Professional Documents

Culture Documents

Axis Bank savings account charges

Uploaded by

Arnab NandiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Axis Bank savings account charges

Uploaded by

Arnab NandiCopyright:

Available Formats

SOC Brochure: Size (Close) 92 x 185 mm

For Details: Visit your nearest branch Call us at 18002335577, 18002095577, 18001035577 (toll free number in India) Log on to www.axisbank.com October 2012

Terms & Conditions

Service Charges & Fees

Savings Account

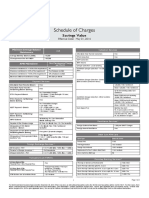

SAVINGS ACCOUNT (Domestic)

Schemes: SBEZY - Easy Access Account, SBSPL - Special Account, SBWDN Withdrawn Account, SBRMT - Remittance Account, SBSA3 - Salary A/c Converted to Normal Saving A/c Due to Non Credit of Salary For 3 Months, SSEZY - Savings Senior Citizen Easy Access Account, SWEZY - Savings Women's Easy Access Account, SBSML - Small Savings Account, SBFTS - Future Stars Savings Account, SBAGT - Insurance Agents Account

SAVINGS BANK ACCOUNT - Schedule for Services Charges (Services Tax applicable will be levied on all charges, and would be roundedoff to the next Rupee) Minimum Average Quarterly Balance (AQB) Requirement: EasyAccess Savings Account (SBEZY & SWEZY) Metro/Urban Branches `10,000/Semi Urban Branches `5,000/Rural Branches `2,500/Senior Citizen EasyAccess Savings Account (SSEZY) Metro/Urban Branches `5,000/Semi Urban Branches `2,500/Rural Branches `1,000/Insurance Agents Savings Account (SBAGT) Metro/Urban `5,000/Semi Urban/Rural `2,500/Future Stars Savings Account (SBFTS) Metro/Urban/Semi Urban `2,500/Rural `1,000/Special/PMS Savings Account** `5,000/- or `2,500/- or `1,000/Withdrawn Account** `5,000/- or `2,500/- or `1,000/* Please ascertain the category of your Axis Bank branch where you maintain your Savings Bank Account. Charges for Non-Maintenance of Average Quarterly Balance (AQB): EasyAccess Savings Account (SBEZY/SWEZY/SSEZY) Metro/Urban Branch `750/Semi Urban Branch `750/Rural Branch `500/Insurance Agents Savings Account (SBAGT) Metro/Urban/Semi Urban/Rural Branch `750/Future Stars Savings Account (SBFTS) Metro/Urban/Semi Urban/Rural `250/No AQB charges in SBFTS scheme in case criterion any 1 of the following criterion is met: TD for a minimum period of 6 months `25,000/RD for a minimum period of 12 months `2,000/Special Saving Account** `750/Withdrawn Account** `750/Branch Transaction Charges (applicable to accounts not maintaining AQB): All Branches Charges 9 branch transactions per Nil quarter Beyond 9 branch `100/- per instance transactions Transactions considered Clearing transactions (Both Debit & Credit) Transfer transactions (Only Debit) NEFT Debit transactions (Processed at Branches) RTGS Debit transactions (Processed at Branches)

** For specific Tie-ups

Note: 1) The period considered for calculation of quarterly charges w.e.f. June 2009 is 15th of last month of previous to the 14th of the last month of the current quarter. For eg. For quarter ended September 09, AQB & quarterly charges would be calculated from 15/06/2009 to14/09/2009. 2) Please note that, in accordance with RBI guidelines, the aggregate of all withdrawals and transfers in a month should not exceed `10,000/-. If at anytime during the financial year the credit balance in your account reaches `50,000/- or the sum total of the credited amounts in your account reaches `1,00,000/- your account will no longer continue as a Small account. To make your account operable again you will need to be KYC compliant and furnish your KYC documents.

Cash Transaction Charges Centre Metro/Urban

Limits/Charges First 5 Transactions OR `10, 00,000 ** of cash deposit/withdrawal in a month is free, whichever is earlier. Post that, `4 per 1000 rupees on the deposit/withdrawal amount or `100 whichever is higher shall be charged Semi Urban/Rural First 10 Transactions OR `10,00,000 ** of cash deposit/withdrawal in a month is free, whichever is earlier. Post that, `4 per 1,000 rupees on the deposit/withdrawal amount or `100 whichever is higher shall be charged The above charges will be calculated on a monthly basis and will be applicable from the monthly charge cycle of 15th May, 2012 - 14th June, 2012.

