFORMANCE

DISCLOSURES

10 - 11

Please refer to the last two pages of this report and individual equity reports for important disclosures.

For a copy of these reports and other important disclosures, call 800-800-4693

Coverage Universe

June 4, 2008

BUY

Ticker

Company Name

BBNK

CCOW

CLFC

CORS

FCAL

HMNF

HBNC

INCB

MOFG

NOVB

PPBI

PFBC

OKSB

TAYC

TSH

YAVY

Bridge Capital Holdings

Capital Corp of the West

Center Financial Corporation

Corus Bankshares, Inc.

First California Financial Group, Inc.

HMN Financial, Inc.

Horizon Bancorp

Indiana Community Bancorp

MidWestOne Financial Group, Inc.

North Valley Bancorp

Pacific Premier Bancorp, Inc.

Preferred Bank

Southwest Bancorp, Inc.

Taylor Capital Group, Inc.

Teche Holding Company

Yadkin Valley Financial Corporation

06/03/08

Last

Trade

Analyst

($)

DW

DW

DW

DC

DW

JW

BM

DC

BM

DW

DW

DW

DC

BM

MQ

MQ

14.90

5.30

9.05

5.34

7.70

17.53

22.00

21.80

15.26

8.66

7.30

8.57

16.67

11.71

35.39

15.00

52-Week

High

($)

Low

($)

24.58

25.54

17.63

18.27

13.00

35.55

28.05

29.65

19.24

25.50

11.75

43.44

25.61

32.83

45.75

19.25

13.45

3.76

7.99

4.95

6.90

16.51

20.00

18.00

14.64

8.50

5.91

7.76

14.08

11.66

29.50

12.27

Howe Barnes Hoefer & Arnett, Inc.

% Change

Week

(%)

0.7

(9.1)

(3.3)

(7.1)

(0.6)

5.0

0.0

0.0

(0.9)

(5.7)

0.7

(3.9)

(1.7)

(8.9)

(1.7)

(1.0)

MTD

(%)

0.7

(9.1)

(3.3)

(7.1)

(0.6)

5.0

0.0

0.0

(0.9)

(5.7)

0.7

(3.9)

(1.7)

(8.9)

(1.7)

(1.0)

YTD

(%)

(30.6)

(72.7)

(26.5)

(50.0)

(14.9)

(28.6)

(14.2)

(5.0)

(17.7)

(33.8)

5.6

(67.1)

(9.1)

(42.6)

(6.3)

(1.8)

12-Month Projected

Target

Total

Price

Return

2007

($)

(%)

($)

19.00

7.00

12.00

9.00

10.00

27.00

26.00

24.00

19.00

11.00

10.50

15.00

20.00

20.00

36.50

18.00

27.5 1.57

32.1 (0.34)

34.8 1.31

68.5 1.85

29.9 0.92

59.7 2.89

20.9 2.51

13.8 1.72

28.5 1.29

31.6 1.12

43.8 0.55

79.7 2.50

22.3 1.46

74.2 1.25

7.0 2.89

23.5 1.32

Diluted

EPS

Diluted

P/E

2008E

($)

2009E

($)

1.35

0.55

1.05

0.25

0.80

2.00

2.68

1.85

1.51

0.50

0.60

1.45

1.30

(3.00)

3.69

1.33

1.70

0.70

1.20

0.25

0.95

2.50

2.55

2.00

1.65

0.80

0.75

2.20

1.50

0.00

3.39

1.62

2007

(X)

9.5

NM

6.9

2.9

8.4

6.1

8.8

12.7

11.8

7.7

13.3

3.4

11.4

9.4

12.2

11.4

Price/

Book Value

2008E 2009E

(X)

(X)

11.0

9.6

8.6

21.4

9.6

8.8

8.2

11.8

10.1

17.3

12.2

5.9

12.8

NM

9.6

11.3

8.8

7.6

7.5

21.4

8.1

7.0

8.6

10.9

9.2

10.8

9.7

3.9

11.1

NM

10.4

9.3

Stated

(%)

140.8

39.7

92.3

38.1

64.4

73.5

94.5

106.9

81.3

78.9

74.4

55.9

108.0

49.4

110.8

114.0

Tang.

(%)

140.8

55.4

93.1

38.1

113.7

76.4

105.5

109.9

112.7

98.5

74.4

55.9

111.5

49.4

117.3

184.7

EPS Growth

Rate

2008/ 2009/

2007

2008

(%)

(%)

(14.0)

NM

(19.8)

(86.5)

(13.0)

(30.8)

6.8

7.6

17.1

(55.4)

9.1

(42.0)

(11.0)

NM

27.7

0.8

25.9

27.3

14.3

0.0

18.8

25.0

(4.9)

8.1

9.3

60.0

25.0

51.7

15.4

NM

(8.1)

21.8

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

NM

NM

14.0

16.6

NM

17.0

6.5

(5.6)

1.8

(5.0)

(13.9)

37.4

5.6

NM

2.7

9.0

NM

NM

NM

NM

NM

NM

1.21

1.56

0.59

NM

1.34

NM

NM

NM

0.35

14.89

Core

LTM

LTM

ROAA ROAE

(%)

(%)

1.29

(0.30)

1.07

0.69

0.95

0.85

0.73

0.75

1.00

0.71

0.48

1.62

0.84

(0.55)

0.99

1.18

16.48

(3.95)

13.63

7.75

8.01

9.64

12.85

9.77

9.05

8.07

5.69

15.02

9.33

(6.88)

10.51

10.33

Div.

Yield

(%)

NA

NA

2.21

NA

NA

5.70

2.73

3.67

4.00

4.62

NA

4.67

2.28

3.42

3.90

3.47

Shares

Out.

(Mil)

6.52

10.81

16.37

55.02

11.48

4.17

3.25

3.36

8.70

7.42

4.90

9.76

14.53

10.92

2.11

11.46

Mkt.

Cap.

($ Mil)

97

57

148

294

88

73

72

73

133

64

36

84

242

128

75

172

Total

Assets

($ Mil)

785

2,104

2,155

9,072

1,135

1,105

1,250

920

1,522

945

770

1,551

2,671

3,520

756

1,425

Page 1

Coverage Universe

June 4, 2008

CALIFORNIA

Ticker

Company Name

AMRB

BOCH

BMRC

BBNK

CCOW

CATY

CLFC

CVCY

CVBF

EWBC

FCAL

HAFC

HTBK

HEOP

NARA

NOVB

PPBI

PSBC

PFBC

BSRR

SSBX

TMCV

TCBK

UCBH

VNBC

WIBC

American River Bankshares

Bank of Commerce Holdings

Bank of Marin Bancorp

Bridge Capital Holdings

Capital Corp of the West

Cathay General Bancorp

Center Financial Corporation

Central Valley Community Bancorp

CVB Financial Corp.

East West Bancorp, Inc.

First California Financial Group, Inc.

Hanmi Financial Corporation

Heritage Commerce Corp

Heritage Oaks Bancorp

Nara Bancorp, Inc.

North Valley Bancorp

Pacific Premier Bancorp, Inc.

Pacific State Bancorp

Preferred Bank

Sierra Bancorp

Silver State Bancorp

Temecula Valley Bancorp Inc.

TriCo Bancshares

UCBH Holdings, Inc.

Vineyard National Bancorp

Wilshire Bancorp, Inc.

FootNotes* Analyst Rating

(1)

(2)

(3)

(4)

DW

KH

DW

DW

DW

DW

DW

KH

DW

DW

DW

DW

DW

KH

DW

DW

DW

DW

DW

KH

DW

KH

KH

DW

KH

DW

N

N

N

B

B

N

B

N

N

N

B

N

S

N

N

B

B

N

B

N

N

N

N

N

N

N

06/03/08

Last

Trade

($)

13.99

7.50

28.37

14.90

5.30

14.84

9.05

10.02

10.74

12.35

7.70

6.18

15.15

9.99

12.59

8.66

7.30

10.25

8.57

21.00

2.94

6.13

15.93

4.28

3.49

8.59

Average:

Median:

Diluted

EPS

% Change

52-Week

High

Low

($)

($)

22.95

11.64

33.82

24.58

25.54

40.52

17.63

15.15

13.00

42.30

13.00

17.66

25.30

17.94

17.88

25.50

11.75

20.74

43.44

32.31

24.10

19.68

26.00

20.22

25.50

12.78

12.89

6.00

26.90

13.45

3.76

14.59

7.99

9.40

8.40

12.18

6.90

6.02

15.00

9.16

9.75

8.50

5.91

9.75

7.76

18.00

2.00

6.00

14.85

4.19

2.50

6.02

Week

(%)

MTD

(%)

Diluted

P/E

YTD

(%)

2007

($)

2008E

($)

2009E

($)

