Professional Documents

Culture Documents

Energy Security and Affordability

Uploaded by

honestscarryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Energy Security and Affordability

Uploaded by

honestscarryCopyright:

Available Formats

Energy Sector

Chapter 10

Energy Security and Affordability

Pakistan is facing an unprecedented energy crisis due to surging demand and supply gap. Its current energy needs are heavily dependent on oil and gas and the demand far exceeds its indigenous supplies. Pakistans primary energy supplies heavily depend upon the imported crude oil and petroleum products due to which the countrys oil import bill has exceeded US$ 14.5 billion, which is a huge burden on the economy. In order to curtail the oil import bill to a sustainable level and to cater for the energy needs of all sectors, the Government is pursuing policies of attracting private investment in the energy sector with greater reliance on indigenous resources. In order to reduce this burden, Government has recently introduced new Petroleum Policy, LPG Policy, LNG Policy, Tight Gas Policy etc. to attract investment and ensure energy security at affordable price. Fiscal regime of new petroleum policy provides level playing field to domestic and international companies to invest in oil and gas sector of the country. The present energy scenario suggests that an affordable and sustainable energy road map for the country is essential to capitalize on the use of indigenous resources in our energy mix. Development of indigenous energy resources such as coal, hydro and alternative/renewable sources is critical for our countrys economic growth. The share of hydro power was 30% of total generation in 2012-13 as compared to nearly 70% in the 1980s. Hydro power development suffered a slowdown due to lingering controversies about major hydro power projects despite a large potential of hydro power available in the country. According to estimates, Pakistan has a hydro potential of about 60,000 MWs, of which only 6556 MW has been tapped. Consequently, thermal power was relied upon, initially, as natural gas was abundant and cheaper than oil, it was the preferred fuel for generation. However, a shortage of gas has resulted in a greater use of expensive furnace oil and high speed diesel oil. As a result, the cost of electricity has also increased substantially. Power load shedding continued during the year, around 25% of the system demand, and has led to a substantial decline in potential economic growth. The average supply remained 12,400 MW against the demand of 17,400 MW and the shortfall during April 2012 being 5,000 MW primarily due to fuel supply constraints and low hydroelectric generation. High fuel cost for thermal power generation, high losses in transmission and distribution, inefficiencies of generation, below cost tariffs and nonpayment of electricity dues by the public and private consumers continued and have resulted in a huge circular debt. The public sector thermal plants are mostly very old and are not properly maintained. Some plants are being refurbished through assistance provided by USAID. The restructuring and reform of the power sector has been held up for over two decades and has resulted in increased cost of electricity provision/service to the consumer. 10.1 Energy Strategy The implementation of reform process under Framework for Growth Strategy for Energy Sector, which emphasizes on the measure for improved governance,

Annual Plan 2013-14 111

Energy Sector

rationalization of energy prices, enhanced energy generation and efficient use has remained the guiding principle. In order to initiate work on implementation of these measures, power sector reforms, mainly covering governance, pricing and legal areas which were envisaged for sustainable, affordable and reliable power supply, need to be put in place. 10.2 Power Sector 10.2.1 Review of 2012-13 The installed power generating capacity increased from 22,797 MW in June 2012 to 23368 MW expected by June 2013 through addition of 571 MW in PEPCO system. (Annexure-10.1, Annexure-10.2 and Annexure-10.3). During the year, the Planning Commission in collaboration with USAID commissioned a study on the causes and consequences of circular debt which suggests that the primary task of the government should be to remove the debt overhang and prevent its recurrence. According to the study, circular debt has risen from Rs.111.26 billion in 2006 to 872.41 billion in 2012. The report opines that not only does the current level of debt prevent sector entities from obtaining funding for improvement in the management system or for systematic operations; it also renders the sector less attractive for prospective investors who could support sector expansion for improved services .The study suggests that the government should take steps to remove the debt from the books of energy sector entities (DISCOs) and the CPPA and debt to the governments account and reallocate it within the consumers tariff or place a tax on consumers to recover the amount over a period of time. The study reiterates to eliminate the circular debt by timely payments to the IPPs; contain growing power theft and system losses. NEPRA initiated process for finalization of the Upfront Tariff for different technologies i.e. Solar, Baggase, Coal, Biomass, Wind etc. The upfront tariff for coal and wind has been determined. Public hearings, regarding determination of up-front tariff for Solar Power Projects and the next proposed up-front tariff for Wind Power Projects, were held on February 27, 2013. A large number of stakeholders including Government representatives, the Alternative Energy Development Board (AEDB), Independent Power Producers (IPPs) etc. participated in the hearings. Having considered the submissions of the stakeholders, comments of the power purchaser, interveners and commentators, the determination of tariff was in an advanced stage of processing and will be finalized shortly. 10.2.2 Program for 2013-14 The installed power generating capacity is planned to increase from 23,368 MW in June 2012 to 25,394 MW in June 2013 through addition of 2026 MW in PEPCO system (Annexure-10.1).

