Professional Documents

Culture Documents

Ford Motor Company Data Reveals Mount Profit

Uploaded by

VJLaxmananCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ford Motor Company Data Reveals Mount Profit

Uploaded by

VJLaxmananCopyright:

Available Formats

Mount Profit

Revealed by Ford Motor Company Profits-Revenues Data (1990-2011)

10 8

Profits, y [$, billions]

6 4 2 0 -2 -4 -6

-8

-10 0 20 40 60 80 100 120 140 160 180 200

Revenues, x [$, billions]

Figure 1: Mount Profit revealed by the graph of profits-revenues data for Ford Motor Company for the years 1990-2011. The diamonds are the actual data points and the dashed curve has been superimposed to reveal the trend. The data has been compiled by Glenn Mercer in Ford, 1993-2007, Losing its way? See http://www.glennmercer.com/MercerFordChapter.pdf Table 10.1 in the Appendix. We can think of money in economics as being just like energy in physics. The power-exponential law, see equation 1 below, with x being revenues and y being profits, may thus be thought of as a generalization of Plancks blackbody radiation

Page 1 of 6

law and can be extended from physics to economics with a reinterpretation of the meaning of the various mathematical symbols. y = mxn [ e-ax/(1 + be-ax) ] + c (1)

The existence of a maximum point on the profits-revenue graph of a company was therefore predicted, theoretically, in recent articles by the present author, after the analysis of the financial data for several companies which were shown to agree with several other predictions made on the basis of equation 1; see the links given below for further discussion on this topic. The actual existence of the maximum point is now confirmed eloquently by the graph of the profits-revenues data for Ford Motor Company, for years 1990-2011. The raw data used to prepare this plot may be found in Glenn Mercers analysis, reference cited above.

8 7 6

Linear law y = hx + c

Mount Profit

Power-law y = mxn

Profits, y

5 4 3 2 1 0 0 5 10 15 20 25

Power-exponential law y= mxnexp(-ax) Maximum point

30 35

Revenues, x Our First Glimpse of Mount Profit

Page 2 of 6

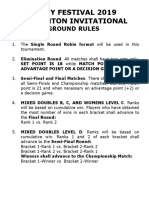

Table 1: Profits-Revenues data for Ford (1990-2011)

Year Revenues, x $, billions Profits, y $, billions Profit Margin, y/x

98 0.9 0.0092 1990 89 -2.2 -0.0247 1991 101 -0.1 -0.0010 1992 109 2.5 0.0229 1993 129 5.3 0.0411 1994 138 4.1 0.0297 1995 148 4.4 0.0297 1996 155 6.9 0.0445 1997 146 6 0.0411 1998 162 6.5 0.0401 1999 172 5.4 0.0314 2000 163 -5.4 -0.0331 2001 163 0.3 0.0018 2002 165 0.9 0.0055 2003 172 3.6 0.0209 2004 178 2.2 0.0124 2005 -0.0778 2006 162 -12.6 172.5 -2.7 -0.0157 2007 -0.1005 2008 146.3 -14.7 116.28 2.72 0.0234 2009 128.95 6.56 0.0509 2010 0.1483 2011 136.26 20.21 Three data points highlighted here for 2006, 2008, and 2011 are NOT included in the graph since these obviously represent extremes. The data for 1990 to 2006 were obtained from Mercer and the subsequent years from Fords website; see also http://www.glennmercer.com/Ford2007to2012Draft.pdf Ford 2007-2012 Finding its way?

Links to other recent documents on this topic

1. http://www.scribd.com/doc/94647467/Three-Types-of-Companies-FromQuantum-Physics-to-Economics Speculations on Types of Companies: From Quantum Physics to Economics, published May 24, 2012.

Page 3 of 6

2. http://www.scribd.com/doc/94325593/The-Future-of-Facebook-I The Future of Facebook: From Theoretical Speculations to Better Understanding Based on Simple Mathematical Laws, published May 21, 2012. 3. http://www.scribd.com/doc/94103265/The-FaceBook-Future The FaceBook Future, Revenues-Profits Analysis, published on May 19, 2012.

A Brief Discussion

The maximum point on the profits-revenues data for Ford Motor Company, as revealed here, was suspected based on the discussion of the Ford Motor Company profits-revenues data in Ref. [1]. This is a stunning confirmation of the predictions based on the significance of the power-exponential law. If we consider the special case of b = 0 and c = 0, the power-exponential law takes the simpler form y = mxne-ax and the derivative dy/dx = (n ax)(y/x). It is clear that there is a maximum point on this curve, at x = n/a, since dy/dx = 0 at this point. The derivative has a positive sign (rising portion of the curve) for x < n/a and a negative sign (falling portion of the curve) for x > n/a. The expression for dy/dx for the entire function, for nonzero values of b, can also be deduced readily and is left as an academic exercise. The scatter that we see in the profits-revenue data is due to what we may call the temperature of the system. A blackbody can be held at different temperatures. Hence,we have to deal with a family of curves, not a single curve. Each curve, called the radiation spectrum, applies for a single temperature. For example, all of the data points (nearly 80) for the Cosmic Microwave Background (CMB) radiation spectrum fall nicely on a single curve corresponding to a temperature of T 2.725 Kelvins. (Recall that 0 K = - 273 C.) http://en.wikipedia.org/wiki/Cosmic_microwave_background_radiation

