Professional Documents

Culture Documents

5/9/12 inquiry from Rep. Rob Woodall to CDC COO Sherri Berger on my behalf re: whether CDC employee Douglas Browne signed six sworn financial reports filed by Save-A-Life Foundation with IL Attorney General

Uploaded by

Peter M. HeimlichOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5/9/12 inquiry from Rep. Rob Woodall to CDC COO Sherri Berger on my behalf re: whether CDC employee Douglas Browne signed six sworn financial reports filed by Save-A-Life Foundation with IL Attorney General

Uploaded by

Peter M. HeimlichCopyright:

Available Formats

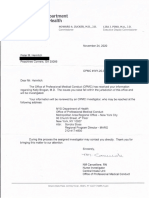

Subject: FW: Constituent Request From: "Murray, Chase" <Chase.Murray@mail.house.gov> Date: 5/10/2012 10:54 AM To : "'Peter M. Heimlich'" <pmh@medfraud.

info>

From: Murray, Chase Sent: Wednesday, May 09, 2012 5:27 PM To: 'sob8@cdc.gov' Subject: Constituent Request Ms. Berger, Attached are documents submitted to our office by Peter Heimlich, a constituent of Congressman Woodall. Mr. Heimlich has requested that our office ask on his behalf if a Mr. Douglas Browne, who works/has worked with the CDC, signed the accompanying documents. I look forward to your response, thank you for your help with this matter.

Chase Murray Legislative Assistant Congressman Rob Woodall 7th District of Georgia 202-226-2036

Attachments:

Heimlich.pdf

774 KB

forOffte?

PMT#

ffitVin^lILUN0IS

VA\Q 0^^

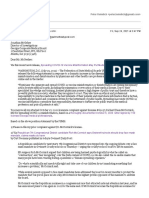

CHARITABLE ORGANIZATION ANNUAL REPORT

Attorney General LISA M A D I G A N State of Illinois Charitable Trust Bureau, 100 West Randolph CO# 3rd Floor, Chicago, Illinois 60601 Report for the Fiscal Period: Beginning^ & EndingiL

MO E Yes D No

01026498

FormAG990-1L Revised 1/03

AMT

INIT

/ 31

-L

/ 03

Check all items attached: E7J Copy of IRS Return *a*c/>*j 0 Auuited dinancial Statements ftyawsto Copy of Form IFC altX* n $15.00 Annual Report Filing Fee a w * * n $100.00 Late Report Filing Fee

MO DAY YR ,93

Federal ID # 3869459 Are contributions to the organization tax deductible?

LEGAL NAME ^ a v e ^ ^e Foundation MAIL ADDRESS "

5 0 w

DAY YR Year-end amounts

A)ASSETS A) $460309 B) $ 364,284

C

D)ate Organization if/as created: 0 2

/ uy

' Lawrence #300

B) LIABILITIES C ) N E T ASSETS

CITY, STATE Schiller Park, IL 50176 I. S U M M A R Y O FA L L R E V E N U E ITEMS D U R I N G T H E YEAR: D) PUBLIC SUPPORT. CONTRIBUTIONS & PROGRAM SERVICE REV, (GROSS AMTS.) E) GOVERNMENT GRANTS & MEMBERSHIP DUES F) OTHER REVENUES G) TOTAL REVENUE, INCOME AND CONTRIBUTIONS RECEIVED (ADD D,E. * F)

) $ 96.025

PERCENTAGE 88.B8 10.27 0,85 % % % 100% D)$

AMOUNT 324,331

E) $ 37,488 F ) $ 3,113 G)$ 364,932

II. SUMMARY OF ALL EXPENDITURES DURING THE YEAR:

H) 1) J> OPERATING CHARITABLE PROGRAM EXPENSE EDUCATION PROGRAM SERVICE EXPENSE TOTAL CHARITABLE PROGRAM SERVICE EXPENSE (ADD H & 1 1 $ 7S.77 76.77 % H ) $ 861,501

%

%

l)S

J) $ 861,501

Ji) JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J): K) GRANTS TO OTHER CHARITABLE ORGANIZATIONS L) TOTAL CHARITABLE PROGRAM SERVICE EXPENDITURE (ADD J & K ) M) MANAGEMENT AND GENERAL EXPENSE N) FUNDRAISING EXPENSE O) T O T A L E X P E N D I T U R E S THIS PERIOD ( A D D L, M, & N)

%

76.77 8.25 14.98 % % % 100%

K)$ L ) $ 861,501

M ) $

92,611 168,086 1,122,198

N)5 )$

III. SUMMARY OF ALL PAID FUNDRAISER AND CONSULTANT ACTIVITIES:

(Attach Attorney General Report ot Individual Fundraising Campaign- Form IFC. One for each PFR.) PROFESSIONAL FUNDRAISERS: P) TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS Q) TOTAL FUNDRAISERS FEES AND EXPENSES R) NET RECEIVED BY THE CHARITY (P MINUS Q=R) PROFESSIONAL FUNDRAISING CONSULTANTS: S) TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS 100% P) $ 0 Q)$ 0 R)$ 0

% %

S)$ o

IV. COMPENSATION TO THE (3) HIGHEST PAID PERSONS

T) NAME, TITLE: Carol Spizzim, CEO U) NAME TITLE: Dane Neal, National Program Coordinator

re-fT-fc W>g!g2^,yEBL'V

^ O t " 1 ATTORNt^ i f l M ^ V T)$ U) $ 71,250 49,638 40,385

,

V) NAME, TITLE: Linda Post, Accountant

VkAL

V)$

^TnUST

V. CHARITABLE PROGRAM DESCR\PT\OM:CHAHITABLE W) DESCRIPTION: Life Saving First Aid Training X) DESCRIPTION: Y) DESCRIPTION:

List on back side of instructions CODE PROGRAM (3 HIGHEST BY SEXFENIXDI CODE CATEGORIES

CHAWlABtfei

w># on

X)# Y)#

IF THE ANSWER TO ANY OF THE FOLLOWING IS YES, ATTACH A DETAILED EXPLANATION: 1. 2. WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION, FINE, PENALTY OR JUDGMENT? HAS THE ORGANIZATION OR A CURRENT DIRECTOR, TRUSTEE, OFFICER OR EMPLOYEE THEREOF, EVER BEEN CONVICTED BY ANY COURT OF ANY MIDSDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY?

0

.2. .4.

3.

DID THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER, DIRECTOR OR TRUSTEE RECEIVE ANYTHING OF VALUE NOT REPORTED AS COMPENSATION? 3. HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER, DIRECTOR OR TRUSTEE OWNS MORE THAN 10% OF THE OUTSTANDING SHARES? IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSON OR ORGANIZATION?

5.

5.

J

B E

6.

DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER? (ATTACH FORM IFC ) _ _ 6.

7a. DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION, MAILING, ADVERTISEMENT OR LITERATURE COSTS BETWEEN PROGRAM SERVICE AND FUNDRAISING EXPENSES?

B

ra

7b. IF "YES", ENTER (i) THE AGGREGATE AMOUNT OF THESE JOINT COSTS5 ;(ii) THE AMOUNT ALLOCATED TO PROGRAM SERVICES $ ; (iw) THE AMOUNT ALLOCATED TO MANAGEMENT AND GENERAL $ ; AND (iv) THE AMOUNT ALLOCATED TO FUNDRAISING $ 8. DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES? 9. HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION SUSPENDED OR REVOKED BY ANY GOVERNMENTAL AGENCY? 9.

8.

10. WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK. BRIBE, OR ANY THEFT, DEFALCATION ^ W = MISAPPROPRIATION, COMMINGLING OR MISUSE OF ORGANIZATIONAL FUNDS? 10. | I l/l 11. LIST THE NAME, ADDRESS AND THE ACCOUNT # OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITS THREE LARGEST ACCOUNTS: Bank One, NA Illinois Market, P.O. Box 260180, Baton Rouge, LA 70826-0180, i

12 NAME AND TELEPHONE NUMBER OF CONTACT PERSON: Carol Sptaiffi (B47) 92B-9693 ALL ATTACHMENTS MUST ACCOMPANY THIS REPORT - SEE INSTRUCTIONS UNDER PENALTY OF PERJURY, I (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I (WE) HAVE EXAMINED THIS ANNUAL REPORT AND THE ATTACHED DOCUMENTS, INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED ARE TRUE AND COMPLETE AND FILED WITH THE ILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE STATE OF ILLINOIS RELY THEREUPON. I HEREBY FURTHER AUTHORIZE AND AGREE TO SUBMIT MYSELF AND THE REGISTRANT HEREBY TO THE JURISDICTION OF THE STATE OF ILLINOIS. h

BE SURE TQ INCJ^UDE ALL FEES DUE: 1.') REPORTS AREDUE wfTHIN fx" " " MONTHS OF YOUR FISCAL YEAR END. 2.) FOR FEES DUE SEE INSTRUCTIONS. 3.) REPORTS THAT ARE LATE OR INCOMPLETE ARE SUBJECT TO A $100.00 PENALTY,

PRESIDENT oAVTRUSlfctt(PRINT TAME)

sh' fiGNATURE~T

f BATE'

TREASURER or TRUSTEE (PRINT NAME)

SIGNATURE

DATE

AZ-^-g E m PREPARER (PRINT NAME}

SIGNA'UKt

DATE

fprPKic*' r -.-lOnl' PMT

T ^ T ^ - p ^ ) 4 L J N O I S CHARITABLE ORGANIZATION ANNUAL REPORT PlenL )" ID / ' A t t o ttomey r n e y General L I S A M A D I G A N State o f Illinois Charitable Trust Bureau, 100 West Randolph 3rd Floor, Chicago, Illinois 60601 Report for the Fiscal Period: Beginning 01 / pi / 3P / 04

C Q

Form AG990-T] Revised I/O

&Ending___06 MO Federal ID # Yes No Are contributions to the organization tax deductible? L E G A L NAMESave A L i f e MAIL ADDRESS 9 9 5 0 CITY. STATE , . ZIP CODE

w n l

/ 04

nin^ftigs Check alf items attached: Q Copy of IRS Return M*.ch*j CS Audited Financial Statements p^wto Copy of Form IFC S 0 ' 1 O H5.00 Annual Report Filing Fe. 8 u ^</ D $100.00 Late Report Filing Fee

MO

DAY

YR

Date Organization was created: Year-end amounts

A)ASSETS A) $

Q2 /OQ / Q3

Foundation

- Lawrence S u i t e 300 _ . rark,

TT

1,403.584 333,61j_ 1,069;"973

AMOUNT

B) LIABILITIES C) N E T ASSETS

,.,,. iL bU17b

B)$ C)$

I. SUMMARY OF ALL REVENUE ITEMS DURING THE YEAR:

D) PUBLIC SUPPORT, CONTRIBUTIONS & PROGRAM SERVICE REV. {GROSS AMTS.) E) GOVERNMENT GRANTS & MEMBERSHIP DUES F) OTHER R E V E N U E S G) TOTAL REVENUE, INCOME AND CONTRIBUTIONS RECEIVED (ADD D.E. & F)

PERCENTAGE 10.04 *

QO-11 D) S E)$ F)$

115,844 ,000 (1,689! 1.154.155 151.664

:.i5'

100%

G)$

H)$

II. SUMMARY OF ALL EXPENDITURES DURING THE YEAR:

H) 0 J) OPERATING CHARITABLE PROGRAM EXPENSE EDUCATION PROGRAM SERVICE EXPENSE TOTAL CHARITABLE PROGRAM SERVICE EXPENSE (ADD H & I)

/ 84.16 %

i) $

84.16 %

J

J)$

151,664

Ji> JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J ) : K> GRANTS T O OTHER CHARITABLE ORGANIZATIONS L) T O T A L C H A R I T A B L E PROGRAM SERVICE EXPENDITURE ( A D D J & K )

K)X

^16

L)$ M)$ N)$

151.664 21.328 7.215 180.207

M) MANAGEMENT A N D GENERAL EXPENSE N) FUNDRAISING EXPENSE

11.84 % 4.00 %

100 %

O) T O T A L E X P E N D I T U R E S THIS P E R I O D ( A D D L, M, & N)

o>$

III. SUMMARY OF ALL PAID FUNDRAISER AND CONSULTANT ACTIVITIES:

(Attach Attorney General Report of Individual Fundraising Campaign- Form IFC. One for each PFR ) PROFESSIONAL FUNDRAISERS: P) TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS Q) TOTAL FUNDRAISERS FEES AND EXPENSES R) NET RECEIVED BY THE CHARITY (P MINUS Q=R) PROFESSIONAL FUNDRAISING CONSULTANTS: S) TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS

100 % % %

P) $

Q)$ R)$

arxJiaUgS

S) $

IV. COMPENSATION TO THE (3) HIGHEST PAID PERSONS DURING THE YEAR: T) NAME, TITLE: C a r o l S p i z z i r r i . U) NAME, TITLE:

Dane

CEO Coordinator

T)$

U)$

20.000 21,663

Neal.

N a t i o n a l Program Accountant

V) NAME, TITLE: Donna A c h s .

ATTORNEY GENERAL.v CHARITABLE TRUST

IF THE ANSWER TO ANY OF THE FOLLOWING IS YES, ATTACH A DETAILED EXPLANATION: 1. 2. WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION, FINE, PENALTY OR JUDGMENT? HAS THE ORGANIZATION OR A CURRENT DIRECTOR, TRUSTEE, OFFICER OR EMPLOYEE THEREOF, EVER BEEN CONVICTED BY ANY COURT OF ANY MIDSDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY?

YES

NO

2.

3.

DID THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER. DIRECTOR OR TRUSTEE RECEIVE ANYTHING OF VALUE NOT REPORTED AS COMPENSATION? 3. HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER, DIRECTOR OR TRUSTEE OWNS MORE THAN 10% OF THE OUTSTANDING SHARES? IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSON OR ORGANIZATION? DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER?( ATTACH FORM IFC )

4.

5.

5. 6.

6.

7a. DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION. MAILING. ADVERTISEMENT OR LITERATURE COSTS BETWEEN PROGRAM SERVICE AND FUNDRAISING EXPENSES?

7

7b. IF "YES". ENTER (I) THE AGGREGATE AMOUNT OF THESE JOINT COSTS $ ;(ii) THE AMOUNT ALLOCATED TO PROGRAM SERVICES $ ; (iii) THE AMOUNT ALLOCATED TO MANAGEMENT AND GENERAL $ ; AND (iv) THE AMOUNT ALLOCATED TO FUNDRAISING $ 8. DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES? HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION S U S P E N D E D OR R E V O K E D BY ANY GOVERNMENTAL AGENCY? 9. X

8.

9.

10. WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK, BRIBE, OR ANY THEFT. DEFALCATION MISAPPROPRIATION, COMMINGLING OR MISUSE OF ORGANIZATIONAL FUNDS? 10. 11. LIST THE NAME, ADDRESS AND THE ACCOUNT # OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITS THREE LARGEST ACCOUNTS:

Bank One. NA I l l i n o i s

kei

I. Box 2 6 0 1 8 0 . B a t o n R o u g e . LA 7 0 8 2 6 - 0 1 8 0

W a c h o v i a Bank N . A . , P . O . Box 5 0 0 1 5 , R o a n o k e , VA 2 4 0 4 0 - 7 3 5 0 12. NAME AND TELEPHONE NUMBER OF CONTACT PERSON: C a r o l S p i z z i r r i

ALL ATTACHMENTS MUST ACCOMPANY THIS REPORT - SEE INSTRUCTIONS UNDER PENALTY OF PERJURY. 1 (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I IWE) HAVE EXAMINED THIS ANNUAL REPORT AND THE ATTACHED DOCUMENTS. INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED A R E TRUE AND COMPLETE A N D FILED WITH THE ILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE STATE OF ILLINOIS RELY THEREUPON, t HEREBY FURTHER AUTHORIZE AND AGREE TO SUBMIT MYSELF AND THE REGISTRANT HEREBY TO THE JURISDICTION OF THE STATE OF ILLINOIS.

(847) 928-9683

BE SURE TO INCLUDE ALL FEES DUE: 1.) REPORTS ARE DUE WITHIN SIX MONTHS OF YOUR FISCAL YEAR END. 2.) FOR FEES DUE SEE INSTRUCTIONS. 3.) REPORTS THAT ARE LATE OR INCOMPLETE ARE SUBJECT TO A $100.00 PENALTY.

PRESIDENT or TRUSTEE (PRWT NAME)

TREASURER or TRUSTEE (PRINT NAM

PREPARER (PRINT NAM~

SIGNATURE

DATE

For O f f l o U i e Only

PMT#

ILLINOIS CHARITABLE ORGANIZATION ANNUAL REPORT

Attorney General U S A M A D I G A N State o f Illinois Charitable Trust Bureau, 100 West Randolph 11th Floor, Chicago, Illinois 60601 CO # 01026498 Report for the Fiscal Period:

Form AG990-IL Revised 3/05

AMT

INIT

Beginning o?

& E n d i n g . 06

MO

/ o*

/ 30

DAY

/

/ 05

Check all items attached: H Copy of IRS Return & Audited Financial Statements ay**,*, n Copy of Form IFC S^0" El $15.00 Annual Report Filing Fee Bum.uFiiim 100.00 Late Report Filing Fee

MO DAY YR

Federal ID # I Are contributions to the organization tax deductible? LEGAL NAME MAIL ADDRESS CITY, STATE ZIP CODE "950 W- Lawrnce', Sutte 30

B Yes D N O

Date Organization was created: 02

/ 09

/ 93

Save A Life Foundation

Year-end amounts

A)ASSETS B) LIABILITIES C) NET ASSETS

A)$ 1643498 B)S 669348

c

Schiller Park, IL 60176

)$

974150

AMOUNT

I. SUMMARY OF ALL REVENUE ITEMS DURING THE YEAR:

D) PUBLIC SUPPORT. CONTRIBUTIONS & PROGRAM SERVICE REV. (GROSS AMTS.] E) GOVERNMENT GRANTS & MEMBERSHIP DUES F) OTHER REVENUES G) TOTAL REVENUE, INCOME AND CONTRIBUTIONS RECEIVED (ADD D,E, & F) II. SUMMARY OF ALL EXPENDITURES DURING THE YEAR: H) I) J) OPERATING CHARITABLE PROGRAM EXPENSE EDUCATION PROGRAM SERVICE EXPENSE TOTAL CHARITABLE PROGRAM SERVICE EXPENSE (ADO H & I) $

PERCENTAGE

D ) $ 533339 E)$ 1196000

F ) $ 2801 100% G ) $ 1732140

H ) $ 1713050 l)$ J ) $ 1713050

J1) JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J): K) GRANTS TO OTHER CHARITABLE ORGANIZATIONS L) TOTAL CHARITABLE PROGRAM SERVICE E X P f D f B ( f p W E J M) MANAGEMENT AND GENERAL EXPENSE N) FUNDRAISING EXPENSE

% Q

K)$ L ) $ 1713050 M ) $ 80431

3 JAN - 2000/^2^ ' ,Mrl 9

N ) $ 34482 100%

O) TOTAL EXPENDITURES THIS PERIOD (ADO l _ W R N E Y G E N E R A L

>* 1827963

III. SUMMARY OF ALL PAID FUNDRAISER AND^C^lJl^lf^C^TviTIES:

(Attach Attorney General Report of Individual Fundraising Campaign- Form IFC. One for each PFR.; PROFESSIONAL FUNDRAISERS: P) TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS Q) TOTAL FUNDRAISERS FEES AND EXPENSES R) NET RECEIVED BY THE CHARITY (P MINUS Q=R) PROFESSIONAL FUNDRAISING CONSULTANTS: S) TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS IV. COMPENSATION TO THE (3) HIGHEST PAID PERSONS DURING THE YEAR: T) NAME, TITLE: Carol Spizzirri, President/Founder U) NAME, TITLE: Dane Neal, National Policy Director V) NAME, TITLE: Ciprina Spizzirri, National Communication Director % 100% P) $ Q)$ R)$

'H-M^U-

S)$

T)S 120000

U ) $ 54381 V ) $ 35446

List on back side of instructions V. CHARITABLE PROGRAM DESCRIPTION CCHARKABLE PROGRAM VHKHEST BY, EXPEHDEO, CODE CATEGORY* CODE W) DESCRIPTION: Life Saving First A i d Training X) DESCRIPTION: Y) DESCRIPTION: W)#0U X)# Y)#

IF THE ANSWER TO ANY OF THE FOLLOWING IS YES, ATTACH A DETAILED EXPLANATION: 1. 2. WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION, FINE, PENALTY OR JUDGMENT? HAS THE ORGANIZATION OR A CURRENT DIRECTOR, TRUSTEE, OFFICER OR EMPLOYEE THEREOF, EVER BEEN CONVICTED BY ANY COURT OF ANY MIDSDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY? 1.

YES NO

2.

3.

DID THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER, DIRECTOR OR TRUSTEE RECEIVE ANYTHING OF VALUE NOT REPORTED AS COMPENSATION?._ . _. 3. HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER, DIRECTOR OR TRUSTEE OWNS MORE THAN 10% OF THE OUTSTANDING SHARES? .4. IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSON OR ORGANIZATION? DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER?( ATTACH FORM IFC )

5.

5. 6.

6.

7a. DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION, MAILING, ADVERTISEMENT OR LITERATURE COSTS BETWEEN PROGRAM SERVICE AND FUNDRAISING EXPENSES? 7

7b. IF "YES", ENTER (i) THE AGGREGATE AMOUNT OF THESE JOINT COSTS $ ;(ii) THE AMOUNT ALLOCATED TO PROGRAM SERVICES $ ; (iii) THE AMOUNT ALLOCATED TO MANAGEMENT AND GENERAL S ; AND (iv) THE AMOUNT ALLOCATED TO FUNDRAISING $ 8. DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES? HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION SUSPENDED OR REVOKED BY ANY GOVERNMENTAL AGENCY? 9.

8.

9.

10. WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK, BRIBE, OR ANY THEFT, DEFALCATION MISAPPROPRIATION, COMMINGLING OR MISUSE OF ORGANIZATIONAL FUNDS? 10. 11. LIST THE NAME AND ADDRESS OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITS THREE LARGEST ACCOUNTS:

Bank One N.A., P.O. Box 260180, Baton Rouge, LA 70826-0180 Wachovia Bank N.A. P.O. Box 50015, Roanoke, VA 24040-7350

12. NAME AND TELEPHONE NUMBER OF CONTACT PERSON: Carol Spizzirri (847) 928-9683 ALL ATTACHMENTS MUST ACCOMPANY THIS REPORT - SEE INSTRUCTIONS UNDER PENALTY OF PERJURY, I (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I (WE) HAVE EXAMINED THIS ANNUAL REPORT AND THE ATTACHED DOCUMENTS, INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED ARE TRUE AND COMPLETE AND FILED WITH THE ILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE STATE OF ILLINOIS RELY THEREUPON. I HEREBY FURTHER AUTHORIZE AND AGREE TO SUBMIT MYSELF AND THEKEGISJRANT HEREBY TO THE JURISDICTION OF THE STATE OF ILLINOIS. rt.^) J " CCi<^ \2f3lr^ $i.a BE SURE TO INCLUDE ALL FEES DUE: 1.) REPORTS ARE DUE WITHIN SIX MONTHS OF YOUR FISCAL YEAR END. 2.) FOR FEES DUE SEE INSTRUCTIONS. 3.) REPORTS THAT ARE LATE OR INCOMPLETE ARE"SUBJECT TO A $100.00 PENALTY. Jrtuh)i>ifl<L

jjt/o lJJJt/ 0J

DATE

lETKiTiJdJlJJfliMIWJiJJH!

NAME)

SIGNATURE

T NAME) TREASURER or TRUSTEE (PRINT

SIGNATURE

(DATE

RINT NAME)

SIGNATURE

DATE

A*t**^fe~-r>i~i

FOfOfflc U n O n i

ILLINOIS CHARITABLE ORGANIZATION ANNUAL REPORT

Attorney General LISA MADIGAN State of Illinois Charitable Trust Bureau, 100 West Randolph 11th Floor, Chicago, Illinois 60601 CO l 0 1 0 2 6 4 9 8

Check ail items

Fo

G< T ?;li Kev,sed 3 05

'

attached:

Report for the Fiscal Period: Beginning^ 0 7

Federal ID #| Are contributions to the organization tax deductible?

n7

z > copy of IRS Return

*.. 5E a*** H D E! n Audited Financial Statements Copy of Form IFC $15.00 Annual Report Filing Fee $100.00 Late Report Filing Fee

MO DAY YR

0. Q 1

05

in

Ol HA yn

& Ending^ ^

0

MO

DAY

Yes No

Date Organization was created: 02

/ 09

/ 93

I.

S U M M A R Y OF A L L REVENUE ITEMS DURING THE YEAR: O) PUBLIC SUPPORT, CONTRIBUTIONS & PROGRAM SERVICE REV. (GROSS AMTS.) E) GOVERNMENT GRANTS & MEMBERSHIP DUES F)OTHER REVENUES G) TOTAL REVENUE. INCOME AND CONTRIBUTIONS RECEIVED (ADD D,E, & F)

PERCENTAGE

AMOUNT

21.30 78.59 .11

100%

D)$ 189,738 E)$ 700,000 F)$ 956 G) $ 890,694 H) $ 1,005,527

l)$

II. SUMMARY OF ALL EXPENDITURES DURING THE YEAR:

H) OPERATING CHARITABLE PROGRAM EXPENSE I) J) EDUCATION PROGRAM SERVICE EXPENSE TOTAL CHARITABLE PROGRAM SERVICE EXPENSE (ADD H 4 I) $_

94.75

<%

94.75

j ) $ 1,005,527

Ji) JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J): K) GRANTS TO OTHER CHARITABLE ORGANIZATIONS L) TOTAL CHARITABLE PROGRAM SERVICE EXPENDITURE (ADD J & K) M) MANAGEMENT AND GENERAL EXPENSE N) FUNDRAISING EXPENSE O) TOTAL EXPENDITURES THIS PERIOD (ADD L, M, & N)

% 5.25 % %

100%

K)$ L)S

M)S 55,716

N)$ 0 0)$ 1,061,243

III. SUMMARY OF ALL PAID FUNDRAISER AND CONSULTANT ACTIVITIES:

(Attach Attorney General Report of Individual Fundraising Campaign- Form IFC. One for each PFR.) PROFESSIONAL FUNDRAISERS: P) TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS Q) TOTAL FUNDRAISERS FEES AND EXPENSES R) NET RECEIVED BY THE CHARITY (P MINUS Q=R) PROFESSIONAL FUNDRAISWO CONSW.TANTS: S) TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS 100% P)$

Q)$

% %

R)$ S)$

IV. COMPENSATION TO THE (3) HIGHEST PAID PERSONS DURING THE YEAR: T) NAME, TITLE: Carol Spizzirri, President/Founder U) NAME, TITLE: Dane Neal, National Policy Director V) NAME. TITLE: Robert Barnes, Director

m$MMiM*h^m<i

T ) $ 130,000

U) $ 63,500 V) S 55,000

. p s t o n ^ s ^ i n ^ o n s V . C H A R I T A B L E P R O G R A M DESCR\PT\ON:cHARmBLE PROGRAM (JH/GHEST BY $ EXPENDED, ooKCATEGomes W) DESCRIPTION: Life Saving First A i d Training X) DESCRIPTION: Y) DESCRIPTION:

W)# 0J1

X)d Y)#

IF THE ANSWER TO ANY OF THE FOLLOWING IS YES, ATTACH A DETAILED EXPLANATION: 1. 2. WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION. FINE. PENALTY OR JUDGMENT? HAS THE ORGANIZATION OR A CURRENT DIRECTOR. TRUSTEE, OFFICER OR EMPLOYEE THEREOF. EVER BEEN CONVICTED BY ANY COURT OF ANY MIDSDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY?

YES NO

2.

3.

DID THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS. DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER, DIRECTOR OR TRUSTEE RECEIVE ANYTHING OF VALUE NOT REPORTED AS COMPENSATION? 3. HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER. DIRECTOR OR TRUSTEE OWNS MORE THAN 10% OF THE OUTSTANDING SHARES? IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSON OR ORGANIZATION? DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER?{ATTACH FORM IFC )_

.4.

5.

. 5. 6.

6.

7a. DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION, MAILING, ADVERTISEMENT OR LITERATURE COSTS BETWEEN PROGRAM SERVICE AND FUNDRAISING EXPENSES?

7.

7b. IF "YES". ENTER (i) THE AGGREGATE AMOUNT OF THESE JOINT COSTS $ :() THE AMOUNT ALLOCATED TO PROGRAM SERVICES $ ; (iii) THE AMOUNT ALLOCATED TO MANAGEMENT AND GENERAL $ ; AND (iv) THE AMOUNT ALLOCATED TO FUNDRAISING 8. DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES? HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION SUSPENDED OR REVOKED BY ANY GOVERNMENTAL AGENCY? 9.

8.

9.

10. WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK. BRIBE, OR ANY THEFT, DEFALCATION MISAPPROPRIATION, COMMINGLING OR MISUSE OF ORGANIZATIONAL FUNDS? 10. 11. LIST THE NAME AND ADDRESS OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITS THREE LARGEST ACCOUNTS:

Bank One N.A., P.O. Box 2601SO, Baton Rouge, LA 70826-0180 TCF National Bank, 500 W, Joliet Rd., Willowbrook, IL 60527

12. NAME AND TELEPHONE NUMBER OF CONTACT PERSON: Carol Spizzirri (847) 928-9683

ALL ATTACHMENTS MUST ACCOMPANY THIS REPORT SEE INSTRUCTIONS UNDER PENALTY OF PERJURY, I (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I (WE) HAVE EXAMINED THIS ANNUAL REPORT AND THE ATTACHED DOCUMENTS. INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED ARE TRUE AND COMPLETE AND FILED WITH THE ILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE STATE OF ILLINOIS RELY THEREUPON. I HEREBY FURTHER AUTHORIZE AND AGREE TO SUBMIT MYSELF AND THE REGISTRANT HEREBY TO THE JURISDICTION OF THE STATE OF ILLINOIS.

i*.e\

PRESIDENT or TRUSTEE (PRINT NAME)

MONTHS OF YOUR FISCAL YEAR END. 2.) FOR FEES DUE SEE INSTRUCTIONS. 3.) REPORTS THAT ARE LATE OR INCOMPLETE ARE SUBJECT TO A $100.00 PENALTY.

,\st>l*A* TREASURER or TRUSTEE (PRINT NAME)

PREPARER (PRINT NAME)

SIGNATURE

DATE

For Office Use Only

Illinois Charitable Organization Annual Report

Attorney Genera! Lisa Madigan State of Illinois Charitable Trust Bureau, 100 West Randolph 11th Floor, Chicago, Illinois 60601

Report for the Fiscal Period: Beginning 7/01/06 &Endinq~67T0/07

MO DAY YR

Form AG990-IL Revised 3/05 ID-I U

CO#

Check all items

01026498

attached:

KhkeCheett

Copy of IRS Return Audited Financial Statements Copy of Form IFC 515.00 An rti/al Report Filing Fee 5100.00 Late Report Filing Fee

Federal ID # Are contributions to the organization tax deductible? |X| Yes | ~ | No Year-end amounts A ASSETS LIABILITIES NET ASSETS

Date Organization was created:

LEGAL

N * SAVE A LIFE FOUNDATION

ADDRESS 9950 LAWRENCE # 3 0 0 -

R E C E I V E D

O

J

2/09/1993 A$ B$

MO

DAY

YR

449,823. 191,214. 258,608.

AMOUNT

CITY, STATE

I

ZIP CODE SCHILLER PARK, IL 60176

MAY l 6 2008

B C

c$

Attorney General

SUMMARY OF A L L REVENUE ITEMS DURING THE Y ^ R 1 - * 1 ' ^ D PUBLIC SUPPORT, CONTRIBUTIONS AND PROGRAM SERVICE REVENUE ^

PERCENTAGE

22.81%

75.63%

D$ E$ F$ G$ H$ 1$ J$

211,116.

700,000.

F OTHERREVENUES

G II

See..Statement.1

1.56% 100% 90.46%

%

TOTAL REVENUE, INCOME AND CONTRIBUTIONS RECEIVED (ADD D, E, AND F) S U M M A R Y OF A L L EXPENDITURES DURING THE YEAR:

14,429. 925,545. 1,330,239. 1,330,239.

90.46%

J l JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J) $

1

K$

L$ M$

%

L TOTAL CHARD"ABLE PROGRAM SERVICE EXPENDrTURE (ADD J AND K)

90.46%

9.54%

1,330,239. 140,299. 1,470,538.

N O III

FUNDRAISING EXPENSE TOTAL EXPENDITURES THIS PERIOD (ADD L, M, AND N) S U M M A R Y OF A L L PAID FUNDRAISER A N D CONSULTANT ACTIVITIES: (Attach Attorney General Report of Individual Fundraising Campaign - Form IFC. One for eacJh PFR.) PROFESSIONAL FUNDRAISERS:

100%

N$ 0$

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^H

P Q R

TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS TOTAL FUNDRAISERS FEES AND EXPENSES NET RECEIVED BY THE CHARITY (P MINUS Q=R) PROFESSIONAL FUNDRAISING CONSULTANTS:

100%

% %

P$ Q$ R$ S$

S IV T

TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS C O M P E N S A T I O N T O T H E (3) HIGHEST PAID P E R S O N S D U R I N G T H E Y E A R : NAME. TITLE: CAROL S P I Z Z I R R I , PRESIDENT/FOUND

Hl^H^H

T$

130,000.

63,520.

U NAME, TITLE: DANE NEAL, DIRECTOR V NAME, TITLE: VINCENT DAVIS, DIRECTOR

V C H A R I T A B L E P R O G R A M D E S C R I P T I O N : CHARITABLE PROGRAM (3 HIGHEST BY $ EXPENDED) CODE CA TEGORIES

u$ v$

W# X# Y#

ILVA0212L 0/V16TO

50,000. See instructions for list CODE

W DESCRIPTION: LIFE SAVING FIRST AID TRAINING

X Y DESCRIPTION: DESCRIPTION:

011

SAVE A LIFE FOUNDATION

IF THE ANSWER TO ANY OF THE FOLLOWING IS YES, ATTACH A DETAILED EXPLANATION: 1 2 WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION, FINE, PENALTY OR JUDGMENT? HAS THE ORGANIZATION OR A CURRENT DIRECTOR, TRUSTEE, OFFICER OR EMPLOYEE THEREOF, EVER BEEN CONVICTED BY ANY COURT OF ANY MISDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY?, DID THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER, DIRECTOR OR TRUSTEE RECEIVE ANYTHING OF VALUE NOT REPORTED AS COMPENSATION? HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER, DIRECTOR OR TRUSTEE OWNS MORE THAN 10% OF THE OUTSTANDING SHARES? IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSON OR ORGANIZATION? DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER? (ATTACH FORM IFC ) 1

Page 2

YES NO

X

I X

3 4 5 6

4 5 6

_x_

X

7a DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION, MAILING, ADVERTISEMENT OR LITERATURE COSTS BETWEEN PROGRAM SERVICE AND FUNDRAISING EXPENSES? 7b IF 'YES', ENTER (.) THE AGGREGATE AMOUNT OF THESE JOINT COSTS $ ; (ii) THE AMOUNT ALLOCATED TO PROGRAM SERVICES $ ; (ii) THE AMOUNT ALLOCATED TO MANAGEMENT AND GENERAL $ ; AND (iv) THE AMOUNT ALLOCATED TO FUNDRAISING $ 8 9 10 11 DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES? HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION SUSPENDED OR REVOKED BY ANY GOVERNMENTAL AGENCY? WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK, BRIBE, OR ANY THEFT, DEFALCATION MISAPPROPRIATION, COMMINGLING OR MISUSE OF ORGANIZATIONAL FUNDS?.

8 9 10

LIST THE NAME AND ADDRESS OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITS THREE LARGEST ACCOUNTS:

See Statement 2

ALL ATTACHMENTS MUST ACCOMPANY THIS REPORT - SEE INSTRUCTIONS UNDER PENALTY OF PERJURY, I (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I (WE) HAVE EXAMINED THIS ANNUAL REPORT AND THE ATTACHED DOCUMENTS, INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED ARE TRUE AND COMPLETE AND FILED WITH THE ILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE STATE OF ILLINOIS RELY THEREUPON. I HEREBY- FURTHER AUTHORIZE AND AGREE TO SUBMIT MYSELF AND THE REGISTRANT HEREBY TO THE JURISDICTION OF THE STA

BE SURE TO INCLUDE ALL FEES DUE: 1 2 3 REPORTS ARE DUE WITHIN SIX MONTHS OF YOUR FISCAL YEAR END. FOR FEES DUE SEE INSTRUCTIONS. REPORTS THAT ARE LATE OR INCOMPLETE ARE SUBJECT TO A $100.00 PENALTY.

PREPARE R (Pfiiw NAME)

SIGNAT

CBIZ ACCTG., TAX & ADVISORY SERVICES, LL One South Wacker Dr., Ste 1800 Chicago, IL 60606-4630

1LVA0212L 08/16/05

ILLINOIS CHARITABLE ORGANIZATION ANNUAL REPORT

Attorney General L I S A M A D I G A N State of Illinois

Chantabie Trust Bureau, 100 West Randolph 11th Floor, Chicago, Illinois 60601

R p n n f t w ^ c i o ^ i B ^ r (T

Fom)AG990-IL Revised 3/05

r\\**j>ixr>& CO# (J \Q Q.&Lf\)/)

Check aft ttmma attached:

Report for the Frscal Penod: f joggf ms R*m B eoinninn it , 1 , i * " *#om** u Audited Financial Statements Beginning^ eeainnma * / -j , \W>_ j ^ %* $15.00 C o p y of FormReport IFC Filing Fee S X " a Annuaf & Ending,^ / ? P J > ( * ? < BUWF** n $100.00Late ReportFiBngFee

fd era l( D# _ a contributions to the organization tax deductible? LEGAL NAME

MAIL

fl

MO

"DAY -WI

MO Date Organization W ^ create*

OAY

f j Y i N

**

^L

SAVE A LIFE FOUNDATION ^ f a c p C I U C n Attorney G e n e r a l Of i7479 W Dartmqor IL Dr 60030

A.DDRESS rv, STATE ZIP CODE

JUN 1 0 2010

Grayslake,

Charitable Trust

SUMMARY OF ALL REVENUE HEMS DURING THE YEAR D) PUBLIC SUPPORT. CONTRIBUTIONSftPROGRAM SERVICE REV. (GROSS AMTS.)) E) GOVERNMENT GRANTS 4 MEMBERSHIP nuES F , OTHER REVENUES G) TOTAL REVENUE, INCOME AND CONTRIBUTIONS RECEIVED (ADD D,E, & F) SUMMARY OF ALL EXPENDITURES DURING THE YEAR: H) I) J) OPERATING CHARITABLE PROGRAM EXPENSE EDUCATION PROGRAM SERVICE EXPENSE TOTAL CHARITABLE PROGRAM SERVICE EXPENSE (ADD H At )

J i ) JOINT COSTS ALLOCATED TO PROGRAM SERVICES (INCLUDED IN J): K) GRANTS TO OTHER CHARITABLE ORGANIZATIONS L! TOTAL CHARITABLE PROGRAM SERVICE EXPENDITURE {ADD J 4 K) GENERAL EXPENSE

M) MANAGEMENT AND

ti] FUNDRAISING EXPENSE O I TOTAL EXPENDITURES THIS PERIOD (ADD L, M, N) SUMMARY OF ALL PAID FUNDRAISER AND CONSULTANT ACTIVITIES: mttBCh Afioffny G9frai Report of hdivfcJuai Fundrsisrng Campaign- For* 1FC. Owfor each PFR. PROFESSIONAL FUNDRAISERS: P) TOTAL AMOUNT RAISED BY PAID PROFESSIONAL FUNDRAISERS G} TOTAL FUNDRAISERS FEES ANO EXPENSES *) NET 4eCElVED BY THE CHARITY {P MINUS Q=R) PROFESSIONAL FUNDRAISING CONSULTANTS; 3) TOTAL AMOUNT PAID TO PROFESSIONAL FUNDRAISING CONSULTANTS :OMPENSAT)ON TO THE (3) HIGHEST PAID PERSONS DURING THE YEAR; r; NAME. TITLE

1) N A M E , T I T L 6

'**

') NAME, TITLE W R I T A B L E PROGRAM D E S C R I P T 1 0 N : w m o * p B W Br t Exp&aeo) cooe CA TEGORES List on b a i * side of Instructions CODE

ANSWER TO ANY OF THE FOLLOWING 13 YES, An/SnTDErwiiD^PLAKATlON:

WAS THE ORGANIZATION THE SUBJECT OF ANY COURT ACTION. FINE. PENALTY OR JUDGMENT? I, HAS THE ORGANIZATION OR A CURRENT DIRECTOR. TRUSTEE, OFFICER OR EMPLOYEE THEREOF EVER BEEN CONVICTED BY ANY COURT OF ANY MIDSDEMEANOR INVOLVING THE MISUSE OR MISAPPROPRIATION OF FUNDS OR ANY FELONY?

YES/W

2.

).

D10 THE ORGANIZATION MAKE A GRANT AWARD OR CONTRIBUTION TO ANY ORGANIZATION IN WHICH ANY OF ITS OFFICERS DIRECTORS OR TRUSTEES OWNS AN INTEREST; OR WAS IT A PARTY TO ANY TRANSACTION IN WHICH ANY OF ITS OFFICERS, DIRECTORS OR TRUSTEES HAS A MATERIAL FINANCIAL INTEREST; OR DID ANY OFFICER, DIRECTOR OR TRUSTEE RECEIVE ANYTHING OF VALUE NOT REPORTED AS COMPENSATION? 3 1 HAS THE ORGANIZATION INVESTED IN ANY CORPORATE STOCK IN WHICH ANY OFFICER, DIRECTOR OR TRUSTEE OWNS MORE THAN 10% OF THE OUTSTANDING SHARES? IS ANY PROPERTY OF THE ORGANIZATION HELD IN THE NAME OF OR COMMINGLED WITH THE PROPERTY OF ANY OTHER PERSONOR ORGANIZATION? DID THE ORGANIZATION USE THE SERVICES OF A PROFESSIONAL FUNDRAISER?(ATTACH FORM IFC) DID THE ORGANIZATION ALLOCATE THE COST OF ANY SOLICITATION, MAILING. ADVERTISEMENT OR LITERATURE COSTS BETWEEN PROGRAM SERVICE AND FUNDRAlSlNG EXPENSES?

4.

5. 6.

7.

IF T c S " , ENTER <i) THE AGGREGATE AMOUNT OF THESE JOINT COSTS | ;(B) THE AMOUNT ALLOCATED TO PROGRAM SERVICES $ : (Hi) THE AMOUNT ALLOCATED TO MANAGEMENT AND GENERAL S ; AND (iv THE AMOUNT ALLOCATED TO FUNDRAISiNG DID THE ORGANIZATION EXPEND ITS RESTRICTED FUNDS FOR PURPOSES OTHER THAN RESTRICTED PURPOSES? HAS THE ORGANIZATION EVER BEEN REFUSED REGISTRATION OR HAD ITS REGISTRATION OR TAX EXEMPTION SUSPENDED OR REVOKED BY ANY GOVERNMENTAL AGENCY? 9.

fi

WAS THERE OR DO YOU HAVE ANY KNOWLEDGE OF ANY KICKBACK, BRIBE, OR ANY THEFT. DEFALCATION MISAPPROPRIATION. COMMINGLING OR MISUSE OF ORGANiZATiONAL FUNDS? 10. LIST THE NAME AND ADDRESS OF THE FINANCIAL INSTITUTIONS WHERE THE ORGANIZATION MAINTAINS ITS THREE LARGEST ACCOUNTS:

