Professional Documents

Culture Documents

WK 11 Supplement

Uploaded by

Shou Yee WongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WK 11 Supplement

Uploaded by

Shou Yee WongCopyright:

Available Formats

STICKY PRICES IN THE EURO AREA: A SUMMARY OF NEW MICRO-EVIDENCE

Luis J. lvarez

Banco de Espaa

Fernando Martins

Banco de Portugal

Emmanuel Dhyne

Banque Nationale de Belgique

Roberto Sabbatini

Banca dItalia

Marco Hoeberichts

De Nederlandsche Bank

Harald Stahl

Deutsche Bundesbank

Claudia Kwapil

Oesterreichische Nationalbank

Philip Vermeulen

European Central Bank

Herv Le Bihan

Banque de France

Jouko Vilmunen

Bank of Finland

Patrick Lnnemann

Banque Centrale du Luxembourg

Abstract This paper summarises the vast evidence on micro price-setting recently obtained for euro area countries. We consider studies with micro data on consumer and producer prices, as well as survey information. The main ndings are: (1) prices in the euro area are sticky and stickier than in the US; (2) downward price rigidity is only slightly more marked than upward price rigidity; (3) heterogeneity and asymmetries are observed in price-setting; and (4) the relevance of theories that explain price stickiness, such as implicit or explicit contracts, marginal costs, and coordination failure, is conrmed, whereas menu costs, pricing thresholds, and costly information explanations are judged much less relevant by rms. (JEL: C25, D40, E31)

Acknowledgments: We are grateful to national statistical institutes for providing the individual price records, all co-authors of national papers, all members of the Eurosystem Ination Persistence Network (IPN), especially Silvia Fabiani, Jordi Gal, Vitor Gaspar, Ignacio Hernando, Johannes Hoffmann, Thomas Math, Frank Smets, and Giovanni Veronese, as well as participants at the 2005 meeting of the European Economic Association, a CEMFI seminar, and the Universit de Toulouse T2M 2006 conference for helpful comments and suggestions. The views expressed in this paper are those of the authors and do not necessarily reect the views of the central banks with which they are afliated. E-mail addresses: L. J. lvarez: ljalv@bde.es; Emmanuel Dhyne: emmanuel.dhyne@nbb.be; Marco Hoeberichts: m.m.hoeberichts@dnb.nl; Claudia Kwapil: claudia.kwapil@oenb.co; Herv Le Bihan: herve.lebihan@banque-france.fr; Patrick Lnnemann: patrick.lunnemann@bcl.lu; Fernando Martins: fernando.manuel.martins@bportugal.pt; Roberto Sabbatini: roberto.sabbatini@ bancaditalia.it; Harald Stahl: harald.stahl@bundesbank.de; Philip Vermeulen: philip.vermeulen@ ecb.int; Jouko Vilmunen: jouko.vilmunen@bof.

Journal of the European Economic Association

April-May 2006

4(23):575584

576

Journal of the European Economic Association

1. Introduction A better empirical understanding of individual price-setting is crucial for building macroeconomic models of ination with adequate microeconomic foundations that may help in the design of monetary policy.1 However, micro-founded macro models of ination are typically based on highly stylised assumptions on rms pricing behaviour and implications for ination dynamics depend on assumed micro price-setting. In addition, the speed of adjustment of ination to shocks to the economy is directly linked to the speed of price adjustment of individual agents. This paper brings together original evidence on price-setting in the euro area based on recently available individual price data underlying ofcial consumer (CPI) and producer (PPI) price indices, as well as survey information.2 These empirical analyses have been produced in the context of the Ination Persistence Network (IPN), a large research effort conducted by economists of the Eurosystem. Available databases for consumer prices and producer prices contain several million monthly price quotes for 10 countries (Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Portugal, and Spain) in the case of the CPI and 5 countries (Belgium, Germany, Italy, Portugal, and Spain) in the case of the PPI. The typical CPI and PPI quantitative information used is the price trajectory associated to one particular product sold in one particular outlet (in the case of CPI) or by one specic manufacturing rm (in the case of PPI). Examples of price trajectories taken from the Belgian CPI and Italian PPI datasets are given in Figure 1. Such large data sets are particularly well-suited for the analysis of price-setting behaviour, because they have a comprehensive coverage of retail and manufacturing prices and extend over several years. This contrasts with most previous micro-studies (e.g., Cecchetti 1986 or Carlton 1986), which mostly focused on very specic products or markets. The third source of information stems from surveys to rms, following Blinder et al. (1998). More than 11,000 rms from 9 countries (Austria, Belgium, France, Germany, Italy, Luxembourg, the Netherlands, Portugal, and Spain) were questioned about their price-setting practices. The remainder of the paper is organised as follows. Section 2 presents a set of stylised facts describing rms price-setting practices with CPI and PPI data. Section 3 presents interesting survey information and Section 4 concludes.

