Professional Documents

Culture Documents

Policy Summary - National Railway Infrastructure Plan

Uploaded by

virgilpaynemsu1286Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Policy Summary - National Railway Infrastructure Plan

Uploaded by

virgilpaynemsu1286Copyright:

Available Formats

Summary of Proposed Federal Income Tax Credits – Intermodal Freight and Passenger Infrastructure

The “Quant” measures a previously overlooked background investment, flowing from Highway Trust Fund (HTF) taxes

on unrelated daily use of locally funded streets that is in turn leveraged mostly toward edge-highways through the gas tax

proxy. This HTF leveraging is like taxing food purchases at all cafes, coffee houses, convenience stores, groceries, and

restaurants to build one new restaurant, enabling an inexpensive buffet, while just painting the walls at the other buildings.

Yes, such could obliquely be called a food user fee for food infrastructure, but the marketplace is obviously affected.

A below-the-rail infrastructure investment program, equivalent to the HTF leveraging by person-mile or by freight truck

trailer-mile, can accelerate the modernization of nationwide railway infrastructure and resolve marketplace inefficiency.

Below-the-Rail Infrastructure – Shareholder Owned:

A Federal Tax Credit to reimburse local property taxes paid on line-haul Right-of-Way, terminals, property, and plant as

Interstate Highways pay no property tax is proposed to promote recapitalization through equalization of investment.

A Federal Tax Credit of $21.0/train-mile for the first 800 train-miles of highway competitive intermodal rail freight

between public terminals is proposed. This rate is but 90% of the $0.26/truck-mile investment over and above user fees

collected between exits of the original Interstate Highway system for a 90 trailer train, thus more fiscally efficient.

In total, the Tax Credit take rate is estimated to be about $2.8 Billion annually based on an average of four round trips a

day over the 46,000 mile core network, spurring a private investment in the early phase of around $8 Billion annually.

These investments on Shareholder owned railroads would be deficit-neutral through:

1. Reducing shippers’ financial costs by around $3 Billion annually through a projected market shift to greater

intermodal use and shorter drayage distances offered by more economical service offerings and near sited new

terminals, while using private entities to achieve the benefits of commercial vehicle TSW study economically.

2. Providing categorically exempt, nimble, privately led infrastructure investment to fund fluidity improvements,

such as passing and staging tracks, new faster alignments and stronger bridges as prioritized by private owners.

3. Ensuring fluid interstate rail routes exist for military movements and seasonal traffic surges, called for in FRA

National Rail Plan; thus postponing General Fund expenses for Interstate Highway congestion relief projects.

Below-the-Rail Infrastructure – Publicly Held:

While intercity passenger rail has been viewed by planners to only fit congested regions where expansion of land-hungry

highways becomes too expensive the overlooked “Quant”, a metric of a leveraged nationwide investment in highways,

suggests a distance based railway infrastructure investment through the National Railroad Passenger Corporation (NRPC)

would be equitable throughout the rural heartland of the country in addition to a fixed investment in congested regions.

A fund for access to shareholder owned Class I railroads, as well as fixed passenger terminal facilities, large loss liability

pools needed for interoperability, and commuter rail infrastructure is proposed. About $2.4 Billion annually would be re-

directed from Federal railroad Income taxes instead of Federal General Fund buckets at the same level.

NRPC Mainline Track Capital Lease (Shareholder or Publicly held railways) = $8.0/train-mile

NRPC Terminal Facilities - Boarding Platforms, ADA mods, Yard Tracks, and Security = $8.0/train-mile

USDOT Large Loss Liability Pool (Operator covers small claims) = $0.007/passenger-mile

Note: Combined the above equals about $17.2 per train-mile in equivalent Below-the-Rail Investment

Nationwide Urban Rail Infrastructure grants (Most Economical congested peak-capacity) $0.9 B annually

NEC Rail Infrastructure grants (Most Economical congested peak-capacity addition) $0.9 B annually

An analysis of Amtrak’s cost center data for existing long-distance operations indicates that the true revenue gap is nearly

equal to the below-the-rail infrastructure costs such as mainline track leases, terminal yards, platforms, and risk

protection. Thus an amicable path forward is to expand passenger volume per train-mile, utilizing the declining cost curve

of passenger trains with respect to volume to improve financial performance. After the investment in Below-the-Rail

infrastructure costs, the operator should be able to cover all remaining Marginal Costs including operating personnel, fuel,

consumables, and equipment capitalization and maintenance from consumer revenue after profit on the longer routes, or

with a smaller sum of local support for shorter routes, thus providing a functioning feedback loop for management to

improve service to the public and make efficient small changes to customer facing provisions without prescriptive rules.

