Professional Documents

Culture Documents

FPI County by County Impact of Raising Min Wage

Uploaded by

jspectorOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FPI County by County Impact of Raising Min Wage

Uploaded by

jspectorCopyright:

Available Formats

Numbers that Count

What is the county-by-county impact of raising New Yorks minimum wage to $8.50 an hour?

The New York State Assembly recently voted to increase the states minimum wage from $7.25 to $8.50 an hour. Over one million New York workers would benefit from such an increase. An estimated 880,000 workers who currently are paid less than $8.50 an hour would benefit directly. About 200,000 more workersthose earning slightly more than $8.50 an hour would likely see an increase as a result of a spillover effect as employers seek to maintain relative wage patterns among their employees. The share of workers affected by an increase is below the statewide average in the downstate suburban counties and in New York City. However, despite these lower shares, the majority of affected workers reside in the higher-cost downstate region: 352,000 New York City workers would directly benefit, as would 126,500 Long Island workers and 72,500 workers in the northern suburban counties of Westchester, Rockland, Orange and Putnam counties.

Fiscal Policy Institute

Statewide, the estimated 880,000 workers who would directly benefit from a minimum wage increase represent 10.1 percent of all resident New York workers. Among several of the state's larger upstate counties, the share of workers who would benefit from a minimum wage increase is well above the statewide average: in Broome County 12.6 percent of workers would benefit, in Oneida County 12.5 percent, in Erie County 11.4 percent, in Monroe County 11.1 percent and in Onondaga County 10.9 percent.

In all, 18 counties in New York State each have 10,000 or more workers who would directly benefit from an increase in the minimum wage to $8.50 an hour.

These estimates were developed by the Fiscal Policy Institute using the 2011 Current Population Survey to generate the statewide, New York City and balance of state estimates. County estimates were generated using each countys share of low-income tax filers for 2008, the latest year for detailed tax data.

Issue 4

May 24, 2012

www.fiscalpolicy.org

Numbers that Count

New York workers who would benefit from an increase in the minimum wage to $8.50 an hour, by county of residence

Annual average resident employment New York State total New York City Bronx Kings Manhattan Queens Richmond Rest of State Albany Allegany Broome Cattaraugus Cayuga Chautauqua Chemung Chenango Clinton Columbia Cortland Delaware Dutchess Erie Essex Franklin Fulton Genesee Greene Hamilton Herkimer Jefferson Lewis Livingston Madison Monroe Montgomery 8,729,600 3,592,200 478,400 1,011,300 853,300 1,028,000 221,300 5,137,300 143,000 21,700 85,900 36,800 37,400 58,000 36,900 22,600 34,300 28,100 22,000 19,600 134,400 424,100 16,000 20,300 24,100 29,600 21,600 2,800 28,300 44,200 11,300 29,600 33,000 339,000 21,400

Number of workers directly benefiting 880,100 352,000 66,700 105,500 63,500 99,500 16,800 528,600 14,700 2,300 10,800 4,300 3,900 7,300 4,600 2,700 4,100 3,100 2,300 2,400 12,400 48,200 2,000 2,400 2,800 3,200 2,500 300 3,200 5,000 1,200 3,000 3,200 37,600 2,900

Percent of workers directly benefiting 10.1% 9.8% 13.9% 10.4% 7.4% 9.7% 7.6% 10.3% 10.3% 10.6% 12.6% 11.7% 10.4% 12.6% 12.5% 11.9% 12.0% 11.0% 10.5% 12.2% 9.2% 11.4% 12.5% 11.8% 11.6% 10.8% 11.6% 10.7% 11.3% 11.3% 10.6% 10.1% 9.7% 11.1% 13.6%

In the highercost downstate region, 352,000 New York City workers would benefit directly as would 126,500 Long Island workers and 72,500 workers in the northern suburban counties

www.fiscalpolicy.org

May 24, 2012

Issue 4

Numbers that Count

New York workers who would benefit from an increase in the minimum wage to $8.50 an hour, by county of residence, cont.

