Professional Documents

Culture Documents

2012 May Bi Seminar Bandung

Uploaded by

isfininOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012 May Bi Seminar Bandung

Uploaded by

isfininCopyright:

Available Formats

Background

Development of Islamic finance would ideally promote financial transactions with underlying asset that attached to the goods market or productive economic activities. The application of this ideal is perhaps entails considerable challenge to Islamic financial institutions particularly in creating some sharia-compliant but economically feasible financial products. Yet, the actual stage of economic development in Indonesia, and possibly in other emerging countries, demand alternate solutions to channel available financial resources to productive economic sectors which not only offer growth opportunities, but expectedly would also fundamentally improve the output and structure of countrys economy. Currently, the Indonesian Islamic Banking industry is characterized by a significant financing to deposit ratio, while placement to financial market products still relatively low. Nevertheless, the tendency towards the use of larger financial markets products continues to grow, as it may improve banks efficiency. Thus, the trend of disintermediation following the improving performance of financial markets and investment rating, are inevitably will affect the future shape of Islamic banking. However, the fact of repeated financial crises including the most recent financial market and debt crisis, seem to confirm risk pertinent to this tendency. The experience from the latest financial crisis has, in general, changed the landscape of regulatory and supervisory framework of central banks, relevant authorities and development agencies. The changes referred to, among others, a tendency toward stricter regulation and monitoring especially for systemic financial institutions, restrictions on certain business activities, as well as enhanced transparency to reduce the potential for moral hazard. In some respects, these changes may not be relevant to the current state of the Islamic financial industry, though the nature of these policies still need to be understood by regulators. Perhaps more important is to reconsider the effectiveness of such solutions and any other alternatives in crisis prevention and what should authorities do, by exploring solutions which are more appropriate for more balanced and sustainable financial institution and economic growth from the perspective of Islamic financial system. Development of Islamic financial system is inextricably associated to the interest of the state and development agencies to reduce poverty and improve various parameters of welfare for more balanced economic growth. These objectives can be achieved by involving the large part of communities in the process of economic development, which in the context of the financial system is done by making financial services acceptable by, as well as accessible to, the public. In this regard, it is important for Islamic finance stakeholders to adopt more effective strategy to strengthen the role of the Islamic financial institutions to improve public awareness and access to financial services. With regard to the abovementioned issues, this seminar will address various topics related to the role of Islamic finance in supporting the development of real sector, while improving social welfare and enhancing financial system stability.

2nd Bank Indonesia International Seminar,

May 2012

Welcoming remarks : HE Governor of West Java Province Opening remarks : HE. Dr. Halim Alamsyah, Deputy Governor, Bank Indonesia Keynote Adress : HE. Dr. Ahmad Mohammed Ali, President, Islamic Development Bank HE. Dr. Darmin Nasution, Governor, Bank Indonesia

Topics will be discussed : Islamic Finance, Financial Stability and Sustainable Economic Growth: bringing virtues into reality through regulatory incentives Contemporary approach of the central bank role in stimulating real sectors growth: a step towards implementation of an Islamic economics compatible role of central bank Euro area debt crisis: lesson learn from imbalance spending on productive economic investment and what should authorities do Increasing awareness of Islamic finance for economic development practices and concept by regional multilateral agency The role of Islamic FSAP to support financial stability in the economy Speakers : IMF (tbc) Prof. Dr. Iwan Jaya Aziz, Head of Office of Regional Economic Integration, Asian Development Bank Dr. Dadang Muljawan, Islamic Development Bank Dr. Mehmet Asutay, Durham University Bank Indonesia Moderator : Mr. Tirta Segara (Bank Indonesia)

Topics will be discussed : The close relations between optimal banking lending with economic productive activities Enhancing support of Islamic banks to corporate and SMEs financing activities: lesson from Turkish Islamic banking model The future model of Islamic banking business: industry perspectives Integrating ZIS and awqaf with Islamic financial services Integrating real sector indices into Islamic banking pricing: an effort to enhance the Islamic banking bussines model to real sector. Speakers : Dr. Eli Remolona, Head of Bank for International Settlements - Hongkong Dr. Lokman Gunduz, Board Member Central Bank of Turkey Mr. Yuslam Fauzi, CEO Bank Syariah Mandiri (tbc) Mr. Ahmad Juwaini, Executive Director, Dompet Dhuafa Dr. Rifki Ismal, Directorate of Islamic Banking, Bank Indonesia Dr. Bambang Hermanto, University of Indonesia Moderator : Dr. Dadang Muljawan, Islamic Development Bank

2nd Bank Indonesia International Seminar,

May 2012

Topics will be discussed : Expanding Islamic Financial Services Access to Indonesias Small and Medium Enterprises The role and practices of Islamic banking in empowering lower income communities The role of ICT to facilitate broader communities access to financial services Challenges in improving financial literacy and potential role of Islamic financial institutions Speakers : Dr. Thomas Timberg and Prof. Iraj Toutounchian, World Bank Bank Indonesia Mr. Moch. Hadi Santoso, CEO Bank Rakyat Indonesia Syariah CEO Bank Tabungan Pensiunan Nasional (tbc) Ms. Mike Rini, Mike Rini Associate & Financial Planning and Education Moderator : Prof. Nen Amran, PhD (Padjajaran University) (11.00 AM - 12.30 PM) Topics will be discussed are the experience, background, values and opportunities of bussines practitioners and entities which using Islamic finance for their operating and/or expanding their activities from various bussines sectors. Speakers : Mr. Faizal Mansor, CFO Malaysia Airports Holdings Berhad, KLIA airport Malaysia (infrastructure sector) Mr. Bobby Gafur Umar, CEO Bakrie & Brothers (holding company of various business) PT. Indah Kiat (manufacture sector) (tbc) PT. Bersaudara Simalungun Energi (energy sector) Moderator : Dr. Suryani S.F. Motik, President Director of Prima Group (tbc)

