Professional Documents

Culture Documents

Internet Video POV 0728FINAL

Uploaded by

Anish GhumariaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internet Video POV 0728FINAL

Uploaded by

Anish GhumariaCopyright:

Available Formats

Point of View

Internet Video: New Revenue Opportunity for Telecommunications and Cable Providers

Author Marco Nicosia Contributors Jaak Defour Richard Medcalf David Parsons Gaetano Pellegrino Scott Puopolo Stuart Taylor

July 2010

Cisco Internet Business Solutions Group (IBSG)

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Point of View

Internet Video: New Revenue Opportunity for Telecommunications and Cable Providers

Ciscos Internet Business Solutions Group (IBSG) has undertaken engagements with major service providers (SPs) worldwide to explore new ways to create profitable revenue from the glut of Internet video traffic currently flooding their networks. This is one of two new Point of View papers in which we discuss a two-sided business model to help service providers derive new video revenue from both consumers and business customers. This paper focuses on how service providers can increase revenues from both sides by improving the quality of video delivery. As Internet video becomes mainstream, we believe there will be incremental opportunities for service providers offering services such as precision advertising, multiscreen content delivery, and so forth. The analysis and quantification of those latest services is the subject of a complementary Cisco IBSG Point of View paper titled Exploring Two-Sided Business Models for Service Providers: Creating Profitability Through Innovation.

Executive Summary

Internet-based video consumption is booming all over the world, but most telecommunications operators1 are not benefiting from it. They must sustain the infrastructure costs needed to support this fast-growing traffic, but they have not been able to create associated incremental revenues. Service providers are trying to find ways to turn this potential threat into an opportunity by generating new, profitable revenue streams from the rise of Internet video. Cisco IBSG suggests that service providers have the opportunity to turn Internet video costs into profits, initially through a two-sided business model that offers: 1. High-quality content delivery services to content providers 2. A TV-ready broadband service for consumers that delivers Internet video with quality equivalent to that of traditional television Cisco IBSG analysis shows that access-based telecommunications operators2 can develop a highly profitable business by offering these two services together, with expected earnings before interest, taxes, depreciation, and amortization (EBITDA) margins above 70 percent. Today, Internet video accounts for less than 2 percent of the total time Americans spend watching video. But with more sophisticated video services coming from the Internet, and with Internet-connected TVs, the time consumers spend watching Internet video could rise significantlypotentially reaching 50 percent of their overall video viewing time in 10 to 15 years.3 Now is the time for service providers to begin realizing the opportunity of Internet video.

Fast Growth in Internet Video Is a Challenge for Service Providers

During the booming Internet video4 growth of the last few years, important Internet players such as Google, Netflix, and Amazon have developed substantial Internet video businesses. Some traditional media companies and broadcasters, such as Hulu and the BBC, have also

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 2

Point of View

built successful Internet video businesses, reaching audiences as large as a million viewersaudiences that start to become comparable to those of traditional television (see Figures 1 and 2).

Figure 1.

Hulus Growth Has Been Substantial in Both Number of Viewers and Video Streams

Source: comScore, February 2010

Figure 2.

BBC iPlayer: Monthly Requests in the U.K. Grew Eightfold in First Two Years of Service

Source: Cisco IBSG analysis of data from BBC press releases, January 2008 - January 2010

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 3

Point of View

The initial success of these services is, in our opinion, an indication of the growth Internet video will enjoy once it is easily available on mainstream TV sets. By the beginning of 2010, there were clear indications that Internet-based video services are becoming increasingly accessible from mainstream TVs via products from companies such as Apple, Cisco, Google, LG, Microsoft, Nintendo, Samsung, Sony, and others. Cisco estimates that by 2014, video will represent 80 percent of consumer Internet traffic (see Figure 3).

Figure 3.

Video Will Drive 80 Percent of Consumer Internet Traffic by 2014

Source: Cisco Visual Networking Index, 2010

Many telecommunications executives see the rise of Internet video as a nightmare for their businesses. They used to manage companies that could bill for every minute of voice transported, every bit of data carried, and every TV channel delivered. Now they are managing companies that transport more and more Internet traffic without any associated incremental revenues. At current traffic growth rates, service provider executives fear their companies will reach zero profitability from Internet access, as marginal revenues approach marginal costs per unit of traffic transported. Additionally, service providers are threatened by the potential of service substitution, where their established, revenue-generating TV services might be partially substituted by Internet over-the-top (OTT) providers for content that can be consumed on-demand by end customers. For this reason, operators in some countries are imposing traffic caps on their customers to avoid the negative impact of the added transport costs on their bottom line.

