Professional Documents

Culture Documents

Tax II Outline 2012 Montero

Uploaded by

Terence GuzmanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax II Outline 2012 Montero

Uploaded by

Terence GuzmanCopyright:

Available Formats

TAXATION II

I. Transfer Taxes A. Estate Tax 1. General Principles & Determination of the Estate Tax Sections 84 & 88, Tax Code Lorenzo vs. Posadas (June 18, 1937) Revenue Regulations 02-03 (December 16, 2002), Sections 1-9 only 2. Gross Estate Sections 85 & 104, Tax Code Collector of Internal Revenue vs. Fisher (January 28, 1961) Zapanta vs. Posadas (December 29, 1928) Tuason vs. Posadas (January 23, 1930) Dison vs. Posadas (November 4, 1932) Vidal de Roces vs. Posadas (March 13, 1933) 3. Deductions Section 86, Tax Code Commissioner of Internal Revenue vs. Court of Appeals and Pajonar (March 22, 2000) Testate Estate of the late Felix de Guzman vs. de Guzman-Carillo (May 18, 1978) Dizon in his capacity as Administrator of deceased Fernandez vs. Commissioner of Internal Revenue (April 30, 2008) 4. Exemptions Section 87, Tax Code 5. Administrative Requirements Sections 89-97, Tax Code Government of the Philippines vs. Pamintuan (October 11, 1930) Commissioner of Internal Revenue vs. Pineda (September 15, 1967) Commissioner of Internal Revenue vs. Gonzales (November 24, 1966) B. Donors Tax 1. General Principles & Determination of the Donors Tax Sections 98-100,102, and 104, Tax Code Spouses Gestopa vs. Court of Appeals (October 5, 2000) Tang Ho vs. The Board of Tax Appeals (November 19, 1955) Gibbs vs. Collector of Internal Revenue (April 28, 1962) Pirovano vs. Commissioner of Internal Revenue (July 31, 1965)

2. Exemptions Section 101, Tax Code Section 13, Republic Act 7166 Revenue Regulations 7-2001 (February 16, 2011) 3. Administrative Requirements Section 103, Tax Code Revenue Regulations 02-03 (December 16, 2002), Sections 10-13 only C. Estates and Trusts Section 60-66, Tax Code General Rule on Taxability: Fiduciary or Beneficiary Personal Exemption Allowed Decedent's Estate Administration Revocable Trusts Income for Benefit of Grantor Revenue Regulations No. 2 (February 10, 1940), Sections 207-213 only II. Value-Added Tax 1. Basic Elements Section 105, 106 (A) & (B), & 108 (A), Tax Code (as amended by Republic Act No. 9337; applies to all provisions infra) Commissioner of Internal Revenue vs. Commonwealth Management & Services Corporation (March 30, 2000) Commissioner of Internal Revenue vs. Magsaysay Lines (July 28, 2006) Commissioner of Internal Revenue vs. Sony Philippines, Inc. (November 17, 2010) 2. VAT on Importations Section 107, Tax Code 3. VAT-taxable transactions Section 106 & 108 (A), Tax Code Commissioner of Internal Revenue vs. SM Prime Holdings, Inc. (February 26, 2010) Diaz vs. Secretary of Finance (July 19, 2011) 4. VAT exempt transactions Section 109, Tax Code Republic Act No. 9994 (February 15, 2010) Tambunting Pawnshop, Inc. vs. Commissioner of Internal Revenue (January 21, 2010) Commissioner of Internal Revenue vs. Philippine Health Care Providers, Inc. (April 24, 2007) Revenue Regulations 16-11 (October 27, 2011)

5. VAT zero-rated transactions Section 106 & 108 (B), Tax Code American Express International, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 6099 (April 19, 2002) Commissioner of Internal Revenue vs. Placer Dome Technical Services, Inc. (June 8, 2007) Commissioner of Internal Revenue vs. Burmeister and Wain Scandinavian Contractor Mindanao, Inc. (January 22, 2007) Commissioner of Internal Revenue vs. Sekisui Jushi Philippines, Inc. (July 21, 2006) Commissioner of Internal Revenue vs. Seagate Technology (February 11, 2005) Commissioner of Internal Revenue vs. Toshiba Information Equipment (August 9, 2005) Commissioner of Internal Revenue vs. Contex Corporation (July 2, 2004) 6. Input VAT Section 110, Tax Code Abakada Guro Party List vs. Ermita (September 1, 2005) Abakada Guro Party List vs. Ermita (October 18, 2005) Commissioner of Internal Revenue vs. Acesite (Philippines) Hotel Corporation (February 16, 2007) Commissioner of Internal Revenue vs. Sony Philippines, Inc. (November 17, 2010) Revenue Regulations No. 16-05 (September 1, 2005), Section 4-110.4 7. Withholding, Presumptive, Transitional Input VAT Section 111, Tax Code Fort Bonifacio Development Corporation vs. Commissioner of Internal Revenue (April 2, 2009; MR on October 2, 2009) 8. VAT refunds Section 112, Tax Code Commissioner of Internal Revenue vs. Mirant Pagbilao Corporation (September 12, 2008) Commissioner of Internal Revenue vs. Aichi Forging Company of Asia, Inc. (October 6, 2010) Western Mindanao Power Corporation vs. Commissioner of Internal Revenue (June 13, 2012) 9. VAT on real properties Revenue Regulations 04-07 (February 7, 2007) 10. Administrative provisions Section 113-115, Tax Code Also read Revenue Regulations 16-05 (September 1, 2005) Revenue Regulations 04-07 (February 7, 2007)