Annual average resident employment

Number of workers directly benefiting 60,500 12,000 12,400 22,800 5,400 15,400 2,100 5,900 3,100 3,900 7,500 13,000 9,900 7,700 1,400 1,000 1,800 5,200 5,000 66,000 3,800 2,500 3,800 8,900 3,800 3,000 4,800 40,200 2,000 1,400

Percent of workers directly benefiting 9.5% 11.9% 12.5% 10.9% 10.4% 9.6% 12.1% 11.4% 10.7% 7.7% 9.9% 8.9% 9.2% 11.2% 10.0% 10.9% 11.6% 12.0% 12.4% 9.2% 12.2% 10.9% 7.3% 11.1% 11.6% 10.1% 11.1% 9.1% 10.8% 11.5%

Among several of the state's larger upstate counties, the share of workers who would benefit is well above the statewide average

Nassau Niagara Oneida Onondaga Ontario Orange Orleans Oswego Otsego Putnam Rensselaer Rockland Saratoga Schenectady Schoharie Schuyler Seneca St. Lawrence Steuben Suffolk Sullivan Tioga Tompkins Ulster Warren Washington Wayne Westchester Wyoming Yates

635,900 100,900 99,000 209,800 52,100 160,300 17,300 51,600 28,900 50,500 75,400 145,700 108,000 68,500 14,000 9,200 15,500 43,400 40,200 721,300 31,200 22,900 52,100 80,500 32,700 29,700 43,400 440,600 18,500 12,200

Source: Estimates by Fiscal Policy Institute. Current Population Survey analyzed to estimate number of workers directly affected for New York State and New York City by a minimum wage increase to $8.50. Rest of State estimate of 528,600 is the difference between the statewide and the NYC estimates. County and NYC borough shares of affected workers based on county shares of low-income tax filers (income less than $20,000), 2008 tax return data, New York State Tax and Finance Department.

Issue 4

May 24, 2012

www.fiscalpolicy.org

Numbers that Count

More information from the Fiscal Policy Institute on the minimum wage in New York State

Raising New Yorks minimum wage will boost the state economy. January 30, 2012.

In fact, one in six New York workers would benefit if the minimum wage were increased to $10 an hour. Includes the history of New York and federal minimum wage changes, shows the purchasing power of New Yorks minimum wage over the decades, and lists the 18 states with higher minimums. http://fiscalpolicy.org/FPI_BoostTheEconomyBoostTheMinimumWage_20120130.pdf.

N.Y. minimum wage doesn't stretch as far as it used to. February 12, 2012.

An op ed by Frank Mauro published in the Poughkeepsie Journal. Also includes FPIs policy recommendation for a smooth transition to an adequate wage, indexed for inflation. http://www.fiscalpolicy.org/20120212_PoughkeepsieJournal.pdf.

Which workers will benefit, if the New York minimum wage is raised to $8.50 an hour? February 17, 2012.

This brief estimates how many workers will benefit (a million) and breaks down the data by demographic category. Includes an estimate of the positive job creation impact of an increase in the minimum wage. http://fiscalpolicy.org/FPI_NumbersThatCount_BenefitsOfIncreasingTheMinimumWage.pdf.

Increasing New York State's Minimum Wage. April 18, 2012.

Testimony presented at a public forum by Frank J. Mauro. Indicates that (1) most minimum wage workers are adults working full-time, and (2) increasing the minimum wage by reasonable amounts has neither reduced employment nor fueled inflation. http://fiscalpolicy.org/FPI_IncreasingTheMinimumWage_20120418.pdf.

Raising New York State's Minimum Wage. April 23, 2012.

Testimony presented to the New York Assembly Labor Committee by James A. Parrott. Ten reasons that an increase in the minimum wage makes sense. Cites academic experts who have carefully analyzed the employment impact of minimum wage increases. http://fiscalpolicy.org/FPI_RaisingNewYorkStatesMinimumWage_20120423.pdf.

Fact vs. Fiction on Raising New Yorks Minimum Wage. May 21, 2012.

The Fiscal Policy Institute and the National Employment Law Project show that, on an after tax basis, all minimum wage workers would bring home more pay following a minimum wage increase. And, Family Health Plus eligibility is not affected for the overwhelming majority of low-wage New Yorkers. http://fiscalpolicy.org/NELP-FPI-fact-vs-fiction-on-raising-NYs-minimum-wage.pdf.

