Professional Documents

Culture Documents

Early Thoughts On The FDA's Move To Regulate E-Cigs: No Heavy Cost To E-Cig Sales, But Potential Cost To Manufacturers

Uploaded by

api-227433089Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Early Thoughts On The FDA's Move To Regulate E-Cigs: No Heavy Cost To E-Cig Sales, But Potential Cost To Manufacturers

Uploaded by

api-227433089Copyright:

Available Formats

Early Thoughts On The FDA's Move To Regulate E-Cigs

Primary Credit Analyst: Gerald T Phelan, CFA, Chicago (1) 312-233-7031; gerald.phelan@standardandpoors.com

Table Of Contents

No Heavy Cost To E-Cig Sales, But Potential Cost To Manufacturers

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 24, 2014 1

1303528 | 301674531

Early Thoughts On The FDA's Move To Regulate E-Cigs

Standard & Poor's Ratings Services' ratings and outlooks on five tobacco companies--Altria Group Inc., Reynolds American Inc., Lorillard Inc., Vector Group Ltd., and North Atlantic Trading Co. Inc.--are currently not affected by the U.S. Food and Drug Administration's (FDA's) just-released proposal to regulate "other tobacco products," which include electronic cigarettes (e-cigs), cigars, and pipe tobacco. Overview The FDA has proposed regulations on e-cigarettes and other tobacco products. The FDA's proposals have no impact on Standard & Poor's ratings on tobacco companies, as we have long expected increased regulatory oversight of e-cigs. We believe tobacco issuers with substantial financial resources will adapt to the proposed regulations without substantial difficulty, while smaller tobacco companies could face tighter profitability. We continue to believe that long-term e-cig growth will depend primarily on product quality and taxation.

In our opinion, the proposed regulations are another step in a long process by the FDA to extend its oversight of the tobacco industry, and for the most part are consistent with our expectations. As with currently regulated tobacco products, makers of the proposed regulated products would, among other requirements: Register with the FDA, and report product and ingredient listings; Market new tobacco products only after FDA review; Only make reduced risk claims if supported by scientific evidence and if marketing of the product will benefit public health as a whole; and Not distribute free samples. Other proposed provisions include: Minimum age and identification restrictions; Health warnings; and Prohibition of sales through most vending machines. We continue to believe increased regulation of the tobacco industry could reduce total tobacco consumption over time and raise manufacturer compliance costs. We believe total tobacco consumption has declined only modestly in recent years thanks to growth in noncigarette volumes.

No Heavy Cost To E-Cig Sales, But Potential Cost To Manufacturers

In our opinion, the proposed restrictions on e-cigs, which currently constitute less than 2% of tobacco industry sales, should not have a material adverse effect on e-cig sales, though they could slow near-term growth and raise costs to manufacturers.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 24, 2014 2

1303528 | 301674531

Early Thoughts On The FDA's Move To Regulate E-Cigs

We still believe over the long term that e-cig growth will depend primarily on product quality, which overall remains inconsistent (specifically, the ability to simulate the conventional cigarette smoking experience), and the level of taxation--which the current proposal does not affect. Taxation of e-cigs could move to the forefront sooner rather than later, and could slow future growth. In addition, the proposal does not restrict e-cig flavors, nor does it ban e-cig advertising or internet sales to adults. This could change in the future, including potentially banning certain characterizing flavors. We believe tobacco issuers with substantial financial resources, including Lorillard, Altria, and Reynolds American, should be able to adapt to the proposed regulations without substantial difficulties. (See table 1 for issuer e-cig product details.) For smaller tobacco companies, including North Atlantic Trading Co. Inc.--which generates a portion of its sales from cigars and pipe tobacco--profitability could suffer because of higher compliance costs, but as yet we do not see prospects for lower profitably leading to a rating change. In addition, although we still believe e-cig internet sales could be banned altogether in the future, the continued ability to sell to adults through the internet could dampen North Atlantic Trading Co.'s near term e-cig growth. This is because its partnership with V2 Cigs--the largest seller of e-cigs on the internet--authorizes it to distribute V2 in stores. Since proposed regulations continue allow adults to buy e-cigs through the internet, V2 customers may continue to buy that way instead of at physical retail locations. With respect to cigars, many local governments already prohibit the purchase of cigars below a specified age limit, in most cases 18 years old. We believe the FDA proposal would establish a national minimum age, so the rating impact should not be significant. The FDA now has a potential implementation timetable, including 75 days for both public comment and elimination of unapproved health claims, and two years for implementation of other provisions (subject to legal challenges). We will monitor developments, including public and issuer responses to the proposals, and refine our opinions accordingly. For more information, see: Summary: Reynolds American Inc., April 16, 2014 Summary: Altria Group Inc., March 14, 2014