Page 4 of 6

It appears that the same is going on here. We may indeed be dealing with a profits and revenues data spectrum corresponding to different operating temperatures. The dashed curve (added schematically, not on the basis of any calculations) joins data for a single temperature. The other data points can be envisioned as falling on a different curve(s) that applies (apply) for a different temperature (s). This actually supports what was mentioned in the references cited earlier. We can systematically extend every single idea, like energy, entropy, and temperature from physics to economics. Let us discuss briefly the meaning of temperature T in quantum physics. Actually, it is very different from what we assume. It has nothing to do with the familiar thermometer but is related to two basic concepts called energy U and entropy S. The temperature T of a blackbody is given by the relation T = dU/dS .(2)

This is the definition of temperature used by Planck to develop quantum physics in his famous December 1900 paper. The above is a consequence of the combined statement of the first and the second laws of thermodynamics. The first law is the energy conservation law and is similar to Profits = (Revenues Costs) in the business world or in economics. The second law leads to a mathematical definition of entropy S. The entropy increases by a small amount dS = dQ/T where dQ is the small amount of heat added to the system at the temperature T. If we assume that all of dQ increases the energy of the system, i.e., dQ = dU, then dS = dU/T or rewriting we get T = dU/dS. Planck therefore defines temperature T as the rate of change of energy with entropy. (In general, dQ = dU + work done, since some work is always done by the system with the addition of heat.) The heat added dQ is like a stimulus and the increase in energy dU is the response of the thermodynamic system (in the world of physics). We can thus generalize these notions of heat added and energy increase and apply them outside physics, as proposed. The notion of entropy has already been applied to describe situations well beyond physics. Entropy is often described as a measure of the extent of chaos, or randomness in a system. According to Planck, it is related to the number of ways

Page 5 of 6

W in which a fixed total amount of energy can be distributed between N elements. The higher the number W, the higher the entropy. Hence, even this notion of entropy too, and thus also the idea of a temperature T, can be extended beyond physics to economics. (Further details may be found in Ref. [1].) The total entropy SN of N elements with total energy UN is given by: SN = k ln W + arbitrary constant (3)

Here ln W is the natural logarithm of W. Planck then applies well-known statistical arguments to determine W, the number of ways of distributing the total energy UN among the N energy elements. Instead of energy distribution, we can envision the distribution of money, which is measured in terms of some elementary monetary unit . Following Planck, we can write P = NU to be the total money that must be distributed and continue to use the symbol U now to denote money instead of energy. The expression for W is: W = (N + P 1)! / (N 1)! P ! (4)

Here P! means the factorial of P and so on. Both N and P are very large integers. With this transition from the terminology of physics to economics and finance, it is now easy to follow the subsequent steps taken by Planck. Firstly, factorials are eliminated by invoking the well-known Stirling approximation, ln P! PP , and so on. From logarithms we arrive at exponentials (upon reversing the process). In subsequent articles we will develop these essentially theoretical ideas further. It is sufficient here to note that the theoretical prediction of a maximum point on the profits-revenue curve for a company is confirmed with the data for Ford Motor Company. The existence of such a maximum point on the profits-revenue curve for a company has not yet been appreciated. This obviously also has a lot of practical implications for Ford Motor Company and its operations and the management strategies to be employed for future success and sustained increase in profitability. Finally, it is interesting to reflect on the different eras at Ford, under the leadership of different CEOs, as discussed by Mercer, and the quiet, unseen, workings of the unheralded mathematical laws envisioned here to explain the same profits-revenue spectrum. As they say, it is not always what it seems to be.

Page 6 of 6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Linear Space-State Control Systems Solutions ManualDocument141 pagesLinear Space-State Control Systems Solutions ManualOrlando Aguilar100% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Understanding Ui-Ux-By Harry Muksit - SDocument109 pagesUnderstanding Ui-Ux-By Harry Muksit - Sgodzalli44100% (1)

- BIOCHEM REPORT - OdtDocument16 pagesBIOCHEM REPORT - OdtLingeshwarry JewarethnamNo ratings yet

- Iso 20816 8 2018 en PDFDocument11 pagesIso 20816 8 2018 en PDFEdwin Bermejo75% (4)

- Concrete Design Using PROKONDocument114 pagesConcrete Design Using PROKONHesham Mohamed100% (2)

- Ergonomics For The BlindDocument8 pagesErgonomics For The BlindShruthi PandulaNo ratings yet

- Prince George Alexander Louis of Cambridge and The Precession of EquinoxesDocument33 pagesPrince George Alexander Louis of Cambridge and The Precession of EquinoxesVJLaxmananNo ratings yet

- Mayor Bloomberg's Comparison of NYC Homicide Rates and Wall Street's Ratio AnalysisDocument15 pagesMayor Bloomberg's Comparison of NYC Homicide Rates and Wall Street's Ratio AnalysisVJLaxmananNo ratings yet