III. Other Business Taxes A. Percentage Tax Sections 116-128, Tax Code (as amended by Republic Act No. 9337) Republic Act No. 9238 (February 5, 2004) Commissioner of Internal Revenue vs. Philippine Airlines, Inc. (July 14, 2009) Revenue Regulations 9-2007 (July 4, 2007) Revenue Regulations 4-2003 (January 29, 2003) Revenue Regulations 25-2003 (September 16, 2003) Revenue Memorandum Circular 18-2010 (March 1, 2010) B. Excise Tax Sections 129-172, Tax Code (as amended by Republic Act No. 9337) Republic Act No. 9224 (August 29, 2003) Republic Act No. 9334 (December 21, 2004) Republic of the Philippines vs. Caguioa (October 15, 2007) Silkair (Singapore) Pte., Ltd. Vs. Commissioner of Internal Revenue (February 6, 2008; November 14, 2008; and January 20, 2012) Exxonmobil Petroleum and Chemical Holdings, Inc.- Phil. Branch vs. Commissioner of Internal Revenue, (January 19, 2011) Commissioner of Internal Revenue vs. Pilipinas Shell Petroleum Corporation (April 25, 2012) British American Tobacco vs. Camacho (August 20, 2008) C. Documentary Stamp Tax Sections 173-201, Tax Code (as amended by Republic Act No. 9243) Republic Act 9648 (June 30, 2009) Commissioner of Internal Revenue vs. Filinvest Development Corporation (July 19, 2011) Philippine Banking Corporation vs. Commissioner of Internal Revenue (January 30, 2009) Revenue Regulations 7-2009 (July 29, 2009) Revenue Regulations 6-2001 (July 31, 2001) IV. Remedies 1. Tax Administration Sections 2-3, 9-20, 244-246, and 290, Tax Code DOF Order No. 007-02 (May 7, 2002) Revenue Regulations 5-2012 (April 2, 2012) Revenue Regulations 14-2008 (November 26, 2008) Revenue Regulations 16-2002 (October 11, 2002) Revenue Memorandum Circular 22-2012 (May 7, 2012) BIR Ruling No. 370-2011 (October 7, 2011) 2. Powers of the Commissioner of Internal Revenue Sections 4-8, Tax Code Republic Act No. 10021 Fitness By Design, Inc. vs. Commissioner of Internal Revenue (October 17, 2008)

Commissioner of Internal Revenue vs. Aquafresh Seafoods, Inc. (October 20, 2010) Commissioner of Internal Revenue vs. Hantex Trading Co., Inc. (March 31, 2005) Revenue Regulations 10-2010 (November 6, 2010) Revenue Regulations 11-2006 (June 15, 2006) as amended by Revenue Regulations 4-2010 (February 24, 2010) and Revenue Regulations 14-2010 (November 25, 2010) 3. Power/Remedy of Assessment Sections 56 and 71, Tax Code Bonifacio Sy Po vs. Court of Tax Appeals (August 18, 1988) Collector of Internal Revenue vs. Benipayo (January 31, 1962) Meralco Securities Corp. vs. Savellano (October 23, 1982) Republic vs. Hizon (December 13, 1999) Commissioner of Internal Revenue vs. Gonzalez (October 13, 2010) Revenue Memorandum Order 5-2009 (January 22, 2009) Revenue Memorandum Order 69-2010, August 11, 2010 Revenue Memorandum Order 55-2010 (June 15, 2010) Revenue Memorandum Circular 40-2003 (July 7, 2003) 4. Prescription of governments right to assess Sections 203, and 222-223, Tax Code Commissioner of Internal Revenue vs. Goodrich Phils., Inc. (February 24, 1999) Basilan Estates, Inc. vs. Commissioner of Internal Revenue (September 25, 1967) Tupaz vs. Ulep (October 1, 1999) Nava vs. Commissioner of Internal Revenue (January 30, 1965) Republic of the Philippines vs. Court of Appeals (April 30, 1987) Commissioner of Internal Revenue vs. Western Pacific Corporation (May 27, 1965) Commissioner of Internal Revenue vs. Primetown Property Group, Inc. (August 28, 2007) Republic of the Philippines vs. Marsman Development Company (April 27, 1972) Commissioner of Internal Revenue vs. Phoenix Assurance Co., Ltd. (May 20, 1965) Butuan Sawmill, Inc. vs. Court of Tax Appeals (February 28, 1966) Commissioner of Internal Revenue vs. Ayala Securities Corporation (March 31, 1976) Philippine Journalists, Inc. vs. Commissioner of Internal Revenue (December 16, 2004) Commissioner of Internal Revenue vs. Kudos Metal Corporation (May 5, 2010) Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue (September 7, 2011) Republic of the Philippines vs. Lim de Yu (April 30, 1964) Republic of the Philippines vs. Heirs of Cesar Jalandoni (September 20, 1965) Aznar vs. Court of Tax Appeals (August 23, 1974) Commissioner of Internal Revenue vs. Ayala Securities Corporation (November 21, 1980) Revenue Regulations 12-99 (September 6, 1999) Revenue Memorandum Circular 29-2012 (June 29, 2012) 5. Imposition of penalties Sections 247-252, Tax Code Philippine Refining Company vs. Court of Appeals (May 8, 1996) Commissioner of Internal Revenue vs. Republic Cement Corp. (August 10, 1983) Cagayan Electric Power & Light Co., Inc. vs. Commissioner of Internal Revenue (September 25, 1985) Commissioner of Internal Revenue vs. Air India (January 29, 1988) Revenue Regulations 12-99 (September 6, 1999)