1.46

0.68

2.31

1.57

(0.34)

2.46

1.31

0.99

0.72

2.60

0.92

(1.27)

1.12

0.95

1.25

1.12

0.55

1.14

2.50

2.09

1.68

1.41

1.57

0.97

(2.48)

0.91

1.33

0.51

2.50

1.35

0.55

2.15

1.05

0.56

0.83

0.95

0.80

0.52

0.70

0.94

0.95

0.50

0.60

0.94

1.45

2.07

(2.25)

0.71

1.20

0.55

(2.16)

0.90

1.45

0.62

2.70

1.70

0.70

2.45

1.20

1.12

0.90

1.60

0.95

0.80

1.00

1.05

1.15

0.80

0.75

1.10

2.20

2.23

0.30

1.08

1.49

1.00

0.39

1.05

1.2

5.6

(0.8)

0.7

(9.1)

(3.5)

(3.3)

0.0

1.3

(6.7)

(0.6)

(3.4)

(4.8)

0.0

(1.0)

(5.7)

0.7

1.2

(3.9)

(4.7)

0.3

0.2

(3.3)

(12.3)

15.2

(3.8)

1.2

5.6

(0.8)

0.7

(9.1)

(3.5)

(3.3)

0.0

1.3

(6.7)

(0.6)

(3.4)

(4.8)

0.0

(1.0)

(5.7)

0.7

1.2

(3.9)

(4.7)

0.3

0.2

(3.3)

(12.3)

15.2

(3.8)

(18.4)

(14.3)

(3.0)

(30.6)

(72.7)

(44.0)

(26.5)

(8.8)

3.9

(49.0)

(14.9)

(28.3)

(17.6)

(16.8)

7.9

(33.8)

5.6

(18.5)

(67.1)

(15.6)

(79.1)

(47.7)

(17.5)

(69.8)

(65.4)

9.4

(1.6)

(0.9)

(1.6)

(0.9)

(28.2)

(18.4)

2007

(X)

Price/

Book Value

2008E 2009E Stated

(X)

(X)

(%)

9.6

11.0

12.3

9.5

NM

6.0

6.9

10.1

14.9

4.8

8.4

NM

13.5

10.5

10.1

7.7

13.3

9.0

3.4

10.0

1.8

4.3

10.1

4.4

NM

9.4

10.5

14.7

11.3

11.0

9.6

6.9

8.6

17.9

12.9

13.0

9.6

11.9

21.6

10.6

13.3

17.3

12.2

10.9

5.9

10.1

NM

8.6

13.3

7.8

NM

9.5

9.6

12.1

10.5

8.8

7.6

6.1

7.5

8.9

11.9

7.7

8.1

7.7

15.2

9.5

10.9

10.8

9.7

9.3

3.9

9.4

9.8

5.7

10.7

4.3

8.9

8.2

8.7

9.5

11.6

11.0

9.0

9.1

128.1

140.7

160.5

140.8

39.7

73.0

92.3

109.7

197.4

70.9

64.4

76.6

120.7

108.5

145.0

78.9

74.4

108.0

55.9

197.2

31.3

57.2

132.5

44.3

52.2

142.2

101.6

100.1

Tang.

(%)

180.1

140.7

160.5

140.8

55.4

112.6

93.1

133.4

233.0

106.0

113.7

110.6

176.0

140.7

147.4

98.5

74.4

110.6

55.9

208.7

36.3

57.2

145.2

76.8

56.1

149.1

119.7

113.2

EPS Growth

Rate

2008/

2009/

2007

2008

(%)

(%)

(8.9)

(25.0)

8.2

(14.0)

NM

(12.6)

(19.8)

(43.4)

15.3

(63.5)

(13.0)

NM

(37.5)

(1.1)

(24.0)

(55.4)

9.1

(17.5)

(42.0)

(1.0)

NM

(49.6)

(23.6)

(43.3)

(12.9)

(1.1)

9.0

21.6

8.0

25.9

27.3

14.0

14.3

NM

8.4

68.4

18.8

53.8

42.9

11.7

21.1

60.0

25.0

17.0

51.7

7.7

NM

52.1

24.2

81.8

NM

16.7

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

10.9

9.6

13.2

NM

NM

12.9

14.0

14.2

4.1

21.1

NM

NM

12.2

13.7

15.8

(5.0)

(13.9)

27.4

37.4

18.1

51.5

23.0

9.9

15.6

NM

23.2

NM

NM

1.38

NM

NM

NM

NM

NM

0.85

NM

NM

NM

NM

NM

NM

NM

1.34

NM

NM

NM

NM

NM

NM

NM

NM

NM

Core

LTM

LTM

ROAA ROAE

(%)

(%)

1.44

0.96

1.33

1.29

(0.30)

1.26

1.07

1.28

1.00

1.02

0.95

(1.79)

0.92

1.09

1.35

0.71

0.48

NA

1.62

1.63

0.29

0.93

1.20

0.79

(2.41)

1.26

13.59

12.47

13.76

16.48

(3.95)

12.59

13.63

11.58

14.86

10.41

8.01

(15.26)

7.48

11.62

14.66

8.07

5.69

NA

15.02

20.54

3.32

11.52

12.40

9.33

(38.91)

15.71

0.77

1.02

8.18

11.62

Div.

Yield

(%)

4.29

4.27

1.97

NA

NA

2.83

2.21

NA

3.17

3.24

NA

3.88

2.11

3.05

0.87

4.62

NA

NA

4.67

3.24

NA

2.61

3.26

3.74

NA

2.33

Shares

Out.

(Mil)

5.53

8.71

5.14

6.52

10.81

49.42

16.37

6.00

83.10

63.44

11.48

45.91

12.01

7.70

26.19

7.42

4.90

3.70

9.76

9.57

15.14

10.03

15.74

110.46

10.22

29.39

Mkt.

Cap.

($ Mil)

Total

Assets

($ Mil)

77

65

146

97

57

733

148

60

892

783

88

284

182

77

330

64

36

38

84

201

44

61

251

473

36

252

588

651

920

785

2,104

10,443

2,155

496

6,375

11,760

1,135

3,940

1,415

761

2,546

945

770

444

1,551

1,282

1,915

1,376

1,999

12,743

2,358

2,260

3.13

3.20

*See Page 8 For Footnotes

Ratings

Buy = B

Neutral = N

Sell = S

Howe Barnes Hoefer & Arnett, Inc.

Page 2

Coverage Universe

June 4, 2008

MIDWEST

Ticker

Company Name

AMFI

ABCW

BANF

BKMU

BYLK

CBC

COBZ

CTBI

CORS

DCBF

DEAR

EFSC

BUSE

FFBC

THFF

FFKY

AMCORE Financial, Inc.

Anchor BanCorp Wisconsin Inc.

BancFirst Corporation

Bank Mutual Corporation

Baylake Corp.

Capitol Bancorp Ltd.

CoBiz Financial Inc.

Community Trust Bancorp, Inc.

Corus Bankshares, Inc.

DCB Financial Corp

Dearborn Bancorp, Inc.

Enterprise Financial Services Corp

First Busey Corporation

First Financial Bancorp.

First Financial Corporation

First Financial Service Corporation

FootNotes* Analyst Rating

(5)

(6)

(7)

BM

JW

DC

JW

BM

BM

JW

DC

DC

JW

JW

BM

JW

DC

DC

BM

N

N

N

N

N

N

N

N

B

N

N

N

N

S

N

N

06/03/08

Last

Trade

($)

9.41

13.42

43.37

11.16

7.20

14.86

9.66

31.05

5.34

15.35

6.20

19.65

17.81

11.73

31.23

21.61

Average:

Median:

Diluted

EPS

% Change

52-Week

High

Low

($)

($)

30.50

29.10

48.95

12.32

14.50

29.31

19.25

34.91

18.27

24.75

17.90

27.15

23.18

15.25

34.00

29.49

9.25

13.39

38.75

9.68

6.65

14.39

9.58

23.38

4.95

12.90

5.38

17.99

17.47

9.87

23.48

20.00

Week

(%)

MTD

(%)

Diluted

P/E

YTD

(%)

2007

($)

2008E

($)

2009E

($)

1.23

1.80

3.33

0.31

0.18

1.27

0.96

2.38

1.85

0.04

0.36

1.40

1.13

0.93

1.94

1.96

(0.75)

1.49

2.85

0.36

0.51

0.46

0.70

2.34

0.25

0.97

0.22

1.26

1.22

0.76

1.98

1.60

1.05

1.60

3.00

0.38

0.56

0.80

0.95

2.45

0.25

1.10

0.40

1.45

1.40

0.85

2.00

1.76

(4.0)

(4.3)

(0.1)

0.6

6.7

(4.0)

(8.7)

1.3

(7.1)