Annual Plan 2013-14

112

Energy Sector

10.3 Fuel Sector

10.3.1 Review of 2012-13 Oil and Gas During 2012-13, the expected local crude oil production was 74,000 barrels per day (BPD) against a target of 69,000 BPD. The domestic gas production is expected to be 4,200 MMCFD against the target of 4,791 MMCFD. A total of only 83 wells (30 exploratory and 53 appraisal/development wells) are expected to be drilled against the target of 100 wells. The following policy measures were taken to enhance Exploration and Production (E & P) activities: New Petroleum Policy 2012 has been promulgated wherein further incentives have been provided to attract local and multi-national companies for investment in oil /gas sector of Pakistan. In order to introduce Petroleum (Exploration & Production) Policy, 2012, Ministry of Petroleum and Natural Resources arranged Pakistan Exploration Promotion Conference (PEPC), 2012 in Houston (USA) & London (UK) to attract foreign investment in Exploration and Production sector. Recently bidding over fifty eight (58) blocks for exploration of oil & gas reservoirs have been conducted for award of exploration licences on competitive basis. Currently 126 exploration licences for exploration of oil & gas reservoirs are being operated by various exploration & production companies. In offshore ten (10) exploration licences have been awarded for exploration of oil & gas reservoirs. Tight Gas (Exploration & Production) Policy, 2011 offers 40-50 % premium over the respective zonal price of Petroleum Policy 2009. Moreover, an additional 10% premium would be given for those Tight Gas volumes that are brought into production within 2 years of announcement of this policy. Low BTU Gas Pricing Policy, 2012 was approved wherein additional incentives to the investors has been given to develop Low BTU fields as soon as possible. Efforts are being made on more exploration in deeper prospects and under explored geological frontiers to add new oil & gas reservoirs. Efforts are being made to enhance exploration activities in all the areas of Pakistan by improving law & order and providing conducive environment to local and foreign E&P companies. Basin study has already carried out to co-relate entire data of different basins which would help to identify new play types. Have-State-of-the-art data repository centre digitized data is available to existing and new companies to participate in exploration, which would help in expediting exploration of oil & gas reservoirs. Marginal/Stranded Gas Fields-Gas pricing criteria and Guidelines 2013 Policy was approved. Shale Gas Framework for first three pilot projects has been approved in principal by the Cabinet

Annual Plan 2013-14

113

Energy Sector

Natural Gas During the year 2012-13, 237,588 additional gas connections including 236,997 Domestic, 221 Commercial and 370 Industrial are expected to be provided across the country. The details may be seen at Annexure-10.4. Natural Gas Efficiency Project (NGEP) Sui Southern Gas Company Ltd. (SSGCL) has launched a five year Unaccounted for Gas (UFG) reduction plan at a cost of Rs 30 billion funded mainly by the World Bank and approved by ECNEC. Oil and Gas Regulatory Authority OGRA has allowed Rs. 3.58 billion in FY 2012-13 in the revenue requirement of SSGCL to initiate the project LPG Air-Mix Projects Four projects with GoP approval have been executed by SSGC mainly Gawadar, Noshki, Kot Ghulam Muhammad and Sorab. Gawdar project is operational after acquiring Marketing License from OGRA while other three projects have been granted Provisional License. Import of Gas Iran-Pakistan (IP) pipeline The estimated cost of laying the Pakistan segment of the 42 diameter pipeline is US$ 1.245 billion. The progress made during the year is summarized below: Bankable Feasibility Study (BFS) Front End Engineering Design (FEED) Detailed Route Survey (DRS) Social Environmental impact Assessment (SEIA) Initialization of Cooperation Agreement with Iran Cabinet approval to give effectiveness to the Cooperation Agreement Installation of concrete markers on Right of Way Land Acquisition ( 384 Km) Initialization of Engineering, Procurement and Construction (EPC) Contract along with the Financing Agreement September 2012 September 2012 September 2012 September 2012 December 2012 January 2013 February 2013 February 2013 February 2013

Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline About 3.2 BCFD gas will flow through the 1,680 km pipeline from Turkmenistan to Afghanistan (500 MMCFD), Pakistan (1,325 MMCFD) and India (1,325 MMCFD). The estimated cost of the 56 pipeline is about US$ 7.6 billion. The progress made during the year is summarized below: Turkmenistan-Pakistan bilateral Gas Sales and Purchase Agreement (GSPA)