6. Criminal action and other penalties Sections 253-280, Tax Code Republic of the Philippines vs. Patanao (July 21, 1967) People of the Philippines vs. Arnault (November 20, 1952) People of the Philippines vs. Tierra (December 28, 1964) Ungab vs. Cusi (May 30, 1980) Commissioner of Internal Revenue vs. Pascor Realty and Development Corporation (June 29, 1999) Adamson vs. Court of Appeals (May 21, 2009) People of the Philippines vs. Gloria Kintanar (CTA Crim. Case No. 006, December 3, 2010; affirmed by the Supreme Court in a minute resolution [GR No. 196340] dated February 2012) 7. Prescription of criminal action Section 281, Tax Code Lim, Sr. vs. Court of Appeals (October 18, 1990) 8. Informers reward Section 282, Tax Code Revenue Regulations 16-2010 (November 25, 2010) 9. Power/Remedy of Collection Collection in cases where assessment has become final and unappelable Section 205, Tax Code Republic Act 9282 Commissioner of Internal Revenue vs. Hambrecht & Quist Philippines, Inc. (November 17, 2010) Dayrit vs. Cruz (September 26, 1988) Marcos II vs. Court of Appeals (June 5, 1997) Republic of the Philippines vs. Lim Tian Teng Sons & Co., Inc. (March 31, 1966) Yabes vs. Flojo (July 20, 1982) Tax Lien Section 219, Tax Code Commissioner of Internal Revenue vs. National Labor Relations Commission (November 9, 1994) Compromise & Abatement Section 204, Tax Code Rovero vs. Amparo (May 5, 1952) Revenue Regulations 30-2002 (December 16, 2002) Revenue Regulations 13-01 (September 27, 2001) as amended by Revenue Regulations 42012 (March 28, 2012) Revenue Regulations 9-2010 (September 3, 2010) Revenue Memorandum Order 20-2007 (August 13, 2007) Civil Remedies for Collection (Distraint & Levy) Sections 205-217, Tax Code Injunction Section 218, Tax Code Section 11, Republic Act 9282