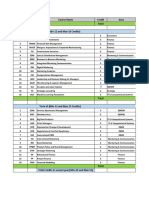

Table 1

Issuer E-Cigarette Summary

Primary U.S. Brands Lorillard Inc. Altria Group Inc. Reynolds American Inc. Vector Group Ltd. North Atlantic Trading Co. Inc. Blu MarkTen, Green Smoke VUSE Zoom V2 (excluding Internet) Estimated Market Share ~45% < 1% < 2% < 1% N.A.*

*2013 partnership with V2 Cigs (the largest e-cig internet retailer by volume) to distribute its e-cigs to physical retail outlets.

Additional Contact: Linda I Phelps, New York (1) 212-438-3059; linda.phelps@standardandpoors.com

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 24, 2014 3

1303528 | 301674531

Copyright 2014 Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

APRIL 24, 2014 4

1303528 | 301674531

You might also like

- Japanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy RideDocument14 pagesJapanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy Rideapi-227433089No ratings yet

- Hooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?Document9 pagesHooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?api-227433089No ratings yet

- Michigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'Document3 pagesMichigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'api-227433089No ratings yet

- UntitledDocument9 pagesUntitledapi-227433089No ratings yet

- 2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial RatiosDocument12 pages2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial Ratiosapi-227433089No ratings yet

- Metropolitan Transportation Authority, New York Joint Criteria TransitDocument7 pagesMetropolitan Transportation Authority, New York Joint Criteria Transitapi-227433089No ratings yet

- Metropolitan Transportation Authority, New York Joint Criteria TransitDocument7 pagesMetropolitan Transportation Authority, New York Joint Criteria Transitapi-227433089No ratings yet

- UntitledDocument7 pagesUntitledapi-227433089No ratings yet

- How Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?Document5 pagesHow Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?api-227433089No ratings yet

- UntitledDocument10 pagesUntitledapi-227433089No ratings yet

- UntitledDocument16 pagesUntitledapi-227433089No ratings yet

- California Governor's Fiscal 2015 May Budget Revision Proposal Highlights Good NewsDocument6 pagesCalifornia Governor's Fiscal 2015 May Budget Revision Proposal Highlights Good Newsapi-227433089No ratings yet

- UntitledDocument5 pagesUntitledapi-227433089No ratings yet

- Report Highlights Qatari Banks' Expected Robust Profitability in 2014 Despite RisksDocument4 pagesReport Highlights Qatari Banks' Expected Robust Profitability in 2014 Despite Risksapi-227433089No ratings yet

- UntitledDocument12 pagesUntitledapi-227433089No ratings yet

- Adding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic GrowthDocument17 pagesAdding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic Growthapi-227433089No ratings yet

- The Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short TermDocument8 pagesThe Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short Termapi-227433089No ratings yet

- UntitledDocument8 pagesUntitledapi-227433089No ratings yet

- UntitledDocument5 pagesUntitledapi-227433089No ratings yet

- UntitledDocument7 pagesUntitledapi-227433089No ratings yet

- How "Abenomics" and Japan's First Private Airport Concession Mark The Beginning of The End For Self-Financing The Nation's Public InfrastructureDocument6 pagesHow "Abenomics" and Japan's First Private Airport Concession Mark The Beginning of The End For Self-Financing The Nation's Public Infrastructureapi-227433089No ratings yet

- UntitledDocument9 pagesUntitledapi-227433089No ratings yet

- Global Economic Outlook: Unfinished BusinessDocument22 pagesGlobal Economic Outlook: Unfinished Businessapi-227433089No ratings yet

- UntitledDocument14 pagesUntitledapi-227433089No ratings yet

- UntitledDocument8 pagesUntitledapi-227433089No ratings yet

- U.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures LagDocument12 pagesU.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures Lagapi-227433089No ratings yet

- Recent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer SpendingDocument6 pagesRecent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer Spendingapi-227433089No ratings yet

