Professional Documents

Culture Documents

Gar-7 Accounting Code of Excise Duties

Uploaded by

shiv_bhargava9368Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gar-7 Accounting Code of Excise Duties

Uploaded by

shiv_bhargava9368Copyright:

Available Formats

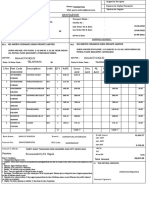

Instructions for filling up G.A.

R-7 Challan Form

1. Name, Address, 15 digit Assessee Code, Commissionerate Name and 8 digit Accounting code is mandatory.

2. The Assessee Code, Commissionerate Code, Division Code and Range Code can be verified from the website http://exciseandservicetax.nic.in

3. The Accounting codes for Duty/Cess are provided in the table below. The total amount tendered should tally with the sum total of amounts for

each accounting code.

4. The total amount tendered should be written both in words and figures.

5. The details filled in the challan and ‘Taxpayer’s Counterfoil’ should be identical.

6. The Receiving Bank Branch Stamp should contain the following:

i) BSR code of the receiving Bank Branch (7 digits)

ii) Date of Deposit of Challan (DDMMYYYY) (8 digits)

iii) Challan Serial Number (5 digits)

The above information is collectively called the Challan Identification Number (20 digit CIN), which will have to be quoted in the return.

Shareable Duties

1 Basic Excise Duties 00380003 5 Special Excise Duties 00380013

2 Patent & Proprietary Medicines 00380007 6 Duties on Motor Vehicle Parts 00380016

3 Auxiliary Duties of Excise 00380010 7 Other Receipts 00380087

4 Addl. Duties On Mineral Products 00380012

Duties Assigned to States

1 Addl. Duties in lieu of Sales Tax 00380018 18 Cess on Woollen Fabrics 00380048

2 Duty on Generation of Power 00380020 19 Cess on Cotton Fabrics 00380050

3 Auxiliary Duties 00380023 20 Cess on Bidi 00380056

4 Special Excise Duties 00380025 21 Welfare Cess on Bidis 00380057

5 Addl. Duties on Textile 00380027 22 Cess on Tobacco 00380059

6 Addl. Duties on TV Sets 00380028 23 Cess on Rubber 00380061

7 Addl. Duties on Motor Spirit 00380101 24 Cess on Crude Oil 00380062

8 Addl. Duty on High Speed Diesel 00380102 25 Cess on Coffee 00380064

9 National Calamity Contingent Duty 00380106 26 Cess on Sugar 00380065

10 Special Addl. Duty on Motor Spirit 00380107 27 Cess on Manmade Fabrics 00380070

11 Other Duties 00380031 28 Cess on Paper 00380072

12 Cess on Jute 00380037 29 Cess on Straw Board 00380074

13 Cess on Tea 00380039 30 Cess on Vegetable Oil 00380076

14 Cess on Copra 00380041 31 Cess on Automobiles 00380078

15 Cess on Oil 00380042 32 Cess on Matches 00380082

16 Cess on Cotton 00380044 33 Cess on other Commodities 00380084

17 Cess on Rayon & Artsilk Fabrics 00380046 34 Education Cess 00380111

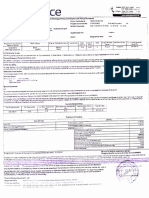

Instructions for Receiving Branches

Receiving Branch should ensure the following:

i) The seal of the receiving branch should contain the CIN information and along with name of the bank branch, date of realization, amount received

in Rs. and signature of the authorised signatory. The seal should be affixed in the space provided on the challan and the Taxpayer’s Counterfoil.

ii) Challans should be arranged according to the serial number of the entry of the item in the scroll under each scroll. Each day’s scrolls should be

given a running serial number separately for each Major Head, prefixed by the numeral denoting the Major Head of Account namely, 0038 for the

financial year from 1st April to 31st March to facilitate detection of any omission in submitting the daily scrolls. (Refer RBI’s Revised Memorandum

of Instruction for Receiving Banks).

Instructions for Focal Point Branch

Focal Point Branch (FPB) should ensure the following:

i) Amount of remittance received by it through the inter-branch account tallies with the challans and the scrolls.

ii) All challans have been attached with the scroll and amounts in the scrolls tally with the physical challan and electronic data.

