Professional Documents

Culture Documents

Eurocurrency Markets

Uploaded by

smh9662Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eurocurrency Markets

Uploaded by

smh9662Copyright:

Available Formats

Greg MacKinnon Finance 476 Sobey Faculty of Commerce Saint Marys University

Eurocurrency Markets Up until the 1950s, most international trade was conducted in s (instead of the currencies of whatever countries were trading). English banks facilitated international trade taking deposits and making loans so that importers/exporters in other countries could simply sign over deposits in order to pay for goods. Also, financing purchases was simple in that firms could simply take out loans in s from these English banks. In 1956, the Suez Canal crisis put downward pressure on the . Attempting to alleviate the pressure, the Bank of England prohibited loans of s to foreign borrowers (the logic being that if the foreign investors did not have pounds, they could not put pressure on the pound by selling them). The banks did not like this because it took away a very profitable piece of their business. English banks decided to take deposits and make loans in $US so that they could continue to finance international trade, except with $US instead of s. This was the start of the Eurocurrency Market. Eurocurrency is any deposit of a currency in a country other than that of the currencys origin. For example, a deposit of $US in a bank in France is a deposit of Euro-dollars. The entire market for loans and deposits in Eurocurrency is the Eurocurrency Market. The Eurocurrency Market does not have buyers and sellers, it has lenders and borrowers. Note that the prefix Euro is historical in nature, referring to the fact that the market was initially centred in Europe. Today, however, a deposit of $US in a Japanese bank is still referred to as Eurocurrency. From relatively humble beginnings, the Eurocurrency deposits have developed into a market measured in the trillions of dollars (as of 1989 the total value of eurocurrency deposits globally was over $5 trillion US). The Eurocurrency market was created to avoid capital controls imposed by governments. It grew in response to further capital controls, especially by the U.S. government (for example the Interest Equalization Tax of 1963 applied to interest earned from $US loans to foreign firms (since repealed), and Regulation Q (also since repealed) which put a limit on the rate that could be paid by American banks on deposits). Generally, Eurobanks are able to pay higher rates on deposits and charge lower rates on loans than purely domestic banks. They are able to do this because they can often avoid government regulations such as reserve requirements and the need to pay deposit insurance. This lowers the cost of operations for Eurobanks and these lower costs can be passed through to the clients. As well, eurocurrency loans are generally very large and the customers are well known firms. This means that the banks are not subject to as much default risk and can charge lower margins on the large loans. Of course, Eurobanks have to offer higher rates on eurocurrency deposits because of the higher risk to the depositor. Part of the risk comes from the fact that eurobanks do not follow the same regulations as domestic banks (these regulations are usually meant to protect depositors). However, a large part of the extra risk comes from sovereign risk. This is the risk that governments impose new regulations that restrict the movement of

Greg MacKinnon Finance 476 Sobey Faculty of Commerce Saint Marys University

capital or control foreign currency transactions. This may mean that any eurocurrency deposits held in that country become inaccessible for the owner. While eurobanks will offer better rates than purely domestic banks, the difference between eurocurrency rate sand domestic rate swill be limited by arbitrage. It must be that: Euro-loan rate > Domestic deposit rate Euro-deposit rate < Domestic loan rate If one of these did not hold then arbitrageurs could simply borrow in the cheaper market and deposit in the money in the in the market where they would get a higher return. Generally, the advantage of eurocurrency rates over domestic rates runs somewhere between 25 and 100 basis points. There are several eurocurrency centres around the world where eurobanks conduct most of their business. The largest are: London, the Cayman Islands, Bahrain, Singapore and some International Banking Facilities that have been set up in the U.S. Approximately 80% of the eurocurrency market involves banks lending to, and depositing with, other banks. This is done on a Bid-Ask basis with the bid being the rate offered on deposits and the ask the rate charged on loans. A main characteristic of eurocurrency loans is that they are usually floating rate (this also referred to as rollover pricing or as cost-plus pricing) and are typically set as a percentage over LIBOR. International Bond Market Bonds are an important source of long term capital for firms. A bond is debt. A firm (or government) issues a certificate, called a bond, that states that the firm will make coupon payments to the holder of the bond and will, at maturity pay the holder the par value of the bond. Coupon payments are simply the interest payments on the debt and the par value is the principal. Firms sell these bonds to investors (thereby borrowing money). The key difference between borrowing money by issuing bonds rather than borrowing directly from a bank is that there exists a secondary market for bonds. That is, if you buy a bond from a firm (lending that firm money) you can later sell the bond to another investor. The act of firms selling bonds directly to investors is termed the primary market, while investors trading bonds among themselves is the secondary market. There exists a well developed domestic market for bonds (Canadian firms issuing bonds denominated in Canadian dollars and selling them in Canada). However, there also exists an international bond market. The international bond market is really a set of loosely connected individual markets around the world. There are many different bond markets in many countries, taken together as a whole they constitute the international bond market. The international bond market can be broken down into two parts: 1) Foreign Bonds 2) Eurobonds