1. See Angeloni et al. (2006) for a discussion of the implications of our ndings for macroeconomic modeling and the design of monetary policy. 2. See the summaries by Dhyne et al. (2006), Vermeulen et al. (2005), and Fabiani et al. (2005) and references to national papers on which they are based therein.

lvarez et al.

Sticky Prices in the Euro Area

577

Figure 1. Examples of individual price trajectories.

Note: Price trajectories from the Belgian CPI and Italian PPI databases (See Aucremanne and Dhyne 2004 and Sabbatini et al. 2005). Prices are in Belgian Francs and euro, respectively.

2. Firms Price-setting Practices: Stylised Facts The following stylised facts emerge consistently in the different countries considered. Firms Change their Prices Rather Infrequently. On average, 15% of consumer prices are changed in a given month in the euro area compared to 25% in the US (Table 1). Producer prices in the euro area are adjusted slightly more frequently: around 20% are changed each month. These frequencies imply average price durations close to one year in the euro area and slightly above half a year in the US. According to surveys, price durations are also longer in the euro area than in the US. These results are also in line with implied durations derived from New Keynesian Phillips curves for the euro area and the US by Gal, Gertler, and Lpez-Salido (2001, 2003). In contrast, Lnnemann and Wintr (2005) nd that in the euro area prices set on the Internet of products with high technological content change much more frequently than those sold by traditional channels. Moreover, frequencies of price adjustment do not differ substantially between the US and the 3 largest euro area countries. Several factors can be put forward to explain the discrepancy in the frequency of price changes between the euro area and the US: (i) the level and variability of ination, (ii) the structure and degree of competition of the distribution sector, (iii) price collecting methods by statistical institutes, (iv) the frequency and magnitude of cost and demand shocks, and (v) the composition of the consumption basket. Next we consider each of these arguments. First, both the level and the volatility of ination in the sample period were somewhat higher in the US than in the euro area. Second, small corner shops, which change their prices less frequently than supermarkets (e.g., Baudry et al., 2004), have a higher market share in euro area countries than in the US (Pilat 1997). Third, there are methodological differences in price-collecting procedures

578

Journal of the European Economic Association

Table 1. Measures of price stickiness in the euro area and the US (% per month unless otherwise stated).

Statistics CPI PPI Surveys NKPC Internet prices Frequency Average duration (months) Median duration (months) Frequency Frequency Average duration ( months) Average durations ( months) Frequency Euro area 15.1 13.0 10.6 20.0 15.9 10.8 13.519.2 79.2 US 24.8 6.7 4.6 n.a 20.8 8.3 7.28.4 64.3

Notes: Dhyne et al. (2006) for the euro area, Bils and Klenow (2004) for the US. Euro area refers to the aggregate of Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Portugal, and Spain. Vermeulen et al. (2005). Euro area corresponds to the aggregate of Belgium, Germany, Italy, Portugal, and Spain. Fabiani et al. (2005) for the euro area and Blinder et al. (1998) for the US. Euro area refers to the aggregate of Austria, Belgium, France, Germany, Italy, Luxembourg, the Netherlands, Portugal, and Spain. Converted from original interval grouped gures. Gali,Gertler, and Lpez-Salido (2001, 2003). Estimates correspond to the GDP deator and are converted from original quarterly gures. Lnnemann and Wintr (2005). Euro area corresponds to the aggregate of Germany, France, and Italy and are converted from original daily gures.

by the different statistical institutes; in particular, price changes due to sales and promotions were not considered in most euro area countries, in contrast with the US. Fourth, a higher variability of wages and other input prices in the US may help explain more frequent price changes than in the euro area. Finally, differences in consumption patterns do not explain the price exibility gap, as the expenditure share of the more exible components of the CPI is larger in the euro area than in the US. Price Adjustment is Heterogeneous Across Sectors. Firms that change their prices very frequently coexist with those keeping them constant for relatively long periods (Table 2). Specically, CPI price changes are relatively frequent for energy and unprocessed food products, but infrequent for services and, to a lesser extent, for non-energy industrial goods. In turn, processed food products occupy an intermediate situation. The same ranking of product categories is also found in the US. As regards producer prices, energy and food products are also characterised by more frequent price changes, whereas capital goods and durables are the stickier components. This suggests that the frequency of price changes decreases with the degree of sophistication of the product. Finally, survey evidence points out that prices of services other than trade are stickier than those for manufacturing goods and trade. Within trade, prices of food and energy are changed more frequently than for other goods or services (lvarez and Hernando 2005), in line with CPI evidence. Heterogeneity is found to be related to differences in costs and market competition. For instance, the degree of consumer price exibility is related to the volatility of input prices (Hoffmann and Kurz-Kim 2006) and differences in the

lvarez et al.

