Professional Documents

Culture Documents

Bank Asia

Uploaded by

Aninda R. DipCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Asia

Uploaded by

Aninda R. DipCopyright:

Available Formats

CHAPTER: ONE

INTRODUCTION

2

1.1 Origin of the Report

The internship report is a basic requirement for the BBA program. The proposed topic is

General Banking & Trade Financial Activities of Bank Asia Limited. The topic is assigned by

Mr. S.M. Arifuzzaman, Senior Lecturer, Department of Business Administration, East West

University, Dhaka.

1.2 Objectives of the study:

The objectives are generally two types. One is broad objective. And another is specific objective.

1.2.1 Broad Objectives:

The Board Objective of this studys to focus on the main activities of General Banking

Department that is Cash, Accounts, Customer service etc & Trade Financial activities of Bank

Asia Limited, MCB Banani Branch and also to know the process and the problems which they

are facing in every stage.

1.2.2 Specific objectives:

The Specific Objectives are as follows:

To explore the activities of General Banking & Foreign Trade department.

To acquire knowledge about foreign exchange department.

To acquire knowledge about general banking activities.

To analyze the total process of letter of credit according to the bank.

To identify different General Banking services available in Bank Asia Limited.

To access the efficiency of the customer service desk.

To assess the overall performance of the banks Foreign Exchange Department.

To know details of Foreign Exchange procedure in Bank Asia Limited

3

1.3 Scope of the Study

This report consists of the writers observation and on the job experiences during the internship

period in MCB Banani Branch, Bank Asia. The report mainly emphasizes the sequential

activities involved in customer service, cash, credit and investment approval process & Trade

and financial actions used by Bank Asia. The report also focuses on the financial analysis,

performance efficiency of the customer service desk, problems faced by GB and foreign trade

department, comparative growth rate and overall performance analysis of Bank Asia Limited.

Finally the report incorporates an evaluation of the different aspects and monitoring techniques

and findings problems and makes some recommendations.

1.4 Limitations of the study

Because Of Short Period of time, and huge working pressure in the branch I could not find

enough time to make my report more informative and creative but still I tried my level best to

cover all the departments where I have worked in this three months, and tried to focus all the

functions/problems/activities I have came aware of; while working in Banani branch as an intern.

4

CHAPTER: TWO

BANK ASIA LIMITED (COMPANY PROFILE)

5

2.1 Historical Background: Bank Asia Limited:

Bank Asia has been launched by a group of successful entrepreneurs with recognized standing in

the society. The management of the Bank consists of a team led by senior bankers with decades

of experience in national and international markets. The senior management team is ably

supported by a group of professionals many of whom have exposure in the international market.

(bankasia-bd.com)

Since its humble beginning in 1999, Bank Asia has established itself as one of the fast growing

local private banks. It has at present a network of eighty branches serving many of the leading

corporate houses and is gradually moving towards retail banking. Another significant delivery

channel is its own as well as shared ATM Network. Bank Asia has a network of 3651 ATMs out

of which Bank Asia owns 81. The other 3570 ATMs are shared through ETN with other banks. It

set milestone by acquiring the business operations of the Bank of Nova Scotia in Dhaka, first in

the banking history of Bangladesh. It again repeated the performance by acquiring the

Bangladesh operations of Muslim Commercial Bank Ltd. (MCB), a Pakistani bank. In the year

2003 the Bank again came to the limelight with oversubscription of the Initial Public Offering of

the shares of the Bank, which was a record (55 times) in our capital market's history and its

shares commands respectable premium. (bankasia-bd.com)

The asset and liability growth has been remarkable. By December 2011 the total asset of the

Bank grew to Tk 11,772,941 million, increase of almost 11.91% comparing to 2010. As of

December 2011 deposits increased to Tk 9,513,110million, an increase of 10.15% over that of

2010, and Loans & Advances reached Tk 8,281,997 million, an increase of 4.17% over that of

2010. And in 2013, Total asset was tk 163778 million and Total deposit was Tk 133489 million.

At present Bank Asia has 86 branches across the nation with more than 1600 employees. Bank

Asia has been actively participating in the local money market as well as foreign currency

market without exposing the Bank to vulnerable positions. The Bank's investment in Treasury

Bills and other securities went up noticeably opening up opportunities for enhancing income in

the context of a regime of gradual interest rate decline. (bankasia-bd.com)

6

Bank Asia Limited started its service with a vision to serve people with modern and innovative

banking products and services at affordable charge. The Bank is maintaining its competitiveness

by leveraging on its Online Banking Software and modern IT infrastructure. It is the pioneer

amongst the local banks in introducing innovative products like SMS banking, and under the

ATM Network the Stelar Online Banking software enables direct linking of a clients account,

without the requirement for a separate account. Being parallel to the cutting edge technology the

Bank is offering online banking with added delivery channels like ATM, Tele-banking, SMS and

Net Banking. And as part of the bank's commitment to provide all modern and value added

banking service in keeping with the very best standard in a globalize world. (bankasia-bd.com)

2.2 Milestones of Bank Asia Limited:

1. Certificate of Incorporation 28/09/1999

2. Certificate of Commencement of Business 28/09/1999

3. Banking License 06/10/1999

4. First Branch License 31/10/1999

5. Inauguration of Bank 27/11/1999

6. Only Bangladeshi bank to acquire operations of 02

foreign banks namely: Bank of Nova Scotia, Canada

and Muslim Commercial Bank of Pakistan

2001 (Bank of Nova Scotia, Canada) 2002 (Muslim

Commercial Bank of Pakistan)

7. Date of IPO subscription 23-24/09/2003

8. IPO oversubscribed by: 56 times

9. Date of First Share Trading in Bourse 08/01/2004

10. Number of Shareholders and Shares (at the end of

2009)

10,868 (shareholders) 21,448,125 shares

11. Date of First Subscription with CDBL 20/12/2005

12. Date of First Script-less Trading 30/01/2006

13. Commenced Operation of Off-Shore Banking 28/01/2008

14. Commenced Operation of Islami Banking 24/12/2008

7

2.3 Mission:

To assist in bringing high quality service to our customers and to participate in the

growth and expansion of our national economy.

To set high standards of integrity and bring total satisfaction to our clients, shareholders

and employees.

To become the most sought after bank in the country, rendering technology driven

innovative services by our dedicated team of professionals.

2.4 Vision:

Bank Asias vision is to have a poverty free Bangladesh in course of a generation in the new

millennium, reflecting the national dream. Our vision is to build a society where human dignity

and human rights receive the highest consideration along with reduction of poverty.

2.5 Core Values:

Place customers interest and satisfaction as first priority and provide customize banking

products and services.

Value addition to the stakeholders through attaining excellence in banking operation.

Maintain high ethical standards and transparency in dealings.

Be a compliant institution through adhering to all regulatory requirements.

Contribute significantly for the betterment of the society.

Ensure higher degree of motivation and dignified working environment for our human

capital and respect optimal work-life balance.

Committed to protect the environment and go green

8

2.6 Code of Conduct:

Employees must be open and loyal to the bank and banks interest.

Employees must keep confidential all banks and other matters that could provide other

third parties unauthorized access to confidential information.

Employees must observe the banks security requirements concealing access to electronic

resources and documents.

All information and communication with the media, the public and financial markets

shall be reliable and correct, maintain high professional and ethical standards and in

accordance established guidelines and regulations.

Customers shall be met with insight, respect and understanding. Employees must always

try to fulfill the needs of the customer in the best possible manner, within the guidelines

for corporate ethics and regulations.

Under no circumstances, employees shall or be a part of any activity that prohibits open

and fair competition of Bank Asia in breach of relevant business laws.

Employees shall never offer or accept illegal or inappropriate gifts or other remuneration

in order to achieve business or personal advantages.

Employees engagement in external duties must not affect his/her working relationship

with Bank Asia or come into conflict with Bank Asias business interest.

Should an employee become aware of an infringement of Bank Asias rules and

guidelines, he/she should blow whistle raising the issue to the line management or to

Human Resource Department.

