Professional Documents

Culture Documents

Dakota Office Productss

Uploaded by

Vikas Joshi0 ratings0% found this document useful (0 votes)

45 views17 pagesDakota office products

Original Title

63650365 Dakota Office Productss

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDakota office products

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views17 pagesDakota Office Productss

Uploaded by

Vikas JoshiDakota office products

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 17

DAKOTA OFFICE PRODUCTS

Activity Based Costing (ABC)

Dakota Office Products (DOP)

Dakota Office Products is a regional distributor of office

supplies to institutions and commercial businesses. It has an

excellent reputation for customer service and responsiveness.

Product line ranges from simple writing implements like pencils

and markers to photo-copy papers.

Operation Process

Warehouse:

a. Unload truckload shipments of products from manufacturers, and

move them into their designated storage locations.

b. After receiving customer orders, DOP warehouse personnel

accumulate the cartons of items and prepare them for shipment.

Customer ordering and validation:

a. Set up a manual customer order

b. Enter individual order lines in an order

c. Validate an EDI/internet order

Orders Delivery

Commercial Trucks.

Dakota Trucks deliver

desktop packages directly

to the customer.

Pricing Structure

Marking up the purchased product cost by 15% to cover

the cost of warehousing, distribution, and freight.

Add another markup to cover the approximate cost for

general and selling expenses, plus an allowance for profit.

The markups were determined at the start of each year,

based on actual expenses in prior years and general

industry and competitive trends.

Actual prices to customers were adjusted based on long-

term relationships and competitive situations, but were

generally independent of the specific level of service

provided to that customer, except for desk top deliveries.

Current Situation

Increase In Sales

Increase In Costs

Loss in profit for the 1st Time

in the DOPs history.

Despite introducing innovations such as desktop delivery

and electronic order entry, the DOP could not earn a profit.

Activity-Based Costing Steps

Cost Object : Orders

Primary Activities

1. Process cartons in and out of the facility

2. New desk top delivery service

3. Order handling

4. Data entry.

Consumption of Resources

Cost

Activity Cost Pools & Measures

Activity Cost Pool Activity Measure

Ship Cartons Number of cartons shipped

commercial freight

Process Cartons Number of cartons ordered

Desktop Delivery Number of desktop deliveries

Process Manual Custom Order Number of orders, manual

Enter Items Ordered (Manual) Number of line items, manual

Process EDI Order Number of EDI orders

Activity Cost Pools Percentages & Amounts

Activity Cost Pools - Percentages

Ship Cartons Process Cartons Desktop Delivery

Process Manual

Customer Order

Enter Items Ordered

(Manual)

Process EDI Order Totals

Freight 100% 0% 0% 0% 0% 0% 100%

Warehouse Rent &

Depreciation

0% 100% 0% 0% 0% 0% 100%

Warehouse

Distribution Personnel

0% 90% 10% 0% 0% 0% 100%

Delivery Truck

Expenses

0% 0% 100% 0% 0% 0% 100%

Order Entry Expenses 0% 0% 0% 20% 75% 5% 100%

Activity Cost Pools - Amounts

Ship Cartons Process Cartons Desktop Delivery

Process Manual

Customer Order

Enter Items Ordered

(Manual)

Process EDI Order Totals

Freight 450,000 - -

-

- - $450,000

Warehouse Rent &

Depreciation

- 2,000,000 - - - - $2,000,000

Warehouse

Distribution Personnel

- 2,160,000 240,000 - - - $2,400,000

Delivery Truck

Expenses

- - 200,000 - - - $200,000

Order Entry Expenses - - - 160,000 600,000 40,000 $800,000

Totals 450,000 4,160,000 440,000 160,000 600,000 40,000 5,850,000

Activity Based Costing Model

Customer Profitability

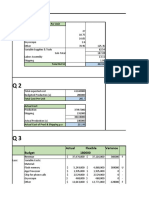

Customer Margin - Activity Based Costing

Rate/$

Customer A Customer B

Item Number of Activity Debit\Credit Number of Activity Debit\Credit

Sales

103,000

104,000

Cost of Items Purchased

(85,000)

(85,000)

Operating Costs:

Processing/Carton

52

200

(10,400)

200

(10,400)

Freight/Carton

6

200

(1,200)

150

(900)

Delivery to Desktop/Delivery

220

-

-

25

(5,500)

Process.CustomOrd/ManualOrd

10

6

(60)

100

(1,000)

EnteringItemsManual/line

4

60

(240)

180

(720)

Process EDI Order/EDI order

5

6

(30)

-

-

Interest on Accounts Receivables

0

9,000

(900)

30,000

(3,000)

Customer Margin

5,170

(2,520)

Profitability percentage(Customer Margin\Sales) 5.02% -2.42%

Differences In Profitability between

Customer A & Customer B

1. The cost of desktop delivery.

2. The processing of manual orders.

3. The cost of entering items manually.

4. The interest on accounts receivable.

Recommendations

Difference 1:

The cost of delivery to the desktop (Applying the fixed cost of the

delivery truck expenses on the Desktop delivery on the customers

who have used it will lower the profitability of these customers)

Recommendation:

Using only the shipping by commercial trucks

Make use of Dakotas truck fleet in another activities as to lower the

delivery truck expenses portion applied on theses customers

Recommendations

Difference 2 & 3:

The processing of manual orders & the cost of entering items

manually.

