Professional Documents

Culture Documents

Nightly Business Report - Wednesday April 10 2013

Uploaded by

Nightly Business Report by CNBCCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nightly Business Report - Wednesday April 10 2013

Uploaded by

Nightly Business Report by CNBCCopyright:

Available Formats

<Show: NIGHTLY BUSINESS REPORT> <Date: April 10, 2013> <Time: 18:30:00> <Tran: 041001cb.

118> <Type: SHOW> <Head: NIGHTLY BUSINESS REPORT for April 10, 2013, PBS> <Sect: News; Domestic> <Byline: Susie Gharib, Tyler Mathisen, Sharon Epperson, Mary Thompson> <Guest: Alan Krueger, Sheryl Palmer> <Spec: Business; Economy; Stock Markets; Wall Street; Barack Obama; Budget; Government; Policies; Business; Taylor Morrison; Housing> <Time: 18:30:00>

ANNOUNCER: This is NIGHTLY BUSINESS REPORT with Tyler Mathisen and Susie Gharib, brought to you by --

(COMMERCIAL AD)

TYLER MATHISEN, NIGHTLY BUSINESS REPORT ANCHOR: Market milestone, the S&P 500 hit a new all time high. What`s driving the rally? Which sectors are being left behind and what`s next for stocks?

SUSIE GHARIB, NIGHTLY BUSINESS REPORT ANCHOR: Building a foundation.

A homebuilder makes his debut on the New York Stock Exchange, so we have asked the CEO why now, and is the housing recovery as strong as some think?

MATHISEN: And made in America. You won`t believe what a new company is manufacturing now in Detroit.

GHARIB: All that and more coming up right here on NIGHTLY BUSINESS REPORT for Wednesday, April 10th.

Good evening, everyone.

The stock market, Tyler, just took off right from the opening bell and it does not stop until the close.

MATHISEN: It`s a rally that does not seem to want to quit. It may be getting a little bit repetitive, Susie, but it is hardly getting old for most investors. Stocks sprinted to more records today in a broad rally that pushed the Dow and the S&P 500 to fresh all-time closing highs.

The NASDAQ for its part closed at its highest level in 12 years. Traders were cheered, among other things, by better than expected import data from China. That suggests the demand in the world`s second largest economy remains strong.

The blue chip Dow index surged 129 points, closing at a record 14,802 with 15,000 Dow in sight now. And the S&P was up 15 points, nearly 2 percent, fueled by sizeable gains in some big tech companies. And the S&P 500 index up 19 points and, again, a new record high, 1,587.

GHARIB: Now, another factor fuelling that rally: some encouraging news from the Federal Reserve. The notes from the Fed`s latest meeting show that most policymakers wants to continue to buy billions in bonds every month to continue stimulating the economy, at least through the end of the year. Those minutes were accidentally leaked five hours ahead of time

and came out before the stock market opened today, giving investors confidence to snap up stops.

Well, the Fed may have helped drive today`s gains, but does the rally have staying power?

We turn to some market pros for answers.

(BEGIN VIDEOTAPE)

TOM CRUISE, ACTOR: Show me the money! Show me the money!

GHARIB (voice-over): Show me the money. Investors have been looking for big returns on their money and it looks like they are finding them with stocks and less so with bonds. And the more stock averages go up and hit new records, the more courage investors have to put stocks in their portfolios. The urge to buy is so strong that investors have been shrugging off bad economic news about the job market, as well as political tensions in North Korea.

But despite all the new milestones on Wall Street, some market pros would like to see the rally spread out.

ART CASHIN, UBS FINANCIAL SERVICES: In all of the upward movement, all the new record highs, there`s a sense of seeking safety and protection. It`s kind of a dichotomy. If you look at the other markets around the globe, they`re not all participating in the same manner. They decided to almost begin to take the summer off already, and it`s been the S&P and been the Dow Jones. That`s encouraging. They`re the two drivers here. But you`d really like to see it broaden out a bit.