Inter-Bank real Time Fund-Transfer a) Outward RTGS `1 lakh to `2 lakhs `25/- per transaction `2 lakhs to `5 lakhs `25/- per transaction Above `5 lakhs `50/- per transaction b) Outward NEFT Upto `10,000 `2.50/- per transaction `10,001 to `1 lakh `5/- per transaction `1,00,001 to `2 lakhs `15/- per transaction Above `2 lakhs `25/- per transaction c) Inward RTGS/NEFT Nil * InterCity means other than the centre where your branch is located ** IntraCity means within the centre in which your branch is located Particulars Range of instrument amount Savings Account Speed Clearing Charges Upto `1,00,000/Nil `1,00,001/- & above `150/Demat Account 1st year Annual Maintenance Charges (AMC) Nil (Except for SBFRL/SBSML) Outstation Cheques: 1. Collection of Outstation Cheques a) Upto `5,000/`25/- per instrument b) `5,001/- to `10,000/`50/- per instrument c) `10,001/- to `1,00,000/`100/- per instrument d) `1,00,001/- and above `200/- per instrument

Cheque Return Charges: a) Inward Clearing I Per instrument b) Outward clearing cheque return c) ECS Debit Return Charges d) ECS Stop Payment Charges Other Account Related Charges: Category 1. Cheque Book Charges: a) Savings Account up to 20 Leaves per quarter b) Savings Account above 1 cheque book per quarter (Applicable to SBSMT, SBEZY and SBSAL) c) Student/Demat Account 2. Stop Payment Instructions:

In India I) Cash Withdrawal `350/`100/- per instrument `200/- per return `100/- per request Charges Free `50/Outside India i) Cash Withdrawal ii) Balance Inquiry iii) Cross Currency Markup d) Surcharge At Petrol Pumps ii) Non-Financial transactions

1st five ATM transactions per calendar month at other Bank ATMs Free; 6th transaction onwards `20/- per transaction (inclusive of service tax) 6th transaction onwards `9.55/-per transaction (inclusive of service tax) `125/`25/3.5% w.e.f 1st February 2013

Free

Free

`125/`25/3.5% w.e.f 1st February 2013 Nil 2.5% of the sale amount (Min. `10/-) + `30/- Per Transaction its own discretion.

`50/- per Cheque Book `100/- per instrument `200/- for a series of instrument (beyond 3 cheque) `25/`50/`50/`100/Nil Charges `50/`2.50/- `1,000/- or part thereof (Min. `80/- and Max. `5,000/-) `2.50/- `1,000/- or part thereof (Min `50/- and Max `10,000/-) `2.50/- `1,000/- (Min `50/-) + Other Bank charges as applicable `25/Charges (Semi Urban/ Rural) `95/`50/`100/-

3. Account Services (at branches) a) Signature Verification b) Address Confirmation c) Photograph Verification 4. Closure of Account: a) If closed within 6 months b) If closed after 6 months Pay Order Charges Category 1. Upto `50,000/2. Above `50,000/Demand Draft 1. Drawn on Axis Bank Centres 2. Drawn on other Centres

2.5% of the sale Amount (Min. `10/-) Railway Ticket 2.5% of the sale Booking amount (Min. `10/-) + `30/- Per Transaction Note: Axis Bank reserve the right to revise the charge at NetSecure Charges: NetSecure with SMS/WebPin NetSecure with 1-Touch

Free `800/- Plus (Issuance charges) `500/- Plus taxes (Replacement charges)

Disclaimers for Salary Account holders

Savings Account under Salary power scheme is a special account offered to customers with regular direct salary credits coming into this account. In case, the monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under the said Account stands withdrawn and the account shall be treated as Normal Savings Account under our standard charge structure and Average Quarterly Balance (AQB) is required to be maintained, and all charges shall be levied and applied as applicable to normal savings accounts. Moreover the Know Your Customer must be complied with as applicable to a Normal Savings Bank Account and documents are to be submitted, failing which there would be a credit freeze marked on the said account. The features of Normal Savings Bank Account and charge structure is available on bank s website www.axisbank.com. You may please contact your nearest Axis Bank branch for further details. Availed salary offerings are subject to change in future at the Bank's discretion.