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 4

Point of View

All operators are trying to figure out new ways to generate profitable revenues from the rise of Internet videothereby turning this threat into an opportunity. Cisco IBSG believes that telecommunications operators and content providers should start working together to develop two-sided business models that bring content-based services to consumers via the Internet infrastructure. This is starting to happen in the United Kingdomfor example, with the Canvas consortium, created by content providers and broadcasters BBC, ITV, Channel 4, and Five, and by service providers BT, Arqiva, and TalkTalk.

Turning the Internet Video Threat into a Revenue Opportunity

Cisco IBSG has worked with a number of service providers to develop long-term strategies to capture the opportunities created by two fundamental market trends: 1. Content providers are willing to pay for quality delivery of their content to consumers over the Internet. Actually, they are already doing so by buying content delivery services from traditional content delivery network (CDN) providers such as Akamai, Limelight Networks, and Level 3 Communications. In the difficult economic environment of 2009, a company like Akamai, for example, experienced substantial revenue growth of 9 percent year over year, with normalized net income representing 36 percent of its revenues.5 2. End users are willing to watch even more video content coming from the Internet, as the growth of Internet video services shows, and are probably willing to pay for watching it on their TVs. Research studies show that consumers would start or increase viewing online TV programs and movies if they could (1) have guaranteed good technical quality and (2) watch content on their TVs without having to connect a PC (see Figure 4).

Figure 4.

Users Want Internet Video Delivered with Good Quality Directly to Their TVs

Source: Olswang Convergence Consumer Survey, November 2008

Moreover, a 2008 Cisco IBSG Connected Life Market Watch study surveyed thousands of broadband consumers in North America, Europe, and Asia, asking how much consumers

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 5

Point of View

would pay for a service enabling them to view content on multiple devices, anywhere, anytime. Forty-two percent of the people surveyed would be willing to pay about US$5 for the service; even at $10 per month, 25 percent of respondents said they would be willing to pay. While the service analyzed in the survey is not exactly bringing Internet video to TV, it is still an indication of consumer willingness to associate a dollar value to a service that would allow them to watch Internet video content on their TVs in full broadcast-like quality. The 2010 Cisco IBSG Connected Life Market Watch study in the United Kingdom confirmed this: 45 percent of surveyed U.K. broadband subscribers have either strong or significant interest in Internet video to TV. Telecommunications operators have an opportunity to ride these two market trends by offering a two-pronged approach to improved quality in content delivery:

Step 1: Content delivery services to content providers Step 2: TV-ready broadband to consumers

We will now take a closer look at both of these options, demonstrating that they can provide the best opportunity for new revenues when used together.

Step 1: Introduce Content Delivery Services on the SP Footprint

From the content providers standpoint, CDN improves the quality of content delivery by bypassing congestion points between the emission point (usually the content providers data center) and the receiving point (the final viewer). Traditional CDN services allow content providers to bypass Internet congestion points, but do not allow them to bypass potential congestion points within the service provider network6 that provide Internet access to consumers, as schematically shown on the right side of Figure 5.

Figure 5.

Traditional CDN (Right) Provides Advantages over Content Without CDN (Left) by Bypassing Internet Congestion Points, but Not Those Within the SP Network

Source: Cisco IBSG, 2010

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 6

Point of View

Content delivery services from telecommunications operators have one important, sustainable strategic advantage over the same services offered by traditional CDN providers: they are delivered by CDN caches placed much closer to the final viewer, thus reducing the probability of having congestion issues over the delivery path, as schematically shown in Figure 6.