Revenue Memorandum Order 39-2007 (December 12, 2007) Revenue Memorandum Order 42-2010 (May 4, 2010) 10. Prescription of governments right to collect Sections 203, and 222-223, Tax Code Guagua Electric Light Plant Company, Inc. vs. Collector of Internal Revenue (April 24, 1967) Vera vs. Fernandez (March 30, 1979) Republic of the Philippines vs. Limcaco (August 31, 1962) Republic of the Philippines vs. Ret (March 31, 1962) Republic of the Philippines vs. Acebedo (March 29, 1968) Commissioner of Internal Revenue vs. Court of Appeals (February 25, 1999) Republic of the Philippines vs. Lopez (March 30, 1963) Republic of the Philippines vs. Ker & Company, Ltd. (September 29, 1966) Republic of the Philippines vs. Arcache (February 29, 1964) Philippine National Oil Corporation vs. Court of Appeals (April 26, 2005) Bank of the Philippine Islands vs. Commissioner of Internal Revenue (October 17, 2005) Commissioner of Internal Revenue vs. Philippine Global Communications, Inc. (October 31, 2006) Bank of the Philippine Islands vs. Commissioner of Internal Revenue (March 7, 2008) Commissioner of Internal Revenue vs. Capitol Subdivision, Inc. (April 30, 1964) Protectors Services, Inc. vs. Court of Appeals (April 12, 2000) 11. Taxpayers Remedies Protest Section 228, Tax Code Commissioner of Internal Revenue vs. Gonzalez (October 13, 2010) Commissioner of Internal Revenue vs. Metro Star Superama, Inc. (December 8, 2010) Commissioner vs. Azucena Reyes (January 27, 2006) Commissioner of Internal Revenue vs. Enron Subic Power Corporation (January 19, 2009) Fluor Daniel Philippines, Inc. vs. Commissioner of Internal Revenue (CTA Case No. 7793, April 17, 2012) Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue (June 16, 2006) Commissioner of Internal Revenue vs. First Express Pawnshop Company, Inc. (June 16, 2009) Rizal Commercial Banking Corporation vs. Commissioner of Internal Revenue (April 24, 2007) Lascona Land Co., Inc. vs. Commissioner of Internal Revenue (March 5, 2012) Revenue Regulations 12-99 (September 6, 1999) Refund Sections 204, and 229-230, Tax Code Vda. de Aguinaldo vs. Commissioner of Internal Revenue (February 26, 1965) Commissioner of Internal Revenue vs. Aichi Forging Company of Asia (October 6, 2010) Gibbs vs. Collector of Internal Revenue (February 29, 1960) Commissioner of Internal Revenue vs. Palanca (October 29, 1966) Gibbs vs. Commissioner of Internal Revenue (November 29, 1965) Far East Bank and Trust Company vs. Commissioner of Internal Revenue (May 2, 2006) Collector of Internal Revenue vs. Sweeney (August 21, 1959) Philex Mining Corporation vs. Commissioner of Internal Revenue (April 21, 1999) Commissioner of Internal Revenue vs. Tokyo Shipping Co. Ltd. (May 26, 1995) Philippine Bank of Communications vs. Commissioner of Internal Revenue (January 28, 1999) Commissioner of Internal Revenue vs. Court of Appeals (January 21, 1999) Commissioner of Internal Revenue vs. Philippine American Life Insurance Co. (May 29, 1995) Commissioner of Internal Revenue vs. Philippine National Bank (October 25, 2005) Philam Asset Management, Inc. vs. Commissioner of Internal Revenue (December 14, 2005)

Asiaworld Properties Philippines Corporation vs. Commissioner of Internal Revenue (July 29, 2010) Commissioner of Internal Revenue vs. Far East Bank & Trust Company (March 15, 2010) Commissioner of Internal Revenue vs. Smart Communication, Inc. (August 25, 2010) Commissioner of Internal Revenue vs. Petron Corporation (March 21, 2012) Felisa Vda. de San Agustin vs. Commissioner of Internal Revenue (September 10, 2001) Revenue Regulations 14-2011 (July 29, 2011) 12. Court of Tax Appeals Republic Act 9282 as amended by Republic Act 9503 Commissioner of Internal Revenue vs. Isabela Cultural Corporation (July 11, 2001) Surigao Electric Co. vs. Court of Tax Appeals (June 28, 1974) Advertising Associates, Inc. vs. Court of Appeals (December 26, 1984) Commissioner of Internal Revenue vs. Union Shipping Corporation (May 21, 1990) Oceanic Wireless Network vs. Commissioner of Internal Revenue (December 9, 2005) City of Makati vs. Commissioner of Internal Revenue (CTA Case No. 641, September 16, 2011) Festo Holdings, Inc. vs. Commissioner of Internal Revenue (CTA Case No. 8226, September 2, 2011) Allied Banking Corporation vs. Commissioner of Internal Revenue (February 5, 2010) Fishwealth Canning Corporation vs. Commissioner of Internal Revenue (January 21, 2010) Judy Anne L. Santos vs. People of the Philippines and Bureau of Internal Revenue (August 26, 2008) Philippine Journalists Inc. vs. Commissioner of Internal Revenue (December 16, 2004) Commissioner of Internal Revenue vs. Leal (November 18, 2002) Asia International Auctioneers, Inc. vs. Parayno (December 18, 2007) City of Manila vs. Coca-Cola Bottlers Philippines, Inc. (August 4, 2009) Commissioner of Customs vs. Marina Sales, Inc. (November 22, 2010) Philippine British Assurance Company, Inc. vs. Republic of the Philippines (February 2, 2010) A.M. No. 05-11-07-CTA Revised Rules of the Court of Tax Appeals (November 22, 2005) 13. Allotment of Internal Revenue Sections 283-289, Tax Code V. Local Taxation Sections 128-196, Local Government Code Art. 217-287, Rules and Regulations Implementing the Local Government Code 1. General Principles, Definitions, and Limitations Sections 128-133, Local Government Code Art. 217-222, Rules and Regulations Implementing the Local Government Code Palma Development Corp. vs. Zamboanga Del Sur (October 16, 2003) Province of Bulacan vs. Court of Appeals (November 27, 1998) Quezon City vs. ABS-CBN Broadcasting Corporation (October 6, 2008) SMART Communications, Inc. vs. The City of Davao (September 16, 2008; MR on July 21, 2009) First Philippine Industrial Corp. vs. Court of Tax Appeals (December 29, 1998) Petron Corporation vs. Tiangco (April 16, 2008) 2. Taxing Powers of LGUs Sections 134-149, and 151-164, Local Government Code Art. 223-242, and 244-252 Rules and Regulations Implementing the Local Government Code

