Professional Documents

Culture Documents

Tea Coffee

Uploaded by

Ronak VoraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tea Coffee

Uploaded by

Ronak VoraCopyright:

Available Formats

TEA-COFFEE

Industry Snapshot

POSITIVE

The Indian tea industry is a 176-year-old industry, with an estimated market size of Rs.19,500 crore. The industry presently employs nearly 35 lakh workers, of which approximately 13 lakh are employed directly in the tea plantations, wherein women constitute almost half the workforce. The tea output in India gradually increased in the calendar year (CY) 2011 at 988 mn kgs, registering 2.3% year-on-year (y-o-y) growth. In CY10, India ranked second in production and consumption after China and fourth in terms of exports. CARE Research expects the recently witnessed positive trend in tea output in CY11, to continue at a CAGR of 0.4% from CY12 to CY14. The domestic tea consumption is also likely to increase from 837 mn kgs in CY10 to about 920 mn kgs by the end of CY14, thus posting 4-year CAGR of 2.4%. Coffee is the second-most traded commodity in the world after crude oil. In coffee season (October to September) CS 2010-11, India produced 3.02 lakh tonnes of coffee, most of which was grown in the southern states of Karnataka (71%), Kerala (22%), and Tamil Nadu (6%). Coffee is cultivated on nearly 4.05 lakh hectares in India, and 70% of production is grown on small farms that own an area lesser than 10.12 hectares. The coffee output is expected to subsequently increase to 3.62 lakh tonnes by the end of coffee season CS 2013-14, at a CAGR of 6.2%, owing to increase in coffee cultivated area from the present 4.05 lakh hectares to 4.2 lakh hectares by the end of CY14. Coffee consumption is expected to improve at a 4-year CAGR of 6.4% from 1.08 lakh tonnes in CY10 to 1.38 lakh tonnes in CY14.

Duty Structure

Customs Duty (%) Machinery for coffee harvesting, processing, packaging, bagging, etc Coffee vending and brewing machine Before After Impact 7.5 5 Excise Duty (%) Before After Impact 1 2

Coffee & tea pre mixes

10

Proposal and Impact

Budget proposals Impact on the industry

Nominal excise duty of 1% increased to 2% on Increase in excise duty to marginally increase 130 items that include tea and coffee pre-mixes. their prices. This would have no major impact on the companies and would be passed on to consumers. Reduction in customs duty on coffee plantation, Will result in marginal cost savings for coffee processing and packaging machinery from 7.5% plantation, processing and packaging to 5% companies. Reduction in customs duty on coffee vending and Will result in marginal cost savings for the brewing machinery from 10% to 5%, with companies operating in coffee vending and concessional custom duty of 2.5% on parts/ coffee outlets. components thereof.

Impact on companies

Company Gujarat Tea Processors & Packers Ltd. (Wagh Bakri Tea Group) Tata Coffee Ltd. Impact Comments Increase in excise duty on tea pre-mixes to 2% would have minimal impact as prices would be passed on. Reduction in customs duty on coffee plantation, processing and packaging machinery will result in marginal cost savings. Increase in excise duty on coffee pre-mixes to 2% would have minimal impact as prices would be passed on. in customs duty on coffee plantation and machinery, in addition to coffee vending and brewing machinery will result in marginal cost savings for the company across its business units. Increase in excise duty on coffee pre-mixes to 2% would have minimal impact as prices would be passed on.

Amalgamated Bean Coffee Trading Company Ltd.

Reduction processing

You might also like

- Soap & Cleaning Compounds World Summary: Market Values & Financials by CountryFrom EverandSoap & Cleaning Compounds World Summary: Market Values & Financials by CountryNo ratings yet

- Synopsis Tea CoffeeDocument2 pagesSynopsis Tea CoffeeMihir6490No ratings yet

- Toilet Preparations World Summary: Market Values & Financials by CountryFrom EverandToilet Preparations World Summary: Market Values & Financials by CountryNo ratings yet

- Coffee Market: India'S Coffee IndustryDocument10 pagesCoffee Market: India'S Coffee IndustryDamanbir_Singh_5920No ratings yet

- Soaps & Detergents World Summary: Market Values & Financials by CountryFrom EverandSoaps & Detergents World Summary: Market Values & Financials by CountryNo ratings yet

- Coffee ProductionDocument52 pagesCoffee ProductionmanishkhatriNo ratings yet

- Cambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapFrom EverandCambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapNo ratings yet

- Mrunal (Food Processing) Tea, Coffee Supply Chain, Upstream, Downstream For UPSC General Studies Mains PrintDocument11 pagesMrunal (Food Processing) Tea, Coffee Supply Chain, Upstream, Downstream For UPSC General Studies Mains PrintRbKahnNo ratings yet

- Pesticide & Agricultural Chemicals World Summary: Market Values & Financials by CountryFrom EverandPesticide & Agricultural Chemicals World Summary: Market Values & Financials by CountryNo ratings yet

- Press Release-CARE Research - Tea-Coffee Industry-03!12!2012Document2 pagesPress Release-CARE Research - Tea-Coffee Industry-03!12!2012Archit GroverNo ratings yet

- Coffee & Coffee Equipment World Summary: Market Values & Financials by CountryFrom EverandCoffee & Coffee Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Coffee IndustryDocument7 pagesCoffee IndustryRajesh NaiduNo ratings yet

- Wet Corn Milling Products World Summary: Market Values & Financials by CountryFrom EverandWet Corn Milling Products World Summary: Market Values & Financials by CountryNo ratings yet

- FMCGDocument45 pagesFMCGapi-2736961867% (9)

- Sl. No. Topic: Certificate Declaration Acknowledgement Chapter - IDocument49 pagesSl. No. Topic: Certificate Declaration Acknowledgement Chapter - IAashish Verma0% (1)

- Investment For Sustainable Development of Bangladesh Tea Industry - An Empirical StudyDocument21 pagesInvestment For Sustainable Development of Bangladesh Tea Industry - An Empirical StudyCarbon_AdilNo ratings yet

- Stevia ProjectDocument34 pagesStevia ProjectHitesh B. Bakutra50% (2)

- Sugar Mills in PakistanDocument26 pagesSugar Mills in Pakistanemadullah123No ratings yet

- COFFEE CONUNDRUM: WHITHER THE FUTURE OF SMALL GROWERS IN INDIADocument28 pagesCOFFEE CONUNDRUM: WHITHER THE FUTURE OF SMALL GROWERS IN INDIAcupendranadhNo ratings yet

- Tea Industry Analysis of Jayshree Tea IndustriesDocument30 pagesTea Industry Analysis of Jayshree Tea IndustriesSathish JuliusNo ratings yet

- Sugar Sector ReportDocument14 pagesSugar Sector ReportsarvanbalajiNo ratings yet

- Problems of Sugar IndustryDocument3 pagesProblems of Sugar IndustrySumit GuptaNo ratings yet

- Indian Sugar Sector Embracing Clean Energy FutureDocument26 pagesIndian Sugar Sector Embracing Clean Energy FutureEquity Nest100% (1)

- Tata Globalw2w Sep 13Document38 pagesTata Globalw2w Sep 13darshanmaldeNo ratings yet

- India's Coffee Industry OverviewDocument2 pagesIndia's Coffee Industry OverviewshashankupNo ratings yet

- What's Brewing?: An Analysis of India's Coffee IndustryDocument69 pagesWhat's Brewing?: An Analysis of India's Coffee Industrymohit sharmaNo ratings yet

- India's Tea Industry: A Historical Overview and Current ScenarioDocument32 pagesIndia's Tea Industry: A Historical Overview and Current ScenarioSathish JuliusNo ratings yet

- Coffee in IndiaDocument8 pagesCoffee in IndiaChintanNo ratings yet

- What's Brewing CoffeeDocument69 pagesWhat's Brewing CoffeeMaitreyi MenonNo ratings yet

- Industry Profile: Chapter-2Document33 pagesIndustry Profile: Chapter-2ideasaratNo ratings yet

- India's Coffee Industry Faces Declining Exports and Pest ProblemsDocument2 pagesIndia's Coffee Industry Faces Declining Exports and Pest ProblemsanwarkhanisNo ratings yet

- Prabhu Sugars ReportDocument27 pagesPrabhu Sugars ReportPrajwal UtturNo ratings yet

- Wet Coffee Processing Industry Startup in EthiopiaDocument33 pagesWet Coffee Processing Industry Startup in EthiopiaHabtamu Wondyifraw100% (6)

- Fundamental Research Of: CCL ProductsDocument15 pagesFundamental Research Of: CCL ProductsThe Hits collectionNo ratings yet

- Fundamental Research Of: CCL ProductsDocument15 pagesFundamental Research Of: CCL ProductsThe Hits collectionNo ratings yet

- Fundamental Research Of: CCL ProductsDocument15 pagesFundamental Research Of: CCL ProductsThe Hits collectionNo ratings yet

- Fundamental Research Of: CCL ProductsDocument15 pagesFundamental Research Of: CCL ProductsThe Hits collectionNo ratings yet

- Fundamental Research Of: CCL ProductsDocument15 pagesFundamental Research Of: CCL ProductsThe Hits collectionNo ratings yet

- Sugar: Sweetness FadingDocument6 pagesSugar: Sweetness FadingPradeep MotaparthyNo ratings yet

- Inbound Supply Chain Modeling in Sugar IndustryDocument10 pagesInbound Supply Chain Modeling in Sugar Industryrsdeshmukh0% (1)

- Coffee TanzaniaDocument64 pagesCoffee Tanzaniarobert.delasernaNo ratings yet

- Chemicals, Fertilizers, Agriculture & SugarDocument66 pagesChemicals, Fertilizers, Agriculture & Sugarfzhaque3525No ratings yet

- Project FA20-BSE-017Document30 pagesProject FA20-BSE-017M.NadeemNo ratings yet

- For Evicha TibiroDocument28 pagesFor Evicha Tibiroalemayehu tariku100% (1)

- Lower Production Sweet For Sugar CompaniesDocument3 pagesLower Production Sweet For Sugar Companiessanghvi21No ratings yet

- Indian Tea IndustryDocument9 pagesIndian Tea IndustrySaGarNo ratings yet

- Indian Sugar Industry: Production, Demand, Cycles and RegulationsDocument9 pagesIndian Sugar Industry: Production, Demand, Cycles and RegulationsBhavikNo ratings yet

- India's Sugar Industry: Largest Producer GloballyDocument13 pagesIndia's Sugar Industry: Largest Producer GloballyLaksha AnandNo ratings yet

- Analysis of Tea Imports/Exports and Trade PoliciesDocument9 pagesAnalysis of Tea Imports/Exports and Trade PoliciesShashwat ShuklaNo ratings yet

- Business PlanDocument25 pagesBusiness Plansaurabhk32100% (3)

- About SugarDocument4 pagesAbout SugarRanganath Ethiraj KumarNo ratings yet

- Coffee in IndiaDocument9 pagesCoffee in IndiaAkash Ulhas NaikNo ratings yet

- Sugar IndustryDocument10 pagesSugar IndustryShoaib JanjirkarNo ratings yet

- Business Plan Wet Coffee Adane NiguseDocument33 pagesBusiness Plan Wet Coffee Adane NiguseHabtamu Wondyifraw83% (12)

- Sugar Industry in Pakistan: - Problems, PotentialsDocument25 pagesSugar Industry in Pakistan: - Problems, PotentialsAtif RehmanNo ratings yet

- A Business Plan On: "Stevia"Document34 pagesA Business Plan On: "Stevia"Sikandar HameedNo ratings yet

- I. Product: Coffee Exports From IndiaDocument15 pagesI. Product: Coffee Exports From IndiasangramNo ratings yet

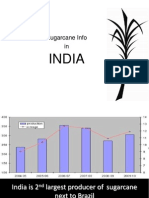

- India: Sugarcane Info inDocument33 pagesIndia: Sugarcane Info inBharat MistryNo ratings yet

- Background of The Study: CopraDocument6 pagesBackground of The Study: CopraMaithri Vidana KariyakaranageNo ratings yet

- Vietnam Coffee Agribusiness OutlookDocument5 pagesVietnam Coffee Agribusiness OutlookNguyễn ThuNo ratings yet

- Fish Farming ProposalDocument16 pagesFish Farming ProposalAngelo Mwamburi86% (96)

- Epreuve Écrite D'anglais (BTS 2009)Document2 pagesEpreuve Écrite D'anglais (BTS 2009)Inoussa SyNo ratings yet

- Modern Digital Enablement Checklist PDFDocument9 pagesModern Digital Enablement Checklist PDFFajar PurnamaNo ratings yet

- Statement of Employment Expenses For Working at Home Due To COVID-19Document2 pagesStatement of Employment Expenses For Working at Home Due To COVID-19Igor GoesNo ratings yet

- GRC FinMan Capital Budgeting ModuleDocument10 pagesGRC FinMan Capital Budgeting ModuleJasmine FiguraNo ratings yet

- Income Tax Short Notes For C S C A C M A Exam 2014Document43 pagesIncome Tax Short Notes For C S C A C M A Exam 2014Jolly SinghalNo ratings yet

- Sec 5.3 MC Three Applications of Supply, Demand, and Elasticity-Document9 pagesSec 5.3 MC Three Applications of Supply, Demand, and Elasticity-Lại Nguyễn Hoàng Phương VyNo ratings yet

- Employment Contract and Complaint LetterDocument8 pagesEmployment Contract and Complaint Letter신혜빈No ratings yet

- GRA Strategic Plan Vers 2.0 06.12.11 PDFDocument36 pagesGRA Strategic Plan Vers 2.0 06.12.11 PDFRichard Addo100% (3)

- Tra Ngo Exemptions May2012Document16 pagesTra Ngo Exemptions May2012Moud KhalfaniNo ratings yet

- Tax Invoice for Monitor PurchaseDocument1 pageTax Invoice for Monitor PurchaseBijendraNo ratings yet

- Press Release - Post Chapter Launch AnnouncementDocument1 pagePress Release - Post Chapter Launch AnnouncementTrina GebhardNo ratings yet

- TDS Story - CA Amit MahajanDocument6 pagesTDS Story - CA Amit MahajanUday tomarNo ratings yet

- Effectiveness of Internal Control With The Role of Corporate Social Responsibility and Its Impact Towards The SocietyDocument3 pagesEffectiveness of Internal Control With The Role of Corporate Social Responsibility and Its Impact Towards The SocietyMojan VianaNo ratings yet

- SPiCE - White Paper v2.1Document35 pagesSPiCE - White Paper v2.1Vincent LuiNo ratings yet

- Chapter 4 Accounting For Partnership OperationsDocument35 pagesChapter 4 Accounting For Partnership OperationsJhazz Do100% (2)

- Standardization and GradingDocument26 pagesStandardization and GradingHiral JoysarNo ratings yet

- Optimize Grocery Inventory & Hotel SCM for GrowthDocument1 pageOptimize Grocery Inventory & Hotel SCM for Growthshahbaaz syedNo ratings yet

- Parliamentary Note - Raghuram RajanDocument17 pagesParliamentary Note - Raghuram RajanThe Wire100% (22)

- The Definitive Guide To A New Demand Planning Process PDFDocument11 pagesThe Definitive Guide To A New Demand Planning Process PDFmichelNo ratings yet

- What Is Double Diagonal Spread - FidelityDocument8 pagesWhat Is Double Diagonal Spread - FidelityanalystbankNo ratings yet

- HdiDocument13 pagesHdiAmeya PatilNo ratings yet

- Finance Group 6Document16 pagesFinance Group 6Niaz MorshedNo ratings yet

- FOE - Presentation On JTA (Jamaica Teachers Association)Document11 pagesFOE - Presentation On JTA (Jamaica Teachers Association)shaniel holnessNo ratings yet

- Chemicals and Fertilizers Industry: Group-3Document11 pagesChemicals and Fertilizers Industry: Group-3Kavya DaraNo ratings yet

- FIN338 Ch15 LPKDocument90 pagesFIN338 Ch15 LPKjahanzebNo ratings yet

- Entrepreneurship Business Plan DR John ProductDocument11 pagesEntrepreneurship Business Plan DR John ProductsuccessseakerNo ratings yet

- Reviewed Cif Procedures (2% PB Upfront)Document1 pageReviewed Cif Procedures (2% PB Upfront)Olufemi E.L OyedepoNo ratings yet

- Strategic Management NikeFINALDocument49 pagesStrategic Management NikeFINALmuhammad irfan100% (4)

- CERTIFIED STATEMENT OF INCOMEDocument17 pagesCERTIFIED STATEMENT OF INCOMEArman BentainNo ratings yet