Professional Documents

Culture Documents

April YTD Budget

Uploaded by

jarrett_renshaw5850Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April YTD Budget

Uploaded by

jarrett_renshaw5850Copyright:

Available Formats

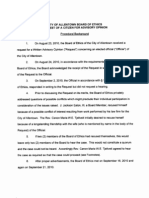

CITY OF ALLENTOWN

REVENUE SUMMARY - GENERAL FUND

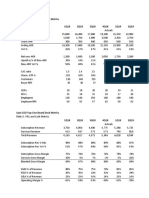

- 2009 - - 2008

April %

Adjusted April %

To Date of Budget Actual To Date of Actual

Budget

Revenues:

Taxes:

Real Estate Tax: 79%

28,850 22,571 78% 28,315 22,360

Current 16%

1,300 150 1 2% 1,100 176

Prior 63%

10 0 0% 8 5

Lehigh Co. Tax Claims

Act 511 Taxes: 31%

1,655 219 13% 1,238 386

Deed Transfer 27%

7,650 2,122 28% 7,236 1,958

Earned Income

5,263 81% 6,311 4,623 73%

Business Privilege 6,500

0 0% 120 5 4%

Occupational Privilege 0

0 0% 0 0 0%

EMST-2006 0

525 1 5% 2,093 502 24%

LST 3,400

20 80% 26 19 73%

Amusement/Devices 25

34 13% 243 20 8%

Per Capita-residence 265

30,904 62% 46,690 30,054 64%

Total Taxes 49,655

Permits & Licenses:

103 26% 450 131 29%

Business License 400

9 15% 57 0 0%

Liquor Licenses 60

188 30% 577 119 21%

Building Permits & Licenses 625

35 18% 161 58 36%

Plumbing Permits & Licenses 200

71 24% 304 96 32%

Electrical Permits & Licenses 300

3 30% 8 4 50%

Billboard & Sign Permit/Licenses 10

20 20% 73 27 37%

Zoning Permits & Fees 100

153 55 36% 149 50 34%

Health Bureau Permits & Licenses

60 26 43% 68 24 35%

Fire Dept Inspection Fees

48 19% 238 73 31%

Other Permits and Licenses 250

252 25% 866 247 29%

CATV Franchise Fees 1,000

318 39% 510 343 67%

Rental Unit Inspections 825

3,983 1,128 28% 3,461 1,172 34%

Total Permits/Licenses

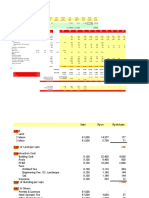

Charges for Services:

Department Earnings:

150 29 19% 101 37 37%

Tax Certifications

0 0% 59 1 2%

A.S.D. Tax Billing/Reimbursement 65

115 29 25% 107 38 36%

Printing & Copier Fees

5 8% 32 7 22%

Street Excavation/Rest. 60

15 3 20% 13 4 31%

Warrants of Survey

145 50 34% 159 62 39%

Towing Agreements

60 7 12% 29 18 62%

Health Bureau Reimbursement

3,125 610 20% 3,096 1,096 35%

EMS Transit Fees

200 49 25% 223 58 26%

Other Charges for Services

550 159 29% 479 146 30%

Police Extra Duty Jobs

4,485 941 21% 4,298 1,467 34%

Total departmental earnings

Municipal Recreation:

140 0 0% 1 47 0 0%

Swimming Pool

80 27 34% 70 18 26%

Recreation

220 27 12% 217 18 8%

Total municipal recreation

4,203 1,395 33% 3,993 1,332 33%

General Fund Service Charges

8,908 2,363 27% 8,508 2,817 33%

Total Charges for Services

CITY OF ALLENTOWN

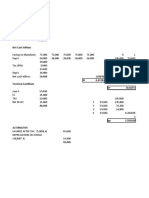

REVENUE SUMMARY - GENERAL FUND

2009 2008

Adjusted April % April %

Budget To Date of Budget Actual To Date of Actual

Revenues (continued)

Fines and Forfeits:

District Court 350 106 30% 326 111 34%

Fines and Restitution 185 32 17% 180 34 19%

Parking Authority Reimbursement 50 0 0% 87 0 0%

Total Fines and Forfeits 585 138 24% 593 145 24%

Intergovernmental Revenue:

State Health Grants - Acts 315 & 12 800 0 0% 809 0 0%

State grant - Health Categorical 1,064 609 57% 1,321 585 44%

State grant - Fire & Police Training 500 107 21% 432 98 23%

Police Grants - Reimbursements 1,764 1 79 10% 1,283 190 15%

Forfeitures 440 0 0% 0 0 0%

Other Grants - Miscellaneous 2,474 259 10% 1,359 375 28%

State Aid for Pension 3,825 0 0% 3,678 0 0%

Total Intergovernmental Revenue 10,867 1,154 11% 8,882 1,248 14%

Investment Income 675 3 0% 631 200 32%

Other Income:

Pennsylvania Utility Realty Tax 65 0 0% 69 0 0%

Allentown Housing Authority PILOT 25 0 0% 78 0 0%

Parking Garage Rents 0 2 0% 3 10 333%

Rental of City Property 100 45 45% 84 19 23%

Contributions 177 3 2% 124 6 5%

Marketing/Advertising 0 0 0% 0 0 0%

Sale-leaseback 0 0 0% 0 0 0%

Miscellaneous 1,100 144 13% 583 102 17%

Damage to City Property 60 9 15% 25 13 52%

Lights in the Parkway 150 32 21% 113 23 20%

Recreation/Special Events 10 2 20% 5 1 20%

Debt restructure recapture 0 0 0% 2 0 0%

Casino Fee 850 0 0% 0 0 0%

Total Other Income 2,537 237 9% 1,086 174 16%

Other Financing Sources:

Operating transfers in: I I

CDBG Reimbursements 695 137 20% 444 165 37%

Sewage Capacity Sales 1,250 1,148 92% 1,098 0 0%

Homeland Security for Water/Sewer 200 0 0% 200 200 100%

Total Other Financing Sources 2,145 1,285 60% 1,742 365 21%

Total Revenue 79,355 37,212 47% 71,593 36,175 51%

I Total Revenue (ex: one times) 79,355 37,212 47% 71,591 36,175 51%

You might also like

- Update Business Performances - 030821Document3 pagesUpdate Business Performances - 030821Zainal AlfinzaNo ratings yet

- Solutions Manual For McGraw Hills Taxation of Business Entities 2019 Edition 10th Edition by Brian C. SpilkerDocument55 pagesSolutions Manual For McGraw Hills Taxation of Business Entities 2019 Edition 10th Edition by Brian C. SpilkerTestbanks Here0% (3)

- DSDDocument5 pagesDSDFrancisco Javier Paz RiosNo ratings yet

- Kellblog SaaS Dashboards, One Slide and Two SlideDocument12 pagesKellblog SaaS Dashboards, One Slide and Two SlideramblingmanNo ratings yet

- MeralcoDocument2 pagesMeralcoTheo Amadeus100% (4)

- Meralco BillDocument2 pagesMeralco BillsdfNo ratings yet

- Statement For Account 0005509885Document2 pagesStatement For Account 0005509885Siyabonga MjwaraNo ratings yet

- Egypt Construction Cost 8-2023Document3 pagesEgypt Construction Cost 8-2023Ahmed Saber Nassar100% (1)

- Account Summary For Account Number 155532235-2: Electric BillDocument4 pagesAccount Summary For Account Number 155532235-2: Electric Billrandy caysip0% (1)

- CIR V BurmeisterDocument3 pagesCIR V BurmeisterGenevieve Kristine ManalacNo ratings yet

- Cir V Ayala Cir v. WanderDocument4 pagesCir V Ayala Cir v. WanderPhilip Frantz Guerrero100% (1)

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLNo ratings yet

- Meralco Bill 325458600101 07272020 - 3 (3591)Document2 pagesMeralco Bill 325458600101 07272020 - 3 (3591)Ave de GuzmanNo ratings yet

- Contact Meralco for inquiries or account updatesDocument2 pagesContact Meralco for inquiries or account updatesAnonymous QqyLDoW1No ratings yet

- Account Summary For Account Number 194417376-7: Electric BillDocument2 pagesAccount Summary For Account Number 194417376-7: Electric BillBrian SantosNo ratings yet