Sticky Prices in the Euro Area

579

Table 2. Frequency of price changes by type of good (% per month).

Unprocessed food 28 48 Processed food 14 27 Durable goods 10 Trade 18 Non-energy industrial goods 9 22 Consumer non durable non food 12 Other services 11

CPI Euro area US

Energy 78 74

Services 6 15 Intermediate goods 22 Capital goods 9

PPI Euro area Surveys

Food 26 Goods 16

Energy 70

Euro area

Notes: Dhyne et al. (2006) for the euro area, Bils and Klenow (2004) for the US. Vermeulen et al. (2005). Fabiani et al. (2005). See additional information in Table 1.

cost structure across sectors help explain differences in the degree of producer price exibility (lvarez, Burriel, and Hernando 2005 and Sabbatini et al. 2005), a result also found with survey data (lvarez and Hernando 2005). Specically, labour intensity negatively affects the frequency of price adjustmentsgiven that wages are typically changed once a yearwhereas the share of costs of intermediate goods in variable costs affects it positively. Regarding market competition, survey evidence shows that sectors in which the perceived degree of competition is high feature less sticky prices (lvarez and Hernando 2005, 2006). Similarly, the frequency of producer price changes is positively related to import penetration (lvarez, Burriel, and Hernando 2005). Moreover, consumer price exibility is positively related to the number of competitors and the frequency of price reductions is negatively affected by the market share (Lnnemann and Math 2005). Price Decreases are Common. Around 40% of CPI and 45% of PPI monthly price changes are price decreases (Table 3). This somewhat surprising fact is in line with the evidence obtained by Klenow and Kryvstov (2005) for the US and characterises all euro area countries. Nevertheless, large sectoral discrepancies are again observed. Particularly, price decreases are relatively uncommon in the service sector, where only 1 price change out of 5 is a price reduction (Dhyne et al. 2006). This may reect that wages do not go down frequently. Price Changes are Sizeable. The average size of price increases (8.2%) and decreases (10.0%) are high relative to the ination rate. In the US, the size of CPI price decreases is also slightly larger than that of price increases. Mean sizes of PPI price increases and decreases are smaller than for the CPI. There is also sectoral heterogeneity in the size of price changes. Prices of unprocessed food products change by a large amount, whereas energy prices

580

Journal of the European Economic Association

Table 3. Frequency and size of price increases and price decreases (% per month).

CPI

Euro area Frequency Average size Frequency Average size Frequency Frequency 8.3 8.2 5.9 10.0 11.0 9.0

US 16.1 12.7 13.2 14.1

Price increases Price decreases PPI Price increases Price decreases

Notes: Dhyne et al. (2006) for the euro area, Klenow and Kryvstov (2005) for the US. Vermeulen et al. (2005). See additional information in Table 1.

change very often but by a limited amount. This is consistent with the pronounced variability of marginal costs and the large incidence of indirect taxation on these products.

3. The Mechanics of Price-setting This section highlights some features of price-setting practices drawing on the survey evidence summarised in Fabiani et al. (2005). Competition and Price-setting Rules. Surveys show that, even though most rms operate in competitive environments, they still possess some degree of pricesetting autonomy. Indeed, mark-up pricing is the dominant pricing rule in the euro area (Table 4). Furthermore, as expected, the use of mark-up pricing increases as the perceived level of competition goes down. In addition, rms facing strong competitive pressures tend to adjust their prices more frequently. Asymmetries in Price Reaction to Shocks. Surveys show that cost shocks are more relevant in driving prices upwards than downwards (Peltzman 2000), whereas changes in market conditions (in demand and competitors prices) matter more for price decreases. The most important factors driving prices upward are labour and raw materials costs, although these factors are less relevant in explaining price decreases. As regards market conditions, the competitors price is the most important factor explaining price decreases, ranking third among the explanations for price increases. In addition, rms in highly competitive markets are more likely to respond to shocks, in particular to demand ones. The time lag of a price reaction after a shock by the median rm lies between 1 and 3 months. Furthermore, there is no evidence that prices adjust faster upward than downward, or respond more quickly to cost shocks than to demand shocks. Both aspects are in line with the evidence for the US (Blinder et al. 1998).

lvarez et al.

Sticky Prices in the Euro Area

581

Table 4. Survey evidence on price setting (mean scores, unless otherwise stated).

Use of price setting rules (percentages) Markup Competitors price Other 54 27 18 Importance of factors driving price decreases Costs of raw materials 2.5 Labour costs 2.1 Competitors price 2.8 Demand 2.5 Financial costs 1.9

Importance of factors driving price increases Costs of raw materials 3.0 Labour costs 3.0 Competitors price 2.4 Demand 2.2 Financial costs 2.2

Source: Fabiani et al. (2005). Note: Mean scores correspond to a scale from 1 (not important) to 4 (very important).

