Professional Documents

Culture Documents

Ups and Downs

Uploaded by

ca.deepaktiwariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ups and Downs

Uploaded by

ca.deepaktiwariCopyright:

Available Formats

Ups and Downs

The rise and fall of the Indian equity markets

Ups and downs are the part and parcel of life. We rise to fall and vice versa. Not all days are sunny. The

same analogy applies to the equity markets as well. Presently we are experiencing a bearish market.

But this is not the first time. Before this, several bull and bear phases have taken place. Of course, what

we saw during 2003-08 was an unprecedented bull rally India has ever experienced. But you must

remember the law of gravity. More the force you use to throw, the thing will fall with equal amount of

force. In other words, an unprecedented bull rally will follow an unprecedented bear phase too.

Technically we see a bearish phase after every 8 years of an uptrend. BSE Sensex witnessed them in

1985, 1992, 2000 and then recently in 2008. We found out that from its highs during each bull phase,

Sensex fell down by 55-60%. However it surged by 191% and 703% during the next bull phases from

the lows of the 8 year cycle during 1992- 2000 and 2000-2008. The 2000-08 rallies were one of its kind,

and if we are going to see the same sort of bull phase in the next cycle then will we see Sensex

touching 59,500 by 2016? You never know. But we are certain that the next rally will be unparalleled

too. It may be 34,000 or 59,500.

Rise in next

Year Fall from high boom High Low

1992 54.40% 191% 4467.32 as on April 22, 1992 2036.81 as on April 26, 1993

2000 56.20% 702.80% 5933.56 as on Feb 11, 2000 2600.12 as on Sept 21, 2001

2008 59.20% ? 20873.33 as on Jan 08, 2008 8509.56 as on Oct 27, 2008

Now let us take the stock of our portfolios. Who has lost what? We have carried out a detailed analysis

about the indices including sectoral indices and stocks they are comprised of. We found out that realty

and metal stocks are the biggest losers with 70 and 81% respectively since January 18, 2008. Sensex

and Nifty lost 48% in comparison BSE mid and small cap that lost 64-68%. Sectors that could weather

the storm included FMCG, Health Care and IT with 14-30% losses since January level. In last one

month sectors that have suffered the most were metal, energy and auto. Sectors that could buck the

falling trend included FMCG, IT, bankex and technology in the same period. During previous week,

however the most beaten down stocks recoiled. Sectors that made good come back during the previous

week were realty (9.4% up) and power (5.4% up).

Since January, sector wise stocks that annihilated by over 60% are as follows:

Sensex: JP, Tata Motors, Tata Steel, Rel Infra, Sterlite, DLF, Grasim, RCom, ICICI Bank and Hindaco

Auto: Amtek, Tata Motors, Bharat Forge, Escort, MRF, and Ashok Leyland

Bankex: Yes Bank, ICICI Bank, Karnataka Bank, Kotak Bank and Indusind Bank

CD: BPL, Videocon, Rajesh Exports, Gitanjali Gems and Blue Star

CG: Gammon Infra, Walchandnagar, Elecon, Suzlon, RIIL, Bharat Bijlee, Jyoti Struct, Kalpataru Power,

BEML, Havells, Usha Martin, Alstom Projects, Siemens, Praj, Bharat Elect, ABB and Punj Industries

FMCG: Pantaloon

HC: Wockhardt, Aurobindo, Opto Circuits, Bilcare and Sun Pharma

IT: NIIT, Aptech, Financial Tech, Moser Baer and Tech Mahindra

Metal: Jai Corp, Ispat, Welspun Gujarat, Jindal Steel & Power, JSW Steel, Gujarat NRE, SAIL, NMDC, Nalco

Oil & Gas: Aban, RNRL and Essar Oil

Deepak Tiwari Power: GVK Power, Lanco Infratech, Neyveli, GMR and Torrent Power

Research Analyst PSU: STC, Hind Copper, RCF, Dredging Corp, Central Bank, Bank of Maharashtra, Chennai Petro and

Vijaya Bank

deepakt@arthamoney.com Realty: Except Akruti all stocks annihilated by over 72%

Media & Tech: IOL Netcom, Adlabs, Teledata, HFCL, Dish TV, Deccan Chr, NDTV, Balaji Tele, Hexaware, Tanla

Solutions, UTV Software, HT Media and Jagaran Prakashan,

T: + 91 22 4063 3032

Nov 10, 2008 For Private Circulation only 1

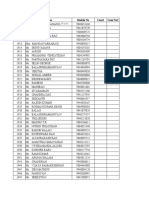

The fall in the indices and stocks constituting them (in the order of maximum loss since Jan. ‘08)