- Manufacturers V MeerDocument3 pagesManufacturers V MeerAnsis Villalon PornillosNo ratings yet

- Meralco Bill 427881610101 12102019Document2 pagesMeralco Bill 427881610101 12102019Mary Louise100% (1)

- PDF Soa 2339110623533Document2 pagesPDF Soa 2339110623533SimplifyIT CorporationNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Appendix A BudgetDocument1 pageAppendix A BudgetJack ChappelNo ratings yet

- Forecast-Administration Expenses (Usd) : Total 2021 12 Months % Increase USD IncreaseDocument1 pageForecast-Administration Expenses (Usd) : Total 2021 12 Months % Increase USD IncreaseBảo AnNo ratings yet

- NH Corporate Presentation 9m 2017Document42 pagesNH Corporate Presentation 9m 2017Nicu ClaudiuNo ratings yet

- Budget Final Draft December 5, 2022 CleanDocument45 pagesBudget Final Draft December 5, 2022 CleanJay BradleyNo ratings yet

- Bharat Hotels Year 0 1 2Document7 pagesBharat Hotels Year 0 1 2YagyaaGoyalNo ratings yet

- Investment Analysis - Saraiva 636 4Document1 pageInvestment Analysis - Saraiva 636 4urban.rise.worksNo ratings yet

- Advanced Auditing Past Papers Analysis - 13 Years of ICAP Topics at a GlanceDocument1 pageAdvanced Auditing Past Papers Analysis - 13 Years of ICAP Topics at a GlanceAhmed NisarNo ratings yet

- Annual Computation of Taxable Salary FY 2021-22Document1 pageAnnual Computation of Taxable Salary FY 2021-22Irfan RazaNo ratings yet

- BS & PL PT XXXDocument3 pagesBS & PL PT XXXchenchen celiaNo ratings yet

- Case 1: Less: Reinvestment at 20%Document4 pagesCase 1: Less: Reinvestment at 20%Vinay JajuNo ratings yet

- India Snapshot Q1 2022, SavillsDocument7 pagesIndia Snapshot Q1 2022, SavillssidhardhapallaviNo ratings yet

- FM AssignmentDocument10 pagesFM AssignmentKaleab TadesseNo ratings yet

- DUBAIDocument2 pagesDUBAIDavid LaliberteNo ratings yet

- Program Summary Report 2018 10/8/2018Document6 pagesProgram Summary Report 2018 10/8/2018Jeff NixonNo ratings yet

- Copia de Caso Healthy Bear 2022Document4 pagesCopia de Caso Healthy Bear 2022rataNo ratings yet

- Qwick Live Video Polices - May 23Document6 pagesQwick Live Video Polices - May 23ddhdbNo ratings yet

- Bata India LTDDocument18 pagesBata India LTDAshish DupareNo ratings yet

- CapBud Problem SolvingDocument2 pagesCapBud Problem SolvingMerliza JusayanNo ratings yet

- Corporate Finance Learning 3-3 Statements ModelDocument37 pagesCorporate Finance Learning 3-3 Statements Modelmichael odiemboNo ratings yet

- Firm ValueDocument2 pagesFirm ValueANo ratings yet

- Power Outage NumbersDocument1 pagePower Outage Numberstmiller6967No ratings yet

- Albemarle Corp SummaryDocument3 pagesAlbemarle Corp SummaryArthur FerreiraNo ratings yet

- Survey of Designs (FSAE Electric 2023)Document15 pagesSurvey of Designs (FSAE Electric 2023)DIECA STNo ratings yet

- Estimate Belimo (6 To 8 Bishops Gate) JW02Document17 pagesEstimate Belimo (6 To 8 Bishops Gate) JW02jwoods0248No ratings yet

- Meralco Contact Details and Bill Payment OptionsDocument2 pagesMeralco Contact Details and Bill Payment OptionsDenice MapayeNo ratings yet

- Cash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. MDocument26 pagesCash Flow Projection of MCV: SQM SQM RP.M/SQM RP.M/SQM SQM SQM RP.M US$. Tho Rp. Mangg4interNo ratings yet

- Feasibility-Legacy Homes v8Document21 pagesFeasibility-Legacy Homes v8Arslan HafeezNo ratings yet