(1.0)

2.5

(2.0)

(2.3)

3.0

(4.6)

3.1

(4.0)

(4.3)

(0.1)

0.6

6.7

(4.0)

(8.7)

1.3

(7.1)

(1.0)

2.5

(2.0)

(2.3)

3.0

(4.6)

3.1

(58.5)

(42.9)

1.2

5.6

(30.4)

(26.1)

(35.0)

12.8

(50.0)

(4.1)

(19.8)

(17.5)

(10.3)

2.9

10.2

(10.0)

(1.4)

(1.7)

(1.4)

(1.7)

(13.5)

(10.0)

2007

(X)

Price/

Book Value

2008E 2009E Stated

(X)

(X)

(%)

7.7

7.5

13.0

36.0

40.0

11.7

10.1

13.0

2.9

NM

17.2

14.0

15.8

12.6

16.1

11.0

NM

9.0

15.2

31.0

14.1

32.3

13.8

13.3

21.4

15.8

28.2

15.6

14.6

15.4

15.8

13.5

9.0

8.4

14.5

29.4

12.9

18.6

10.2

12.7

21.4

14.0

15.5

13.6

12.7

13.8

15.6

12.3

14.1

12.7

15.8

14.0

13.0

11.7

60.1

84.0

170.5

126.8

68.6

66.4

116.0

151.6

38.1

98.1

36.6

137.7

122.2

158.3

139.5

135.0

106.7

107.7

Tang.

(%)

61.1

89.2

191.5

147.2

74.2

81.7

159.1

193.8

38.1

98.1

53.6

214.3

263.1

176.7

143.9

152.1

141.7

140.2

EPS Growth

Rate

2008/

2009/

2007

2008

(%)

(%)

NM

(17.2)

(14.4)

16.1

NM

(63.8)

(27.1)

(1.7)

(86.5)

NM

(38.9)

(10.0)

8.0

(18.3)

2.1

(18.4)

NM

7.4

5.3

5.6

9.8

73.9

35.7

4.7

0.0

13.4

81.8

15.1

14.8

11.8

1.0

10.0

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

(6.8)

3.7

10.4

(1.8)

(55.5)

(4.2)

12.6

5.6

16.6

(47.0)

(11.4)

21.9

5.4

(2.2)

(1.6)

5.8

NM

NM

NM

1.92

NM

NM

NM

NM

NM

NM

NM

NM

1.83

NM

7.65

NM

Core

LTM

LTM

ROAA ROAE

(%)

(%)

(0.08)

0.74

1.26

0.49

0.29

0.37

NA

1.23

0.69

(0.04)

0.24

0.94

0.86

0.86

1.16

1.04

(1.04)

10.00

12.35

3.79

3.99

4.50

NA

12.12

7.75

(0.46)

1.76

10.20

7.66

10.30

9.24

12.19

0.62

0.73

6.94

8.40

Div.

Yield

(%)

2.13

5.37

1.84

3.23

NA

4.04

2.90

3.74

NA

4.17

NA

1.07

4.49

5.80

2.82

3.52

Shares

Out.

(Mil)

21.95

21.34

15.18

48.24

7.91

17.32

23.07

14.99

55.02

3.72

8.08

12.52

35.77

37.48

13.10

4.66

Mkt.

Cap.

($ Mil)

207

286

659

538

57

257

223

465

294

57

50

246

637

440

409

101

Total

Assets

($ Mil)

5,177

4,726

3,786

3,548

1,077

5,067

2,449

2,904

9,072

719

1,048

2,048

4,252

3,323

2,299

882

3.97

3.88

*See Page 8 For Footnotes

Ratings

Buy = B

Neutral = N

Sell = S

Howe Barnes Hoefer & Arnett, Inc.

Page 3

Coverage Universe

June 4, 2008

MIDWEST

Ticker

Company Name

FRME

FBMI

GABC

GSBC

HTLF

HMNF

HFBC

HBNC

IBCP

INCB

IBNK

LKFN

LNBB

MCBC

MSFG

MBFI

MBTF

First Merchants Corporation

Firstbank Corporation

German American Bancorp, Inc.

Great Southern Bancorp, Inc.

Heartland Financial USA, Inc.

HMN Financial, Inc.

HopFed Bancorp, Inc.

Horizon Bancorp

Independent Bank Corporation

Indiana Community Bancorp

Integra Bank Corporation

Lakeland Financial Corporation

LNB Bancorp, Inc.

Macatawa Bank Corporation

MainSource Financial Group, Inc.

MB Financial, Inc.

MBT Financial Corp.

FootNotes* Analyst Rating

(8)

(9)

BM

BM

JW

JW

BM

JW

JW

BM

JW

DC

DC

DC

DC

JW

BM

DC

BM

N

N

N

N

N

B

N

B

N

B

N

N

N

N

N

N

N

06/03/08

Last

Trade

($)

23.75

12.68

12.63

11.08

22.70

17.53

13.85

22.00

5.70

21.80

13.65

24.21

11.40

8.75

16.41

27.78

8.55

Average:

Median:

Diluted

EPS

% Change

52-Week

High

Low

($)

($)

30.00

19.67

14.09

28.00

25.83

35.55

16.35

28.05

17.56

29.65

23.92

25.98

16.12

16.44

19.20

37.88

14.60

18.30

12.32

11.00

10.68

15.98

16.51

13.00

20.00

5.36

18.00

12.50

16.87

9.65

7.56

11.99

25.41

7.93

Week

(%)

MTD

(%)

Diluted

P/E

YTD

(%)

2007

($)

2008E

($)

2009E

($)

1.73

1.21

0.85

2.15

1.54

2.89

1.14

2.51

0.45

1.72

1.66

1.55

0.79

0.54

1.17

2.12

0.47

1.88

1.12

1.00

0.22

1.45

2.00

1.29

2.68

0.40

1.85

1.25

1.58

0.82

0.38

1.36

1.64

0.60

2.00

1.20

1.10

2.10

1.58

2.50

1.33

2.55

0.90

2.00

1.40

1.70

0.90

0.52

1.42

2.15

0.63

(4.0)

(0.5)

(2.8)

(4.1)

(3.0)

5.0

(1.7)

0.0

(5.2)

0.0

(5.0)

1.2

3.6

(2.7)

(2.2)

(2.4)

1.1

(4.0)

(0.5)

(2.8)

(4.1)

(3.0)

5.0

(1.7)

0.0

(5.2)

0.0

(5.0)

1.2

3.6

(2.7)

(2.2)

(2.4)

1.1

8.7

(8.2)

(0.9)

(49.5)

22.2

(28.6)

(6.0)

(14.2)

(40.0)

(5.0)

(3.3)

15.8

(22.2)

1.9

5.5

(9.9)

(3.1)

(1.4)

(1.7)

(1.4)

(1.7)

(13.5)

(10.0)

2007

(X)

Price/

Book Value

2008E 2009E Stated

(X)

(X)

(%)

13.7

10.5

14.9

5.2

14.7

6.1

12.1

8.8

12.7

12.7

8.2

15.6

14.4

16.2

14.0

13.1

18.2

12.6

11.3

12.6

50.4

15.7

8.8

10.7

8.2

14.3

11.8

10.9

15.3

13.9

23.0

12.1

16.9

14.3

11.9

10.6

11.5

5.3

14.4

7.0

10.4

8.6

6.3

10.9

9.8

14.2

12.7

16.8

11.6

12.9

13.6

14.1

12.7

15.8

14.0

13.0

11.7

122.4

78.8

140.0

86.4

157.0

73.5

86.5

94.5

55.0

106.9

84.9

196.0

99.7

91.3

111.3

110.5

107.7

106.7

107.7

Tang.

(%)

199.9

118.3

161.9

87.4

193.4

76.4

99.4

105.5

83.5

109.9

142.5

203.4

137.3

110.9

219.1

201.9

107.7

141.7

140.2

EPS Growth

Rate

2008/

2009/

2007

2008

(%)

(%)

8.7

(7.4)

17.6

(89.8)

(5.8)

(30.8)

13.2

6.8

(11.1)

7.6

(24.7)

1.9

3.8

(29.6)

16.2

(22.6)

27.7

6.4

7.1

10.0

NM

9.0

25.0

3.1

(4.9)

NM

8.1

12.0

7.6

9.8

36.8

4.4

31.1

5.0

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

0.5

(7.2)

1.7

0.8

3.8

17.0

(2.0)

6.5

(19.1)

(5.6)

5.6

8.3

(10.7)

(2.4)

(0.2)

8.7

(15.9)

1.46

NM

0.72

NM

NM

NM

0.82

1.21

NM

1.56

NM

7.92

3.66

NM

0.74

NM

0.52

Core

LTM

LTM

ROAA ROAE

(%)

(%)

NA

0.61

0.99

0.32

0.73

0.85

0.53

0.73

0.24

0.75

0.93

1.01

0.50

0.33

0.93

0.58

0.44

NA

6.98

11.91

3.98

10.55

9.64

7.81

12.85

3.21

9.77

9.40

13.52

6.14

4.15

8.80

5.36

5.03

0.62

0.73

6.94

8.40

Div.