Figure 6. SP-Delivered CDN Improves Internet Delivery by Locating Content Caches Closer to the End User than Traditional CDN

Source: Cisco IBSG, 2010

With potentially hundreds of thousands, or even millions, of video streams being delivered simultaneously in one region or country, having content caches closer to the final viewer is a strategic advantage over established, traditional CDN providers. While operators may have only a national or regional footprint as compared to the global footprint of traditional CDN providers, typically this will not be a strategic disadvantage because most video content is specific to a particular country or language. For example, 100 percent of the video streams on both BBC iPlayer and Hulu are delivered to their target geographiesthe United Kingdom and the United States, respectivelybecause of both language and rights issues. In Europe, most broadcasters experimenting with Internet video (through catch-up TV and start-over services) are focusing on their own target geography. Over time, telecommunications operators can develop partnerships to interconnect their content delivery services, offering a broader footprint if needed.

Step 2: Enable QoS in Access, and Market It as TV-Ready Broadband

The second fundamental step operators should take is to enable quality of service (QoS) in access and market it as TV-ready broadband: a broadband line that guarantees a predefined quality for the delivery of content between the operators content delivery caches and customer viewing devices (TVs, computers, game consoles, set-top boxes, etc.).7 The

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 7

Point of View

actual result of TV-ready broadband is to give the end customer a TV-like viewing experience when watching videos coming from the Internet: full-screen, crystal-clear, high-quality videos shown on their TVs, with no interruptions for rebuffering or other technical reasons. Service providers are in the unique position of being able to address all potential Internet congestion points in the delivery of video content over the Internet, bringing them from 5 to zero, as shown in Figures 5, 6, and 7.

Figure 7. Quality of Service in Access, Added to SP-Provided CDN, Eliminates All Potential Congestion Points

Source: Cisco IBSG, 2010

Two-Sided Business Model Delivers Maximum Opportunity

We propose a two-sided business model where operators serve two different customer types and two different customer needs with two different services. Content delivery services help content providers scale the distribution of their content, while TV-ready broadband helps final consumers watch video content coming from the Internet in full quality. Service providers should offer content delivery services with a set of features comparable to those of established CDN providers. These should include origin storage, transcoding and transrating, security tools, policing tools, and customer analytics, in addition to the actual content delivery service. Pricing for all those services should be aligned with actual practices in the industry.8 In addition, SPs could complement their CDN services with geolocation information, especially when integrated with mobile broadband access. Guaranteed bandwidthQoS between content caches and end customersshould be embedded into higher-speed broadband lines and then marketed as TV-ready broadband. The business rationale behind this recommendation comes from Cisco IBSGs

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 8

Point of View

experience that higher-speed broadband customers are, in most countries, a small minority of total broadband customers, paying an average premium 30 percent greater than that of entry-level broadband customers. The majority of consumers do not buy higher-speed broadband lines because they consider lower-speed broadband sufficient for their Internet needs. Promoting higher-speed broadband lines as TV-ready broadband will give consumers one important reason for migrating their lower-speed broadband lines to higherspeed (or, in case they do not have broadband already, for adopting it directly at higher speed), thus increasing operator average revenue per user (ARPU) substantially. By combining content delivery services and guaranteed access bandwidth (QoS) for TVready broadband, operators can become ideal enablement partners for both content providers and vendors of Internet-attached video devices. These service providers are wellpositioned to orchestrate development of the nascent Internet-video-to-TV market via comarketing campaigns and co-promotions of products and services (see Figure 8).

Figure 8.

The Virtuous Circle of Content Distribution Plus Guaranteed Bandwidth in Access

Source: Cisco IBSG, 2010

Business Case for Incremental Revenues

Cisco IBSGs Service Provider Practice has been working with multiple clients to analyze the potential of the proposed two-sided business model. From this work with customers, we conservatively estimate that operators can achieve the following results in a five-year time frame: 1. Capture 20 percent to 30 percent market share for Internet video content delivery services in their specific target market. This share target was considered realistic by multiple service providers, as operators launching the service now will have to gain share from established content delivery providers. 2. Convert one-third of broadband customers to TV-ready broadband. Most forecasts show that about two-thirds of the broadband population in Western

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 9

Point of View

countries will have their TVs connected to the Internet by 2015. IBSGs own Connected Life Market Watch studies from 2008 and 2010 (cited above) indicate that between 25 percent and 45 percent of broadband subscribers have an interest in watching Internet video on TV, based on various pricing schemes. Our recommendation to embed TV-ready broadband functionality into higher-speed broadband lines assumes that this service would have the same price premium as higher-speed broadband lines versus the lowest-speed broadband lines: about 30 percent in the average Western country (approximately $7 per month).9 The important benefit to service providers would be to accelerate the migration of their broadband customers toward higher-speed broadband lines. Our work with service providers shows that a hypothetical wireline operator10 with 10 million broadband customers in a highly developed telecommunications country could convert more than 30 percent of those customers to TV-ready broadband, generating cumulative revenues of about $700 million in the 2010-2015 time frame, starting from zero revenues in 2010 (see Figure 9).