Recommendation:

Increase the pricing on Customer B to cover the loss incurred from

this activity.

Encourage customer B on using the EDI and the Internet for

placing their sales orders by offering them a competitive pricing

when using these two tools.

To encourage Customer B on placing bulk orders rather than small

orders, this will save the time of processing manual orders.

Recommendations

Difference 4:

The interest on accounts receivable - Customer B is consuming

much more from Customer A by applying the 10% interest Rate.

This lost amount is a cost that needs to be figured out on how to

lower it as it is lowering the cash flow and it disables the company

capability in using it in other opportunities.

Recommendation:

To have an agreement with customer B on the payments due date

by encouraging them with a price discount.

Conclusion

From applying the activity based costing the company

could find the activities lowering the profit.

It gives a base for further decision making to:

Enhance the operations,

Remove the unneeded activities,

Increase the profit.

It gives a realistic costs on the designated cost objects

(Order) in our case

You might also like

- Dakota Office Products Activity-Based Costing Case StudyDocument5 pagesDakota Office Products Activity-Based Costing Case StudyAriyo Roberto Carlos BanureaNo ratings yet

- Dakota Office Products CaseDocument3 pagesDakota Office Products CaseKambria Butler89% (18)

- Case Analysis of Dakota Office ProductsDocument12 pagesCase Analysis of Dakota Office ProductsAditi2303100% (2)

- Dakota Office Products - Case StudyDocument7 pagesDakota Office Products - Case Studynicolasv100% (2)

- Dakota AnalysisDocument13 pagesDakota Analysistonylcaston100% (2)

- Dakota Office ProductsDocument17 pagesDakota Office Productsamitdas200867% (3)

- Week 3 Individual Case - Dakota Office Products Case StudyDocument9 pagesWeek 3 Individual Case - Dakota Office Products Case StudyMoriba TourayNo ratings yet

- Why was Dakota's existing pricing system inadequateDocument10 pagesWhy was Dakota's existing pricing system inadequatesourabhphanaseNo ratings yet

- Dakota Office ProductsDocument10 pagesDakota Office ProductsMithun KarthikeyanNo ratings yet

- DakotaDocument5 pagesDakotaMadhavi SerenityNo ratings yet

- Dakota Case Activity-Based Costing SolutionDocument6 pagesDakota Case Activity-Based Costing SolutionKamruzzamanNo ratings yet

- Solution To Dakota Office Product ProblemDocument3 pagesSolution To Dakota Office Product ProblemRehanBhagat0% (1)

- Dakota Office ProductsDocument4 pagesDakota Office Productsrahulchohan21080% (1)

- Marion Case Study PracticeDocument6 pagesMarion Case Study Practicechomka0% (1)

- Davey Brothers Watch Co. SubmissionDocument13 pagesDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNo ratings yet

- Danshui Plant 2 - 2019Document19 pagesDanshui Plant 2 - 2019louie florentine Sanchez67% (3)

- Danshui PlantDocument5 pagesDanshui PlantSabbirAhmedNo ratings yet

- Classic Pen Company: Case Analysis - Activity Based Cost System Group - 07Document16 pagesClassic Pen Company: Case Analysis - Activity Based Cost System Group - 07Anupriya Sen100% (1)

- Case: Danshui Plant No. 2: Presented By:-Group 9Document7 pagesCase: Danshui Plant No. 2: Presented By:-Group 9LOKESH YADAV100% (2)

- Danshui Plant 2 - Group 6 - Section BDocument13 pagesDanshui Plant 2 - Group 6 - Section BSoumyajit Lahiri100% (8)

- Danshui Plant No. 2Document2 pagesDanshui Plant No. 2Sahil Kashyap83% (6)

- SectionB Group16 DanshuiDocument5 pagesSectionB Group16 DanshuiRishabh Vijay100% (1)

- Classic Pen Company Activity Based CostingDocument16 pagesClassic Pen Company Activity Based CostingIndahKusumawardhaniNo ratings yet

- Estimate break-even quantity for iPhone 4 using cost dataDocument1 pageEstimate break-even quantity for iPhone 4 using cost dataAnkit VermaNo ratings yet