Yield

(%)

3.87

7.10

4.43

6.50

1.76

5.70

3.47

2.73

7.72

3.67

5.27

2.56

6.32

5.94

3.53

2.59

8.42

Shares

Out.

(Mil)

18.20

7.45

11.03

13.38

16.31

4.17

3.57

3.25

22.77

3.36

20.66

12.23

7.30

17.02

18.57

34.74

16.13

Mkt.

Cap.

($ Mil)

432

94

139

148

370

73

50

72

130

73

282

296

83

149

305

965

138

Total

Assets

($ Mil)

3,767

1,382

1,175

2,502

3,300

1,105

813

1,250

3,247

920

3,401

2,205

1,067

2,139

2,528

8,090

1,555

3.97

3.88

*See Page 8 For Footnotes

Ratings

Buy = B

Neutral = N

Sell = S

Howe Barnes Hoefer & Arnett, Inc.

Page 4

Coverage Universe

June 4, 2008

MIDWEST

Ticker

Company Name

MBWM

MCBI

MBHI

MOFG

MROE

MFSF

NSFC

OSBC

PEBO

PNBC

PVTB

PRSP

PULB

OKSB

TAYC

TFIN

TOFC

WTBA

Mercantile Bank Corporation

MetroCorp Bancshares, Inc.

Midwest Banc Holdings, Inc.

MidWestOne Financial Group, Inc.

Monroe Bancorp

MutualFirst Financial, Inc.

Northern States Financial Corporation

Old Second Bancorp, Inc.

Peoples Bancorp Inc.

Princeton National Bancorp, Inc.

PrivateBancorp, Inc.

Prosperity Bancshares, Inc.

Pulaski Financial Corp.

Southwest Bancorp, Inc.

Taylor Capital Group, Inc.

Team Financial, Inc.

Tower Financial Corporation

West Bancorporation, Inc.

FootNotes* Analyst Rating

(10)

(11)

(12)

(13)

DC

DW

DC

BM

BM

BM

BM

BM

JW

BM

DC

DC

DC

DC

BM

DC

DC

JW

N

N

N

B

N

N

N

N

N

N

S

N

N

B

B

S

N

N

06/03/08

Last

Trade

($)

8.05

12.90

8.16

15.26

12.66

10.64

18.15

18.85

23.72

28.19

35.80

31.48

11.99

16.67

11.71

7.76

10.15

11.25

Average:

Median:

Diluted

EPS

% Change

52-Week

High

Low

($)

($)

28.58

22.08

16.12

19.24

18.77

19.75

25.97

31.00

28.26

29.75

38.74

36.00

16.90

25.61

32.83

17.20

15.48

16.36

7.80

12.01

8.04

14.64

12.63

9.81

17.45

18.34

20.38

23.04

25.41

21.96

9.40

14.08

11.66

6.87

8.79

11.25

Week

(%)

MTD

(%)

Diluted

P/E

YTD

(%)

2007

($)

2008E

($)

2009E

($)

1.06

1.10

0.72

1.29

1.24

1.02

1.05

1.89

1.74

2.03

0.53

1.94

0.88

1.46

1.25

1.13

(0.64)

1.08

(0.42)

1.00

0.29

1.51

1.12

1.12

1.15

1.95

2.00

2.45

(0.37)

2.15

0.97

1.30

(3.00)

(1.53)

0.50

0.77

0.53

1.15

0.80

1.65

1.20

1.25

1.23

2.12

2.08

2.60

1.45

2.30

1.05

1.50

0.00

0.25

0.70

1.05

(4.3)

0.4

(7.1)

(0.9)

(2.7)

4.6

(6.7)

(0.7)

0.1

0.9

(5.5)

(1.4)

6.9

(1.7)

(8.9)

(3.6)

9.1

(6.3)

(4.3)

0.4

(7.1)

(0.9)

(2.7)

4.6

(6.7)

(0.7)

0.1

0.9

(5.5)

(1.4)

6.9

(1.7)

(8.9)

(3.6)

9.1

(6.3)

(48.1)

(0.8)

(34.3)

(17.7)

(20.9)

(23.7)

(17.5)

(29.6)

(4.7)

16.2

9.6

7.1

19.9

(9.1)

(42.6)

(47.7)

(21.9)

(13.7)

(1.4)

(1.7)

(1.4)

(1.7)

(13.5)

(10.0)

2007

(X)

Price/

Book Value

2008E 2009E Stated

(X)

(X)

(%)

7.6

11.7

11.3

11.8

10.2

10.4

17.3

10.0

13.6

13.9

67.5

16.2

13.6

11.4

9.4

6.9

NM

10.4

NM

12.9

28.1

10.1

11.3

9.5

15.8

9.7

11.9

11.5

NM

14.6

12.4

12.8

NM

NM

20.3

14.6

15.2

11.2

10.2

9.2

10.6

8.5

NA

8.9

11.4

10.8

24.7

NA

11.4

11.1

NM

31.0

14.5

10.7

14.1

12.7

15.8

14.0

13.0

11.7

39.4

116.3

67.2

81.3

140.2

51.3

101.5

130.3

117.7

132.5

224.2

121.4

142.1

108.0

49.4

57.4

83.3

164.0

106.7

107.7

Tang.

(%)

39.4

143.2

140.9

112.7

140.2

62.1

118.9

197.8

174.7

227.9

287.3

415.3

149.7

111.5

49.4

66.7

83.3

211.9

141.7

140.2

EPS Growth

Rate

2008/

2009/

2007

2008

(%)

(%)

NM

(9.1)

(59.7)

17.1

(9.7)

9.8

9.5

3.2

14.9

20.7

NM

10.8

10.2

(11.0)

NM

NM

NM

(28.7)

NM

15.0

NM

9.3

7.1

11.6

NA

8.7

4.0

6.1

NM

NA

8.2

15.4

NM

NM

40.0

36.4

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

(1.8)

5.8

(6.2)

1.8

6.4

(7.5)

(9.3)

7.0

(4.5)

1.8

(4.9)

9.7

12.4

5.6

NM

0.0

NM

3.3

NM

NM

NM

0.59

NM

0.97

1.66

3.04

0.79

0.56

NM

1.35

1.21

NM

NM

NM

NM

NM

Core

LTM

LTM

ROAA ROAE

(%)

(%)

0.05

0.79

0.33

1.00

0.95

0.45

0.62

0.91

1.17

0.66

(0.14)

1.49

0.80

0.84

(0.55)

(0.37)

(0.30)

1.21

0.53

9.56

3.43

9.05

13.06

4.94

5.55

15.59

10.94

10.45

(1.92)

8.40

11.05

9.33

(6.88)

(5.65)

(4.22)

13.35

0.62

0.73

6.94

8.40

Div.

Yield

(%)

3.98

1.24

6.37

4.00

4.11

6.02

4.41

3.18

3.88

3.97

0.84

1.59

3.00

2.28

3.42

4.12

1.73

5.69

Shares

Out.

(Mil)

8.53

10.85

27.86

8.70

6.23

4.14

4.07

13.74

10.40

3.30

28.55

44.29

10.15

14.53

10.92

3.60

4.07

17.40

Mkt.

Cap.

($ Mil)

69

140

227

133

79

44

74

259

247

93

1,022

1,394

122

242

128

28

41

196

Total

Assets

($ Mil)

2,116

1,510

3,730

1,522

777

960

645

3,001

1,891

1,087

6,014

6,465

1,260

2,671

3,520

848

691

1,333

3.97

3.88

*See Page 8 For Footnotes

Ratings

Buy = B

Neutral = N

Sell = S

Howe Barnes Hoefer & Arnett, Inc.

Page 5

Coverage Universe

June 4, 2008

PACIFIC NORTHWEST

Ticker

Company Name

AWBC

BANR

CACB

CASB

CTBK

CBBO

COLB

FTBK

HRZB

NRIM

PCBK

RVSB

TSBK

WCBO

AmericanWest Bancorporation

Banner Corporation

Cascade Bancorp

Cascade Financial Corporation

City Bank

Columbia Bancorp

Columbia Banking System, Inc.

Frontier Financial Corporation

Horizon Financial Corp.

Northrim BanCorp, Inc.

Pacific Continental Corporation

Riverview Bancorp, Inc.

Timberland Bancorp, Inc.