3. DD/PO Cancellation Charges Debit Card Charges Category (Metro/Urban) Issuance Fees Annual Fees Card Replacement Charges 4. Duplicate Pin Category 5. a) b) Transaction Charges At Axis Bank ATMs At VISA/Master Card Enabled ATMs of Other Banks 1. 2. 3. `95/`100/`100/`50/-

(Titanium Rewards Card) `500/`300/`150/-

For more details on Salary Account applicable to you as per your eligibility/approval by employer, write to us at salary.assist@axisbank.com For more details on Salary Account Fees & Charges, please visit http://www.axisbank.com

(Debit Card) Nil

`50/`50/Charges (Titanium Rewards Card) Nil

SAVINGS ACCOUNT (Domestic)

Schemes: SBPRM - Prime Savings Account, SBPRP - Prime Plus Savings Account

Average Quarterly Balance (AQB) Requirement (SBPRM) Metro/Urban Centres `25,000/Semi-Urban/Rural Centres `10,000/Charges for Non-Maintainance of AQB Metro/Urban Centres `750/- per quarter (If AQB is between `10,000/- - `25,000/-) `1000/- per quarter (If AQB is less than `10,000/-) Semi-Urban/Rural Centres `500/- per quarter (If AQB is between `5,000/- - `10,000/-) `750/- per quarter (If AQB is less than `5,000/-) Average Quarterly Balance (AQB) Requirement (SBPRP) Metro/Urban Centres `1,00,000/Semi-Urban/Rural Centres `50,000/Charges for Non-Maintainance of AQB Metro/Urban Centres/Semi-Urban/ NIL Rural Centres Branch Transaction Charges (applicable to accounts not maintaining AQB): All Branches Charges 9 branch transactions per Nil quarter Beyond 9 branch `100/- per instance transactions Transactions considered Clearing transactions (Both Debit & Credit) Transfer transactions (Only Debit) NEFT Debit transactions (Processed at Branches) RTGS Debit transactions (Processed at Branches) NOTE: The Period considered for calculation of quarterly charges w.e.f June 2009 is 15th of last month of previous quarter to the 14th of the last month of the current quarter. Cash Transaction Charges (SBPRM) Centre Limits/Charges Metro/Urban First 5 Transactions OR `25,00,000 of cash deposit/withdrawal in a calendar month is free, whichever is earlier. Post that, `4 per 1,000 rupees on the deposit/withdrawal amount or `100 whichever is higher shall be charged Semi Urban/Rural First 10 Transactions OR `25,00,000 ** of cash deposit/withdrawal in a calendar month is free, whichever is earlier. Post that, `4 per 1,000 rupees on the deposit/withdrawal amount or `100 whichever is higher shall be charged

Cash Transaction Charges (SBPRP) Centre Limits/Charges Metro/Urban First 5 Transactions OR `50,00,000 of cash deposit/withdrawal in a month is free, whichever is earlier. Post that, `4 per 1,000 rupees on the deposit/ withdrawal amount or `100 whichever is higher shall be charged Semi Urban/Rural First 10 Transactions OR `50,00,000 ** of cash deposit/withdrawal in a month is free, whichever is earlier. Post that, `4 per 1,000 rupees on the deposit/ withdrawal amount or `100 whichever is higher shall be charged Inter-Bank Real Time Fund-Transfer a) Outward RTGS `1 lakh to `2 lakhs `25/- per transaction `2 lakhs to `5 lakhs `25/- per transaction Above `5 lakhs `50/- per transaction b) Outward NEFT Charges Upto `10,000 `2.50/- per transaction `10,001 to `1 lakh `5/- per transaction `1,00,001 to `2 lakhs `15/- per transaction Above `2 lakhs `25/- per transaction c) Inward RTGS/NEFT Nil The above charges will be calculated on a monthly basis & will be applicable from the monthly charge cycle of 15th May, 2012 - 14th June, 2012. Particulars Range of instrument amount Savings Account Speed Clearing Charges Upto `1,00,000/Nil `1,00,001/- & above `150/Free passbook on request Demat Account 1st year Annual Maintenance Charges (AMC) Nil Axis Direct online trading Account Account opening charges `850/Cash back* `400/*Brokerage of `400/- to be generated within 2 months from the date of account opened Outstation Cheques: 1. Collection of Outstation Cheques Charges a) Upto `5,000/`25/- per instrument b) `5,001/- to `10,000/`50/- per instrument c) `10,001/- to `1,00,000/`100/- per instrument d) `1,00,001/- and above `200/- per instrument Cheque Return Charges: a) Inward clearing I. Per instrument `350/b) Outward cheque clearing `100/- per instrument c) ECS Debit Return Charges: `200/- per instrument d) ECS Stop Payment Charges `100/- per request