GHARIB: Health care stocks, consumer staples and utilities are popular with investors. They are also loading up on defensive names and big blue chips that pay dividends. Technology, materials and energy are the under performers and have been lagging the market.

DAVID KELLY, JPMORGAN FUNDS, CHIEF GLOBAL STRATEGIES: We have seen the first few months of the year, we have seen much more interest among mutual fund buyers to buy into equity funds. I think we`re also seeing that, we`re still seeing that, but also, I think some institutions are buying it.

The one thing that all the Q.E. has done, it`s made it sort of a TINA market, there is no alternative to being overweight equity markets.

GHARIB: As long as money managers dole out that kind of advice, it looks like we`ll be seeing more records in the markets.

(END VIDEOTAPE)

MATHISEN: Well, the House has one. The Senate has one, too. And today, President Obama sent Congress his fiscal year 2014 budget proposal. The $3.8 trillion spending plan would be dead on arrival in the House.

But it is designed to jump start talks to achieve a so-called grand plan with Republicans, sort of middle of the road Republicans in the Senate is most especially to tame the nation`s deficit. The Obama blueprint out today includes deficit reductions of $1.8 trillion over the next decade, achieved through higher taxes on the wealthiest Americans, including a 30 percent tax rate on those pulling in more than $1 million a year of income.

And as expected, there`s a reduction in payments to Medicare providers and cut backs in cost of living increases so Social Security recipients. The proposal also nearly doubles federal taxes on cigarettes to $1.95 a pack in order to fund a new preschool program.

For more now on the president`s spending plan, we`re joined by Alan Krueger, chair of the White House Council of Economic Advisers.

Mr. Krueger, welcome back. Great to have you with us.

ALAN KRUEGER, WHITE HOUSE COUNCIL OF ECONOMIC ADVISERS CHAIRMAN: Thank you.

MATHISEN: One of the biggest items in this budget are the savings, some $230 billion. Largely from slower growth of Social Security benefits that come from using a different kind of inflation measure.

Whose benefits will be reduced and on average by how much?

KRUEGER: The proposal to switch to use the chained consumer price index to adjust for inflation is an idea that came up in the negotiations with Speaker Boehner and Senator McConnell. It`s a technical fix. It addresses some issues that economists have raised in the past about the consumer price index and the Congressional Budget Office concludes that it grows about a quarter of a percentage point more slowly, not very much in any particular year.

One thing I would add, Tyler, is the president has insisted all along that we include safeguards for the most vulnerable, that we protect the oldest olds that their benefits are adjusted, as well as those who are just barely getting by.

MATHISEN: So, not everyone`s Social Security benefit would be reduced as a result of the switch to the so-called chained CPI (NYSE:CPY). There would be some blunting in there for certain individuals. And are we talking here for the average check, a difference of dollars, $10. $5? What?

Do you have any idea?

KRUEGER: Well, it accumulates over time, because the change index grows more slowly and the protections that the president has built in would kick in at age 76. So it helps to protect the oldest old and that gets phased in over time to individual.

MATHISEN: So, $370 billion worth of Medicare cuts in the program. What do they consist of? Do they largely come from reduced payments to drug makers?

KRUEGER: A lot comes from reduced payments to providers. The president has been very clear that he`s not going to simply shift cost on to seniors. That he wants to have more efficiency in the system, so that we`re not reducing quality and raising the cost for our seniors.

And he also we would have more means testing as part of Medicare.

MATHISEN: How much more then, will those affluent, supposedly affluent Medicare recipients how pay premiums under Part B and D, how much more are they likely to pay? And what`s the measure of affluent for this case?

KRUEGER: It`s a sliding scale. Offhand, I don`t recall, I`m afraid, exactly where the cut was for the means testing to start in for the premiums.

MATHISEN: For the premiums.