Time-dependent versus State-dependent Price Reviewing. Firms apply both time-dependent rules (i.e., they review prices with a given periodicity) and statedependent rules (i.e., in response to market conditions). Around one third follow pure time-dependent strategies, whereas the rest use some sort of state-dependent rules (Table 5). Among these, rms that mainly follow time-dependent rules, but change prices in the case of specic events predominate. These ndings are in line with those obtained for the US, where the share of rms following time-dependent rules is 40%. Indirect evidence of time and state dependence is also found with CPI and PPI data. For instance, the frequency of price adjustment or the probability of price change is generally found to be related to sectoral or aggregate price or wage developments, changes in indirect taxation, and the euro-cash changeover (Dhyne et al. 2006). Moreover, prices exhibit a seasonal pattern: Prices are more likely to be changed in January or in September. This may be interpreted as a sign of time dependence, especially given that a fraction of retailers keep their prices unchanged for one year, although seasonality in demand or costs could also lead to a seasonal pattern in price changes. Information Set and Market Behaviour. Firms were also asked to report the information set used in reviewing their prices, with a view to determining the appropriateness of considering ination a backward-looking variable, as in

Table 5. Survey evidence on price reviewing (percentages).

Price reviewing rules Time-dependent State-dependent Both

Source: Fabiani et al. (2005).

Information set used in price reviews 34 20 46 Rule of thumb Past and present Present and future Past, present and future n.a. 34 48 n.a.

582

Journal of the European Economic Association

Table 6. Theories of price stickiness.

Euro area (mean score) US (ranking) 4 5 2 1 12 3 6 8

Implicit contracts Explicit contracts Cost-based pricing Coordination failure Judging quality by price Temporary shocks Change non-price factors Menu costs Costly information Pricing thresholds

2.7 2.6 2.6 2.4 2.1 2.0 1.7 1.6 1.6 1.6

Sources: Euro area: Fabiani et al. (2005). US: Blinder et al. (1998).

the traditional expectations-augmented Philips curve, or as a forward-looking variable, as in the New Keynesian Philips curve. Around one half of rms consider a large information set, which includes expectations about future economic developments. However, one third of rms make price decisions without using economic forecasts. Further evidence that rms do not optimise when reviewing prices is available for Belgium, Luxembourg, Portugal, and Spain: Around 30% of rms use a rule of thumb (e.g., CPI or wage growth indexation) in price-setting. Main Theories of Price Stickiness. Among explanations about the reasons which prevent a prompt adjustment of prices, the theory of implicit contracts ranks rst (Table 6). This result is consistent with the fact that 70% of rms have long-term relationships with their customers and may also explain why rms are more likely to increase their prices in response to cost shocks than to demand shocks, as they try not to jeopardise customer relationships. Other explanations considered as important by rms were explicit contracts, which are costly to renegotiate, marginal costs that vary too little when costs are an important determinant in rms pricing decisions, and coordination failure problems arising from the preference of rms not to change prices unless their competitors do so. In contrast, alternative explanations such as menu costs, pricing thresholds, and costly information were not considered very relevant by respondents. These results are in line with US (Blinder et al. 1998) and UK evidence (Hall, Walsh, and Yates 2000), although the existence of implicit or explicit contracts is considered less important in the US than in the euro area. This could also partly explain the higher frequency of price changes observed in the US. The four most relevant theories underlying price stickiness do not concern the price review decision, suggesting that the main impediment to price adjustments lies at the stage in which rms consider the possibility of changing the price, without necessarily taking any action. Indeed, the theory of costly information received the lowest score in the euro area surveys.

lvarez et al.

Sticky Prices in the Euro Area

583

4. Conclusions The research summarised in this paper has produced numerous new empirical results on the characteristics and determinants of price-setting in the euro area. The four most noticeable are the following. First, prices in the euro area are sticky and stickier than in the US. Second, there is no apparent general downward price rigidity: Around 40% of price changes are decreases. Third, there is evidence of heterogeneity and of asymmetries in price-setting that suggest the need to consider models with several sectors. Fourth, the relevance of some theoretical explanations is conrmed by survey analyses (explicit contracts, marginal costs, and coordination failure); others, instead, are judged much less relevant by rms (menu costs, pricing thresholds, and costly information). References