Other Account Related Charges: Category 1. Chequebook Charges: a) Up to 1 Chequebook per quarter b) Above 1 Chequebook per quarter 2. Stop Payment Instructions

Charges Free `50/`100/- per instrument `200/- for a series of instruments (beyond three cheques) `25/`50/`50/-

Outside India I) Cash Withdrawal ii) Balance Inquiry iii) Cross Currency Markup c) Surcharge At Petrol Pumps For Railway Ticket Booking

`125/`25/3.5% w.e.f 1st February 2013 2.5% of the sale Amount (Min. `10/-) 2.5% of the sale Amount (Min. `10/-) + `30/- per transaction `50,000/`50,000/`50,000/-

3.5% w.e.f 1st February 2013 2.5% of the sale Amount (Min. `10/-) + `30/- per transaction `50,000/`75,000/`75,000/-

`125/`25/3.5% w.e.f 1st February 2013 Nil 2.5% of the sale Amount (Min. `10/-) + `30/- per transaction `50,000/`2,00,000/ `2,00,000/-

`100/NIL 2 DDs/POs free per month at Axis Bank Locations (irrespective of value) & a charge of `50 thereafter 6. DD/PO Cancellation Charges: `25 7. Axis Direct: `400 refunded on account opening charges if brokerage of `400 is generated in the first 2 months of account opening 8. Locker Tariff: 25% off in 1st year rent (subject to availability of lockers) *This charge will be w.e.f. 1st December, 2010. The charge for the month of December, 2010 will be debited at the end of January, 2011, i.e. the charges for a particular month will be debited at the end of the subsequent month. Debit Card Charges Category Charges Titanium Prime Titanium Prime Titanium Rewards Plus Cards Photo No No No Issuance fees Primary: FREE FREE `500/Joint: `100 Annual fees `150 (Waived on `200/`300/POS transaction of `50,000 p.a./10 POS transactions of any value in year) Card Replacement `100/`100/`150/Charges Duplicate PIN `50/`50/`50/Transaction Charges a) At the Axis Bank Nil Nil Nil ATMs b) At the VISA/Master Card enabled ATMs of other Banks In India I) Cash Withdrawal `20/- above 10 10 free transactions Nil transactions per in a month `20/month (inclusive of for each cash service tax) withdrawal after that (inc. taxes) ii) Non-Financial `9.55/- for each non-financial Nil Transactions transaction after that (inc. taxes)

3. Account Services: (at branches) a) Signature verification b) Address confirmation c) Photograph verification 4. Closure of Accounts: a) If Closed within 6 months b) If Closed after 6 months 5. Pay order/Demand Draft Charges*

ATM Withdrawal Limit (per day) Daily POS Limit Combined Lost Card Liability Cover and Purchase Protection Limit PA Insurance Cover Lounge Access Reward Points

`3 lakhs* Yes No

`3 lakhs* Yes 1 per INR 200 worth of purchases

`5 lakhs Yes 1 per INR 100 Worth of purchases

NetSecure Charges NetSecure with SMS/Web Pin NetSecure with 1-Touch

Free `800/- plus taxes (Issuance charges) `500/- plus taxes (Replacement charges)

* Subject to one successful POS transaction in the 90 days preceding the date of incident

