Professional Documents

Culture Documents

Insurance

Uploaded by

Aminul Haque RusselCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance

Uploaded by

Aminul Haque RusselCopyright:

Available Formats

Insurers business model

Profit = Earned premium + Investment income - Incurred loss - Underwriting expenses. Insurers make money in two ways: (1) through underwriting, the process by which insurers selects the risks to insure and decide how much in premiums to charge for accepting those risks and (2) by investing the premiums they collect from insureds. he most complicated aspect of the insurance business is the underwriting of policies. !sing a wide assortment of data, insurers predict the likelihood that a claim will be made against their policies and price products accordingly. o this end, insurers use actuarial science to "uantify the risks they are willing to assume and the premium they will charge to assume them. #ata is analy$ed to fairly accurately pro%ect the rate of future claims based on a given risk. &ctuarial science uses statistics and probability to analy$e the risks associated with the range of perils covered, and these scientific principles are used to determine an insurer's overall e(posure. !pon termination of a given policy, the amount of premium collected and the investment gains thereon minus the amount paid out in claims is the insurer's underwriting profit on that policy. )f course, from the insurer's perspective, some policies are winners (i.e., the insurer pays out less in claims and e(penses than it receives in premiums and investment income) and some are losers (i.e., the insurer pays out more in claims and e(penses than it receives in premiums and investment income). &n insurer's underwriting performance is measured in its combined ratio. he loss ratio (incurred losses and loss*ad%ustment e(penses divided by net earned premium) is added to the e(pense ratio (underwriting e(penses divided by net premium written) to determine the company's combined ratio. he combined ratio is a reflection of the company's overall underwriting profitability. & combined ratio of less than 1++ percent indicates underwriting profitability, while anything over 1++ indicates an underwriting loss. Insurance companies also earn investment profits on ,float-. ,.loat- or available reserve is the amount of money, at hand at any given moment, that an insurer has collected in insurance premiums but has not been paid out in claims. Insurers start investing insurance premiums as soon as they are collected and continue to earn interest on them until claims are paid out.

/roperty and casualty insurers currently make the most money from their auto insurance line of business. 0enerally better statistics are available on auto losses and underwriting on this line of business has benefited greatly from advances in computing. &dditionally, property losses in the , due to natural catastrophes, have e(acerbated this trend. .inally, claims and loss handling is the materiali$ed utility of insurance. In managing the claims* handling function, insurers seek to balance the elements of customer satisfaction, administrative handling e(penses, and claims overpayment leakages. &s part of this balancing act, fraudulent insurance practices are a ma%or business risk that must be managed and overcome.

Define insurance

ar!eting"

)rgani$ation that conducts research on distribution systems for the life and health insurance products on behalf of its member companies. 1tudies range from consumer attitudes towards the life insurance product to reasons for turnover of the agency field force. Insurance marketing is the direct marketing of the company products. Insurance companies use direct marketing, here the companies uses salespeople to inform the customer about their product. Insurance companies use door to door marketing. he field force is widely used in insurance marketing. #eveloping citi$en*centric programs. /romoting and enhancing citi$en participation. /erfecting on*line service delivery through analysis and evaluation, measuring efficiency, and benchmarking against other forms of service delivery. 2ake sales door to door.

#actors affecting insurance mar!eting

Insurance companies are in a uni"ue position when it comes to marketing. hey have no tangible products to sell, but must instead rely on strong relationships with loyal customers and word of mouth to help them compete. 1till, despite the challenges, the marketing strategies for insurance

companies are really no different than for any other company, and re"uire a strong focus on the basics of effective marketing. $now t%e ar!et