Lepanto Consolidated Mining Company vs. Ambanloc (June 29, 2010) Philippine Match Co., Ltd. vs. City of Cebu (January 18, 1978) Yamane vs. BA Lepanto Condominium Corporation (October 25, 2005) Philippine Basketball Association vs. Court of Appeals (August 8, 2000) Ericsson Telecommunications, Inc. vs. City of Pasig (November 22, 2007) DOF Local Finance Circular 01-93 DOF Local Finance Circular 02-93 DOF Local Finance Circular 03-93 3. Situs of Local Taxes Section 150, Local Government Code Art. 243, Rules and Regulations Implementing the Local Government Code Bureau of Local Government Finance Opinion dated February 17, 2010 Bureau of Local Government Finance Opinion dated March 7, 1994 Bureau of Local Government Finance Opinion dated March 29, 1993 4. Collection of Local Taxes Sections 165-171, Local Government Code Art. 253-259, Rules and Regulations Implementing the Local Government Code Mobil Phils. Inc. vs. Treasurer of Makati (July 14, 2005) 5. Remedies for the Collection of Local Taxes Sections 172-191, Local Government Code Art. 260-281, Rules and Regulations Implementing the Local Government Code 6. Exemption from Local Taxes Sections 192-193, Local Government Code Art. 282-283, Rules and Regulations Implementing the Local Government Code Manila Electric Company vs. Province of Laguna (May 5, 1999) NPC vs. City of Cabanatuan (April 9, 2003) Batangas Power Corporation vs. National Power Corporation (April 28, 2004) City of Iloilo vs. Smart Communications, Inc. 7. Taxpayers Remedies Sections 194-196, Local Government Code Art. 284-287, Rules and Regulations Implementing the Local Government Code Jardine Davies Insurance Brokers vs. Aliposa (February 27, 2003) Drilon vs. Lim (August 4, 1994) Coca-Cola Bottlers Phils., Inc. vs. City of Manila (June 27, 2006) Angeles City vs. Angeles Electric Corporation (June 29, 2010) VI. Real Property Taxation 1. General Principles and Definitions Sections 197-200, Local Government Code Art. 288-291, Rules and Regulations Implementing the Local Government Code

2. Machinery as Real Property Section 199 (o), Local Government Code Art. 290 (o), Rules and Regulations Implementing the Local Government Code Mindanao Bus Co., vs. City Assessor and Treasurer and the Board of Tax Appeals of Cagayan de Oro City (September 29, 1962) Caltex (Philippines), Inc. vs. Central Board of Assessment Appeals (May 31, 1982) Manila Electric Co. vs. Central Board of Assessment Appeals (May 31, 1982) Board of Assessment Appeals vs. Manila Electric Co. (January 31, 1964) Local Finance Circular 001-2002 (April 25, 2002) Bureau of Local Government Finance Opinion dated November 28, 2011 Bureau of Local Government Finance Opinion dated December 15, 2006 Bureau of Local Government Finance Opinion dated March 22, 2005 Bureau of Local Government Finance Opinion dated February 17, 2005 Bureau of Local Government Finance Opinion dated August 5, 2004 Bureau of Local Government Finance Opinion dated November 21, 2002 3. Appraisal and Assessment of Real Property Sections 201- 231, Local Government Code Art. 292-322, Rules and Regulations Implementing the Local Government Code Lopez vs. City of Manila (February 19, 1999) Tabuena vs. Court of Appeals (May 6, 1991) 4. Imposition of Real Property Tax Sections 232-233, Local Government Code Art. 323-324, Rules and Regulations Implementing the Local Government Code 5. Exemption from Real Property Tax Section 234, and 276-277, Local Government Code Sections 3 (am) & 91, Republic Act 7942 (March 3, 1995) Art. 367-368, and 325, Rules and Regulations Implementing the Local Government Code Fels Energy, Inc. vs. Province of Batangas (February 16, 2007) Manila International Airport vs. Paranaque City (July 20, 2006) Philippine Fisheries Development Authority vs. C.A. (July 31, 2007) Mactan Cebu International Airport Authority vs. Marcos (September 11, 1996) Government Service Insurance System vs. City Treasurer of Manila (December 23, 2009) National Power Corporation vs. Province of Quezon (July 15, 2009; MR on January 25, 2010) Digital Telecommunications Philippines, Inc. vs. City Government of Batangas (December 11, 2008) City Government of Quezon City Vs. Bayan Telecomunications (March 6, 2006) City of Pasig vs. Presidential Commission on Good Government (August 24, 2011) Philippine Reclamation Authority vs. City of Paranaque (July 18, 2012) Lung Center of the Philippines vs. Quezon City (June 29, 2004) Provincial Assessor of Marinduque vs. Court of Appeals (April 30, 2009) Light Rail Transit Authority vs. Central Board of Assessment Appeals (October 12, 2000) City Assessor of Cebu City vs. Association of Benevola De Cebu, Inc. (June 8, 2007) Executive Order 27 (February 28, 2011)

