Professional Documents

Culture Documents

Joint Farm Bill Letter Senate May23

Uploaded by

Adam BerklandOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joint Farm Bill Letter Senate May23

Uploaded by

Adam BerklandCopyright:

Available Formats

NEW FAR BIL MU H W RM LL UST HARVE SA EST AVING GS AN NO PL ND OT LANT N NEW E ENTIT MENTS TLEM S

May 23, 2 2012 Dear Sena ator: On behalf of the millio of membe represented by our orga f ons ers d anizations, we urge you to vote no on Th e he Agricultur Reform, Fo and Jobs Act of 2012 (Farm Bill). T bill barel makes a dent in the massive re ood The ly agricultur subsidy system and fails to decrease Washington outsized an outdated ro in America ral s nd ole an agricultur re. inesses are a testament to t skill, inge t the enuity, and pe ersistence of A Americans. W While many se ectors Farm busi continue t feel the eff to fects of the rec cession, Ame erican agricult ture is one of the few brigh spots in the f ht e economy. Net farm inc come is at $98 billion, near doubling b 8 rly between 2001 and 2011. Farm businesses 1 exported n nearly $140 billion worth o products, e b of exceeding imp ports of agric cultural produ by more t ucts than $37 billion. And its es stimated that o out of every 12 jobs is connected to agriculture. one s o Congress must take thi opportunity to reassess u is y unnecessary a complicat federal po and ted olicies that manipulat market dec te cisions in this critical and v vibrant compo onent of our e economy. Yet, the F Farm Bill fails to even mee the meager $30 billion deficit reductio target in th Presidents s et on he s fiscal year 2013 budge request, con r et ntaining a mer $23 billion in deficit red re n duction, squan ndering this opportuni The bill does eliminate some unnece ity. d e essary progra ams, like direc payments, c ct counter-cycli ical payments, and ACRE - a step that is long overdu But it then turns around and replaces them with n s ue. n d s new entitlemen programs to guarantee a nt t agricultural bu usiness profit such as Ag ts, gricultural Ris Coverage a sk and Crop Insu urance Supple emental Coverage Option. This is indefe ensible. Cong gress must not create any n t new

potentially budget-busting entitlement programs that would increase Washingtons role in farm business decisions while destroying the nascent private supplemental crop insurance industry. These new programs are not a safety net; theyre a springboard to guaranteed profits for agriculture at the cost of major annual drains on the treasury. The Farm Bill also fails to make meaningful reforms to the largest Washington-based support for agriculture, federally subsidized crop insurance. The Congressional Budget Office (CBO) estimates this programwhich provided $2.2 million in subsidies for just one agricultural producers insurance premiums in 2011will cost more than $90 billion over the next ten years. According to CBOs preliminary score of the Farm Bill, costs for federally subsidized crop insurance will actually increase $3 billion. We also oppose using the Farm Bill to undo recent progress on reducing misguided biofuels subsidies. Americas agricultural economy is strong. This strength and the glaring weakness of the federal budget $15 trillion in debt and trillion dollar deficits projected for the next decademake it essential that Washingtons role in agricultural policy be reformed. For more information, please contact Joshua Sewell of Taxpayers for Common Sense at 202-546-8500 x116, or josh@taxpayer.net. Sincerely, American Commitment Americans for Prosperity Americans for Tax Reform Competitive Enterprise Institute Council for Citizens Against Government Waste FreedomWorks Heritage Action for America R Street National Taxpayers Union Taxpayers for Common Sense Taxpayer Protection Alliance

You might also like

- Fiscal Clif InfographicDocument1 pageFiscal Clif Infographicjames_valvoNo ratings yet

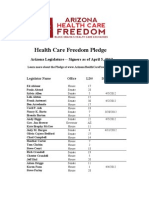

- AZHCxpledgers07 19 2012Document3 pagesAZHCxpledgers07 19 2012james_valvoNo ratings yet

- 07-27-12 Coalition Letter Farm Bill Short ExtensionDocument2 pages07-27-12 Coalition Letter Farm Bill Short Extensionjames_valvoNo ratings yet

- Title 17 Coalition LetterDocument2 pagesTitle 17 Coalition Letterjames_valvoNo ratings yet

- Az HC Pledge July 2012Document3 pagesAz HC Pledge July 2012james_valvoNo ratings yet

- Azhcpledgersigners04 11 2012Document3 pagesAzhcpledgersigners04 11 2012james_valvoNo ratings yet

- NLRB Cra Multi-Party FinalDocument2 pagesNLRB Cra Multi-Party Finaljames_valvoNo ratings yet

- Health Care ExchangesDocument2 pagesHealth Care Exchangesjames_valvoNo ratings yet

- Health Care ExchangesDocument2 pagesHealth Care Exchangesjames_valvoNo ratings yet

- AzhcfpledgeDocument1 pageAzhcfpledgejames_valvoNo ratings yet

- AFPComment CMS-9975-P 3RsDocument6 pagesAFPComment CMS-9975-P 3Rsjames_valvoNo ratings yet

- AFPComment CMS-9989-P ExchangeDocument5 pagesAFPComment CMS-9989-P Exchangejames_valvoNo ratings yet

- 112th Congress Mid-Term Review Key Vote ScorecardDocument10 pages112th Congress Mid-Term Review Key Vote Scorecardjames_valvoNo ratings yet

- 01-30-12 Coalition Letter NAT GASDocument2 pages01-30-12 Coalition Letter NAT GASjames_valvoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)