lvarez, Luis J., Pablo Burriel, and Ignacio Hernando (2005). Price-setting Behaviour in Spain: Evidence from Micro PPI Data. ECB Working Paper Series No. 522. lvarez, Luis J., and Ignacio Hernando (2006). Competition and Price Flexibility in the Euro Area. Mimeo, Banco de Espaa. lvarez, Luis J., and Ignacio Hernando (2005). The Price-setting Behaviour of Spanish Firms: Evidence from Survey Data. ECB Working Paper Series No. 538. Angeloni, Ignazio, Luc Aucremanne, Michael Ehrmann, Jordi Gal, Andrew Levin, and Frank Smets (2006). New Evidence on Ination Persistence and Price Stickiness in the Euro Area: Implications for Macro Models. Journal of the European Economic Association, 4(23). Aucremanne, Luc, and Emmanuel Dhyne (2004). How Frequently Do Prices Change? Evidence Based on the Micro Data Underlying the Belgian CPI. ECB Working Paper Series No. 331. Baudry, Laurent, Herv Le Bihan, Patrick Sevestre, and Sylvie Tarrieu (2004). Price Rigidity: Evidence from French CPI Micro-data. ECB Working Papers Series No. 384. Bils, Mark, and Peter J. Klenow (2004). Some Evidence on the Importance of Sticky Prices. Journal of Political Economy, 112, 947985. Blinder, Alan, Elie Canetti, David E. Lebow, and Jeremy B. Rudd (1998). Asking about Prices: A New Approach to Understanding Price Stickiness. Russell Sage Foundation. Carlton, Dennis W. (1986). The Rigidity of Prices. American Economic Review, 76, 637658. Cecchetti, Stephen (1986). The Frequency of Price Adjustment: A Study of the Newsstand Prices of Magazines. Journal of Econometrics, 31, 255274. Dhyne, Emmanuel, Luis J. lvarez, Herv Le Bihan, Giovanni Veronese, Daniel Dias, Johannes Hoffmann, Nicole Jonker, Patrick Lnnemann, Fabio Rumler, and Jouko Vilmunen (2006). Price Changes in the Euro Area and the United States: Some Stylized Facts from Individual Consumer Price Data. Journal of Economic Perspectives, 20, 2. Fabiani, Silvia, Martine Druant, Ignacio Hernando, Claudia Kwapil, Bettina Landau, Claire Loupias, Fernando Martins, Thomas Math, Roberto Sabbatini, and Ad Stokman (2005). The Pricing Behaviour of Firms in the Euro Area: New Survey Evidence. ECB Working Paper No. 535. Gal, Jordi, Mark Gertler, and David Lpez-Salido (2001). European Ination Dynamics. European Economic Review, 12371270.

584

Journal of the European Economic Association

Gal, Jordi, Mark Gertler, and David Lpez-Salido (2003). Erratum to European Ination Dynamics. European Economic Review, 47, 7, 759760. Hall, Simon, Mark Walsh, and Anthony Yates (2000). Are UK Companies Prices Sticky? Oxford Economic Papers, 52, 42546. Hoffmann, Johannes, and Jeong-Ryeol Kurz-Kim (2006). Consumer Price Adjustment Under the Microscope: Germany in a Period of Low Ination. Working paper, Deutsche Bundesbank. Klenow, Peter, and Oleksiy Kryvtsov (2005). State-dependent or Time-dependent Pricing: Does it Matter for Recent US Ination?. NBER Working Paper No. 11043. Lnnemann, Patrick, and Thomas Math (2005). Consumer Price Behaviour in Luxembourg: Evidence From Micro CPI Data. ECB Working Paper No. 541. Lnnemann, Patrick, and Ladislav Wintr (2005). Are Internet Prices Sticky? Mimeo, Banque Centrale du Luxembourg. Peltzman, Sam (2000). Prices Rise Faster Than They Fall. Journal of Political Economy, 108(3), 466502. Pilat, Dirk (1997). Regulation and Performance in the Distribution Sector. OECD Economics Department Working Paper No. 180. Sabbatini, Roberto, Silvia Fabiani, Angela Gatulli, and Giovanni Veronese (2005). Producer Price Behaviour in Italy: Evidence from Micro PPI Data. Mimeo, Banca dItalia. Vermeulen Philip, Daniel Dias, Maarten Dossche, Erwan Gautiar, Ignacio Hernando, Roberto Sabbatini, and Harald Stahl (2005). Price Setting in the Euro Area: Some Stylised Facts from Individual Producer Price Data. Mimeo, European Central Bank.