All right. Let`s talk about where the $580 billion in additional revenues come from. One area is the so-called Buffett Rule, which would impose a 30 percent minimum tax on those people who have more than $1 million a year in income. Let me understand this if I might.

Is this 30 percent on the marginal income above a million dollars or a flat tax on anyone who has incomes of a million or more should we be so lucky?

KRUEGER: It`s on the marginal tax, so it`s on the income above.

MATHISEN: Does it include all sources of income including dividends, capital gains and carried interest, or what?

KRUEGER: It does. It broadly defines income.

MATHISEN: All right, let`s talk about the tobacco tax. It`s some $78 billion and this would go to fund exactly what?

KRUEGER: It goes to fund the universal prekindergarten program. Research has shown that students benefit throughout their lives if they got an early start in their education. High quality preschool seems to be a very effective pay off for the investment.

So, I think this is a very good use of funds and I think it will discourage more teenagers from starting smoking in the first place.

MATHISEN: And the growth forecast in the plan are about 2.3 percent in the latter years of the 10-year plan. Is there anything that we can do to get the economy growing faster than that? That`s lower than it`s been in this country over the past 50 years, for example.

KRUEGER: Well, the budget is a plan to strengthen growth and speed up job creation. That`s exactly what the president has designed the budget to do. So, it`s critical that we make the kinds of investments that will speed up growth. Like investing more in our infrastructure, our roads and our highways, like enabling more people to go to college, helping youngsters go to preschool. That will help growth in the long run.

But because of slower population growth and slower growth in the working age population, in the assumptions in the budget and we tried to be modest in our assumptions, we assume that the long run rate of growth is around 2.3 percent, 2.4 percent.

MATHISEN: OK.

KRUEGER: It`s about the same as the Congressional Budget Office.

MATHISEN: I`m afraid we have to leave it there. Mr. Krueger, thank you again for being with us.

KRUEGER: My pleasure.

GHARIB: From the U.S. economy to the global economy. Easy monetary policy is one of the reasons that the world economy is getting stronger, according to the chief of the International Monetary Fund.

Christine Lagarde speaking today at the Economic Club of New York, which I attended, said inflation expectations are stable, giving central banks around the world greater leeway to support growth.

(BEGN VIDEO CLIP)

CHRISTINE LAGARDE, IMF MANAGING DIRECTOR: The good news is that after a volatile period, financial conditions are showing signs of improvement. You, of course, have noticed. Thanks to the action of policymakers, the economy world no longer looks quite as dangerous as it did nine months ago. Yet, we do not expect global growth to be much higher this year than last year.

(END VIDEO CLIP)

GHARIB: Lagarde went on to say that the U.S. economy is making rapid progress, but she said U.S. budget cuts are, quote, "too deep in some areas and leaving untouched key drivers of long-term spending"

MATHISEN: In another sign of recovery in housing, mortgage applications rose 4 1/2 percent as interest rates fell to their lowest levels since January. The Mortgage Bankers Association says much of that increase was from existing homeowners whose rising equity increasingly lets them refinance their current loan at cheaper rates. Request for loans on new purchases actually dipped 1 percent.

GHARIB: One company that`s benefitting from that boom in home loans, Taylor Morrison. This is the sixth largest homebuilder in the U.S. and today it went public. Trading on the New York Stock Exchange under the ticker symbol, TMHC, Taylor Morrison`s IPO opened at $22 a share and closed with a gain of almost 5 percent.

I caught up with CEO Sheryl Palmer at the NYSE today, and asked her why she decided to go public now.

(BEGIN VIDEOTAPE)

SHERYL PALMER, TAYLOR MORRISON INC., PRESIDENT & CEO: You know, it`s the perfect time. When we look at where we are in the recovery, and what has happened with the consumer mind set, it`s actually the perfect time. We`ve almost spent two years, three years positioning the business just for today. And when we look at where the company is, and the opportunity ahead with our geographic footprint in some of the best markets in the United States, it`s a perfect time.