Summary - National Railway Infrastructure Plan 1 1/3/2020

Beneficial Changes for Future Authorization Legislation

1. Structure Federal Amtrak and Common Carrier investments through railroad industry income Tax Credits either

claimed directly by private owners or assigned to the USDOT for nationally held assets.

a. Fixed investments in two groups of unique bottleneck infrastructure costs, Northeast Corridor (NEC) and

Nationwide Corridors, whose costs are largely unchanging with respect to train-mile volume. This is the

least expensive way to provide intercity travel capacity for shorter intercity trips in crowded urban areas

where land for expansion is occupied, funded at $0.9 Billion annually for each, $1.8 Billion total.

b. Variable investments in terminal and line-haul infrastructure by Train-mile for NEC, National Network,

Private, long-Commuter, and State Corridor intercity rail passenger services that cross a state boundary or

are over 50 miles in route length, the intercity trip cutoff point used in various USDOT studies. Funding

passenger trains at a $16.0 per train-mile Interstate Highway equivalent investment metric would

consolidate many of the various USDOT Federal programs, the FRA for Amtrak and the FTA for long-

commuter rail, provide coordination for infrastructure expansion and long-term improvement where such

services mix, and allow for efficient incremental improvements in a multi-year construction program.

c. Variable investment in Intermodal rail freight infrastructure at a $21.0 per train-mile Interstate Highway

equivalent investment metric for the first 800 miles between public terminals, for nimble private

investment to ensure major capacity projects are pursued to support the national economy efficiently.

d. Rebate fully all highway fuel taxes paid by Motor coach operators on Common Carrier routes to simplify

funding given the existing very low rates of infrastructure cost recovery anyway from operators due to the

existing leveraged highway investment program and partial rebates in Federal and State law.

e. Rebate fully local property taxes paid on mainlines by railroads on routes with Class 4 track or above.

2. Establish a large loss $295 Million per occurrence, liability pool at the USDOT for all ground passenger common

carriers operating from accessible terminals, either by railways or highways, with coverage provided by the

USDOT at a budget rate of $0.007/passenger mile; significantly below the existing rates other Federal general

fund social programs expend on automobile accidents outside the HTF. The route operators would in turn be

responsible for arranging first-dollar coverage of at least $2 Million per occurrence at a safety record rated

deductible, which the insurance market could price based on the operator’s safety record and management plan.

3. Enable Competitive Pilot Project petitioners to optionally pass-through as a NRPC subcontract, track access rights

and agreements when NRPC Train and Engine Operating crews or the infrastructure owner crews are used from

existing crew bases; revising the competitive pilot rule to allow petitioners to count these pass-through, sub-

contracted, provisions as meeting the requirements to first have an access agreement. This is similar to the pass-

through arrangement the States enjoy when sponsoring rail services and as such has survived legal challenge. This

also recognizes that NRPC exclusively acts as the gateway to the remaining Common Carrier right of access for

passenger operations at incremental cost with performance incentives. The action would spur NRPC to respond

competitively to marketplace opportunities or another operator may take up the challenge.

4. Extend the Competitive Pilot franchise period to at least 8 years, with dedicated funding from a pool of related

federal refundable Tax Credits assigned in the year of award so as not to rely on future appropriations.

5. Ensure a USDOT buy-back provision exists for equipment purchased for Competitive Pilot operations at the end

of contract, as there is not enough volume, as exists in the United Kingdom, for leasing companies.

6. Simplify the Competitive Pilot program agreement starting point as such has been left to be arbitrated through a

complicated and lengthy Surface Transportation Board (STB) process should an agreement not be forthcoming. It

would be advantageous for Legislation to set a upper level cost to access nationally held assets like terminals and

yards as well as state funded commuter infrastructure that will always be jointed shared as well as specifying the

actual investment to be provided by the US on the route in lieu of the Amtrak subsidy should an existing route be

assumed from Amtrak. Conceptually, these values could be near to those proposed for Amtrak’s federal funding

earlier, thus providing a level playing field for competition and certainly when bidding.