You might also like

- NBER Macroeconomics Annual 2016From EverandNBER Macroeconomics Annual 2016Martin EichenbaumNo ratings yet

- Project Servemploi: Retail Sector Retail SectorDocument41 pagesProject Servemploi: Retail Sector Retail SectorGovind RbNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Understanding European Real Exchange RatesDocument15 pagesUnderstanding European Real Exchange RatesTimNo ratings yet

- Jurnal Inter 2Document18 pagesJurnal Inter 210K GOLDNo ratings yet

- The Mundell-Fleming Economic Model: A crucial model for understanding international economicsFrom EverandThe Mundell-Fleming Economic Model: A crucial model for understanding international economicsNo ratings yet

- Perotti (2002)Document60 pagesPerotti (2002)Hoang Lan HuongNo ratings yet

- Euro ZoneDocument4 pagesEuro ZoneAves MalikNo ratings yet

- The Regional Effects of Monetary Policy in EuropeDocument20 pagesThe Regional Effects of Monetary Policy in EuropeKanita Imamovic-CizmicNo ratings yet

- Country Adjustments Within EurolandDocument26 pagesCountry Adjustments Within EurolandGeorge DraghiciNo ratings yet

- Is There Inflation Inequality Across Household Types in Europe?Document39 pagesIs There Inflation Inequality Across Household Types in Europe?FritscheUNo ratings yet

- 6.3 Political and Monetary UnionDocument2 pages6.3 Political and Monetary UnionkoraNo ratings yet

- The International Dimension of Inflation: Evidence From Disaggregated Consumer Price DataDocument20 pagesThe International Dimension of Inflation: Evidence From Disaggregated Consumer Price DataFadel MuhammadNo ratings yet

- The Impact of The Financial Crisis On The Real EconomyDocument17 pagesThe Impact of The Financial Crisis On The Real EconomyRajbir BhatiaNo ratings yet

- Economie en AnglaisDocument11 pagesEconomie en AnglaisKévin PereiraNo ratings yet

- BOE - Q2 2011 ReportDocument100 pagesBOE - Q2 2011 Reportrryan123123No ratings yet

- Differences between European and American IPO MarketsDocument22 pagesDifferences between European and American IPO MarketsAchyutanand ChaturvediNo ratings yet

- Food Retail GermanyDocument27 pagesFood Retail GermanyRaghav AjmaniNo ratings yet

- Gevit Duca No 36 Autumn 2007Document12 pagesGevit Duca No 36 Autumn 2007liemuelNo ratings yet

- Coulibaly Inflation Targeting Decrease Exchange Rate Pass-Through Emerging CountriesDocument34 pagesCoulibaly Inflation Targeting Decrease Exchange Rate Pass-Through Emerging CountriesJuan CisnerosNo ratings yet

- Common Factors of Commodity PricesDocument40 pagesCommon Factors of Commodity PricesPranav KompallyNo ratings yet

- Документ Microsoft Office WordDocument2 pagesДокумент Microsoft Office WordNaila AghayevaNo ratings yet

- Working Paper Series: Bank Lending and Monetary Transmission in The Euro AreaDocument32 pagesWorking Paper Series: Bank Lending and Monetary Transmission in The Euro AreacaitlynharveyNo ratings yet

- Expensive Living: The Greek Experience Under The Euro: Theodore Pelagidis and Taun ToayDocument10 pagesExpensive Living: The Greek Experience Under The Euro: Theodore Pelagidis and Taun ToayThanos DrakidisNo ratings yet

- BIS Working Papers: Exchange Rate Pass-Through: What Has Changed Since The Crisis?Document33 pagesBIS Working Papers: Exchange Rate Pass-Through: What Has Changed Since The Crisis?yockydockyNo ratings yet

- Efecto de La gLOBALIZACIÓN SOBTRE LA Inflación en La Era DE Gran Moderación - Nueva Evidencia de Los Países Del G-10Document36 pagesEfecto de La gLOBALIZACIÓN SOBTRE LA Inflación en La Era DE Gran Moderación - Nueva Evidencia de Los Países Del G-10Inocente ReyesNo ratings yet

- Activity+ +Empirical+Results+for+GermanyDocument24 pagesActivity+ +Empirical+Results+for+GermanyShikhar MehraNo ratings yet

- MPRA Paper 835Document44 pagesMPRA Paper 835Dragos MihalceaNo ratings yet

- Exposure to External Country Shocks and Income VolatilityDocument23 pagesExposure to External Country Shocks and Income VolatilityPrem KumarNo ratings yet

- Stock Prices, Asset Portfolios and Macroeconomic Variables in Ten European CountriesDocument24 pagesStock Prices, Asset Portfolios and Macroeconomic Variables in Ten European CountriesMario CruzNo ratings yet

- Euro 3Document38 pagesEuro 3Madalina TalpauNo ratings yet

- Monetary Policy, Currency Unions and Open Economy MacrodynamicsDocument50 pagesMonetary Policy, Currency Unions and Open Economy MacrodynamicsrerereNo ratings yet

- The Disconnect Between Financial Markets and The Real EconomyDocument10 pagesThe Disconnect Between Financial Markets and The Real EconomySamra Saquib ImaanNo ratings yet

- PC 12 2017 - 2Document17 pagesPC 12 2017 - 2TBP_Think_TankNo ratings yet

- Presented By:: (Jon Faust, John H. Rogers, Shing-Yi B. Wang and Jonathan H. Wright)Document24 pagesPresented By:: (Jon Faust, John H. Rogers, Shing-Yi B. Wang and Jonathan H. Wright)Wicky AkhtarNo ratings yet