You might also like

- Account Codes in Central Excise (Major Head 0038) : SR - No. Description Code Shareable DutiesDocument1 pageAccount Codes in Central Excise (Major Head 0038) : SR - No. Description Code Shareable DutiesSuresh NainNo ratings yet

- B2B_012024_3_GSTR2B_04042024Document7 pagesB2B_012024_3_GSTR2B_04042024ayyanar7No ratings yet

- SBI-MultiCap-Fund 2Document9 pagesSBI-MultiCap-Fund 2garvitaneja477No ratings yet

- AllafsDocument17 pagesAllafsKim Jong YungNo ratings yet

- MITHRA AGENCIES QUOTATION FOR CLUTCH PARTSDocument1 pageMITHRA AGENCIES QUOTATION FOR CLUTCH PARTSV.Sampath RaoNo ratings yet

- Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPrivate Car Package Policy: Certificate of Insurance Cum Policy ScheduleNathan ChenNo ratings yet

- Adjusting Entries Practice Question December 22, 2022Document5 pagesAdjusting Entries Practice Question December 22, 2022Mohammed AhamadNo ratings yet

- Reshan HD Medical 06.01.2021Document47 pagesReshan HD Medical 06.01.2021Rashan Jida ReshanNo ratings yet

- BFC 3225 Intermediate Accounting I 2 - 2Document6 pagesBFC 3225 Intermediate Accounting I 2 - 2karashinokov siwoNo ratings yet

- Sample QuestionsDocument3 pagesSample QuestionstulikaNo ratings yet

- Budget Final Draft December 5, 2022 CleanDocument45 pagesBudget Final Draft December 5, 2022 CleanJay BradleyNo ratings yet

- Mdarasa PFT CAT 1 - SEM 1 2024Document4 pagesMdarasa PFT CAT 1 - SEM 1 2024Sam OwinoNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- Kenya Methodist University Tax Exam QuestionsDocument6 pagesKenya Methodist University Tax Exam QuestionsJoe 254No ratings yet

- Two Wheeler Standalone OD Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesTwo Wheeler Standalone OD Only: Certificate of Insurance Cum Policy Scheduleprasanth adabalaNo ratings yet

- Reshan HD Medical 07.01.2021Document52 pagesReshan HD Medical 07.01.2021Rashan Jida ReshanNo ratings yet

- JB1000966 Budget Quotation Vr. Ag 10 2023Document58 pagesJB1000966 Budget Quotation Vr. Ag 10 2023Julio BarreraNo ratings yet

- CORRUGATED BOX GUIDEDocument8 pagesCORRUGATED BOX GUIDEabhi050191No ratings yet

- Reliance Miscellaneous InsuranceDocument1 pageReliance Miscellaneous Insurancefurquan10010No ratings yet

- ICAN ADVANCE TAXATIONDocument11 pagesICAN ADVANCE TAXATIONAdebayo Yusuff AdesholaNo ratings yet

- HDFC FW Comprehensive MH70UVIVIGJ 1705417806189Document2 pagesHDFC FW Comprehensive MH70UVIVIGJ 1705417806189f2994667No ratings yet

- Practical 2Document12 pagesPractical 2Rohit ReddyNo ratings yet

- Sales-5Document1 pageSales-5skgts787737No ratings yet

- Private Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPrivate Car Comprehensive Policy: Certificate of Insurance Cum Policy ScheduleNathan ChenNo ratings yet

- Appendix - Business Model: Patrick's Cod Fishing LTDDocument4 pagesAppendix - Business Model: Patrick's Cod Fishing LTDsamra azadNo ratings yet

- B2B_022024_1_GSTR2B_04042024Document7 pagesB2B_022024_1_GSTR2B_04042024ayyanar7No ratings yet

- Standalone Motor Own Damage Cover - Private Car: Certificate of Insurance Cum Policy ScheduleDocument4 pagesStandalone Motor Own Damage Cover - Private Car: Certificate of Insurance Cum Policy ScheduleRajiv FalodiyaNo ratings yet