(Annual Report 2013, Bank Asia)

9

2.7 Board of Directors:

Mr. A Rouf Chowdhury, Chairman

Mr. A M Nurul Islam, Vice Chairman

Mr. Mohammed Lakiotullah, Vice Chairman

Ms. Hosneara Sinha, Director

Mr. Mohd. Safwan Choudhury, Director

Mr. Rumee A Hossain, Director

Ms. Farhana Haq Chowdhury, Director

Ms. Naheed Akhter Sinha, Director

Mr. Nafees Khundker, Director

Mr. M Irfan Syed, Director

Mr. Faisal Samad, Director

Mr. Shah Md. Nurul Alam, Director

Ms. Sohana Rouf Chowdhury, Director

Mr. Md. Mehmood Husain, President and Managing Director

2.8 Management Team:

Mr. Md. Mehmood Husain, President and Managing Director

Mr. Aminul Islam, Deputy Managing Director, Chief Operating Officer & Company Secretary

Mr. Mohammed Roshangir, Deputy Managing Director & Chief Business Officer (Corporate)

Ms. Humaira Azam, Deputy Managing Director & Chief Risk Officer

Mr. Md. Arfan Ali, Deputy Managing Director & Chief Business Officer (SMR)

Mr. Nasirul Hossain, Senior Executive Vice President & Head of Recovery

Mr. Syed Nazimuddin, Senior Executive Vice President & Head of Foreign Remittance

Mr. Md. Touhidul Alam Khan, ACMA Senior Executive Vice President & Head of Corporate

Assets and Client Origination

Mr. Mohammad Borhanuddin, Senior Executive Vice President & Head of Internal Control &

Compliance

Mr. Md. Abu Bakar Laskar, Senior Vice President & Head of Branch Operations

Mr. Imran Ahmed, FCA, CISA

Senior Vice President & Chief Financial Officer

Mr. Md. Zia Arfin, Senior Vice President & Head of International Division

Mr. Mohammad Abdul Qaium Khan, Senior Vice President & Head of Information and

Communication Technology

Mr. Mamun Mahmud, Senior Vice President & Head of Human Resources

Mr. Arequl Arefeen, Vice President & Head of Treasury

Mr. Afzalul Haq, Vice President & Head of Islamic Banking

10

Bank Asia Ltd

Main

Operation

Conventional

Banking

Islamic

Banking

Off-shore

banking

Subsidiary

Companies

Bank Asia

Securities Ltd

BA Exchange

Company (UK)

Ltd

2.9 Corporate Structure:

Figure-1: Corporate Structure of Bank Asia (Annual Report 2013, Bank Asia)

2.10 Salient features of Bank Asia:

Only Bangladeshi Bank to acquire operations of two foreign banks

o Bank of Nova Scotia of Canada

o Muslim Commercial Bank of Pakistan.

Majority stake holder of ERA INFOTECH (A joint Venture IT Company).

Centralized Trade Services Operation

o Facilitates Export/ Import and Inward and Outward Remittance for non-AD Branches.

Central Clearing -Fully Automated.

Online & ATM Charges - Free.

ATM Booth- 48 & E-Cash Booth- 125.

24 Hours Call Centre for customer service.

Member- Dhaka Stock Exchange (DSE) & Commenced Capital Market Operations (Share

Trading).

Internet & Mobile Banking

SME Banking

Consumer Banking

Islamic Banking

Green Banking

11

2.11 Product & Services of Bank Asia (In a Nutshell)

(Source: Annual Report 2013, Bank Asia)

2.11.1 Business Banking

Overdraft

Secured Overdraft

Secured OD (Earnest Money)

Working Capital Finance

Loan against Trust Receipt

Loan against Cash Incentives

Bill Discounting

Loan Syndication and Structured Finance

Packing Credit

Demand Loan

Demand Loan (Work Order)

Time Loan

Transport Loan

Lease Finance

Letter of Guarantee

Letter of Credit

Back to Back Letter of Credit

2.11.2 Credit card

Master Card Local (Gold & Silver)

Visa Local (Gold & Classic)

Visa Dual Currency Credit Card (Gold & Classic): Local and foreign currency in same

plastic.

Visa Card against RFCD, RQ A/c

12

Visa Mini

Virtual Card

SME Credit Card

Lanka Bangla Card Cheque: To make payments where the customer cannot make

payment through cards like house rent, education fees etc.

Major Credit Card features:

Double Credit Shield: Bank Asia introduced double credit shield program for the valued credit

cardholders. Under double shield plan in the unfortunate event of death or permanent total

disability of the cardholder, cardholders nominee or cardholder shall receive Tk. 50,000 for

Silver/Classic cardholder and Tk. 1, 00,000 for Gold card in addition to the auto settlement of

entire dues on the credit card.

Free SMS service: A cardholder is able to get information about cards outstanding and different

value added services over cell phone through SMS service.

E-statement: A Bank Asia cardholder has facilities to get monthly statement over e-mail

anywhere in the world.

Reward Points: A cardholders accumulates reward points against purchase.

24 hours call center: Our enthusiastic customer care agents are ready to attend customers query

round the clock through our call center.

Soft turn: Bank Asia Cards has offered the employees of MNC, FI and renowned corporate

houses to transfer their existing other bankss credit card outstanding to Bank Asia MasterCard or

VISA credit card.

Easy buy: Under this scheme Bank Asia cards have flexibility to pay in installment basis on any

purchase with the credit card.

SMS Alert Service: Cardholders are being same SMS upon approval of each transaction

13

2.11.3 Small and Medium Enterprise (SME)

Sachondo Product Features:

SL Product

Name

Nature Maximum Loan

Tenor

Interest

Rate

Loan Type

1 Subidha unsecured trading 3 years 16% Equal Monthly

Installment

2 Sristi unsecured manufacturing 3 years 16% Equal Monthly

Installment

3 Sofol unsecured service 3 years 16% Equal Monthly

Installment

4 Sondhi secured trading 5 years 15% Equal Monthly

Installment

5 Sombridhi secured manufacturing 5 years 15% Equal Monthly

Installment

6 Seba secured service 5 years 15% Equal Monthly

Installment

Overdraft Features:

7 Somadhan Trading Manufacturing

Service

1 year 13-15% Over Draft

Special Product Features:

8 Utshob Seasonal 9 months 16% Single Installment

9 Subarno Women entrepreneur 3 years 10% Equal Monthly

Installment

Table 1- SME Product Features, Bank Asia Annual Report 2013

14

Interest rate may be revised by Corporate Office/ competent authority from time to time and

charges & commissions may be relaxed by Corporate Office depending on customers

performance with our Bank or other Bank.

2.11.4 Deposit Accounts:

Saving Account

Current Account

Short notice Deposit

Fixed Term Deposit

Foreign Currency Account

Deposit Pension Scheme

Monthly Benefit Scheme

Double Benefit Scheme: Doubles your deposit in 7 years.

Triple Benefit Scheme: Triples your deposit in 11 years.

Bank Asia Sanchoy Plus

2.11.5 Treasury

Money Market

Overnight Call

Repo and Reverse Repo

Swap

Sale and Purchase of treasury Bill & Bond

Term Placement

Term Borrowing

Foreign Exchange

Spot

Forward

Interbank Buy/Sell

15

2.11.6 Consumer Finance

Auto Loan

Consumer Durable Loan

House Finance

Loan for Professionals

Senior Citizen Support

2.11.7 Internet Banking

Connect Asia

Bank Asia symbolizes modern banking with innovative services in Bangladesh. We provide

Online Banking, ATM Support, SMS and Net Banking Services in the country. Our newly

developed web application is fully authentic, secured and robust. This technology based services

also provide you Fund Transfer through internet, Debit/Credit Card facility, free SMS message

of special type of withdrawal from your account time to time.

On-line Banking:

All branches under online banking system will be able to do banking practices using a common

server (which is centralized) from where only the branches will be able to enter using a common

password

Internet Banking Services

Check account balance

Take print out of account statement for a particular period

Transfer fund within your own account

Make payment of mobile phone bill

Recharge your mobile phone as well as others from your account

Enquire foreign exchange rate

Enquire currency exchange rates.

Acquire information on all our products.