- Day of The Week Effect ItalyDocument29 pagesDay of The Week Effect ItalyRENJiiiNo ratings yet

- Itskhoki Fiscal DevaluationsDocument54 pagesItskhoki Fiscal DevaluationsUNLV234No ratings yet

- Paper On Mcap To GDPDocument20 pagesPaper On Mcap To GDPgreyistariNo ratings yet

- Exchange Rate Policy Strategies and Foreign Exchange Interventions in The Group of Three EconomiesDocument0 pagesExchange Rate Policy Strategies and Foreign Exchange Interventions in The Group of Three EconomiesalphathesisNo ratings yet

- The Distribution of Household Income and Expenditure in Portugal - 1980 and 1990Document17 pagesThe Distribution of Household Income and Expenditure in Portugal - 1980 and 1990Edivaldo PaciênciaNo ratings yet

- Jurnal Ing - Pengaruh Perubahan Nilai Tukar Terhadap Harga Barang Impor Di ASEANDocument29 pagesJurnal Ing - Pengaruh Perubahan Nilai Tukar Terhadap Harga Barang Impor Di ASEANpapa wawaNo ratings yet

- Ribba Ecomod2016Document28 pagesRibba Ecomod2016george wilfredNo ratings yet

- Economic LetterDocument4 pagesEconomic LettershamyshabeerNo ratings yet

- 2008 Benchmark PPPs Measurement and UsesDocument8 pages2008 Benchmark PPPs Measurement and Usesmiguel_zas_1No ratings yet

- Monitoring Macro Economic Imbalances in Europe Proposal For A Refined Analytical FrameworkDocument16 pagesMonitoring Macro Economic Imbalances in Europe Proposal For A Refined Analytical FrameworkBruegelNo ratings yet

- Wpiea2020126 Print PDFDocument38 pagesWpiea2020126 Print PDFPrabudh MishraNo ratings yet

- Macroeconomics 2022Document212 pagesMacroeconomics 2022duy phamNo ratings yet

- CPI May Understate Costs of Living in NorwayDocument34 pagesCPI May Understate Costs of Living in NorwayMustafa TopalNo ratings yet

- bOOk 2Document21 pagesbOOk 2ctsrinivas19No ratings yet

- The Real Effects of European Monetary Union: Philip R. LaneDocument20 pagesThe Real Effects of European Monetary Union: Philip R. LanedanielpupiNo ratings yet

- Financial Integration and European Priorities: Jean Pisani-Ferry (Bruegel)Document15 pagesFinancial Integration and European Priorities: Jean Pisani-Ferry (Bruegel)BruegelNo ratings yet

- W o R K I N G P A P e R 6 8: Monetary Union:European LessonsDocument56 pagesW o R K I N G P A P e R 6 8: Monetary Union:European Lessonsjrsurf00No ratings yet

- (Macro) SlidesDocument212 pages(Macro) SlidesMinh NgọcNo ratings yet

- Global and Regional Spillovers in Emerging Stock Markets: A Multivariate GARCH-in-mean AnalysisDocument15 pagesGlobal and Regional Spillovers in Emerging Stock Markets: A Multivariate GARCH-in-mean Analysismarwane99No ratings yet

- Inflation and Price Setting WP 1695Document44 pagesInflation and Price Setting WP 1695awesomeshitNo ratings yet

- Consumers Europe Edition2 enDocument383 pagesConsumers Europe Edition2 enMihai Cristian100% (1)

- Falling Labor Share and Rising Unemployment: Long-Run Consequences of Institutional Shocks?Document38 pagesFalling Labor Share and Rising Unemployment: Long-Run Consequences of Institutional Shocks?Minda de Gunzburg Center for European Studies at Harvard UniversityNo ratings yet

- Mooij-Hofstede Convergence Vs DivergenceDocument9 pagesMooij-Hofstede Convergence Vs DivergenceCristina SavaNo ratings yet

- Labor Market SclerosisDocument49 pagesLabor Market SclerosisKarthy MurthyNo ratings yet

- Sav 5446Document21 pagesSav 5446Michael100% (2)

- COVID-19's Impact on Business PresentationsDocument2 pagesCOVID-19's Impact on Business PresentationsRetmo NandoNo ratings yet

- Bill of ConveyanceDocument3 pagesBill of Conveyance:Lawiy-Zodok:Shamu:-El80% (5)

- MSDS Summary: Discover HerbicideDocument6 pagesMSDS Summary: Discover HerbicideMishra KewalNo ratings yet

- 158 Oesmer Vs Paraisa DevDocument1 page158 Oesmer Vs Paraisa DevRobelle Rizon100% (1)