- Sales Online Report Week 42 2021Document2 pagesSales Online Report Week 42 2021Septiadi HendriantoNo ratings yet

- Peter 526Document4 pagesPeter 526Peter D.No ratings yet

- Godrej ConsumerDocument7 pagesGodrej ConsumermuralyyNo ratings yet

- Solar Quotation Format 05Document2 pagesSolar Quotation Format 05Walia AtifNo ratings yet

- MDF Effectiveness ClaimsDocument1,712 pagesMDF Effectiveness ClaimsSaeeChaudhariNo ratings yet

- Screener - in TempleteDocument11 pagesScreener - in TempleteSumantha SahaNo ratings yet

- Degasification CostingDocument1 pageDegasification CostingKrishNo ratings yet

- 4 November 2022Document1 page4 November 2022Ega DarmawanNo ratings yet

- Y-O-Y Sales Growth % 25% 14% 16% 11% 5% 6% 12% 14% 5% - 9%: Excel Sheet Made byDocument9 pagesY-O-Y Sales Growth % 25% 14% 16% 11% 5% 6% 12% 14% 5% - 9%: Excel Sheet Made byKshatrapati SinghNo ratings yet

- Asian Paints 1Document7 pagesAsian Paints 1akaish26No ratings yet

- ASP_EID Weekly Governance Meeting – W25_2021 PM ProgressDocument10 pagesASP_EID Weekly Governance Meeting – W25_2021 PM ProgressabahaangNo ratings yet

- Tasl - TBDocument9 pagesTasl - TBcmakuldeepNo ratings yet

- Villa Paraiso ProjectionsDocument22 pagesVilla Paraiso ProjectionsArslan HafeezNo ratings yet

- Meralco bill details and payment instructionsDocument2 pagesMeralco bill details and payment instructionsCarl Joseph OrtegaNo ratings yet

- Jan - Mars 20 Jan - Mai 20 Jan - Juin 20 Jan - Juil 20 Jan-Juil/LFR (%)Document6 pagesJan - Mars 20 Jan - Mai 20 Jan - Juin 20 Jan - Juil 20 Jan-Juil/LFR (%)DahBellahiNo ratings yet

- Load Sheet Format - 1Document27 pagesLoad Sheet Format - 1Vivek ThakurNo ratings yet

- PrelimsDocument1 pagePrelimscard ttht tthtNo ratings yet

- PDF Balance General El Restaurante Quotdel Pasoquot - CompressDocument2 pagesPDF Balance General El Restaurante Quotdel Pasoquot - CompressHassan Vasquez LuisNo ratings yet

- European Contract Electronics Assembly Industry - 1993-97: A Strategic Study of the European CEM IndustryFrom EverandEuropean Contract Electronics Assembly Industry - 1993-97: A Strategic Study of the European CEM IndustryNo ratings yet

- Rutgers Ticket Office: Event Income WorksheetDocument6 pagesRutgers Ticket Office: Event Income Worksheetjarrett_renshaw5850No ratings yet

- Rutgers Ticket Office: Event Income WorksheetDocument7 pagesRutgers Ticket Office: Event Income Worksheetjarrett_renshaw5850No ratings yet

- Rutgers - NCAAA Filing 2010Document26 pagesRutgers - NCAAA Filing 2010jarrett_renshaw5850No ratings yet

- 2004 NCAA ReportDocument27 pages2004 NCAA Reportjarrett_renshaw5850No ratings yet

- Ethics BD Opinion 10Document5 pagesEthics BD Opinion 10jarrett_renshaw5850No ratings yet

- Hamilton Street GrantsDocument74 pagesHamilton Street Grantsjarrett_renshaw5850No ratings yet

- Resolution Athletic ProgramDocument2 pagesResolution Athletic Programjarrett_renshaw5850No ratings yet

- Close Votes2Document2 pagesClose Votes2jarrett_renshaw5850No ratings yet

- Weed and SeedDocument2 pagesWeed and Seedjarrett_renshaw5850No ratings yet

- Conshohocken One-Way and Parking StudyDocument6 pagesConshohocken One-Way and Parking Studyjarrett_renshaw5850No ratings yet