Every transaction report will be sent to clients e-mail account.

16

Can change the password, pin code and respective mobile number (For All Mobile

Operator's).

How to Use Internet Banking

Go to: www.bankasia.net

Insert User ID

Insert PIN Code

Click "Sign in" Button

2.11.8 Islamic Banking

Deposit Products

Mudaraba Saving Account

Al-Wadiah Current Account

Mudaraba Special notice Deposit

Mudaraba Term Deposit

Mudaraba Hajj savings Scheme

Mudaraba Deposit Pension Scheme

Mudaraba Monthly Profit Paying Deposit Scheme

Smart Junior Saver

Investment Products

Bai Murabaha Muajjal

Hire Purchase Shirkatul Melk

Musharaka

Quard against accepted Bills

17

2.11.9 Off-shore Banking Unit (OBU) Products

On-shore Bill Discounting through OBU

Bill Discounting

Capital Finance

Working Capital Finance

Trade Finance

2.11.10 Services

ATM

Remittance

Locker Service

Online banking

Internet Banking

Phone Banking

Mobile Banking

SWIFT

Centralized Trade

Travellers Cheque

Student File

2.11.11 Capital Market Operation

Brokerage operation

Margin Loan

18

2.12 Financial Performance of Bank Asia (Last 5 Years):

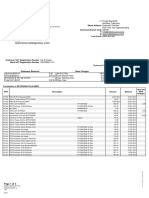

Table 2: Balance Sheet Matrix Of Bank Asia; As per Annual Report 2013 (Figures in Million taka)

Table 3: Income Statement Matrix, Annual Report 2013 (Million Taka)

Balance Sheet Matrix 2013 2012 2011 2010 2009

Authorized Capital 15,000.00 15,000.00 15,000.00 4,450.00 4,450.00

Paid up Capital 6,936.32 6 305.75 5 254.79 3 002.74 2 144.81

Reserve Fund & Surplus 7,681.38 6 739.42 7 224.14 4 057.20 2 809.33

Total Shareholders Equity 14,617.70 13 ,045.17 12 478.93 7 059.94 4 954.14

Deposits 133,489.37

110

061.78 95 131.10 86 365.64

54

832.82

Loans and Advances 104,911.26 92, 328.82 82 819.97 79 504.23

50

267.92

Investments 33,933.36 25 114.90 15 950.51 12 575.70 9 663.1

Fixed Assets 5,288.35 4 520.49 4 584.55 1 837.28 1 18.38

Total Assets 163,777.74

140

361.37 117 729.41 105 198.05

68

663.2

Total Off Balance Sheet Items 67,164.26 59 215.74 47 457.25 48 974.68

27

978.82

Interest Earning Assets 150,629.28

129

078.12 108 418.60 98 949.48

65

432.19

Non-Interest Earning Assets 13,148.46 11 283.26 9 310.81 6 248.57 3 231.01

Income Statement Matrix 2013 2012 2011 2010 2009

Interest Income 14346.31 13296.06 10903.58 8381.35 6247.49

Interst Expenses 11166.02 9616.35 8202.66 5420.58 4498.02

Investment income 3053.8 1930.64 1285.55 1163.49 1012.99

Non interest income 2299.04 2210.32 2416.97 2546.73 1367.03

Non Interest expenses 3117.36 2768.87 2361.47 2422.13 1512.47

Total Income 19699.15 17437.02 14606.1 12091.58 8627.52

Total expenditure 14283.38 12385.22 10564.13 7842.72 6010.48

operating profit 5415.76 3051.8 4041.97 4248.86 2617.04

profit before tax 3520.59 2723 3432.21 3579.52 2286.19

Net profit after tax 1459.82 908 1916.21 1929.56 1327.18

19

Capital Measures 2013 2012 2011 2010 2009

Risk Weighted Assets 140976.92 106719 83664.2 100545.9 45150

Core capital 11904.15 10444.33 9536.33 6569.16 4644.4

Supplementary Capital 3670.7 3485.86 2911 1587.8 893.77

Total Capital 15574.85 13930.19 12447.33 8156.96 5538.17

Capital Surplus 1477.16 3258.29 4080.9 -892.14 1023.15

Table 4: Capital Measures, Annual Report 2013 (Million Taka)

Credit Quality 2013 2012 2011 2010 2009

Classified Loans 5878.79 5251.48 2249.96 1284.25 785.07

Provision For Unclassified

Loans

1038.2 989.2 974.03 959.67 622.93

Provision For Classified

Loans

3074.43 2641.11 772.42 354.63 355.38

Table 5: Credit Quality, Annual Report 2013 (Million Taka)

Foreign Exchange

Business

2013 2012 2011 2010 2009

Import 110738.08 106746.15 99414.2 110417.9 67378.3

Export 71968.33 66478.34 74794.5 57281.67 30953.4

Remittance 34334.4 32110.1 21776.7 18441.71 15555.1

Table 6: Foreign Exchange Business, Annual Report 2013 (Million Taka)

20

Operating Profit Ratios 2013 2012 2011 2010 2009

Credit Deposit Ratio 78.59% 83.89% 87.06% 92.06% 91.67%

Cost of Deposit 8.81% 9.49% 9.09% 7.15% 8.97%

Administrative Cost 2.63% 2.82% 2.88% 2.08% 2.76%

Yield on loans &

advances

14.99% 15.20% 14.11% 12.72% 13.95%

Spread 6.18% 5.71% 5.02% 5.57% 4.98%

ROA 0.96% 0.70% 1.72% 2.22% 2.18%

ROE 10.55% 7.11% 19.61% 32.12% 32.03%

Table 6: Operating Profit Ratios of Bank Asia, Annual Report 2013

Performance Ratios 2013 2012 2011 2010 2009

Profit Per Employee 3.38% 3.40% 3.18% 3.43% 2.54%

Operating Profit 3.31% 3.60% 3.43% 4.04% 3.81%

Net Interest Income 3.70% 3.61% 3.33% 3.76% 3.76%

Burden Coverage 57.78% 63.58% 83.80% 88.41% 77.85%

Expense Coverage 79.44% 99.37% 105.38% 113.12% 102.44%

Efficiency ratio 36.53% 35.40% 36.88% 36.31% 36.63%

Table 7: Performance Ratios of Bank Asia, Annual Report 2013

Table 8: Other Informations, Annual Report 2013

OTHER INFORMATIONS 2013 2012 2011 2010 2009

Number Of Branches 86 73 63 49 41

Number Of SME service centers 6 6 7 9 3

Number Of Islamic Windows 5 5 5 5 2

Number Of employees 1600 1485 1270 1237 1031

Number Of Foreign Correspondent 761 776 775 770 625

21

Ref: Annual Report 2013 Bank Asia Limited

0

500

1000

1500

2000

2009 2010 2011 2012 2013

Number Of Employees

0

20

40

60

80

100

2009 2010 2011 2012 2013

Number Of Branches

0

5000

10000

15000

20000

2009 2010 2011 2012 2013

Total Capital (Million Taka)

22

Ref: Annual Report 2013 Bank Asia Limited

0

50000

100000

150000

200000

2009 2010 2011 2012 2013

Total Assets (Million Taka)

0

50000

100000

150000

2009 2010 2011 2012 2013

Total Deposit (Million Taka)

0

20000

40000

60000

80000

100000

120000

2009 2010 2011 2012 2013

Advances

23

Ref: Annual Report 2013 Bank Asia Limited

0

500

1000

1500

2000

2500

2009 2010 2011 2012 2013

Net Profit After Tax

0

5000

10000

15000

20000

2009 2010 2011 2012 2013

Total Shareholder's

Equity

28%

29%

22%

9%

12%

ROA

2009 2010 2011 2012 2013

32%

32%

19%

7%

10%

ROE

2009 2010 2011 2012 2013

24

CHAPTER: THREE

Project Part: General Banking & Trade

Financial Activities of Bank Asia LTD.