Greg MacKinnon Finance 476 Sobey Faculty of Commerce Saint Marys University

1) Foreign bonds are simply bonds issued in a bond market by a foreign company. For example, a Japanese firm issuing a U.S. dollar denominated bond in the U.S. is issuing a foreign bond. Because foreign bonds are simply a part of the domestic bond market, the only real difference is their treatment under the law. In many countries, foreign bonds are subject to different tax treatment, registration requirements et cetera. The most important foreign bond markets are located in Zurich, New York, Tokyo, Frankfurt, London and Amsterdam. The reasons that a company may go to another country to issue bonds include the simple fact that there may not be enough demand in the domestic market. Going to a foreign market opens up a whole new set of potential investors to the firm. For instance, a German pharmaceutical firm may wish to borrow DM 500 million. However, its investment bank tells it that there is only demand for DM 250 million of its bonds. In order to float the rest it would have to offer a much higher yield. But, for some reason there is demand in the US for the debt of pharmaceutical firms, and that demand is not being met by US companies. The German firm could then float an issue in Germany (in DM) and also float an issue in the US (in $US) in order to sell all of the bonds it wants. Of course, the firm may choose to swap its new $US debt for DM debt at the same time. Note that issuing a bond in Zurich (for instance) does not mean that the firm is necessarily borrowing from Swiss lenders. Generally, a foreign firm issues a Swiss Franc denominated bond in Zurich and most of the buyers of that bond will also be foreign. Basically, the Sfr is simply a unit of account for the transaction between the buyer and the lender. A taxonomy has arisen for foreign bonds. Foreign bonds issued in the U.S. are termed Yankee bonds, in Japan they are called Samurai bonds, in England Bulldog bonds and in the Netherlands Rembrandt bonds. 2) Eurobonds are bonds denominated in one currency but issued in a country that is not the home of that currency. For example, a bond denominated in $Can but issued in London is a Eurobond. Similarly, a Sfr denominated bond issued in Germany is a Eurobond. Most countries have very few regulations governing the issuance of Eurobonds (since they are not denominated in that countrys currency, the government does not care all that much about them). While some countries have tried to control issues of bonds denominated in their currency even if issued in a foreign country, this is very hard to do for obvious reasons. One thing that this means is that interest paid on Eurobonds is usually free of all withholding taxes. A withholding tax is when the government takes a portion of each interest payment before the lender gets it. The borrower (the firm issuing the bond) withholds a part of the interest and gives it to the government. With a withholding tax, the firm issuing the bonds would have to pay a higher rate of interest in order to

Greg MacKinnon Finance 476 Sobey Faculty of Commerce Saint Marys University

compensate lenders. In the eurobond market, therefore, firms can often pay a lower rate by avoiding the tax. Most eurobonds are bearer bonds. The owner of the bond is not registered with the firm that initially issued the bond. Actually having physical possession of the bond is evidence of ownership. This makes eurobonds attractive to investors who wish to remain anonymous (to avoid taxes or for other reasons). Eurobonds have been popular as a source of funds for firms because they allow borrowers and lenders to avoid taxes and government regulations. The rate of growth in the eurobond market has slowed over the last 8-10 years because of reductions in these factors in the domestic bond market. Governments realized that securities issues were going offshore to avoid regulations and therefore were forced to reduce the regulatory burden for domestic issues. This is best exemplified by the introduction in the early 1980s of the Prompt Offering Prospectus method of issuing securities in Canada which reduced the time needed for established firms to register and issue new securities from weeks (sometimes months)to a few days (the Prompt Offering Prospectus was introduced in response to similar legislation in the U.S. known by the term shelf registration). The eurobond market is still large and is driven in large part by firms ability and desire to engage in swaps.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Art of Landscape Painting in Oil Colour 1000066895Document189 pagesThe Art of Landscape Painting in Oil Colour 1000066895smh9662No ratings yet

