Professional Documents

Culture Documents

Foreign Banks in India: Presented By: Anjali Singh & Nitesh Kumar

Uploaded by

Nitesh Shetty0 ratings0% found this document useful (0 votes)

225 views10 pagesOriginal Title

Foreign Banks

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

225 views10 pagesForeign Banks in India: Presented By: Anjali Singh & Nitesh Kumar

Uploaded by

Nitesh ShettyCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

FOREIGN BANKS IN INDIA

PRESENTED BY: ANJALI SINGH & NITESH KUMAR

Friday 20 February 2009 1

Introduction

• REFORMS

• ECONOMIC ACTIVITY AND

GROWTH RATE

• GOVERNMENT NORMS

• POTENTIAL FOR ATTRACTIVE

RETURNS

• CUSTOMER SERVICE

• COMPETITIVE

• ACCURATIVE

• LATEST TECHNOLOGY AND

PRACTICES

Friday 20 February 2009 2

List Of Foreign

Banks

ABN Amro Bank N.V. JP Morgan Chase Bank

Abu Dhabi Commercial Bank Limited Krung Thai Bank Public Company Ltd.

American Express Bank Limited Mashreq bank psc

Antwerp Diamond Bank N.V. MIZUHO Corporate Bank Ltd.

AB Bank Limited Oman International Bank S.A.O.G.

Bank International Indonesia Shinhan Bank

Bank of America NA Societe Generale

Bank of Bahrain and Kuwait B.S.C. Sonali Bank

Bank of Ceylon Standard Chartered Bank

Barclays Bank PLC State Bank of Mauritius Ltd.

BNP Paribas The Bank of Nova Scotia

Chinatrust Commercial Bank The Bank of Tokyo-Mitsubishi UFJ, Ltd.

Citibank N.A. The Development Bank of Singapore Ltd.

Calyon Bank The Hongkong and Shanghai Banking

Deutsche Bank AG Corporation. Ltd.

Friday 20 February 2009 3

Major Foreign

Banks In India

• STANDARD CHARTERED

• CITIBANK

• HSBC BANK

• ABN-AMRO BANK

Friday 20 February 2009 4

WTO Agreement

Phase I: March 2005 to March 2009

New banks – First time presence

Minimum start up capital of Rs 3 billion and capital adequacy ratio of 10%

Existing banks – Branch expansion policy

limitation of setting up a maximum of 12 branches per year is to be relaxed and a more liberal policy for under banked areas will be adopted

Conversion of existing branches to wholly owned subsidiaries

Acquisition of shareholding in select Indian private sector banks(74% cap)

Phase II: April 2009 onwards

According ‘full national treatment’ to wholly owned subsidiaries of foreign banks

Dilution of stake in wholly owned subsidiaries

Merger and acquisition of any private sector bank in India

Friday 20 February 2009 5

Foreign Banks:

Strong Areas

• FOREIGN EXCHANGE

• TREASURY

• CORPORATE LENDING

• PROJECT FINANCING

• INVESTMENT BANKING

• ASSET MANAGEMENT

• CORPORATE FINANCE

• MERGER AND ACQUISITIONS

• OFF-SHORING

• TRADE FINANCE

Friday 20 February 2009 6

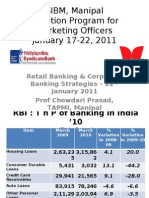

RBI

Regulations

• Compliance with BASEL norms

• Approval of home country regulator

• Good political relations with parent country.

• Financial soundness

• Start up capital of 3 billion and 10%capital adequacy ratio.

• Corporate Governance:

• minimum 50% directors are Indian nationals

• minimum 50% non executive directors

• one third are independent directors

• Compliance to companies act 1956 and RBI act 1934, and Banking

regulation act 1949

Friday 20 February 2009 7

Challenges

Faced

• PRODUCT CHANGES

• INCREASING COMPETITION

• PARENT BANK STRATEGY

CHANGES

• REGULATORY CHANGES

• STATE OF ECONOMY

• DEVELOPMENT OF

OUTSOURCING MARKET

• INCREASING COMPETITION

Friday 20 February 2009 8

Competition

• Many new banks expected to

open in 2009

• StanChart, Citibank, and HSBC

have the lions share among the

foreign banks

• Foreign banks bring with them a

variety of expertise, which needs

to be countered by other Indian

Banks.

• 2009 will be crucial in terms of

competitions.

Friday 20 February 2009 9

THANK YOU!