.irst and foremost, insurance companies must know their market. his means having a strong understanding of their target audience, their competition and the most effective ways to connect with that audience, according to 3in 0rensing*/ophal, author of 4 "uot5 2arketing 6ith the 7nd in 2ind.4"uot5 8ompetition is fierce, but service organi$ations like insurance agencies that thoroughly understand the needs and concerns of their target audience can effectively motivate that audience to connect with them. Establis% a Plan 1uccessful marketers based on their knowledge of the market, and their overall goals and ob%ectives, successful marketers identify and prioriti$e the communication strategies most likely to generate the results they need. his generally involves a combination of activities that include both traditional and new media, direct and indirect sales. easure Effectiveness It is important for insurance companies to measure the effectiveness of their marketing efforts based on the goals they have established. his may be as simple as comparing the number of clients before and after a campaign. It may also involve using online analytics to monitor website visits after launching a promotion. &at%er #eedbac! .or insurance marketers, word of mouth is key. In addition to measuring the effectiveness of marketing efforts based on "uantitative data, insurance marketers can seek input from their e(isting and new clients about their communication efforts. 6hat worked well9 6hat was unclear9 :ow might they communicate more clearly in the future9 In addition, clients can be e(cellent advocates and part of the marketing process. 1uccessful insurance marketers will take advantage of the opportunity to leverage their clients as word*of*mouth marketing advocates.

You might also like

- Production & Operations Management: Group ListDocument2 pagesProduction & Operations Management: Group ListAminul Haque RusselNo ratings yet

- Business ResearchDocument1 pageBusiness ResearchAminul Haque RusselNo ratings yet

- PLSDocument1 pagePLSAminul Haque RusselNo ratings yet

- Chapter - Investment CompaniesDocument16 pagesChapter - Investment CompaniesAminul Haque RusselNo ratings yet

- Financial LeverageDocument1 pageFinancial LeverageAminul Haque RusselNo ratings yet

- Staple GoodsDocument1 pageStaple GoodsAminul Haque RusselNo ratings yet

- Financial System of BangladeshDocument2 pagesFinancial System of BangladeshAminul Haque Russel100% (1)

- RiskDocument2 pagesRiskAminul Haque RusselNo ratings yet

- SMLDocument1 pageSMLAminul Haque RusselNo ratings yet

- Bank Job General KnowledgeDocument6 pagesBank Job General KnowledgeAminul Haque RusselNo ratings yet

- Chapter Insurance CompaniesDocument22 pagesChapter Insurance CompaniesAminul Haque RusselNo ratings yet

- Question PaperDocument6 pagesQuestion PaperAminul Haque RusselNo ratings yet

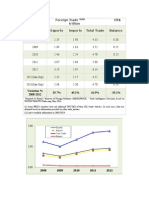

- Foreign TradeDocument4 pagesForeign TradeAminul Haque RusselNo ratings yet

- E-Cmrc AssignmentDocument34 pagesE-Cmrc AssignmentAminul Haque RusselNo ratings yet

- Question PaperDocument6 pagesQuestion PaperAminul Haque RusselNo ratings yet

- Short Notes MGTDocument9 pagesShort Notes MGTAminul Haque RusselNo ratings yet

- Business, Management, Economics, Finance Submission EmailDocument1 pageBusiness, Management, Economics, Finance Submission EmailAminul Haque RusselNo ratings yet

- Topics of Project ReportDocument1 pageTopics of Project ReportAminul Haque RusselNo ratings yet

- Project Appraisal: The First Step of Project Appraisal Is To Estimate The Potential Size ofDocument3 pagesProject Appraisal: The First Step of Project Appraisal Is To Estimate The Potential Size ofAminul Haque RusselNo ratings yet

- Growth in India: InfrastructureDocument2 pagesGrowth in India: InfrastructureAminul Haque RusselNo ratings yet

- Inventory Policy SystemDocument3 pagesInventory Policy SystemAminul Haque Russel0% (1)

- Operational IssuesDocument4 pagesOperational IssuesAminul Haque RusselNo ratings yet

- Main Characteristics of ManagementDocument3 pagesMain Characteristics of ManagementAminul Haque RusselNo ratings yet

- Question ListDocument5 pagesQuestion ListAminul Haque RusselNo ratings yet

- Syllabus BankingDocument1 pageSyllabus BankingAminul Haque RusselNo ratings yet

- Insurance Company RatingDocument2 pagesInsurance Company RatingAminul Haque RusselNo ratings yet

- DifferenceDocument2 pagesDifferenceAminul Haque RusselNo ratings yet

- Principles of ManagementDocument3 pagesPrinciples of ManagementAminul Haque RusselNo ratings yet