- OBHR Case StudyDocument8 pagesOBHR Case StudyYvonne TanNo ratings yet

- Question Paper Code: 31364Document3 pagesQuestion Paper Code: 31364vinovictory8571No ratings yet

- Mapping Groundwater Recharge Potential Using GIS-Based Evidential Belief Function ModelDocument31 pagesMapping Groundwater Recharge Potential Using GIS-Based Evidential Belief Function Modeljorge “the jordovo” davidNo ratings yet

- Information Pack For Indonesian Candidate 23.06.2023Document6 pagesInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaNo ratings yet

- Dwnload Full International Monetary Financial Economics 1st Edition Daniels Solutions Manual PDFDocument36 pagesDwnload Full International Monetary Financial Economics 1st Edition Daniels Solutions Manual PDFelegiastepauleturc7u100% (16)

- SAP PS Step by Step OverviewDocument11 pagesSAP PS Step by Step Overviewanand.kumarNo ratings yet

- Cars Should Be BannedDocument3 pagesCars Should Be BannedIrwanNo ratings yet

- 9780702072987-Book ChapterDocument2 pages9780702072987-Book ChaptervisiniNo ratings yet

- 2022 Product Catalog WebDocument100 pages2022 Product Catalog WebEdinson Reyes ValderramaNo ratings yet

- Global Cleantech Innovation Programme IndiaDocument122 pagesGlobal Cleantech Innovation Programme Indiaficisid ficisidNo ratings yet

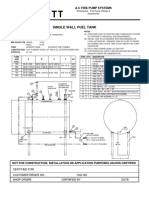

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDocument1 pageSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNo ratings yet

- Chill - Lease NotesDocument19 pagesChill - Lease Notesbellinabarrow100% (4)

- Management Pack Guide For Print Server 2012 R2Document42 pagesManagement Pack Guide For Print Server 2012 R2Quang VoNo ratings yet

- New Installation Procedures - 2Document156 pagesNew Installation Procedures - 2w00kkk100% (2)

- Gerhard Budin PublicationsDocument11 pagesGerhard Budin Publicationshnbc010No ratings yet

- 1 Estafa - Arriola Vs PeopleDocument11 pages1 Estafa - Arriola Vs PeopleAtty Richard TenorioNo ratings yet

- Spouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsDocument11 pagesSpouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsRobyn JonesNo ratings yet

- BA 9000 - NIJ CTP Body Armor Quality Management System RequirementsDocument6 pagesBA 9000 - NIJ CTP Body Armor Quality Management System RequirementsAlberto GarciaNo ratings yet

- Oop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Document14 pagesOop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Hashir KhanNo ratings yet

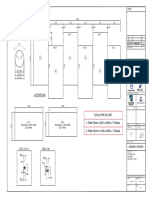

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFDocument23 pagesPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangNo ratings yet

- Hardened Concrete - Methods of Test: Indian StandardDocument16 pagesHardened Concrete - Methods of Test: Indian StandardjitendraNo ratings yet

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Welding MapDocument5 pagesWelding MapDjuangNo ratings yet

- Top Brand Story Bar Supervisor Jobs Chennai Apply Now Latest Fresher Experienced Bar Supervisor Jobs in Various Location July 18 2021Document1 pageTop Brand Story Bar Supervisor Jobs Chennai Apply Now Latest Fresher Experienced Bar Supervisor Jobs in Various Location July 18 2021Surya JamesNo ratings yet

- 4Q Labor Case DigestsDocument53 pages4Q Labor Case DigestsKaren Pascal100% (2)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (16)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- How an Economy Grows and Why It Crashes: Collector's EditionFrom EverandHow an Economy Grows and Why It Crashes: Collector's EditionRating: 4.5 out of 5 stars4.5/5 (102)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (2)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyFrom EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyRating: 4.5 out of 5 stars4.5/5 (69)

- Against the Gods: The Remarkable Story of RiskFrom EverandAgainst the Gods: The Remarkable Story of RiskRating: 4 out of 5 stars4/5 (352)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)

- Bottle of Lies: The Inside Story of the Generic Drug BoomFrom EverandBottle of Lies: The Inside Story of the Generic Drug BoomRating: 4 out of 5 stars4/5 (44)

- The Origin of Capitalism: A Longer ViewFrom EverandThe Origin of Capitalism: A Longer ViewRating: 5 out of 5 stars5/5 (17)

- The New Elite: Inside the Minds of the Truly WealthyFrom EverandThe New Elite: Inside the Minds of the Truly WealthyRating: 4 out of 5 stars4/5 (10)

- The Finance Curse: How Global Finance Is Making Us All PoorerFrom EverandThe Finance Curse: How Global Finance Is Making Us All PoorerRating: 4.5 out of 5 stars4.5/5 (18)