GHARIB: So, Sheryl, you talk about the recovery. Is this housing recovery for real? What do you think?

PALMER: Oh, it is. You know, we`ve watched over the last 12 months, a very -- a lot of momentum in the recovery. And we are seeing it across the board. When you look at the mortgage business, when you are looking at affordability, when you look at, you know, what has happened to inventory across our markets. And really most importantly the consumers mind set, and the security they have in their own personal situations, I think we are in very early innings.

GHARIB: So, Taylor Morrison operates in markets like California, Texas, Arizona, Florida, parts of Canada. All those markets, which one is the strongest right now?

PALMER: You know, the great news is that we have strength across all of the markets. Certainly, we have seen just remarkable results in Arizona, in Phoenix. You know, it`s probably dropped farthest, and parts of California are just on fire.

But I will tell you equally across all of the business, we are seeing really wonderful results.

GHARIB: So, how would you describe your sales so far this year?

PALMER: Our first quarter this year versus first quarter last year is up on all metrics. It`s up in sales, closings. If we look at the customer contracts we have in our, what we call our order book, our backlog today, I think in the U.S. we`re up 150 percent over first quarter last year.

GHARIB: Right now, we see mortgage rates super low, what happens when they start going up? What impact could that have on your business?

PALMER: If mortgage rates are going up, that means the economy is improving. I don`t think that we expect this ridiculous amount of change over the next couple of years. But I think we still have some good, you know, good time ahead of us. But, over time, we`re going to start to see that inch up.

GHARIB: So, tell us about your stock, your IPO today, how do you feel it has been doing. It`s sort of bouncing around.

PALMER: I think we`re going to see some movement all day. I think that`s good, I think that`s exciting, what is supposed to happen. We have priced at the highest point in the range. We`ve oversold the subscription.

So, actually we feel so fortunate and I`m excited to see how the day continues.

GHARIB: So, you are going to be talking to a lot of investors now. What is your pitch to investors about why they should buy Taylor Morrison?

PALMER: What Taylor Morrison is, is we are a top homebuilder in some of the best markets in the United States today. We have a remarkable business, our Monarch business in Canada that has been in business for almost 100 years. And when you look at that and where the business is today and the results we have generated over the last many years, it`s a pretty special story.

(END VIDEOTAPE)

GHARIB: Taylor Morrison is the second home builder to go public this year. Tri Pointe Homes came to market in January. And then just this week, another home builder, William Lyon Homes filed for an IPO.

MATHISEN: Coming up, women and retirement.

But, first, a look at the international markets.

(MUSIC)

GHARIB: Merck (NYSE:MRK) and Pfizer (NYSE:PFE) were the biggest performing blue chips today. And that`s where we begin our "Market Focus."

The FDA green-lighted big projects, accepting a new antifungal proposal from Merck (NYSE:MRK) and granting Pfizer`s experimental breast cancer drug breakthrough status. Shares of both Merck (NYSE:MRK) and Pfizer (NYSE:PFE) surged nearly 3 percent.

MATHISEN: It was a different story, though, Susie, for hospital stocks. Health Management Associates (NYSE:HMA) reduced its outlook for 2013 earnings and revenues, citing weak patient admissions in the first quarter of the year. That dragged on the stock and the entire sector.

HMA down more than 16 percent, followed by Tenet in more than 5 percent, Community Health at more than 3 1/2 percent.

GHARIB: Fastenal (NASDAQ:FAST) also down on guidance that its sales growth was hurt partially by global economic uncertainty. Fastenal (NASDAQ:FAST) sells industrial and construction supplies. And even though the company doubled the quarterly dividend, shares tumbled about 3 1/2 percent, closing at $49.

MATHISEN: Reporting after the bell, the retailer Bed Bath & Beyond`s earnings were in line, revenues beat, but guidance for the current quarter below what analysts had expected because the company is modeling higher tax charges as it integrates world market stores. Bed Bath & Beyond (NASDAQ:BBBY) is up almost 20 percent so far this year, and up again today before the close at $65.50.