West Coast Bancorp

FootNotes* Analyst Rating

(14)

(15)

KH

KH

JW

DW

KH

JW

KH

KH

KH

KH

DW

DW

KH

JW

N

S

N

N

N

N

S

N

N

N

N

N

N

N

06/03/08

Last

Trade

($)

3.14

17.67

8.58

9.15

13.68

10.67

25.79

14.54

10.33

19.50

14.44

8.74

10.38

11.11

Average:

Median:

Diluted

EPS

% Change

52-Week

High

Low

($)

($)

20.96

37.79

25.28

16.75

33.20

22.40

34.00

26.17

23.87

28.57

16.41

15.82

19.15

32.83

2.93

17.56

8.50

8.97

13.75

9.75

21.07

14.30

10.28

17.44

10.35

7.30

10.05

10.51

Week

(%)

MTD

(%)

Diluted

P/E

YTD

(%)

2007

($)

2008E

($)

2009E

($)

0.54

2.49

1.05

1.27

2.62

1.42

1.91

1.62

1.51

1.80

1.08

0.79

1.17

1.04

(0.19)

0.87

0.75

0.90

2.21

0.60

1.80

1.14

1.25

1.56

1.10

0.70

0.98

0.70

0.52

1.47

0.90

1.05

2.53

0.90

1.99

1.30

1.47

1.80

1.23

0.90

1.11

1.25

(6.3)

(2.9)

(2.2)

1.4

(5.5)

(6.5)

(3.5)

(1.1)

(4.5)

4.0

(3.3)

(1.2)

(5.5)

(4.0)

(6.3)

(2.9)

(2.2)

1.4

(5.5)

(6.5)

(3.5)

(1.1)

(4.5)

4.0

(3.3)

(1.2)

(5.5)

(4.0)

(82.2)

(38.5)

(38.4)

(32.7)

(39.0)

(35.4)

(13.3)

(21.7)

(40.8)

(8.5)

15.3

(24.3)

(14.8)

(39.9)

(2.9)

(3.4)

(2.9)

(3.4)

(29.6)

(34.1)

08A

08A

09E

09E

2007

(X)

10E

10E

Price/

Book Value

2008E 2009E Stated

(X)

(X)

(%)

5.8

7.1

8.2

7.2

5.2

7.5

13.5

9.0

6.8

10.8

13.4

11.1

8.9

10.7

NM

20.3

11.4

10.2

6.2

17.8

14.3

12.8

8.3

12.5

13.1

12.5

10.6

15.9

6.0

12.0

9.5

8.7

5.4

11.9

13.0

11.2

7.0

10.8

11.7

9.7

9.4

8.9

21.5

64.4

86.3

89.1

99.2

104.5

132.6

146.0

95.7

120.7

157.3

103.1

95.4

83.2

8.9

8.5

12.8

12.5

9.7

9.6

99.9

97.5

Tang.

(%)

40.4

94.6

146.2

111.9

99.2

112.6

187.3

175.4

96.4

133.3

199.2

144.2

104.8

89.5

123.9

112.2

EPS Growth

Rate

2008/

2009/

2007

2008

(%)

(%)

NM

(65.1)

(28.6)

(29.1)

(15.6)

(57.7)

(5.8)

(29.6)

(17.2)

(13.3)

1.9

(11.4)

(16.2)

(32.7)

NM

69.0

20.0

16.7

14.5

50.0

10.6

14.0

17.6

15.4

11.8

28.6

13.3

78.6

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

(13.3)

24.9

12.6

10.2

14.5

8.8

19.6

14.3

10.9

7.9

23.9

10.0

6.4

(1.5)

NM

NM

NM

NM

NM

NM

NM

NM

NM

NM

7.09

NM

NM

NM

Core

LTM

LTM

ROAA ROAE

(%)

(%)

(1.22)

0.78

1.10

1.03

3.39

1.19

1.17

1.94

1.35

1.15

1.40

1.04

1.17

0.40

(8.78)

8.16

9.31

11.98

18.74

12.33

11.20

17.14

14.28

10.91

12.29

8.97

9.95

4.76

1.14

1.16

10.09

11.06

Div.

Yield

(%)

NA

4.53

4.66

3.93

4.39

3.75

2.64

4.95

5.23

3.49

2.77

4.12

4.24

4.86

Shares

Out.

(Mil)

17.21

15.74

28.08

12.05

15.76

10.09

18.09

47.01

11.89

6.31

11.96

10.91

6.88

15.69

Mkt.

Cap.

($ Mil)

54

278

241

110

216

108

467

684

123

123

173

95

71

174

Total

Assets

($ Mil)

2,108

4,572

2,406

1,503

1,309

1,046

3,247

4,063

1,392

1,002

997

887

655

2,621

4.12

4.24

*See Page 8 For Footnotes

Ratings

Buy = B

Neutral = N

Sell = S

Howe Barnes Hoefer & Arnett, Inc.

Page 6

Coverage Universe

June 4, 2008

SOUTHEAST

Ticker

Company Name

ABVA

OZRK

BNCN

CAPE

CBKN

CSBC

CPBK

COOP

CRFN

FCCO

FSBK

FNBN

FOFN

GRNB

IBKC

MSL

NCBC

NXTY

PNFP

SUPR

TSH

WGNB

YAVY

Alliance Bankshares Corporation

Bank of the Ozarks, Inc.

BNC Bancorp

Cape Fear Bank Corporation

Capital Bank Corporation

Citizens South Banking Corporation

Community Capital Corporation

Cooperative Bankshares, Inc.

Crescent Financial Corporation

First Community Corporation

First South Bancorp, Inc.

FNB United Corp.

Four Oaks Fincorp, Inc.

Green Bankshares, Inc.

IBERIABANK Corporation

MidSouth Bancorp, Inc.

New Century Bancorp, Inc.

Nexity Financial Corporation

Pinnacle Financial Partners, Inc.

Superior Bancorp

Teche Holding Company

WGNB Corp.

Yadkin Valley Financial Corporation

FootNotes* Analyst Rating

(16)

(17)

(18)

(19)

(20)

(21)

(22)

(23)

(24)

(25)

(26)

(27)

(28)

MQ

BM

MQ

MQ

MQ

MQ

MQ

MQ

MQ

MQ

MQ

MQ

MQ

BM

MQ

MQ

MQ

JW

BM

JW

MQ

MQ

MQ

N

N

N

N

N

N

N

N

N

S

N

N

N

N

N

N

N

N

N

N

B

S

B

06/03/08

Last

Trade

($)

4.20

23.94

13.75

8.80

10.03

9.05

10.90

8.10

7.12

13.27

18.37

10.43

15.00

19.18

52.68

19.20

6.51

5.12

25.80

14.57

35.39

12.25

15.00

Average:

Median:

Diluted

EPS

% Change

52-Week

High

Low

($)

($)

14.75

33.87

18.61

11.33

17.62

12.99

19.90

17.93

12.10

17.25

29.85

16.49

20.68

38.63

54.36

28.57

14.28

11.48

31.31

43.88

45.75

28.95

19.25

4.20

18.49

13.09

8.50

8.60

8.89

10.75

7.86

6.80

12.00

18.01

8.66

11.00

15.06

37.44

16.67

6.05

4.52

20.82

10.00

29.50

12.16

12.27

Week

(%)

MTD

(%)

Diluted

P/E

YTD

(%)

2007

($)

2008E

($)

2009E

($)

(0.55)

1.89

1.05

0.35

0.77

0.70

1.62

1.19

0.65

1.20

1.70

1.05

0.92

2.07

3.47

1.32

0.24

0.62

1.34

0.80

2.89

0.61

1.32

(0.32)

2.00

0.95

(0.17)

0.80

0.66

1.21

0.58

0.42

1.34

1.48

1.05

1.13

2.12

3.81

1.14

0.40

0.22

1.56

0.17

3.69

0.82

1.33

0.00

2.20

1.28

0.20

0.85

0.81

1.50

1.04

0.60

1.35

1.62

1.18

NA

2.25

4.35

1.43

0.46

0.50

1.80

0.65

3.39

1.08

1.62

(4.3)

(1.8)

(0.4)

0.0

(3.7)

(1.3)

(3.3)

(4.7)

(2.7)

(2.4)

(4.6)

3.7

(1.6)

(1.0)

(0.1)

(1.3)

(1.4)

(9.4)

(4.1)

(1.6)

(1.7)

0.7

(1.0)

(4.3)

(1.8)

(0.4)

0.0

(3.7)

(1.3)

(3.3)

(4.7)

(2.7)

(2.4)

(4.6)

3.7

(1.6)

(1.0)

(0.1)

(1.3)

(1.4)

(9.4)

(4.1)

(1.6)

(1.7)

0.7

(1.0)

(35.6)

(8.6)

(18.7)

(22.3)

(4.9)

(10.7)