Indices and BSE sectoral indices

% Change Current levels Since January Last one month Last one week

Realty 2342.82 -80.5% -17.6% 9.4%

Metal 5152.33 -70.1% -28.5% -8.4%

Smallcap 3900.1 -67.9% -17.0% -0.7%

CD 2094.87 -64.2% -12.0% -0.5%

Midcap 3355.38 -62.3% -16.3% 0.0%

Power 1777.57 -58.7% -12.6% 5.4%

CG 7635.41 -58.4% -13.2% 0.6%

Oil & Gas 6013.57 -52.3% -22.9% -8.1%

Bankex 5532.15 -51.4% -4.2% 2.7%

PSU 4965.8 -48.6% -14.3% 2.5%

Auto 2661.53 -48.3% -22.7% -3.1%

Nifty 2973 -47.9% -15.4% -2.3%

Sensex 9964.29 -47.6% -12.0% -3.6%

Technology 2085.84 -40.0% -7.9% -6.0%

IT 2670.54 -29.5% -1.1% -7.1%

HC 2937.11 -27.0% -12.2% 2.8%

FMCG 1968.7 -14.5% 1.1% 5.2%

20.0%

%age change

10.0%

0.0%

-10.0%

-20.0%

-30.0%

-40.0%

-50.0%

-60.0%

-70.0%

Since January Last one month Last one week

-80.0%

-90.0%

Auto

Midcap

CD

HC

PSU

IT

CG

Sensex

Nifty

Bankex

FMCG

Metal

Smallcap

Power

Oil & Gas

Realty

Technology

Nov 10, 2008 For Private Circulation only 2

Stocks constituting the BSE indices

Sensex

%age Change Current levels Since January Last one month Last one week

Jaiprakash Associates Ltd. 87.7 -79.1% -3.6% 7.7%

Tata Motors Ltd. 158.9 -76.8% -47.0% -16.8%

Tata Steel Ltd. 190.1 -75.7% -43.8% -15.6%

Reliance Infrastructure Ltd. 560.9 -73.6% -12.1% 4.8%

Sterlite Industries (India) Ltd. 246.15 -72.1% -15.9% -16.5%

D L F Ltd. 280.9 -72.1% -9.0% 11.0%

Grasim Industries Ltd. 1043.15 -68.8% -33.8% -5.3%

Reliance Communications Ltd. 228.15 -67.5% -24.1% -1.9%

I C I C I Bank Ltd. 431.25 -65.4% -4.9% 0.1%

Hindalco Industries Ltd. 60.45 -64.0% -33.4% -4.8%

Reliance Industries Ltd. 1217.85 -56.5% -26.2% -15.3%

Larsen & Toubro Ltd. 870.95 -55.7% -9.9% -2.4%

Mahindra & Mahindra Ltd. 372.25 -48.9% -22.7% -3.1%

Tata Power Co. Ltd. 737.35 -48.6% -8.4% 6.4%

A C C Ltd. 478.7 -44.6% -16.1% -6.4%

State Bank Of India 1249.25 -44.1% -5.5% 0.7%

Ranbaxy Laboratories Ltd. 218.4 -43.5% -21.8% 14.7%

Wipro Ltd. 260.45 -42.8% -7.8% -5.7%

Tata Consultancy Services Ltd. 524.55 -42.0% -4.0% -4.4%

Housing Development Finance Corpn. Ltd. 1700.5 -39.7% -10.0% -10.1%

Bharat Heavy Electricals Ltd. 1405.1 -39.0% -4.2% 4.8%

Oil & Natural Gas Corpn. Ltd. 741.6 -38.7% -23.0% 4.3%

N T P C Ltd. 151.2 -36.9% -13.7% 0.0%

H D F C Bank Ltd. 1088.55 -30.9% -1.5% 1.7%

Maruti Suzuki India Ltd. 597.65 -28.9% -13.2% -0.7%

Bharti Airtel Ltd. 650 -25.6% -11.3% -5.5%

Satyam Computer Services Ltd. 277.75 -25.5% 4.9% -7.4%

I T C Ltd. 174.8 -17.8% 5.6% 10.2%

Infosys Technologies Ltd. 1262.5 -13.8% 0.6% -8.4%

Hindustan Unilever Ltd. 249.3 16.4% 4.7% 4.8%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 3

Auto

%age Change Current levels Since January Last one month Last one week

Amtek Auto Ltd. 70.2 -81.5% -50.5% -3.0%

Tata Motors Ltd. 158.9 -76.8% -47.0% -16.8%

Bharat Forge Ltd. 101.6 -70.7% -38.6% -2.1%

Escorts Ltd. 39.55 -70.0% -16.5% 2.9%

M R F Ltd. 2022 -67.0% -20.7% -4.8%

Ashok Leyland Ltd. 16.7 -63.5% -31.4% -19.5%

Apollo Tyres Ltd. 25.75 -51.0% -24.0% 5.3%

Mahindra & Mahindra Ltd. 372.25 -48.9% -22.7% -3.1%

Exide Industries Ltd. 49.8 -36.2% -13.8% 3.6%

Cummins India Ltd. 226.95 -34.0% -17.2% 7.1%

Maruti Suzuki India Ltd. 597.65 -28.9% -13.2% -0.7%

Bosch Ltd. 3447.95 -24.7% -2.4% 5.2%

Hero Honda Motors Ltd. 753.7 9.0% -13.9% 3.9%

Bajaj Auto Ltd. 411.3 NA -24.2% -17.5%

Source: Prowess, Artha Money Research

Bankex

%age Change Current levels Since January Last one month Last one week

Yes Bank Ltd. 82.1 -66.9% -8.6% 5.7%

I C I C I Bank Ltd. 431.25 -65.4% -4.9% 0.1%

Karnataka Bank Ltd. 91.15 -64.3% -14.4% 8.0%

Kotak Mahindra Bank Ltd. 411.5 -63.6% -9.3% 11.3%

Indusind Bank Ltd. 44.7 -60.9% -7.5% 5.4%

Allahabad Bank 53.9 -57.1% -9.7% 4.7%

Federal Bank Ltd. 147.3 -56.1% -20.0% 5.3%

I D B I Bank Ltd. 65.1 -56.0% -6.1% 4.7%

Indian Overseas Bank 83.95 -54.0% -1.8% 6.9%

Oriental Bank Of Commerce 148.5 -48.6% -4.9% 13.9%

Axis Bank Ltd. 581 -47.8% -9.7% -3.5%

State Bank Of India 1249.25 -44.1% -5.5% 0.7%

Canara Bank 193.2 -39.2% 16.0% 15.3%

Bank Of Baroda 292.65 -33.1% 3.4% 17.9%

Bank Of India 271.7 -33.1% 0.4% 9.8%

H D F C Bank Ltd. 1088.55 -30.9% -1.5% 1.7%

Union Bank Of India 155.35 -23.1% 7.1% 14.0%

Punjab National Bank 496.3 -22.1% 1.4% 9.7%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 4