25

3.0 Project Part:

I have been joined as an intern of Bank Asia Limited (Banani Branch) from the month

of 9th January 2014. The working criteria and my main duty and responsibility is to know and

support my colleagues in their day to day workplace and the whole environment is much more co

operative and helpful with me which encourage me to familiar with the environment. Everyone

tried to make me understand what to do, when to do and how to handle this and how these works

being done. My working department basically which I have been placed in the general banking

department & foreign trade department. In My report I mainly focused on the general banking

activities & trade financial activities of Bank Asia, MCB banani branch.

3.1 General Banking:

General banking is the starting point of all the banking operations. It is the department which

provides day-to-day services to the customers. Every day it receives deposits from the customers

and meets their demand for cash by honoring cheques. It opens new accounts, remit funds, issues

bank drafts and pay orders etc. Since bank is confined to provide the services every day, general

is also known as retail banking.

Bank Asia Ltd. is providing modern banking facilities to the customer. It is committed to fulfill

every possible customer need with high efficiency and satisfaction. Its team of dedicated

professionals is committed to provide an unparalleled service and to bring maximum benefits for

the customers, the shareholders and the society at large. Its a great pleasure of Bank Asia to

introduce following services.

In general banking department Bank Asia Limited is divided into several parts. They are as

follows:

1. Cash

2. Account Opening

3. Accounts

4. Reception

5. Customer service

26

As I was in the customer service desk, so I will mainly focus the dealings of customer service

desk of Bank Asia, banana branch.

3.2 Accepting Deposits

Bank Asia Limited accepts the deposits like other banks may be classified into:

1) Demand Deposits :

These deposits are withdrawn able without notification e.g. current deposits bank

Asia Limited accepts demand through the opening of a) Current account b) Savings account

2) Time Deposits:

Time deposits are payable at a fixed date of after period of notice. Bank Asia

Limited accepts time deposits through fixed deposits receipt (FRD), short term deposit (STD).

While accepting these deposits a contract is made between the bank and the customer.

In customer service section, I have seen first and then I have opened the following accounts:

Savings Bank (SB) Account.

Current Deposit (CD) Account.

DPS.

FDR.

3.3 Procedure for opening of accounts

1) I have seen that the customer service officer wants to know whether the customer has an

introducer or not (the introducer must be an account holder with the bank or an officer of the

bank who is authorized to sign on behalf of the bank). If yes then the officer gives him/her an

Account Opening Form along with Specimen Signature Card and requests the customers are

filling up the form appropriately and submit the form with essential documents.

27

2) Then the customers submit the account opening form with the following documents:

Two copies passport size photographs of the applicant attested by the introducer name

and one copy passport size photograph of the nominee attested by the applicant name.

Signature Card duly singed by the applicant name and his/her signature.

A/c opening form appropriately filled up.

Copy of passport/ National ID card/ Certificate from Ward Commissioner or Union

Perished Chairman. One should need must to open a new account.

Any other documents required by the bank time to time

After getting the required documents, the customer service officer will proceed as follows:

Examine the form and the attach documents with the form. Personal information and

nominee information is must to fulfill.

Then the officer fill up the section named For Banks Use only in the Account Opening

Form and take appropriate approval from proper authority. Upon approval officer will

Open the account in the name of applicant by giving posting in Banks computer system

STELAR.

The applicant must deposit 5000 taka to the cash counter to open a new account.

After opening of an account Bank sends Thanks Letter to the new client stating thanks

and gratefulness to the new customer for making relation with the bank. Another purpose

of this letter is to confirm the correctness of the customers address.

28

3.4 Other Services of Customer Service Desk:

a) ATM Service: If any customer wants to have an ATM card, at first he/she needs to fill

up a form. This is known as ATM request form. The ATM issue charge is Tk.345.00

where Tk.300.00 is the card charge and Tk.45.00 VAT is taken to issue the ATM card.

Using stealer the customer service officer request for the card. After the request it takes

around 5 to 7 working days to get the card in the branch. Then customer service officer

call the customer and give the card to the customer after verifying the signature using

the stealer. After providing the card to the customer, it takes 12 or maximum 24 hours to

activate.

b) Solvency Certificate: If any customer wants to have a solvency then he/she must have

good transaction volume and minimum Tk.1, 00,000.00 balance in the account. The

Solvency issue charge is Tk.230.00 where Tk.200.00 is the issuance charge and

Tk.30.00 is taken as VAT.

c) Statement Certificate: If any customer ask for a statement, customer service officer

provide the statement right way. But before that customer needs to fill up a statement

request form, mentioning from which date to which date he/she needs the statement?

After that the service officer provides that statement to the customer. All the statements

are system generated and Bank Asia Limited do not require any sign or date to verify

these statements but the will provide the sill of the bank with the branch name in each of

the statement page. The statement charge is Tk.58.00 per page, where Tk.50 is charged

as the service charge and Tk.8.00 as VAT.

d) DPS: To start a DPS account a customer must have a saving account at first. After

having that saving account the customer can start a DPS account. Actually, the DPS

account is linked with the saving account, for this a customer must need to start the

saving account first. The DPS opening date is 1

st

to 10

th

day of every month. The DPS

rate is Bank Asia Limited is from 11.20% to 11.87%. It will vary depending on the

tenure of the DPS. Bank Asia Limited has DPS of minimum 3 years and the maximum

29

length is 12 years. A customer can give the DPS amount any time during a month. But,

from 1

st

to 10

th

of every month there is no additional charge. If a customer unable to pay

the DPS amount within 10

th

of that month then he/she needs to pay TK.50.00 extra as

penalty charge.

e) FDR: A customer can open a FDR any time in the bank during the working hour. But, at

1

st

he/she needs to fill up an individual form. The customer must provide the nominee

picture, signature and other required document properly to have an FDR account. Bank

Asia Limited has different FDR rate for different tenure. Most popular FDR is for the

months and the rate of interest is 9.8%. Bank Asia Limited offer auto renewal system,

that means if any customer does not want to withdraw the interest amount it will be

renewed with the interest amount for the next time. Bank Asia Limited also provides

double benefit scheme. Any amount is double within 5 years and 6 months. But for an

individual minimum amount should be Tk.1, 00,000.00 and maximum amount can be

Tk.40, 00,000.00.

f) Pay-order: Pay-order is one of the most essential services of Bank Asia Limited. In a

working day around 20 to 30 pay-order is being issued. If any customer wants to issue a

pay order he/she needs to fill up a pay order form. After that, the pay-order is issued

using the stealer system. Then customer officer write that pay-order manually. For

Tk.1.00 to up to Tk.2, 00,000.00 the pay-order service charge is Tk.58.00 where

Tk.50.00 is taken as pay-order charge and Tk.8.00 as VAT. And from Tk.2, 00,001.00

up to any amount the pay-order charge is Tk.87.00 where Tk.75.00 is taken as charge

and Tk12.00 as VAT.

g) Fund Transfer/ Cheque transfer: Using a form or cheque a customer can transfer the

balance to another account he/she wants to. In each day around 15 to 20 transaction

occurs where customer wants to transfer the fund. The customer uses these services to

maximize the business and to minimize the time by not travelling far.

30

h) Salary: In Stealer there is a section named batch. Doing batch transaction salary is being

posted to the particular account. The customer service officer needs to be extra careful

while giving a salary. The officer basically check the name, account number and amount

then post the salary to a particular account. There are around 50 large companies provide

salaries to their staffs using Bank Asia Ltd, MCB Banani Branch.

i) Cheque Request: When a customer is short of cheque book leaves they can easily fill

up the form which is given with every cheque book issue and ask for a new cheque

book. Bank Asia Limited; provide 2 different types of books. One type of books

contains 10 leaves and another contains 25 leaves. For 10 leaves Tk.35.00 is charged

and for 25 leaves, Tk. 87.00 is being charged.

Those are among the most common services that I was able to see while working in Bank Asia

Limited, MCB Banani Branch. I must admit there customer service department is very efficient,

prompt and dedicated. There customer service officers are always keen to give proper attention

to the customer. That is why they are able to retain smooth growth in every year. There officers

are very friendly, always willing to keep close relationship with the entire customer. I was really

lucky that I could see their service and also I was a part of their customer service team. This

department helped me a lot to learn how to deal with an individual. It helped me to build up the

self confidence; I will need to work in any work place. I believe in myself now. Though it seems

it is so tough to meet the expected expectation of the customer, I am sure; I will be able meet that

level and I will be able to handle such a work load that I saw almost every day while working in

Bank Asia Limited.