The Fiscal Policy Institute is an independent, nonpartisan, nonprofit research and education organization committed to improving public policies and private practices to better the economic and social conditions of all New Yorkers.

One Lear Jet Lane Latham, NY 12210 518-786-3156 11 Park Place, Suite 701 New York, NY 10007 212-721-5624

www.fiscalpolicy.org

May 22, 2012

Issue 4

You might also like

- IG LetterDocument3 pagesIG Letterjspector100% (1)

- Joseph Ruggiero Employment AgreementDocument6 pagesJoseph Ruggiero Employment AgreementjspectorNo ratings yet

- Cornell ComplaintDocument41 pagesCornell Complaintjspector100% (1)

- NYSCrimeReport2016 PrelimDocument14 pagesNYSCrimeReport2016 PrelimjspectorNo ratings yet

- State Health CoverageDocument26 pagesState Health CoveragejspectorNo ratings yet

- Federal Budget Fiscal Year 2017 Web VersionDocument36 pagesFederal Budget Fiscal Year 2017 Web VersionjspectorNo ratings yet

- Pennies For Charity 2018Document12 pagesPennies For Charity 2018ZacharyEJWilliamsNo ratings yet

- Film Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFDocument8 pagesFilm Tax Credit - Quarterly Report, Calendar Year 2017 2nd Quarter PDFjspectorNo ratings yet

- Opiods 2017-04-20-By Numbers Brief No8Document17 pagesOpiods 2017-04-20-By Numbers Brief No8rkarlinNo ratings yet

- SNY0517 Crosstabs 052417Document4 pagesSNY0517 Crosstabs 052417Nick ReismanNo ratings yet

- Inflation AllowablegrowthfactorsDocument1 pageInflation AllowablegrowthfactorsjspectorNo ratings yet

- Teacher Shortage Report 05232017 PDFDocument16 pagesTeacher Shortage Report 05232017 PDFjspectorNo ratings yet

- Abo 2017 Annual ReportDocument65 pagesAbo 2017 Annual ReportrkarlinNo ratings yet

- 2017 08 18 Constitution OrderDocument27 pages2017 08 18 Constitution OrderjspectorNo ratings yet

- Class of 2022Document1 pageClass of 2022jspectorNo ratings yet

- Siena Poll March 27, 2017Document7 pagesSiena Poll March 27, 2017jspectorNo ratings yet

- Darweesh Cities AmicusDocument32 pagesDarweesh Cities AmicusjspectorNo ratings yet

- Review of Executive Budget 2017Document102 pagesReview of Executive Budget 2017Nick ReismanNo ratings yet

- Youth Cigarette and E-Cigs UseDocument1 pageYouth Cigarette and E-Cigs UsejspectorNo ratings yet

- 2017 School Bfast Report Online Version 3-7-17 0Document29 pages2017 School Bfast Report Online Version 3-7-17 0jspectorNo ratings yet

- Pub Auth Num 2017Document54 pagesPub Auth Num 2017jspectorNo ratings yet

- Oag Sed Letter Ice 2-27-17Document3 pagesOag Sed Letter Ice 2-27-17BethanyNo ratings yet

- Schneiderman Voter Fraud Letter 022217Document2 pagesSchneiderman Voter Fraud Letter 022217Matthew HamiltonNo ratings yet

- Hiffa Settlement Agreement ExecutedDocument5 pagesHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- 16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsDocument55 pages16 273 Amicus Brief of SF NYC and 29 Other JurisdictionsjspectorNo ratings yet

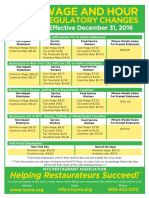

- Wage and Hour Regulatory Changes 2016Document2 pagesWage and Hour Regulatory Changes 2016jspectorNo ratings yet

- 2016 Local Sales Tax CollectionsDocument4 pages2016 Local Sales Tax CollectionsjspectorNo ratings yet

- Voting Report CardDocument1 pageVoting Report CardjspectorNo ratings yet

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Document4 pagesActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorNo ratings yet

- p12 Budget Testimony 2-14-17Document31 pagesp12 Budget Testimony 2-14-17jspectorNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- China Power Plant DocumentDocument1 pageChina Power Plant DocumentFahad SiddikNo ratings yet