- 2223TBS0002253Document1 page2223TBS0002253Huskee CokNo ratings yet

- Venue Royal QuoteDocument1 pageVenue Royal QuoterathsanjehoNo ratings yet

- Tax Final Part 5Document37 pagesTax Final Part 5Angelica Jane AradoNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)aswin manojNo ratings yet

- Tn22dx4191 Royal QuoteDocument1 pageTn22dx4191 Royal QuoteKavitha VijayaraghavanNo ratings yet

- Sbi Blue Chip Fund June 2023Document9 pagesSbi Blue Chip Fund June 2023varipe1667No ratings yet

- Worksheet AmmDocument4 pagesWorksheet AmmRobert OchienoNo ratings yet

- CIN: U66000MH2014PLC260291, Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra East, Mumbai 400051. Maharashtra, IndiaDocument5 pagesCIN: U66000MH2014PLC260291, Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra East, Mumbai 400051. Maharashtra, Indiagsgangadaran59No ratings yet

- Protect your Royal Enfield with Digit Motor InsuranceDocument4 pagesProtect your Royal Enfield with Digit Motor InsuranceDEV PALIWALNo ratings yet

- Trading & Profit & Loss Sheet 3Document2 pagesTrading & Profit & Loss Sheet 3Anshul JainNo ratings yet

- Cash FlowDocument71 pagesCash Flowpuput utomoNo ratings yet

- Brief Note On Car Hiring of CarDocument2 pagesBrief Note On Car Hiring of CarDilip AgrawalNo ratings yet

- 01apr23 To 30apr23Document14 pages01apr23 To 30apr23aqeela aleshaNo ratings yet

- Comprehensive insurance certificate and policy schedule for a private carDocument3 pagesComprehensive insurance certificate and policy schedule for a private carvishal thaparNo ratings yet

- 24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: InvoiceDocument2 pages24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: InvoiceSunil PatelNo ratings yet

- Actual Income Detail For AuditDocument6 pagesActual Income Detail For AuditAamirNo ratings yet

- Cost of Furniture, Security Equipment, Vehicles & BuildingDocument52 pagesCost of Furniture, Security Equipment, Vehicles & BuildingRashan Jida ReshanNo ratings yet

- Facturier Excel AutoDocument1,664 pagesFacturier Excel AutoxcvxccxvNo ratings yet

- Invoice # 2024032900398Document1 pageInvoice # 2024032900398nikolaigray249No ratings yet

- Daily Production Report: Company Name: SHEMU PLCDocument4 pagesDaily Production Report: Company Name: SHEMU PLCShemu PlcNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)ms veluNo ratings yet

- Acko Bile BookDocument2 pagesAcko Bile BookpankajNo ratings yet

- Data Master Junio 2020Document56 pagesData Master Junio 2020Ricardo Alberto GilvonioNo ratings yet

- EoDR 08 08 2006Document2 pagesEoDR 08 08 2006api-3818152No ratings yet

- TS30T4398 LabourDocument2 pagesTS30T4398 Labourphani kumarNo ratings yet

- Received Quantity From 2778Document3 pagesReceived Quantity From 2778Rabee BataynehNo ratings yet

- Additional Questions 02Document7 pagesAdditional Questions 02SharomyNo ratings yet

- Ti Ti Chumik Filling Station: StatementDocument1 pageTi Ti Chumik Filling Station: StatementHas SanNo ratings yet

- Screenshot 2023-07-19 at 12.21.56Document1 pageScreenshot 2023-07-19 at 12.21.56vincentphaliNo ratings yet

- NATIONAL OPEN UNIVERSITY OF NIGERIA FINANCIAL ACCOUNTING EXAMDocument6 pagesNATIONAL OPEN UNIVERSITY OF NIGERIA FINANCIAL ACCOUNTING EXAMjoshua yakubuNo ratings yet

- Synthetic and Structured Assets: A Practical Guide to Investment and RiskFrom EverandSynthetic and Structured Assets: A Practical Guide to Investment and RiskNo ratings yet

- SatDocument8 pagesSatshiv_bhargava9368No ratings yet

- Mock Paper of ChemestryDocument14 pagesMock Paper of Chemestryshiv_bhargava9368No ratings yet

- Mock Paper of ChemestryDocument14 pagesMock Paper of Chemestryshiv_bhargava9368No ratings yet