Consumer Durables

%age Change Current levels Since January Last one month Last one week

B P L Ltd. 20.05 -85.3% -15.4% 2.6%

Videocon Industries Ltd. 126.75 -78.8% -20.8% 0.8%

Rajesh Exports Ltd. 30.5 -78.4% 28.7% 22.2%

Gitanjali Gems Ltd. 91.4 -75.2% -33.9% 11.9%

Blue Star Ltd. 193 -60.2% -23.8% 3.0%

Titan Industries Ltd. 916.9 -34.1% 2.9% -7.5%

Source: Prowess, Artha Money Research

Capital Goods

%age Change Current levels Since January Last one month Last one week

Gammon India Ltd. 84.95 -86.1% -26.8% 7.2%

Walchandnagar Industries Ltd. 113.95 -85.7% -31.4% -8.0%

Elecon Engineering Co. Ltd. 47.25 -83.2% -30.4% 16.7%

Suzlon Energy Ltd. 70.7 -81.4% -37.8% 53.9%

Reliance Industrial Infrastructure Ltd. 428.6 -81.1% -1.9% 2.4%

Bharat Bijlee Ltd. 740.55 -78.4% -13.0% -4.1%

Jyoti Structures Ltd. 63.1 -76.6% -18.8% 6.2%

Lakshmi Machine Works Ltd. 695.45 -76.1% -7.6% 10.1%

Kalpataru Power Transmission Ltd. 419.3 -74.2% -40.3% -7.3%

B E M L Ltd. 418.5 -73.8% -25.3% -5.7%

Havells India Ltd. 170.05 -73.8% -30.4% -6.7%

Usha Martin Ltd. 32.3 -72.7% -33.0% -13.9%

Alstom Projects India Ltd. 258.55 -71.1% -16.0% 5.0%

Siemens Ltd. 295.6 -69.7% -9.8% 3.5%

Praj Industries Ltd. 72.15 -63.8% -18.2% 1.5%

Bharat Electronics Ltd. 662.05 -63.7% -17.5% 4.1%

A B B Ltd. 497.2 -63.5% -28.0% -11.4%

Punj Lloyd Ltd. 199 -60.3% -15.8% 2.3%

S K F India Ltd. 163.35 -59.3% -4.8% -4.6%

Thermax Ltd. 314.75 -57.0% -9.8% -3.9%

Areva T & D India Ltd. 178 -55.9% -24.1% -8.9%

Larsen & Toubro Ltd. 870.95 -55.7% -9.9% -2.4%

Crompton Greaves Ltd. 168.8 -53.2% -19.1% 0.2%

A I A Engineering Ltd. 153.25 -50.0% -27.6% -9.3%

Everest Kanto Cylinder Ltd. 182.3 -43.4% -20.0% -5.4%

Bharat Heavy Electricals Ltd. 1405.1 -39.0% -4.2% 4.8%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 5

FMCG

%age Change Current levels Since January Last one month Last one week

Pantaloon Retail (India) Ltd. 237.5 -64.5% 13.4% 14.4%

Radico Khaitan Ltd. 60 -57.7% 0.1% -1.2%

Nirma Ltd. 90.5 -57.5% -14.3% 0.2%

United Spirits Ltd. 802.85 -56.5% -14.5% -13.2%

Tata Tea Ltd. 514.2 -33.8% -17.0% -2.3%

Britannia Industries Ltd. 1147 -26.0% -8.9% -2.6%

Dabur India Ltd. 85.85 -24.3% -1.0% 3.5%

Marico Ltd. 50.2 -23.1% -8.2% 1.0%

Gillette India Ltd. 764.65 -22.6% 8.3% 0.3%

Colgate-Palmolive (India) Ltd. 374.1 -18.4% 1.0% -3.4%

I T C Ltd. 174.8 -17.8% 5.6% 10.2%

Glaxosmithkline Consumer Healthcare Ltd. 556.95 -17.1% -4.8% -7.2%

Godrej Consumer Products Ltd. 108.65 -10.7% 0.9% 7.1%

Procter & Gamble Hygiene & Health Care Ltd. 737.1 -2.9% 6.1% -2.4%

Hindustan Unilever Ltd. 249.3 16.4% 4.7% 4.8%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 6