NAME AND TELEPHONE NUMBER OF CONTACT PERSON: ATTACHMENTS MUST ACCOMPANY THIS REPORT - SEE INSTRUCTIONS : PENALLY OF PERJURY. I (WE) THE UNDERSIGNED DECLARE AND CERTIFY THAT I (WE) HAVE EXAMINED THIS ANNUAL REPORT HE ATTACHED DOCUMENTS, INCLUDING ALL THE SCHEDULES AND STATEMENTS AND THE FACTS THEREIN STATED ARE \HD COMPLETE AND FILED WITH THE ILLINOIS ATTORNEY GENERAL FOR THE PURPOSE OF HAVING THE PEOPLE OF THE

OF ILLINOIS: R Pl' Y T H E R E U P O N I HEREBY FURTHER AUTHORIZE AMD A fi R FF TO SUBMIT MYSFI F AMD T MF RERIOTRAMT

Y TO TH ^RM r fiTOT*N&AT E OF ILLINOIS

"= u *

MI3CLr

*""

m e W

"

w n

tifwaul

? TO iMCLUPeALL FEES PU.fr RTSAKE DUE WITHIN SIXTHS drfYOUR FISCAL Y&l&SND. *Pl_ET ARE SUBJECT TO A

CAROL SPI2ZXRRI RESIDENT or TRUSTEE PRINT NAME)

TRJASURER or TRUSTEE (PRINT NAME)

afr/jtef

SIGNATURE

You might also like

- 1/10/23 Letter From "Carrie Lynn Beneficiary" (Presumably Dr. Carrie Lynn Madej) To TN Attorney Dail R. CantrellDocument1 page1/10/23 Letter From "Carrie Lynn Beneficiary" (Presumably Dr. Carrie Lynn Madej) To TN Attorney Dail R. CantrellPeter M. HeimlichNo ratings yet

- Bennun v. Carrie Lynn Madej, Process Serve Report by Gravitas Investigations (Kings Mills, OH), March 2023Document3 pagesBennun v. Carrie Lynn Madej, Process Serve Report by Gravitas Investigations (Kings Mills, OH), March 2023Peter M. HeimlichNo ratings yet

- Three Years After My Complaint, Kelly Fink Brogan MD Surrenders Her New York State Medical LicenseDocument16 pagesThree Years After My Complaint, Kelly Fink Brogan MD Surrenders Her New York State Medical LicensePeter M. HeimlichNo ratings yet

- Thank-You Letter To Me From Director of NYS Office of Medical Conduct For Filing Licensure Complaint Against Kelly Fink Brogan MD (3/8/24)Document1 pageThank-You Letter To Me From Director of NYS Office of Medical Conduct For Filing Licensure Complaint Against Kelly Fink Brogan MD (3/8/24)Peter M. HeimlichNo ratings yet

- Licensure Details For Carrie Lynn Madej, Georgia Composite Medical Board (4/18/23)Document3 pagesLicensure Details For Carrie Lynn Madej, Georgia Composite Medical Board (4/18/23)Peter M. HeimlichNo ratings yet

- Bennun v. Carrie Lynn Madej, Complaint & Jury Demand, Filed 2/27/23, TN Ninth Judicial District Circuit CourtDocument26 pagesBennun v. Carrie Lynn Madej, Complaint & Jury Demand, Filed 2/27/23, TN Ninth Judicial District Circuit CourtPeter M. HeimlichNo ratings yet

- Paul Vallas's Role in The $9M Save-A-Life Foundation (SALF) ScamDocument82 pagesPaul Vallas's Role in The $9M Save-A-Life Foundation (SALF) ScamPeter M. HeimlichNo ratings yet

- US Patent No. 6,725,863 B2 To Louis M. Karpel For A "Choking Assistance Device" Later Marketed As The "Heimlich Helper" (4/27/04)Document7 pagesUS Patent No. 6,725,863 B2 To Louis M. Karpel For A "Choking Assistance Device" Later Marketed As The "Heimlich Helper" (4/27/04)Peter M. HeimlichNo ratings yet

- COVID-19 Quack Carrie Lynn Madej MD Voluntarily Surrenders Her Georgia Medical License GA (1/6/23)Document1 pageCOVID-19 Quack Carrie Lynn Madej MD Voluntarily Surrenders Her Georgia Medical License GA (1/6/23)Peter M. HeimlichNo ratings yet

- My Complaints Against Indiegogo Hosting Lifewand "Anti-Choking Device" Crowdfunding Filed With FTC & Attorneys General of CA, NY & GADocument19 pagesMy Complaints Against Indiegogo Hosting Lifewand "Anti-Choking Device" Crowdfunding Filed With FTC & Attorneys General of CA, NY & GAPeter M. HeimlichNo ratings yet

- Correspondence Between My Friend, The Late Gordon T. "Gordy" Pratt, and Chicago Tribune Reporter Lisa Black and Editor Peter Hernon (Sept/Oct 2009)Document8 pagesCorrespondence Between My Friend, The Late Gordon T. "Gordy" Pratt, and Chicago Tribune Reporter Lisa Black and Editor Peter Hernon (Sept/Oct 2009)Peter M. HeimlichNo ratings yet

- Kelly Brogan v. Sayer Ji 2022 Divorce Proceedings (Ongoing) - Key Court Records To DateDocument57 pagesKelly Brogan v. Sayer Ji 2022 Divorce Proceedings (Ongoing) - Key Court Records To DatePeter M. HeimlichNo ratings yet

- 10/19/22 Conviction Order, Commonwealth of VA vs. James "Jimmy" Moore, Cases Nos. CR22-1293 Through 1299-00FDocument2 pages10/19/22 Conviction Order, Commonwealth of VA vs. James "Jimmy" Moore, Cases Nos. CR22-1293 Through 1299-00FPeter M. HeimlichNo ratings yet

- New York State Confirms They Are Investigating COVID-19 Quack Kelly Brogan MD Based On My Complaint (11/20/20)Document1 pageNew York State Confirms They Are Investigating COVID-19 Quack Kelly Brogan MD Based On My Complaint (11/20/20)Peter M. HeimlichNo ratings yet

- My 11/12/21 Licensure Complaint Against COVID-19 Quack Dr. Carrie Madej (Canton, GA)Document2 pagesMy 11/12/21 Licensure Complaint Against COVID-19 Quack Dr. Carrie Madej (Canton, GA)Peter M. HeimlichNo ratings yet

- 8/22/22 FOIA Response From IL Attorney General Confirming Their Investigation of The Save-A-Life Foundation Investigation: Is "Ongoing"Document2 pages8/22/22 FOIA Response From IL Attorney General Confirming Their Investigation of The Save-A-Life Foundation Investigation: Is "Ongoing"Peter M. HeimlichNo ratings yet

- My Inquiry Re: Delaware Solar Farm Named After My Notorious, Destructive Father (1/24/22)Document2 pagesMy Inquiry Re: Delaware Solar Farm Named After My Notorious, Destructive Father (1/24/22)Peter M. HeimlichNo ratings yet

- TX Medical Board Website Profile For Vaccine Skeptic Peter A. McCullough MD MPHDocument5 pagesTX Medical Board Website Profile For Vaccine Skeptic Peter A. McCullough MD MPHPeter M. HeimlichNo ratings yet

- Psihountas V Jewish Hospital Et Al Complete FileDocument102 pagesPsihountas V Jewish Hospital Et Al Complete FilePeter M. HeimlichNo ratings yet

- All IL Corporate Filings by The Save-A-Life Foundation (SALF) Including 9/17/09 Dissolution (1993-2009)Document48 pagesAll IL Corporate Filings by The Save-A-Life Foundation (SALF) Including 9/17/09 Dissolution (1993-2009)Peter M. HeimlichNo ratings yet