- Mock Paper of ChemestryDocument14 pagesMock Paper of Chemestryshiv_bhargava9368No ratings yet

- Forms of EnergyDocument2 pagesForms of Energyshiv_bhargava9368No ratings yet

- "Tsogttetsii Soum Solid Waste Management Plan" Environ LLCDocument49 pages"Tsogttetsii Soum Solid Waste Management Plan" Environ LLCbatmunkh.eNo ratings yet

- Internship Report On An Analysis of Marketing Activities of Biswas Builders LimitedDocument45 pagesInternship Report On An Analysis of Marketing Activities of Biswas Builders LimitedMd Alamin HossenNo ratings yet

- Building Economics Complete NotesDocument20 pagesBuilding Economics Complete NotesManish MishraNo ratings yet

- Steeler Shaftwall CH StudsDocument20 pagesSteeler Shaftwall CH Studsrodney_massieNo ratings yet

- Lehman's Aggressive Repo 105 TransactionsDocument19 pagesLehman's Aggressive Repo 105 Transactionsed_nycNo ratings yet

- International Finance - TCS Case StudyDocument22 pagesInternational Finance - TCS Case StudyPrateek SinglaNo ratings yet

- BY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Document31 pagesBY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Ili SyazwaniNo ratings yet

- Assumptions in EconomicsDocument9 pagesAssumptions in EconomicsAnthony JacobeNo ratings yet

- Bid Data SheetDocument3 pagesBid Data SheetEdwin Cob GuriNo ratings yet

- Edwin Vieira, Jr. - What Is A Dollar - An Historical Analysis of The Fundamental Question in Monetary Policy PDFDocument33 pagesEdwin Vieira, Jr. - What Is A Dollar - An Historical Analysis of The Fundamental Question in Monetary Policy PDFgkeraunenNo ratings yet

- PDACN634Document69 pagesPDACN634sualihu22121100% (1)

- Practical IFRSDocument282 pagesPractical IFRSahmadqasqas100% (1)

- Oct 2022 Act BillDocument2 pagesOct 2022 Act Billdurga prasadNo ratings yet

- IptspDocument6 pagesIptspMD ABUL KHAYERNo ratings yet

- Value Stream Mapping Case StudyDocument12 pagesValue Stream Mapping Case StudySaikat GhoshNo ratings yet

- Encyclopedia of American BusinessDocument863 pagesEncyclopedia of American Businessshark_freire5046No ratings yet

- National Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AsDocument3 pagesNational Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AskrishnaNo ratings yet

- Arcelor Mittal MergerDocument26 pagesArcelor Mittal MergerPuja AgarwalNo ratings yet

- D01 - Scope of Work-Jenna McClendonDocument3 pagesD01 - Scope of Work-Jenna McClendonadriana sierraNo ratings yet

- Types of CooperativesDocument11 pagesTypes of CooperativesbeedeetooNo ratings yet

- Cloth RecycleDocument4 pagesCloth RecycleMuhammad Ammar KhanNo ratings yet

- AssignmentDocument1 pageAssignmentdibakar dasNo ratings yet

- SHFL Posting With AddressDocument8 pagesSHFL Posting With AddressPrachi diwateNo ratings yet

- Quiz #3 Q1) Q2) : Qandeel Wahid Sec BDocument60 pagesQuiz #3 Q1) Q2) : Qandeel Wahid Sec BMuhammad AreebNo ratings yet

- Damodaran PDFDocument79 pagesDamodaran PDFLokesh Damani0% (1)

- 04 - 03 - Annex C - Maintenance Plan - Ver03Document2 pages04 - 03 - Annex C - Maintenance Plan - Ver03ELILTANo ratings yet

- 2014-04-03 The Calvert GazetteDocument24 pages2014-04-03 The Calvert GazetteSouthern Maryland OnlineNo ratings yet

- AE 5 Midterm TopicDocument9 pagesAE 5 Midterm TopicMary Ann GurreaNo ratings yet

- Rent Agreement - (Name of The Landlord) S/o - (Father's Name of TheDocument2 pagesRent Agreement - (Name of The Landlord) S/o - (Father's Name of TheAshish kumarNo ratings yet

- Sample Construction ContractDocument7 pagesSample Construction ContractKim100% (1)