Topics will be discussed : Enhancing role of financial market to support the development of productive sectors through sharia compliance instruments Developing a project-linked Sukuk: market and regulator perspectives Developing comprehensive line of products for trade & financing Structuring sharia compliant hedging instruments Speakers : Mr. Dahlan Siamat, Director of Islamic Finance Policy, Debt Management Office - Ministry of Finance Ms. Friderica Widyasari Dewi, Director of Bussiness Development, Indonesian Stock Exchange Mr. Ijlal Alvi, CEO International Islamic Financial Market , Bahrain Mr. Razi Fakih, Deputy CEO HSBC Amanah, Dubai Mr. Adrian A. Gunadi, Director of PT. Bank Muamalat Indonesia CEO Kuwait Finance House (tbc) Contact Person : irfan@bi.go.id

Moderator : Mr. Rizqullah, CEO BNI Syariah (tbc)

2nd Bank Indonesia International Seminar,

May 2012

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

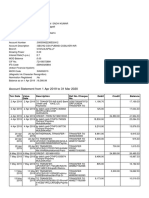

- Account Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSadhi KumarNo ratings yet

- Ch13 (Man)Document44 pagesCh13 (Man)kevin echiverriNo ratings yet

- JD - SR Credit Analyst - BBGDocument1 pageJD - SR Credit Analyst - BBGpreeti jainNo ratings yet

- Personal Bank Account: West End Ret PK BlanchardstownDocument5 pagesPersonal Bank Account: West End Ret PK BlanchardstownViorica Zaporojan Iascerinschi100% (3)

- Accounts CIA 3 FinalDocument6 pagesAccounts CIA 3 FinalTanmay AroraNo ratings yet

- Deepak ProjectDocument88 pagesDeepak ProjectSandeep JacobNo ratings yet

- Krishi Farm Naubise FPDocument5 pagesKrishi Farm Naubise FPRamHari AdhikariNo ratings yet

- Guide For Credinet WebDocument58 pagesGuide For Credinet WebVladimir Ramos MachacaNo ratings yet

- Stock Selection Masterclass NotesDocument7 pagesStock Selection Masterclass NotesRupesh PNo ratings yet

- Cpa Australia Financial Reporting Notes PDFDocument11 pagesCpa Australia Financial Reporting Notes PDFpriyank100% (1)

- The Ine That We NeedDocument8 pagesThe Ine That We NeedTyrion LannisterNo ratings yet

- Capital BudgetingDocument48 pagesCapital Budgetingarthur portalNo ratings yet

- Unit 3: Exercise 1 Types of BanksDocument4 pagesUnit 3: Exercise 1 Types of BanksTrương Ngọc Minh AnhNo ratings yet

- Performance Appraisal at KMBDocument66 pagesPerformance Appraisal at KMBKrishna ChodasaniNo ratings yet

- Human Resource Department: by J.A.V.R.N.V.PRASADDocument28 pagesHuman Resource Department: by J.A.V.R.N.V.PRASADAmarnath VuyyuriNo ratings yet

- Coding and Decoding QuestionsDocument28 pagesCoding and Decoding QuestionsAbdulawwal IntisorNo ratings yet

- Business Finance: Quarter 1 - Module 3 Types of InvestmentDocument11 pagesBusiness Finance: Quarter 1 - Module 3 Types of Investmentalmira calaguioNo ratings yet

- 6 For-TkyDocument36 pages6 For-TkyTotzkie LumpoyNo ratings yet

- Sales Data - Reach2Every1Document33 pagesSales Data - Reach2Every1Vivek PatilNo ratings yet

- What Is RMADocument1 pageWhat Is RMAPurevdorj DorjNo ratings yet

- Accounting PrincipleDocument28 pagesAccounting PrincipleAlyssa Nikki Versoza100% (1)

- Bihar Gramin Bank Bihar Gramin Bank: Challan Form-01 (Cash Voucher) Challan Form - 01 (Cash Voucher)Document1 pageBihar Gramin Bank Bihar Gramin Bank: Challan Form-01 (Cash Voucher) Challan Form - 01 (Cash Voucher)anand singhNo ratings yet

- Amortization and AccretionDocument3 pagesAmortization and Accretionnaan_padikanumNo ratings yet

- Merchant BankingDocument26 pagesMerchant BankingSanjay PareekNo ratings yet

- Definition of BankDocument14 pagesDefinition of BankSuman RoyNo ratings yet

- IC-46 Chapter 1Document3 pagesIC-46 Chapter 1Allu arjun50% (2)

- Receivable-Financing-Quizbowl DONE For CpaDocument30 pagesReceivable-Financing-Quizbowl DONE For CpaKae Abegail GarciaNo ratings yet

- ACC1026 Topic 7Document66 pagesACC1026 Topic 7Ceae SeaNo ratings yet

- Month/Year Deductions Carried Out From My Account Repayment Scheduled at The Approval Time of Loan /installments Difference in AmountDocument1 pageMonth/Year Deductions Carried Out From My Account Repayment Scheduled at The Approval Time of Loan /installments Difference in AmountAdeenaNo ratings yet

- (IJA) Institute of Judicial Administration LushotoDocument2 pages(IJA) Institute of Judicial Administration LushotoIbrahim Samsoni Christian100% (1)