(27.2)

(31.4)

(25.1)

2.9

(17.2)

(14.2)

(4.8)

(0.1)

12.7

(17.6)

(21.1)

(22.9)

1.5

(32.2)

(6.3)

(38.7)

(1.8)

(2.1)

(1.6)

(2.1)

(1.6)

(15.0)

(17.2)

2007

(X)

Price/

Book Value

2008E 2009E Stated

(X)

(X)

(%)

NM

12.7

13.1

25.1

13.0

12.9

6.7

6.8

11.0

11.1

10.8

9.9

16.3

9.3

15.2

14.5

27.1

8.3

19.3

18.2

12.2

20.1

11.4

NM

12.0

14.5

NM

12.5

13.7

9.0

14.0

17.0

9.9

12.4

9.9

13.3

9.0

13.8

16.8

16.3

23.3

16.5

NM

9.6

14.9

11.3

NM

10.9

10.7

44.0

11.8

11.2

7.3

7.8

11.9

9.8

11.3

8.8

NA

8.5

12.1

13.4

14.2

10.2

14.3

22.4

10.4

11.3

9.3

13.9

12.8

13.5

13.5

12.9

11.2

49.2

189.1

115.4

119.2

67.1

80.7

74.4

82.2

72.4

66.4

205.9

54.7

164.5

75.5

132.5

180.3

71.6

56.6

121.6

41.5

110.8

92.0

114.0

101.6

82.2

Tang.

(%)

57.6

194.5

171.0

119.2

107.5

127.1

87.5

90.2

109.0

123.7

216.9

118.0

164.5

144.1

269.1

209.2

85.1

57.3

267.4

88.2

117.3

144.3

184.7

141.4

123.7

EPS Growth

Rate

2008/

2009/

2007

2008

(%)

(%)

(41.8)

5.8

(9.5)

NM

3.9

(5.7)

(25.3)

(51.3)

(35.4)

11.7

(12.9)

0.0

22.8

2.4

9.8

(13.6)

66.7

(64.5)

16.4

(78.8)

27.7

34.4

0.8

NM

10.0

34.7

NM

6.3

22.7

24.0

79.3

42.9

0.7

9.5

12.4

NA

6.1

14.2

25.4

15.0

NM

15.4

NM

(8.1)

31.7

21.8

EPS

CAGR

PEG

Ratio

5-Year

(%)

2008

(X)

NM

15.5

13.8

0.6

(2.2)

7.4

7.2

9.6

13.2

6.1

13.3

(7.2)

12.3

7.7

6.2

12.0

(0.8)

31.1

68.0

NM

2.7

(13.4)

9.0

NM

2.06

NM

NM

3.22

NM

NM

NM

NM

0.85

NM

NM

0.58

3.75

1.41

NM

0.24

NM

1.01

NM

0.35

0.43

14.89

Core

LTM

LTM

ROAA ROAE

(%)

(%)

(1.09)

1.19

0.66

0.10

0.58

0.66

0.80

0.74

0.72

0.77

1.82

0.56

0.83

0.94

0.96

0.94

0.09

0.56

0.92

0.22

0.99

0.40

1.18

(12.20)

16.66

9.10

1.62

5.20

5.96

9.85

10.70

6.57

6.81

19.49

4.91

10.50

8.55

9.43

12.07

0.87

7.76

7.78

1.83

10.51

4.16

10.33

0.68

0.74

7.32

7.78

Div.

Yield

(%)

NA

2.01

1.45

NA

3.19

3.76

5.50

2.47

NA

2.41

4.35

5.75

2.13

2.71

2.58

1.46

NA

NA

NA

NA

3.90

3.43

3.47

Shares

Out.

(Mil)

5.11

16.82

7.29

3.84

11.24

7.54

4.47

6.58

9.52

3.20

9.75

11.43

6.24

13.00

12.87

6.62

6.82

7.77

22.60

10.05

2.11

6.06

11.46

Mkt.

Cap.

($ Mil)

21

403

100

34

113

68

49

53

68

42

179

119

94

249

678

127

44

40

583

146

75

74

172

Total

Assets

($ Mil)

554

3,052

1,186

470

1,575

777

811

958

881

590

914

2,035

771

2,913

5,132

937

603

997

3,889

2,964

756

886

1,425

3.16

2.95

*See Page 8 For Footnotes

Ratings

Buy = B

Neutral = N

Sell = S

Howe Barnes Hoefer & Arnett, Inc.

Page 7

Coverage Universe

June 4, 2008

FOOTNOTES

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2007A EPS includes $0.08 in nonrecurring gains.

2007A EPS excludes net nonrecurring items of $0.15.

2007A EPS excludes YTD net nonrecurring expense of $0.26.

2007A EPS excludes nonrecurring expense of $0.26.

2008E EPS includes $0.02 in securities gains.

2008E EPS includes gains from the sale of securities.

2007A EPS includes $0.12 of nonrecurring items.

2008E EPS includes $0.02 in one-time expenses.

2007A EPS includes nonrecurring income and expenses.

2008E EPS excludes expected one-time charge.

2007A EPS excludes $0.07 in net nonrecurring charges.

2008E EPS includes $0.05 of nonrecurring gains.

2007A EPS excludes a $2.14 write-off of goodwill.

2007A EPS includes $0.17 in one-time expenses.

2008E EPS excludes $0.13 nonrecurring VISA gains.

2007A EPS excludes $0.05 securities gains.

2007A EPS excludes $0.02 FAS 159 gain.

2007A EPS excludes $0.09 restructuring charge.

2007A EPS excludes $0.03 net nonrecurring gain.

2007A EPS excludes securities transactions and nonrecurring items.

2007A EPS excludes $0.03 nonreccuring gain.

2007A EPS excludes securities transactions and nonrecurring gains.

2007A EPS excludes securities transactions and nonrecurring items.

2007A EPS excludes nonrecurring loss on obsolete fixed assets.

2007A EPS excludes merger-related charges and nonrecurring items.

2007E EPS excludes $0.04 in nonrecurring expense.

2007A EPS excludes $0.05 securities gains.

2008E EPS excludes $0.03 nonrecurring gain.

2007A EPS excludes $0.06 of merger expenses.

2007A EPS excludes $0.05 in aggregate securities gains and nonrecurring items.

Howe Barnes Hoefer & Arnett, Inc.

Page 8

Coverage Universe

June 4, 2008

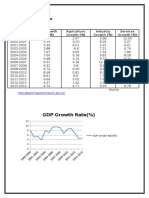

Industry Medians And Price Performance

5-Yr. Comparative Return

80.00%

60.00%

40.00%

20.00%

0.00%

-20.00%

Jun-03 Oct-03 Feb-04 Jun-04 Oct-04 Feb-05 Jun-05 Oct-05 Feb-06 Jun-06 Oct-06 Feb-07 Jun-07 Oct-07 Feb-08 Jun-08

Nasdaq Bank Index

S&P 500

Dates Graphed: 06/03/03 - 06/03/08

Price Performance

YTD

2008

(%)

2004

(%)

2003

(%)

5-Year

Average

(%)

(4.3)

3.0

11.0

9.0

29.9

26.3

5.1

11.1

13.3

5.4

13.3

11.5

3.4

(1.9)

(5.4)

(3.7)

1.8

4.5

7.6

14.5

20.9

10.9

13.1

30.4

34.9

32.9

41.2

43.6

4.9

5.5

6.9

8.7

8.9

13.4

11.8

12.1

20.1

9.4

4.0

(10.3)

(3.4)

(6.9)

(8.2)

8.1

7.3

11.1

8.3

4.6

35.6

40.8

47.1

39.4

37.6

2.2

5.2

8.6

7.7

5.2

2007

(%)

2006

(%)

(8.8)

(6.2)

(22.1)

3.5

11.0

13.6

SNL Bank Indexes

Assets > $10B

Assets of $5B - $10B

Assets of $1B - $5B

Assets of $500M - $1B

Assets < $500M

(16.6)

(8.2)

(7.0)

(10.3)

(6.8)

(25.1)

(22.1)

(28.9)

(21.7)

(20.2)

SNL Thrift Indexes

Assets > $10B

Assets of $5B - $10B

Assets of $1B - $5B

Assets of $500M - $1B

Assets < $500M

(13.3)

5.6

(3.9)

(5.5)

(1.2)

(50.2)

(23.7)

(23.9)

(22.4)

(17.2)

NASDAQ Bank Index

S&P 500 Index

2005

(%)

Indexes priced as of 06/03/08

Data Source: SmartStation and SNL Financial

Industry Medians

Price/Earnings

2007

2008

2009

Price

EPS

Book Value

Growth Rate

Stated

Tangible 2008/2007 2009/2008

(%)

(%)

Core

ROAA

LTM

ROAE

LTM

(%)