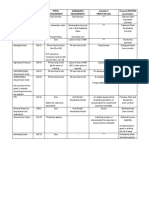

Figure 9. Business Case Financials for Two-Sided Business Model

Source: Cisco IBSG, 2010

About $420 million of those cumulative revenues would be generated by the TV-enabled broadband migration, while the remaining $280 million would result from the content delivery service itself. The level of investment (CapEx) required to develop this business would be between 15 percent and 30 percent of total cumulative revenues generated, depending on the transport capacity already available to the service provider in its network, with marginal up-front investment needed to start the business. Operating costs (OpEx) would be less than 20 percent of revenues for an established operator with sales, marketing, and administrative processes already in place.

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 10

Point of View

Cisco IBSGs client work shows that infrastructure-based telecommunications operators (incumbent operators, cable operators, alternative operators with owned or unbundled access infrastructure) could generate EBITDA margins of more than 70 percent by offering content delivery services combined with TV-ready broadband. This excellent profitability margin results from developing an incremental business that runs atop existing infrastructure, with operations in place. In addition to their strong current revenue and profit potential, we believe that content delivery plus TV-ready broadband provide a strong platform for future innovative applications that service providers can offer within the two-sided business model. Access-infrastructure-based operators could also play an important role in further developing the Internet video market by wholesaling content delivery and TV-ready broadband services to alternative operators who lack the capability and scale to deploy these services on their own. Our work with clients shows that the wholesale opportunity, adjusted for common wholesale volume discounting, has revenue and profitability patterns similar to those presented for the retail business.

Conclusions

Internet video is the future of the Internet. Within five years, 80 percent of Internet traffic will be video-based. Telecommunications and cable operators should act now to become the enabling platform for delivering TV-quality video streams from the Internet to consumers, regardless of whether they watch it on their computers, on their TVs, or on their mobile devices. Content delivery services, combined with QoS on the access line, are the two building blocks that, if implemented properly, will enable operators to develop a sustainable, profitable, and differentiated business for themselves, while driving development of the Internet video delivery industry. With their own content delivery infrastructure in place, operators will be in position to explore and develop new services based on this infrastructure. Operators should position themselves as the enablement platform for this nascent market. They should collaborate with media companies, broadcasters, independent content producers, and TV/CPE manufacturers to build value for end customersand a profitable new revenue stream for themselves.

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 11

Point of View

For more information about service provider opportunities in Internet video, please contact: Marco Nicosia, Senior Manager, Service Provider Practice Cisco Internet Business Solutions Group mnicosia@cisco.com

Endnotes

1. In this paper, we use the terms telecommunications operator or service provider to mean any provider of Internet access service, whether a traditional telecommunications operator or a cable operator. 2. With the term access-based telecommunications operators, we mean any service provider able to control its access infrastructure, either because it owns it (incumbent operators, cable operators, challengers with alternative access network infrastructure, etc.) or because it uses its access infrastructure under a ULL (unbundling of the local loop) agreement. 3. Cisco IBSG analysis of Nielsen report, February 2009. 4. Internet video: user-generated or professionally produced video content, delivered to end customers via the Internet, and watched via Internet-attached devices such as computers, TVs, phones, music players, or game devices. 5. Akamai Annual Report, 2009. 6. The exception to this occurs when the service provider allows a traditional CDN provider to install its content caches into its network. In that case, the service provider should contract a form of compensation from the CDN provider. 7. Some operators will need to upgrade their access network to be able to deliver TVready broadband. 8. As of the end of 2009, the pure delivery part of content delivery services is priced between $0.03/GB and $0.30/GB, based on actual total monthly volumes. 9. This price is in line with the price ranges tested in the Connected Life Market Watch study of 2008. 10. Either cable or incumbent telecommunications operator.

