Professional Documents

Culture Documents

Jay Taylor Refreshes Dynacor Buy

Uploaded by

Dynacor Gold MinesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jay Taylor Refreshes Dynacor Buy

Uploaded by

Dynacor Gold MinesCopyright:

Available Formats

J Taylors

WWW.MININGSTOCKS.COM

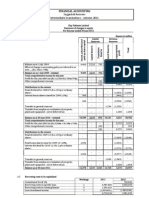

D o w J o n e s /G o ld A n n u a l R e tu rn s

Gold

Weekly Hotline Message (Now in our 30th Year)

8 0%

6 0% Percentage Gains/(Loss)

D J IA %

4 0% G o ld % 2 0%

0%

-2 0%

-4 0% 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997

Y e ar s 1 96 8 -1 9 9 6

Energy & Tech Stocks

April 20, 2012

Dynacor Gold Mines Remains a Favorite

Traded TSX: DNG/US OTC DNGDF 35.5 million Shares O/S. Price 4/19/12 $0.66 = $23.4 million Market Cap. - Although I remain bearish on gold mining shares given my general bearish view on equities, now is a time we want to hunt through the universe of gold mining shares to pick that that will not only be able to survive the downturn, but will be able to thrive at the expense of the dead bodies that litter the junior space when the markets finally start to give the gold mining sector the respect it deserves. No doubt that will happen after the next recession reminds people that Ben Bernanke and other statists not only do not have an answer to solving our problems but that they are making our situation sicker and sicker. At some point in time during the bull market in a lifetime for gold, the global economy will need some sort of gold backing in its monetary system. That is when I think we will see a mania in gold and gold stocks that will make the 1980s blow off look like childs play. Sharply in my focus is a small, still largely unrecognized company named Dynacor Gold Mines. Based in Montreal, this company just keeps plodding along increasing gold production and profits from its operations in Peru year after year. Not only has its growth been organic, which means it still has a miniscule 35.5 million shares outstanding, but it has a gold-copper skarn target in elephant country in Peru that could make this tiny company into something much larger. Unlike most junior gold exploration companies, this one has cash flow to fund its exploration efforts and thus avoid the most lethal dynamic of the junior mining sector, namely dilution. Im bringing this name back to your attention this week because the company just put out another very positive report about its most recent quarterly production and revenues achievements. It produced a record 13,101 ounces during Q1-2012. Thats a 32% increase over the like period of 2011. In conjunction with the higher metal production, Dynacor estimates a quarterly gold and silver sales record of US $23.5 million compared to revenues of $14.7 million in Q1-2011 for a 60% increase.

TAYLOR HARD MONEY ADVISORS, INC.

PO Box 780555, Maspeth, NY 11378

(718) 457-1426

April 20, 2012

During the first quarter of 2012, Dynacor continued operating at optimum recovery rates of 94%, processing 17,558 tonnes of ore at an average grade of 22.39 g/t Au or 0.78 oz. tonne. That compares with 13 520 tonnes at 22.11 g/t Au or 0.78 oz /tonne 2011. Leading to this increase in production was an increase in the companys plant expansion during the fourth quarter of 2011. Dynacor also reported record silver production of 41,112 ounces during the quarter. Thats a 94% increase over Q-1 of 2011. Jean Martineau, who is well known to your editor, has a tendency to under promise and over deliver. So when he projects 50,000 ounces of production this year, barring any unforseen circumstance, I think it is likely to happen. Steady growth in production and earnings can be expected. What is harder to predict but what could produce an enormous rocket-like projection in this companys share price would be a major gold-copper discovery on its Tumipampa skarn target, that over lays a highgrade gold vein system that is part of the companys steady growth projectile. Ever since I wondered into the Montreal offices of Dynacor in the summer of 2010 looking for Face the Analyst video prospects, I have loved this company. Jean Martineau is as honest and hard working as anyone you will find in this business. And his honesty and hard work are paying off for shareholders including himself. Jean and other insiders hold a significant portion of this companys shares, which is most often a very good sign. Look for periods of weakness like the present to add Dynacor to your holdings. The stock closed up 2 cents yesterday on the latest production news. But at $0.66 it is only 2 or 3 cents above its 52-week low. This is a buying opportunity in my view though given my bearish macro viewpoint, Im not suggesting immediate gratification with this or any other gold shares.

J Taylors Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for presentation in JTGTS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of $500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS.