(%)

(X)

(X)

(X)

(%)

(%)

Banks

Assets < $500 Mil

Assets b/w $500 Mil - $1 Bil

Assets b/w $1 - $5 Bil

Assets b/w $5 - $10 Bil

Assets > $10 Bil

14.4

12.7

13.4

13.2

11.3

15.1

12.8

13.9

13.4

13.1

11.3

10.8

12.0

12.2

11.2

102.5

106.9

111.9

121.4

107.0

108.0

121.8

146.2

182.1

162.8

(16.7)

(7.4)

(5.7)

(1.7)

(10.3)

16.8

17.9

14.3

9.4

12.5

0.71

0.82

0.91

0.95

1.13

7.71

9.75

9.75

8.76

11.40

Thrifts

Assets < $500 Mil

Assets b/w $500 Mil - $1 Bil

Assets b/w $1 Bil - $5 Bil

Assets b/w $5 Bil - $10 Bil

Assets > $10 Bil

31.7

19.7

18.8

24.5

17.3

30.8

16.4

15.3

23.0

20.1

76.9

16.3

14.2

19.9

13.6

96.3

98.9

110.1

96.0

54.5

100.7

104.9

124.9

178.4

148.9

(20.0)

6.9

8.9

14.4

12.2

143.8

7.8

14.0

12.9

3.0

0.44

0.46

0.58

0.54

0.35

3.63

4.60

5.41

3.41

2.72

Industry Medians Priced as of 06/03/08

Data Source: SNL Financial

Howe Barnes Hoefer & Arnett, Inc.

Page 9

Coverage Universe

June 4, 2008

DISCLOSURES

RATING SYSTEM

Category

BUY

NEUTRAL

SELL

Description

Those equities that we think will provide an expected total return (price appreciation plus dividend yield) of 10% or more over the next 12 months.

Those equities that we think will provide an expected total return (price appreciation plus dividend yield) of 0-10% over the next 12 months.

Those equities that we think will provide a negative expected total return (price appreciation plus dividend yield) over the next 12 months.

RATING DISTRIBUTION (as of March 31, 2008)

Coverage Universe

Count Percent

Investment Banking Relationship*

Count

Percent

16.5%

BUY

20

BUY

2

16.7%

79.3%

NEUTRAL

96

NEUTRAL

10

83.3%

4.1%

SELL

5

SELL

0

0.0%

* Companies which Howe Barnes Hoefer & Arnett, Inc. has received within the past 12 months or will receive within the next 3 months compensation for services rendered in

connection with activities relating to: underwriting an offering for the issuer; acting as a financial advisor in a merger or acquisition; providing valuation services; or serving as

placement agent for the issuer. Percentages may not add up to 100.0% due to rounding.

ADDITIONAL INFORMATION AVAILABLE UPON REQUEST

Howe Barnes Hoefer & Arnett, Inc. makes a market in the companies listed in this report.

Howe Barnes Hoefer & Arnett, Inc. and its affiliates beneficially own 1% or more of the common stock of Capital Corp of the West.

Howe Barnes Hoefer & Arnett, Inc. co-managed a public offering for the following companies within the past 12 months:

Midwest Banc Holdings, Inc.

Silver State Bancorp

Temecula Valley Bancorp Inc.

Howe Barnes Hoefer & Arnett, Inc. expects to receive compensation for investment banking services from the following companies within

the next three months:

AmericanWest Bancorporation

East West Bancorp, Inc.

Howe Barnes Hoefer & Arnett, Inc. has received compensation for investment banking services from the following companies within the past

12 months:

American River Bankshares

Center Financial Corporation

East West Bancorp, Inc.

Firstbank Corporation

Independent Bank Corporation

Midwest Banc Holdings, Inc.

MidWestOne Financial Group, Inc.

Old Second Bancorp, Inc.

Prosperity Bancshares, Inc.

Silver State Bancorp

Temecula Valley Bancorp Inc.

Tower Financial Corporation

The following companies are or have been non-investment banking clients for securities-related services of Howe Barnes Hoefer &

Arnett, Inc. within the past 12 months:

Alliance Bankshares Corporation

AMCORE Financial, Inc.

American River Bankshares

AmericanWest Bancorporation

Anchor BanCorp Wisconsin Inc.

BancFirst Corporation

Bank Mutual Corporation

Bank of Commerce Holdings

Bank of Marin Bancorp

Banner Corporation

Baylake Corp.

Capital Bank Corporation

Capital Corp of the West

Cascade Financial Corporation

Cathay General Bancorp

Center Financial Corporation

Central Valley Community Bancorp

Citizens South Banking Corporation

Columbia Bancorp

Community Capital Corporation

Community Trust Bancorp, Inc.

Corus Bankshares, Inc.

DCB Financial Corp

Dearborn Bancorp, Inc.

East West Bancorp, Inc.

Enterprise Financial Services Corp

First Busey Corporation

First Community Corporation

First Financial Bancorp.

First Financial Corporation

First Financial Service Corporation

First Merchants Corporation

Firstbank Corporation

Frontier Financial Corporation

Great Southern Bancorp, Inc.

Green Bankshares, Inc.

Hanmi Financial Corporation

Heartland Financial USA, Inc.

Heritage Oaks Bancorp

HMN Financial, Inc.

HopFed Bancorp, Inc.

Horizon Bancorp

Horizon Financial Corp.

Independent Bank Corporation

Indiana Community Bancorp

Integra Bank Corporation

LNB Bancorp, Inc.

Macatawa Bank Corporation

MainSource Financial Group, Inc.

MB Financial, Inc.

MBT Financial Corp.

Mercantile Bank Corporation

MidSouth Bancorp, Inc.

Midwest Banc Holdings, Inc.

MidWestOne Financial Group, Inc.

Monroe Bancorp

MutualFirst Financial, Inc.

New Century Bancorp, Inc.

Nexity Financial Corporation

North Valley Bancorp

Howe Barnes Hoefer & Arnett, Inc.

Northern States Financial Corporation

Northrim BanCorp, Inc.

Old Second Bancorp, Inc.

Pacific State Bancorp

Peoples Bancorp Inc.

Preferred Bank

Princeton National Bancorp, Inc.

Prosperity Bancshares, Inc.

Pulaski Financial Corp.

Riverview Bancorp, Inc.

Sierra Bancorp

Silver State Bancorp

Superior Bancorp

Taylor Capital Group, Inc.

Team Financial, Inc.

Teche Holding Company

Temecula Valley Bancorp Inc.

Timberland Bancorp, Inc.

Tower Financial Corporation

TriCo Bancshares

UCBH Holdings, Inc.

West Bancorporation, Inc.

Wilshire Bancorp, Inc.

Yadkin Valley Financial Corporation

Page 10

Coverage Universe

June 4, 2008

DISCLOSURES (CONTINUED)

Howe Barnes Hoefer & Arnett, Inc. has received compensation for non-investment banking services from the following companies

within the past 12 months:

Alliance Bankshares Corporation

American River Bankshares

BancFirst Corporation

Bank Mutual Corporation

Bank of Commerce Holdings

Bank of Marin Bancorp

Banner Corporation

Baylake Corp.

Capital Bank Corporation

Cascade Financial Corporation

Cathay General Bancorp

Center Financial Corporation

Central Valley Community Bancorp

Citizens South Banking Corporation

Columbia Bancorp

Community Capital Corporation

Community Trust Bancorp, Inc.

Corus Bankshares, Inc.

Dearborn Bancorp, Inc.

Enterprise Financial Services Corp

First Busey Corporation

First Community Corporation

First Financial Bancorp.

First Financial Corporation

First Financial Service Corporation

First Merchants Corporation

Firstbank Corporation

Great Southern Bancorp, Inc.

Hanmi Financial Corporation

Heartland Financial USA, Inc.

Heritage Oaks Bancorp

HMN Financial, Inc.

HopFed Bancorp, Inc.

Horizon Bancorp

Horizon Financial Corp.

Indiana Community Bancorp

Macatawa Bank Corporation

MainSource Financial Group, Inc.

MB Financial, Inc.

MBT Financial Corp.

Mercantile Bank Corporation

MidSouth Bancorp, Inc.

Midwest Banc Holdings, Inc.

MidWestOne Financial Group, Inc.

Monroe Bancorp

MutualFirst Financial, Inc.

New Century Bancorp, Inc.

Nexity Financial Corporation

Northern States Financial Corporation

Northrim BanCorp, Inc.

Old Second Bancorp, Inc.

Pacific State Bancorp

Peoples Bancorp Inc.

Preferred Bank

Princeton National Bancorp, Inc.

Prosperity Bancshares, Inc.

Pulaski Financial Corp.

Riverview Bancorp, Inc.