Annual Plan 2013-14

23rd May 2012

114

Energy Sector

Mid & Downstream Oil Sector Oil Refinery An Oil Refinery of 120000 barrels/day of M/s Byco Oil Pakistan Limited (BOPL) situated at Hub, Balochistan, has been set up and is in the process of commissioning. The approximate investment of the project was US$ 337 million. Oil Storages / Oil Terminals A new oil storage (10200 M.Ton) jointly owned by M/s. Bakri Trading Company Pakistan Limited & M/s Overseas Oil Trading Company Pakistan (Pvt.) Limited has been completed at Machike. Liquified Natural Gas (LNG) In order to encourage LNG import to abridge widening gap between gas demand and supply, the government has further improved/liberalized its LNG import policy in the form of LNG Policy, 2011. The new policy has removed bottlenecks of the previous policy and encourages private parties to develop LNG projects and sell RLNG to their end consumers mutually negotiated price by using the gas network of gas utility companies .Efforts are afoot for import of LNG. The following strategy is being followed.

Two Long Term Integrated Projects SSGCL, will seek proposals for delivery of 400 MMCFD Re-gasified Liquified Natural Gas (RLNG) under two separate projects through open competitive bidding under PPRA Rules. The selected party will perform all activities i.e. securing LNG supply, marine transportation and establishment of LNG terminal and injection of RLNG into SSGCLs network. The bids will be evaluated based on the gas price at SSGC delivery point. The contract will be for 5 years with 5 years price review clause.

Fast Track LNG Import Project. M/s SSGCLs subsidiary company (M/s SSGCL LPG Company) will act as Special Purpose Vehicle (SPV) to secure LNG supply. To receive the LNG, the LNG terminal will be set up at the existing LPG Terminal site(s) to reduce commissioning time. Under a separate proposal for import of LNG from Qatar . SSGC shall negotiate with Qatar gas to finalize the terms and conditions of LNG sales and purchase agreement for import of 2.0 million tons of LNG on government to government basis. Moreover, setting up of the LNG terminals shall be decided by Board of Directors of SSGC. Coal Thar Coal is needed for the basic reason that the Pakistans energy sector development strategy aims to enhance energy supply sustainably for growth and expanded access - while reducing the dependence on imported oil. Thar development is a crucial part of the future energy portfolio of Pakistan. It will provide energy security

Annual Plan 2013-14 115

Energy Sector

by lessening the reliance on imported fuels, re-balance the energy portfolio where higher cost fuels are being used to generate power, and provide low-cost electricity to the nations poorest citizens and to fuel Pakistans economic development. The Government attaches great importance to Thar Coal development. Presently, three open cast coal mining & power generation commercial projects are at the take off stage. These include, Sindh Engro Coal Mining Company in Block-II, Sino Sindh Resources in Block-I & Oracle Coal Fields UK in Block-VI. All three-lease holders have completed their bankable feasibilities and are actively working to achieve financial close. In order to create, capable and conducive institutional infrastructure for Thar Coal Development the Thar Coal and Energy Board with Provincial and Federal composition is taking decisions, which can ensure fast track development of Thar coalfields and attract local and foreign investment. It has played a crucial role in recommending special fiscal package for coal mining and power projects, coal pricing and other concessions necessary for attracting the investors. In addition, a full-fledged Department in the name of Coal and Energy Development Department established to expedite the execution of coal development plans. The Government of Sindh has initiated a wide range of infrastructure projects in order to facilitate investors and to create an enabling environment for large-scale mining and power projects. Promotion of Public Private Partnership in Coal Development has been introduced by entering into a unique joint venture agreement, with one of the largest industrial groups of the country, viz Engro Group for Thar Coal Development. The Joint Venture Project has successfully completed its Bankable Feasibility Study in compliance with International Standards that has proved the project technically and economically viable. In the March 2013, the Government of Pakistan has approved Sovereign Guarantee of US$ 700 million for this project. The JV Project has invited EOI for Overburden Removal for development of coal mining in Thar in the leading newspapers on 11th April, 2013. In Block VI, Oracle Coalfield of UK has started pre-development work and are bringing foreign investment up to US$ 600 million for this project. Another company Sino-Sindh Resources has also completed Feasibility for Block-I and will start mine development activities by the end of this year.Efforts are being made to establish power plant based on this coal gas. The expected power generation from these, ready to execute, projects is around 2500 MW by 2015-16. The Government of Sindh has made consistent successes in attracting investors, both local and foreign towards Thar Coalfield and its related infrastructure projects because of its investment friendly and transparent policies.