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 12

Point of View

Cisco IBSG 2010 Cisco and/or its affiliates. All rights reserved.

Page 13

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- (TUI3011C) SimpleModelDetermingTrueTCO PDFDocument9 pages(TUI3011C) SimpleModelDetermingTrueTCO PDFAnish GhumariaNo ratings yet

- DWDMDocument57 pagesDWDMmajorhone100% (1)

- Intro EPC WP 0309Document12 pagesIntro EPC WP 0309simishuNo ratings yet

- 2009 Census Summary Release Final PDFDocument34 pages2009 Census Summary Release Final PDFAnish GhumariaNo ratings yet

- 2012 Cisco Global Cloud Networking Survey ResultsDocument21 pages2012 Cisco Global Cloud Networking Survey Resultsbeta_2No ratings yet

- TD-LTE Whitepaper Low-Res OnlineDocument10 pagesTD-LTE Whitepaper Low-Res OnlineDebasis RoyNo ratings yet

- CourseDescription EPCDocument5 pagesCourseDescription EPCAnish GhumariaNo ratings yet

- MA5600T&MA5603T V800R010C00 Feature DescriptionDocument824 pagesMA5600T&MA5603T V800R010C00 Feature DescriptionAnish Ghumaria100% (3)

- CourseDescription PaCo SignalingDocument5 pagesCourseDescription PaCo SignalingAnish GhumariaNo ratings yet

- 2012 Cisco Global Cloud Networking Survey ResultsDocument21 pages2012 Cisco Global Cloud Networking Survey Resultsbeta_2No ratings yet

- ATM PrincipleDocument37 pagesATM PrincipleAnish GhumariaNo ratings yet

- VodafoneCloudHosting Computacenter Case StudyDocument3 pagesVodafoneCloudHosting Computacenter Case StudyAnish GhumariaNo ratings yet

- Course DescriptionDocument6 pagesCourse DescriptionAnish GhumariaNo ratings yet

- RFC 5944 Mobility SupportDocument101 pagesRFC 5944 Mobility SupportSarah Ben MusaNo ratings yet

- Background Final To CRPE Modified SHORT FORM 150409Document5 pagesBackground Final To CRPE Modified SHORT FORM 150409Anish GhumariaNo ratings yet

- 3-CRPE Standard of Professional Engineering Competence 2007Document42 pages3-CRPE Standard of Professional Engineering Competence 2007Anish GhumariaNo ratings yet

- Ceragon - FibeAir IP-10 - BrochureDocument4 pagesCeragon - FibeAir IP-10 - BrochureAnish GhumariaNo ratings yet

- EnterpriseCIO Security FinalDocument20 pagesEnterpriseCIO Security FinalHardiyanto ChanNo ratings yet

- ManagedHostingWhitepaper 2011 NL WebDocument16 pagesManagedHostingWhitepaper 2011 NL WebAnish GhumariaNo ratings yet

- Brochura Satellite Communication - CEDocument2 pagesBrochura Satellite Communication - CEAnish GhumariaNo ratings yet

- UA5000 System DescriptionDocument80 pagesUA5000 System Descriptionjaybrata80% (5)

- Integrated Services Digital Network: BackgroundDocument6 pagesIntegrated Services Digital Network: BackgroundAnca RadulescuNo ratings yet

- Lucent IP Service ProvisionningDocument24 pagesLucent IP Service ProvisionningAnish GhumariaNo ratings yet

- Data Center CostDocument36 pagesData Center Costbaokrimba100% (1)

- Internet Video POV 0728FINALDocument13 pagesInternet Video POV 0728FINALAnish GhumariaNo ratings yet

- VodafoneCloudHosting Computacenter Case StudyDocument3 pagesVodafoneCloudHosting Computacenter Case StudyAnish GhumariaNo ratings yet

- Cloud: Powered by The Network: What A Business Leader Must KnowDocument15 pagesCloud: Powered by The Network: What A Business Leader Must KnowJoeri Van GeystelenNo ratings yet

- Cisco NGN Solution and Architecture Strategy W RossouwDocument46 pagesCisco NGN Solution and Architecture Strategy W RossouwAnish GhumariaNo ratings yet