Sierra Bancorp

Silver State Bancorp

Superior Bancorp

Taylor Capital Group, Inc.

Team Financial, Inc.

Teche Holding Company

Temecula Valley Bancorp Inc.

Timberland Bancorp, Inc.

Tower Financial Corporation

TriCo Bancshares

West Bancorporation, Inc.

Wilshire Bancorp, Inc.

Yadkin Valley Financial Corporation

William R. Rybak, a member of the Board of Directors of Howe Barnes Hoefer & Arnett, Inc. is also a director of PrivateBancorp, Inc.

We, the research analysts responsible for this report, assert that the views expressed in this report accurately reflect our personal

views regarding all of the subject securities or issuers. We have not received, and will not receive, any compensation related to

the specific recommendations or views expressed in this report.

The factual statements herein have been taken from sources we believe to be reliable but such statements are made without any

representation as to accuracy or completeness or otherwise and this report does not purport to be a complete analysis of the securities,

companies or industries involved. All opinions and estimates included in this report are our own unless otherwise stated and are subject to

change without notice. This report has no regard to the specific investment objective; financial situation or particular needs of any specific

recipient and should not be considered as a solicitation or offer of the purchase or sale of securities. Howe Barnes Hoefer & Arnett, Inc.

and/or its directors, officers and employees may have or have had interest or positions or traded or acted as principal in relevant securities

and derivatives thereon. Howe Barnes Hoefer & Arnett, Inc. accepts no liability whatsoever for any loss or damage of any kind arising out of

the use of all or any part of this report. Howe Barnes Hoefer & Arnett, Inc. sets its price targets based on past financial performance, forward

looking earning assumptions and absolute and relative valuation levels. Factors that could impede the achievement of our target price

include, but are not limited to, the following: shifts in investor sentiment and a weakening of 1) the subject companys fundamentals, 2)

industry trends, 3) industry pricing multiples, 4) local and/or national economies, and 5) general market conditions. Research analyst

compensation is based on general revenues and profits of Howe Barnes Hoefer & Arnett, Inc. as a whole, which includes revenues from

investment banking activities. Prices shown are approximate.

Howe Barnes Hoefer & Arnett, Inc.

Page 11

You might also like

- ASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFDocument589 pagesASA Valuing Machinery and Equipment 4th Edition 2020-0620 PDFLea Ann Cruz100% (1)

- Seagate LBO AnalysisDocument58 pagesSeagate LBO Analysisthetesterofthings100% (2)

- Financial Performance Comparison of Tobacco CompaniesDocument9 pagesFinancial Performance Comparison of Tobacco Companiesjchodgson0% (2)

- NPV Analysis Comparing Investment in Two Machines for Production ProcessDocument19 pagesNPV Analysis Comparing Investment in Two Machines for Production Processdubbs21100% (2)

- IATA-Aviation Industry Fact 2010Document3 pagesIATA-Aviation Industry Fact 2010revealedNo ratings yet

- Session 3 ADocument10 pagesSession 3 AAashishNo ratings yet

- The Asian Financial Crisis: Hung-Gay Fung University of Missouri-St. LouisDocument32 pagesThe Asian Financial Crisis: Hung-Gay Fung University of Missouri-St. LouisPrateek BatraNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- First Global: DanoneDocument40 pagesFirst Global: Danoneadityasood811731No ratings yet

- Macroeconomic TrendsDocument5 pagesMacroeconomic Trendsberi tsegeabNo ratings yet

- JPM Guide To The Markets - Q1 2014Document71 pagesJPM Guide To The Markets - Q1 2014adamsro9No ratings yet

- Inquirer Briefing by Cielito HabitoDocument47 pagesInquirer Briefing by Cielito Habitoasknuque100% (2)

- Whitehall: Monitoring The Markets Vol. 4 Iss. 39 (October 28, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 39 (October 28, 2014)Whitehall & CompanyNo ratings yet

- Sri Lanka GDP - Real Growth RateDocument4 pagesSri Lanka GDP - Real Growth RateRasya ArNo ratings yet

- Global Recession and Its Impact On The Asian Economy: Dr. Bernardo M. VillegasDocument24 pagesGlobal Recession and Its Impact On The Asian Economy: Dr. Bernardo M. VillegasPandit Here Don't FearNo ratings yet

- Economic Instability in PakistanDocument35 pagesEconomic Instability in PakistanJunaid NaseemNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Whitehall & CompanyNo ratings yet

- Elasticity of Demand and Supply Chapter 3Document3 pagesElasticity of Demand and Supply Chapter 3Jeric LepasanaNo ratings yet

- Scottsdale Instit Presentation - WegmillerDocument116 pagesScottsdale Instit Presentation - WegmillerRick KneipperNo ratings yet

- Colgate OverviewDocument108 pagesColgate OverviewmhyigitNo ratings yet

- The World of International Economics: Mcgraw-Hill/IrwinDocument21 pagesThe World of International Economics: Mcgraw-Hill/IrwinLA SyamsulNo ratings yet

- India'S Macroeconomic Indicators: Updated On August 05, 2013Document1 pageIndia'S Macroeconomic Indicators: Updated On August 05, 2013Mahesh VermaNo ratings yet

- Practical Issues: Helping You in Preparing For Your Essay & Group Project AssignmentDocument25 pagesPractical Issues: Helping You in Preparing For Your Essay & Group Project AssignmentBilal shujaatNo ratings yet

- Stock Volatility During The Recent Financial Crisis: G. William SchwertDocument20 pagesStock Volatility During The Recent Financial Crisis: G. William SchwertGeorgiana JuganaruNo ratings yet

- HDFC Bank Ltd. Hero Motocrop Nifty 50 Date Close Return Date Close Return Date Close ReturnDocument3 pagesHDFC Bank Ltd. Hero Motocrop Nifty 50 Date Close Return Date Close Return Date Close Returntommy chadhaNo ratings yet

- India GDP - Real Growth RateDocument13 pagesIndia GDP - Real Growth RateDeepak GoyalNo ratings yet

- A Global Market Rotation Strategy With An Annual Performance of 41.4% Since 2003 - Seeking AlphaDocument96 pagesA Global Market Rotation Strategy With An Annual Performance of 41.4% Since 2003 - Seeking Alpha_karr99No ratings yet

- Fed Refocus: Sector WatchDocument5 pagesFed Refocus: Sector WatchSokhomNo ratings yet

- GBS Group 8Document20 pagesGBS Group 8AISHWARYANo ratings yet

- Mstar Anip 13 10Document1 pageMstar Anip 13 10derek_2010No ratings yet

- STJ Write UpDocument5 pagesSTJ Write Upmunger649No ratings yet

- TWIA Board of Directors: Rate Adequacy AnalysisDocument13 pagesTWIA Board of Directors: Rate Adequacy AnalysiscallertimesNo ratings yet

- ValuEngine Weekly Newsletter August 27 2010Document11 pagesValuEngine Weekly Newsletter August 27 2010ValuEngine.comNo ratings yet

- City of Houston Public Neighborhood PresentationDocument50 pagesCity of Houston Public Neighborhood PresentationOrganizeTexasNo ratings yet

- Feasibility ReportDocument14 pagesFeasibility ReportZP CHNo ratings yet

- ISO 22000 - Food Safety Management Systems - Requirements For Any Organization in The Food ChainDocument44 pagesISO 22000 - Food Safety Management Systems - Requirements For Any Organization in The Food ChainJose LopezNo ratings yet

- Global NutshellDocument50 pagesGlobal NutshellDat Dinh QuangNo ratings yet

- Corp Vs - Pers TaxDocument3 pagesCorp Vs - Pers TaxmrpoissonNo ratings yet

- 2Q09 Conference Call PresentationDocument28 pages2Q09 Conference Call PresentationJBS RINo ratings yet

- Status of Indian Economic Reforms A Hiatus or A Pause Before Acceleration?Document25 pagesStatus of Indian Economic Reforms A Hiatus or A Pause Before Acceleration?msrathodNo ratings yet

- ALGERIE CoucheDocument99 pagesALGERIE CoucheDj@melNo ratings yet

- October 2022 Monthly Gold CompassDocument84 pagesOctober 2022 Monthly Gold CompassburritolnxNo ratings yet

- Ifi 5Document334 pagesIfi 5MARCO DAVID COPATITI ULURINo ratings yet

- Om G7 To G20 (A J W Dominick Salvatore) 2013Document9 pagesOm G7 To G20 (A J W Dominick Salvatore) 2013pedronuno20No ratings yet

- Korea FY08 ABP MKTG Plan - 07 06 19 (Final)Document25 pagesKorea FY08 ABP MKTG Plan - 07 06 19 (Final)Kyungjoo ChoiNo ratings yet

- ValuEngine Weekly NewsletterDocument14 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet