Professional Documents

Culture Documents

Asim Dasgupta On State Finances, 11th March 2012

Uploaded by

Ajoy DasguptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asim Dasgupta On State Finances, 11th March 2012

Uploaded by

Ajoy DasguptaCopyright:

Available Formats

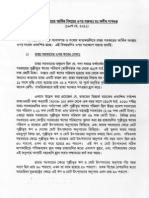

State Finances: Misleading Statements by TMC-Congress-led Govt Dr.

Asim K Dasgupta MISLEADING statements are often being made by the TMC-Congress-led state government in West Bengal regarding state finances, particularly relating to (a) debt of the state government and (b) low availability of funds for Plan expenditure in the state. According to these maligning allegations, these two financial problems have arisen due to the wrong policies of the Left Front government in West Bengal. These allegations have already been refuted several times by facts and analysis, and the refutations have also been duly published in most of the local print and also in some of the national newspapers. The allegations have been rebutted through some news channels also. It may be useful to restate the correct facts with analysis. ON GOVT DEBT Misleading Statement: The Left Front government in West Bengal has left a debt of Rs 2.04 lakh crore. Facts: It is well known that in terms of Constitutional provisions and existing centre-state relations, all state governments are entitled to raise revenues from certain taxes and non-tax items; get share of central taxes and central grants and they are also entitled to borrow with approval of the central government. The total borrowed amount of the state governments usually consists of market borrowing (raised in terms of state government bonds generally subscribed by banks and insurance companies), central loans, loans imposed on the states related to small savings, General Provident Fund (GPF) of employees kept with the state governments etc. In terms of these Constitutional provisions, all the state governments have certain accumulated or outstanding debt, and similarly the central government also has an amount of outstanding debt. The outstanding debt of the government of West Bengal as on May 18, 2011 (the last date before the TMC-Congress-led state government assumed power) was Rs 1.91 lakh crore, and not 2.04 lakh crore as wrongly alleged. As per the latest data on

State-wise debt position (as on March 31, 2011) published by the Reserve Bank of India (State Finances, 2010-11, RBI, p. 152), the highest outstanding debt among the states is that of Maharashtra (Rs 2.36 lakh crore), followed by UP (Rs 2.35 lakh crore), then West Bengal (Rs 1.91 lakh crore as on May 18, 2011, as already mentioned), Andhra Pradesh (Rs 1.37 lakh crore), Gujarat (Rs 1.36 lakh crore), Tamilnadu (Rs 1.09 lakh crore) etc. The debt figures of all these other states will, of course, be higher on the later date of May 18, 2011, but for that date only the figure for West Bengal is readily available as has already been presented. The outstanding debt of the government of India is, of course, very high at Rs 39.44 lakh crore as on March 31, 2011. The debt position of the states is usually compared by the Reserve Bank of India by expressing outstanding debts of the states in terms of ratios of debts to corresponding Gross State Domestic Products (GSDP) of the states, and that of government of India as ratio of debt to the corresponding GDP. In terms of this proper measure of comparison, the debt position of government of West Bengal has been 11th among the states with the debt-GSDP ratio at 40.8 per cent in 2010-11 (State Finances, 2010-11, RBI, p. 153). It may further be noted that due to the policies followed by the Left Front government in West Bengal, this debt-GSDP ratio has systematically fallen from 49.9 per cent in 2005-06 to 40.8 per cent in 2010-11. However, the debt-GDP ratio of the government of India has still remained high at 50.1 per cent in 2010-11 (Economic Survey, Government of India, 2010-11, p. 59). It is by now well known that debt-GDP ratio of the US has recently increased to reach 100 per cent and that of the several European countries has crossed 100 per cent. A distinguishing feature of the debt of West Bengal is that the most significant component (nearly Rs 75,000 crore) of this total debt has been caused by small savings related debt burden imposed by the centre on the state government. The Small Savings programme implemented primarily through post offices across the country is a good national level programme. However, according to the unilateral decision of the government of India, if in any financial year, there is a certain amount of net small savings collection in the post offices in a state by the people of that state (i.e. after allowing for withdrawals), then 80 per cent of that amount of net small saving collection would be compulsorily imposed as

debt on the state government with high rate of interest, without the state government having any say in the matter. Since people of West Bengal have over the years decided, for reasons of financial security and returns, to keep their hard-earned savings significantly in the small saving schemes, and West Bengal has occupied the first position among the states in this important national programme, the government of West Bengal has, in effect, been paradoxically penalised in terms of the most significant incidence of the small savings related debt component in the total debt of the state. The Left Front government of West Bengal has repeatedly argued before the government of India that if net small savings collection in a state is a positive surplus, then after allowing for a deduction for interest payment, that net surplus of small savings collection should be shared between the centre and the state as grants, and that this surplus should not be unilaterally imposed only on the state as loan. But, the government of India has not listened to this argument, presumably because of the fact that if net small savings collection is imposed as central loan to the states, that will, through loan repayment, add to extra earnings for the centre. This unjust decision of the centre has specially increased (because of the highest position of West Bengal in small savings collection) the debt of the government of West Bengal. Despite this injustice, the Left Front government had succeeded, as mentioned earlier, in reducing the debt-GSDP ratio systematically in recent years. This was made possible by higher collection of state tax revenue, and availing lesser market borrowings than even what was approved by the government of India. In the 2010-11, the last financial year of the Left Front government, the total market borrowing approved by the government of India was Rs 15,056 crore. But the actual borrowing taken by the Left Front government in the entire year 2010-11, was much less - only Rs 9,500 crore. In the sphere of market borrowing, the position of government ofWest Bengal was sixth among the major states. However, after TMCCongress-led government came to power on May 19, 2011, over a period of only nine months, this new government has already taken recourse to market borrowing of an alarming amount Rs 17,500 crore and has become the highest market borrower among all the state governments.