Friday 20 February 2009 10

You might also like

- (Amit Kumar) Foreign Banks in IndiaDocument27 pages(Amit Kumar) Foreign Banks in IndiaPrachi PandeyNo ratings yet

- Manjula: Banking-Sectoral StudyDocument20 pagesManjula: Banking-Sectoral Studysantosh prasadNo ratings yet

- Analysis of Habib Metropolitan Bank LTD PakistanDocument29 pagesAnalysis of Habib Metropolitan Bank LTD PakistanMBA...KID50% (2)

- Foreign Banks in IndiaDocument27 pagesForeign Banks in IndiaamitmohanvermaNo ratings yet

- Banking_Aw16733487930Document281 pagesBanking_Aw16733487930CJNo ratings yet

- Banking Sector OverviewDocument34 pagesBanking Sector OverviewteckdivNo ratings yet

- Topic I Commercial BankingDocument3 pagesTopic I Commercial BankingDhruv JainNo ratings yet

- Submitted By: Mahesh Raut IB Anand - Iim JammuDocument9 pagesSubmitted By: Mahesh Raut IB Anand - Iim JammuAnandNo ratings yet

- Report On Institutional Training at Canara BankDocument51 pagesReport On Institutional Training at Canara BankPoojaNo ratings yet

- A Study of Bank Audit ProcessDocument61 pagesA Study of Bank Audit ProcessSunil PawarNo ratings yet

- Collapse Bank: Assignment: 1Document13 pagesCollapse Bank: Assignment: 1NANDINI PANDEYNo ratings yet

- Banking & Insurance MGTDocument11 pagesBanking & Insurance MGTSandip PradhanNo ratings yet

- Consolidation in BanksDocument32 pagesConsolidation in BanksprasannarbNo ratings yet

- Understanding Global Trust Bank What To Do and What Not To Do Project GroupDocument5 pagesUnderstanding Global Trust Bank What To Do and What Not To Do Project GroupJinesh ShahNo ratings yet

- Business Environment Business EnvironmentDocument18 pagesBusiness Environment Business EnvironmentSarveshwar SharmaNo ratings yet

- India Banking SystemDocument33 pagesIndia Banking SystemKalp VaghelaNo ratings yet

- Banking in India: An Introduction To The Banking System in The CountryDocument16 pagesBanking in India: An Introduction To The Banking System in The CountryJayesh SinghNo ratings yet

- GTBDocument8 pagesGTBRishabh WadhwaNo ratings yet

- PPB Module 1Document42 pagesPPB Module 1RAJNo ratings yet

- Impact of Recession On BanksDocument45 pagesImpact of Recession On BanksgiadcunhaNo ratings yet

- Sheam. Bank Management.-1Document121 pagesSheam. Bank Management.-1SM SheamNo ratings yet

- Presentation FinalDocument23 pagesPresentation FinalRitu RawatNo ratings yet

- Shraddha G. Padolkar SKDocument10 pagesShraddha G. Padolkar SKPooja PatilNo ratings yet

- India Banking Towards A High-Performing Sector: Munish Mahajan Priyanka Joel Raj KumarDocument25 pagesIndia Banking Towards A High-Performing Sector: Munish Mahajan Priyanka Joel Raj KumarAnkur GuptaNo ratings yet

- Accounting Fundamentals - Session 1 - For ClassDocument13 pagesAccounting Fundamentals - Session 1 - For ClassPawani ShuklaNo ratings yet

- Internship Report On MCB 2009Document85 pagesInternship Report On MCB 2009siaapaNo ratings yet

- Leading Private Bank Review: Yes Bank Market Share and ProductsDocument3 pagesLeading Private Bank Review: Yes Bank Market Share and Productssaheb167No ratings yet

- Central Banking Reserve Bank of India (RBI)Document20 pagesCentral Banking Reserve Bank of India (RBI)mayanksonucoolNo ratings yet

- Study On HSBC BankDocument48 pagesStudy On HSBC Bankvarun_new87No ratings yet

- Interntional BankingDocument13 pagesInterntional BankingJogu AnjanaNo ratings yet

- UNITIDocument60 pagesUNITIAmrendra KumarNo ratings yet

- GK Tornado Ibps RRB Main Exam 2019 English 43 PDFDocument150 pagesGK Tornado Ibps RRB Main Exam 2019 English 43 PDFSankar SreeramdasNo ratings yet

- List of Foreign Banks in India As On May 31, 2019 - branch/WOS Form of Presence No of Banking BranchesDocument4 pagesList of Foreign Banks in India As On May 31, 2019 - branch/WOS Form of Presence No of Banking BranchesNiyati BagweNo ratings yet

- Sector Overview On Indian Banking Industry: BY BhausahebDocument38 pagesSector Overview On Indian Banking Industry: BY BhausahebPranavNo ratings yet

- Problems Faced by Commercial BanksDocument29 pagesProblems Faced by Commercial BanksPantula ChandanaNo ratings yet