Summary - National Railway Infrastructure Plan 2 1/3/2020

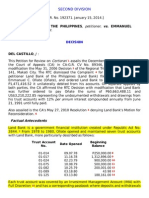

Table B-2. Fully Allocated Costs by Subfamily, Pre-Audit FY2018 Dollars (Millions) APT Average Costs FY2018 Dollars (Millions) -

This table provides the allocated costs of each APT Subfamily. Responsibility for Infrastructure and Operations parsed per

Highway and Aviation Divisions

Percent

Operating Below-the-Rail Above-the-Rail Operations

Operating of Amtrak % of

Subfamily and Capital Infrastructure Investment (Mostly Variable with

Family Family Name Subfamily Name Costs Fully Operating

Number Costs (Mostly Fixed with Respect Respect to Train

(Millions) Allocated and Capital

(Millions) to Train Movements) Movements)

Costs

FM_101 Central Div MoW $19.90 0.5% $26.30 0.5% X $26.30

FM_102 MidAtlantic Div MoW $93.20 2.2% $150.30 2.7% X $150.30

FM_103 New England Div $59.10 1.4% $85.30 1.5% X $85.30

MoW

FM_104 New York Div $110.10 2.6% $140.10 2.5% X $140.10

Maintenance of

FM_MOW MoW

Way

FM_105 MoW Support $113.80 2.7% $572.60 10.4% X $572.60

FM_106 System Gangs $8.60 0.2% $114.00 2.1% X $114.00

FM_107 West Div MoW $11.10 0.3% $11.20 0.2% X $11.20

FM_108 Empire District $10.70 0.3% $14.70 0.3% X $14.70

FM_109 Michigan Line $10.30 0.2% $10.40 0.2% X $10.40

FM_201 MoE Turnaround $163.00 3.9% $163.30 3.0% X $163.30

FM_202 MoE Loco $88.30 2.1% $88.50 1.6% X $88.50

Maintenance

FM_203 MoE Car $38.00 0.9% $38.00 0.7% X $38.00

Maintenance

Maintenance of FM_204 MoE Support $39.10 0.9% $44.00 0.8% X $44.00

FM_MOE

Equipment FM_205 MoE Multiple $186.60 4.4% $344.00 6.2% X $344.00

FM_206 MoE HSR $57.60 1.4% $58.20 1.1% X $58.20

Maintenance

FM_207 MoE Back Shop $18.00 0.4% $79.10 1.4% X $79.10

FM_208 MoE Material Control $10.60 0.3% $10.60 0.2% X $10.60

FM_301 On Board Services $262.70 6.2% $262.70 4.8% X $262.70

(OBS)

FM_302 T&E $438.40 10.4% $438.40 7.9% X $438.40

FM_OPS_ Ops -

FM_303 Yard $71.00 1.7% $71.20 1.3% X $71.20

TRANS Transportation

FM_304 Fuel $128.10 3.0% $128.10 2.3% X $128.10

FM_305 Transportation - $11.50 0.3% $11.50 0.2% X $11.50

Multiple

FM_306 Train Movement $86.70 2.0% $86.80 1.6% X $86.80

FM_307 Train Movement - $152.30 3.6% $160.10 2.9% X $160.10

Host RR

FM_OPS_ Ops - FM_308 Transportation $77.60 1.8% $149.80 2.7% X $149.80

TRANS Transportation Support

FM_309 Power - Electric $81.10 1.9% $81.10 1.5% X $81.10

Traction

FM_310 Stations $196.90 4.7% $196.90 3.6% X $196.90

FM_SALES Sales and FM_401 Sales $10.30 0.2% $10.30 0.2% X $10.30

_MKTG Marketing FM_402 Information & $73.00 1.7% $73.00 1.3% X $73.00

Reservations

FM_403 Marketing $54.90 1.3% $77.40 1.4% X $77.40

FM_404 Station and On- Board $5.00 0.1% $5.00 0.1% X $5.00

Technology

FM_601 Corporate $144.10 3.4% $190.30 3.4% X $190.30

Administration

FM_602 Centralized $237.20 5.6% $296.40 5.4% X $296.40

General and Services

FM_G_A

Administrative FM_603 Qualified Mgmt $971.50 23.0% $1,015.60 18.4% X $1,015.60

FM_604 Direct Customer (Non- $49.40 1.2% $154.10 2.8% X $154.10

NTS)

FM_605 Subsidiary $39.20 0.9% $39.20 0.7% X $39.20

FM_UTILI Utilities FM_801 Utilities $5.80 0.1% $5.80 0.1% X $5.80

TIES

Police, FM_901 Police $58.90 1.4% $60.90 1.1% X $60.90

Environmental & FM_902 Emergency Mgmt $28.40 0.7% $34.40 0.6% X $34.40

FM_POLIC Safety & Corp Security

E_SAFETY

FM_903 Environmental & $7.40 0.2% $22.30 0.4% X $22.30

Safety

Grand Total $4,229.10 100% $5,521.60 100% $1,917.90 $3,604.00

Reconcilliation of APT Formula to Actual FY2018 Costs and Revenues

FY2018 Federal Government Investment after FRA witholding1 $1,924.90

Below-the-Rail Infrastrucutre Remaining to be Covered by Operations ($7.00) $7.00