- Scope Management PlanDocument10 pagesScope Management Plansmh966250% (2)

- Process Intervention SkillsDocument20 pagesProcess Intervention Skillssmh9662100% (4)

- Excel Practice ActivitiesDocument4 pagesExcel Practice Activitiessmh9662No ratings yet

- Rely On God, and Do Not Give Up.Document5 pagesRely On God, and Do Not Give Up.smh9662No ratings yet

- Housing The Growing Population of Saudi ArabiaDocument15 pagesHousing The Growing Population of Saudi Arabiasmh9662No ratings yet

- Mein Deccan HounDocument1 pageMein Deccan Hounsmh9662No ratings yet

- McKinsey On Supply Chain Select Publications 20111Document32 pagesMcKinsey On Supply Chain Select Publications 20111Ajinkya PawarNo ratings yet

- Cave of Forgotten Dreams - An EssayDocument3 pagesCave of Forgotten Dreams - An Essaysmh9662100% (1)

- Strategic Management and Business PolicyDocument5 pagesStrategic Management and Business Policysmh9662No ratings yet

- Cost Leadership and DifferentiationDocument61 pagesCost Leadership and Differentiationsmh966250% (2)

- Signs of IntrovertsDocument9 pagesSigns of Introvertssmh9662100% (1)

- Why Mergers Fail?Document32 pagesWhy Mergers Fail?smh9662No ratings yet

- Data Center Ops & Preventive Network Maintenance at MobilyDocument2 pagesData Center Ops & Preventive Network Maintenance at Mobilysmh9662No ratings yet

- BP Meets OperationsDocument7 pagesBP Meets Operationssmh9662No ratings yet

- Alan Rugman's Contribution To International BusinessDocument14 pagesAlan Rugman's Contribution To International Businesssmh9662No ratings yet

- New Food Products - Technical DevelopmentsDocument42 pagesNew Food Products - Technical Developmentssmh9662No ratings yet

- Islamic Perspective!: Source URLDocument1 pageIslamic Perspective!: Source URLsmh9662No ratings yet

- Product Innovation and AdvertisingDocument47 pagesProduct Innovation and Advertisingsmh9662No ratings yet

- Potential Cause of Depression IdentifiedDocument3 pagesPotential Cause of Depression Identifiedsmh9662No ratings yet

- Depression Strongly Linked To Stroke RiskDocument20 pagesDepression Strongly Linked To Stroke Risksmh9662No ratings yet

- The Exit OptionDocument16 pagesThe Exit Optionsmh9662No ratings yet

- Virtue of PatienceDocument1 pageVirtue of Patiencesmh9662No ratings yet

- Balancing Between Tawakkul-Allah and Human-EffortsDocument2 pagesBalancing Between Tawakkul-Allah and Human-Effortssmh9662No ratings yet

- Depression Strongly Linked To Stroke RiskDocument20 pagesDepression Strongly Linked To Stroke Risksmh9662No ratings yet

- Top 40 Regrets of Becoming Overweight or Not Saving MoneyDocument4 pagesTop 40 Regrets of Becoming Overweight or Not Saving Moneysmh9662No ratings yet

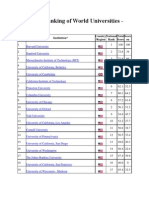

- Academic Ranking of World UniversitiesDocument23 pagesAcademic Ranking of World Universitiessmh9662No ratings yet

- Good Manners - Be LenientDocument1 pageGood Manners - Be Lenientsmh9662No ratings yet

- Having A Good NatureDocument1 pageHaving A Good Naturesmh9662No ratings yet

- Cure For A Weak FaithDocument2 pagesCure For A Weak Faithsmh9662No ratings yet