- 4/11/07 Joint Statement Re: Choking Rescue Recommendations Issued by The American Red Cross & The American Heart AssociationDocument1 page4/11/07 Joint Statement Re: Choking Rescue Recommendations Issued by The American Red Cross & The American Heart AssociationPeter M. HeimlichNo ratings yet

- My 9/24/21 Licensure Complaint Against Richard D. McCormick MD For Spreading COVID-19 MisinformationDocument5 pagesMy 9/24/21 Licensure Complaint Against Richard D. McCormick MD For Spreading COVID-19 MisinformationPeter M. HeimlichNo ratings yet

- Palm Beach County, FL, Police Felony Drug Arrest of Judith (Judi) Ann McGaffey (6/23/11)Document4 pagesPalm Beach County, FL, Police Felony Drug Arrest of Judith (Judi) Ann McGaffey (6/23/11)Peter M. HeimlichNo ratings yet

- My Correspondence With CDC COO Robin Bailey Re: My Complaint Against CDC FOIA Director Roger Andoh (Oct/Nov 2021)Document10 pagesMy Correspondence With CDC COO Robin Bailey Re: My Complaint Against CDC FOIA Director Roger Andoh (Oct/Nov 2021)Peter M. HeimlichNo ratings yet

- 11/22/74 Letter From My Father: " (The) Media Has Labeled (My Procedure) The "Heimlich Maneuver"Document2 pages11/22/74 Letter From My Father: " (The) Media Has Labeled (My Procedure) The "Heimlich Maneuver"Peter M. HeimlichNo ratings yet

- Rebecca Simpson v. Phil Heimlich 9/8/21 Divorce Complaint and 11/29/21 Final DecreeDocument39 pagesRebecca Simpson v. Phil Heimlich 9/8/21 Divorce Complaint and 11/29/21 Final DecreePeter M. HeimlichNo ratings yet

- Emma Floyd - : CoogleDocument59 pagesEmma Floyd - : CooglePeter M. HeimlichNo ratings yet

- 3/23/21 Letter of Order From GA Ethics Commission Re: Six Alleged Campaign Finance Violations by Angela Mayfield, Failed Dem. Candidate For GA HouseDocument4 pages3/23/21 Letter of Order From GA Ethics Commission Re: Six Alleged Campaign Finance Violations by Angela Mayfield, Failed Dem. Candidate For GA HousePeter M. HeimlichNo ratings yet

- ... While Holly Did Sustain Four Fractured Ribs and A Swollen Spleen As A Result of The Final Common As A Result of Using The Heimlich ManeuverDocument3 pages... While Holly Did Sustain Four Fractured Ribs and A Swollen Spleen As A Result of The Final Common As A Result of Using The Heimlich ManeuverPeter M. HeimlichNo ratings yet

- People v. Clarence Lee Scott, Court of Appeals of California, Fifth District. Opinion (3/3/11)Document8 pagesPeople v. Clarence Lee Scott, Court of Appeals of California, Fifth District. Opinion (3/3/11)Peter M. HeimlichNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Taxability of AOP BOI Local Govt. Trust by CA. Anil Sathe 1 PDFDocument47 pagesTaxability of AOP BOI Local Govt. Trust by CA. Anil Sathe 1 PDFBhanuNo ratings yet

- Vanguard Charitable Endowment Foundation Form 990 (2010)Document121 pagesVanguard Charitable Endowment Foundation Form 990 (2010)bangpoundNo ratings yet

- Income Tax Provisions Related To Charitable Trust in Brief: Income From Business Which Is Not IncidentalDocument5 pagesIncome Tax Provisions Related To Charitable Trust in Brief: Income From Business Which Is Not IncidentalAnkur MittalNo ratings yet

- PEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)Document13 pagesPEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)lbaker2009No ratings yet

- In The Court of The Civil Judge, S. D. Pune Regular Civil Suit No. of 2013Document20 pagesIn The Court of The Civil Judge, S. D. Pune Regular Civil Suit No. of 2013Anand KirtiNo ratings yet

- Endowments ProjectDocument30 pagesEndowments ProjectTasaduqNo ratings yet

- Indirect TaxDocument10 pagesIndirect TaxAishwarya TiwariNo ratings yet

- CHARITABLE TRUST DT CONCEPT BOOK (FINAL) Nov 2023Document11 pagesCHARITABLE TRUST DT CONCEPT BOOK (FINAL) Nov 2023Apurva MehtaNo ratings yet

- Shri Gaurang Radha Krishna Brochure PDFDocument8 pagesShri Gaurang Radha Krishna Brochure PDFSHASHIKANT GANPAT TARINo ratings yet

- Charitable Trusts – Exemption Under Section 11 of Income Tax Act, 1961Document6 pagesCharitable Trusts – Exemption Under Section 11 of Income Tax Act, 1961avinashkives21No ratings yet

- Non Individual REKYCDocument15 pagesNon Individual REKYCDeepankar SinghNo ratings yet

- Charitable Remainder TrustDocument4 pagesCharitable Remainder Trustapi-246909910100% (1)

- Taxation OF: Charitable TrustsDocument22 pagesTaxation OF: Charitable TrustsVicky DNo ratings yet

- 2017 NoVo 990Document216 pages2017 NoVo 990Noam BlumNo ratings yet

- F Trust Primer 1Document28 pagesF Trust Primer 1albtrosNo ratings yet

- Suggested Answer - Syl12 - June2017 - Paper - 7 Intermediate ExaminationDocument16 pagesSuggested Answer - Syl12 - June2017 - Paper - 7 Intermediate ExaminationShivam MittalNo ratings yet

- Ohio Charitable Trust Act Information SheetDocument1 pageOhio Charitable Trust Act Information SheetMary GallagherNo ratings yet

- HDFC MarketingDocument85 pagesHDFC MarketingDeeptimaan Dutta100% (2)

- Charitable TrustDocument2 pagesCharitable TrustvipingplNo ratings yet

- LACMA 990 Tax Form 2011Document79 pagesLACMA 990 Tax Form 2011Shane FerroNo ratings yet

- Picower Foundation - 2001 Tax ReturnDocument48 pagesPicower Foundation - 2001 Tax ReturnMain JusticeNo ratings yet

- 12A & 80G ProcedureDocument4 pages12A & 80G ProcedurekshripalNo ratings yet

- Chick-Fil-A 2009 Tax RecordsDocument57 pagesChick-Fil-A 2009 Tax RecordsSergio Nahuel CandidoNo ratings yet

- Who Can Be Trustee in Charitable Remainder TrustDocument12 pagesWho Can Be Trustee in Charitable Remainder Trustshahid jamal tubrazyNo ratings yet

- Hindu Religious and Charitable EndowmentDocument23 pagesHindu Religious and Charitable EndowmentArunaML75% (12)

- DT CASE STUDY SERIES FOR FINAL STUDENTs - SET 4Document8 pagesDT CASE STUDY SERIES FOR FINAL STUDENTs - SET 4tusharjaipur7No ratings yet

- CRI Healthcare Procedure Manual 240218Document40 pagesCRI Healthcare Procedure Manual 240218Poornima DeviNo ratings yet

- BBLocks FullDocument61 pagesBBLocks FullTinaStiffNo ratings yet

- TrustsDocument11 pagesTrustsNavin BhutadaNo ratings yet

- Stewardship Plan ExamplesDocument105 pagesStewardship Plan ExamplesawallenNo ratings yet