31

3.5 Trade Financial Activities (Foreign Trade Department):

Foreign exchange is an important department of Bank Asia Limited, which deals with import,

export and foreign remittances. Foreign Exchange is an International Department of the Bank. It

facilitates international trade through its various modes of services. It bridges between importers

and exporters. This department mainly deals in foreign currency, thats why it is called foreign

exchange department.

Foreign trade department plays an important role for bank Asia as well as it contributes in

the growth of our national economy. Like other departments of Bank Asia Limited

also gives emphasis on smooth and quick service for this particular department.

Foreign trade consists of export and import of goods and services from a country. It is an integral

part and parcel of foreign exchange. It refers business performed by the buyer and seller

participating from different country holds distinctive cultural values, normative beliefs and

ideology. Some country has special advantage to produce certain items while other country

possesses dearth of facility.

Foreign Trade includes:

Import

Export

Trade Finance is the science that describes the management of money, banking, credit,

investments and assets for international trade transactions. Trade Finance enables credit worthy

businesses to fund purchases from suppliers (particularly wholesalers, distributors and

manufacturers.)

The institutions or transaction involved in the financing of international trade. Trade finance

looks at banks credit agencies, insurers, forfeiters, and any other person or institution that

enables importers and exporters to trade across borders. Trade finance is related to international

32

trade. While a seller (the exporter) can require the purchaser (an importer) to prepay for goods

shipped, the purchaser (importer) may wish to reduce.

3.5.1 Major functions of the foreign department:

Collection of foreign documentary and clean bills.

The main importance of my duties and responsibilities is to do the report in the Bangladesh

Bank. So that the central bank can know how much export and import is being done in our

country yearly. When I have placed this information in the system, according to its code, it is

then placed with the Bangladesh Banks system.

This is an important task because with this the Government of the country will be able to know

how much export and import is being done yearly so that they can make the budget much more

comprehensive for the people of Bangladesh and also some following facts are mentioned here:

33

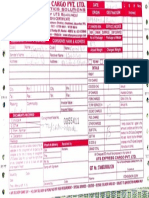

3.5.2 Import Department

Imports are foreign goods and services purchased by consumers, firms, & Governments in

Bangladesh. The importers are asked by their exporters to open letter of credits so that their

payment against goods is ensured.

3.5.3 Import Producer

To import through a customer requires-

Bank account

Import registration certificate (IRC)

Taxpaying identification number

Preformed invoice indent

Membership certificate

LCA (letter of credit authorization) form duly attested

One set of imp form

Insurance cover note with money receipt other import procedure can be shown by

the following flow chart.

34

3.5.4 Tasks which are performed here

The following things are done in this department:

Total supervision of Import Department (Cash/Back to Back L/C)

Foreign Correspondence related to above

Payment of Back-to-Back L/C and endorsement of Export L/C against payment

Follow-up of Back-to-Back overdue bills

Correspondence regarding Back-to-Back L/C and Cash L/C

Maintenance of Due Date Diary

Maintenance & record of related L/C Documents

Audit Compliance

Matching of Bill of Entry with IMP

follow-up of pending Bill of Entry Quarterly Statement

Batch Checking

Checking lodgment, retirement of Import documents under Back-to-Back L/C

Issuance of Shipping Guarantee (Back to Back L/C)

IMP Form Fill-up (Cash L/C)

Inform negotiating Bank about maturity date of Back-to-Back L/C

Maintenance & Record of related L/C (s) & Documents

Credit Report

Preparation of monthly foreign exchange business position

L/C Lodgment (Cash)

Checking of Cash L/C documents

Differed Payment (Cash)

Follow-up of outstanding BLC

35

3.5.5 Export

Pre-shipment advance

Purchase of foreign bills

Export guaranties

Advising/ Confirming letter of credit

Advance against bills for collection.

3.5.6 Methods of trading

Four common methods of conducting international trade are-

Open account

Advance payment

Documentary collections

Letters of credit

3.5.7 Open account:

Under an open account payment method, title to the goods usually passes from the Seller to the

Buyer prior to payment. Open account terms give the maximum security to the buyer and

represent the greatest risk to the seller. This mechanism offers the seller no protection in case of

non-payment. Furthermore, there may be a time delay in payment. This form of payment is used

when the seller has enough trust in the buyer's ability and willingness to pay once the goods have

been shipped, provided the buyer's country makes it possible for the buyer to effect payment as

promised.

3.5.8 Advance payment:

The name suggests that, it is the system where the importer pays first, and then the exporter

dispatches the goods. Advance payment is often used when the buyer is not known to the seller.

36

3.5.9 Documentary collections:

In that trading method, the seller dispatches the goods to the buyers by sea or any other

transports. The goods are loaded onto a ship at sellers port. The ship sails to importers port. The

carrier (shipping company) gives the exporter a bill of lading. This serves as a receipt for the

goods, and is also a document of title. The buyer must have this document of title (B/L) in order

to claim the goods at their destination. After the goods are dispatched, the seller sends to its

bank:

I. A request for payment (a B/E)

II. The Bill of Lading (receipt & document of title)

III. All the other documents relating to the transaction.

Other documents typically include- invoice, insurance certificate, packing list, etc. These are all

sent to the exporters bank along with the request for payment and instructions to the bank. The

bank sends the Bill of Exchange (request for payment) and all the documents to the importers

bank. The importers bank presents the bill of exchange to the importer. Bills of Exchange can be

drawn payable upon presentation (Sight bill); or if the exporter wishes to extend credit to the

importer, the bill may be payable at a later date (Usance bill / Term bill). In this case, the

exporter wants the buyer to pay for the goods immediately. Once the buyer has paid for the

goods, the overseas bank releases the documents (including the B/L). So, the importer now has

the Bill of Lading and so has control over the goods. So, they can claim the goods. The overseas

bank will only release the document of title (in this case a bill of lading) only when the importer

has paid for the consignment (or has agreed to pay by accepting a term bill). So, in a

documentary collection, the exporter instructs the overseas bank to Obtain payments from the

importer (or for a term bill, an agreement to pay) then release the document.

37

Importer Sale/Purchase

Contract

Exporter

7. Presents

Document

s

5. Makes

payment by

negotiating

documents

3. Advises

or confirm

the L/C

1. Apply

in

writing

to issue

L/C

8. Makes

Payment

against

Documents

2. Issue

L/C

4. Submits

Documents

Issuing Bank

Advising/

Negotiating

Bank

6. Forward

Document

s

Reimbursing Bank

Reimbursement

Claim

Reimbursement

Instruction

Importer

Sale/Purchase

Contract

Exporter

Figure: Graphical representation of trading Procedure.

38

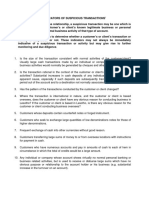

3.5.10 Documentation Letter of Credit (Imp/Exp Documentation)

Documentary letter of credit is such kinds of commercial letter which a bank issue on behalf of

foreign seller (exporter) according to the direction of the (importers) purchasers. The documents

shown under are known as export documents from the importer's side. These are:-

(i) Bill of exchange: The bill of exchange is that particular instrument through which payment is

effected in trade deals internal and international. The payment for the goods is received by the

seller through the medium of a bill of exchange drawn on the buyer for the amount depending on

the contract. It is a negotiable instrument. There are five main parties involved in a bill of

exchange. They are:-

(a) Drawer

(b) Drawee

(c) Payee

(d) Endorser

(e) Endorsee

(ii) Bill of lading: A bill lading is a document of title to goods entitling the holder to receive the

goods as beneficiary or endorsee and it is with the help of this document on receipt from the

exporter that the importer takes possession of the goods from the carrying vessel at the port of

destination.

(iii) Airway bill / Railway receipt: When goods to be transported are small in bulk or requiring

speedy delivery or those are perishable in nature on the deal is in between the neighboring

countries then mode of transports other than shipping may be resorted to far the carriage of the

goods Airways bill / Railway receipt take place of Bill of lading depending on the nature of the

carrier.