Health Care

%age Change Current levels Since January Last one month Last one week

Wockhardt Ltd. 103.1 -74.7% -32.7% -4.3%

Aurobindo Pharma Ltd. 113.15 -72.4% -46.4% -13.0%

Opto Circuits (India) Ltd. 94.9 -66.1% -13.9% -0.8%

Bilcare Ltd. 450.1 -64.0% -11.1% -5.4%

Sun Pharma Advanced Research Co. Ltd. 48.9 -61.8% -32.2% -5.4%

Orchid Chemicals & Pharmaceuticals Ltd. 119.75 -59.1% -37.5% 10.9%

Matrix Laboratories Ltd. 87.85 -58.7% -15.7% 13.6%

Dishman Pharmaceuticals & Chemicals Ltd. 139.6 -57.7% -42.8% 7.1%

Biocon Ltd. 119.75 -53.8% -12.9% 18.3%

Ipca Laboratories Ltd. 397.4 -44.0% -23.1% 1.5%

Glenmark Pharmaceuticals Ltd. 306.15 -43.7% -14.2% -0.9%

Ranbaxy Laboratories Ltd. 218.4 -43.5% -21.8% 14.7%

Dr. Reddy'S Laboratories Ltd. 407.4 -39.6% -11.8% 1.0%

Piramal Healthcare Ltd. 215 -34.9% -22.4% -11.6%

Pfizer Ltd. 500.8 -29.0% -8.4% 2.9%

Divi'S Laboratories Ltd. 1257.9 -23.0% 8.2% 2.8%

Apollo Hospitals Enterprise Ltd. 402.85 -18.3% 1.0% -0.7%

Cipla Ltd. 184.35 -8.9% -11.2% 4.9%

Cadila Healthcare Ltd. 260 -5.8% -15.1% -4.2%

Glaxosmithkline Pharmaceuticals Ltd. 1063.7 5.5% -2.6% -3.2%

Sun Pharmaceutical Inds. Ltd. 1193 9.6% -12.7% 7.8%

Sterling Biotech Ltd. 179.45 11.7% 5.6% -0.7%

Lupin Ltd. 690.7 20.2% -4.6% -3.3%

Source: Prowess, Artha Money Research

Information Technology

%age Change Current levels Since January Last one month Last one week

N I I T Ltd. 28.8 -78.1% -14.9% -15.5%

Aptech Ltd. 87.8 -72.3% -13.3% 0.9%

Financial Technologies (India) Ltd. 684.1 -71.0% -10.4% 9.3%

Moser Baer India Ltd. 77.2 -69.6% -24.7% -1.8%

Tech Mahindra Ltd. 325.2 -64.1% -29.6% -3.4%

Oracle Financial Services Software Ltd. 595.35 -57.0% 5.4% -1.0%

Rolta India Ltd. 165 -52.1% 1.9% -13.5%

Patni Computer Systems Ltd. 139.05 -46.6% -13.1% 0.6%

Wipro Ltd. 260.45 -42.8% -7.8% -5.7%

Tata Consultancy Services Ltd. 524.55 -42.0% -4.0% -4.4%

Mphasis Ltd. 163.7 -40.0% 4.1% 0.4%

H C L Technologies Ltd. 165.35 -37.8% -12.6% -5.2%

Satyam Computer Services Ltd. 277.75 -25.5% 4.9% -7.4%

Infosys Technologies Ltd. 1262.5 -13.8% 0.6% -8.4%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 7

Metal

%age Change Current levels Since January Last one month Last one week

Jai Corp Ltd. 158.05 -85.1% -21.3% 5.4%

Ispat Industries Ltd. 12.35 -79.6% -17.7% 0.2%

Tata Steel Ltd. 190.1 -75.7% -43.8% -15.6%

Welspun-Gujarat Stahl Rohren Ltd. 120.7 -75.6% -32.6% -7.3%

Jindal Steel & Power Ltd. 737.6 -74.3% -22.1% -8.7%

J S W Steel Ltd. 285.35 -74.0% -2.5% -8.5%

Sterlite Industries (India) Ltd. 246.15 -72.1% -15.9% -16.5%

Gujarat N R E Coke Ltd. 30.75 -69.0% 11.3% -6.8%

Hindalco Industries Ltd. 60.45 -64.0% -33.4% -4.8%

Steel Authority Of India Ltd. 84.45 -63.9% -27.3% -6.3%

N M D C Ltd. 155.9 -62.5% -17.9% 3.2%

National Aluminium Co. Ltd. 165.75 -62.1% -55.7% 12.5%

Jindal Saw Ltd. 397.4 -59.2% -2.9% -1.2%

Hindustan Zinc Ltd. 315.3 -55.8% -2.4% -0.8%

Sesa Goa Ltd. 79.9 -50.3% -17.9% -4.0%

Source: Prowess, Artha Money Research

Oil & Gas

%age Change Current levels Since January Last one month Last one week

Aban Offshore Ltd. 970.15 -77.9% -10.3% 9.9%

Reliance Natural Resources Ltd. 51.7 -74.9% -13.5% -3.8%

Essar Oil Ltd. 82.15 -69.7% -33.6% -9.5%

Reliance Petroleum Ltd. 85.2 -59.2% -30.3% -6.6%

Reliance Industries Ltd. 1217.85 -56.5% -26.2% -15.3%

Indian Oil Corpn. Ltd. 367.35 -39.5% -0.4% 4.6%

Oil & Natural Gas Corpn. Ltd. 741.6 -38.7% -23.0% 4.3%

Cairn India Ltd. 143.3 -35.7% -16.1% 3.2%

G A I L (India) Ltd. 213.9 -32.6% -13.5% -3.9%

Hindustan Petroleum Corpn. Ltd. 219.25 -29.5% 2.6% 6.6%

Bharat Petroleum Corpn. Ltd. 332.15 -23.5% -2.5% 9.6%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 8

Power

%age Change Current levels Since January Last one month Last one week

Suzlon Energy Ltd. 70.7 -81.4% -37.8% 53.9%

G V K Power & Infrastructure Ltd. 18.19 -76.9% 9.9% 51.2%

Reliance Infrastructure Ltd. 560.9 -73.6% -12.1% 4.8%

Lanco Infratech Ltd. 168.95 -72.6% 0.1% 22.6%

Neyveli Lignite Corpn. Ltd. 64.45 -69.9% -14.1% 8.3%

Siemens Ltd. 295.6 -69.7% -9.8% 3.5%

G M R Infrastructure Ltd. 67.5 -66.9% -4.9% 29.6%

A B B Ltd. 497.2 -63.5% -28.0% -11.4%

Torrent Power Ltd. 75.35 -61.1% -7.0% 5.5%

Crompton Greaves Ltd. 168.8 -53.2% -19.1% 0.2%

Tata Power Co. Ltd. 737.35 -48.6% -8.4% 6.4%

Power Grid Corpn. Of India Ltd. 75.3 -43.4% -16.4% 4.5%

Bharat Heavy Electricals Ltd. 1405.1 -39.0% -4.2% 4.8%

N T P C Ltd. 151.2 -36.9% -13.7% 0.0%

Reliance Power Ltd. 117.2 NA -14.8% 7.8%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 9