- Uganda National Fertilizer Policy April23-2016Document33 pagesUganda National Fertilizer Policy April23-2016Elvis100% (1)

- S.6 GEO URBANIZATION Revised 2015Document15 pagesS.6 GEO URBANIZATION Revised 2015Male DaviesNo ratings yet

- Sample Assignment 1-1Document20 pagesSample Assignment 1-1Nir IslamNo ratings yet

- Construction Management OverviewDocument16 pagesConstruction Management OverviewAnarold Joy100% (2)

- Rural MarketingDocument40 pagesRural MarketingBARKHA TILWANINo ratings yet

- Multiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionDocument36 pagesMultiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionKing MercadoNo ratings yet

- SEPO Policy Brief - Maharlika Investment Fund - FinalDocument15 pagesSEPO Policy Brief - Maharlika Investment Fund - FinalDaryl AngelesNo ratings yet

- Varun MotorsDocument81 pagesVarun MotorsRohit Yadav86% (7)

- ROSHNI RAHIM - Project NEWDocument37 pagesROSHNI RAHIM - Project NEWAsif HashimNo ratings yet

- SERVICE QUALITY AND MEASUREMENT SEM 6 CH 1-Ilovepdf-CompressedDocument16 pagesSERVICE QUALITY AND MEASUREMENT SEM 6 CH 1-Ilovepdf-CompressedDj kakaNo ratings yet

- Calculate Car Interest RatesDocument1 pageCalculate Car Interest RatesKevinNo ratings yet

- Human Capital December 11 Issue - Low ResDocument65 pagesHuman Capital December 11 Issue - Low RessunilboyalaNo ratings yet

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaNo ratings yet

- ALL IN MKT1480 Marketing Plan Worksheet 1 - Team ContractDocument29 pagesALL IN MKT1480 Marketing Plan Worksheet 1 - Team ContractBushra RahmaniNo ratings yet

- Chapter 2 - Consumer BehaviourDocument95 pagesChapter 2 - Consumer BehaviourRt NeemaNo ratings yet

- A2 Sample Chapter Inventory Valuation PDFDocument19 pagesA2 Sample Chapter Inventory Valuation PDFRafa BentolilaNo ratings yet

- T24 Accounting Introduction - R15Document119 pagesT24 Accounting Introduction - R15Jagadeesh JNo ratings yet

- Information Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsDocument4 pagesInformation Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsPeter BensonNo ratings yet

- Creating A BudgetDocument2 pagesCreating A BudgetLaci NunesNo ratings yet

- Chapter 9 Saving, Investment and The Financial SystemDocument24 pagesChapter 9 Saving, Investment and The Financial SystemPhan Minh Hiền NguyễnNo ratings yet

- 2 - OFW Reintegration Program Generic PresentationDocument19 pages2 - OFW Reintegration Program Generic PresentationReintegration CagayanNo ratings yet

- Introduction To Oil Company Financial Analysis - CompressDocument478 pagesIntroduction To Oil Company Financial Analysis - CompressRalmeNo ratings yet

- BBA618 - Goods & Service Tax - CASE STUDIES - UNIT-2Document2 pagesBBA618 - Goods & Service Tax - CASE STUDIES - UNIT-2Md Qurban HussainNo ratings yet

- Government of Karnataka's Chief Minister's Self-Employment Program DetailsDocument4 pagesGovernment of Karnataka's Chief Minister's Self-Employment Program DetailsHajaratali AGNo ratings yet

- Chapter 01 Introduction To OMDocument31 pagesChapter 01 Introduction To OMmehdiNo ratings yet

- My Tax Espresso Newsletter Feb2023Document21 pagesMy Tax Espresso Newsletter Feb2023Claudine TanNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingDocument7 pagesMTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingJagannath RaoNo ratings yet

- TUTDocument2 pagesTUTNadia NatasyaNo ratings yet

- Financial Accessibility of Women Entrepreneurs: (W S R T W P W E)Document5 pagesFinancial Accessibility of Women Entrepreneurs: (W S R T W P W E)Vivi OktaviaNo ratings yet