6. Special Levies Sections 235-245, Local Government Code Art. 326-336, Rules and Regulations Implementing the Local Government Code 7. Collection of Real Property Tax Sections 246-251, and 254-255, Local Government Code Art. 336-342, and 345-361, Rules and Regulations Implementing the Local Government Code 8. Taxpayers Remedies Section 252-253, Local Government Code Art. 343-344, Rules and Regulations Implementing the Local Government Code Talento vs. Escalada (June 27, 2008) 9. Remedies for Collection of Real Property Tax Sections 256-270, Local Government Code Art. 347-361, Rules and Regulations Implementing the Local Government Code Testate Estate of Concordia Lim vs. City of Manila (February 21, 1990) Reyes vs. Almanzor (April 26, 1991) City Mayor of Quezon City vs. Rizal Commercial Banking Corporation (August 3, 2010) 10. Disposition and Allotment of Local Taxes Sections 271-274, 284-294, Local Government Code Art. 362-366, 369-392, Rules and Regulations Implementing the Local Government Code

Michael N. Montero

You might also like

- TAX II OUTLINEupdated 2020cleanDocument14 pagesTAX II OUTLINEupdated 2020cleanAsia WyNo ratings yet

- Remedies and Taxpayer Relief in Philippine Tax LawDocument10 pagesRemedies and Taxpayer Relief in Philippine Tax LawMich Kristine BANo ratings yet

- ALS Incomesyllabus Updated021318Document14 pagesALS Incomesyllabus Updated021318Zoe RodriguezNo ratings yet

- Tax I OutlineDocument11 pagesTax I OutlinebedanNo ratings yet

- SDFSDDocument701 pagesSDFSDDrew ReyesNo ratings yet

- DeductionsDocument4 pagesDeductionsJeric Angelo GalonNo ratings yet

- Tax 2 SyllabusDocument10 pagesTax 2 SyllabusJunnieson BonielNo ratings yet

- Tax 2 Course OutlineDocument10 pagesTax 2 Course OutlineBoy Omar Garangan DatudaculaNo ratings yet

- Case AssignmentsDocument4 pagesCase AssignmentsPBWGNo ratings yet

- Income Taxation Syllabus ExplainedDocument20 pagesIncome Taxation Syllabus ExplainedRenzo Ross Sarte100% (1)

- (UP) Taxation 2 Syllabus 2012-1013Document14 pages(UP) Taxation 2 Syllabus 2012-1013Eins Balagtas100% (4)

- Income Taxation GuideDocument20 pagesIncome Taxation GuideEllyssa TimonesNo ratings yet

- TAXATION 2 Syllabus Updated Nov 2018Document9 pagesTAXATION 2 Syllabus Updated Nov 2018Agot GaidNo ratings yet

- Tax Law Review Syllabus Part 2Document20 pagesTax Law Review Syllabus Part 2chaynagirlNo ratings yet

- Taxation Law 1 - Mijares SyllabusDocument11 pagesTaxation Law 1 - Mijares SyllabusAngelo Tiglao100% (1)

- Course Outline Tax I Income Tax: 1. DefinitionsDocument2 pagesCourse Outline Tax I Income Tax: 1. DefinitionsJunelyn T. EllaNo ratings yet

- Substantial EvidenceDocument15 pagesSubstantial EvidenceArahbells100% (1)

- Tax SyllabusDocument2 pagesTax Syllabusjohn uyNo ratings yet

- English BusinessDocument24 pagesEnglish Businessyusmar basriNo ratings yet

- Tax1 Dimaampao Lecture NotesDocument61 pagesTax1 Dimaampao Lecture NotesSui100% (1)

- Syllabus Part 1 - NIRC Remedies (Revised Latest)Document8 pagesSyllabus Part 1 - NIRC Remedies (Revised Latest)Jonathan UyNo ratings yet

- Cases GENERAL PRINCIPLES AND LIMITATIONS ON THE POWER OF TAXATIONDocument2 pagesCases GENERAL PRINCIPLES AND LIMITATIONS ON THE POWER OF TAXATIONVictor Ryan DellosaNo ratings yet

- Tax SyllabusDocument7 pagesTax Syllabuscrizzia fanugaNo ratings yet

- Income Taxation GuideDocument16 pagesIncome Taxation Guideautumn moonNo ratings yet

- Income Tax Act 75.01Document228 pagesIncome Tax Act 75.01damian hardeoNo ratings yet

- C.T.A. CASE NO. 8149. June 24, 2013Document69 pagesC.T.A. CASE NO. 8149. June 24, 2013Edu ParungaoNo ratings yet

- Taxation Law SyllabusDocument7 pagesTaxation Law SyllabusYan PascualNo ratings yet

- Taxation Law II SyllabusDocument4 pagesTaxation Law II SyllabusVikki Mae AmorioNo ratings yet

- Table of ContentsDocument3 pagesTable of ContentsKhaiye De Asis AggabaoNo ratings yet