Yum Brands (NYSE:YUM) feeling the effects of the bird blue fears on their KFC outlets in China. Yum announcing its same store sales in China were down 16 percent year to year in March. Yum calling it a significant negative impact. Shares of Yum Brands (NYSE:YUM) up on the day, lost ground when the company issued its release.

GHARIB: Switching gears here. Saving for retirement is different for men and women. A new prudential financial survey finds that the top priority for men is to maintain their current life lifestyle in retirement. But for women, the goal is not become a financial burden to their loved ones.

Well, whatever the objected. Many women are finding it`s never too late to ramp up savings to meet their retirement goals.

Sharon Epperson reports.

(BEGIN VIDEOTAPE)

SHARON EPPERSON, NIGHTLY BUSINESS REPORT CORRESPONDENT (voiceover): Lorin Palmer, a South Carolina homeowner helps families face the finality of passing on.

Making the arrangements is instructive. She knows it`s time to ramp up planning for her own financial future now.

LORIN PALMER, PALMER MEMORIAL CHAPEL OWNER: I have learned that in this business, just as families preplan and they come in and they make funeral arrangements and pay for them in advance, likewise, that same principles applies with retirement planning.

EPPERSON: Palmer, the third generation to own this family business knows careful retirement planning is also important for her son`s future. But for this 56-year-old, staying on track hasn`t been easy.

PALMER: I have been through a divorce. I have raised a son as a single parent. I have educated my son. He has been to college, mortuary school and then the crises of the debts (ph) of every member of my family that`s been in the business occurred.

EPPERSON: Many women face similar obstacles that have impacted their retirement savings.

SANDRA CARR, STATE FARM CENTER FOR WOEN & FINANCIAL SERVICES: We found there was a challenge with the women to be able to save the way they`d like to save because of their families` needs needing to come first.

EPPERSON (on camera): A recent study by the State Farm Center for Women and Financial Services at the American College found that only 42 percent of woman surveyed save a certain amount each month.

CARR: About 54 percent of all the women said that their families needs are really impending their ability to save for retirement. They will have to take time away from work which, of course, will affect their pensions and so forth. They are also actually making less money than men.

So, again, how much money they`ll be able to save is affected by those factors.

EPPERSON: According to the U.S. Labor Department, full time working women earn about 78 cents for every dollar men earn. Women also spend years out of the workforce on average to care for their families.

DEBORAH BREEDLOVE, AMERIPRISE FINANCAIL ADVISOR: We look at care giving for children, care giving for parents, possible layoffs, disabilities.

EPPERSON: Financial planner Deborah Breedlove says considering these scenarios and how they will impact their own finances encourages some women to start to save more.

BREEDLOVE: We have to put plans in action for those what ifs and then we are realistic about how much money you`re going to need at retirement.

EPPERSON: Breedlove says using 401(k)s, IRAs, Roth accounts and diversifying investments within those portfolios helps most clients reach their intended goals.

PALMER: I wish I had more retirement savings at this time.

EPPERSON: But Palmer says she now has an effective plan in place. She`s putting herself first so she can leave a legacy for her family.

For NIGHTLY BUSINESS REPORT, I`m Sharon Epperson.

(END VIDEOTAPE)

MATHISEN: Our tax tips series continues tomorrow with a look at your refund. This year, tax refund checks are even more critical to many household budgets. Find out who is saving, who is spending and where all that the money is actually going.

GHARIB: Still ahead on the program, we`ll introduce you to a company that`s bringing manufacturing back to Detroit, one watch at a time.

But, first, here`s a look at how commodities, treasuries, currencies fare today.

(MUSIC)

GHARIB: If you think about manufacturing in Detroit, the first thing you probably picture is cars. But one company is trying change all that, using some of Motor City`s skilled workforce to make something completely different.