PSU

%age Change Current levels Since January Last one month Last one week

State Trading Corpn. Of India Ltd. 123.75 -78.3% -21.6% 4.4%

Hindustan Copper Ltd. 100.3 -78.0% -19.1% -0.4%

B E M L Ltd. 418.5 -73.8% -25.3% -5.7%

Rashtriya Chemicals & Fertilizers Ltd. 32.85 -73.5% -10.6% -1.1%

Dredging Corpn. Of India Ltd. 247.85 -73.4% -34.0% 7.7%

Central Bank Of India 38 -70.8% -13.8% -0.7%

Neyveli Lignite Corpn. Ltd. 64.45 -69.9% -14.1% 8.3%

Bank Of Maharashtra 25.25 -68.6% -9.2% -4.5%

Chennai Petroleum Corpn. Ltd. 127.8 -64.7% -27.9% -2.5%

Steel Authority Of India Ltd. 84.45 -63.9% -27.3% -6.3%

Bharat Electronics Ltd. 662.05 -63.7% -17.5% 4.1%

Vijaya Bank 28.25 -63.0% -19.6% 6.0%

N M D C Ltd. 155.9 -62.5% -17.9% 3.2%

National Aluminium Co. Ltd. 165.75 -62.1% -55.7% 12.5%

Engineers India Ltd. 393.4 -59.4% -15.8% -5.1%

Jammu & Kashmir Bank Ltd. 337.85 -59.2% -18.2% -12.2%

Mahanagar Telephone Nigam Ltd. 70.1 -58.8% -1.1% 1.7%

Dena Bank 32.2 -58.6% -6.9% 3.4%

Uco Bank 30.1 -57.6% 0.0% -2.1%

Allahabad Bank 53.9 -57.1% -9.7% 4.7%

I D B I Bank Ltd. 65.1 -56.0% -6.1% 4.7%

M M T C Ltd. 13655.25 -55.0% -18.1% -2.9%

Shipping Corpn. Of India Ltd. 86.1 -54.1% -0.8% -0.8%

Indian Overseas Bank 83.95 -54.0% -1.8% 6.9%

Bongaigaon Refinery & Petrochemicals Ltd. 39.1 -53.5% -9.4% 2.4%

Andhra Bank 50.5 -52.5% -4.8% 9.3%

Power Finance Corpn. Ltd. 110.95 -52.2% -0.1% 1.5%

Syndicate Bank 54.55 -50.4% -6.2% 5.5%

Oriental Bank Of Commerce 148.5 -48.6% -4.9% 13.9%

Corporation Bank 214.45 -48.0% -8.0% 1.6%

State Bank Of India 1249.25 -44.1% -5.5% 0.7%

Power Grid Corpn. Of India Ltd. 75.3 -43.4% -16.4% 4.5%

Indian Oil Corpn. Ltd. 367.35 -39.5% -0.4% 4.6%

Canara Bank 193.2 -39.2% 16.0% 15.3%

Bharat Heavy Electricals Ltd. 1405.1 -39.0% -4.2% 4.8%

Oil & Natural Gas Corpn. Ltd. 741.6 -38.7% -23.0% 4.3%

N T P C Ltd. 151.2 -36.9% -13.7% 0.0%

Indian Bank 136.2 -34.1% 7.8% -0.5%

Bank Of Baroda 292.65 -33.1% 3.4% 17.9%

Bank Of India 271.7 -33.1% 0.4% 9.8%

G A I L (India) Ltd. 213.9 -32.6% -13.5% -3.9%

Hindustan Petroleum Corpn. Ltd. 219.25 -29.5% 2.6% 6.6%

Nov 10, 2008 For Private Circulation only 10

Bharat Petroleum Corpn. Ltd. 332.15 -23.5% -2.5% 9.6%

Union Bank Of India 155.35 -23.1% 7.1% 14.0%

Punjab National Bank 496.3 -22.1% 1.4% 9.7%

Container Corpn. Of India Ltd. 687.7 -11.6% -13.2% 7.9%

Rural Electrification Corpn. Ltd. 66.4 NA -5.4% -1.6%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 11