Annual Plan 2013-14

116

Energy Sector

10.3.2 Program for 2013-14 Oil and Gas Physical Activities During 2013-14, it is planned that the crude oil production is expected to increase to 91,977 BPD whereas gas production to 5,127 MMCFD. It is also expected that Gas will be supplied to approximately 390,000 new consumers and about 350 new towns/villages will be connected to the gas network. The details may be seen at Annexure-10.4. Supervisory Control and Data Acquisition (SCADA) In order to reduce pipeline vulnerability due to degradation over a period of time, vandalism and terrorist attacks, SSGC embarked upon installing improved SCADA System. SSGC intends to completely revamp Telecom and SCADA System from Shikarpur to Quetta (Terminal) via Sibi at an estimated project cost of 3.91 million US$ during FY 2013-14. Import of Gas The planned activities regarding import of gas via pipelines are as follows: Iran-Pakistan (IP) pipeline Major activities planned are as follows: Appointment of Third Party Inspector Agency Procurement and supply of Equipment and Material under Employer scope Construction of Pipeline system and First gas flow June-July 2013 FY 2013-14 FY 2013-14 (December 2014)

Turkmenistan-Afghanistan-Pakistan-India (TAPI) Pipeline Major activities scheduled are as follows: Appointment of Transaction Advisor (TA) Update of Feasibility Study and Route survey by Transaction Advisor Formation of Pipeline Consortium Selection of Consortium Lead Finalization of TAPI-Operations Agreement Finalization of Transit Fee Agreement

10.4 Financial Allocations Financial allocations and utilization for the Energy Sector (PSDP) are summarized below in Table-10.1. An allocation of Rs186.2 billion including foreign aid component

Annual Plan 2013-14 117

Energy Sector

of Rs 46.29 billion was made for the power sector during 2012-13. This includesd ongoing public sector power projects for generation and distribution (self-financing and with government support). An allocation of Rs 0.8 billion was made for the fuel sector. An allocation of Rs 221.4 billion including foreign aid component of Rs 59.8 billion is made for the power sector during 2013-14 besides an allocation of Rs 1.66 billion for the fuel sector. Table 10.1: Financial Allocations Utilization Energy Sector (PSDP) 2012-13 and 2013-14 (Rs Million) Revised Expected Allocation Allocation Utilization 2013-14 Name of Agencies 2012-13 Power Sector Total (Foreign) 2012-13 Total (Foreign) Power Sector WAPDA (Hydel) PEPCO PNRA PAEC Kashmir & Gilgit Baltistan Total (Power) Fuel Sector PAEC MPNR Total (Fuel) Grand Total 833 ( 0 ) 5.0 (0) 838 (0) 187062 (46291) 353 3 356 147147 1629.0 (0) 30 (0) 1,659.0 (0) 223057.425 (59844.0) 74,609 (6546) 71,455 (11,895) 400 ( 0 ) 39167 (27450) 593 (400) 186224 (46291) 79,309 30,340 284 36265 593.2 146791 82921 (21755) 86244.425 (11951.0) 316 (0) 49512.186 (26138) 2405 (0) 221398.425 (59844.0)

Annual Plan 2013-14

118

Energy Sector

Annexure-10.1 Physical Targets: Power Sector Pakistan Items 2011-12 Actual Additional Installed Capacity (MW) Total Installed Capacity (MW) Growth Rate (%) Maximum Demand (MW) Growth Rate (%) Energy Generation (GWh) Growth Rate (%) Annual Energy Sales (GWh) Growth Rate (%) Transmission & Distribution Losses System Losses (%) Consumers Cumulative (Million) Consumers Added (Million) Electrification of Villages/ Abadies (Nos.) Addition (Nos.)

Source: Data received Planning, NTDC/KESC from GM,

2012-13* Estimates 420 23395 2.50% 22706 0.37% 132094 5.51% 106235 6.03% 19.58%

2013-14** Targets 2026 25421 8.66% 24204 6.60% 138294 4.69% 111856 5.29% 19.12%

560 22824 22622 125192 100192

23.42 0.79 175377 10319

24.21 0.83 185696 12295

25.04 0.83 197991 12375

*Expected Addition 2012-13 Jinnah Low Head Allai Khawar HPP Fauji Wind Power Zorlu Wind Power Gomal Zam Dam Duber Khwar HPP Satpara Dam New Bong Escape Total

Source: NTDC

in

MW 96 121 50 56 17 130 17 84 571

**Planned Addition in 2013-14 Nandipur Power Project Guddu New CC Rehabilitation of GENCOS Uch-II Three Gorges Wind Farm Pakistan Wind Energy Hydropower Dawood Power Foundation Wing energy I Ltd. Foundation Wing energy-II Ltd. Total

MW 425 747 245 404 50 5 50 50 50 2026

Annual Plan 2013-14

119

Energy Sector

Annexure-10.2 Physical Targets: Power Sector PEPCO System Items Additional Installed Capacity (MW) Total Installed Capacity (MW) Growth Rate (%) Maximum Demand (MW) Growth Rate (%) Energy Generation (GWh) Growth Rate (%) Annual Energy Sales (GWh) Growth Rate (%) Transmission & Distribution Losses System Losses (%) Consumers Cumulative (Million) Consumers Added (Million) Electrification of Villages/Abadies (Nos.) Addition (Nos.) 2011-12 Actual 0 20,443 20,058 117,163 89,916 2012-13 Estimates 420 21,014 2.79% 20,058 4.80% 123,513 5.49% 95,119 5.79% 23.00% 21.79 0.78 185,068 12,200 2013-14 Targets 2026 23,040 9.64% 21,490 4.75% 129,699 4.96% 100,364 5.51% 22.60% 22.57 0.78 197,268 12,300