Mary Thompson is in Detroit and has more for us now.

Mary, fill us in.

MARY THOMPSON, NIGHTLY BUSINESS REPORT CORRESPONDENT: Well, Susie, the name is old but the company is new. Here at the Shinola`s 30,000 square foot factory in Detroit, they can make over a million watches a year. But that`s in the future -- a future that`s intimately tied to Detroit.

(BEGIN VIDEOTAPE)

THOMPSON (voice-over): In the Motor City, Shinola is making motors for its watches, part of Shinola`s plan to revive U.S. watch-making in a town in need of life support.

OLIVIER DE BOEL, SHINOLA WATCH FACTORY MANAGER: It`s like a crazy idea to make watches in the United States again. But it`s possible.

THOMPSON: Olivier de Boel manages Shinola`s watch factory -- a venture crazy to some given Asia and Switzerland`s half century dominance of the industry, possible to Shinola because of Detroit.

HEATH CARR, SHINOLA CEO: If you get in your car, you can drive around Detroit and you can understand the past. And the people we met weren`t so focused on the past. They were focused on the future and where this was going. That energy is what we wanted to tie into and that helped to evolve the Shinola story.

THOMPSON: CEO Heath Carr says Detroit is so crucial to the Shinola story, its watch face bares the city`s name, and Shinola will only partner with retailers that visit the factory floor.

Here with steady hands and good eyes, 12 workers put together a movement or a watch`s motors, 48 pieces with tiny screws.

But whether Shinola`s story of high-end watches made here in the U.S. sells, Mehmet Tangoren of the luxury Web site Haute Look says customers will decide.

MEHMET TANGOREN, HAUTELOOK SVP: I think it`s admirable great that they are trying enter into a market that is very competitive. But I think if the product is right and the styling is right, the consumer will -- the consumer will be the judge.

THOMPSON: Retailing for $475 to $995, Shinola starts assembling its watch shows (ph) next month and selling them in June. New products putting a new face on Detroit.

(END VIDEOTAPE)

THOMPSON: Now, about that name, these days, Shinola makes high end bikes and leather goods, along with watches. Having bought the name from the former shoe shine company, a name typically uttered in the phrase that I can`t utter on TV.

Back to you.

GHARIB: You know, they are really good looking watches and it`s so refreshing to see a businessman doing all this. What was your take? You think he`s going to succeed?

THOMPSON: I think they`ve got a really great story to tell. They`ve got a really neat marketing package. And as you pointed out, Susie, they have a beautiful product and, you know, they did sell limited edition online and it sold out in a week. So that gives you some indication of what demand could be like.

MATHISEN: Those some funky offices there, Mary.

THOMPSON: Yes, it`s very cool. It`s -- I wish I could show you the sweeping views. They have beautiful displays everywhere. They have the high end bikes hanging on the walls. It`s a great space for this company, which again is backed by some savvy retail executives. People with experience in companies like Fossil (NASDAQ:FOSL), of course, which makes apparel and accessories.

GHARIB: Fascinating story. Thank you so much, Mary. Mary Thompson reporting from Detroit.

Now, here`s a look at what`s coming up tomorrow on NIGHTLY BUSINESS REPORT.

RealtyTrac releases its foreclosure report for the first quarter. We`ll also get a check on the job market with the release of weekly jobless claims. And top bank CEOs meet with President Obama.

MATHISEN: And that will do it for tonight`s edition of NIGHTLY BUSINESS REPORT. Thanks so much for watching. I`m Tyler Mathisen.

GHARIB: And I`m Susie Gharib. Have a great evening, everyone.

You too, Tyler.

MATHISEN: You too.

GHARIB: We`ll see all of you tomorrow.