Actual FY2018 Total Operating, Capital, Interest, Pensions, Tax, and Net Change in Cash1 $5,063.70

APT Formulaic Cost Above Actual FY2018 Costs $457.90 9.0% $ (457.90)

Total Above-the-Rail Operations Cost + Remaining Infrastructure Cost $ 3,153.10

Actual FY2018 Total Revenues (Tickets, State Contributions, Ancillary, and Other Core) 1 $ 3,386.70

1. Consolidated Financial Statements National Railroad Passenger Corporation and Subsidiaries (Amtrak) for FY2018

Summary - National Railway Infrastructure Plan 3 1/3/2020

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SaharaDocument14 pagesSaharaSunnyVermaNo ratings yet

- Brigham & Ehrhardt: Financial Management: Theory and Practice 14eDocument46 pagesBrigham & Ehrhardt: Financial Management: Theory and Practice 14eAmirah AliNo ratings yet

- Job CostingDocument11 pagesJob Costingbellado0% (1)

- Coaching Assembly - Interview AnswersDocument4 pagesCoaching Assembly - Interview Answersmiraj93No ratings yet

- Coc Model Level Iv ChoiceDocument22 pagesCoc Model Level Iv ChoiceBeka Asra100% (3)

- ADVANCED StrategiesDocument7 pagesADVANCED StrategiesMisterSimple100% (1)

- Supply Chain Management in Banking Sector PDFDocument37 pagesSupply Chain Management in Banking Sector PDFAdv Sunil JoshiNo ratings yet

- Notice For MemberDocument5 pagesNotice For MemberDEEPAK KUMARNo ratings yet

- Evidence of FundsDocument3 pagesEvidence of FundsMIrfanFananiNo ratings yet

- Electrometals AuditDocument62 pagesElectrometals AuditMuhammad Ramiz AminNo ratings yet

- Books of Prime Entry: The Cash BookDocument11 pagesBooks of Prime Entry: The Cash Bookأحمد عبد الحميدNo ratings yet

- Residential Valuation Sydney SampleDocument6 pagesResidential Valuation Sydney SampleRandy JosephNo ratings yet

- UnpaidDividend 2009 2010Document49 pagesUnpaidDividend 2009 2010harsh bangurNo ratings yet

- Disposable SyringeDocument13 pagesDisposable SyringemanojassamNo ratings yet

- Paramaunt ViacomDocument10 pagesParamaunt ViacomNatalia GastenNo ratings yet

- Project Report On Cash Management of State Bank of SikkimDocument39 pagesProject Report On Cash Management of State Bank of Sikkimdeivaram50% (10)

- What Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?Document9 pagesWhat Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?International Journal of Innovative Science and Research TechnologyNo ratings yet

- Law of Agency CasesDocument10 pagesLaw of Agency CasesAndrew Lawrie75% (4)

- Blaw Review QuizDocument34 pagesBlaw Review QuizRichard de Leon100% (1)

- PT Wahana Ottomitra Multiartha TBKDocument97 pagesPT Wahana Ottomitra Multiartha TBKHellcurtNo ratings yet

- Acknowledgement To ContentsDocument4 pagesAcknowledgement To Contentsvandv printsNo ratings yet

- Heswall Local March 2013Document40 pagesHeswall Local March 2013Talkabout PublishingNo ratings yet

- The Impact of Auditor Quality, Financial Stability, and Financial Target For Fraudulent Financial Statement.Document6 pagesThe Impact of Auditor Quality, Financial Stability, and Financial Target For Fraudulent Financial Statement.Surya UnnesNo ratings yet

- Dealer Management System v2.3.Xlsx - GetacoderDocument19 pagesDealer Management System v2.3.Xlsx - Getacoderapsantos_spNo ratings yet

- Grameen Bank - A Case StudyDocument9 pagesGrameen Bank - A Case Studyajeyasimha100% (4)

- Kasus Perusahaan Jasa Linda Laundry (1) - DikonversiDocument12 pagesKasus Perusahaan Jasa Linda Laundry (1) - DikonversiJulia FatmiNo ratings yet

- Tflow®-Course-Level-1-Final-19Oct2015-Binni OngDocument48 pagesTflow®-Course-Level-1-Final-19Oct2015-Binni Ongchen mlNo ratings yet

- Land Bank of The PhilippinesDocument30 pagesLand Bank of The PhilippinesAdam WoodNo ratings yet

- Mahatma Gandhi University Mba SyllabusDocument188 pagesMahatma Gandhi University Mba SyllabusTony JacobNo ratings yet

- Bloomberg Top Hedge Funds 2010Document14 pagesBloomberg Top Hedge Funds 2010jackefeller100% (1)