(iv) Commercial invoice: It is the seller's bill for the merchandise. It contains a description of

goods, the price per unit at a particular location, total value of the goods, packing specifications,

terms of sale, letter of credit, bill of lading number etc. There is no standard form far a

commercial invoice. Each exporter designs his own commercial invoice form. The invoice is

made out by the seller under his signature in the name of the buyer and must be submitted in a

39

set of at least 3 copies. Its main purpose is to check whether the appropriate goods have been

shipped and also that their unit price, total value, marking on the package etc. are consistent with

those given in other documents.

(v) Insurance policy: In the international trade insurance policy is a must to cover the risk of

loss on consignments while they are on seas, roads, and airways. The insurance is the

responsibility of the buyers (consignee) under FAS, FOB and C&F contracts and of the seller

(consignor) under CIF contract. The policy must be of the type as specified in the relative

contract / credit. The policy would be for the value of CIF price plus 10 (ten) percent to cover the

expenses and that is required to be obtained in the same currency as that of the credit and dated

not later than the date of shipment with claims being payable at the destination. It must be

properly stamped. Like a bill lading it must be negotiable and be endorsed where it is payable to

order.

(vi) Certificate of origin: This is a certificate issued by a recognized authority in exporting

country certifying the country of origin of the goods. It is usually by the Chambers of commerce.

Sometimes, it is certified by local consul or Trade Representative of the importing country as per

terms of the credit.

(vii) Packing list : The exporter must prepare an accurate packing list showing item by item, the

contents of the consignment to enable the receiver of the shipment to check the contents of the

goods, number and marks of the package, quality, per package net weight, gross weight,

measurement etc.

(viii) Weightiest and Measurement: Issued by recognized authority (like chambers of

commerce and industry) in exporting country certifying correct weightiest and measurement of

the goods exported.

(ix) Bill of entry: A bill of entry is documents which contain the particulars of the imported

goods as well as the amount of customs duty payable.

40

The exporter submit the following papers/documents to the Negotiating bank:

i) Bill of exchange / Draft.

ii) Bill of lading.

iii) Airway bill / Railway receipt.

iv) Commercial invoice.

v) Insurance policy.

vi) Certificate of origin.

vii) Packing list.

viii) Weightiest & measurement list.

ix) Other etc.

The negotiating bank after received the above documents / papers then this bank scrutiny the

documents. The negotiating bank sends the original shipping documents to the L/C opening bank

and keeping the second copy with the negotiating bank.

3.5.11 Parties Involve with L/C

Importer /Buyer/Opener/Applicant

Applicant is the people who request/instructs the opening bank to open a L/C. He is also known

as importer /buyer /consignee.

Opening /Issuing Bank

Opening /issuing Bank is the bank which opens/issues a L/C is on behalf of the importer. It is

also called the importers/ buyers bank.

Exporter /Seller /Beneficiary

Exporter /seller/Beneficiary is the party in whose favor the L/C is established.

41

Advising /Notifying Bank

Advising notifying Bank is the bank through which the L/C is advised to the exporter. It is a

bank situated usually in the exporting country and it may be a branch of the opening bank or a

correspondent bank. It may also assume the role of confirming and /or negotiating bank

depending upon the conditions of the credit.

Confirming Bank

Confirming bank is a bank, which adds its confirmation to the credit, and it is done at the request

of the issuing bank .The confirming bank may or may not be the advising bank .

Negotiating Bank

Negotiating bank is the bank, which negotiates the bill and pays the amount to the beneficiary. It

has to carefully scrutinize the documentary credit before negotiation in order to see whether the

documents apparently are in order or not. The advising bank and the negotiating bank may not be

one and the same. Sometimes it can also be the confirming bank.

Paying /Reimbursing Bank

Paying /Accepting Bank is the bank on whom the bill will be drawn (as per condition of the

credit). It is nominated is the credit to make payments against stipulated documents complying

with the terms of the credit. It may or may not be the issuing bank.

42

3.5.12 How the L/C is Open

The following steps are followed while a L/C is opened:

a contract and issue a PI (Performa Invoice) before a

letter of credit has been issued.

have to use his credit lines.

redit that is channeled through its overseas correspondent

bank, known as the advising bank.

credit.

other documents from relevant parties. All these documents will be sent to his banker, which is

acting as the negotiating bank.

such case, he obtains payment immediately upon presentation of documents. If not, the

documents will be sent to the issuing bank for payment or on an approval basis as in the next

step.

Documents are sent to the issuing bank (or reimbursing bank, which is a bank nominated by

the issuing bank to honor reimbursement from negotiating bank) for reimbursement or payment.

dition that the

documents comply with the letter of credit terms and conditions.

or against the latters trust receipt facility.

f goods upon presentation of the transport (usually shipping)

documents.

43

3.5.13 Operations of Documentary Letter of Credit

The following five major steps are involved in operation of a documentary letter of credit:

1. Issuing.

2. Advising

3. Amendment (if necessary)

4. Presentation and

5. Settlement.

44

CHAPTER: FOUR

SWOT ANALYSIS OF BANK ASIA LTD.

45

SWOT Analysis Summary:

Table-9: SWOT summary for Bank Asia

STRENGTH

-Trustworthy image among public

-Brand image.

-Strong network of Branches.

-Reputed as a good employer

-Devotion to IT and technology.

-Creating and sustaining effective

leadership.

-Learning organization.

WEAKNESS

-Less market share.

-Criticism with customer service in

branches.

-Lack of segment oriented offering.

-Poor advertising and promotions:

-Lack of Co-ordination between Central and

-Branch Office employees.

-Criticism of poor ATM Service.

OPPORTUNI TY

-E-commerce.

-Introduce special credit cards for

privileged clients.

-Establish remote financial kiosk.

THREAT

-Economic downturn.

-Decline in value of Taka.

-Increased competition.

-Upcomig Political Unrest.

-Increased government regulation may

increase cost or reduce profit.

SWOT

46

CHAPTER: FIVE

Lessons Learned From the Internship

Program

47

Chapter Five: (LESSONS LEARNED FROM THE INTERNSHIP PROGRAM)

5.1. Implications to Organization/Company Based Affiliation

The software and make it user friendly so that the software could run easily and the user

can work swiftly within short period of time. Therefore, the management needs to notice

this particular problem faced by the employees, otherwise everyone will have to suffer.

I just learn how to communicate to each other. Because there is lots of pressure in the

work side.

It has been a three months period of time I spend with this bank and learned many

working criteria of banking sector like how to deal with the customers, how to open the

account of an individual or of a firm. My main focus was the Trade Finance Department

where I have worked and prepared my report based on this area.

The customers are the main part of any kind of banking sector. To assess their mind is

very tough for the banking people. Because the customers try to find the best service and

they will go that bank which are provided lots extra facilities. So I learned that how to

assess the customers mind.

Microsoft Office 2003 and Microsoft Office 2007 are the most useful of all. MS Word and MS

Excel are two most important soft-wares for the overall database and documentation process. And

In my 3 month internee period I just learn lots of excel and word related work. And this skill can

help me in my future work.

5.2. Implications to Universitys Internship Program

An implication to universitys internship program is to build a good relation with the

organization. Because each student represents his/her university. If they create good sign in

organization it also increases universitys reputation. So students are the main part if they work

well in any organization its good for them also for the university. If they create goodwill in

organization, sometimes organizations recruit them. And it is very helpful for students and it also

increases universitys goodwill. So internship program is important for university and students

both. And this internship program can help to make a better future for the students.

48

5.3 Problem faced while working:

Lots of problems have arisen while working in Bank Asia. Most common problem is in the

system software named Staler, where lots of information is required to update. I personally feel

that these are some of the following problems I have faced while performing my tasks:

Sometimes the software is hanged and it becomes so slow that it is difficult to work on it

which is why we need to wait for some time to make it user friendly.

While reporting in the Bangladesh Bank, some goods country code and HS code is not

found Therefore it takes time to complete the work.

Sometimes the workplace makes me monotonous because it is difficult to concentrate on

the same work again and again.