- Close Votes2Document2 pagesClose Votes2jarrett_renshaw5850No ratings yet

- RFP 2008-45 Restaurant ConcessionaireDocument22 pagesRFP 2008-45 Restaurant Concessionairejarrett_renshaw5850No ratings yet

- Financial Disclosure ReportsDocument11 pagesFinancial Disclosure Reportsjarrett_renshaw5850No ratings yet

- Ethics CodeDocument40 pagesEthics Codejarrett_renshaw5850No ratings yet

- Michael D'Amore, President Allentown City CouncilDocument7 pagesMichael D'Amore, President Allentown City Counciljarrett_renshaw5850No ratings yet

- State Labor NumbersDocument16 pagesState Labor Numbersjarrett_renshaw5850No ratings yet

- TC Salon Grant ApplicationDocument14 pagesTC Salon Grant Applicationjarrett_renshaw5850100% (1)

- Zoning Hearing BoardDocument1 pageZoning Hearing Boardjarrett_renshaw5850No ratings yet

- DT Bullet by CA Saumil Manglani - CS Exec June 21 ExamsDocument325 pagesDT Bullet by CA Saumil Manglani - CS Exec June 21 ExamsRahul Jain100% (1)

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisNo ratings yet

- (Solved) Preferably Filipino Tutor - Course HeroDocument2 pages(Solved) Preferably Filipino Tutor - Course HeroANNEDANYLE ACABADONo ratings yet

- Taxation Powerpoint ShengDocument17 pagesTaxation Powerpoint ShengannabelNo ratings yet

- Financial Accounting Assignment: Withholding?Document2 pagesFinancial Accounting Assignment: Withholding?KhalidNo ratings yet

- G.R. Nos. L-28508-9Document4 pagesG.R. Nos. L-28508-9looadadodNo ratings yet

- Negotiable Commercial Paper: Not Guaranteed ProgrammeDocument21 pagesNegotiable Commercial Paper: Not Guaranteed ProgrammeDavid CartellaNo ratings yet

- GPF statement for customs employeeDocument4 pagesGPF statement for customs employeemarchkotNo ratings yet

- Capiii Advtax June13Document13 pagesCapiii Advtax June13Narendra KumarNo ratings yet

- Budget 2023-2024Document1 pageBudget 2023-2024Vanessa SchoenNo ratings yet

- Ias 36 Example Simple Impairment Test of CGU Based On Value in UseDocument7 pagesIas 36 Example Simple Impairment Test of CGU Based On Value in Usedevanand bhawNo ratings yet

- TVET Formative Assessment for Basic Accounts Work Level IIDocument2 pagesTVET Formative Assessment for Basic Accounts Work Level IIEdomNo ratings yet

- Manjaree Demo Class-Types of BudgetDocument10 pagesManjaree Demo Class-Types of Budgetanon_461513108No ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City Second DivisionDocument38 pagesRepublic of The Philippines Court of Tax Appeals Quezon City Second DivisionMaricon Bangalan-CanarejoNo ratings yet

- Deemed Ownership and Taxation of House Property IncomeDocument13 pagesDeemed Ownership and Taxation of House Property IncomeDipanshu chauhanNo ratings yet

- Domestic LPG price build-up explainedDocument2 pagesDomestic LPG price build-up explainedSanjai bhadouriaNo ratings yet

- Set Off & Carry Forward of LossesDocument4 pagesSet Off & Carry Forward of LossesdamspraveenNo ratings yet

- Quo-PS-GU-2223-015995 ANSAL HOUSING LIMITEDDocument1 pageQuo-PS-GU-2223-015995 ANSAL HOUSING LIMITEDPrasoon sysmindNo ratings yet

- FABM ReviewerDocument4 pagesFABM ReviewerKrizel AtienzaNo ratings yet

- Armscor Official ReceiptsDocument6 pagesArmscor Official Receipts16michaelaganaNo ratings yet

- HRM - Assignment One - V10Document8 pagesHRM - Assignment One - V10quratulainNo ratings yet

- Anti Profiteering in GST: The Institute of Cost Accountants of IndiaDocument28 pagesAnti Profiteering in GST: The Institute of Cost Accountants of Indiakalyan sundarNo ratings yet

- 2628984Document1 page2628984Fuzzy PandaNo ratings yet