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (1)

- Seimens Electric Motor WorksDocument5 pagesSeimens Electric Motor WorksShrey BhalaNo ratings yet

- Danshui Plant No 2Document5 pagesDanshui Plant No 2Thao Nguyen100% (2)

- Magal Murthi Case StudyDocument3 pagesMagal Murthi Case Studyrajesh0% (3)

- Case Study: Danshui Plant No2Document3 pagesCase Study: Danshui Plant No2Abdelhamid JenzriNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma0% (1)

- Dan ShuiDocument12 pagesDan ShuiSai KiranNo ratings yet

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionKaushal Agrawal100% (1)

- Siemens Electric Motor Works (A) Assignment QuestionsDocument3 pagesSiemens Electric Motor Works (A) Assignment QuestionsDeana Chandler Jackson100% (2)

- Classic Pen Company Costing Analysis CaseDocument4 pagesClassic Pen Company Costing Analysis CasemokotoNo ratings yet

- Siemens CaseDocument4 pagesSiemens Casespaw1108No ratings yet

- Wllkerson Company operating results valves pumps flow controllersDocument2 pagesWllkerson Company operating results valves pumps flow controllersdp14No ratings yet

- Balance Sheet as of March 30th 2006Document6 pagesBalance Sheet as of March 30th 2006subratajuNo ratings yet

- SiemensDocument10 pagesSiemenssharadharjai100% (2)

- Activity-Based Cost Systems: The Classic Pen Company A Case AnalysisDocument14 pagesActivity-Based Cost Systems: The Classic Pen Company A Case AnalysisSarveshwar Sharma50% (2)

- Case ColorscopeDocument7 pagesCase ColorscopeRatin MathurNo ratings yet

- Lilac Flour Mills: Managerial Accounting and Control - IIDocument9 pagesLilac Flour Mills: Managerial Accounting and Control - IISoni Kumari50% (4)

- MAC Davey Brothers - AkshatDocument4 pagesMAC Davey Brothers - AkshatPRIKSHIT SAINI IPM 2019-24 BatchNo ratings yet

- SiemensDocument7 pagesSiemensshshank pandeyNo ratings yet

- Colorscope 1Document6 pagesColorscope 1Oca Chan100% (2)

- Colorscope ExcelDocument11 pagesColorscope ExcelPriyabrat Mishra100% (1)

- Hallstead Jewelers Case Presentation AnalysisDocument9 pagesHallstead Jewelers Case Presentation Analysiskaran_w350% (4)

- E0311 Hallstead JewelersDocument2 pagesE0311 Hallstead Jewelersaltemurcan kursunlu100% (1)

- iPhone 4 Contract ProblemsDocument10 pagesiPhone 4 Contract ProblemsPulkit ChawlaNo ratings yet

- Costing Systems Reveal True Product MarginsDocument1 pageCosting Systems Reveal True Product Marginsfelipevwa100% (1)

- Dhanshui PlantDocument7 pagesDhanshui PlantAkanksha Nikita Khalkho100% (1)

- Variable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesDocument6 pagesVariable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesArindam MandalNo ratings yet

- A - 2021MBA051 - Mohammed Suhaim A G - DakotaCaseDocument6 pagesA - 2021MBA051 - Mohammed Suhaim A G - DakotaCasemohammedsuhaim abdul gafoorNo ratings yet

- Allied Office ProductDocument26 pagesAllied Office ProductAnanda Agustin Fitriana100% (1)

- Allied Office ProductsDocument10 pagesAllied Office Productsdian ratnasari100% (7)

- Dakota Office ABC AnalysisDocument11 pagesDakota Office ABC AnalysisShibani Shankar RayNo ratings yet

- 8.1 Allied Office Product Case McsDocument5 pages8.1 Allied Office Product Case McsMahfoz Kazol100% (1)

- Allied Services Case Study-ABC CostingDocument20 pagesAllied Services Case Study-ABC CostingSavita Soni100% (4)

- Management Control SystemDocument9 pagesManagement Control SystemAyushi JalanNo ratings yet

- Why Dakota's pricing was inadequate for its operating environmentDocument2 pagesWhy Dakota's pricing was inadequate for its operating environmentaman KumarNo ratings yet

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Thesis Chapter 1Document5 pagesThesis Chapter 1Thomy EsNo ratings yet

- C.H. Robinson logistics services guideDocument4 pagesC.H. Robinson logistics services guidepradyum kumarNo ratings yet

- Annual Report - 2015Document158 pagesAnnual Report - 2015Anonymous oWCnglbYgNo ratings yet