Everyone is busy in their work so they cant give me lot more time to learn lot more

thinks about the bank.

Export Register is not available in the system so it is difficult for them to work

As there is huge pressure in the customer service desk, as people are coming to receive

different kind of services it is sometimes hard to maintain proper concentration and huge

causes mistakes.

49

CHAPTER: SIX

Recommendation

50

6.0 Recommendation:

I have observed some important operational activities of the bank. On the basis of my inspection

I would like to recommend the following suggestion-

Though the performance of general customer service is good, and their employees are

well trained but shortage of employees and lack of space, employees cannot provide

better service to the customer. So the authority ensuring this facility to provide good

customer service, which will bring efficiency of the banks operation

Make a good relationship or respect to the other employee

Should increase the number of ATM booth. And also ATM processing system should be

improve.

The loan approve process should be easier that the clients can feel convenient to take loan

from the bank.

IT division must be developed.

Should increase the space inside the branch especially in the cash counter & customer

service.

Bank should introduce more promotional programs for the customers.

Conduct quarterly or half-yearly economic analysis of existing industries of the country

to point out profitable sectors to invest this analysis will help to create a separate

investment portfolio for the bank.

Introduce a special yearly bonus for achieving the target set by the bank. Target will be

set by senior authority based on the overall condition of the market. This bonus will

motivate employees to give more of their effort, which will possibly become fruitful for

the bank.

51

CHAPTER: SEVEN

Conclusion

52

7.0 Conclusion:

Bank Asia Limited is one of the most successful bank of our country. In this report an honest attempt is

made to describe the General banking & Trade financial activities of Bank Asia Limited. I did my

internship program in Bank Asia Limited, Banani Branch. Here, I have got an overall knowledge

about the bank operation, but my main focus was in General Banking & Foreign Exchange

Department. Internship program is very important for every BBA student because it helps to

make real life experience in the business world. And Also it enhances the self confidence of the

student which will help him/her to survive in the competitive corporate world in the future. I am

greatly indebted to all the three departments: General Banking department, Trade Finance

Department and Credit department of MCB Banani Branch for their continuous support and

inspiration during the period of Internship.

53

References

www.bankasia-bd.com (Official website of Bank Asia Limited)

Bank Asia Limited, Annual Report 2013

Corporate Outlook- September 30, 2013 (www.bankasia-bd.com)

http://www.bankasia-bd.com

http://www.bankasia-bd.com/home/vision

http://www.bankasia-bd.com/home/sme_banking

http://www.bankasia-bd.com/home/retail_banking

http://www.bankasia-bd.com/home/soc

http://www.bankasia-bd.com/home/branch

You might also like

- Mercantile Law) Practical Exercises by Balbastro) Made 2003) by SU Law (Daki) ) 18 PagesDocument18 pagesMercantile Law) Practical Exercises by Balbastro) Made 2003) by SU Law (Daki) ) 18 PagesbubblingbrookNo ratings yet

- Law On Negotiable Instruments (Memory Aid)Document24 pagesLaw On Negotiable Instruments (Memory Aid)Christian De Leon100% (1)

- Credit InstrumentsDocument18 pagesCredit InstrumentsRichard100% (2)

- Invoice 6398Document1 pageInvoice 6398diana rodreguzeNo ratings yet

- Tax Invoice DetailsDocument2 pagesTax Invoice DetailsWall Street Forex (WSFx)No ratings yet

- Bar Examination Questionnaire On Mercantile Law MCQ (50 Items)Document14 pagesBar Examination Questionnaire On Mercantile Law MCQ (50 Items)Aries MatibagNo ratings yet

- Tachyon Communications PVT LTD: InvoiceDocument1 pageTachyon Communications PVT LTD: InvoiceVivek dubeyNo ratings yet

- FNB Verified Statement 1Document2 pagesFNB Verified Statement 1keideen178043No ratings yet

- Dishonor of ChequeDocument16 pagesDishonor of Chequeumang0987No ratings yet

- Memory Aid - COMMLDocument100 pagesMemory Aid - COMMLvoitjon100% (5)

- Invoice INV318Document2 pagesInvoice INV318shecamazicaNo ratings yet

- Tax Invoice: Name Address State State Code Description AmountDocument1 pageTax Invoice: Name Address State State Code Description AmountArun UpadhyeNo ratings yet

- October Heating Bill 2Document3 pagesOctober Heating Bill 2pypr56jt49No ratings yet

- Paycheck - 2023 11 14 - 2023 11 27Document1 pagePaycheck - 2023 11 14 - 2023 11 27cmte.pantera1No ratings yet

- Wa0038Document1 pageWa0038Rs TiwariNo ratings yet

- XELNZJYE8JLNDocument1 pageXELNZJYE8JLNAkshayNo ratings yet

- MR Aggrey J Mopikanyambi Joshua POBOX1299 Gaborone 0000: Page 1 of 3Document3 pagesMR Aggrey J Mopikanyambi Joshua POBOX1299 Gaborone 0000: Page 1 of 3AG GŕəyNo ratings yet

- BBSR SBPDocument1 pageBBSR SBPSudhir Kumar MishraNo ratings yet

- Tax Invoice: Bill ToDocument1 pageTax Invoice: Bill ToCOCA SLOTNo ratings yet

- To Be Used For Pars Service Option Only in Bond: ExpressDocument4 pagesTo Be Used For Pars Service Option Only in Bond: ExpressRidha AbbassiNo ratings yet

- Duplicate: Tax InvoiceDocument1 pageDuplicate: Tax InvoiceDevesh SharmaNo ratings yet

- Invoice RemovedDocument1 pageInvoice Removedabhishekravi793No ratings yet

- LK InvoiceDocument1 pageLK InvoicekanggadeviNo ratings yet

- Grand Total 100.00: District-Jhajjar, FC - Farrukhnagar, Jhajjar, Haryana, India - 124103, IN-HRDocument4 pagesGrand Total 100.00: District-Jhajjar, FC - Farrukhnagar, Jhajjar, Haryana, India - 124103, IN-HRrishovNo ratings yet

- Inv 004381Document1 pageInv 004381Shobhit BehalNo ratings yet

- Activa InsuranceDocument1 pageActiva Insuranceyash shahNo ratings yet

- FEE Payment Reciept ExampleDocument1 pageFEE Payment Reciept ExampleEngr GospelNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnkur RatheeNo ratings yet

- NDTL JLN STADIUM - Sept'23Document1 pageNDTL JLN STADIUM - Sept'23vineet.tpsNo ratings yet

- Yuantai Amc Invoice No.51Document6 pagesYuantai Amc Invoice No.51Saurabh K MishraNo ratings yet

- FmlpsushilDocument2 pagesFmlpsushilrabikhadka94No ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- ACFrOgBNRppEQC DWGGV uJqpoY2hX9mEFUXxqkoJ3H1DDcOVUkiRfgQzPcmy8L3bTf YT4fEZDzowwmH-17Vheg6bSrFh7rQdjy72j7ezSYoejzm3H7fDYrYo-8E5YDocument1 pageACFrOgBNRppEQC DWGGV uJqpoY2hX9mEFUXxqkoJ3H1DDcOVUkiRfgQzPcmy8L3bTf YT4fEZDzowwmH-17Vheg6bSrFh7rQdjy72j7ezSYoejzm3H7fDYrYo-8E5YArif KhanNo ratings yet

- Pari International Holidays RW27CF0084: Terms & ConditionsDocument1 pagePari International Holidays RW27CF0084: Terms & ConditionsHotel Anushri innNo ratings yet

- 150 Massar Al-Ingaz 3M Cat6 CablesDocument1 page150 Massar Al-Ingaz 3M Cat6 CablesIbrahim AljunaidiNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptalizaranniNo ratings yet

- - OIEP0173273100000007756p~: كﺮﺘﺸﻤﻟا تﺎﻧﺎﻴﺑ Customer DetailsDocument1 page- OIEP0173273100000007756p~: كﺮﺘﺸﻤﻟا تﺎﻧﺎﻴﺑ Customer Detailsمحمود المغيري محمود المغيريNo ratings yet