ABOUT LOW AVAILABILITY OF FUNDS Misleading Statement: Payment of salary and pension of employees, teachers and others and payment of interest and principal of loans take away 94 per cent of total budget, and only 6 per cent is available, which is too low for Plan expenditure etc. Facts : The Left Front government of West Bengal has given effect to pay revision of not only state government employees, but also of teachers, employees of panchayats, municipalities, undertakings etc., and has during its tenure already borne the entire financial burden of current revision from 2009-10, and two-thirds of arrear payments. At the same time, with introduction of comprehensive Value Added Tax, and strict measures at tax compliance, there has been a significant growth of state tax revenue, of about 25 per cent in the last financial year. In consequence of these measures and other factors, the space of state budgetary resource available for Plan expenditure after payment of salary, pension and interest and principal of loan is now significantly much wider than 6 per cent. According to the Budget Publication No. 9 (pages 4, 5, 6, 7 and 20), presented by the TMC-Congress-led government itself in West Bengal state assembly in June, 2011, the estimated total receipts of the state government in the financial year (2011-12) is at Rs 87,643 crore. On the other hand, the sum total of payment on account of salary, pension, interest and principal of loan is Rs 54,930 crore which is 63 per cent (and not 94 per cent as misleadingly stated), and therefore 37 per cent (and not 6 per cent) of total budgetary resource, i.e. more than Rs 32,000 crore is available for Plan expenditure and other essential expenditure. Both the allegations relating to the debt of the state government and availability of funds for Plan expenditure in the state have thus been once again factually refuted. (The writer was finance minister in the Left Front government of West Bengal)

You might also like

- Thirty Years of Left Front Government in West Bengal - WBIDC 2007Document26 pagesThirty Years of Left Front Government in West Bengal - WBIDC 2007Ajoy DasguptaNo ratings yet

- AMIYA KUMAR BAGCHI On LEFT FRONT GOVT.Document10 pagesAMIYA KUMAR BAGCHI On LEFT FRONT GOVT.Ajoy DasguptaNo ratings yet

- Financial Situation of West Bengal As On 19th May, 2011Document7 pagesFinancial Situation of West Bengal As On 19th May, 2011Ajoy DasguptaNo ratings yet

- PRAKASH KARAT - On Left-Led Govts. & Our Understanding (BENGALI)Document8 pagesPRAKASH KARAT - On Left-Led Govts. & Our Understanding (BENGALI)Ajoy DasguptaNo ratings yet

- Buddhadeb Bhattacharjee - Interview - June 21, 2010Document8 pagesBuddhadeb Bhattacharjee - Interview - June 21, 2010Ajoy DasguptaNo ratings yet

- Amartya Sen - An InterviewDocument11 pagesAmartya Sen - An InterviewAjoy DasguptaNo ratings yet

- Amartya Sen - Primary Schooling in West BengalDocument10 pagesAmartya Sen - Primary Schooling in West BengalAjoy DasguptaNo ratings yet

- AMARTYA SEN-Developments in West BengalDocument6 pagesAMARTYA SEN-Developments in West BengalAjoy DasguptaNo ratings yet

- Communist Memories - A. G NooraniDocument31 pagesCommunist Memories - A. G NooraniAjoy DasguptaNo ratings yet

- Jyoti Basu's Life in Pictures p67-p75Document9 pagesJyoti Basu's Life in Pictures p67-p75Ajoy DasguptaNo ratings yet

- Jyoti Basu's Life in Pictures p76-p96Document21 pagesJyoti Basu's Life in Pictures p76-p96Ajoy DasguptaNo ratings yet

- Jyoti Basu's Life in Pictures p01-p33Document33 pagesJyoti Basu's Life in Pictures p01-p33Ajoy DasguptaNo ratings yet

- Jyoti Basu's Life in Pictures p56-p66Document11 pagesJyoti Basu's Life in Pictures p56-p66Ajoy DasguptaNo ratings yet

- Jyoti Basu's Life in Pictures p34-p55Document22 pagesJyoti Basu's Life in Pictures p34-p55Ajoy DasguptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Memorandum of Law On Offer To Pay (July 5, 2013)Document15 pagesMemorandum of Law On Offer To Pay (July 5, 2013)Keith Muhammad: Bey100% (7)