- Trust Me, The Financial World Will Change Forever If Wall Street Starts Analyzing Financial Data Like We Do Baseball Stats: Miguel CabreraDocument38 pagesTrust Me, The Financial World Will Change Forever If Wall Street Starts Analyzing Financial Data Like We Do Baseball Stats: Miguel CabreraVj LaxmananNo ratings yet

- The Correlation Between Highway Deaths and The US EconomyDocument21 pagesThe Correlation Between Highway Deaths and The US EconomyVJLaxmananNo ratings yet

- Gun Violence in America: Americans Are Killing Themselves NOT Each Other Across StatesDocument22 pagesGun Violence in America: Americans Are Killing Themselves NOT Each Other Across StatesVJLaxmananNo ratings yet

- An MIT Non-Economist's View of The Harvard-UMass Debt/GDP Ratio and The Economic Growth DebateDocument74 pagesAn MIT Non-Economist's View of The Harvard-UMass Debt/GDP Ratio and The Economic Growth DebateVJLaxmananNo ratings yet

- The Average Net Worth by Country Part 1: Introducing The X-Y DiagramDocument14 pagesThe Average Net Worth by Country Part 1: Introducing The X-Y DiagramVJLaxmananNo ratings yet

- Growth in The Combined Net Worth of Billionaires From 2000-2013: An Interesting Limit To Growth Is RevealedDocument11 pagesGrowth in The Combined Net Worth of Billionaires From 2000-2013: An Interesting Limit To Growth Is RevealedVJLaxmananNo ratings yet

- Anclas Placas Base para Columnas Thomas MurrayDocument89 pagesAnclas Placas Base para Columnas Thomas MurrayMariano DiazNo ratings yet

- Operations Management (Scheduling) PDFDocument4 pagesOperations Management (Scheduling) PDFVijay Singh ThakurNo ratings yet

- Administrative LawDocument7 pagesAdministrative LawNyameka PekoNo ratings yet

- Diabetes & Metabolic Syndrome: Clinical Research & ReviewsDocument3 pagesDiabetes & Metabolic Syndrome: Clinical Research & ReviewspotatoNo ratings yet

- Memoire On Edgar Allan PoeDocument16 pagesMemoire On Edgar Allan PoeFarhaa AbdiNo ratings yet

- Sample Questions 2019Document21 pagesSample Questions 2019kimwell samson100% (1)

- TypeFinderReport ENFPDocument10 pagesTypeFinderReport ENFPBassant AdelNo ratings yet

- Update UI Components With NavigationUIDocument21 pagesUpdate UI Components With NavigationUISanjay PatelNo ratings yet

- Bagon-Taas Adventist Youth ConstitutionDocument11 pagesBagon-Taas Adventist Youth ConstitutionJoseph Joshua A. PaLaparNo ratings yet

- Ground Rules 2019Document3 pagesGround Rules 2019Jeremiah Miko LepasanaNo ratings yet

- Delaware Met CSAC Initial Meeting ReportDocument20 pagesDelaware Met CSAC Initial Meeting ReportKevinOhlandtNo ratings yet

- A/L 2021 Practice Exam - 13 (Combined Mathematics I) : S.No Name Batch School Ad No. Marks RankDocument12 pagesA/L 2021 Practice Exam - 13 (Combined Mathematics I) : S.No Name Batch School Ad No. Marks RankElectronNo ratings yet

- Bab 3 - Soal-Soal No. 4 SD 10Document4 pagesBab 3 - Soal-Soal No. 4 SD 10Vanni LimNo ratings yet

- Trigonometry Primer Problem Set Solns PDFDocument80 pagesTrigonometry Primer Problem Set Solns PDFderenz30No ratings yet

- MPCDocument193 pagesMPCpbaculimaNo ratings yet

- Grade 7 1ST Quarter ExamDocument3 pagesGrade 7 1ST Quarter ExamJay Haryl PesalbonNo ratings yet

- Mat Clark - SpeakingDocument105 pagesMat Clark - SpeakingAdiya SNo ratings yet

- Errol PNP Chief AzurinDocument8 pagesErrol PNP Chief AzurinDarren Sean NavaNo ratings yet

- Contract of PledgeDocument4 pagesContract of Pledgeshreya patilNo ratings yet

- The Idea of Multiple IntelligencesDocument2 pagesThe Idea of Multiple IntelligencesSiti AisyahNo ratings yet

- (Music of The African Diaspora) Robin D. Moore-Music and Revolution - Cultural Change in Socialist Cuba (Music of The African Diaspora) - University of California Press (2006) PDFDocument367 pages(Music of The African Diaspora) Robin D. Moore-Music and Revolution - Cultural Change in Socialist Cuba (Music of The African Diaspora) - University of California Press (2006) PDFGabrielNo ratings yet

- Gits Systems Anaphy DisordersDocument23 pagesGits Systems Anaphy DisordersIlawNo ratings yet

- Roofing Shingles in KeralaDocument13 pagesRoofing Shingles in KeralaCertainteed Roofing tilesNo ratings yet

- Global Marketing & R&D CH 15Document16 pagesGlobal Marketing & R&D CH 15Quazi Aritra ReyanNo ratings yet