- Evolution and Structure of Banking System in IndiaDocument67 pagesEvolution and Structure of Banking System in IndiaTilak RokrNo ratings yet

- Public V/S Private Sector Banks ComparisonDocument64 pagesPublic V/S Private Sector Banks ComparisonRanjith AlappadanNo ratings yet

- SMS UnhappyA concise, SEO-optimized title for the given document focusing on SBI's SMS Unhappy marketing campaign. The title is less than 40 charactersDocument37 pagesSMS UnhappyA concise, SEO-optimized title for the given document focusing on SBI's SMS Unhappy marketing campaign. The title is less than 40 charactersnishantNo ratings yet

- Financial System of China: Lecturer - Oleg Deev Oleg@mail - Muni.czDocument37 pagesFinancial System of China: Lecturer - Oleg Deev Oleg@mail - Muni.czSaurabh BhirudNo ratings yet

- Bank of Baroda Key Strengths in 40 CharactersDocument15 pagesBank of Baroda Key Strengths in 40 Charactersnarayanpawar1416No ratings yet

- GK Tornado Ibps RRB Main Exam 2019 English 54Document148 pagesGK Tornado Ibps RRB Main Exam 2019 English 54Narejo KashifNo ratings yet

- JayyzzzuuuuDocument594 pagesJayyzzzuuuuHarsh GandhiNo ratings yet

- Role of Commercial BanksDocument44 pagesRole of Commercial BanksSanika SankheNo ratings yet

- Classification of BanksDocument14 pagesClassification of BanksJas KaranNo ratings yet

- Ijmra 13869Document13 pagesIjmra 13869kapa123No ratings yet

- Merchant BankingDocument18 pagesMerchant BankingRashi TutejaNo ratings yet

- Punjab National Bank - Banking ReportDocument36 pagesPunjab National Bank - Banking ReportGoutham SunilNo ratings yet

- Scheduled Bank Non Scheduled Bank PDFDocument6 pagesScheduled Bank Non Scheduled Bank PDFSelvaraj Villy100% (1)

- Group 3 - Financial InstitutionDocument21 pagesGroup 3 - Financial InstitutionivandimaunahannnNo ratings yet

- 22 08 ClassDocument7 pages22 08 ClassDivyajeet Singh ChampawatNo ratings yet

- BankingDocument20 pagesBankingAnand VenugopalNo ratings yet

- Financial Management of Banks, NBFCs and Insurance Companies in IndiaDocument27 pagesFinancial Management of Banks, NBFCs and Insurance Companies in IndiaankeloeNo ratings yet

- Banking & Financial Awareness (July 2018)Document10 pagesBanking & Financial Awareness (July 2018)Bvr Pavan KumarNo ratings yet

- Retail Banking: by - Sunil DeoreDocument17 pagesRetail Banking: by - Sunil DeoreSunil DeoreNo ratings yet

- Sibm, RBCBDocument20 pagesSibm, RBCBProf Dr Chowdari PrasadNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Understanding Commerce: A High School Student’S CompanionFrom EverandUnderstanding Commerce: A High School Student’S CompanionNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Industry Analytics PresentationDocument13 pagesIndustry Analytics PresentationNitesh ShettyNo ratings yet

- A Presentation by Group 9 Asha Nachi Kritika Prabhakar Nitesh Kumar Raunaq Chawla Seshu Pinnamineni Vijay Pal SinghDocument17 pagesA Presentation by Group 9 Asha Nachi Kritika Prabhakar Nitesh Kumar Raunaq Chawla Seshu Pinnamineni Vijay Pal SinghNitesh ShettyNo ratings yet

- Cost LeadershipDocument20 pagesCost LeadershipNitesh Shetty100% (3)

- Cost Leadership Term PaperDocument19 pagesCost Leadership Term PaperNitesh ShettyNo ratings yet

- Prometheus NewsletterDocument12 pagesPrometheus NewsletterNitesh ShettyNo ratings yet

- Aviation Report GROUP 9Document89 pagesAviation Report GROUP 9Nitesh Shetty100% (3)

- Foreign Banks in India: Presented By: Anjali Singh & Nitesh KumarDocument10 pagesForeign Banks in India: Presented By: Anjali Singh & Nitesh KumarNitesh ShettyNo ratings yet

- Maximization ProblemDocument10 pagesMaximization ProblemNitesh Shetty100% (2)

- QuestionnaireDocument2 pagesQuestionnaireNitesh Shetty74% (23)

- Marketing Assignment 1Document10 pagesMarketing Assignment 1Nitesh ShettyNo ratings yet

- Group AssignmentDocument2 pagesGroup AssignmentNitesh ShettyNo ratings yet