SAVINGS TRUST ACCOUNT

SAVINGS TRUST ACCOUNT

Minimum Average Quarterly Balance (AQB) Requirement SBTRS `25,000/Charges for Non-Maintainance of AQB SBTRS `750/The following account are offered Zero Balance facility Section 25 companies Account opened for permission from Ministry of Home Affairs under Foreign Contribution Regulation Act 2010 Account for self help groups Account of PF/Gratuity/Supper Anuation/Pension Trust Anywhere Banking Charges NIL Outstation Cheques Collection of Outstation Cheques NIL *Free at Axis Bank location. Out of pocket expenses to be recovered. Cheque Return Charges a) Inward Clearing I Per instrument `350/b) Outward clearing cheque return `100/c) ECS Debit Return Charges `200/*Beyond 3 returns in Quarter `750/- per return will be charged. Other Account Related Charges Category Charges 1. Cheques Book Charges NIL 2. Stop Payment Instructions `100/- per instrument `200/- for a series of instruments (beyond 3 cheques) 3. Account Services (at branches) a) Signature Verification `25/b) Address Confirmation `50/c) Photograph Verification `50/4. Closure of Accounts a) If closed within 6 months `100/b) If closed after 6 months NIL Pay Order Charges NIL Demand Draft (at Axis Bank Location) NIL RTGS/NEFT NIL Debit Card Charges (issued on request only for A/c having single signatory) Category Charges (Normal Debit Card) (Gold Plus Debit Card) 1. Issuance Fees `95/`500/2. Annual Fees `50/`250/ 3. Card Replacement `100/`250/Charges 4. Duplicate Pin Category `50/`50/ 5. Transaction Charges a) At Axis Bank ATMs NIL NIL b) At VISA/MasterCard ebabled ATMs of other Banks In India I) Cash withdrawal

ii) Balance Inquiry Outside India I) Cash withdrawal ii) Balance Inquiry iii) Cross Currency Markup c) Surcharge At Petrol Pumps

1st five ATM transactions Free Per month at other Bank ATMs Free; 6th transaction Onwards `20/- per transaction NIL NIL `125/`25/3.5% w.e.f 1st February 2013 `125/ `25/ 3.5% w.e.f 1st February 2013

2.5%of the sale NIL Amount (Min `10/) At Railway Stations 2.5% of the sale 2.5% of the sale Amount (Min `10/-) + Amount (Min `10/-) + `30/- per transaction `30/- per transaction Note: Axis Bank reserves the right to revise the charges at its own discretion. NetSecure Charges Net Secure with SMS/WebPin Net Secure with 1-Touch

Free `800 plus taxes (Issuance charges) `500 plus taxes (Replacement charges)

SAVINGS BANK- RULES & REGULATIONS

1. The Savings Bank Account should be used to route transactions of only non-business/noncommercial nature. In the event of occurrence of such transactions or any other such transactions that may be construed as dubious or undesirable, the Bank reserves the right to unilaterally freeze operations in such accounts. 2. The savings interest rate has been de-regulated by RBI, presently it is 4 % and RBI has revised the method of application. With effect from 01-04-2010, savings interest is being paid on a daily product method on quarterly basis. Presently the quarterly interest is paid on the first Monday (or the next working day, if Monday is a National Holiday) after the quarter-end date. The said interest credit is also value dated of the quarter-end date. 3. The balance in the account must adhere to the minimum quarterly average balance stipulation laid down by the Bank and communicated to you at the time of opening of the account. Nonmaintenance of this quarterly average balance will attract applicable penalty on a quarterly basis and on a date determined by the Bank. 4. If there are no transactions in the account for a period of two years, the account will be treated as an inoperative account. The customer should thus transact on the account periodically, so that it does not become inoperative. In case there are no customer induced debit, credit and/or third party transactions in the account, it may be classified as inoperative. The service charges levied by the Bank and/or interest credited by the Bank would not be considered as customer induced transactions. 5. Please note that in the event of the account balance being zero consecutively for 3 months or more, the Bank reserves the right to close the account without any obligation to intimate the customer. 6. Satisfactory conduct of the account entails maintaining stipulated minimum quarterly average balance as well as sufficient balance to honour cheques issued to third parties. If there are high incidences to the contrary, the Bank reserves the right to close the account under intimation to the customer. 7. Any special instructions, both financial and non-financial in nature, like standing instructions, stop payment instructions, issuance of cheque books, Demand Drafts, pay Orders, requests for hot carding ATM/DEBIT Cards, Issuance of duplicate card/PIN must be communicated in writing and/or via valid Internet Banking User ID (wherever such an option is available subject to terms and conditions applicable for such facility), otherwise it shall not be binding on the Bank to comply with such instructions. 8. The Savings Bank Account entitles free access to Axis Bank ATMs, Internet banking and Tele banking unless otherwise stated. 9. Availing of the Anywhere Banking facility and the At Par Cheque facility is contingent upon the limits and service charges stipulated for these facilities. 10. Any change of address should be immediately communicated in writing to the Bank. 11. For Trust Account, any change of address, trustees, authorised signatories, office beares should be immediately communicated in writing to the Bank. 12. Opening of the Savings Account tantamount to deemed acceptance of the aforesaid rule & regulations as well as the fact of being informed about the various service charges being levied by the Bank and the terms and conditions guiding related products and services.