22.00% 21.05 0.74 174,800 10,268

Annual Plan 2013-14

120

Energy Sector

Annexure-10.3 Physical Targets: Power Sector KESC System Items 2011-12 Actual Additional Installed Capacity (MW) Total Installed Capacity (MW) Growth Rate (%) Maximum Demand (MW) Growth Rate (%) Energy Generation (GWh) Growth Rate (%) Annual Energy Sales (GWh) Growth Rate (%) Transmission & Distribution Losses System Losses (%) Consumers Cumulative (Million) Consumers Added (Million) Electrification of Villages/Abadies (Nos.) Addition (Nos.) 29.70% 2.37 0.05 577 51 560 2,381 2,564 8,029 10,276 2012-13 Estimates 0 2,381 0.00% 2,648 3.00% 8,581 5.00% 11,116 8.00% 27.50% 2.42 0.05 628 95 2013-14 Targets 0 2,381 0.00% 2,714 2.00% 8,595 2.00% 11,492 2.00% 26.60% 2.47 0.05 723 75

Annual Plan 2013-14

121

Energy Sector

Annexure-10.4

Item Gas Consumers (Addition) Domestic(Addition) Commercial (Addition) Industrial(Addition) Supply of Gas to new Villages/towns (Addition) Transmission Pipelines (Addition) Distribution Pipelines (Addition) Services Pipelines (Addition)

Unit

Achievements 2011-12 379,474 377,473 1,784 217

Estimated Achievements 2012-13 365,862 365,060 721 81

Targets 2013-14 340,000 339,503 412 85

Nos Nos Nos Nos

Nos

692

362

600

Km

104

144

465

Km Km

5,906 1,574

6,591 1,564

5,196 1,550

Annual Plan 2013-14

122

You might also like

- Bangladesh Fuel Additional InformationDocument14 pagesBangladesh Fuel Additional InformationdpmgumtiNo ratings yet

- Philippine Cobp Phi 2014 2016 Ssa 02Document6 pagesPhilippine Cobp Phi 2014 2016 Ssa 02LuthfieSangKaptenNo ratings yet

- India Energy Conclave 2007: India Energy Inc. - Emerging Opportunities and Challenges December 2007Document42 pagesIndia Energy Conclave 2007: India Energy Inc. - Emerging Opportunities and Challenges December 2007sunny_mkarNo ratings yet

- Discussion Paper 01Document43 pagesDiscussion Paper 01Sari YaahNo ratings yet

- Policy Brief On "Development and Governance of The Energy Sector"Document53 pagesPolicy Brief On "Development and Governance of The Energy Sector"tajreen01No ratings yet

- Ministry of Energy Jamaica: Energy Conservation and Efficiency (ECE) Policy 2008-2022Document43 pagesMinistry of Energy Jamaica: Energy Conservation and Efficiency (ECE) Policy 2008-2022Detlef LoyNo ratings yet

- Chapter 1Document6 pagesChapter 1mohshin06009No ratings yet

- Coal and Power Related Issues SummaryDocument3 pagesCoal and Power Related Issues SummaryRahul MathurNo ratings yet

- Nigerias Energy Transition Oil An Gas UpdateDocument20 pagesNigerias Energy Transition Oil An Gas UpdateAmanu EkiyeNo ratings yet

- Energy: Performance Review 2014-15Document19 pagesEnergy: Performance Review 2014-15Muhammad SaqibNo ratings yet

- Pre Feasibility Study Mundargi Gas Based Power PlantDocument71 pagesPre Feasibility Study Mundargi Gas Based Power Plantrrs41100% (1)

- Domestic GasDocument2 pagesDomestic GasOdiri OginniNo ratings yet

- Republic of Mauritius Long-Term Energy Strategy 2009 - 2025Document56 pagesRepublic of Mauritius Long-Term Energy Strategy 2009 - 2025Mirnal MungraNo ratings yet

- Government of India Policy Towards Green Economy and Sustainable DevelopmentDocument4 pagesGovernment of India Policy Towards Green Economy and Sustainable DevelopmentNehal SharmaNo ratings yet

- DOE Acc ReportDocument24 pagesDOE Acc ReportElena LegaspiNo ratings yet

- Renewable Electricity Corporate Power Purchase Agreements RoadmapDocument19 pagesRenewable Electricity Corporate Power Purchase Agreements RoadmapHarshita DixitNo ratings yet