- Income TaxationDocument4 pagesIncome TaxationCervus Augustiniana LexNo ratings yet

- UCC Taxation-2 Syllabus VAT Updated PDFDocument2 pagesUCC Taxation-2 Syllabus VAT Updated PDFAnjessette MantillaNo ratings yet

- Local Taxation Under the Local Government CodeDocument13 pagesLocal Taxation Under the Local Government CodeGrace EnriquezNo ratings yet

- City University of PasayDocument19 pagesCity University of PasayFroilan G. AgatepNo ratings yet

- PLM-Taxation 2 Syllabus - SY2019-20 - BVQDocument22 pagesPLM-Taxation 2 Syllabus - SY2019-20 - BVQlyka timanNo ratings yet

- 2014 Tax Syllabus (San Beda College)Document8 pages2014 Tax Syllabus (San Beda College)Jhoy CorpuzNo ratings yet

- Tax SyllabusDocument7 pagesTax Syllabussarah91403No ratings yet

- AUSL Tax 2 SyllabusDocument4 pagesAUSL Tax 2 Syllabuskaira marie carlosNo ratings yet

- Bibliography SampleDocument8 pagesBibliography SampleKenzo RodisNo ratings yet

- Tax 2 SyllabusDocument9 pagesTax 2 SyllabusAlvin RufinoNo ratings yet

- Documentary Stamp Tax WagaDocument10 pagesDocumentary Stamp Tax WagaUP Law Block DNo ratings yet

- Local Tax - SyllabusDocument8 pagesLocal Tax - Syllabusmark_aure_1No ratings yet

- 4.1.1 Revenue Classification - Tax Revenue: OtherDocument2 pages4.1.1 Revenue Classification - Tax Revenue: OtherPrabath WijewardanaNo ratings yet

- Taxation 1-3E: Syllabus - Taxation 1 A. IntroductionDocument5 pagesTaxation 1-3E: Syllabus - Taxation 1 A. IntroductionJericho Labay JamigNo ratings yet

- RTB Taxation II Course Outline 2016-2017Document21 pagesRTB Taxation II Course Outline 2016-2017Victor LimNo ratings yet

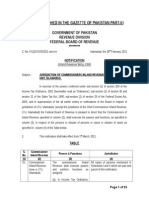

- To Be Published in The Gazette of Pakistan Part-IiDocument23 pagesTo Be Published in The Gazette of Pakistan Part-IisadamNo ratings yet

- Syllabus Tax 1 2019 2020Document8 pagesSyllabus Tax 1 2019 2020Sand FajutagNo ratings yet

- Tax Syllabus 2020Document5 pagesTax Syllabus 2020Asher CruzNo ratings yet

- VatDocument4 pagesVatmonaileNo ratings yet

- NIRC Table of AmendmentsDocument1 pageNIRC Table of AmendmentsAlejandro de LeonNo ratings yet

- Taxation II OUTLINE W Cases - 2nd Semester 2011-2012Document15 pagesTaxation II OUTLINE W Cases - 2nd Semester 2011-2012Tina Marie E. GrandeNo ratings yet

- Commercial Taxes-Tamil NaduDocument40 pagesCommercial Taxes-Tamil NaduharidasskNo ratings yet

- Banking G.R. Nos. 250736 and 250801-03. December 05, 2022)Document18 pagesBanking G.R. Nos. 250736 and 250801-03. December 05, 2022)Sam ConcepcionNo ratings yet

- Cases in Taxation I Part One: General Principles: G.R. No. 158540, August 3, 2005Document3 pagesCases in Taxation I Part One: General Principles: G.R. No. 158540, August 3, 2005Legem DiscipulusNo ratings yet

- PM Reyes Notes On Taxation 2 - Local Taxation (Working Draft)Document9 pagesPM Reyes Notes On Taxation 2 - Local Taxation (Working Draft)dodong123No ratings yet

- North American Free Trade Agreement, 1992 Oct. 7 Tariff Phasing DescriptionsFrom EverandNorth American Free Trade Agreement, 1992 Oct. 7 Tariff Phasing DescriptionsNo ratings yet

- Commlawrev QuizzesDocument10 pagesCommlawrev QuizzesTerence GuzmanNo ratings yet

- Tambunting v. CIRDocument12 pagesTambunting v. CIRTerence GuzmanNo ratings yet

- Commercial Law Review LectureDocument63 pagesCommercial Law Review LectureSong OngNo ratings yet

- Montero Cases Missing.111414Document3 pagesMontero Cases Missing.111414Terence GuzmanNo ratings yet

- Am11 1 6 SC PhiljaDocument37 pagesAm11 1 6 SC PhiljaTerence GuzmanNo ratings yet

- Agrarian Law - Case Digests 3 - Just CompensationDocument5 pagesAgrarian Law - Case Digests 3 - Just CompensationTrek AlojadoNo ratings yet