10

11

You might also like

- BOB Revised Service ChargesDocument36 pagesBOB Revised Service ChargesKulbhushan SinghNo ratings yet

- MITCs AND FEESDocument5 pagesMITCs AND FEESLoesh WaranNo ratings yet

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- CD PremiumDocument1 pageCD PremiumnelzonpouloseNo ratings yet

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Document2 pagesParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNo ratings yet

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENo ratings yet

- MidDocument1 pageMidSdspl DelhiNo ratings yet

- Citigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeDocument1 pageCitigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeNikhil RaviNo ratings yet

- Schedule of Charges: Smart Salary ExclusiveDocument2 pagesSchedule of Charges: Smart Salary ExclusivevedavakNo ratings yet

- Important Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDocument10 pagesImportant Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDeepak GuptaNo ratings yet

- Crown salary account benefitsDocument2 pagesCrown salary account benefitsVikram IsgodNo ratings yet

- SOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsDocument26 pagesSOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsZeynab AbrezNo ratings yet

- EDB Service Charges2011Document8 pagesEDB Service Charges2011Imran Ali MirNo ratings yet

- Bank service charges guideDocument17 pagesBank service charges guideshaantnuNo ratings yet

- Service ChargesDocument56 pagesService ChargesAshokkumar Madhaiyan0% (1)

- Bank Alfalah Islamic Banking Schedule of Charges July-Dec 2013Document14 pagesBank Alfalah Islamic Banking Schedule of Charges July-Dec 2013krishmasethiNo ratings yet

- Schedule of Charges Without SignatureDocument1 pageSchedule of Charges Without SignatureNandita ThukralNo ratings yet

- Notification FinalDocument4 pagesNotification FinalBrahmanand DasreNo ratings yet

- Per Lot: Plus KRA Charges (As Applicable) Plus KRA Charges (As Applicable)Document2 pagesPer Lot: Plus KRA Charges (As Applicable) Plus KRA Charges (As Applicable)RBalajiNo ratings yet

- Bank Alfalah Schedule of Islamic Banking ChargesDocument16 pagesBank Alfalah Schedule of Islamic Banking Chargesfaisal_ahsan7919No ratings yet

- HSBC Credit Card T&C SummaryDocument10 pagesHSBC Credit Card T&C SummaryMohit AroraNo ratings yet

- Yes Bank Smart SalaryDocument2 pagesYes Bank Smart SalaryVicky SinghNo ratings yet

- Annex 2 Super Savings AccountDocument2 pagesAnnex 2 Super Savings AccountPhani BhupathirajuNo ratings yet

- Schedule of Charges (Standard Charterd)Document0 pagesSchedule of Charges (Standard Charterd)Kiran Maruti ShindeNo ratings yet

- Sabka Basic Savings Account Complete KYC 10-10-2013Document2 pagesSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNo ratings yet

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Document5 pagesSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNo ratings yet

- PK 4Document15 pagesPK 4Instagram OfficeNo ratings yet

- Rca SocDocument3 pagesRca SocKrishna Kiran VyasNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- Fees and Charges GuideDocument3 pagesFees and Charges GuideShashank AgarwalNo ratings yet

- Charges for Roaming Current Account at ICICI BankDocument3 pagesCharges for Roaming Current Account at ICICI Bankashishtiwari92100% (1)

- 150722-Revision in Service Charges Updated As On 30062022Document21 pages150722-Revision in Service Charges Updated As On 30062022Vinoth KumarNo ratings yet

- SERVICE CHARGES AND FEES SUMMARYDocument10 pagesSERVICE CHARGES AND FEES SUMMARYBella BishaNo ratings yet

- Savings Account DetailsDocument2 pagesSavings Account Detailsmysto9No ratings yet

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikNo ratings yet

- Most Important Terms and ConditionsDocument5 pagesMost Important Terms and ConditionsaavisNo ratings yet

- New Schedule of Charges For Current AccountDocument2 pagesNew Schedule of Charges For Current AccountKishan DhootNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Citi Banks Credit NormsDocument6 pagesCiti Banks Credit NormsAshutosh TripathiNo ratings yet