To Subscribe to J Taylors Gold, Energy & Tech Stocks Visit: http://www.miningstocks.com/select/gold

Receive J Taylors Gold, Energy & Tech Stocks monthly newsletter and weekly email messages for the period of your choice (U.S. and Canada). For foreign postal delivery contact us at email below. Return to: PO Box 778555, Maspeth, NY 11378, USA. Phone or Fax: 718-457-1426, E-mail: questions@miningstocks.com. (Make Check Payable in US$ to Taylor Hard Money Advisors, Inc.) Please Select Subscription: _____2 Years US$360.00 _____1 Year US$198.00 _____3-Months US$69.00

Name Address City Telephone Primary E-mail: Secondary E-Mail:

State/Prov. Fax

Zip/Postal Code

Check Card Number Signature

Visa

MasterCard

Exp. 3-digit Code

Discover

(Last 3 digits of the number found on the back of your credit card, below your signature)

TAYLOR HARD MONEY ADVISORS, INC. PO Box 780555, Maspeth, NY 11378 (718) 457-1426 Copyright @ 2012 TAYLOR HARD MONEY ADVISORS, INC. ALL RIGHTS RESERVED

April 20, 2012

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Appendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearDocument1 pageAppendix 2: Revenue and Expenditures of Chaman BCP From Year 01 To YearKAshif UMarNo ratings yet

- BS Islamic Banking and FinanceDocument13 pagesBS Islamic Banking and FinanceNaveed Akhtar ButtNo ratings yet

- Supply Chain Director Manager in Willoughby OH Resume Gene MackDocument2 pagesSupply Chain Director Manager in Willoughby OH Resume Gene MackGeneMackNo ratings yet

- BMA 1 HW#5.1 GUERRERO, RonneLouiseDocument6 pagesBMA 1 HW#5.1 GUERRERO, RonneLouiseLoisaDu RLGNo ratings yet

- B2011 Guidebook 2 PDFDocument175 pagesB2011 Guidebook 2 PDFRkakie KlaimNo ratings yet

- Process Identification Part 2Document16 pagesProcess Identification Part 2hover.dragon16No ratings yet

- Free Printable Financial Affidavit FormDocument3 pagesFree Printable Financial Affidavit FormfatinNo ratings yet

- Econ 221 Chapter 7. Utility MaximizationDocument9 pagesEcon 221 Chapter 7. Utility MaximizationGrace CumamaoNo ratings yet

- Three Years Performance Report MoDPDocument15 pagesThree Years Performance Report MoDPUswa ShabbirNo ratings yet

- Ap Macroeconomics Syllabus - MillsDocument6 pagesAp Macroeconomics Syllabus - Millsapi-311407406No ratings yet

- Lesson 2 Global EconomyDocument18 pagesLesson 2 Global EconomyEngr. Kimberly Shawn Nicole SantosNo ratings yet

- OM Assignment Sec 2grp 3 Assgn2Document24 pagesOM Assignment Sec 2grp 3 Assgn2mokeNo ratings yet

- Progress Test 3Document7 pagesProgress Test 3myriamdzNo ratings yet

- ISO Certification in NepalDocument9 pagesISO Certification in NepalAbishek AdhikariNo ratings yet

- HRMS Project Plan FinalDocument17 pagesHRMS Project Plan FinalSaravana Kumar Papanaidu100% (2)

- Heritage Tourism: Submitted By, Krishna Dev A.JDocument5 pagesHeritage Tourism: Submitted By, Krishna Dev A.JkdboygeniusNo ratings yet

- Invitation: Integrated Food and Nutrition Security Initiative Presidential MeetingDocument3 pagesInvitation: Integrated Food and Nutrition Security Initiative Presidential MeetingCityPressNo ratings yet

- Mawb LR 749-30816310Document1 pageMawb LR 749-30816310Hemant PrakashNo ratings yet

- 5d6d01005f325curriculum MPSM LatestDocument51 pages5d6d01005f325curriculum MPSM LatestMostafa ShaheenNo ratings yet

- 26912Document47 pages26912EMMANUELNo ratings yet

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasNo ratings yet

- Inevitrade Crypto Guidebook 2Document6 pagesInevitrade Crypto Guidebook 2ValmorTube100% (1)

- Statement MayDocument2 pagesStatement Mayayankashyap204No ratings yet

- Cacthanhphancobancuacau - Docx Dethionline1Document4 pagesCacthanhphancobancuacau - Docx Dethionline1leanhtuan7126No ratings yet

- Chapter 2Document27 pagesChapter 2ןאקויב ףארהאנNo ratings yet

- Banking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andDocument10 pagesBanking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andgalilleagalillee100% (1)

- Corporate Finance 8thDocument15 pagesCorporate Finance 8thShivani Singh ChandelNo ratings yet

- Notes of Business Environment Class 12Document5 pagesNotes of Business Environment Class 12s o f t a e s t i cNo ratings yet

- Life Insurance Corporation of India: (To Be Mentioned After Issuance of Policy)Document2 pagesLife Insurance Corporation of India: (To Be Mentioned After Issuance of Policy)Ravikiran Reddy AdmalaNo ratings yet