- 3GPP TS 23.203Document123 pages3GPP TS 23.203Anish GhumariaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- UBL UK Application Form FinalDocument6 pagesUBL UK Application Form Finalfaisal_ahsan7919No ratings yet

- India Digital Economy Report 22 - Fintech EditionDocument15 pagesIndia Digital Economy Report 22 - Fintech EditionVinay AgarwalNo ratings yet

- DorkdorkDocument6 pagesDorkdorkBudy SantosoNo ratings yet

- ePMP AX 5.4.1 Release NotesDocument9 pagesePMP AX 5.4.1 Release NotesOmar PalmaNo ratings yet

- Prashant MRP Project Report of Mba Docx 2Document74 pagesPrashant MRP Project Report of Mba Docx 2ChandrakantBangarNo ratings yet

- Supply Chain DriversDocument11 pagesSupply Chain DriversamnaNo ratings yet

- HSBC - Personal Banking Agreement en PDFDocument52 pagesHSBC - Personal Banking Agreement en PDFRuslan ParisNo ratings yet

- Transportation in A Supply Chain: Powerpoint Presentation To Accompany Chopra and Meindl Supply Chain Management, 5EDocument29 pagesTransportation in A Supply Chain: Powerpoint Presentation To Accompany Chopra and Meindl Supply Chain Management, 5Eosama haseebNo ratings yet

- SWIFT FIN Payment Format Guide For European AcctsDocument19 pagesSWIFT FIN Payment Format Guide For European AcctsdestinysandeepNo ratings yet

- Asset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDocument3 pagesAsset Standard Initial Measurement Subsequent Measurement Included in Profit or Loss Financial POSITION PresentationDidhane MartinezNo ratings yet

- Types of RetailersDocument9 pagesTypes of RetailershhaiderNo ratings yet

- ACCT 1 - Ch.7Document13 pagesACCT 1 - Ch.7HIEP PHAM HOANGNo ratings yet

- Priyanka Resume (Update)Document2 pagesPriyanka Resume (Update)Priyanka PatiNo ratings yet

- Fintech Report StudyDocument2 pagesFintech Report StudyAishwaryaNo ratings yet

- PNBDocument6 pagesPNBCristine Damirez TadleNo ratings yet

- Bank ChallanDocument1 pageBank Challansulaimankhokher0No ratings yet

- Important Banking Awareness PDFDocument193 pagesImportant Banking Awareness PDFsidNo ratings yet

- Optimize Inventory Management With EOQ & Reorder PointDocument38 pagesOptimize Inventory Management With EOQ & Reorder PointAniket Patil100% (2)

- Unit-4: Iot Architecture and ProtocolsDocument22 pagesUnit-4: Iot Architecture and ProtocolsMahesh ChauhanNo ratings yet

- Government of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryDocument2 pagesGovernment of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryPratik JainNo ratings yet

- TicketDocument2 pagesTicketNavneet SinghNo ratings yet

- Banking Awareness Questions With AnswersDocument3 pagesBanking Awareness Questions With AnswersarunkumarraviNo ratings yet

- Infrastructure Hosting and Deployment OptionsDocument31 pagesInfrastructure Hosting and Deployment OptionsNadia MaryamNo ratings yet

- Account Entries in p2p CycleDocument2 pagesAccount Entries in p2p CycleNikhil SharmaNo ratings yet

- Riska Amelia Xii Akl B (Ud Saloka)Document60 pagesRiska Amelia Xii Akl B (Ud Saloka)Riska AmeliaNo ratings yet

- KBZ (Spe)Document1 pageKBZ (Spe)Hnin EiNo ratings yet

- 2022 Gr11 Mathematical Literacy WRKBK ENGDocument20 pages2022 Gr11 Mathematical Literacy WRKBK ENGmanganyeNo ratings yet

- Aging 2014 AccurateDocument314 pagesAging 2014 AccurateAnonymous sKVFtcNo ratings yet

- Iwokazpy Fo - QR Forj.K Fuxe Fyfevsm: Purvanchal Vidyut Vitaran Nigam LTDDocument2 pagesIwokazpy Fo - QR Forj.K Fuxe Fyfevsm: Purvanchal Vidyut Vitaran Nigam LTDShashank PandeyNo ratings yet

- ReportsDocument3 pagesReportsashish sharmaNo ratings yet