Realty

%age Change Current levels Since January Last one month Last one week

Orbit Corporation Ltd. 74.7 -92.1% -38.3% 5.7%

Unitech Ltd. 50.8 -89.3% -46.2% 3.7%

Parsvnath Developers Ltd. 47.4 -88.5% -34.4% 4.8%

Sobha Developers Ltd. 105.8 -88.1% -8.6% -7.4%

Housing Development & Infrastructure Ltd. 116.95 -87.9% 2.9% -15.5%

Phoenix Mills Ltd. 58.6 -86.9% -51.1% 11.5%

Omaxe Ltd. 63.6 -85.0% -21.6% 4.9%

Ansal Properties & Infrastructure Ltd. 47.2 -84.9% -34.0% 1.2%

Anant Raj Inds. Ltd. 55.7 -84.4% -40.9% 14.0%

Peninsula Land Ltd. 25 -80.7% -25.7% 6.4%

Mahindra Lifespace Developers Ltd. 189.4 -76.4% -26.1% 0.8%

Indiabulls Real Estate Ltd. 157.15 -76.1% 32.6% 23.7%

D L F Ltd. 280.9 -72.1% -9.0% 11.0%

Akruti City Ltd. 649.8 -49.7% -6.3% -5.6%

Source: Prowess, Artha Money Research

Media & Technology

%age Change Current levels Since January Last one month Last one week

I O L Netcom Ltd. 33.65 -92.9% -41.0% 3.9%

Adlabs Films Ltd. 183.1 -87.3% -27.7% -1.0%

Teledata Informatics Ltd. 6.75 -87.0% -10.4% -5.5%

Himachal Futuristic Communications Ltd. 7.96 -80.3% -11.8% 0.4%

Dish T V India Ltd. 16.97 -79.5% -13.6% 9.0%

Deccan Chronicle Holdings Ltd. 45.25 -78.5% -33.3% 3.5%

N I I T Ltd. 28.8 -78.1% -14.9% -15.5%

New Delhi Television Ltd. 98.1 -78.0% -32.5% -6.4%

Balaji Telefilms Ltd. 66.9 -77.7% -46.0% -10.0%

Hexaware Technologies Ltd. 20.4 -73.2% -30.1% 2.0%

Aptech Ltd. 87.8 -72.3% -13.3% 0.9%

Tanla Solutions Ltd. 93.45 -72.3% -31.0% -6.1%

Financial Technologies (India) Ltd. 684.1 -71.0% -10.4% 9.3%

U T V Software Communications Ltd. 266.4 -70.8% -61.1% -40.4%

H T Media Ltd. 69.25 -69.4% -28.9% -11.7%

Reliance Communications Ltd. 228.15 -67.5% -24.1% -1.9%

Jagran Prakashan Ltd. 50.8 -64.7% -21.5% -6.0%

Mahanagar Telephone Nigam Ltd. 70.1 -58.8% -1.1% 1.7%

Oracle Financial Services Software Ltd. 595.35 -57.0% 5.4% -1.0%

Sun T V Network Ltd. 158.15 -56.8% -10.4% 5.9%

Ibn18 Broadcast Ltd. 100.9 -52.0% 6.7% 4.2%

Zee Entertainment Enterprises Ltd. 142.15 -50.9% -19.6% -6.6%

Zee News Ltd. 36.7 -47.3% 4.6% -5.2%

Nov 10, 2008 For Private Circulation only 12

Patni Computer Systems Ltd. 139.05 -46.6% -13.1% 0.6%

Wipro Ltd. 260.45 -42.8% -7.8% -5.7%

Tata Consultancy Services Ltd. 524.55 -42.0% -4.0% -4.4%

Mphasis Ltd. 163.7 -40.0% 4.1% 0.4%

H C L Technologies Ltd. 165.35 -37.8% -12.6% -5.2%

Bharti Airtel Ltd. 650 -25.6% -11.3% -5.5%

Satyam Computer Services Ltd. 277.75 -25.5% 4.9% -7.4%

Tata Communications Ltd. 491.35 -23.4% 6.5% -9.4%

G T L Ltd. 198.6 -21.7% 24.9% 1.6%

Infosys Technologies Ltd. 1262.5 -13.8% 0.6% -8.4%

Source: Prowess, Artha Money Research

Nov 10, 2008 For Private Circulation only 13

Sensex during 1990-94 Sensex during 1994-2000

7000

5000

4500 6000

4000

5000

3500

3000 4000

2500

3000

2000

1500 2000

1000

1000

500

0 0

15-Jul-95

15-Jul-96

15-Jul-97

15-Jul-98

15-Jul-99

15-Jul-00

15-Nov-94

15-Mar-95

15-Nov-95

15-Mar-96

15-Nov-96

15-Mar-97

15-Nov-97

15-Mar-98

15-Nov-98

15-Mar-99

15-Nov-99

15-Mar-00

15-Nov-00

2-Jan-90

2-Apr-90

2-Jul-90

2-Oct-90

2-Jan-91

2-Apr-91

2-Jul-91

2-Oct-91

2-Jan-92

2-Apr-92

2-Jul-92

2-Oct-92

2-Jan-93

2-Apr-93

2-Jul-93

2-Oct-93

2-Jan-94

2-Apr-94

2-Jul-94

2-Oct-94

Sensex during 2001-03 Sensex during 2003-08

7000 25000

6000

20000

5000

15000

4000

3000

10000

2000

5000

1000

0 0

1-May-04

1-Sep-04

1-Jan-05

1-May-05

1-Sep-05

1-Jan-06

1-May-06

1-Sep-06

1-Jan-07

1-May-07

1-Sep-07

1-Jan-08

1-May-08

1-Sep-08

31-Dec-03

1-Jan-01

1-May-01

1-Jul-01

1-Sep-01

1-Nov-01

1-Jan-02

1-May-02

1-Jul-02

1-Sep-02

1-Nov-02

1-Jan-03

1-May-03

1-Jul-03

1-Sep-03

1-Nov-03

1-Mar-01

1-Mar-02

1-Mar-03

Disclaimer: This document has been prepared by Arthaeon Financial Services and is meant for sole use by the recipient and not for circulation. This document is not to

be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information

contained herein is from sources believed to be reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. Arthaeon Financial

Services and/or its affiliates or employees shall not be liable for loss or damage that may arise from any error in this document. Arthaeon Financial Services may have

from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other

services for, any company mentioned in this document.

Nov 10, 2008 For Private Circulation only 14

You might also like

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comNo ratings yet

- Market Outlook Review and StrategyDocument34 pagesMarket Outlook Review and StrategyVijay Kumar GabaNo ratings yet

- Day Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74Document3 pagesDay Ahead: .DJI 12,258.20 .SPX 1,330.97 .IXIC 2,798.74Andre_Setiawan_1986No ratings yet

- Orporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Document4 pagesOrporate Ews: .DJI 12,350.60 (+71.60) .SPX 1,328.26 (+8.82) .IXIC 2,776.79 (+19.90)Andre SetiawanNo ratings yet

- ValuEngine Weekly Newsletter July 30, 2010Document16 pagesValuEngine Weekly Newsletter July 30, 2010ValuEngine.comNo ratings yet

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument7 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- #DiwaliPicks SBI Capital SecuritiesDocument15 pages#DiwaliPicks SBI Capital SecuritiesVenkatpradeepManyamNo ratings yet

- Introduction, Products, Brands, Services & Segmentation of Realty SectorDocument16 pagesIntroduction, Products, Brands, Services & Segmentation of Realty Sectorankitgupta2k52477No ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Orporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Document4 pagesOrporate Ews: .DJI 12,297.01 (+81.13) .SPX 1,319.44 (9.25) .IXIC 2,756.89 (+26.21)Andre SetiawanNo ratings yet

- Business Studies: Exports and ImportsDocument3 pagesBusiness Studies: Exports and ImportsDimple VaishnavNo ratings yet

- The ValuEngine Weekly Is An Investor EducationDocument11 pagesThe ValuEngine Weekly Is An Investor EducationValuEngine.comNo ratings yet

- Lifted The Mood: PayrollsDocument5 pagesLifted The Mood: PayrollsAndre SetiawanNo ratings yet