- Pinv12035 PDFDocument1 pagePinv12035 PDFIsaac MangochiNo ratings yet

- General Power of Atterney FormatDocument4 pagesGeneral Power of Atterney FormatArul Thangam KirupagaranNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoice2018hw70285No ratings yet

- PaymentReceipt - 6A - 61 - R - 00000137 - 1687318827937Document2 pagesPaymentReceipt - 6A - 61 - R - 00000137 - 1687318827937Ishini NadeeshaNo ratings yet

- Carolina CDL TC Enrollment ApplicationDocument2 pagesCarolina CDL TC Enrollment Application2bmnvdy7kgNo ratings yet

- In Voice 23023Document3 pagesIn Voice 23023drogonNo ratings yet

- Invoice (1377 52902)Document2 pagesInvoice (1377 52902)JonaNo ratings yet

- TASL Export Commercial Invoice (ZHEX)Document1 pageTASL Export Commercial Invoice (ZHEX)Vinod KumarNo ratings yet

- Manuel JR Del Puerto Onquit: Statement of AccountDocument6 pagesManuel JR Del Puerto Onquit: Statement of Accountlhotc421No ratings yet

- PNR Check-in Details for 3 PassengersDocument3 pagesPNR Check-in Details for 3 PassengersLove SummerNo ratings yet

- Https WWW - GoairDocument2 pagesHttps WWW - GoairALTAF HUSSAIN KAWANo ratings yet

- Equitable Banking Corporation v. Intermediate Appelate Court G.R. No. 74451Document4 pagesEquitable Banking Corporation v. Intermediate Appelate Court G.R. No. 74451Roms RoldanNo ratings yet

- 9.13.22 Dickinson TX To Bowling Green KyDocument2 pages9.13.22 Dickinson TX To Bowling Green KyalbinaaldyrakhmanovaNo ratings yet

- Sterling N ComputingDocument2 pagesSterling N ComputingSwagBeast SKJJNo ratings yet

- TGT403Document7 pagesTGT403vikasNo ratings yet

- Load Confirmation 1265437Document1 pageLoad Confirmation 1265437lesevicmarko.mlNo ratings yet

- III InvoiceDocument1 pageIII InvoiceAshu SinghNo ratings yet

- Net Star InfotechDocument1 pageNet Star InfotechRitesh pandeyNo ratings yet

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoiceমধু্স্মিতা ৰায়No ratings yet

- I CRMDocument2 pagesI CRMAnupesh PachoriNo ratings yet

- INV#23002073 Tejas Networks LTD (DTA Unit) (PO-1122201371)Document1 pageINV#23002073 Tejas Networks LTD (DTA Unit) (PO-1122201371)Venkatesan ANo ratings yet

- Tax Invoice for 100 Mbps Home InternetDocument1 pageTax Invoice for 100 Mbps Home Internetpriyank31No ratings yet

- FS 006245 Mag 06 2023Document1 pageFS 006245 Mag 06 2023grshop euNo ratings yet

- Sewa bill-AED 559Document1 pageSewa bill-AED 559muhdazarNo ratings yet

- Info Edge (India) LTD: Tax InvoiceDocument1 pageInfo Edge (India) LTD: Tax Invoicephani raja kumarNo ratings yet

- HSRP Online Appointment Transaction Receipt Rosmerta Safety Systems PVT - LTDDocument1 pageHSRP Online Appointment Transaction Receipt Rosmerta Safety Systems PVT - LTDTaj HackersNo ratings yet

- Tranf-33Tf090469450 Agent Id: Transfast:Cash Pickup Anywhere ? LBC, Bdo, Palawan, Bayad CTR, Cebuana, Mlhuillier, Gcash & MoreDocument1 pageTranf-33Tf090469450 Agent Id: Transfast:Cash Pickup Anywhere ? LBC, Bdo, Palawan, Bayad CTR, Cebuana, Mlhuillier, Gcash & MoreJacky Dupos BenyasanNo ratings yet

- UIN EXPRESS CARGO PVT. LTD. total logistics solutionsDocument1 pageUIN EXPRESS CARGO PVT. LTD. total logistics solutionsMD Amir SohailNo ratings yet

- Chapter 1 To 5Document28 pagesChapter 1 To 5Md.Amran BhuiyanNo ratings yet

- Origin of The StudyDocument23 pagesOrigin of The StudyrafiNo ratings yet

- Bank Asia LimitedDocument29 pagesBank Asia LimitedJehan MahmudNo ratings yet

- Final 501 Report EDUCATION TVDocument26 pagesFinal 501 Report EDUCATION TVAninda R. DipNo ratings yet

- Doors To The WorldDocument13 pagesDoors To The WorldGuillermo P. OrduñaNo ratings yet

- Contract Act 1872Document17 pagesContract Act 1872Aninda R. DipNo ratings yet

- Contract Act 1872Document17 pagesContract Act 1872Aninda R. DipNo ratings yet

- 507 Index NumberDocument4 pages507 Index NumberAninda R. Dip100% (1)

- Marketing Plan Template and GuideDocument29 pagesMarketing Plan Template and GuideMark WillNo ratings yet

- WPS No7Document26 pagesWPS No7Ferdous Hasan RumiNo ratings yet

- DAIBB Foreign Exchange-2Document15 pagesDAIBB Foreign Exchange-2arman_2772762710% (1)

- Form of A Complaint On Behalf of The Proprietorship FirmDocument3 pagesForm of A Complaint On Behalf of The Proprietorship Firmkinnari bhutaNo ratings yet

- Nego Notes LawphilDocument16 pagesNego Notes LawphilPatrice De CastroNo ratings yet

- Nego CodalDocument4 pagesNego CodalGines LimjucoNo ratings yet

- Premier BankDocument127 pagesPremier BankUpama MondalNo ratings yet

- Sincere Villanueva vs. Marlyn Nite - GR 148211Document4 pagesSincere Villanueva vs. Marlyn Nite - GR 148211Krister VallenteNo ratings yet

- NP727 Traveller English Amended 120821v2Document2 pagesNP727 Traveller English Amended 120821v2didinurieliaNo ratings yet

- Indicators of Suspicious TransactionsDocument3 pagesIndicators of Suspicious TransactionsArtūras CimbalistasNo ratings yet

- Regional Trade Solutions ECOBANKDocument22 pagesRegional Trade Solutions ECOBANKwatradehubNo ratings yet

- PNB v. Picornell Facts: Picornell Bought Bales of Tobacco From PNB For AnDocument6 pagesPNB v. Picornell Facts: Picornell Bought Bales of Tobacco From PNB For AnPatricia Jazmin PatricioNo ratings yet

- Negotiable Instruments Act NotesDocument71 pagesNegotiable Instruments Act Notesshubh1612100% (2)

- Boc 2016 Mercantile PDFDocument332 pagesBoc 2016 Mercantile PDFMark Catabijan Carriedo100% (1)

- Legal Aspect of Business MBA-II (22-24 Batch)Document8 pagesLegal Aspect of Business MBA-II (22-24 Batch)DiptNo ratings yet

- Ramo 1-2000Document526 pagesRamo 1-2000Mary graceNo ratings yet

- Corporate LawDocument14 pagesCorporate LawnupurNo ratings yet

- Intestate of Luther Young and Pacita Young, PACIFICA JIMENEZ vs. BUCOYDocument2 pagesIntestate of Luther Young and Pacita Young, PACIFICA JIMENEZ vs. BUCOYKaye Miranda LaurenteNo ratings yet

- Aoa of Reliance PowerDocument182 pagesAoa of Reliance PowerRaghavendra Sudhir RaghavendraNo ratings yet

- Cases 5Document4 pagesCases 5Thoughts and More ThoughtsNo ratings yet

- Case DigestDocument15 pagesCase DigestReyniere AloNo ratings yet

- Finance Act 2022Document133 pagesFinance Act 2022Protap Kumar DasNo ratings yet

- NIL ForgeryDocument1 pageNIL ForgeryZail Jeff DaleNo ratings yet

- G.R. No. 211564, November 20, 2017Document7 pagesG.R. No. 211564, November 20, 2017mondaytuesday17No ratings yet