- India Will Miss Power Target of 62,000 MW: News, AnalysisDocument10 pagesIndia Will Miss Power Target of 62,000 MW: News, AnalysisdevavasanNo ratings yet

- CHP and District Cooling: An Assessment of Market and Policy Potential in IndiaDocument12 pagesCHP and District Cooling: An Assessment of Market and Policy Potential in IndiamgewaliNo ratings yet

- Cobp Phi 2013 2015 Ssa 02 PDFDocument6 pagesCobp Phi 2013 2015 Ssa 02 PDFMhay VelascoNo ratings yet

- Power and Energy Industry in IndiaDocument16 pagesPower and Energy Industry in IndiaSayan MaitiNo ratings yet

- 2024 Oil and Gas Industry Outlook - Deloitte InsightsDocument28 pages2024 Oil and Gas Industry Outlook - Deloitte InsightsCarlos Alberto Chavez Aznaran IINo ratings yet

- Policy Measures - Industry Sector 5.1. Critique A. Energy Efficiency and Conservation in The Textile and Steel Sector IndustriesDocument14 pagesPolicy Measures - Industry Sector 5.1. Critique A. Energy Efficiency and Conservation in The Textile and Steel Sector IndustriesSathea NuthNo ratings yet

- Demand Projection and Generation Planning: Reasons For SlippageDocument6 pagesDemand Projection and Generation Planning: Reasons For SlippageAnil SarangNo ratings yet

- Guyana Power Sector Policy and Implementation Strategy 2010Document19 pagesGuyana Power Sector Policy and Implementation Strategy 2010Taísa FelixNo ratings yet

- Green Hydrogen in IndiaDocument8 pagesGreen Hydrogen in IndiaManoj KumarNo ratings yet

- Case Study PhilippinesDocument4 pagesCase Study PhilippinesNelbert SumalpongNo ratings yet

- PTI Energy PolicyDocument52 pagesPTI Energy PolicyPTI Official100% (9)

- Check For Answers. Hope You Will Find ItDocument11 pagesCheck For Answers. Hope You Will Find ItMohammad Nazmul IslamNo ratings yet

- Coal output key to India's energy securityDocument5 pagesCoal output key to India's energy securitylaloo01No ratings yet

- Bangladesh Energy Efficiency ContextDocument7 pagesBangladesh Energy Efficiency ContextASHUTOSH RANJANNo ratings yet

- Yojana Article-Energy SecurityDocument4 pagesYojana Article-Energy SecurityHimanshu GuptaNo ratings yet

- Indian Express 14 September 2012 4Document1 pageIndian Express 14 September 2012 4Shahabaj DangeNo ratings yet

- Energy, Infrastructure and Communications: Verview OF ErformanceDocument23 pagesEnergy, Infrastructure and Communications: Verview OF ErformanceAlviro CossemeNo ratings yet

- Renovation, Modernization and Life Extension of Power PlantsDocument24 pagesRenovation, Modernization and Life Extension of Power PlantskrcdewanewNo ratings yet

- Report On Power System Master Plan (PSMP) 2016: Submitted To: Mahmud or Rashid Lecturer Dept. of MEEDocument7 pagesReport On Power System Master Plan (PSMP) 2016: Submitted To: Mahmud or Rashid Lecturer Dept. of MEEফারহান আহমেদ আবীরNo ratings yet

- Indian Power Sector Analysis PDFDocument9 pagesIndian Power Sector Analysis PDFvinay_814585077No ratings yet

- Press Release - Indian Gas Transmission Business: Sun Is Shining, The Weather Is SweetDocument10 pagesPress Release - Indian Gas Transmission Business: Sun Is Shining, The Weather Is Sweetanzin_87No ratings yet

- Pakistan's Energy Crisis Worsens in FY1276543210FY07FY08FY09FY10FY11FY12Gas3.23.53.74.25.15.5Furnace Oil7.58.28.58.79.19.7Source: NEPRA; Analyst estimatesDocument9 pagesPakistan's Energy Crisis Worsens in FY1276543210FY07FY08FY09FY10FY11FY12Gas3.23.53.74.25.15.5Furnace Oil7.58.28.58.79.19.7Source: NEPRA; Analyst estimatesQamar KazmiNo ratings yet

- AR 2013 14 Infra-ReviewDocument12 pagesAR 2013 14 Infra-ReviewHarshal PhuseNo ratings yet

- Chapter 11 EnergyDocument45 pagesChapter 11 EnergyTanuShuklaNewDelhiNo ratings yet

- Powering India: The Road To 2017Document13 pagesPowering India: The Road To 2017Rajnish SinghNo ratings yet

- Towards Energy Sustainability Bangladesh PerspectivesDocument17 pagesTowards Energy Sustainability Bangladesh PerspectivesElisa PrandoNo ratings yet