- 5 Dec 16Document3 pages5 Dec 16asifNo ratings yet

- Morning Cuppa 06-JanDocument2 pagesMorning Cuppa 06-JanSaroNo ratings yet

- Morning Cuppa 31-OctDocument2 pagesMorning Cuppa 31-OctKeshavNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Daily Digest - 15 June, 2023Document2 pagesDaily Digest - 15 June, 2023Anant VishnoiNo ratings yet

- ValuEngine Weekly NewsletterDocument12 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- Morning Cuppa 14-DecDocument2 pagesMorning Cuppa 14-DecKeshav KhetanNo ratings yet

- MoneyFest - Diwali Pick - 2023 Report0938279210212-1Document27 pagesMoneyFest - Diwali Pick - 2023 Report0938279210212-1dineshrjpt0707No ratings yet

- Inners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Document5 pagesInners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Andre SetiawanNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Daily Digest - 01 April, 2024Document2 pagesDaily Digest - 01 April, 2024saraonahembram3No ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- ValuEngine Weekly Newsletter July 2, 2010Document10 pagesValuEngine Weekly Newsletter July 2, 2010ValuEngine.comNo ratings yet

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Document4 pagesSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanNo ratings yet

- MNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFDocument8 pagesMNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFANIL PARIDANo ratings yet

- NBDocument6 pagesNBVijay S PatilNo ratings yet

- NBDocument6 pagesNBNandhakumar SethupandiyanNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- Bonus For Readers: February 26, 2010Document10 pagesBonus For Readers: February 26, 2010ValuEngine.comNo ratings yet

- Morning Cuppa 08-Oct-202110080838430715214Document2 pagesMorning Cuppa 08-Oct-202110080838430715214flying400No ratings yet

- Country Fact Sheet 2007Document54 pagesCountry Fact Sheet 2007aqua01No ratings yet

- ValuEngine Weekly Newsletter April 1, 2010Document9 pagesValuEngine Weekly Newsletter April 1, 2010ValuEngine.comNo ratings yet

- Research Insight On Automotive Industry: 165 Million Tyres / Year ProductionDocument8 pagesResearch Insight On Automotive Industry: 165 Million Tyres / Year ProductionShilpi KumariNo ratings yet

- Morning Cuppa 09-JanDocument2 pagesMorning Cuppa 09-JanWhaosidqNo ratings yet

- Managerial Economics - Trend Analysis of Petroleum ProductsDocument5 pagesManagerial Economics - Trend Analysis of Petroleum ProductsTaha SuhailNo ratings yet

- CAPM Numerical - With FormulaDocument8 pagesCAPM Numerical - With FormulaJaya RoyNo ratings yet

- Morning Cuppa 30-OctDocument2 pagesMorning Cuppa 30-OctKeshavNo ratings yet

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaNo ratings yet

- Managing Marketable SecuritiesDocument25 pagesManaging Marketable SecuritiesGemechu AlemuNo ratings yet

- Morning Cuppa 20-DecDocument3 pagesMorning Cuppa 20-DecSaroNo ratings yet

- Stock Market Reports For The Week (16th - 20th May '11)Document6 pagesStock Market Reports For The Week (16th - 20th May '11)Dasher_No_1No ratings yet

- Bab I Pendahuluan A. Latar Belakang Masalah: Estate Sangat Berperan Penting Dalam Perekonomian SuatuDocument14 pagesBab I Pendahuluan A. Latar Belakang Masalah: Estate Sangat Berperan Penting Dalam Perekonomian SuaturahayuNo ratings yet

- IPO Market UpdateDocument133 pagesIPO Market Updatejeevan gangavarapuNo ratings yet

- ValuEngine Weekly Newsletter February 12, 2010Document12 pagesValuEngine Weekly Newsletter February 12, 2010ValuEngine.comNo ratings yet

- BCG India Economic Monitor Jan 2021Document33 pagesBCG India Economic Monitor Jan 2021akashNo ratings yet

- Overview of Movement of Stock Market IndexesDocument26 pagesOverview of Movement of Stock Market IndexesAlok AgarwalNo ratings yet

- February 19, 2010: Bonus For ReadersDocument7 pagesFebruary 19, 2010: Bonus For ReadersValuEngine.comNo ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- I Care Oct'08Document8 pagesI Care Oct'08rashmipraNo ratings yet

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaNo ratings yet

- Calling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Document5 pagesCalling Skype: .DJI 12,684.68 (+45.94) .SPX 1,346.29 (+6.09) .IXIC 2,843.25 (+15.69)Andre SetiawanNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010MansukhNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- The Biometric Industry Report - Forecasts and Analysis to 2006From EverandThe Biometric Industry Report - Forecasts and Analysis to 2006M LockieNo ratings yet

- ANDHRA BANK: STRONG CREDIT GROWTH OUTLOOK AND SUPERIOR ASSET QUALITY TO DRIVE EARNINGSDocument30 pagesANDHRA BANK: STRONG CREDIT GROWTH OUTLOOK AND SUPERIOR ASSET QUALITY TO DRIVE EARNINGSca.deepaktiwariNo ratings yet

- All About InflationDocument2 pagesAll About Inflationca.deepaktiwari100% (1)

- The Political AccountDocument5 pagesThe Political Accountca.deepaktiwariNo ratings yet

- Year That Went byDocument9 pagesYear That Went byca.deepaktiwariNo ratings yet

- IT Industry - Q2FY09 UpdateDocument7 pagesIT Industry - Q2FY09 Updateca.deepaktiwariNo ratings yet

- It's Socialist AmericaDocument2 pagesIt's Socialist Americaca.deepaktiwariNo ratings yet

- Dangerous Than InflationDocument3 pagesDangerous Than Inflationca.deepaktiwariNo ratings yet

- What Should Obama DoDocument4 pagesWhat Should Obama Doca.deepaktiwariNo ratings yet

- IT Industry Q3FY09Document4 pagesIT Industry Q3FY09ca.deepaktiwariNo ratings yet