- Presented By:: Aastha Garg Akanksha Malhotra Manasvi Singh Mayank Kapoor Mohit Bhambri Pankul Ashok Parv BansalDocument26 pagesPresented By:: Aastha Garg Akanksha Malhotra Manasvi Singh Mayank Kapoor Mohit Bhambri Pankul Ashok Parv BansalShilpi PachauriNo ratings yet

- Quality Control Process Chart: Prototype Pre-Launch ProductionDocument2 pagesQuality Control Process Chart: Prototype Pre-Launch Productionmaria katherine pantojaNo ratings yet

- Module 5 INVENTORIES AND RELATED EXPENSESDocument4 pagesModule 5 INVENTORIES AND RELATED EXPENSESNiño Mendoza MabatoNo ratings yet

- Blue Ocean Strategy Daraz - PK (Msvi)Document28 pagesBlue Ocean Strategy Daraz - PK (Msvi)shavaisNo ratings yet

- Veggie KartDocument18 pagesVeggie KartSoumya Ranjan SwainNo ratings yet

- Preservation of Production of Crops in IndiaDocument22 pagesPreservation of Production of Crops in IndiaXoni SK JhaNo ratings yet

- Reducing Logistics Costs in International Physical DistributionDocument12 pagesReducing Logistics Costs in International Physical DistributionLuis Enrique HernadezNo ratings yet

- Palm Oil BusinessDocument8 pagesPalm Oil BusinessAzike NnamdiNo ratings yet

- ERP Implementation in Food IndustryDocument7 pagesERP Implementation in Food IndustryKavan ChhedaNo ratings yet

- Industrial Building Allowance (IBA)Document32 pagesIndustrial Building Allowance (IBA)Ee LynnNo ratings yet

- Fundamentals of Warehouse Operations Space, Equipment and HRDocument16 pagesFundamentals of Warehouse Operations Space, Equipment and HRAinIdris 1007No ratings yet

- CH 4 FinalDocument31 pagesCH 4 FinalSudip BaruaNo ratings yet

- Ch-5 Audit of InventoryDocument30 pagesCh-5 Audit of InventoryTesfaye SimeNo ratings yet

- Final SCMDocument92 pagesFinal SCMNiro ThakurNo ratings yet

- Multicriteria Inventory Model For Spare Parts PDFDocument6 pagesMulticriteria Inventory Model For Spare Parts PDFsaeedalemveNo ratings yet

- WAREHOUSING MANAGEMENT FinalDocument31 pagesWAREHOUSING MANAGEMENT FinalEr Rahul Punk RockNo ratings yet

- Booklet On Covid-19 Vaccines: Luisa Fernanda Londoño Cadavid Mariana Restrepo Londoño Fernando Mejia QuinteroDocument3 pagesBooklet On Covid-19 Vaccines: Luisa Fernanda Londoño Cadavid Mariana Restrepo Londoño Fernando Mejia QuinteroMariana RestrepoNo ratings yet

- Principles of Marketing Finals Section B Jazemaine Francis Y1G2Document7 pagesPrinciples of Marketing Finals Section B Jazemaine Francis Y1G2Jazemaine FrancisNo ratings yet

- Merchandising and Supply Chain Management - Unit 2 - Introduction To Retail Supply ChainDocument28 pagesMerchandising and Supply Chain Management - Unit 2 - Introduction To Retail Supply Chainsonam agrawalNo ratings yet

- HAKIMAHDocument21 pagesHAKIMAHVelan SupramaniamNo ratings yet

- SAP EWM T-Codes for Warehouse ManagementDocument12 pagesSAP EWM T-Codes for Warehouse ManagementRaja NareshNo ratings yet

- WM Mvt Type In Posting Change NoticeDocument2 pagesWM Mvt Type In Posting Change NoticeAnil KumarNo ratings yet

- Chapter 4 Plant LayoutDocument90 pagesChapter 4 Plant Layoutrazlan ghazaliNo ratings yet

- Fast Moving H&M: An Analysis of Supply Chain Management: Manvinder Singh Rathore, Kriti Maheshwari, Shreyans JainDocument12 pagesFast Moving H&M: An Analysis of Supply Chain Management: Manvinder Singh Rathore, Kriti Maheshwari, Shreyans JainEmaNo ratings yet

- Computers and Chemical Engineering: Kefah Hjaila, Luis Puigjaner, José M. Laínez, Antonio Espu NaDocument27 pagesComputers and Chemical Engineering: Kefah Hjaila, Luis Puigjaner, José M. Laínez, Antonio Espu NaIsrael RicoNo ratings yet

- Logistics Individual AssignmentDocument5 pagesLogistics Individual AssignmentJeffery MillefioreNo ratings yet

- Sanket Dhariwal Final ProjectDocument71 pagesSanket Dhariwal Final ProjectSanjay Devkar0% (2)