- Eng Nkea Oil Gas EnergyDocument16 pagesEng Nkea Oil Gas EnergytanboemNo ratings yet

- Mnre PDFDocument171 pagesMnre PDFPadhu PadmaNo ratings yet

- MNRE Annual Report 2019-20Document192 pagesMNRE Annual Report 2019-204u.nandaNo ratings yet

- Report of Working Group On Power: 12th Five Year Plan (2012 - 17) IndiaDocument466 pagesReport of Working Group On Power: 12th Five Year Plan (2012 - 17) IndiaRaghvendra UpadhyaNo ratings yet

- WG PowerDocument427 pagesWG PowerDebanjan DasNo ratings yet

- India's Power Sector Growth and Future PlansDocument6 pagesIndia's Power Sector Growth and Future PlansDivya ParvathaneniNo ratings yet

- White PaperDocument13 pagesWhite Paperasaditya109No ratings yet

- Promotion of Hydro SectorDocument2 pagesPromotion of Hydro SectornamitaNo ratings yet

- UK hydrogen economy planDocument45 pagesUK hydrogen economy plantopspeed1No ratings yet

- Energy: Vision of The Government: A Broader PictureDocument10 pagesEnergy: Vision of The Government: A Broader PicturekingNo ratings yet

- Engro CleanDocument3 pagesEngro CleanKamran KhanNo ratings yet

- Renewable Energy Tariffs and Incentives in Indonesia: Review and RecommendationsFrom EverandRenewable Energy Tariffs and Incentives in Indonesia: Review and RecommendationsNo ratings yet

- Carbon Pricing for Energy Transition and DecarbonizationFrom EverandCarbon Pricing for Energy Transition and DecarbonizationNo ratings yet

- A Brighter Future for Maldives Powered by Renewables: Road Map for the Energy Sector 2020–2030From EverandA Brighter Future for Maldives Powered by Renewables: Road Map for the Energy Sector 2020–2030No ratings yet

- CAREC Energy Strategy 2030: Common Borders. Common Solutions. Common Energy Future.From EverandCAREC Energy Strategy 2030: Common Borders. Common Solutions. Common Energy Future.No ratings yet

- EU China Energy Magazine 2023 April Issue: 2023, #3From EverandEU China Energy Magazine 2023 April Issue: 2023, #3No ratings yet

- COVID-19 and Energy Sector Development in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Energy Sector Development in Asia and the Pacific: Guidance NoteNo ratings yet

- Strategy 2030 Energy Sector Directional Guide: Inclusive, Just, and Affordable Low-Carbon Transition in Asia and the PacificFrom EverandStrategy 2030 Energy Sector Directional Guide: Inclusive, Just, and Affordable Low-Carbon Transition in Asia and the PacificNo ratings yet

- Report On Old Spice Bold SprayDocument29 pagesReport On Old Spice Bold SprayhonestscarryNo ratings yet

- Old Spice Consumer QuestionniareDocument2 pagesOld Spice Consumer QuestionniarehonestscarryNo ratings yet

- Online Grocery Shopping Marketing Research PresentationDocument20 pagesOnline Grocery Shopping Marketing Research Presentationhonestscarry100% (1)

- PPIS - PPLDocument15 pagesPPIS - PPLhonestscarry100% (1)

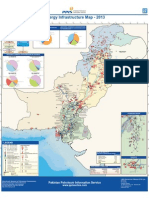

- PPIS - Energy Map 2013 A4Document1 pagePPIS - Energy Map 2013 A4honestscarryNo ratings yet

- Who Is Working Where in IraqDocument1 pageWho Is Working Where in IraqhonestscarryNo ratings yet

- Damodaran AswathDocument53 pagesDamodaran AswathhonestscarryNo ratings yet

- RC 2013 Winning Presentation Wroclaw UnivDocument31 pagesRC 2013 Winning Presentation Wroclaw UnivhonestscarryNo ratings yet

- Habiba Ahsan Muhammad Ali Muhammad Maqbool Sidra Shahid Saleha Afzal Butt Sameer Abdal Malik Zain NoorDocument23 pagesHabiba Ahsan Muhammad Ali Muhammad Maqbool Sidra Shahid Saleha Afzal Butt Sameer Abdal Malik Zain NoorhonestscarryNo ratings yet

- Research Challenge Official Rules-2013-14Document16 pagesResearch Challenge Official Rules-2013-14honestscarryNo ratings yet

- RC 2013 Winning Presentation Wroclaw UnivDocument31 pagesRC 2013 Winning Presentation Wroclaw UnivhonestscarryNo ratings yet

- Distribution Channel of OlpersDocument30 pagesDistribution Channel of Olpershonestscarry100% (2)