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajNo ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- Sme BookDocument397 pagesSme BookVivek Godgift J0% (1)

- Schedule of Charges 2011-12Document28 pagesSchedule of Charges 2011-12Aamir ShehzadNo ratings yet

- HDFC Bank Demat Tariff SheetDocument1 pageHDFC Bank Demat Tariff SheetpanduranganraghuramaNo ratings yet

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Document2 pagesNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741No ratings yet

- Crest Mitc LowDocument12 pagesCrest Mitc LowswastikNo ratings yet

- IOB-Commission ChartDocument5 pagesIOB-Commission ChartSubham Pnb RoyNo ratings yet

- Sib GssaDocument16 pagesSib GssaVibha PorwalNo ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- Acc No: 948267401 Bsno: 5: M/S C M Flowmeters - India PVT LTDDocument2 pagesAcc No: 948267401 Bsno: 5: M/S C M Flowmeters - India PVT LTDTapas GhoshNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Y Y Y Y N N Y Y: Client Detail SheetDocument2 pagesY Y Y Y N N Y Y: Client Detail SheetanuragpagariaNo ratings yet

- Customer Undertaking For Opening CA Silver Plus With Average Quarterly Balance of INR 1,00,000Document1 pageCustomer Undertaking For Opening CA Silver Plus With Average Quarterly Balance of INR 1,00,000Kumar HemantNo ratings yet

- Prority Mid Version XviiDocument2 pagesPrority Mid Version XviiKartik ShuklaNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- SBSTCDocument2 pagesSBSTCArnab NandiNo ratings yet

- Allowances Civilian NE UT AndamanDocument12 pagesAllowances Civilian NE UT AndamanSrinivas ShettyNo ratings yet

- Performance Evaluation and Optimum Power Estimation in Wireless Sensor Networks in Presence of Rayleigh FadingDocument4 pagesPerformance Evaluation and Optimum Power Estimation in Wireless Sensor Networks in Presence of Rayleigh FadingArnab NandiNo ratings yet

- Selection List PSCDocument1 pageSelection List PSCArnab NandiNo ratings yet

- Synthesis of Nonuniformly Spaced Linear Array of Parallel and Collinear Dipole With Minimum Standing Wave Ratio Using Evolutionary Optimization TechniquesDocument8 pagesSynthesis of Nonuniformly Spaced Linear Array of Parallel and Collinear Dipole With Minimum Standing Wave Ratio Using Evolutionary Optimization TechniquesArnab NandiNo ratings yet

- Logarithm RulesDocument18 pagesLogarithm RulesArnab Nandi50% (2)

- Notices Routine Routinefor2ndSem2014Document7 pagesNotices Routine Routinefor2ndSem2014Subhas RoyNo ratings yet

- Microwaves BandsDocument1 pageMicrowaves BandsArnab NandiNo ratings yet

- Beam Reconfiguration of Linear Array of Parallel Dipole Antennas Through Switching With Real Excitation Voltage DistributionDocument9 pagesBeam Reconfiguration of Linear Array of Parallel Dipole Antennas Through Switching With Real Excitation Voltage DistributionArnab NandiNo ratings yet

- Energy Level Performance of Packet Delivery Schemes in Wireless Sensor Networks in Presence of Rayleigh Fading ChannelDocument6 pagesEnergy Level Performance of Packet Delivery Schemes in Wireless Sensor Networks in Presence of Rayleigh Fading ChannelArnab NandiNo ratings yet

- Optimal Transmit Power in Wireless Sensor Networks in A Multipath Rician Fading ChannelDocument5 pagesOptimal Transmit Power in Wireless Sensor Networks in A Multipath Rician Fading ChannelArnab NandiNo ratings yet

- Radio SpectrumDocument9 pagesRadio SpectrumArnab NandiNo ratings yet

- Basic Interview Question of Electronics & Communication EngineeringDocument4 pagesBasic Interview Question of Electronics & Communication EngineeringArnab NandiNo ratings yet

- List of Trigonometric IdentitiesDocument16 pagesList of Trigonometric IdentitiesArnab NandiNo ratings yet

- Basic Interview Question of Electronics & Communication EngineeringDocument4 pagesBasic Interview Question of Electronics & Communication EngineeringArnab NandiNo ratings yet

- College List 2011Document42 pagesCollege List 2011Arnab NandiNo ratings yet

- Money and Credit-Ncert SolutionsDocument4 pagesMoney and Credit-Ncert SolutionsSafwa KhasimNo ratings yet