- Tambunting v. CIRDocument12 pagesTambunting v. CIRTerence GuzmanNo ratings yet

- ICT SyllabusDocument4 pagesICT SyllabusTerence GuzmanNo ratings yet

- Travelers Health Assn vs. Virginia PDFDocument10 pagesTravelers Health Assn vs. Virginia PDFTerence GuzmanNo ratings yet

- Torts Class Digest Outline.060913Document1 pageTorts Class Digest Outline.060913Terence GuzmanNo ratings yet

- ICT SyllabusDocument4 pagesICT SyllabusTerence GuzmanNo ratings yet

- Agency ReviewerDocument20 pagesAgency ReviewerJingJing Romero92% (72)

- JDM F 9Document9 pagesJDM F 9FCP PUNEKARNo ratings yet

- Courtesy & DisciplineDocument47 pagesCourtesy & DisciplineLiz FellerNo ratings yet

- Milestone Three SWOT AnalysisDocument8 pagesMilestone Three SWOT AnalysisJennifer BrownNo ratings yet

- Vinča Waste Management Complex ESIA Non-Technical SummaryDocument15 pagesVinča Waste Management Complex ESIA Non-Technical SummaryDragoljub DjordjevicNo ratings yet

- Socratic Seminar Reflection Emmerson and ThoreauDocument2 pagesSocratic Seminar Reflection Emmerson and Thoreauapi-473261690No ratings yet

- Panden Lhamo Tea PDFDocument2 pagesPanden Lhamo Tea PDFamjr1001No ratings yet

- US Bank Statement BankStatementsDocument4 pagesUS Bank Statement BankStatementsTyvette Venters100% (1)

- Booker T. Washington/ Essay / PaperDocument8 pagesBooker T. Washington/ Essay / PaperAssignmentLab.comNo ratings yet

- Volume 43, Issue 2 - January 13, 2012Document48 pagesVolume 43, Issue 2 - January 13, 2012BladeNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961digi timeNo ratings yet

- Liturgy of The Ordinary PaperDocument4 pagesLiturgy of The Ordinary Paperapi-525644495No ratings yet

- United States v. Levern Woods, 4th Cir. (2014)Document6 pagesUnited States v. Levern Woods, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Summary of Nursing Informatics in AsiaDocument2 pagesSummary of Nursing Informatics in AsiaJake Yvan Dizon0% (1)

- q3 1Document26 pagesq3 1api-321469925No ratings yet

- Financial Management Analysis of Financial PlansDocument11 pagesFinancial Management Analysis of Financial Plansaasim aghaNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Law, Politics and Society - Course OutlineDocument7 pagesLaw, Politics and Society - Course OutlineKiryuu KanameNo ratings yet

- Accounting for partnership profitsDocument19 pagesAccounting for partnership profitsየሞላ ልጅNo ratings yet

- Curriculum Vitae: IdentitéDocument2 pagesCurriculum Vitae: IdentitéJalel SaidiNo ratings yet

- Personal Development Grade 11 ModuleDocument184 pagesPersonal Development Grade 11 ModuleGabrielle Sumague100% (1)

- List of Recessions in The United States - WikipediaDocument19 pagesList of Recessions in The United States - WikipediaCarlos JesenaNo ratings yet

- West Tower Condominium Corporation vs. First Philippine Industrial CorporationDocument70 pagesWest Tower Condominium Corporation vs. First Philippine Industrial CorporationJessamine RañaNo ratings yet

- BEDOYA, Soledad (1999) - La Ecología Política y La Crítica Al DesarrolloDocument25 pagesBEDOYA, Soledad (1999) - La Ecología Política y La Crítica Al DesarrolloCARLOS AARÓN HERZ ZACARÍASNo ratings yet

- CHUYÊN ĐỀ 14 liên từDocument15 pagesCHUYÊN ĐỀ 14 liên từHạnhhNo ratings yet

- WLAN Concepts PDFDocument5 pagesWLAN Concepts PDFAlonso Maurico Bolaños GuillenNo ratings yet

- Robert Bogan and Scott Bogan v. Austin E. Hodgkins, JR., Northwestern Mutual Life Insurance Company, 166 F.3d 509, 2d Cir. (1999)Document11 pagesRobert Bogan and Scott Bogan v. Austin E. Hodgkins, JR., Northwestern Mutual Life Insurance Company, 166 F.3d 509, 2d Cir. (1999)Scribd Government DocsNo ratings yet

- 2018-19 UEFA Champions League Knockout Phase PDFDocument11 pages2018-19 UEFA Champions League Knockout Phase PDFReyner MoralesNo ratings yet

- LTE Call Flow - PS Redirection To UTRAN-V2015 0105-V1.0Document16 pagesLTE Call Flow - PS Redirection To UTRAN-V2015 0105-V1.0Ashish75% (4)

- Understanding the subtle signs and impacts of depressionDocument3 pagesUnderstanding the subtle signs and impacts of depressionKarla AcotNo ratings yet

- PGA Sompo Insurance CorporationDocument2 pagesPGA Sompo Insurance CorporationJohn Benedict LascunaNo ratings yet