END

Nightly Business Report transcripts and video are available on-line post broadcast at http://nbr.com. The program is transcribed by CQRC Transcriptions, LLC. Updates may be posted at a later date. The views of our guests and commentators are their own and do not necessarily represent the views of Nightly Business Report, or CNBC, Inc. Information presented on Nightly Business Report is not and should not be considered as investment advice. (c) 2013 CNBC, Inc.

<Copy: Content and programming copyright 2013 CNBC, Inc. Copyright 2013 CQ- Roll Call, Inc. All materials herein are protected by United States copyright law and may not be reproduced, distributed, transmitted, displayed, published or broadcast without the prior written permission of CQ-Roll Call. You may not alter or remove any trademark, copyright or other notice from copies of the content.>

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Case Study, g6Document62 pagesCase Study, g6julie pearl peliyoNo ratings yet

- BL3B User Manual PDFDocument142 pagesBL3B User Manual PDFRandy VanegasNo ratings yet

- 021SAACK Burner Operating Instructions PDFDocument136 pages021SAACK Burner Operating Instructions PDFmekidmu tadesse100% (1)

- Types of Sensor and Their ApplicationDocument6 pagesTypes of Sensor and Their Applicationpogisimpatiko0% (1)

- Project On International BusinessDocument18 pagesProject On International BusinessAmrita Bharaj100% (1)

- NRSPDocument27 pagesNRSPMuhammad Farhan67% (3)

- Nightly Business Report - Thursday August 8 2013Document25 pagesNightly Business Report - Thursday August 8 2013Nightly Business Report by CNBCNo ratings yet

- NBR Transcripts Friday, August 9. 2013Document11 pagesNBR Transcripts Friday, August 9. 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Wednesday April 17 2013Document26 pagesNightly Business Report - Wednesday April 17 2013Nightly Business Report by CNBCNo ratings yet

- Transcripts: Tuesday, August 12, 2013Document11 pagesTranscripts: Tuesday, August 12, 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Tuesday August 6 2013Document18 pagesNightly Business Report - Tuesday August 6 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Tuesday July 30 2013Document19 pagesNightly Business Report - Tuesday July 30 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Friday August 2 2013Document29 pagesNightly Business Report - Friday August 2 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Monday August 5 2013Document17 pagesNightly Business Report - Monday August 5 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Friday July 26 2013Document26 pagesNightly Business Report - Friday July 26 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Wednesday August 7 2013Document18 pagesNightly Business Report - Wednesday August 7 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Thursday August 1 2013Document26 pagesNightly Business Report - Thursday August 1 2013Nightly Business Report by CNBCNo ratings yet

- Thursday, August 1 2013Document25 pagesThursday, August 1 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Thursday July 25 2013Document20 pagesNightly Business Report - Thursday July 25 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Friday July 19 2013Document27 pagesNightly Business Report - Friday July 19 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Tuesday July 23 2013Document27 pagesNightly Business Report - Tuesday July 23 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Monday July 22 2013Document19 pagesNightly Business Report - Monday July 22 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Monday July 8Document26 pagesNightly Business Report - Monday July 8Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Wednesday July 24 2013Document20 pagesNightly Business Report - Wednesday July 24 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Monday July 15 2013Document26 pagesNightly Business Report - Monday July 15 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Wednesday July 17 2013Document20 pagesNightly Business Report - Wednesday July 17 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Thursday July 18 2013Document20 pagesNightly Business Report - Thursday July 18 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Tuesday July 9 2013Document19 pagesNightly Business Report - Tuesday July 9 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Friday July 5 2013Document19 pagesNightly Business Report - Friday July 5 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Tuesday July 16 2013Document26 pagesNightly Business Report - Tuesday July 16 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Friday July 12 2013Document22 pagesNightly Business Report - Friday July 12 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Wednesday July 10 2013Document21 pagesNightly Business Report - Wednesday July 10 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Thursday July 11 2013Document20 pagesNightly Business Report - Thursday July 11 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Wednesday July 3 2013Document19 pagesNightly Business Report - Wednesday July 3 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Tuesday July 2 2013Document27 pagesNightly Business Report - Tuesday July 2 2013Nightly Business Report by CNBCNo ratings yet