- Chapter 8Document5 pagesChapter 8Aminul Haque RusselNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1 Simple Linear Regression ModelDocument2 pagesChapter 1 Simple Linear Regression ModelNermine LimemeNo ratings yet

- 04 - BIOE 221 - Basic Demog and Health Indicator FormulaDocument17 pages04 - BIOE 221 - Basic Demog and Health Indicator FormulaJhelloNo ratings yet

- Econometrics ReviewDocument49 pagesEconometrics ReviewkjustmailmeNo ratings yet

- Route To Becoming An Actuary - Soa: 1. Preliminary Education ComponentDocument2 pagesRoute To Becoming An Actuary - Soa: 1. Preliminary Education ComponentNabila ZailanNo ratings yet

- Cowman Index To Actuarial Literature 1889-1989Document1,013 pagesCowman Index To Actuarial Literature 1889-1989Steve AvisNo ratings yet

- Extensive Reading 05Document15 pagesExtensive Reading 05Ivana TodorovNo ratings yet

- Degree FSKMbookhr PDFDocument48 pagesDegree FSKMbookhr PDFAlif HaiqalNo ratings yet

- Corr and RegressDocument61 pagesCorr and Regresskamendra chauhanNo ratings yet

- TVM TablesDocument21 pagesTVM Tablesanamika prasadNo ratings yet

- ST326 - Irdap2021Document5 pagesST326 - Irdap2021NgaNovaNo ratings yet

- Practice QuestionsDocument6 pagesPractice QuestionsDolendra PaudelNo ratings yet

- How to Optimize a JavaScript Document for PerformanceDocument30 pagesHow to Optimize a JavaScript Document for PerformanceSMGNo ratings yet

- Mathematical Methods in Risk TheoryDocument217 pagesMathematical Methods in Risk TheoryAnonymous Tph9x741No ratings yet

- Realestate Quiz Part1Document27 pagesRealestate Quiz Part1Shazeb LaluNo ratings yet

- Usha Deep Academy of Insurance & Finance: PH: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896 Email: WebsiteDocument2 pagesUsha Deep Academy of Insurance & Finance: PH: 0522-4000806 M: 9415080338 / 9335233798 / 9795367896 Email: WebsiteSuresh KumarNo ratings yet

- Problem Set 2Document3 pagesProblem Set 2Luca VanzNo ratings yet

- Actuarial Society of The PhilippinesDocument33 pagesActuarial Society of The PhilippinesAlvin Dela Cruz100% (1)

- Passing-Bablok Regression For Method ComparisonDocument9 pagesPassing-Bablok Regression For Method Comparisondata4.phtNo ratings yet

- Demographic TrendsDocument43 pagesDemographic TrendsPrince AlexNo ratings yet

- Chapter 04 - Acturial PrinciplesDocument15 pagesChapter 04 - Acturial PrinciplesAmit Kumar Jha100% (1)

- Formula AnnuityDocument9 pagesFormula AnnuityReese Victoria C. TorresNo ratings yet

- Canada's Changing PopulationDocument5 pagesCanada's Changing PopulationRania IhsanNo ratings yet

- Chapter 3Document36 pagesChapter 3feyisaabera19No ratings yet

- Deloitte CH en Ifrs 17 Webinar 3febDocument23 pagesDeloitte CH en Ifrs 17 Webinar 3febЙоанна ЗNo ratings yet

- Risk Management Plan: Train SmartpassDocument16 pagesRisk Management Plan: Train SmartpassIonut AlexandruNo ratings yet

- PV Tables 2020Document2 pagesPV Tables 2020Saurabh TripathiNo ratings yet

- Am 1 NotesDocument92 pagesAm 1 NotesSHELLY NYABOKE MEXILLAHNo ratings yet

- Module 6A Estimating RelationshipsDocument104 pagesModule 6A Estimating Relationshipscarolinelouise.bagsik.acctNo ratings yet

- Sa1 Pu 15 PDFDocument78 pagesSa1 Pu 15 PDFPolelarNo ratings yet

- An Article in The Journal of Environmental Engineering Vol. 115Document4 pagesAn Article in The Journal of Environmental Engineering Vol. 115Ed Lawrence MontalboNo ratings yet