- Goodbye,: Tanner Street Project, Bancroft Property Among Top StoriesDocument20 pagesGoodbye,: Tanner Street Project, Bancroft Property Among Top StorieselauwitNo ratings yet

- Power Point PR B.Inggris 11A Ed. 2019Document44 pagesPower Point PR B.Inggris 11A Ed. 2019Ikhsan Tria SantikaNo ratings yet

- Emi Calculator AdvanceDocument8 pagesEmi Calculator AdvanceRana BiswasNo ratings yet

- 1234Document8 pages1234ashokbehereNo ratings yet

- 04 Assignments Practical Questions NEWDocument21 pages04 Assignments Practical Questions NEWBhupendra MendoleNo ratings yet

- Assign 1 HUMA 701 2019Document5 pagesAssign 1 HUMA 701 2019diaa gamelNo ratings yet

- Ch 6 Receivables ConceptsDocument15 pagesCh 6 Receivables ConceptsAnas Alimoda100% (2)

- Loan Proposal of BakeryDocument60 pagesLoan Proposal of BakeryWasim Khan100% (2)

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Document350 pagesCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- Provisional Remedies Midterm PDFDocument46 pagesProvisional Remedies Midterm PDFPhil JaramilloNo ratings yet

- 1250 Fremont Street Probate File May 26, 2015Document599 pages1250 Fremont Street Probate File May 26, 2015Stan J. CaterboneNo ratings yet

- Discounted Cash Flow Valuation: Answers To Concepts Review and Critical Thinking Questions 1. 2. 3. 4. 5. 6. 7Document5 pagesDiscounted Cash Flow Valuation: Answers To Concepts Review and Critical Thinking Questions 1. 2. 3. 4. 5. 6. 7Sitti NajwaNo ratings yet

- Danasiri Ratnaweera Pushpa Ratnaweera v. Federal Deposit Insurance Corporation John Stafford, Managing Agent of Rtc, in Its Capacities Sued Herein and His Successor in Office Imperial Federal Savings Association, a Federal Savings Association Imperial Savings Association, a California Corporation an Van Duong Churchill Service Corporation First Line Mortgage, Inc. Ticor Title Insurance Company Gateway Title Company, 82 F.3d 423, 1st Cir. (1996)Document2 pagesDanasiri Ratnaweera Pushpa Ratnaweera v. Federal Deposit Insurance Corporation John Stafford, Managing Agent of Rtc, in Its Capacities Sued Herein and His Successor in Office Imperial Federal Savings Association, a Federal Savings Association Imperial Savings Association, a California Corporation an Van Duong Churchill Service Corporation First Line Mortgage, Inc. Ticor Title Insurance Company Gateway Title Company, 82 F.3d 423, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- MA SIN Consent FormDocument1 pageMA SIN Consent FormAnonymous 1OlQQ3cWNo ratings yet

- Dela Vega V BallilosDocument2 pagesDela Vega V BallilosFrederick Xavier LimNo ratings yet

- ANNEX 2: Related Party ChecklistDocument2 pagesANNEX 2: Related Party ChecklistCreez TeenaNo ratings yet

- Cibil Score and Diff Between LLP & LTD CoDocument2 pagesCibil Score and Diff Between LLP & LTD Cog h raoNo ratings yet

- SHG Role of Self Help GroupsDocument13 pagesSHG Role of Self Help Groupsapi-372956486% (7)

- Set BDocument7 pagesSet BJeremiah Navarro PilotonNo ratings yet

- The FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry InsidersDocument31 pagesThe FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry Insiders83jjmack100% (1)

- Cases - BankingDocument52 pagesCases - Bankingjared gaelNo ratings yet

- The Doj - Chase $13 Billion Settlement Docs - Nov 2013Document162 pagesThe Doj - Chase $13 Billion Settlement Docs - Nov 201383jjmack100% (1)

- FDIC Continental Illinois ResolutionDocument22 pagesFDIC Continental Illinois ResolutionБоби ПетровNo ratings yet

- 15-Internal Project PipelineDocument3 pages15-Internal Project PipelineCOASTNo ratings yet

- FAS 140 Setoff Isolation Letter 51004Document15 pagesFAS 140 Setoff Isolation Letter 51004Madu El Musa Bey90% (10)

- G.R. No. 200274. April 20, 2016. Melecio Domingo, Petitioner, vs. Spouses Genaro MOLINA and ELENA B. MOLINA, Substituted by ESTER MOLINA, RespondentsDocument17 pagesG.R. No. 200274. April 20, 2016. Melecio Domingo, Petitioner, vs. Spouses Genaro MOLINA and ELENA B. MOLINA, Substituted by ESTER MOLINA, RespondentsLalaNo ratings yet

- Subsidance in Low Rise BuildingsDocument177 pagesSubsidance in Low Rise Buildingsalphatotas100% (1)

- Watch Out For Flying Pumpkins: BOE Member PromotedDocument16 pagesWatch Out For Flying Pumpkins: BOE Member PromotedelauwitNo ratings yet