- Q3 Update TelecosDocument6 pagesQ3 Update Telecosca.deepaktiwariNo ratings yet

- IT UpdateDocument3 pagesIT Updateca.deepaktiwariNo ratings yet

- IT Industry WatchDocument3 pagesIT Industry Watchca.deepaktiwariNo ratings yet

- IPO DiaryDocument5 pagesIPO Diaryca.deepaktiwariNo ratings yet

- Telecom UpdateDocument5 pagesTelecom Updateca.deepaktiwariNo ratings yet

- Telecom Compendium: Financial Snapshots of Consolidated Q2 Fy09 Results Bharti Airtel Rcom Idea CellularDocument5 pagesTelecom Compendium: Financial Snapshots of Consolidated Q2 Fy09 Results Bharti Airtel Rcom Idea Cellularca.deepaktiwariNo ratings yet

- World Financial Crisis IIDocument4 pagesWorld Financial Crisis IIca.deepaktiwari100% (1)

- Telecom Industry WatchDocument3 pagesTelecom Industry Watchca.deepaktiwariNo ratings yet

- Global Economies: How The World Economies Are Expected To PerformDocument9 pagesGlobal Economies: How The World Economies Are Expected To Performca.deepaktiwariNo ratings yet

- World Financial Crisis IIIDocument10 pagesWorld Financial Crisis IIIca.deepaktiwariNo ratings yet

- Market OutlookDocument7 pagesMarket Outlookca.deepaktiwariNo ratings yet

- India RocksDocument4 pagesIndia Rocksca.deepaktiwariNo ratings yet

- The BailoutsDocument3 pagesThe Bailoutsca.deepaktiwariNo ratings yet

- The India Growth StoryDocument7 pagesThe India Growth Storyca.deepaktiwariNo ratings yet

- World Financial CrisisDocument3 pagesWorld Financial Crisisca.deepaktiwari100% (1)

- Sheetal Kaur PNBDocument7 pagesSheetal Kaur PNBvaibhav tanejaNo ratings yet

- Sun Pharma Launches Gemcitabine InfuSMART, World's First Licensed Ready-To-Administer Bag For Oncology Treatment (Company Update)Document3 pagesSun Pharma Launches Gemcitabine InfuSMART, World's First Licensed Ready-To-Administer Bag For Oncology Treatment (Company Update)Shyam SunderNo ratings yet

- SBI Savings Account Opening Form For Resident IndividualsDocument8 pagesSBI Savings Account Opening Form For Resident Individualsssbaidya75% (12)

- Sbi Po Mains Result 2023Document4 pagesSbi Po Mains Result 2023Robin SinghNo ratings yet

- Savings account statement transactionsDocument8 pagesSavings account statement transactionsAmit KumarNo ratings yet

- 4 Months Statement PDFDocument12 pages4 Months Statement PDFVinay TripathiNo ratings yet

- NPS Return 15052012 Credit Date May 01 To May 14 2012Document302 pagesNPS Return 15052012 Credit Date May 01 To May 14 2012Yashpal TalanNo ratings yet

- BFSI Sample DatabaseDocument11 pagesBFSI Sample DatabasePoonamNo ratings yet

- CP (Including Reedemed) - 25.09.2020Document69 pagesCP (Including Reedemed) - 25.09.2020Shabaz ShaikhNo ratings yet

- EPS1995 PensionDisbursingAgenciesListDocument14 pagesEPS1995 PensionDisbursingAgenciesListtela ijointeractNo ratings yet

- Banks in CbeDocument28 pagesBanks in Cbemanu_9040100% (1)

- School Grant For The Year 2015-16 To Be Release On 07.12.2015Document88 pagesSchool Grant For The Year 2015-16 To Be Release On 07.12.2015Akram MohammadNo ratings yet

- Joy 1Document27 pagesJoy 1rp63337651No ratings yet

- Ros Rof z5575Document1 pageRos Rof z5575Chaitanya ZirkandeNo ratings yet

- Onmags Bank Contact Details Jan 19 2021Document78 pagesOnmags Bank Contact Details Jan 19 2021Bullzeye StrategyNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument17 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePrasanta BarmanNo ratings yet

- Citibank savings account statement summary July-JanuaryDocument39 pagesCitibank savings account statement summary July-Januaryminesh rainaNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument14 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureShaikh AmjadNo ratings yet

- List of Accredited Agents Training Institutes in Nothern Zone Approved by The Authority - As Per Data Received Upto 31/07/2006Document118 pagesList of Accredited Agents Training Institutes in Nothern Zone Approved by The Authority - As Per Data Received Upto 31/07/2006arbaz khanNo ratings yet

- Ay 2017-18Document11 pagesAy 2017-18Hari babuNo ratings yet

- Important InformationDocument193 pagesImportant InformationDharmendra KumarNo ratings yet

- List Is Arranged Chronologically Based On Their Recognition by IRDAIDocument5 pagesList Is Arranged Chronologically Based On Their Recognition by IRDAIbathula veerahanumanNo ratings yet

- SOP DiscDocument6,931 pagesSOP DiscGD SinghNo ratings yet

- Brahmpur Aadhar Pending 09.09.2022Document100 pagesBrahmpur Aadhar Pending 09.09.2022sanny sannyNo ratings yet

- Statement 1674884645412Document10 pagesStatement 1674884645412JeyeshNo ratings yet

- Top Indian stock market indices and derivatives symbolsDocument4 pagesTop Indian stock market indices and derivatives symbolsPeter SamualNo ratings yet

- Bank Account Statement Nov 2020 to May 2021Document15 pagesBank Account Statement Nov 2020 to May 2021ASHISH PANDEYNo ratings yet

- HSBC BankDocument21 pagesHSBC BankDigi CreditNo ratings yet

- POP-SP Location To Open New Pension Scheme AccountDocument17 pagesPOP-SP Location To Open New Pension Scheme AccountkpugazhNo ratings yet

- Live Banks in API E MandateDocument2 pagesLive Banks in API E MandateShivam SrivastavaNo ratings yet