- Sip ReportDocument3,648 pagesSip Reportdipakmajethia89No ratings yet

- The Impact of The Lack of Transparency On CorporatDocument8 pagesThe Impact of The Lack of Transparency On CorporatLily ChoiNo ratings yet

- NIGO's ProjectDocument119 pagesNIGO's ProjectAhmad MustafaNo ratings yet

- High Level Solution BlueprintDocument3 pagesHigh Level Solution BlueprintrajeshkriNo ratings yet

- NQF Level 5 Qualification Options for Management DevelopmentDocument9 pagesNQF Level 5 Qualification Options for Management DevelopmentLizelleNo ratings yet

- A Study On Rural Banking in India: 1) SummaryDocument72 pagesA Study On Rural Banking in India: 1) SummarySagar A. BarotNo ratings yet

- Petition For Writ of Praecipe Against JudgeDocument12 pagesPetition For Writ of Praecipe Against Judgetexrees100% (3)

- Additional Illustration-9Document12 pagesAdditional Illustration-9alokpandeygenxNo ratings yet

- Dimensions of E-Commerce Security - IntegrityDocument16 pagesDimensions of E-Commerce Security - IntegrityZain Ali Dhakku100% (5)

- DSPIM COB Form PDFDocument1 pageDSPIM COB Form PDFMohd AftabNo ratings yet

- Financial Analysis at Eastern Condiments PVT LTDDocument96 pagesFinancial Analysis at Eastern Condiments PVT LTDjjjajjaaa100% (4)

- Effects of Board and Ownership Structure On Corporate PerformanceDocument16 pagesEffects of Board and Ownership Structure On Corporate PerformanceDwi Bagus PriambodoNo ratings yet

- Emishaw Tefera - 2017Document100 pagesEmishaw Tefera - 2017Hussen SeidNo ratings yet

- Please Update Mentioned Mobile Number As Primary Contact Details Against My Policy. I Also Hereby Confirm To Be Contacted On The Number Provided Below For Claim Status /policy RenewalDocument4 pagesPlease Update Mentioned Mobile Number As Primary Contact Details Against My Policy. I Also Hereby Confirm To Be Contacted On The Number Provided Below For Claim Status /policy RenewalSumit BhallaNo ratings yet

- Theory and Evidence For A Free LunchDocument45 pagesTheory and Evidence For A Free LunchCsoregi NorbiNo ratings yet

- Sacco Societies Act 2008Document139 pagesSacco Societies Act 2008James GikingoNo ratings yet

- Comprehensive Development of Church StreetDocument156 pagesComprehensive Development of Church StreetVinesh ChandraNo ratings yet

- Short TermDocument4 pagesShort Termjeanniemae100% (2)

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument15 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionTausif ArshadNo ratings yet

- Hotel Feasibility StudyDocument32 pagesHotel Feasibility StudyKamlesh PatelNo ratings yet

- Land Bank of The Philippines: Zamboanga Veterans BranchDocument4 pagesLand Bank of The Philippines: Zamboanga Veterans BranchAigene PinedaNo ratings yet

- (Emerson) Lead Magnet - CompressedDocument4 pages(Emerson) Lead Magnet - CompressedJohn BuenviajeNo ratings yet

- ISFIF Programme Schedule - 08 12 2017Document31 pagesISFIF Programme Schedule - 08 12 2017Saurav DashNo ratings yet

- Indonesia Automotive Industry Outlook 2020Document31 pagesIndonesia Automotive Industry Outlook 2020Dallie Kurniawan100% (1)

- Competency Mapping - A Managerial Perception (A Study of HDFC Bank LTD.)Document12 pagesCompetency Mapping - A Managerial Perception (A Study of HDFC Bank LTD.)Vinoth KannanNo ratings yet

- HSBC Everyday Global Account Bonus Interest PromotionDocument3 pagesHSBC Everyday Global Account Bonus Interest PromotionhjwhtfvttrvakjjchoNo ratings yet

- Pledge of SharesDocument8 pagesPledge of Sharesshubhamgupta04101994No ratings yet

- 2 - Cash and Cash EquivalentsDocument5 pages2 - Cash and Cash EquivalentsandreamrieNo ratings yet

- 02audit of CashDocument12 pages02audit of CashJeanette FormenteraNo ratings yet