- GreyFox Intercom Install GuideDocument12 pagesGreyFox Intercom Install GuideAbdallah HashemNo ratings yet

- Hydraulic Power Steering System Design PDFDocument16 pagesHydraulic Power Steering System Design PDFAdrianBirsan100% (1)

- Manual of Curatorship: A Guide To Museum PracticeDocument7 pagesManual of Curatorship: A Guide To Museum PracticeLuísa MenezesNo ratings yet

- Proceedings of National Conference on Landslides held in LudhianaDocument8 pagesProceedings of National Conference on Landslides held in LudhianaAniket PawarNo ratings yet

- 1 s2.0 S2210803316300781 MainDocument8 pages1 s2.0 S2210803316300781 MainGilang Aji P. EmonNo ratings yet

- Australian 9 Grade Physics Lesson 1Document32 pagesAustralian 9 Grade Physics Lesson 1binoyrajcrNo ratings yet

- 322439480MVR Single Page Single Page Booklet - OPTDocument12 pages322439480MVR Single Page Single Page Booklet - OPTlarry vargas bautistaNo ratings yet

- Vertical Jaw Relation Recording MethodsDocument17 pagesVertical Jaw Relation Recording MethodsHarish VsNo ratings yet

- Parts of Speech 15Document16 pagesParts of Speech 15lost finNo ratings yet

- Kaustubh Laturkar Fuel Cell ReportDocument3 pagesKaustubh Laturkar Fuel Cell Reportkos19188No ratings yet

- Cardiopulmonary System: Relevant Anatomy & Physiology: HeartDocument12 pagesCardiopulmonary System: Relevant Anatomy & Physiology: HeartJulia SalvioNo ratings yet

- Capacity and Safety Analysis of Hard Shoulder Running HSR A Motorway Case Study 2016 Transportation Research Part A Policy and PracticeDocument22 pagesCapacity and Safety Analysis of Hard Shoulder Running HSR A Motorway Case Study 2016 Transportation Research Part A Policy and PracticeZen ZeeNo ratings yet

- Paradise Pools Flyer With Price ListDocument5 pagesParadise Pools Flyer With Price ListKhuzaima HussainNo ratings yet

- 20 N 60 C 3Document13 pages20 N 60 C 3rashidmirzaNo ratings yet

- Ex Ophtalmo Eng 1Document4 pagesEx Ophtalmo Eng 1Roxana PascalNo ratings yet

- MATERIAL SAFETY DATA SHEET FOR PREVENTOL-D6 PRESERVATIVEDocument3 pagesMATERIAL SAFETY DATA SHEET FOR PREVENTOL-D6 PRESERVATIVEAkshay PushpanNo ratings yet

- Classified Advertisements from Gulf Times NewspaperDocument6 pagesClassified Advertisements from Gulf Times NewspaperAli Naveed FarookiNo ratings yet

- Large and Medium Manufacturing Industry Survey Report 2018Document778 pagesLarge and Medium Manufacturing Industry Survey Report 2018melakuNo ratings yet

- Man FXM FKM Motors PDFDocument176 pagesMan FXM FKM Motors PDFRenato MeloNo ratings yet

- 03.can-Bus and Sae-Bus j1939 - CatDocument29 pages03.can-Bus and Sae-Bus j1939 - CatEdison Pfoccori BarrionuevoNo ratings yet

- The Blue Hotel PDFDocument22 pagesThe Blue Hotel PDFGabriel OvidorNo ratings yet

- AAA Variable Spring Hangers CatalogDocument31 pagesAAA Variable Spring Hangers CatalogNopparut0% (1)

- Features General Description: 3A 24V 340Khz Synchronous Buck ConverterDocument18 pagesFeatures General Description: 3A 24V 340Khz Synchronous Buck ConverterAntonioNobregaNo ratings yet

- 3 Edition February 2013: Ec2 Guide For Reinforced Concrete Design For Test and Final ExaminationDocument41 pages3 Edition February 2013: Ec2 Guide For Reinforced Concrete Design For Test and Final ExaminationDark StingyNo ratings yet

- Design of Steel BeamsDocument4 pagesDesign of Steel BeamsSankalp LamaNo ratings yet

- Vapour Bar Exchange IMFL PackageDocument4 pagesVapour Bar Exchange IMFL PackageNishank AgarwalNo ratings yet

- 3.1 The Truth About Air TravelDocument14 pages3.1 The Truth About Air TravelСвітлана Свирид0% (1)

- Ebook Scientific InstrumentsDocument9 pagesEbook Scientific InstrumentsPavans LuckyNo ratings yet

- MSC Syllabus AllDocument13 pagesMSC Syllabus AllOmSilence2651No ratings yet

- Engineering Mechanics Lectures PDFDocument83 pagesEngineering Mechanics Lectures PDFluay adnanNo ratings yet