- Nightly Business Report - Thursday July 4 2013Document28 pagesNightly Business Report - Thursday July 4 2013Nightly Business Report by CNBCNo ratings yet

- Conceptual Framework For Group Processing of Lyric Analysis Interventions in Music Therapy Mental Health PracticeDocument9 pagesConceptual Framework For Group Processing of Lyric Analysis Interventions in Music Therapy Mental Health Practiceantonella nastasiaNo ratings yet

- Bonding in coordination compoundsDocument65 pagesBonding in coordination compoundsHitesh vadherNo ratings yet

- Galley cleaning hazards and controlsDocument9 pagesGalley cleaning hazards and controlsRosalie RosalesNo ratings yet

- Assessment of Benefits and Risk of Genetically ModDocument29 pagesAssessment of Benefits and Risk of Genetically ModSkittlessmannNo ratings yet

- Corporate GovernanceDocument35 pagesCorporate GovernanceshrikirajNo ratings yet

- AIIMS Mental Health Nursing Exam ReviewDocument28 pagesAIIMS Mental Health Nursing Exam ReviewImraan KhanNo ratings yet

- OV2640DSDocument43 pagesOV2640DSLuis Alberto MNo ratings yet

- © 2020 Lippincott Advisor Nursing Care Plans For Medical Diagnoses - Coronavirus Disease 2019 (COVID 19) PDFDocument7 pages© 2020 Lippincott Advisor Nursing Care Plans For Medical Diagnoses - Coronavirus Disease 2019 (COVID 19) PDFVette Angelikka Dela CruzNo ratings yet

- 2020 - Audcap1 - 2.3 RCCM - BunagDocument1 page2020 - Audcap1 - 2.3 RCCM - BunagSherilyn BunagNo ratings yet

- Experiment Vit CDocument4 pagesExperiment Vit CinadirahNo ratings yet

- KS4 Higher Book 1 ContentsDocument2 pagesKS4 Higher Book 1 ContentsSonam KhuranaNo ratings yet

- Divide Fractions by Fractions Lesson PlanDocument12 pagesDivide Fractions by Fractions Lesson PlanEunice TrinidadNo ratings yet

- Abend CodesDocument8 pagesAbend Codesapi-27095622100% (1)

- AI Search Iterative DeepeningDocument4 pagesAI Search Iterative DeepeningNirjal DhamalaNo ratings yet

- IS 2848 - Specition For PRT SensorDocument25 pagesIS 2848 - Specition For PRT SensorDiptee PatingeNo ratings yet

- Capex Vs RescoDocument1 pageCapex Vs Rescosingla.nishant1245No ratings yet

- Pic Attack1Document13 pagesPic Attack1celiaescaNo ratings yet

- Module 5 Communication & Change MGT - HS Planning & Policy Making ToolkitDocument62 pagesModule 5 Communication & Change MGT - HS Planning & Policy Making ToolkitKristine De Luna TomananNo ratings yet

- Type of PoemDocument10 pagesType of PoemYovita SpookieNo ratings yet

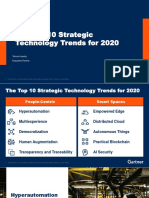

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocument31 pagesThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloNo ratings yet

- VFD ManualDocument187 pagesVFD ManualgpradiptaNo ratings yet

- 50hz Sine PWM Using Tms320f2812 DSPDocument10 pages50hz Sine PWM Using Tms320f2812 DSPsivananda11No ratings yet

- Recent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4Document12 pagesRecent Advances in Active Metal Brazing of Ceramics and Process-S12540-019-00536-4sebjangNo ratings yet

- Describing An Object - PPTDocument17 pagesDescribing An Object - PPThanzqanif azqaNo ratings yet