- UntitledDocument6 pagesUntitledapi-227433089No ratings yet

- New Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook StableDocument6 pagesNew Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook Stableapi-227433089No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lecture 1 Understanding EntrepreneurshipDocument15 pagesLecture 1 Understanding EntrepreneurshipTest MockNo ratings yet

- Open Cut Coal XpacDocument4 pagesOpen Cut Coal XpacAlessandro SignoriNo ratings yet

- Business Impact AssessmentDocument10 pagesBusiness Impact Assessmentदीपक सैनीNo ratings yet

- CMA TOPIC4 Differential Analysis (Chapter 14) PDFDocument3 pagesCMA TOPIC4 Differential Analysis (Chapter 14) PDF靳雪娇No ratings yet

- Proposed Review of Exemption Criteria For Private Companies in Malaysia (SSM)Document19 pagesProposed Review of Exemption Criteria For Private Companies in Malaysia (SSM)bearteddy17193No ratings yet

- Engineering Marketing and EntrepreneurshipDocument41 pagesEngineering Marketing and Entrepreneurshipimma coverNo ratings yet

- Pyramid of QualityDocument1 pagePyramid of Qualitytrijunarso714No ratings yet

- Orca Share Media1547030319812Document523 pagesOrca Share Media1547030319812Maureen Joy Andrada80% (10)

- Footwear Industry in NepalDocument76 pagesFootwear Industry in Nepalsubham jaiswalNo ratings yet

- LeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENDocument13 pagesLeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENSocialMedia NewLifeNo ratings yet

- Yamal NCND IMFPA DE JP54 - 17 DICIEMBRE CONTRATODocument15 pagesYamal NCND IMFPA DE JP54 - 17 DICIEMBRE CONTRATOyuzmely67% (3)

- Problem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at ADocument2 pagesProblem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at AMa Teresa B. CerezoNo ratings yet

- Asm1 - Bee - Ha Thi VanDocument25 pagesAsm1 - Bee - Ha Thi VanVân HàNo ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Planner Approval For Move Order RequisitionsDocument7 pagesPlanner Approval For Move Order RequisitionsSrimannarayana KasthalaNo ratings yet

- 1 LiabilitiesDocument39 pages1 LiabilitiesDiana Faith TaycoNo ratings yet

- New Amazon BPLDocument19 pagesNew Amazon BPLpallraunakNo ratings yet

- Financial Accounting Report (Partnership - Group 2)Document20 pagesFinancial Accounting Report (Partnership - Group 2)syednaim0300No ratings yet

- Freedom Baromoter Asia 2010Document82 pagesFreedom Baromoter Asia 2010Friedrich Naumann-Stiftung Untuk Kebebasan (FNF)No ratings yet

- Case Study BookDocument106 pagesCase Study BookshubhaomNo ratings yet

- Infosys Sourcing & Procurement - Fact Sheet: S2C R2I I2PDocument2 pagesInfosys Sourcing & Procurement - Fact Sheet: S2C R2I I2PGautam SinghalNo ratings yet

- EFFECTS OF ECONOMIC GROWTH AND GST RISEDocument41 pagesEFFECTS OF ECONOMIC GROWTH AND GST RISESebastian ZhangNo ratings yet

- CPA licensure exam syllabus management accountingDocument3 pagesCPA licensure exam syllabus management accountingLouie de la TorreNo ratings yet

- Case Study - Circuit City CaseDocument4 pagesCase Study - Circuit City CaseMohammedNo ratings yet

- Bangladesh Pharmaceutical IndustryDocument5 pagesBangladesh Pharmaceutical IndustryMizanur Rahman0% (1)

- Orientation and TrainingDocument28 pagesOrientation and TrainingSunny Ramesh SadnaniNo ratings yet

- ISO 14000 Understanding, Documenting and Implementing Slides R8.02.05Document195 pagesISO 14000 Understanding, Documenting and Implementing Slides R8.02.05Tanuj MadaanNo ratings yet

- Assignment 1 Student: Sidad Ibrahim: Hasbro OverviewDocument2 pagesAssignment 1 Student: Sidad Ibrahim: Hasbro OverviewSidad KurdistaniNo ratings yet

- HS AgroDocument42 pagesHS AgroSHIVANSHUNo ratings yet

- I HG F Autumn 2018 ApplicationformDocument8 pagesI HG F Autumn 2018 ApplicationformSnzy DelNo ratings yet